Good morning, it's Paul & Jack here with the SCVR for Tuesday.

Agenda -

Paul's section:

Quick reviews of the largest fallers yesterday.

Sopheon (LON:SPE) - a positive update for FY 12/2021 - it's beaten the (low) expectations set in Dec 2021. I quite like the company, but it's difficult to justify the valuation on the poor performance over the last 4 years. It needs to step up a gear to maintain this valuation, in my opinion.

Sureserve (LON:SUR) - a reader request, and I form a positive view of the FY 9/2021 results. This looks a decent value/GARP company, performing well, and priced reasonably. The problems from its past (when it was called Lakehouse) look to have been fixed. It gets a thumbs up from me.

Jack's section

Ergomed (LON:ERGO) - adjusted EBITDA to be ahead of expectations, which appear to be for around £24m. The group has a very positive operational track record in recent times, including expansion overseas and notably in the US. Good organic growth continues, with firepower for acquisitions. The valuation remains ‘expensive’ and this is a risk depending on wider market sentiment, but the company's prospects are positive.

Ekf Diagnostics Holdings (LON:EKF) - continued strong trading and adjusted EBITDA will again be ahead of upgraded expectations. There’s a longer term growth strategy in place, which is positive as presently results are boosted by Covid testing. It’s an interesting company, but one I struggle to value.

Paul's market thoughts

We're seeing a remarkably rapid & steep decline in US markets, which very much sets the tone for sentiment in the UK. Take your pick from any of the reasons given (although most of these were already known, so don't strike me as particular catalysts for a big fall) -

- Higher inflation (due to supply chain problems and excess demand)

- Fed expected to raise interest rates 3-4 times in 2022 (but only by 0.25% each time, hardly a big deal)

- 10-year US Govt bond rate rising (but still insanely low, given where inflation is)

- Tapering of QE and the idea that the Fed might actually unwind some of the QE (which I don't think is ever likely to happen)

- Buying the dip stopped working

- Higher oil price & energy supply problems

- Risk of war in Ukraine

I think that's most of them. I'm not blase about these things, but the markets always have to "climb a wall of worry", and there are always macro economic and geopolitical worries.

I think it's more about a general unwinding of multiple speculative bubbles. We've been in pretty crazy market conditions for years now, in a long bull market. Valuations got very stretched by historic standards in growth companies, and there's no doubt that higher interest rates make future cashflows (long into the future) a lot less valuable now.

That said, to my mind, with inflation now eroding say 5-7% of our money each year, this makes sensibly priced equities a lot more attractive. Holding cash for a year or two seemed OK, when inflation was 0-2%, and remember for a long time people were worried about deflation. Now though, holding cash for any more than a few months, is seeing your assets decline in purchasing power. This bout of inflation is seriously bad news for the millions of pensioners out there, sitting on whacking great cash balances in their savings accounts, and earning negligible returns. If this current bout of inflation runs into 2023 (looking likely I'd say), then those pensioners could effectively see c.15% of their savings wiped out in purchasing power. Just like we saw in the 1970s and early/late 1980s. Holding cash for long periods in an inflationary environment is a terrible idea. That's why I think equities are becoming more attractive, not less. Divis of say 4-5% are not hard to find, and that reimburses us for nearly all the inflation impact on our money, with a chance of a capital gain on top too.

Equities are more attractive after recent steep falls too, due to BLASH (buy low and sell high). Over the years, I've trained my mind to think the opposite of the instinctive, negative emotional reaction to falling share prices. So instead of becoming despondent and panic-filled at my plummeting portfolio (my SIPP is down 13% year-to-date, just 24 days, with no gearing remember). My spread bet accounts are filed in the "Just don't ask" tray! It happens sometimes, I accept losses. This is the hangover after the party we all enjoyed from Oct 2020 to July 2021. I knew the party would end sometime, so adopted a hedging strategy, which would have worked if I'd run it for a few more months, but the losses in late 2021 meant I had to abandon it. Ho hum, there we go. Memo to self is obviously to just sell things next time, when all around me looks incredibly rosy, not try to dream up a fancy hedging strategy.

As regards yesterday's widespread panic selling, that looked to me very much like short term capitulation - a possible sign of a bottom, at least short term. Discussing this with friends last night, most disagreed, thinking it was just a typical powerful rally that you get in a bear market. Who knows? I can't predict market movements, nobody can with reliability (although plenty pretend they can!).

