Good morning from Paul & Graham!

Today's report is now finished.

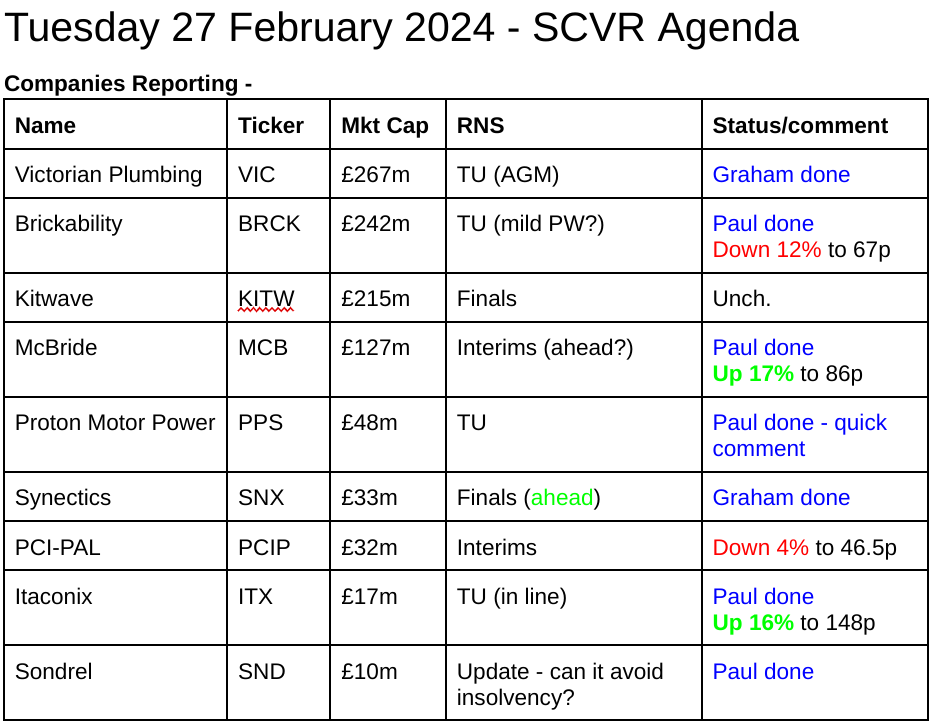

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

ITIM (LON:ITIM) - up 58% to 34p (£11m) - Contract win from QUIZ - “five year multi-million-pound contract”. Quiz is the first retailer to take its full end-to-end software package, including wholesale. FY 12/2023 TU update coming “shortly”.

ITIM floated June 2021 (WH Ireland, 154p, now down 78%!) not covered in SCVR before. H1 saw £(1.1)m loss on £7.4m revenues. Cash-burning, and balance sheet only just OK at £1m NTAV. Paul’s view - potentially interesting, worth a closer look for higher risk investors. Founder owns 38%.

Silver Bullet Data Services (LON:SBDS) - up 13% to 180p (£31m) - Extends $2.3m contract for a third consecutive year, with Mars Petcare in US. Historically loss-making. Did £1m placing in Nov 2023 at 70p. Reckons it can achieve positive EBITDA in early 2024. No forecasts. H1 results showed revenue almost doubled to £4.2m, and loss before tax halved to £(1.8)m. Threadbare balance sheet with debt. Will almost certainly need another fundraise in my view. But, this looks an interesting business, in a hot area (data, AI), with impressive clients (eg Heineken, Mars, Sony and Omnicom) - I’m intrigued, and tempted to have a little speculative punt on it once it’s properly refinanced.

OptiBiotix Health (LON:OPTI) - up 11% to 25p (£23m) - Strategic & Commercial Update - listed 13 years, and has achieved nothing in commercial success, apart from profitably selling shares in similar spin-off Skinbiotherapeutics (LON:SBTX) . It says “ the last three quarters of 2023 have seen a gradual return to strong sales growth.” The rest of this update seems to me more of the same that I’m used to from OPTI - a mixture of cherry-picked percentages, and hot air. The only updates that matter from OPTI are the results statements, which always disappoint. I’ll be happy to change my mind if OPTI actually produces some decent trading results at some point in the future. For me, it’s still a firm RED.

