Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

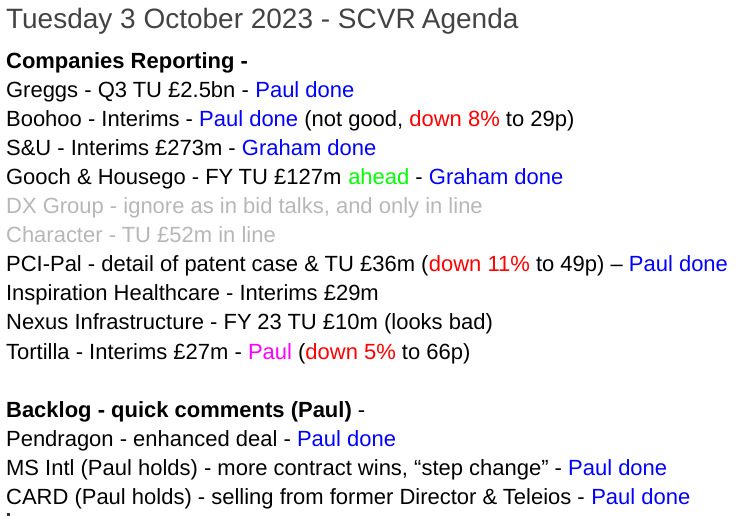

A nice comfortable workload today, we should be able to cover most/all of these. Note we're tending to grey out "in line" statements, as there's nothing much of interest in those -

Summaries

Not a small cap but ...

Greggs (LON:GRG) - 2478p (pre-market) £2.5bn - Q3 Trading Update - Paul - AMBER

As always very impressive, and with interesting sector read-across. "Strong trading continues" in Q3, and "Inflation beginning to ease", as it annualises the large % food/drink cost increases in 2022. Superb LFL revenue performance in Q3 of +14.2% - wow! Store opening programme continues wiith c.140 net new stores this year. Only in line with full year expectations, but it says this is because the Q4 2022 comps are very strong. Paul's opinion - a fabulous business, doing well when almost everything else is struggling. Their secret sauce? I'd say - low prices, ramming through high volumes, decent enough quality, not much direct competition, and constant innovation. Are the shares attractive? Not really no, as it's already priced in: PER 20.9x, 2.4% yield - would you want to chase it any higher? Only if you think it can smash forecasts. For me then, I admire the business very much, but shares are fully priced. [no section below].

Pendragon (LON:PDG) - up 5% y’day to 35p (£490m) - Improved Lithia deal - Paul

A big increase in the terms of the deal with Lithia, to sell the core car dealership business. Lithia has upped the price by 42% to £397m, which confirms out earlier thinking that the original deal undervalued the core business (calling into question management competence). The proposed 16p dividend is upped to 24.5p. The implied total value is 35.4p, but that’s using an arbitrary valuation of the Pinewood Tech software business. I still think shareholders might prefer a clean cash takeover for the whole thing, but we’ll soon find out from the shareholder vote. Exciting times for PDG shareholders - well done! I’m pleased to say we flagged it here as an interesting trade at c.16p, when Odey's forced selling caused a spike down in price. [no section below]

MS International (LON:MSI) (Paul holds) - 780p (£127m) - Contract wins - Paul - GREEN

Just in case you missed it, the military contract wins are coming thick and fast, mainly from the US armed forces. A $15.8m contract with the US navy was announced yesterday. On 29 Sept, this announcement was a $23.5m contract also with the US navy. Here on 1 Sept saw a maintenance contract, also with the US navy.

Note the company’s comments (it’s not given to hyperbole, so I’m taking this seriously) -

“We perceive that we are achieving a significant upward step change in the further development of the Company that will again bring additional rewards and success for the business".

This contract is further confirmation of that upward step change.”

