Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

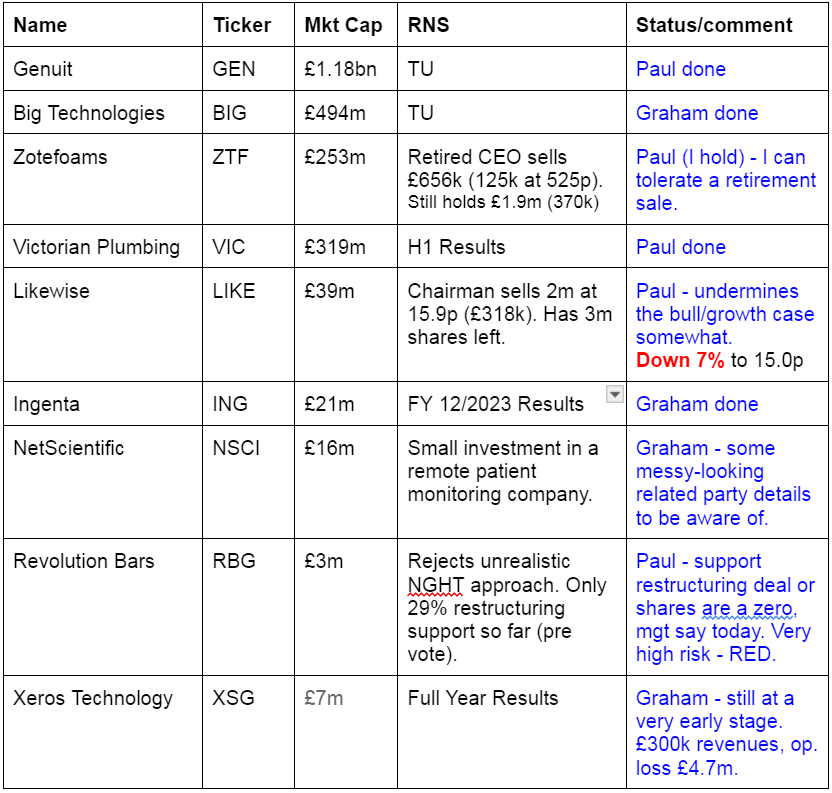

Companies Reporting Today

Quiet today, presumably lots of people on holiday this week. We've had to pad out the list a bit -

Summaries

Victorian Plumbing (LON:VIC) - down 3% to 94p (£309m) - Half Year Results - Paul - AMBER

Good H1 results, with adj PBT up 40%. However the full year outlook is only broadly in line, with some hesitant-sounding comments about current trading. I think this is a good business, but overall shares seem priced about right for now.

Ingenta (LON:ING) - up 4% to 152.5p (£22m) - Final Results - Graham - AMBER/GREEN

Decent results from this small software company/consultancy that serves the publishing industry. It stands out as a conservatively-run small-cap with cash on the balance sheet, no debt and a stream of dividends. Due to its lack of growth (historically and in the forecasts), I prefer AMBER/GREEN to GREEN.

Genuit (LON:GEN) - down 1% to 468p (£1.16bn) - Trading Update [in line] - Paul - AMBER

AGM update is only in line with expectations, and based on cost-cutting and margin improvements, offsetting revenue declines. Looks well set up for a cyclical recovery, but no longer a bargain after a c.50% rise from last autumn's lows. So I'm shifting down from amber/green to AMBER, to reflect the forecast PER having gone up from 12x to 18x.

Big Technologies (LON:BIG) - down 2% to 167p (£485m) - AGM Statement - Graham - AMBER

It’s an in-line update from this provider of electronic tags to the justice sector and fall alarms for the elderly. This share offers an enormous net cash position (£86m, Dec 2023) and healthy profitability. However, I do have one or two concerns, which includes a demanding valuation at this level.

Paul’s Section:

Victorian Plumbing (LON:VIC)

Down 3% to 94p (£309m) - Half Year Results - Paul - AMBER

Victorian Plumbing Group plc ("Victorian Plumbing", the "Group"), the UK's leading bathroom retailer(1), announces its half year results for the six months ended 31 March 2024 ("H1 2024").

(1) Mintel (2023) Bathrooms & Bathrooms Accessories UK.

The highlights table below for H1 looks good to me - with revenue slightly down, but a good improvement in gross margin from 46% to 50% (helped by own brand sales, and lower shipping costs) resulting in an impressive 40% rise in H1 adj PBT -

Marketing spend is still massive, at 29% of revenue. If only they could figure out a way of building customer loyalty, so they don’t need to spend so much to attract each customer order?