On Beach group (LON:OTB) - up 13% to 159p - Partnership with Ryanair. A “transformational shift” in their relationship. OTB customers will be able to book Ryanair flights through OTB as part of a package holiday, with transparent pricing, and no additional overcharges. So presumably OTB gets commission from Ryanair? Seems to suggest (not directly stated though) that litigation has been settled - “this agreement enables both parties to move on from outstanding litigation”. Paul’s view - I’m already GREEN on OTB, and think the shares still look good value, even after the recent re-rating. Ryanair partnership sounds intriguing, although financial effect unknown. Good to see litigation settled in a constructive way.

Tortilla Mexican Grill (LON:MEX) [Paul holds] - up 5% to 44p (£17m) - awaiting RNSs to see who the buyer(s) and seller(s) are from yesterday's flurry of very large trades, in this normally very illiquid share. Hopefully this might have cleared an overhang of persistent selling? Andy Naylor moved up from CFO to COO recently, then last week was promoted again to CEO, replacing Richard Morris who held the role for 10 years. Mild profit warning on 20/12/2023 - adj PBT forecast now is only £0.3m FY 12/2023. Plan is to increase margins gradually, as energy & food inflation recede. However, sector-wide problem of 10% living wage increase in April 2024 will be a fresh headwind. Will be interesting to see how it pans out. Biggest & best UK burrito chain, in my view, and also has successful & growing franchising activities through SSP. I think it's too cheap, as a recovery situation, and possible bid target. UPDATE: Luke Johnson has popped up with 1.4m shares (one of the big trades yesterday) at 3.6% just announced by RNS.

Sondrel (Holdings) (LON:SND) - down 3% to 10.75p (£10m) - contract wins and negotiations with suppliers (presumably over onerous software rental charges) pale into insignificance compared with this latest bombshell - it needs additional financing by TOMORROW! -

“the Group will now require additional capital by the end of February 2024, in order to inter alia, meet payroll and other short-term working capital requirements. The Company is in advanced discussions with a potential provider of capital which would serve to extend this working capital runway.”

Paul’s view - you can’t get much higher risk than this, but good luck to everyone involved. It seems an interesting company, but woefully under-resourced - the same pitiful story with so many smaller UK companies. I've been RED since the profit warning in Aug 2023, and remain so due to ultra high risk. We can review it fresh if it successfully manages to refinance, fingers crossed.

Summaries of main sections

Itaconix (LON:ITX) - 128p pre-market (£17m) - Trading Update [in line] - Paul - AMBER

Trading update only talks about revenues. Rapid revenue growth, but loss-making still. Its saving grace is an ample cash pile of about half the market cap, and moderate cash burn so no need to raise more in these very tough markets. Worth a closer look I think, it's going on my watchlist.

McBride (LON:MCB) - 74p pre-market (£128m) - H1 Results [ahead] - Paul - AMBER/GREEN

An excellent H1 report from this supermarket supplier of personal/cleaning products. FY profit guidance is raised again. The balance sheet is still weak, but decent debt reduction is demonstrated, so excessive gearing is no longer an emergency, but is a drag on valuation. No divis for the time being. It looks cheap, and has pulled off a remarkable turnaround, so I'm moderately positive now risk has receded somewhat.

Victorian Plumbing (LON:VIC) - 82p pre-market (£268m) - AGM Trading Update - Graham - AMBER

An “in line with expectations” update when it comes to EBITDA, but I’m guessing that revenue will struggle to hit forecasts as consumers prioritise value over luxury. My overall impressions here are positive as VIC does tend to chuck out a low-margin profit every year.

Synectics (LON:SNX) - up 1% to 187.4p (£33m) - Final Results - Graham - GREEN

This security and surveillance company’s end markets (particularly oil and gas but also casinos) have recovered strongly and enabled it to beat forecasts, although broker estimates for FY24 and FY25 are unchanged. Looking ahead the valuation should still allow for upside.