Paul’s opinion - so far, so good. This share is rather under the radar, because there aren’t any broker forecasts, so it doesn’t come up on many value or growth screens. But big (good) things seem to be happening, especially at its military division. It depends what the profit margin is on these contracts, which I don’t know. Combine that with upbeat Directorspeak, and the signs are looking good, so I’m holding very tight onto my own personal MSI shareholdings, and will run it, and see what happens over the next year or two. Shares are illiquid, and can be volatile. [no section below]

Card Factory (LON:CARD) (Paul holds) - 102p (£348m) - Major shareholders selling - Paul - GREEN

A much-discussed value retailer of greetings cards & gifts, which seems to be trading very well, and shares attractively priced. However, there’s little doubt that the major shareholder Teleios dumping shares clumsily in the market seems to be preventing the share price from breaking upwards from 100p. Also, I think maybe some short term traders bailed out on results day recently, when it dropped 10% for no fundamental reason that I could see. The latest update said Teleios still has 40.1m shares, 11.7% of the company. If that is all going to be dribbled out into the market, then there seems only a slim chance of the share price going anywhere for now, which of course doesn’t matter to medium-long term investors, but it’s still annoying. Yesterday, I spotted that Stuart Middleton had reduced from 3.8% to 2.6%. Googling him, he’s the former Creative Director of CARD. Distinctly unhelpful, and it does raise the worry as to whether these bigger shareholders know something we don’t? Some good readers comments here in the last week, thank you for your interesting & varied views. We don’t want to slip into group-think, so appreciate a variety of opinions. [no section below]

Gooch & Housego (LON:GHH) - up 5% at 523p (£135m) - Full Year Trading Update (ahead) - Graham - GREEN

I’m tentatively giving this one the thumbs up on the back of a positive trading update. Revenues are ahead of expectations and the profit forecast gets a slight boost. Acquisitions are bedding in. I’d really like to see an operating margin of 10%+ here in the next few years.

Boohoo (LON:BOO) - down 10% to 28.4p (£360m) - Interim Results - Paul - AMBER

Lacklustre H1 results, positive EBITDA, but here in the real world, the important numbers are a loss before tax, and negative cashflow. Balance sheet & liquidity look fine, providing the RCF remains in place. I discuss the pros and cons in more detail below.

S&U (LON:SUS) - up 1% at £22.74 (£276m) - Interim Results - Graham - GREEN

The key numbers here were already flagged by the H1 update. Profits are up despite a large increase in the interest bill and softness in collections at the motor finance division. Property bridging continues to grow well. At an 8x multiple I continue to view this as attractive.

PCI- PAL (LON:PCIP) - down 13% to 48p (£31m) - Patent detail & trading update - Paul - GREEN

What a pity that PCIP slips out a forecast downgrade without mentioning it at all in the positive sounding RNS! Seems deceptive to me. Despite this, I think the positives outweigh the negatives, and with breakeven approaching this year FY 6/2024, and the patent case hopefully now behind it, then risk:reward looks better than ever before in my opinion.

Paul’s Section:

Boohoo (LON:BOO)

Down 10% to 28.4p (£360m) - Interim Results - Paul - AMBER

My love affair with this fast fashion eCommerce business ended a long time ago, and looking back to previous reports this year, we’ve been either AMBER or RED on Boohoo.

With hindsight, the main problem facing fast fashion businesses is that Chinese (unfair) competitor Shein is under-cutting them on price, by using cheap labour, and then exploiting the small packets exemption from import duty, selling individual parcels direct to consumers. Hardly any investors spotted this threat to Boohoo, instead obsessing over completely irrelevant factors such as ESG, which had little to no bearing on performance. Meanwhile Shein was quietly eating Boohoo’s lunch, something which I only spotted too late.

Although Boohoo does have one key advantage over Shein - namely speed of delivery, next day, whereas ordering from Shein typically involves 1-2 week wait - not much use if you’re impulse shopping for an outfit to wear out the next evening.

Shein seems determined to wipe out the competition, hence why I’ve completely give up on this fast fashion, cheap end of the sector, which doesn’t really interest me at all any more.

Sosandar (LON:SOS) (I hold) is a different matter altogether, with a more affluent customer who I doubt would order anything cheap direct from China, but even then, we can’t be sure that will always remain the case.

H1 figures today from BOO are for 6m to 31 Aug 2023. I’m not going to spend much time on it, as the figures have not impressed.

