Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Very thin pickings today, I'm afraid -

Summaries

Dalata Hotel (LON:DAL) - 374p (unchanged) (£787m/€900m) - Half Year Report - Graham - GREEN

Strong results from this Irish/UK hotel chain with significant improvements in revenues, room rates and occupancy. A comparison with pre-Covid margins suggests that we are fully back to normal here. This is a dividend payer once again and I think it deserves a second look.

Pelatro (LON:PTRO) - Down 79% to 0.668p (£0.6m) - Delisting - Paul - RED

Nanocap software company announces it is to delist. I run through the issues below, and a checklist of warning signs that might indicate a delisting is likely at many other tiny listed companies. Expect a continued mass exodus.

Liontrust Asset Management (LON:LIO) - up 2% to 670.95p (£435m) - Offer for GAM - Graham - GREEN

These shares are up 10% over the past week as news has emerged that the proposed acquisition of Swiss fund manager GAM has met with rejection by GAM shareholders. GAM’s largest shareholder had pledged to support it, but it seems that few other GAM shareholders were keen on the deal (which did seem to be extraordinarily cheap relative to the amount of assets that would be taken over).

I took a neutral view on the planned deal, thinking that the expected synergies and the bump in AUM (from around £30bn to around £50bn) might ultimately benefit Liontrust shareholders. In the short term, however, there would likely be a great deal of complexity, risk and one-off costs of integration. All of those issues are now off the table and the Liontrust investment thesis can go back to being a simple one of cheapness and equity market recovery.

The Liontrust CEO has made a statement admitting defeat, defending the offer made to GAM, and reiterating Liontrust’s strategy to (among other things) diversify its product range.

This isn’t my top share pick in the fund management sector but I continue to view it as very cheap. The StockReport puts it on a PER of 8x with a dividend yield of nearly 11%. [no section below]

Batm Advanced Communications (LON:BVC) - Up 3% to 26.8p (£116m) - Interim Results - Paul - AMBER/RED

There's a good increase in profit, and a perky outlook statement. Although I question whether these figures justify a valuation anywhere near £116m. Bulls are obviously optimistic about the future, and think the big forecast profit increases for 2024 & 2025 might be achievable. A strange, apparently strong balance sheet, but why no divis, if it's rolling in cash? I'm not keen.

Paul’s Section:

£PTRO

Down 79% to 0.668p (£0.6m) - Paul - RED

Proposes cancelling its AIM listing.

This comment is just to close the file on this minnow, which offers marketing software to telcos. We haven’t covered it here since 2019, when it looked half-decent, but performance since the pandemic has badly deteriorated, so it wasn't worth covering here.

The shareholding structure shows that 2 dominant holders control nearly half the company, which heightens the risk of a delisting.

It mentions other reasons for delisting, many of which apply to other nanocaps, so I expect we’ll see many more delistings -

Considerable cost,

Management time,

Legal & regulatory burdens,

Inability to access capital.

Hence it sees these costs as being disproportionate to the benefits of a listing.

Once it delists, a matched bargain facility will be provided to enable shareholders to possibly buy or sell.

Paul’s opinion - I see it as a positive thing that tiny companies which have failed to live up to expectations exit the UK stock market. Many shouldn’t have listed in the first place. A smaller market, but with better quality companies, is what I hope we end up with after the current bear market ends.

The key thing is that we don’t end up holding shares which decide to delist, as they typically crash 50%+ on the announcement. The warning signs (off the top of my head) are -

Tiny market cap - anything below £10m must be a high delisting risk.

Poor financial performance.

Shortage of cash - maintaining a listing costs hundreds of £k’s each year, and is a big hassle. Tiny, loss-making companies can’t afford these costs, especially if they’re running low on cash.

Dominant major shareholders - if a handful of holders own over 50%, then there’s not a lot of point in having a listing, and they often decide to take it private, leaving small shareholders high & dry, and nursing a big loss.

A stale story that nobody’s interested in any more.

Few shares traded.

Lack of access to funding - poorly performing companies are probably finding it difficult to impossible to raise fresh funds from the stock market, in this bear market.

So it’s worth reviewing our portfolios to see if we hold anything that ticks those boxes. As small shareholders, we can exit - but it might involve having to take a haircut on price, and sell in tranches over a few days/weeks. The institutions can’t sell, they’re completely stuck in many embarrassingly poor companies. Hence we have a big advantage, so I’m being much more ruthless about dumping my mistakes these days. It’s such a relief getting mistakes off the screen too, so you don’t have to worry any more. Even if it’s just a few hundred quid, it’s worth salvaging something I think.

Some investors are able to hold shares in private companies, and I have heard of delisted companies subsequently doing well, occasionally. If any readers have any insights into delisted companies that you have held, then I'd be interested to hear of your experiences in the comment section below.

