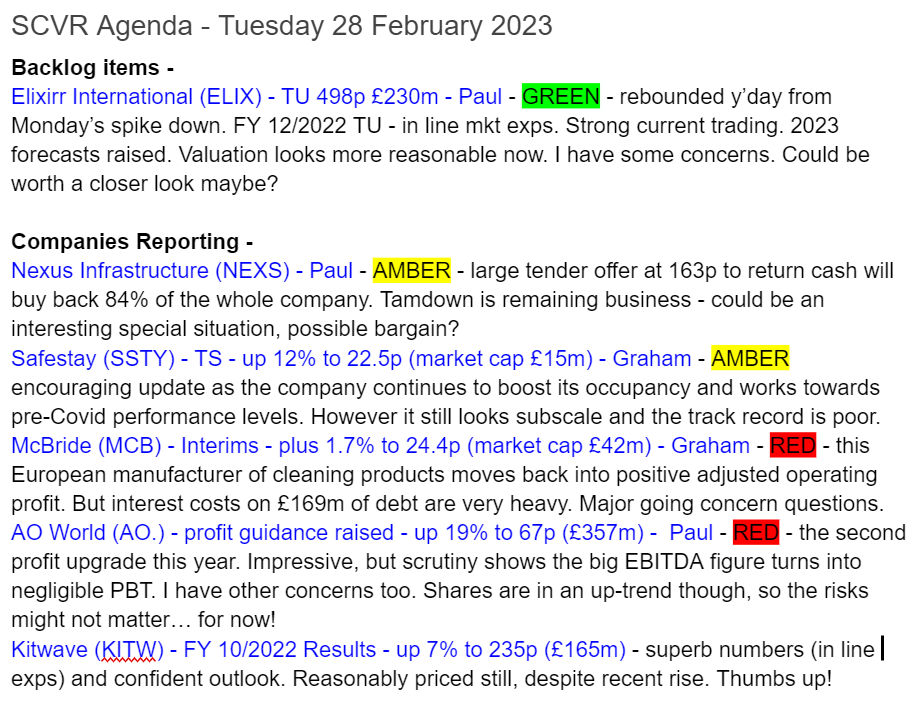

Good morning! It's Paul & Graham here.

Today's report is now finished. That was a good 6 hour stint today, plus 2 hours last night, which is the most my eyes can cope with, so we'll leave it there for today.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Kitwave (LON:KITW)

235p (up 7% at 11:44)

Market cap £165m

Kitwave Group plc (AIM: KITW), the delivered wholesale business, is pleased to announce its final results for the twelve months ended 31 October 2022…

Kitwave is a delivered wholesale business, specialising in selling and delivering impulse products, frozen, chilled and fresh foods, alcohol, groceries and tobacco to approximately 42,000, mainly independent, customers.

I’ve got a favourable impression of Kitwave, and checking our archive, I reported favourably on it as good value here on 3 Nov 2022, when it was on a fwd PER of 8.5, with a 5% yield, and a solid trading update for FY 10/2022 under its belt. The share price was 170p then, and strangely there was a delayed response, with the shares only really moving up significantly more recently, in the first 2 weeks of Feb 2023. That’s a 38% share price rise in the last 4 months, so I’m wondering if the price is now up with events? Let’s find out!

Review of FY 10/2022 results -

Big jump in revenue, to £503m (both organic, and acquisitions)

Really impressive profit growth, PBT is £17.8m (up from just £2.1m LY) - in line with expectations.

Big turnover & low gross margins, but the improvement in gross margin from 18% to 20% has been key, as that’s an additional £10m profit.

Seems to have handled inflation well.

EPS up from 2p to 20p - wow that is impressive! So a PER of just under 12 now.

Accounts look clean to me - few adjustments, and no funnies that I can see.

Upbeat outlook comments.

Debt & liquidity look fine to me.

Balance sheet is alright, with NAV of £72m, take off £45m intangibles, and NTAV is adequate if not particularly strong at £27m.

Dividends - policy is to pay out 40-50% of PAT. This year total divis will be 9.25p, a yield of 3.9%, still pretty good, but the recent share price appreciation has reduced the yield from 5.0% when I last reviewed it in Nov 2022. Remember that KITW is also making acquisitions, so I wonder if it should perhaps scale back divis a bit to avoid debt piling up? Although so far, that hasn’t happened, so I could be too cautious on this point possibly.

