Good morning, it's Paul & Graham here as usual!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

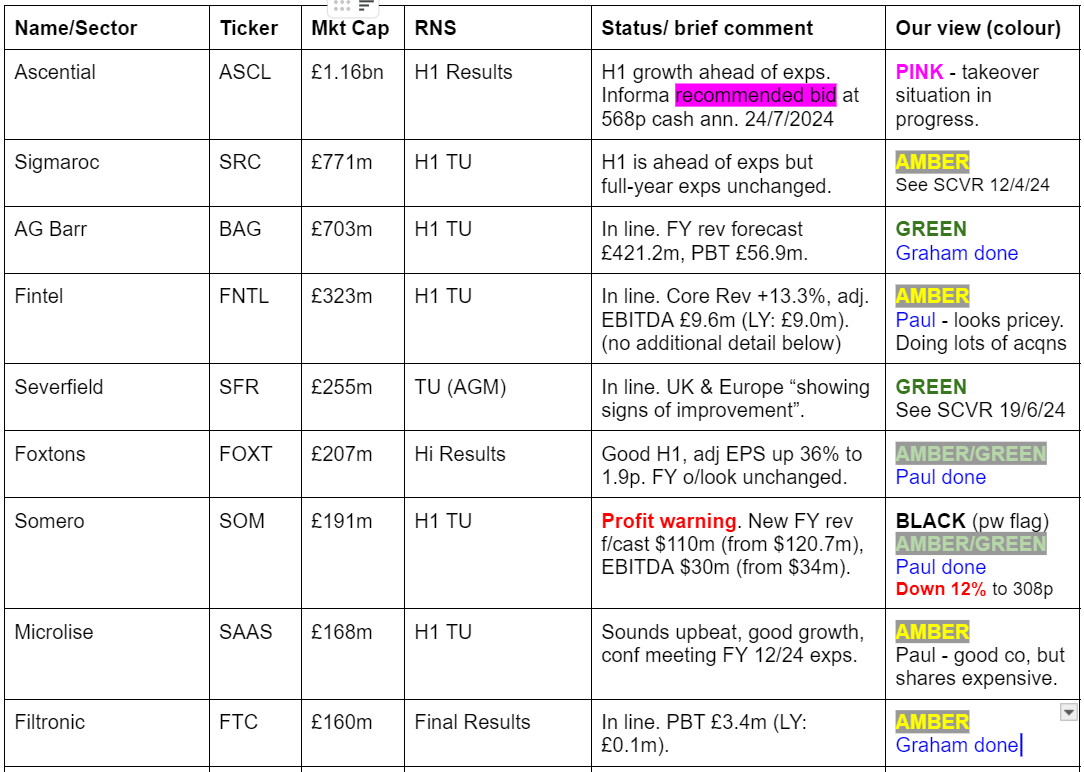

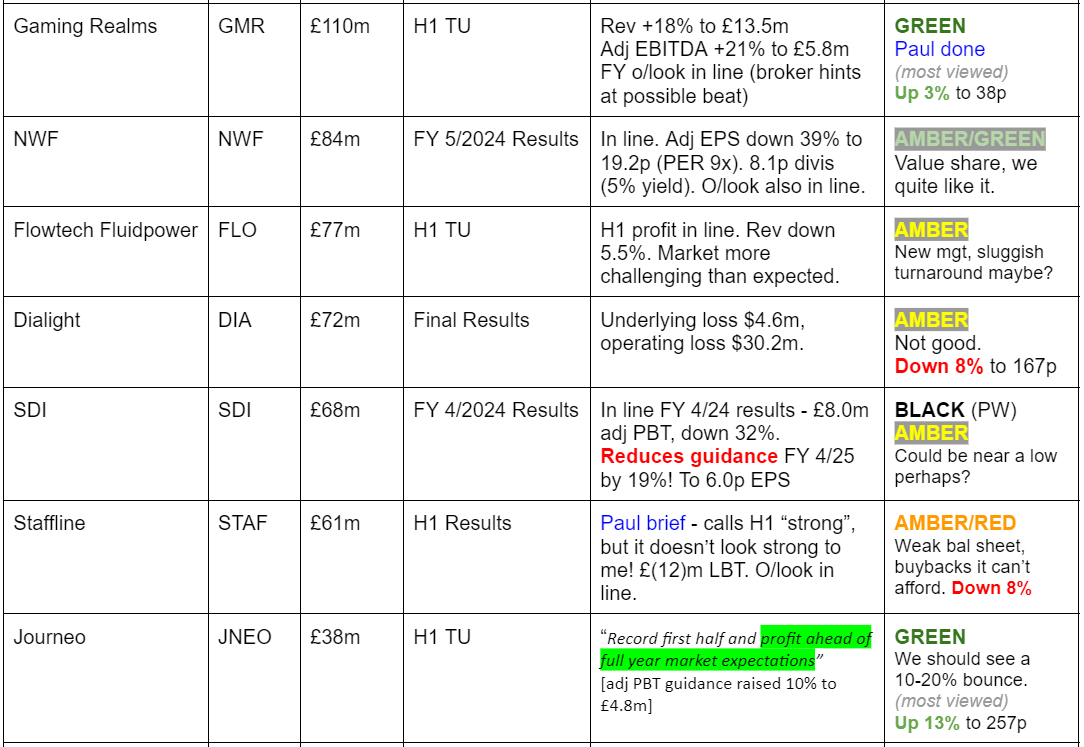

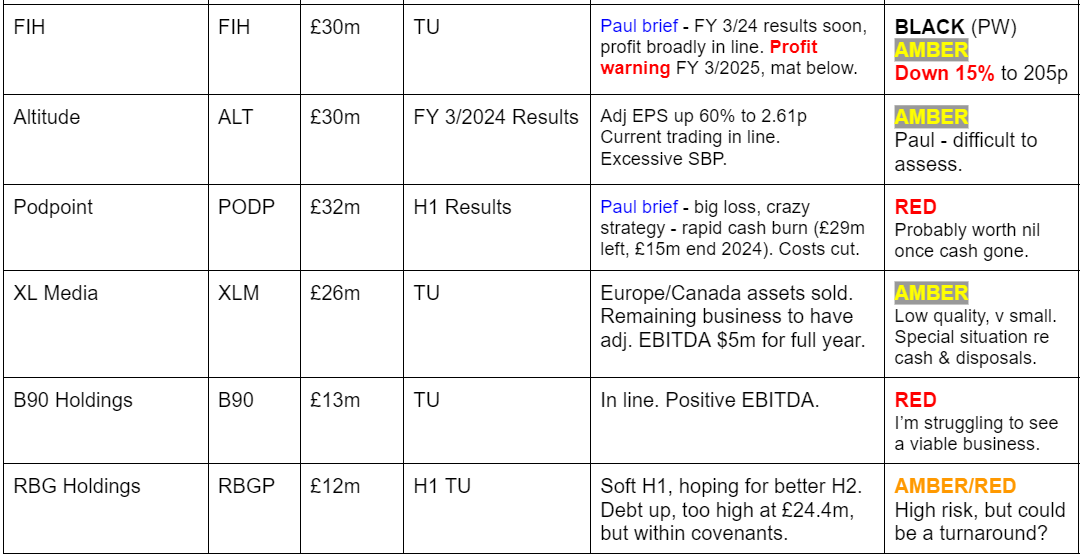

Companies Reporting

I'll try to get SOM up before 8am (just about, it was up at 07:59)!

Other mid-morning movers (with news)

St James's Place (LON:STJ) - up 20% to 670p (£3.67bn) - H1 Results - Paul - No view.

A very positive market reaction to this mid cap fund manager’s H1 results and strategy update. This share is up 60% just in the last 3-4 months, but the StockReport still showed a low forward PER of 7.8x as of last night.

It reports a net funds inflow in H1, and a positive market return on funds invested. Total AuM a record £182bn. Plans to cut costs.

Bullish sounding outlook -

“While near-term profit growth will reflect the structural impact of transitioning to our new simpler and more comparable charging structure as announced last October, we expect to see the Underlying cash result accelerate in 2027 and beyond, doubling between 2023 and 2030. Importantly, much of this rapid growth is highly predictable because of those changes that we are making to our charges.”