Brickability (LON:BRCK) - down 12% to 67p (£214m) - Trading Update (PW) - Paul - BLACK (profit warning) - on fundamentals: AMBER/GREEN

Forecasts have once again proven a bit too optimistic, so it's another mild profit warning (last one was 11/10/2023). Also, recovery is now expected later than its original view. I think it's right that BRCK shares have given up some of the recent big % gains. Medium term, this share should do fine I think, but for now it's had a wobble, but far from disastrous.

Quick comments -

Proton Motor Power Systems (LON:PPS) - Unch 3.0p (£48m) - FY 12/2023 Trading Update - Paul - RED

Nothing much going on here, with revenue unchanged at only £2.1m, selling some hydrogen fuel cells. Nothing said about profit or cash. H1 results showed £6.1m operating loss (FY 12/2022: loss £(10.5)m). Utterly bonkers balance sheet, with borrowings of £109m! So clearly there will have to be a debt for equity swap at some stage to straighten out this insolvent balance sheet at NAV of £(105)m. 2 major shareholders together hold 82%. I’m steering well clear, as existing equity looks worthless to me. RED.

Paul’s Section:

Itaconix (LON:ITX)

Up 16% to 148p (£20m) - Trading Update [in line] - Paul - AMBER

Why on earth is he starting today’s SCVR with this loss-making minnow, you might justifiably ask?! It’s because I read the update first, and it’s quick & easy to summarise. For background, Roland reviewed it here in June 2023.

Itaconix (AIM: ITX) (OTCQB: ITXXF), a leading innovator in sustainable plant-based polymers used to decarbonise everyday consumer products, is pleased to provide a trading update and report that trading is in line with current expectations.

This isn’t really a trading update, because it only talks about revenues and not profit (or rather losses) -

Itaconix achieved another record year with unaudited revenues of $7.9 million, a substantial increase of 40.6% over FY22 of $5.6 million. The Company has now grown revenues at a compound annual growth rate of 54.9% since 2018. Europe led this year's growth rate, with revenues increasing by 89.3% to $1.0 million, while North America continued to generate significant increases, with revenues growing by 35.6% to $6.9 million.

Obviously if it had broken through into profit, then the company would be shouting about it, so the silence must mean continuing losses to add to the historical losses - although I do like the impressive revenue growth, so there might be something here worth further investigation -

Almost all revenue comes from the cleaning sector, ingredients for detergent.

It’s quite impressive that sales are global, not just UK.

ITX makes these claims for its products, so getting third-party verification of this would be a key area to research -

Although Itaconix ingredients increase sustainability, the Company's key competitive advantage is in delivering both performance and affordability, which remain major concerns for brands, retailers, and consumers alike.

Cash - interesting, as it’s got plenty, following a placing at 5p (pre 50:1 share consolidation, so 250p in new money) early in 2023 -

Unaudited net cash and investments as at 31 December 2023 was $10.0 million (2022: $0.6 million).

That’s about £8.0m in sterling, almost half the market cap, which means most of the £10.5m (before costs) raised last year is still in the bank, suggesting a moderate level of cash burn relative to the funds available, which I like.

Outlook - all very nice, but these are mostly aspirations rather than facts -

"We have completed another record-setting year with revenues again growing substantially. This is being driven by both new customer wins and an expanding base of recurring revenues from existing customers. Our strong balance sheet is enabling us to target new customers and product innovation to underpin our growth objectives. With our commercial advancements and the development of new revenue opportunities, we are well placed to fulfil our strategy of becoming a large, profitable specialty ingredient company, distinguished by our commitment to safer chemicals, superior performance, cost-efficiency, and sustainability."

Paul’s opinion - I like the compound revenue growth over several years. Also I like the cash pile being about half the market cap. So this is worth further investigation, for people who absolutely have to invest in loss-making, cash-burning companies - which is usually a total disaster because they run out of cash, often repeatedly. ITX seems to have done that already, and is now nicely cashed up, providing management don’t squander the funds raised last year, as I doubt more would be forthcoming from investors in current market conditions.