With about a third of the trades in the US being done by computers using a pre-programmed approach, often chasing direction (up or down), rather than valuation or logic, it's sometimes pointless trying to rationalise why share prices are doing what they do. It's often just the speculative flow of money.

The market is offering me unacceptably low prices for my shares, so I'm not selling. I think that's the key point to keep in mind. Or, if you think the outlook is awful, then the market might be offering a good price, in which case you would sell. Everyone just has to make up their own mind.

Are you investing long-term, and based on analysis of company fundamentals? That's what we focus on here, so this is not relevant to traders going in & out of shares. Lots of people think they're investors, but are actually trading, so it's important to know where you sit. For long-term investors, I think this is a time to check that your analysis is right, and if it is, then market gyrations are just background noise, to be ignored.

As we saw in early 2020, when the pandemic hit, markets roughly halved, it was total carnage, then they recovered. People who held their nerve recovered all their losses. What we're seeing at the moment is nowhere near as bad. I see it as healthy actually - speculative stuff in particular, on crazy valuations, has been slaughtered over the last year. As we saw in the March 2000 tech boom & bust, a lot of the new entrants, who created new paradigms and fancy ways to value shares on KPIs which we'd never heard of before, disappeared without trace. I think the same thing is happening now, as the Robinhood traders and Bitcoin crowd are gradually learning that fundamentals and valuation do actually matter, and their speculative gains melt away.

CNBC showed an interesting graphic last night, that Cathie Wood's boom & bust Ark fund, poster child for the latest tech boom, has now fallen so much that it's been overtaken by Uncle Warren & Charlie's slow but sure $BRK.A - very much tortoise & hare.

Anyway, my key message is that markets are inherently volatile, due to sentiment, and large elements of the market being used as a giant casino. That provides opportunities for longer term investors like most of us, to buy good assets cheaply from panic sellers, who are letting them go at an irrational price, due to fear of further price falls.

Once we've bought a share, then I think (providing the fundamentals remain positive), the day-to-day share price, and our running profit or loss, is just best ignored. Although an unusual fall in the share price, when the market is generally sound, is obviously a concern that means research needs to be revisited. But a general plunge in the market, which takes down good stocks and bad, is not a concern to me, and for long-term investors we can just ignore it.

Some individual shares will beat expectations, some will warn on profits. Hence why it's important to have a portfolio. You can't avoid profit warnings, so just accept the occasional one as an inherent risk in what we do.

As I remember saying when covid began in Feb 2020 - work out your strategy now. Either sell early (before markets plunge), or resolve to sit tight. The worst thing is to panic sell - because that's often at or near the bottom, when people capitulate. That remains relevant today. I don't know when the current sell-off ends, but with the pandemic apparently now drawing to a close, this strikes me as a funny time to be selling shares with good upside on fundamentals, like the re-opening trades that I'm mainly focused on.

If things really get too much for you, emotionally, then just turn off the computer! I sometimes do that, and have a nap, to de-stress. Going for a brisk walk, or cycle ride also helps, listening to music, gardening, whatever relaxes you. If you're not geared, then you can ride out any downturn, no matter how severe. As long as you're holding sensibly priced, decent quality companies, then everything should be fine in the long run. There's absolutely no point, and it's very emotionally destructive actually, to run "if only" scenarios through your mind. We can't change anything that has happened. So focus on now, and the future, as you can change that. Also, appreciate what you do have, even if it's less money than it was 6 months ago. This is how I handle horrible market conditions.

If you're holding speculative, over-priced stuff, then some tough decisions might still need to be made. That's up to each investor, we all have to work out our own strategy, learn from our mistakes, and hopefully do alright in the long run. Good luck, and don't panic! We're in this together, so if you're tearing your hair out with anxiety, post a comment below, and the community will I'm sure help you by discussing it - a problem shared, and all that.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Some large fallers from yesterday

Amigo Holdings (LON:AMGO)

3.5p (down 42% y’day) - mkt cap £17m

The market cap looks about £17m too high. An announcement yesterday made it clear that the company is teetering on the brink of insolvency. To avoid insolvency, it will have to do a Rights Issue that will involve issuing at least 19 new shares for every 1 existing share. If shareholders don’t approve this, then it will file for insolvency.

The announcement really couldn’t make it clearer that the equity is now worth nothing, or very little. The cause is that redress for customers is now taking priority, with negotiations underway. The court has made it clear that equity should be wiped out, if creditors are to take a haircut. That would leave the loan book going into run down, presumably managed by an Administrator?