Fragmented market - presents opportunities for trading, and for acquisitions.

As the company says in its commentary, KITW has been a rare success from a generally dismal year in 2021 for stock market floats.

My opinion - remains positive, this looks an excellent business, and the shares are still reasonably-priced despite the recent strong rise. Taking into account today’s 7% rise, I reckon the fwd PER is now about 10x which strikes me as very reasonable, given the strong performance of the business, and the lack of any concerns from these numbers.

So a thumbs up from me! As with everything, obviously I have no way of knowing what the future holds, so I’m only giving a view on how things stand at this point in time. This is just a view on the fundamentals of the company, from a value investing standpoint. I have no idea what the share price will do, nor does anyone!

KITW has done pretty well since listing, given tough markets since then.

Note also the high StockRank, which adds to my positive view on the share.

AO World (LON:AO.)

67p (up 19% at 09:56)

Market cap £357m

Trading Update and Increased Profit Guidance

AO World plc ("the Company" or "AO"), a leading online electrical retailer, today issues the following trading update, increasing our profit guidance for the year to March 2023.

Continuing to reduce costs & improve margins, resulting in -

Increased EBITDA guidance -

Accordingly, the Board now expects Adjusted EBITDA1 to be in a range of £37.5m to £45m for the full year, an increase to the previous guidance2 that we gave in January 2023.

2 In our trading update announcement on 10 January 2023 we guided to a range of £30m to £40m.

That’s a useful increase. Also I applaud the crystal clear profit guidance, if only all companies were this transparent, it saves us so much time.

The next step is to look for broker update notes, to help translate these numbers into the reality of PBT, and EPS (as opposed to the often unreliable EBITDA, which the City seems obsessed with).

Unfortunately, there’s nothing available to us on Research Tree. I’ll have to try and work it out manually.

H1 results showed adj EBITDA of £9m, but that translated into a loss before tax of £(11.6)m. So a difference of £20.6m just in H1. Of this, £3.6m was restructuring, so being charitable and assuming that’s a one-off (which it probably won’t be!), then I estimate the shortfall from adj EBITDA to PBT in H2 might be £17m. Put that together with the £20.6m in H1, and we get a full year estimate of a £37.6m shortfall.

Hence I’m estimating that the new (today) mid-range adj EBITDA guidance for FY 3/2023 of £41.25m would become only about £3.7m of profit before tax - barely above breakeven, and a wafer thin margin on revenues of c.£1.1bn.

A lot of the adjustments between EBITDA and PBT seem to relate to leases (a lot of the costs are now buried in depreciation, and finance charges, thanks to IFRS 16). So we cannot ignore those costs, hence why EBITDA is not a reliable profit measure at AO, in my opinion. If you value the shares on any multiple of EBITDA, you're almost certainly over-valuing the shares, because you're ignoring a large slug of day-to-day costs.

In a nutshell, this business has undergone extensive restructuring, and put out 2 positive out-performing trading updates this year so far, only to get to a whisker above breakeven. And it’s gone up 20% today, and is now valued at £357m.

My opinion - this share has a history of becoming seriously over-valued, and then plunging. Could the same thing be happening again? Quite possibly, I think. Performance is definitely improving now, and the 2 positive updates this year are good news. But it only takes a little digging through the numbers to realise that this business is still not actually making any genuine profit of any significance, once all costs are taken into account.

My other worries concern the on-balance-sheet risk of commissions and contracts (things like extended warranties, or phone contracts I think, not sure). It has been said that AO’s business model is selling electrical items at a loss, in order to generate fees from ancillary things like warranties. I’ve always worried that this could be a mis-selling risk, as we’ve seen so much in recent years, from PPI, and other similar schemes. Modern electrical goods rarely break in the first 5 years or so, they're designed to break after something like 12 years, depending on brand. So it could be argued the extended warranties are a con, with very high profit margins. That sounds a risky proposition to base your business on, in my view.