Outlook - sounds a little hesitant to me (below), so I can see why some punters might have decided to bank their recent profits this morning. I think a forward PER of 17.8x (per the StockReport) needs a more upbeat commentary than this -

Current trading and outlook

As customers continue to seek value, demand for 'big ticket' discretionary items is unchanged. The Group has continued to take market share organically; LFL revenue in April and the early part of May 2024 has been in line with H1 2024 trends, with order volume growth offset by lower AOVs.

The decline in AOV has shown early signs of levelling off, indicative of a slowdown in the shift by consumers to buy more of our own brand product range. Additionally, comparative shipping cost tailwinds have diminished over recent weeks, with both factors stabilising gross margin.

Looking forward, the Group will benefit from revenue growth as a result of further market share gains from the acquisition of Victoria Plum, albeit tempered by a continuation of recent trading trends in the market. While the ongoing Victoria Plum cost reduction programme is finalised, losses from the business will have a marginal impact on Group profitability in H2 2024, therefore adjusted EBITDA in FY 2024 is expected to be broadly in line with current consensus. The Acquisition is expected to be EPS accretive from FY 2025. Net cash (excluding IFRS 16) at the full year is expected to be in the range of £5m to £7m, reflecting the impact of the Acquisition and investment in the DC.

Broker forecasts - nothing available for us plebs! Given that the trend for consensus forecast (data we do have available to us, on the StockReport) is clearly downwards, and that today’s outlook is only broadly in line (slightly below), then I’d say the likelihood of the premium brokers slipping out a further small decrease in forecasts is probably >50%, but that’s just educated guesswork -

Balance sheet - note that fixed assets are rising fast (from a small base) which is due to building a new, large distribution centre, which it says will remove capacity constraints. Hence the “assets under construction” line in note 10 now has net book value of £15.5m. I wonder if this is freehold or leasehold? Maybe someone could ask, if they do a webinar? Ah I think I’ve answered my own question, as the lease entries on the balance sheet have shot up (RoU assets up from £4.1m a year ago to £48.5m at 31/3/2024), which suggests the new dist centre must be leasehold. Pity, but never mind.

The rest of the balance sheet looks fine, but bear in mind the £36m cash pile will be mainly gone by 9/2024 year end, since they spent £22.5m on buying Victoria Plum. If I make manual adjustments for that acquisition, the balance sheet will still look OK, although with the surplus cash moved up into intangible assets (goodwill) and increased stockholdings probably. No cause for alarm though, it should be fine.

Cashflow statement - looks OK, although note that it’s capitalising increased amounts of IT spend into intangible assets, £2.0m in H1. That’s c.22% of operating cashflow. The main cash outflow was £12.4m spent on physical capex, being the fit-out of the new dist centre, so let’s hope they generate a decent enough return from this capex to make it worthwhile. The size of the capex suggests to me it’s not just a shed with racking and forklifts in it, they must be spending on automated systems to hopefully make it more efficient. That would be an interesting area to hear management give us more colour. It’s on time, and on budget they say, to commence operations fairly soon. Sorry, I’ve just found the detail on it - so yes a 20-year leased site, and “semi-automated”.

Dividends are now only small, as the surplus cash has been spent on the big new distribution centre capex, and acquiring Victoria Plum. That’s fine, investors are looking for growth more than income at this type of share I think.

Paul’s opinion - I think this is a fundamentally good business. However the shares look priced up with events, hence I’m comfortable at AMBER for now. It’s almost amber/green though. After many years of attributing very high valuations to eCommerce businesses, that era now seems over, and they’re being valued like normal companies. Hence I think a forward PER of 17.8x looks about right for VIC. Why pay more? That said, once the economy is recovering more strongly, and they’ve bolted on Victoria Plum, maybe there’s upside on FY 9/2025 forecast numbers and beyond? I’ll keep an eye on it. A dip, maybe on a mild profit warning in future, could be a buying opportunity maybe, but I don’t see the current price as being attractive enough to tempt me in.