Amazingly, there’s still time to sell, so I think the only logical course of action, is to sell for anything you can get, and donate the money to ZANE, instead of inactivity, and a probably 0p end result.

Water Intelligence (LON:WATR)

Down 18% yesterday to 815p on no news.

Unless I've missed something, this plunge in price seems down to panic selling meeting illiquidity.

WATR is on a high valuation rating, so I suppose it would only take a handful of people to panic sell, and the price tanks. We’re seeing a lot of that at the moment, so I don’t think it necessarily says anything bearish about the company itself.

WATR’s track record on growing EPS has been very good, but as I’ve been saying for some time, the valuation seemed to get well ahead of reality. It's obviously more attractive, now that the price has fallen a lot from the peak, but still doesn't strike me as a particular bargain.

Supreme (LON:SUP) (I hold)

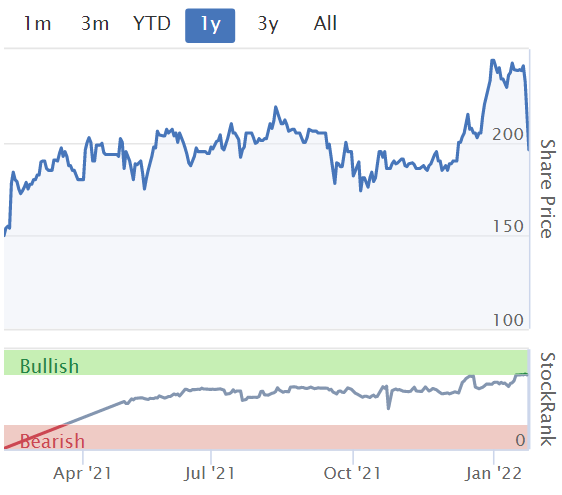

Down 15% yesterday to 196p

This is another one that dropped really sharply, on the general market panic sell-off we say yesterday. Although looking at the chart, it’s only really scrubbed off a recent spike in price, which I seem to recall might have been due to year end tip sheet selections, or something similar?

I reviewed its interim results in Dec 2021, which looked solid. Nice company, at a reasonable price, in my view. It’s only a tiny position in my portfolio currently, but I might top up when markets settle down a bit, if it drops a bit more.

Microlise (LON:SAAS)

167p (down 18% y’day) - mkt cap £195m

This company listed on AIM in July 2021. We’ve not covered it here before, so I’ll take a first look today.

There’s an investor presentation on IMC which I’m watching now, it’s a good introduction to the company. It claims dominant market share of transport management software in the UK - e.g. all 15 of largest retailers are Microlise clients. Product used internationally. Very low churn rate (under 1%). Great visibility as contracts are generally 5 year. Been around since 1982. 600 staff around the world. 400+ large (enterprise) customers, main part of the business. £18.6m raised in July 2021 to fund growth. (webinar overlooks that IPO also raised £42.6m for selling shareholders. Naughty!). Suite of 6 modules, not just telematics. IPO was 135p (now still above that, at 167p).

I’m rapidly losing interest, whilst looking through the AIM Admission Document, due to modest (and falling) levels of profitability for a company with almost £200m mkt cap -

.

Trading Update & Directorate Addition

The main financial highlight items look OK -

· Strong growth in Revenue and EBITDA, in line with market expectations

· Annual Recurring Revenue (ARR) run rate as at 31 December 2021 was £39.0m, an increase of 9% on December 2020 (£35.7m)

· Net cash at Period end of £13.4m

As we can see from the table above, that I copied from the AIM Admission Document, EBITDA looks meaningless (as it often is for software companies that capitalise large development spending).

Outlook - sounds a bit hesitant, and no specific guidance on profit is provided -

The Board remains confident in the Group's future growth which is underpinned by long-term structural drivers. The Group has a healthy pipeline of new opportunities, in the UK and internationally, and continues to invest in product development, notwithstanding the continued operating challenges caused by the pandemic and global microchip shortage. The Board expects these supply chain issues to last longer into 2022 than previous industry estimates, and the Group's management will continue to implement and execute its plans to mitigate the impact.

Valuation - with nothing said in today’s update in terms of profit guidance, and being a new listed company (hence no track record), this is tricky to value.

Many thanks to Singers for publishing an update note today, written by star tech analyst Kevin Ashton, no less!