Revenue down 17% to £729m

Gross margin slightly up to 53.4% (H1 LY: 52.5%)

Adj EBITDA doesn’t interest me, as it’s not a real profit figure, but it’s £31.3m (down 12%)

Adj PBT is more relevant, and this is poor, at a £(9.1)m loss (down from £6.2m profit H1 LY)

Statutory loss before tax is £(26.4)m.

All of that is pretty poor I’d say.

Share based payments of £11.2m stands out as inappropriate, given the shareholder value destruction in recent years.

Exceptional costs, adjusted out, of £10.2m look dubious to me, being warehouse & IT costs.

Cashflow - not good, with a net cash outflow of £(40.9)m. Note quite heavy capex of £36.3m in H1, which is greater than operating cashflow of £21.8m.

Outlook - expecting revenues for FY 2/2024 to be down by 12-17%. I wouldn’t obsess too much on revenues, as eCommerce fashion companies should be focusing on profitable customers, and letting go of customers who are eg. serial returners of product. So I can tolerate reduced revenues, if it helps profitability, and is being done deliberately, which is difficult for outsiders to determine.

Adj EBITDA guidance is £58-70m for the year, but this omits lots of costs, so doesn’t mean a thing.

There’s an aspiration to get EBITDA back up to 6-8% (it used to be 10%), which is just that - an aspiration.

Balance sheet - inventories are much lower than a year ago, but similar to 6 months ago. It’s good to see BOO focusing more on the test & repeat model, which served it well originally.

The huge cash pile of £290m is down by £41m in the last 6 months. This has all been borrowed though, with interest-bearing borrowings static at £325m. Note 14 says this is an RCF, which has (unspecified) covenants related to interest cover, and adj leverage. I don’t think we ever got to the bottom of who is providing this facility? People assumed it was HSBC, but I’ve never seen any proof of that, so post a comment if you have got any information on this.

Overall, if I eliminate intangible assets and the usually related deferred tax, then NTAV is £273m, which is pretty good, and much better than ASOS (LON:ASC) or THG (LON:THG) for example.

The big question is what the terms of the RCF are, because if that £325m RCF was pulled by the lender, then BOO could be in trouble. If the RCF is secure, even at a reduced amount, then BOO should be fine for liquidity and solvency.

Paul’s opinion - ignore me obviously, as I’ve been horribly wrong about Boohoo’s prospects in the past. Although also horribly right, when it originally 15-bagged, and was one of the biggest ever winners we had here. Just shows doesn’t it, business models change so fast now, that the disrupters soon become the disrupted.

I’ve come to the conclusion that my experience in the clothing retailing sector is now too outdated (from the 1990s), to be relevant to the modern world, so I no longer consider myself an expert in this sector, hence am mostly focusing on other sectors where there’s greater visibility of the future.

For what it’s worth though, I think these H1 numbers from BOO are disappointing, it’s basically now operating at a moderate loss. Providing the RCF remains in place, then liquidity is ample, so no solvency issues I can see (unless the RCF was pulled).

How can it fight back against Shein? With great difficulty I imagine. So the days of fat margins look long gone, especially if as some are expecting, it tightens its grip on the UK fast fashion space, eg partnering with Frasers (LON:FRAS) . FRAS has shareholdings in both Asos and Boohoo.

Maybe we should see Asos and Boohoo as special situations, “in play” as Shein and Frasers seemingly try to dominate and carve up UK eCommerce fashion? I can’t imagine the Kamani family being pushed around by any outside shareholders! Will they take it private? I wouldn’t be surprised at all by that, but doubt the price would be generous, given that they’re astute, hard-nosed rag traders.

Zeus has updated its numbers for FY 2/2024, with much lower revenues, but only slightly lower LBT of £(21.5)m, versus its previous £(13.4)m forecast LBT.

Overall, it’s difficult to see why we’d want to invest in a cut-throat sector, where even the shrewdest player (BOO) can’t make any PBT any more, and is forecast for continued losses in FY 2/2025 too. What’s going to change, to get back to decent profitability? I can’t see anything big on the horizon, so it seems more a case of BOO fighting a rearguard action to stay in the game, rather than dominating and making big profits any more.

The value in BOO shares is probably now more strategic, over what happens to what is a sizeable business, generating £1.5bn revenues pa, a bit like Asos nearer £4bn, but neither is making any money. Are they now trophy assets rather than having any intrinsic value?