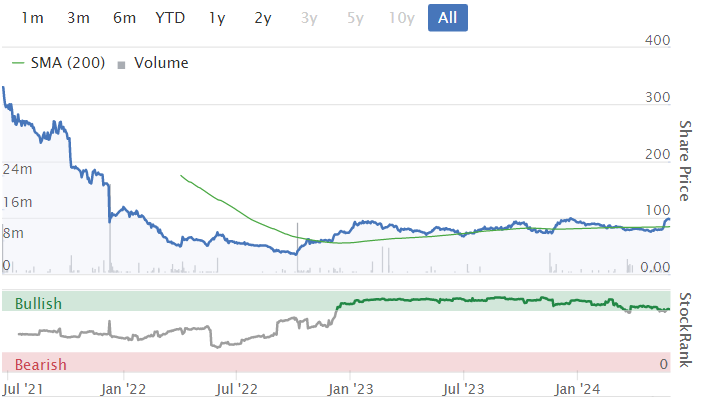

A seriously over-priced 2021 float, but finding its feet now at a more sensible valuation -

Genuit (LON:GEN)

Down 1% to 468p (£1.16bn) - Trading Update [in line] - Paul - AMBER

Genuit, the UK's largest provider of sustainable water, climate and ventilation solutions for the built environment, today issues an update on trading for the four months ended 30 April 2024 ahead of its Annual General Meeting ("AGM")...

Genuit used to be called Polypipe. I recall being moderately positive on this share with AMBER/GREEN here on 17/11/2023 at 315p, flagging the value at 12.3x PER, 3.9% divis, and a “marginally ahead” trading update.

It’s since risen c.49% in share price, so is it still good value?

Today’s update strikes me as lacklustre, given that GEN shares have considerably re-rated. I’d be looking for an ahead of expectations update to support a forward PER which is now 18.0x.

Instead we’re told for FY 12/2024 -

No change to management's full year earnings expectations

4 month revenue to end April 2024 is down 8.6% vs LY, blamed on soft markets.

It seems to be compensating for lower demand through costs & margins -

We are continuing to benefit from our focus on business simplification, continuous operational improvement and product innovation which is driving an improved operating margin.

Markets seem very relaxed about this, and seem to be anticipating recovery -

Genuit is in a strong position to benefit from the normalisation of volumes as markets recover, and we continue to see growth potential in our markets due to the structural sustainability drivers to which we are exposed."

… Genuit is on track to deliver the previously announced £15m of annualised savings from this programme, and will realise further productivity gains through the ongoing rollout of the GBS.

Upgrade cycle? This is the big question generally for construction, and related cyclical companies. Numerous companies are telling us that markets should improve in 2025. Although broker forecasts often lag behind these recoveries, presenting good opportunities for us at this stage in the cycle. That seems to be very much what the GEN share price has done, anticipating a not-yet-forecast recovery.

Paul’s opinion - the forward PER could turn out to be less than 18.0x, once brokers begin raising forecasts. But we need to see ahead of expectations updates, instead of the in line one provided by GEN today.

I think there are possibly better bargains at the smaller cap end of this sector, where you can still find some good potential recovery shares on much lower forward PERs than this.

Genuit looks a decent quality business, making a decent operating profit margin, suggesting it has some pricing power. For me though, the obvious value last time at 315p has been recognised by a share price rise to 468p, so I can’t see value here any more. For that reason I’m reducing from amber/green to AMBER.

Note also that the share count has risen from 202m to 249m over the chart period below -

Graham’s Section:

Ingenta (LON:ING)

Up 4% to 152.5p (£22m) - Final Results - Graham - AMBER/GREEN

Ingenta plc (AIM: ING) a leading software and services provider to the publishing and media industries, announces its final audited results for the year ended 31 December 2023.

We haven’t covered this one since 2022, when the company again published its annual results at a considerable delay: results to December 2021 were not published until nearly the end of June 2022!

It seems that the company is on a slightly tighter schedule this year, publishing 2023 results at the end of May 2024.

The share price has done well over the past two years:

Here are today’s full-year results highlights:

Revenue +3% to £10.8m

Annual recurring revenue £8.7m (last year: £9m)

Adj. EBITDA £2.2m (last year: £2.3m)

Net profit £2.3m (last year: £1.8m)

You may notice that the net profit figure is surprisingly large vs. adj. EBITDA. This is due to modest depreciation/amortisation charges and the company benefiting from tax credits.

Dividend: the full-year dividend is 4.1p. Ingenta has an impressive track record for dividends, for a company of this size:

Cash increased slightly during the year to £2.7m. Speaking of the balance sheet, Ingenta has tangible equity of £3m, approximately matching the cash balance, and zero borrowings.

Operational highlights: the company highlights a couple of new customers and “go-lives”. This is a B2B company and so the numbers of new customers can seem alarmingly small but I suppose it goes with the territory.