AO got into financial trouble earlier this financial year, and had to prop up its finances with a placing. NTAV after that placing is c.£47m. That’s still not great, because a lot of the assets are a long-term receivable of £89m, which I think relates to estimated commission. I’m never keen on that type of thing on the balance sheet, and I think AO is still under-capitalised. Although to be fair, balance sheet risk becomes less important when trading is improving, as it is here.

Overall then, investors just have to weigh up the undoubtedly positive improvement in trading, with all the negatives outlined above. It doesn’t float my boat at all, so I’ll give it a thumbs down on the fundamentals. But the share price could continue to be buoyant, since a lot of investors ignore negative risks when companies are reporting improving trading, as AO is. So it could go either way really, your guess is as good as mine! Maybe a positive shorter term trade, but with rather flimsy underpinnings, is the best way I can describe it.

It's amazing how wrong the stock market got the valuation during the pandemic boom. Note that market sentiment has completely changed towards eCommerce companies, with many investors having now realised that these are not tech businesses at all. They're low margin box-shifters with a website. We've had that discussion before here over the years.

(also note the low StockRank, so Stockopedia's computers don't like this share either)

Elixirr International (LON:ELIX)

498p (up 19% yesterday)

Market cap £230m

Elixirr International plc (AIM:ELIX), an established, global award-winning challenger consultancy, is pleased to provide an update on trading for the year ended 31 December 2022 ("FY22").

The 19% share price rise yesterday looks odd, in that it seems to be reversing a spike down the previous day -

Elixirr International calls itself a challenger management consultancy. It joined AIM in July 2020, and has since made several acquisitions.

Key points from the latest trading update for FY 12/2022-

In line with expectations.

Revenue £70.7m - this is near the bottom of the £70-75m range given with the interim results, published on 20 Sept 2022.

Revenue up an impressive 40% on last year, of which 18% was organic, the rest from acquisitions.

Adj EBITDA £20.5m, slightly above previous guidance of £20.0m

Cash of £20.4m, “with no debt” - although I note from the interims that there was £12.0m in contingent consideration creditors, which is sort-of debt.

Final divi of 10.8p. There doesn’t seem to have been any interim divi, so the yield is unexciting at 2.2%, but growing fast.

Strong current trading - nicely upbeat comments, which suggest possible upgrades later in 2023, if this momentum continues -

2023 has also started strongly with organic growth accelerating in Q1. January 2023 was a record revenue month for the business, with absolute revenue growth of 76% against January 2022 and organic growth of 29%. Expectations for full year FY23 are for revenue of £85-87m with Q1 currently trading ahead of this.

This all sounds quite interesting, so I had a look through the last interim results to June 2023, and jotted down a few key points -

USA is important, generating 40% of revenues in H1.

H1 EBITDA of £10.4m turned into PBT of £8.4m, so the profits look real, and this is high margin work.

Balance sheet - NAV £90.0m, which is nearly all goodwill & similar, of £84.4m, so only £5.6m NTAV. Hence this share is all about earnings & divis, and isn’t asset-backed - which is fine as long as the profits keep flowing.

Some items to be cautious about & need further checking I would suggest, before anyone buys the shares -

- Loans to shareholders on the balance sheet seems odd. A £4.2m receivable was shown at June 2022, and the cashflow statement shows loans being made, and then repaid. Why is this? It’s a people business, so looks to be something connected with the partner/Directors maybe?

- A large amount of cash £11.3m was spent by the Employee Benefit Trust buying ELIX shares. This seems to be to pay earn-outs on acquisitions, and for employee share options.

- Outstanding share options look excessive, at 10.8m shares (avg strike price 316p). That compares with the current share count of 46.2m shares in issue. That's potential dilution of just over 23% (10% is usually seen as an absolute maximum). Although of the 10.8m share options, only 146k are currently exercisable.

My opinion - this seems a pretty decent business, making hefty profit margins, in a lucrative sector. As a “challenger” to the big accounting firms, even if it only gets a few scraps that fall from the giants’ table, it could still be a nice business.

The problem is though, that ELIX is a people business, and it tends to be a few partners who generate most of the profits in people businesses. They can then either leave, or negotiate very lucrative remuneration packages to stay.