He’s showing much higher historic adj profits than the numbers in the table above from the AIM Admission Document. So I’ll have to investigate what costs have been adjusted out?

Singers forecast 3.7p adj EPS for FY 12/2021 (which will be an 18 month period, but Kevin seems to have annualised the forecasts, to make sense)

Then 4.0p adj EPS in FY 12/2022

Then a drop to only 3.7p in FY 12/2023.

The reason for the earnings drop in 2023 seems to be that 2021 and 2022 have a zero tax charge, but kicks in again in 2023.

At 167p per share, the PER is 45 times 2023 forecasts. How on earth does that make sense?

My opinion - tech valuations seem to be coming down to earth, but Microlise still looks valued on a boom time rating from when it was floated.

It seems to me, on an initial look, that this company looks high quality (dependable, recurring SaaS revenues), and low churn, but the valuation is much too high to interest me.

There’s nothing magic about tech shares, and I think this share should probably be valued on a PER of maybe 20-25. That implies a share price of about 74-93p. It’s currently 167p, so looks significantly over-valued to me, in today’s much more sceptical markets, so I reckon this share is probably heading a good bit lower.

No wonder the owners were happy to trouser £42.6m in the IPO.

The pre-IPO balance sheet looks a bit strange, so I’ll be interested to view the next balance sheet.

.

Thg (LON:THG)

121p (down 19% yesterday) - mkt cap £1.24bn

This multi-£billion IPO (valuation peaked at an insane £8bn a year ago) looked seriously over-priced & over-hyped to me from day 1.

It’s now rapidly approaching small cap territory, with the market cap down to £1.24bn.

The trouble is, despite big, and rapidly rising revenues, it doesn’t seem to make a profit.

Also, the whole float was a story spun around supposedly ground-breaking software, and the latest buzzword of being a “platform” - hence no need to make any profits in a tech boom.

THG has since lost 85% of its peak valuation just one year ago, of about 800p. Reality is really biting with growth tech, and eCommerce businesses, as many valuations have crashed, but this one is particularly bad.

Looking at the last interims, it’s actually loss-making, because depreciation & amortisation (of development spend) together exceed EBITDA.

So I’m not tempted to bottom fish at this level. The balance sheet looks sound though, with plenty of cash, although note it also has £500m of debt.

I’ll wait to see where the dust settles. There’s talk of it spinning off its eCommerce beauty business into a separate listing, which sounds a bit desperate.

Moving on to today's updates:

Sopheon (LON:SPE)

885p (pre market open) - mkt cap £93m

Sopheon, the international provider of software and services for Enterprise Innovation Management solutions, is pleased to provide the following trading update for the year ended 31 December 2021.

I reviewed Sopheon’s positive-sounding update here on 20 Dec 2021, but came away unimpressed because “comfortable meet(ing) expectations” actually meant being only slightly over breakeven!

They must have clinched some contracts just before year end, or held a bit back for a rainy day, because today’s update now says revenues “will exceed $34m” - which is better than the previous estimate (from a Progressive research note) of $32.7m.

Annualised recurring revenue is >$20.5m - good, but that means about a third of revenue is still non-recurring, hence potentially lumpy licence wins could still make profits volatile.

Revenue visibility for 2022 is good, at $23.4m

EBITDA guidance -

Adjusted EBITDA is expected to exceed $6m (2020: $5.9m).

Net cash looks very healthy -

Net cash on 31 December 2021 was $24.1m (2020: $21.6m)

Deferred recruitment helped profitability. I’m impressed the company has been transparent about this, I think many companies would have kept this quiet -

In addition to the revenue out-performance, the profit result was assisted by the deferral of some of our anticipated investment plans, in particular in the staffing of product development. Like many other software businesses, we face ongoing challenges in recruiting technical staff…

Growth plans - good (faster growth?) or bad (higher costs)? It depends if the money is being spent wisely, and likely to generate a decent return on a timely basis -

Our growth initiatives will continue and accelerate in 2022.

SaaS - interesting commentary here - but it’s a really long haul for any software business to transition from one-off licences to SaaS - possibly beyond the investment horizons of many people? -

The improvement in ARR underlines continued traction in our migration to a Software as a Service ("SaaS") recurring revenue model, giving both enhanced revenue visibility to future periods and improved quality of earnings. Approximately 50% of more than 70 license transactions signed during 2021 were for SaaS contracts.