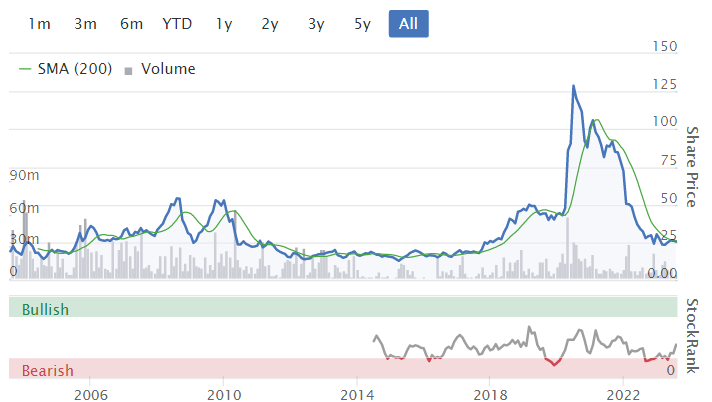

Batm Advanced Communications (LON:BVC)

Up 3% to 26.8p (£116m) - Interim Results - Paul - AMBER/RED

We’ve not looked at this Israeli group so far in 2023. Looking at our previous notes, it did well in the pandemic, and boosted profits from a disposal. Shares have done a big round-trip in the pandemic, and previously went nowhere for years -

This share has been listed in the main UK market for many years, which helps reduce my anxiety about overseas small caps listed in London (many of which go badly wrong). Dividends have been very sparse over the years - which seems odd, given the large cash pile.

BATM (LSE: BVC; TASE: BVC), a leading provider of real-time technologies for networking solutions and medical laboratory systems, announces its interim results for the six months ended 30 June 2023.

Key numbers for H1 -

Revenue $60.2m (up 5%)

Profit before tax $2.3m (up 130% - very nice) - NB this is adjusted, and excludes goodwill amortisation and share based payments. Statutory PBT is only $0.7m.

Basic EPS $0.39 (up 225%)

Dividends - were paid last year, but seem to have stopped. Why no divis this year, given how strong the balance sheet appears?

Outlook - is in line with expectations -

"Looking ahead, we have entered the second half of the year in a better position than at the same point last year, with sustained revenue momentum and a higher backlog. We expect to deliver year-on-year growth in Networking, with increased revenues from both carrier ethernet and Edgility. Our cyber business revenues are expected to be higher in the second half than in H1 as we ramp up delivery of our large contract won earlier this year. Our Bio-Medical division is also expected to continue to increase sales. As a result, we expect to report year-on-year growth for 2023, in line with market expectations."

The Group continues to have a strong balance sheet as well as property and valuable IP. Accordingly, the Board remains confident in the Group's prospects and looks forward to reporting on its progress.

Balance sheet - looks a bit strange to me.

NAV is $116m. I always deduct intangible assets, which total $19m here. Also there’s a $16m investment in a JV and associate, which it’s safest to write off. That gets me to NTAV of $81m, which seems very strong.

This includes $33.7m cash, plus $8.2m “short term investment in deposits and other securities”, which sounds like it’s near-cash. So that’s $41.9m cash. Yet it also has $5.6m in “short term bank credit”. Why? Surely if it’s sitting on so much cash, there wouldn’t be any need to have bank credit showing as a liability.

Receivables $34m, and inventories of $37m both look quite high, compared with revenues in H1 were $60m.

Shareholding structure - is dominated by Lombard Odier on 28.9%, and the founder (who recently retired) Zvi Marom, holding 22.2%. Possible delisting risk there, if the 2 big holders decide to take it private? It would be interesting to hear Lombard Odier’s take on things, and why they hold such a large position, and seem to have added to it in Dec 2022.

Valuation - many thanks to Shore Capital, for publishing an update note today on Research Tree.

Shore forecasts revenue of $131.6m, and adj PBT $3.4m for FY 12/2023.

Given that it has already done $2.3m in H1, and the outlook sounds perky about H2, it looks to me as if a beat against market expectations could be in the pipeline possibly?

The PER works out at a sky high 82x for 2023 forecasts, so it really does need to thrash that forecast.

Big rises in profit to $6.9m, and $16.1m in 2024 and 2025 are forecast. How realistic is such a massive jump in profitability? Are you happy paying up-front for it?

Paul’s opinion - the valuation looks punchy to me, and I’m not happy with the lack of divis for a company that claims to be so cash-rich.

So I think bulls would need to understand, and be very positive, about its products and future prospects. I’ve not looked into that. Just based on these numbers, I’m struggling to justify the valuation.

Overall, I see this share mildly negatively, so I’ll go AMBER/RED. If it does deliver on the big jump in forecast profits for 2024 & 2025, and does something useful with the cash pile, then I’d see it more positively, so we’ll keep an open mind.

Graham’s Section:

Volvere (LON:VLE)

Share price: 1052p (-12%)

Market cap: £26m

(Graham has a long position in Volvere)

This RNS has come as a complete shock to me and I’m sure to many others:

Volvere plc (AIM: VLE), the growth and turnaround investment company, announces with great sadness that its Chief Executive, Jonathan Lander, died peacefully after a short illness fought with much courage, on 28 August 2023, surrounded by his family.