I’m increasingly sceptical about why firms like this list on the stock market (e.g. the flurry of lawyers & other consultancies that have listed in recent years). All too often it’s a disguised/delayed exit by the partners, on tax efficient terms, which makes them rich, whilst continuing to get nice salaries. Do outside shareholders get a fair deal? Generally speaking, I’m working on the assumption that outside shareholders are likely to do less well than the very clever & shrewd people who run these type of businesses and float them. Although in this case maybe I’m being over-sceptical, as Stephen Newton the CEO here, has almost 29% of the company. So interests look well aligned there.

I have looked at this share once before, in Sept 2021, and flagged that a PER of c.30x at the time looked punchy for a people business, at 688p per share. Since then good progress has been made with the business growing, and at 498p per share, the price is lower.

EPS is forecast at c.30p for 2022, rising to 33p in 2023 (could be too low, given the upbeat outlook? Hence a PER of 15.1x 2023 strikes me as quite reasonable actually.

That’s an attractive enough valuation to make it get a cautious thumbs up from me, for further research, although personally I’m not interested in people businesses, due to the conflict of interest, and how frequently things seem to go wrong with shares in people businesses. So if the category existed, I would be half way between green and amber.

Nexus Infrastructure (LON:NEXS)

165p (pre market)

Market cap £75m (reducing to £12m post tender offer)

Return of Capital - Tender Offer

An unusual situation here, where Nexus has sold its main operating divisions, for £77.7m, as previously announced. Today we’re told the terms of the tender offer, to return cash to shareholders. It’s very unusual, in that most of the company is being bought back. Key terms -

Basic entitlement is that shareholders can tender 5 out of 6 of their existing shares (this entitlement is guaranteed to be met).

Additional shares can be tendered, using up the entitlements of other shareholders to the extent they don’t take up their own entitlements.

This will buy back almost 84% of all the company’s issued shares.

Priced at 163p per share, so little different from the current market price.

This will leave the company with only 7.5m shares in issue, valuing those at 163p, gives a market cap of only £12m (down hugely from the existing £75m).

Remaining business is called Tamdown, and is said today to be in a “well advanced” turnaround.

Possible future cash returns if Tamdown turns out to have excess capital.

My opinion - I can’t recall anything similar happening before, not recently anyway.

The question now is whether Tamdown is too small (£12m mkt cap) to be listed, and what its potential is, as a standalone business? Does it have any attractions to investors?

There might be a special situation opportunity here, as Tamdown looks set to be in a good cash position (it’s retaining £12m of the sale proceeds, which will be equal to its entire market cap). Although there does seem to be some existing bank debt to deduct from that £12m cash, I'm not sure how much. Hence I’m not sure what the pro forma balance sheet would look like, that would require more research. Sometimes people who really dig into the detail can unearth a bargain, so this one might be worth some additional work for special situation investors. I don’t have a view on it either way.

The last group accounts mention that Tamdown has moved back into profit of £2.3m, and has revenues of nearly £100m, plus an order book of £96m, providing good visibility. Given that Tamdown’s market cap is only going to be c.£12m, and probably with good cash backing on its balance sheet, then I reckon this share could end up undervalued, possibly, post tender offer? Worth a closer look, I’d say.

Graham’s Section:

Safestay (LON:SSTY)

Share price: 22.5p (+12%)

Market cap: £15m

This is an owner and operator of branded hostels. According to the most recent interim report, it had 16 sites.

Previous commentary from the company said that they would become “self-funding” when they had 20 sites.

The financial track record here is poor (and not helped by Covid):

Let’s take a look at this morning’s full-year trading update for FY December 2022 (isn’t it a bit late to be coming out with one of these updates at the end of February?)

Key points:

Revenues ahead of expectations at £19m

Adjusted EBITDA in line with expectations at £5.9m

On a personal note, I consider adjusted EBITDA to be meaningless for this business, since depreciation is likely to be significant (not to mention the other adjustments).

For example, the H1 period saw depreciation and amortisation of £1.9m (versus revenues of only £7.3m). Depreciation is a real cost, because assets that wear out will need to be replaced!

Anyway, let’s get back to the update:

“Near-normal premium hostel market with further upside anticipated.”

Average bed rate increases 20% to £23.70

I studied this company way back in 2017, and estimated that it had an occupancy rate of 65%.