Moreover, the value of SaaS bookings was more than double that of perpetual contracts. This includes another six existing customers converting from the perpetual model to a SaaS model.

Gross retention of ARR returned to our normal strong levels, at 95% compared to 91.5% during the challenging conditions of 2020.

Diary date - 24 March 2022, for FY 12/2021 results.

Outlook - fairly general, but upbeat comments from the Chairman -

Sopheon's Chairman, Andy Michuda said: "As I noted in our December announcement, it was great to end the year with our first acquisition for some time, coupled with strong execution in the core business. We continue to explore and evaluate further M&A opportunities. In parallel, we are also advancing nicely on our stated transition towards a SaaS business, both operationally as well as financially, intended to enhance predictability, quality of earnings and overall shareholder return. I am encouraged with the foundational progress Greg and the team have made in 2021 and look forward to further positive developments as the new year progresses."

Broker update - Progressive has put out a note this morning, which doesn’t make any sense! They’ve noted the upward guidance on revenue & EBITDA, but then ignored it, by leaving adj EBITDA at $4.5m in their forecast, despite the company saying today it will be >$6.0m. That’s ridiculous! Progressive says it’s leaving estimates unchanged, to allow easy comparison with the trading update. Pull the other one! That’s the sort of excuse I make, when I don’t hear the alarm go off! Normally the analyst would revise up the forecasts when specific guidance is given, and provide an old & new table to show the comparison.

Finncap is more on the ball, with an updated note which does reflect the improved guidance given today by the company.

Note that $6.0m adj EBITDA only turns into $2.0m adj PBT, and 16.0p adj EPS - this is now the 3rd year when EPS has fallen. The trend looks awful :

2018: 61.2p

2019: 24.5p

2020: 17.2p

2021: 16.0p

[source: Finncap note today]

So despite all the upbeat commentary, the numbers that matter to a value/GARP investor are really not trending in a good way.

Finncap’s forecast for FY 12/2022 is even worse, with adj PBT of only £0.7m, and 3.4p EPS. That’s despite revenues forecast to rise 8.5%, and must be due to the increased costs alluded to in the commentary above. I imagine that's been set low, so the company can keep putting out ahead of expectations updates during 2022.

I understand that the company is not being run for short-term profits, it’s a growth company, supposedly. But revenue hasn’t gone anywhere for 4 years too! That’s meant to be because of the switch to SaaS. Fair enough, but flat revenues, and greatly declining profitability, doesn’t look any good to me. The valuation therefore hinges on expectations that the company can become a lot more profitable in future. This is not an ideal story to tell, in today’s much more sceptical market conditions.

My opinion - from reading things on the internet, I know many shareholders are very committed to Sopheon shares, so sorry if this article rattles your cage! But the fundamentals really don’t look much good here, at this moment in time. That makes the valuation questionable. It’s all based on hopes that the company can grow, and start to show an improving trend - which shouldn’t be too difficult, starting from what is now a low base in profitability.

I think it needs to show faster growth, to justify the valuation, but you may disagree.

The trouble is, I don’t know whether the company will grow more strongly or not. I prefer shares where you can justify the valuation on the existing profits, then growth from that strong base provides your upside on the share price. Whereas Sopheon’s current profits probably only justify a share price of maybe 320p (20x 2021 EPS). The price is 885p, so that’s 565p extra valuation for hopes of future profit growth. It might achieve the growth, or it might not.

.

.

Sureserve (LON:SUR)

91.5p (up 6% at 10:24) - mkt cap £151m

Jack wrote an excellent review of this support services group here in Oct 2021 - well worth a read to get up to speed on the company, which is what I've just done.

Sureserve, the social housing energy services Group, is pleased to announce its audited preliminary results for the year ended 30 September 2021.

Financial highlights - this looks impressive -

Profit margins at contracting groups are usually low, but in this case PBT divided by revenues is 5.6% - not bad at all for the sector.

Adj EPS is 7.1p (diluted), barely different from statutory diluted EPS of 7.0p - pleasing to see very few adjustments, which tends to make me believe the numbers more.

The PER on FY 9/2021 earnings is therefore currently 12.9 - that looks about right to me, as this sector rarely attracts a high price.

Balance sheet - NAV of £60.3m, less £43.3m intangible assets (which I nearly always write off) arrives at NTAV of £17.0m - that looks fine to me.

The overall structure of the balance sheet looks fine, with £16.4m cash, and apparently no interest-bearing debt.