Current trading: in line with expectations. A very important piece of information, as we are already five months into 2024! But it all sounds fine, with “a strong pipeline of project work being built for later in the year”. The outlook section also mentions that the company will consider potential acquisitions, although they do expect to see opportunities for organic growth.

CEO’s comment:

"It is pleasing to see the Company continuing its progression on an upward trajectory. The expansion of our web-based content platform has been critical to driving growth, and the continued expansion of our IP product into new markets which is now in use in five countries has demonstrated the offering and the adaptability of our Commercial product to meet new markets.

Continued growth and expansion of our customer base will be the primary focus in 2024. Having won a number of key new customer accounts, and demonstrated that with our streamlined operating structure we can deliver new business more profitably, we are expecting any new future revenues to make a substantial contribution to our profits and cash flows."

Graham’s view

The financials are all very reasonable, as they were when I studied the company two years ago. I noted then that the company had been around for many years, but had failed to make much progress in terms of market cap.

Important context here is that the company has a 28% shareholder in the form of its Chairman:

Judging by his CV, Mr. Rose appears to be involved with a number of different businesses but Ingenta is one that he has been involved with since 1999.

Ingenta has rarely increased its share count, pays a dividend and has a solid balance sheet - all signs of a business where management are heavily aligned with existing shareholders and are eager to earn a return from the business itself, instead of earning a living through fundraisings.

It’s tempting to give this one the green light but the lack of growth over the long-term is holding me back. The StockReport forecasts suggest that muted revenue growth (4%) is expected again this year.

In summary: this seems to be a successful business in the content management space with good financials, a decent long-term track record, a sound balance sheet and well-aligned management. If I could get excited about growth prospects I’d be willing to pay a high multiple for it. However, it’s been around for a long time and has experienced only very limited growth during most of its life, and that remains the case currently. Therefore, I’m AMBER/GREEN at this level.

Big Technologies (LON:BIG)

Down 2% to 167p (£485m) - AGM Statement - Graham - AMBER

Big Technologies plc, the UK-based, remote people monitoring technology company provides the following trading update ahead of its Annual General Meeting ("AGM") in London later today.

This is a 2021 IPO that issued a profit warning in January (covered by Paul), on the loss of a major contract.

As you would expect from stocks of the 2021 vintage, BIG has been a poor share to hold since IPO.

However, it is up about 60% from the low it hit on the day of the January profit warning, so perhaps it may have hit the bottom already?

Here is the latest from today’s AGM update, which is in line with expectations.

Revenue £18.5m in first four months of the year (2023: same).

H2 revenues will be lower due to the loss of the contract announced in January.

“Overall, the forward visibility from our core global customer base remains excellent - 86% of the revenue from our largest customers is contracted beyond the end of 2026.”

Forecasts: the 2024 revenue forecast is £51.4m, down from last year.

The 2024 adj. EBITDA forecast is £27m to £29.5m (last year: £33m), implying healthy profit margins on sales.

Actual operating profit last year was £16.8m; I’d expect another wide gulf this year between adj. EBITDA and operating profit.

As an aside, I feel compelled to point out that share-based payments have been huge in each of the past two years (the cost of these payments is excluded from adj. EBITDA).

2023 is on the left, 2022 on the right:

The share-based bonus schemes “were established to reward and incentivise the senior management team and employees to deliver share price growth”.

If the share price had soared in 2022 and 2023, it would be a little easier to defend these payments. This is how the share has actually performed:

Medium-term outlook:

Drivers for continued growth across both sectors remain strong in the medium-term. With our clear strategy and market-leading products, we are well positioned to generate strong cash flow and expect a return to growth in 2025 and beyond.

Here “both sectors” refers to the criminal justice sector (tagging offenders) and remote care (fall alarms for the elderly).

Graham’s view

I’m neutral on this. The company itself is profitable and should have some growth prospects again next year when the contract it lost is less influential in the comparatives. Electronic tags and fall alarms strike me as highly investable products.

I also note that the company finished 2023 with an extraordinary net cash position of £86m, covering nearly a fifth of the market cap.

However, the size of the share-based payments has spooked me, and the earnings-based valuation multiples are rather demanding.

Price to sales is 9x, or about 7.5x if you adjust for the cash balance.

The StockRanks see a high-quality company but with little value on offer:

I should note in passing that the CEO is a 25% shareholder, and she was buying shares outright (not exercising options) in January this year, with a £300k+ purchase. Her business dealings and certain legal claims have been scrutinised by journalists at The Times this year (1, 2)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.