In 2022, it achieved occupancy of 63%. It says that this is “well below historic market levels with significant opportunity for continuing improvement”.

According to a note from Liberum today, Safestay did achieve 73%-77% pre-Covid.

For context, here are the average occupancy rates for hotels:

It may be a misleading comparison, since hotels and hostels have quite different business models. But I still think occupancy of 75% would be very reassuring.

A note on the customers:

Importantly, guests were predominantly young travellers visiting European cities as group bookings by schools and colleges had not yet returned in significant numbers, but there are positive signs that they are in 2023.

Cash - the company has £4.8m.

According to Liberum, the company finished the year with c. £17m of gross debt, excluding leases.

Safestay’s interim report stated that its Elephant and Castle site was worth £26.8m. So in theory it could sell off this property, pay off its debts, and still be left with its current cash balance plus another £10m.

My view

I’m tempted to take a positive stance on this because of the following bull points:

As school and college trips get back into full swing, occupancy should climb over 70% and reach more profitable rates.

If the property valuations are to be trusted, the debt load does not pose a concern.

Balance sheet net assets (£29m - June 2022) are around double the current market cap.

Broker forecasts suggest positive adjusted PBT in the current year.

However:

The company’s repeated emphasis of a meaningless EBITDA number is a turn-off.

It has never made a reported profit and even in FY 2024, adjusted PBT is only estimated at £1m. Meaningful unadjusted profits might not be seen until FY 2025.

As a capital-intensive business in a highly competitive sector, there are arguments to be made that it should trade cheaply. Particularly while it's still subscale at less than 20 sites.

For these reasons, I’ll sit on the fence. I do think this is an interesting one and could be worth researching in further detail.

McBride (LON:MCB)

Share price: 24.4p (+1.7%)

Market cap: £42m

I wrote a negative comment on McBride when it gave us the H1 update in January.

Let’s see how the interim results have panned out in reality:

Revenues +30% at constant FX to £426m

Operating loss £2.6m (improved from an operating loss of £14.7m in H1 last year).

Pre-tax loss £20m (pre-tax loss £16.8m in H1 last year).

The difference between the £2.6m operating loss and the £20m pre-tax loss is explained by enormous finance costs of £17.4m.

This figure includes:

£6.6m of “non-exceptional” finance costs, i.e. interest on the debt load.

£10.8m of exceptional charges - “costs incurred in respect of an independent business review and refinancing work completed in September 2022”.

So if we ignore those exceptional charges, the pre-tax loss for the six-month period is “only” around £9m.

Outlook - the company expects “a stronger operating margin performance and hence a return to adjusted operating profit in the second half of the year”. The CEO mentions that positive adjusted operating profit was achieved in the last two months of H1 (note that this is before interest costs).

Going concern - net debt finished the calendar year at £169m.

Only around £10m of this is lease liabilities, i.e. it is mostly financial debt.

That’s a lot of debt to carry for a loss-making producer of commoditised cleaning products. So it’s hardly a surprise to find that there are “going concern” questions.

Let’s dig into this a little. Here’s an excerpt from the going concern note:

The rapid and unprecedented rise in input costs and the ongoing macroeconomic supply chain challenges as a result of the Covid-19 pandemic have had a negative effect on the financial performance of the Group and has cast a degree of uncertainty as to the future financial performance and cash flows of the Group. In particular, the Group's inability to immediately offset the significant input cost inflation by raising prices at which its products are sold to private label customers has resulted in a significant deterioration of the Group's profitability.

As we previously reported, a revised lender agreement puts off certain covenant tests until 2024. It also forbids dividends unless certain conditions are met.

In a “severe but plausible downside risk scenario” envisaged by the Directors:

…the Group would incur a covenant breach and a liquidity shortfall. In this downside risk scenario, the Group would therefore need to obtain a covenant waiver and increase its funding facilities compared to those that are currently committed, to ensure that the business can meet its obligations for the next 18 months.

As a result, there is a material uncertainty around McBride’s ability to continue as a going concern.

I don’t need to read any more. This is way too risky for me, and I see few signs of quality even if it recovers from its debt burden. So it gets the thumbs down from me. I still don’t understand why the market cap remains above £40m.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.