Note 22 says there are £20m in bank facilities available, recently renewed to Jan 2025, which should help with any unusual cashflow spikes. There’s possible scope for funding a modest acquisition from existing cash/debt I think.

Being a services business, it holds little inventories. Hence the balance sheet can run quite lean with no trouble at all. Fixed assets, and capex spending are also quite modest, which I like.

It gets clean bill of health for the balance sheet from me.

Cashflow statement - this also looks good - it’s a genuinely cash generative business.

I’m always ranting about IFRS 16 having messed up accounts, so have demonstrated in the picture below, how I manually adjust lease costs back up to the top (out of financing activities), for all companies. These are operating costs, so shouldn’t be in finance charges.

This adjustment reduces operating cashflow to £10,362k, which more closely reflects the real world than the distorted IFRS 16 figure of £14,170k. If you have to make manual adjustments to accounts because an accounting standard messes up the numbers, then that accounting standard needs to be scrapped (IFRS 16). Also maybe find some people with a bit of common sense & more real world experience, to set future accounting standards?

Overall, the cashflows look good, in both years. In FY 9/2021 only 20% was needed for capex. 15% was paid to shareholders in divis (so there’s clearly scope to raise divis if they wish) and the remaining cashflow resulted in a £6.77m increase in cash on the balance sheet.

That all looks really healthy to me.

.

Outlook - all good -

.

My opinion - I’ve not read all the narrative, I just wanted to interrogate the numbers, and see if I can find anything unpleasant, and assess the valuation.

SUR passes both tests with flying colours! This looks a decent business, at a reasonable valuation.

So a thumbs up from me. High StockRank too - useful because as speculative bubbles seem to be deflating now, I think that should set market conditions to favour high StockRank companies, ahead of more speculative story stocks which can do very well (for a limited time) in more frothy markets.

.

.

Jack’s section

Ergomed (LON:ERGO)

Share price: 1,115p (+5.19%)

Shares in issue: 49,138,071

Market cap: £547.9m

Founded in 1997, Ergomed is a full-service pharmaceutical services company.

Its two divisions are CRO, which provides Phase I to III clinical trial services, and PrimeVigilance, which provides postmarketing PV (Phase IV) services. The company has expertise across all common disease areas but is predominantly focused on oncology and rare diseases/orphan drugs.

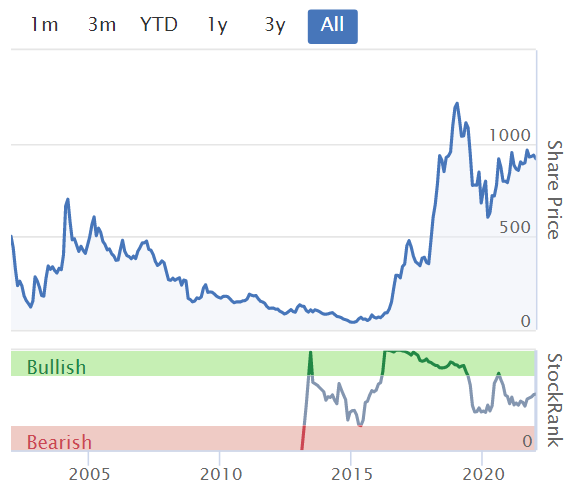

Ergomed has performed very well in recent years, successfully tweaking its strategy and establishing bases in overseas markets (notably the US). The recent market sell off sees it back firmly in SCVR territory however, with a nearly a third wiped off the market cap since the start of the year.

- Adjusted EBITDA ahead of expectations,

- Revenue +37.3% (and +44.3% in constant currency) to £118.6m,

- Order book +24.2% to £240m,

- US growth of 59.5% (71% in constant currency),

- Cash up by £12.2m to £31.2, with no debt.

Unfortunately, the note detailing just what adjusted EBITDA expectations are has been left out of the update. The most recent Edison note has £24m penciled in, rising to £27.9m in FY22 and £34.9m in FY23. That’s about 21.5x EV/EBITDA for this year, likely less in the wake of today’s announcement.

Pharmacovigilance (PV) and the Ergomed’s Clinical Research Organisation (CRO) both continued to trade well in H2 and had strong order books heading into the new year.

CRO (including MedSource, acquired in December 2020) saw revenue increase by 85.6% to £58.1m and by 26.2% to £38.1m excluding the acquisition. PV revenue grew by 9.8% to £60.5m.