Key areas to research are the track record of management, and whether the products are any good. I’ll put it on my watchlist, and await further details with its results due in early April.

McBride (LON:MCB)

Up 17% to 86p (£150m) - H1 Results [ahead] - Paul - AMBER/GREEN

McBride, the leading European manufacturer and supplier of private label and contract manufactured products for the domestic household and professional cleaning/hygiene markets, announces its unaudited interim results for the six months ended 31 December 2023 (the 'period').

I like the headlines -

Strong first half performance underpinned by continued consumer shift to private label

Full year profit expectations raised

H1 key numbers - a fantastic turnaround vs last year -

· Group revenue of £468.0m (2022: £426.3m), up 9.8% (9.9% at constant currency(1))

· Adjusted operating profit(2) of £30.5m (2022: loss of £1.3m)

· Adjusted profit before taxation(2) of £22.4m (2022: loss of £7.9m)

Adj EPS in H1 was 9.1p.

Net debt - is coming down nicely, so no longer looks a major problem (although it’s still above the market cap, so is clearly still excessive, and needs to be taken into account when valuing the shares) -

Net debt(2) decreased to £145.7m (30 June 2023: £166.5m), liquidity increased to £85.0m (30 June 2023: £59.3m)

Pension deficit is consuming £4m pa in deficit recovery payments, plus potential top-ups up to £1.7m if profits exceed a benchmark.

Going concern - gives a clean bill of health, although I see the severe downside scenario as having quite soft assumptions.

Balance sheet - is clearly still stretched, with only £17m NTAV, and far too much debt for me to be comfortable. The restrictions on divis is further evidence that the bank wants its exposure reduced, and I don’t blame them after sailing so close to the wind in the last few years.

However, things are clearly moving in the right direction, so the weak balance sheet is no longer an emergency, and if MCB continues performing so well, should gradually repair itself from retained profits.

Outlook - great to see guidance being raised, and the debt EBITDA multiple coming into more acceptable territory -

Valuation - looks incredibly cheap on a PER basis even before today’s news of guidance being raised. So I imagine this update should propel shares higher (I haven’t looked at opening trades yet).

There are no broker updates available to me. Stockopedia has existing broker consensus for FY 6/2024 at 16.5p, so if we assume that might be raised to perhaps 18-20p, then the PER is only about 4! Obviously there’s a mountain of debt which will have to be reduced further, although probably won’t need to be fully repaid. So I doubt generous divis will be on the agenda for some time, and are still currently restricted by the terms of the bank facility - see the section titled “Payments to shareholders”.

My opinion - MCB has been a tremendously impressive turnaround, from a position that looked highly precarious back in the summer of 2022. The bank gave it a generous lifeline (suspending covenant testing), which we commented on here at the time, taking away insolvency risk. With hindsight, that was a great time to take a punt on this share, and well done to subscribers who saw the opportunity. I didn't imagine that earnings would recover to anything like the extent they have, it's been tremendously impressive.

I think today’s positive update justifies a resumption of the bullish share price trend. Maybe 100p might be achievable now? I’ve not yet looked at the share price, but imagine it’s likely to be usefully higher this morning.

EDIT: MCB shares are up 17% to 86p at 9:00, well done to holders!

It remains to be seen if the aggressive supermarket buyers will allow MCB to continue making decent profits, or if as in the past, they’ll squeeze it out again?

Brickability (LON:BRCK)

Down 12% to 67p (£214m) - Trading Update (PW) - Paul - BLACK (profit warning) - on fundamentals: AMBER/GREEN

Construction materials distributor. Today it says -

Bricks demand down on last year (but it already expected that)

“Pricing is becoming increasingly competitive given the softer demand.”