The shares could go either way, I don’t know what’s likely to happen, so I’ll just declare myself AMBER on BOO.

PCI- PAL (LON:PCIP)

Down 13% to 48p (£31m) - Patent detail & trading update - Paul - GREEN

What a pity, the euphoria on winning its patent case against Sycurio has been very short-lived, as you can see -

PCI-PAL PLC (AIM: PCIP), the global cloud provider of secure payment solutions for business communications, is pleased to provide an update following the successful defence in the UK High Court of the unfounded patent claims being made against it.

Here’s the full Court ruling, if you’re interested in reading it.

PCIP is seeking full costs, which should be determined by the Court in Dec 2023.

The other side might launch an appeal, which PCIP says is commonplace.

Trading update - this sounds positive to me, so I’m unsure why the share price has fallen sharply today -

In FY23 we achieved revenue growth of 25%. Based on the trading year to date we now expect to see revenue growth in FY24 of between 28-30%. This is expected to allow the business to report the Company's first full year of adjusted pre-tax profit.

The year ends are June. Breaking into (adjusted) profit in FY 6/2024 strikes me as impressive.

Broker update - ah I think I’ve discovered why the share price has fallen today! PCIP’s trading update strikes a universally positive tone. However Cavendish says that customers have “slightly delayed decision-making”, resulting in it reducing forecast revenue growth from +34%, down to +28-30%. Not a huge difference, true, but it really grates on me that the company’s RNS reads like a PR release, but the bad news (of slightly lowered expectations) is slipped out via the house broker. I’ve read the RNS twice, and I cannot see any reference to the growth rate slowing. This feels deceptive, which really undermines my trust in management.

Cavendish lowers FY 6/2024 revenue forecast from £20.0m to £19.1m. This results in adj PBT of just £0.1m, so breakeven really.

Forecast net cash looks tight, forecast at only £0.3m by 6/2024 (previous forecast £1.5m). Three’s possible upside from any costs recovery from Sycurio though. Also a £3m RCF is available.

Paul’s opinion - what a pity this has been so badly handled, with I think PCIP being very badly advised, putting out an upbeat trading update, which is actually a downgrade to forecasts, sneaked out via Cavendish. Shareholders need to read the riot act to management, explaining why this is so badly perceived by investors, and undermines trust in them. Why do this, when it only fools people for at best, one day? But it leaves behind a nasty taste, and a feeling that management can’t be trusted, and everything they say in future needs to be taken with a pinch of salt.

So very badly handled today. However, with the patent case now looking resolved (hopefully), and still-good growth in the pipeline, with breakeven now approaching in 12-months, combined with a market cap of only £31m, I’m leaning positively towards this share now. We had to be AMBER whilst the patent case was up in the air, but I moved to AMBER/GREEN on 26 Sept when it announced “total victory”! Despite today’s deceptive handling of the slower growth, the positives outweigh the negatives for me, so I’m happy to see this with a GREEN view now. Risk:reward seems better now than it was earlier this year, and the price has barely changed.

Graham’s Section:

Gooch & Housego (LON:GHH)

Share price: 523p (+5%)

Market cap: £135m

This leads with a positive headline:

"Trading ahead of expectations. Integration of the two recent acquisitions progressing well"

Gooch & Housego is “the specialist manufacturer of photonic components and systems”. I’ve commented previously on the company’s turnaround attempts: in the post-Covid period it built up large order book arrears and suffered a delay before it could pass on cost inflation to its customers, hurting its profitability.

After a few tough years, I’m wondering if it might be in value territory at this point:

As demonstrated again by today’s positive trading update, it has had some time to adjust to changes in costs and pricing, and appears to be doing well in the new environment.

Today we learn:

Industrial markets: destocking in the industrial laser market, but higher sales volumes of acousto-optics and fibre optics.

Aerospace and defence: also sounds positive, especially that there is “good progress on design and development activities for a number of customers for our embedded imaging periscope systems which has the potential to unlock significant orders based upon forecast vehicle build rates”.

Medical diagnostics: revenues are up and the engineering team in Ashford are “fully utilised”.