US performance has been driven by revenue growth, new key senior hires, ongoing investment in employment, and the integration of acquisitions. Further expansion is anticipated in the world’s largest pharmaceutical services market.

Dr Miroslav Reljanović, Executive Chairman of Ergomed, comments:

We start 2022 with an exceptionally strong platform - a robust order book, a track record of delivery and an offering that demonstrably meets the needs of a growing market. Ergomed is firmly positioned for further growth, both organically and through M&A, via geographic expansion and broadening of our service offering. We remain extremely confident in our future as a leading global provider of specialist pharmaceutical services.

Conclusion

There’s a lot to like about Ergomed, in my view.

Organic growth across both divisions, successful acquisitions, growing US sales, a robust order book, a growing cash balance with no debt, and positioned in the fast-growing rare disease, oncology, and pharmacovigilance sectors. Management has executed very well so far.

The questions remain the same: for how long can current growth rates be maintained, and are the shares too highly valued? The multiples here are roughly equivalent to that of MedPace over on the Nasdaq.

Ergomed is on the left below and MedPace on the right. Hopefully you can make out the figures.

I still grapple with the valuation. I think the group warrants a premium rating given the growth prospects and track record so far. That said, yesterday’s market fall shows that taking on companies at high valuations can invite a sharp correction. And the StockRanks are lukewarm, brought down by a Value Rank of just 18.

There is such a thing as recency bias. Just because yesterday was red for the market, it likely does not affect Ergomed’s medium-term prospects. It’s still the same company it was at 1,500p a few weeks ago. The group is growing and has been for some time. What’s more, today’s results are impacted by FX headwinds, so underlying progress is stronger.

The company is back on my radar at these levels, although I don’t tend to buy at such high multiples. I’m also instinctively wary of the phrase ‘adjusted EBITDA’... I’m curious to hear what others think of the company at 1,115p? I’m tempted to at least revisit the investment case.

Ekf Diagnostics Holdings (LON:EKF)

Share price: 66.3p (-1.04%)

Shares in issue: 463,930,564

Market cap: £307.6m

EKF is a listed point-of-care, central lab devices, and chemistry reagents business. It also has a partnership with Mt Sinai, which has led to a couple of recent stock market listings.

As a result of customer demand, EKF has invested significantly in increasing the company's fermentation capacity. Meanwhile the dramatic growth in its sample manufacture and collection business has been driven by Covid, but management is now working on diversifying income here into non-Covid diagnostic testing areas.

EKF Diagnostics Holdings… confirms that continued strong trading will result in its performance for the financial year ended 31 December 2021, including adjusted EBITDA, being ahead of already upgraded market expectations.

Trading in the core business in Q4 continued to be robust, with revenue up by more than 13% in the financial year. Ongoing demand for sample collection kits and testing remained strong.

Cash, net of borrowings, at 31 December 2021 was £19.6m (31 December 2020: £21.4m), reflecting further strong operational cash generation offset by ‘substantial investment’ in the business, as well as working capital expansion to support anticipated growth and the payment of a 1.1p per dividend in December 2021.

Significant investment was made to expand fermentation capabilities and contract manufacturing to drive further organic growth. Further investment in enzyme fermentation is scheduled for FY22. Growth and investment in the core business is complemented by a strategy to exploit expanded capabilities to meet the demand for contract manufacturing services.

Advanced Diagnostic Laboratory, the CLIA-certified lab testing business acquired in October 2021 is integrating well and has begun diversifying into non-COVID testing, ‘as evidenced by the recent partnership relating to the provision of a non-invasive prenatal testing service’.

Conclusion

What do I make of EKF? Frankly I’m still not sure. That’s not to dismiss the company, but I’m not appropriately familiar with its products, economics, end markets, and prospects. I wrote up some presentation notes in September (here) but have not looked further since then.

The Mt Sinai partnership has led to a couple of listings, and there could well be more coming. It’s hard to forecast, but it could potentially be a source of significant value.

Add to that another layer in that Covid testing is skewing results - the StockReport consensus figures suggest net profits are forecast to fall over FY21 and FY22. All in all, I think this is a hard company to value, and you don’t have to swing at every pitch.

That said, I have a positive overall impression of the management. What we do know is that this marks a strong end to the year with EKF again upgrading expectations. It comes across as a quality operator, a cut above other Covid-related stories.

The fact that the shares are down suggests the market can’t quite make up its mind right now either.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.