Non-bricks “traded well” and “gross margins remained strong”

Overall - it’s a mild profit warning for FY 3/2024 -

FY24 adjusted EBITDA is expected to be towards the lower end of current market expectations.1

1 Complied analyst consensus for the Company, prior to this announcement, is for FY24 adjusted EBITDA of £46.2m with a range of £44.8m to £47.2m.

That’s a tight range anyway, so being at the lower end is neither here nor there to me. However, shares have had a strong run since the Oct 2023 low, and are still up c.50% since then. So I can see why the market has been unimpressed with today’s mild profit warning.

Outlook comments are not good -

Whilst it is encouraging that the rate of inflation is trending down favourably and the widely expected fall in interest rates will benefit the wider market, trading conditions are expected to remain challenging for longer than initially anticipated.

As a result, the Board now considers it appropriate to assume a more conservative profile for the Group's recovery over the next twelve months. The underlying long-term demand for UK housing remains robust, and the Group is well placed to benefit significantly as the market and volumes recover.

Revised forecasts - thanks to Cavendish for updating us. It lops a fair bit off revenue, but only slightly reduces profit expectations for FY 3/2024 and FY 3/2025. I’m struggling to understand that, but it might be because recent acquisitions have masked the underlying fall, possibly?

I vaguely recall that in the past the company has said its business model is not particularly highly operationally geared, since it’s a distributor, as opposed to a manufacturer with high fixed costs.

EPS is now expected at 8.3p FY 3/2024, and similar at 8.4p for FY 3/2025, then a recovery anticipated in FY 3/2026 to 11.3p. So the PER looks reasonable, and this may be at or near low of the cycle earnings?

Paul’s opinion - broker forecasts had already been reduced in several stages since last July, so to miss these reduced numbers does suggest that BRCK isn’t forecasting very well - they’re clearly being too optimistic. I think that often happens when management are fairly new to public markets, and they need to learn to under-promise and over-deliver. BRCK has been listed nearly 5 years, so this should have been handled better.

That said they’re not responsible for macro factors, which is what has caused a deeper downturn than previously anticipated.

We know a recovery is likely, from what the housebuilders are saying, so that should feed through in due course and see earnings recover.

Overall, I think this share remains attractive as a medium term recovery investment, like many other building supplies shares. I like several in this sector, but don’t know where the low point will be, or has been? It’s tempting to buy a basket of the better quality/cheap building supplies company, then just wait 2 years or so, and the basket is likely to be worth more I reckon, and would collect in some decent divis along the way too.

I’m happy to stick with AMBER/GREEN, same as last time it warned on profits on 11/10/2023. In both cases, these are not huge misses, just fairly modest profit warnings.

Graham’s Section:

Victorian Plumbing (LON:VIC)

82p pre-market (£268m) - AGM Trading Update - Graham - AMBER

Let’s briefly review today’s trading update from “the UK’s leading bathroom retailer”.

Full-year adjusted EBITDA is still expected in line with expectations.

Today’s update relates to the first 21 weeks of FY September 2024, which is not intuitive at all! Let’s instead say that it covers the five-month period beginning last October and continuing until now.

Key points:

Revenue growth 1%

Average order value is down 3%, but order volumes are up 4%. This is considered to represent market share gains.

It’s not a surprise given what we know about cost of living conditions, but “customers are continuing to seek value and are purchasing proportionately more own brand products”.

This “continues to improve the Group’s gross margin” and is one of the reasons, along with “stable marketing spend efficiency” for VIC’s confidence in meeting EBITDA expectations.

They only mention hitting EBITDA expectations, not hitting revenue expectations. There is a cynical voice whispering in my ear that revenue expectations (£305m, according to Stocko) will be very difficult to meet. After all, the revenue estimate from the StockReport suggests a 7% gain on last year, whereas today’s update says that revenues are only up 1% on last year.

Their new distribution centre, “which will address current capacity constraints”, is expected to be operational in H2.

Graham’s view

I’m new to studying this one, but overall impressions are positive. See Paul’s summary of their full-year results in November.