Estimates: full-year adjusted PBT (for FY September 2023) should be above market expectations.

Order book is stable at around £125m, down slightly on a like-for-like basis, but further confirming that the business has stabilised, and “provides a good underpin for trading in the new financial year”.

Broker note: the latest note from Cavendish (i.e. finnCap/Cenkos) raises the 2023 revenue forecast by 5.8% to £147.9m, and marginally increases the adj. PBT estimate to £9.6m.

Estimates for subsequent years, including the current year (FY September 2024) are unchanged, except for a reduced net debt forecast.

Net debt is currently estimated to be c. £23m.

Acquisitions are “proceeding to plan”.

Graham’s view

I’m leaning towards taking a positive view on this one, as the serious challenges it faced appear to be in the rear-view mirror.

Looking ahead, it should again earn a reasonable operating margin: it used to consistently earn more than 10%, so I’m wondering if it can do that again?

It passes a nice stock screen, highlighting the high-tech nature of the business: the R&D Breakthrough Screen, which is a Quality Investing Screen.

It trades at a moderate P/E rating:

I think I’ll tentatively give this one the thumbs up, switching from a neutral view previously. For me, it has done enough at this stage to deserve that. I don’t often use “price targets” but perhaps I would switch back to neutral around 800-900p.

S&U (LON:SUS)

Share price: £22.74 (+1%)

Market cap: £276m

S&U, the specialist motor and property financier, today announces its results for the six months ending 31 July 2023. S&U continues to trade well and, despite current economic, tax and regulatory burdens weighing on business generally, views the future with confidence.

I covered S&U’s H1 update here, and today we have the results in full.

S&U’s group results:

Revenue £55.3m (H1 last year: £49.4m)

PBT £21.4m (H1 last year: £20.9m)

Gearing is 80% (H1 last year: 73%)

Earnings per share are 133.2p (H1 last year: 140.7p), reflecting higher corporation tax.

The Chairman’s statement is always worth a read.

He notes that the company paid an extra £4.2m in interest during the period, thanks to rate increases.

We had already been told in the H1 update that the net interest margin - the difference between the rate of interest charged to S&U’s customers, and the rate of interest paid to S&U’s lenders - had reduced, as a result of Bank of England rate rises.

So the modest growth in PBT looks much better, once you take this into account.

Let’s look at the two divisions (motor finance and property bridging) separately::

Advantage Finance

PBT almost unchanged at £19.1m

Collection rate 91.1% of due (H1 last year: 94.3%)

S&U has been taking a somewhat cautious approach here, and net new advances of £81m are 11% lower than in H1 last year. But that does still allow for significant growth and the lending book has hit a record high of over £300m. A new CEO will join this division at the start of the new financial year

Aspen Bridging

PBT £2.4m (H1 last year: £2m)

Net receivables £104m (H1 last year: £90m)

Given the property market struggles, average gross LTV from Aspen is now only 65%, down from 72% a year ago.

Out of 130 loans made by Aspen, 15 are “beyond term and in technical default, all of which we anticipate will be profitably recovered”.

Net debt: S&U’s net borrowings finished the first half of the year at £184m, as previously disclosed.

Outlook: cards are kept close to their chest. “Cautious optimism”.

Graham’s view

I don’t see any reason to change my view on this one. The valuation hasn’t increased since the last time I looked at it, and I thought it was attractively priced then:

When it comes to financial stocks, I’m far more interested in the small and simple businesses such as this one, rather than the high street behemoths.

Although, if you’re interested, Barclays (LON:BARC) is thought to be trading on a PER of less than 5x, and Lloyds Banking (LON:LLOY) is at less than 6x. These numbers reflect investor attitudes to UK stocks and the UK economy right now, and they trickle down to S&U, whose 8x P/E multiple seems rich in comparison!

However, in isolation, I do think that 8x is cheap for a business that has historically been as well-run as this one (and long may it continue). It is trading at a premium to net asset value, but I do think it deserves that.

Barring economic armageddon, this looks set up to do very well for shareholders, in my view.

The share price hasn’t progressed in five years, but the company has. The yield of 6% looks sustainable, and is a significant part of the total return here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.