I only met Jonathan Lander in person on a few occasions - at a couple of AGMs, and at a Mello presentation. But I’ve been studying his work for many years. Of course I would not have made Volvere the largest holding in my personal portfolio, and left it there, if I did not rate Mr. Lander extremely highly, both in terms of his intelligence and his integrity.

In every interaction I had with him, he was generous with his time and a pleasure to deal with. I believe that like us, he viewed investing as something that was not just a career but also something that was fun and interesting. I would always learn something new when he spoke. In many ways I would say that he was a credit to the financial industry and to the City.

Besides his personal qualities, Jonathan and his brother built a company with a tremendous long-term track record. He achieved truly astonishing success and it was well-deserved. He had all of the personal characteristics needed: patience, analytical skills, and unquestionable trustworthiness.

I can’t believe that I won’t get to hear him speak again. My sincere condolences to his brother Nick and to all of his family and friends.

Nick Lander, COO:

"As shareholders and staff will understand, it is with almost unimaginable personal grief and the heaviest of hearts that I write this. Jonathan was not only my business partner for more than 23 years but also my brother and best friend. He was a rare blend of so many qualities - visionary and challenging but always fair. His leadership of the Group was focused on enabling those around him, and throughout the Group's businesses, to achieve their personal and collective potential. This ensured that our shareholders, employees, and our former employees achieved the returns and rewards that they have over such a long period…

"Jonathan leaves in place a strong team with extensive, loyal service to the Group. I know that, in this moment of great loss, the Volvere team will do what Jonathan would expect - to support each other and preserve his legacy.

"For me, this moment is about remembering Jonathan and all that we tackled together - always with a sense of fun - both as brothers and colleagues. His wife and three children, as well as our parents are, and will continue to be, in our thoughts and prayers."

I don’t feel that it would be appropriate to comment further at this time. Rest in Peace.

Dalata Hotel (LON:DAL)

Share price: 374p (unch)

Market cap: £787m (c. €900m)

Dalata Hotel Group plc (‘Dalata’ or the ‘Group’), the largest hotel operator in Ireland, with a growing presence in the United Kingdom and continental Europe, announces its results for the six-month period ended 30 June 2023.

It’s nice to see this hotel group performing well: revenues are up 29%, although there is no increase in PBT (€50.4 million in H1 this year, vs. €52m in H1 last year). Having checked the footnotes, I think the primary reason for this is that last year’s results benefited from more positive property revaluations going through the P&L:

Operationally, occupancy is up from 70% to 78% (using rounded figures) and the average room rate is up 10%, which is reasonable given inflation.

The combination of higher occupancy and higher prices means a 23% increase in revenue per available room. Excellent!

Dividend: we have a 4 cent dividend per share, the first one since pre-Covid.

Gearing: sounds low with 11% LTV (using net debt).

Gross borrowings on the balance sheet are €265m, plus another €657m of lease liabilities (these are measured at their present value). So the balance sheet paints a slightly different picture than the 11% LTV quoted by the company. About 55% of the company’s assets are financed by equity, with the rest being mostly financed by leases and financial debt.

Overall, the company seems to be financed in a conservative way. Rate risk on their outstanding term loan is hedged until October next year. Importantly, most (31) of their 52 hotels are owned outright.

Balance sheet equity is €1,347 million (£1.15 billion), nearly all of it tangible, offering a good premium over the market cap. They have gained from the further revaluation of properties over the past six months, and of course readers may differ on whether hotels have increased in value over this time!

Properties: they have added two London hotels so far this year, and Maldron Hotel Shoreditch will be ready in Q2 2024.

Outlook: after a “very successful start”, they are “optimistic” for the remainder of the year.

Gas/electric is 80% fixed until December 2024, with a cost reduction expected in H2 vs. H1.

On travel numbers:

Recovery of international travel, including resurgent UK Airport traffic statistics and record numbers at Dublin Airport, provides a positive backdrop for the markets in which we operate. While we continue to monitor potential slowdowns in demand as a result of high inflation levels, we are not seeing any such indicators.

CEO comment is very positive, describing performance as “exceptional” and pointing out that the “EBITDAR” margin (EBITDA also excluding interest on lease liabilities) has improved by 1% compared to 2019.

Graham’s view

We don’t discuss this one very often (last mentioned August 2022) but as a customer I’m a fan of the Clayton brand. I haven’t stayed in a Maldron but the reviews I’ve seen of hotels under that brand are also very positive.

As an investment, I continue to think that this looks interesting. It’s still not particularly expensive either on earnings or in relation to the balance sheet (true balance sheet value is of course highly uncertain).

Stockopedia’s computers have noticed some attractions:

It’s now paying a dividend again, in a strong sign of a return to post-Covid financial stability.

Trading at a PER of about 10x, without excessive leverage, and with interest rate and gas/electricity price risks seeming carefully managed, I’ll take a positive view on this.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.