For a bit of financial history, I feel obliged to mention that this was the largest ever IPO on AIM. Shares hit the market during that terrible vintage year of 2021, priced at 3x their current level. Nearly £300m of shares changed hands at that level:

Looking ahead, from the current valuation, this might be priced sensibly:

There has been pressure on estimates:

And I expect that quality is limited, e.g. operating margin struggles to ever break into double digits. But it could be a reasonable company offering reasonable value at the current level. Until I’ve studied it in more detail, I’ll be staying neutral.

Synectics (LON:SNX)

Share price: 187.4p (+1%)

Market cap: £33m

Synectics plc (AIM: SNX), a leader in advanced security and surveillance systems, announces its audited final results for the year ended 30 November 2023 ("FY 2023").

Congratulations to Paul for his positive coverage of this one in December (share price at the time: 105p), when he said “risk:reward is probably as good as it’s likely to get”.

It has been a remarkable few months:

Here are the full-year highlights:

Revenue +26% to £49m

Underlying operating profit up to £3.1m (last year: £1.2m)

These are “strong results, exceeding market expectations, underpinned by growing demand from the oil and gas sector”.

Synectics provides security and surveillance products (e.g. camera systems) used by casinos, airports, railways, cities and towns, and oil and gas.

Net cash is £4.6m.

Order book finished the financial year at £29m (last year: £24m).

The dividend gets a substantial increase; the dividend record is quite good here:

The 3p final dividend (the only dividend for the year) is well-covered by 14p of underlying EPS.

Estimates: many thanks to Shore Capital for publishing a new note on the company. While today’s results are slightly ahead of forecast, they leave FY Nov 2024 and FY Nov 2025 estimates unchanged.

Estimates suggest revenue growth of 8% in the current year (to £52.9m) and then a further 13% in the following year (to £60m).

Adjusted PBT is seen rising to £5m by FY November 2025.

Outlook in the company’s words:

Extended agreement with National Grid, with contracts of £4.0 million signed to upgrade more sites across its estate

Key end markets continue to recover, and we are seeing opportunities for both new projects and the renewal of existing infrastructure and systems in all sectors

Strong new business momentum delivered at the end of FY 2023 has continued into H1 2024, underpinning the Board's confidence in the Company's outlook for the medium term.

Management and shareholders: the CEO has been with the company for over 20 years, which I take as a positive sign. However, he’s not really an owner-CEO or a founder-CEO, having a 3% stake in the business.

The shareholder register shows that SNX also has a 30% investor - an offshore, anonymised entity that also has a decent stake in First Property (LON:FPO). Perhaps it’s someone we know in the value investor community!

Interim Chair’s statement is reassuring:

In 2020, we initiated a comprehensive restructuring programme whilst focusing on maintaining our core market insight and technology skills in response to a slowdown in our key end markets.

Continued progress and investment since then have ensured that we have advanced our proposition and knowledge, positioning us well to capitalise on the recovery in our core markets, which returned to growth in FY 2023.

Building on these foundations, the Company is ideally placed to capitalise further on its specialist end markets…

Adjustments: I’m reassured to see that there are only £300k of non-underlying items for the year, which makes this quite a clean set of accounts. The company spent £200k on “a confidential legal matter in the US which has now been settled”. Ok!

After all taxes and without making any adjustments, the net income for the year is £2.2m (last year: net income £1.5m, including discontinued operations).

It’s true that £1m of technology development spending was capitalised, instead of going through the income statement. But the company also wrote down (amortised) £0.7m of previously capitalised spending. So when you net these out, the decision to capitalise development spending didn’t make a big difference to reported profits.

Graham’s view

I feel as though I’m late to the party here, with the share price rising by 80p in a few months. Perhaps it has already reached fair value but I’m going to respect momentum and maintain the positive stance here.

If they hit the target of £5m adj. PBT over the next two years, then the current market cap (£33m) will, I suspect, be seen as having offered good value. Especially considering that the company has a net cash position.

I haven’t seen anything to suggest that SNX has any revolutionary technology or an extraordinary competitive advantage, but it does appear to be well-run and a solid performer.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.