Paul’s view - no colour, as I haven’t properly researched it, but there are certainly interesting elements here, and it could be worth further research. We’ve been anticipating a recovery in this sector, and it now seems to be happening, selectively.

Diageo (LON:DGE) - down 8% to 2,339p (£52bn) - FY 6/2024 Results - Paul - No view.

Amazingly quick reporting of FY 6/2024 preliminary numbers. Why do the tiny companies we cover take months to report, when this drinks giant can do it in 30 days?! DGE shares have been in a nasty downtrend for 2 1/2 years being roughly back down to the pandemic lows.

Figures today have clearly disappointed, as it’s down 8%. Debt looks high at 3.0x, so it’s surprising to see it doing share buybacks (fuelled by debt). The StockReport shows earnings forecasts in almost continuous decline, a fwd PER of 17x, lots of debt, and an unremarkable 3.2% dividend yield.

Paul’s view - it still looks overvalued to me, despite the big drop in share price. Where’s the profit growth? There doesn’t seem to be any. Negative NTAV, and a huge pile of debt c.$20bn, definitely not my cup of tea! Although the business clearly has some attractions, as a portfolio of quality brands, with a high operating profit margin. Is that enough though? Markets want growth, and this business is effectively shrinking, when you take into account inflation - flat revenues over 6 years is going backwards significantly in real terms.

Summaries

Somero Enterprises (LON:SOM) - down 14% to 305p (08:07) £166m - Trading Update - Paul - BLACK (profit warning flag). AMBER/GREEN (on fundamentals)

Various factors have caused H1 to be soft, but a recovery is expected in H2. Disappointing, not a disaster, is my conclusion. With a strong balance sheet, and a modest PER on lowered forecasts, I think the value is now looking quite attractive. Probably not a time to be panic selling in my view, but that's your call.

A G Barr (LON:BAG) - up 0.6% to 634p (£710m) - Trading Statement - Graham - GREEN

An in-line H1 update from this soft drinks group. There is positive momentum with revenue growth and solid profit margins combining to give forecast EPS growth of c. 13% this year. The soft drinks industry faces some macro challenges but I remain a fan of BAG. PER is around 16x. Cash c. £60m forecast.

Foxtons (LON:FOXT) - up 1% to 68p (£206m) - H1 Results - Paul - AMBER/GREEN

Good H1 results, with profit up strongly. Reiterates full year forecasts, but broker suggests it could beat rather than just meet. Adequate balance sheet. We were green in April 2024, but it's risen c.30% since then. I still like the share, but price maybe up with events for now, so moderating slightly to AMBER/GREEN.

Gaming Realms (LON:GMR) - up 7% to 40p (£117m) - H1 Trading Update - Paul - GREEN

Continuing strong organic growth from its core Slingo game. Broker forecast unchanged, but looks set up to beat rather than just meet. I find the valuation still appealingly good value, with considerable further upside possible. It's net cash too. Lots to like here, one of my favourite GARP shares, looks like I forgot to include it in my top 20 share ideas this year.

Filtronic (LON:FTC) - down 1% to 72p (£157m) - Final Results - Graham - AMBER

Excellent results from this component manufacturer, as expected, and brokers have left their FY May 2025 forecasts unchanged, predicting continued improvements in revenues and profitability. I applaud shareholders who have held this through its bull run, but personally I would see it as fully valued here.

Paul’s Section:

Gaming Realms (LON:GMR)

Up 7% to 40p (£117m) - H1 Trading Update - Paul - GREEN

Gaming Realms plc (AIM: GMR), the developer and licensor of mobile-focused gaming content, announces a pre-close trading update for the half-year ending 30 June 2024 ("H1 2024" or "the Period").

Decent growth here -

“H1 2024 Revenue and EBITDA growth of 18% and 21% respectively, driven by growth in content licensing and market expansion”

H1 revenue £13.5m

Adj EBITDA £5.8m (*EBITDA before share based payments)

It doesn’t mention what actual profit is (PBT)! Probably because adj PBT is only about half the misleading EBITDA number.

Outlook - sounds encouraging -

“The strong momentum experienced during this period provides the Board with the belief that the Company is on track to meet its full-year targets, as it continues to expand into new markets and launch new games with existing partners.”

What are the targets?

Canaccord helps us out with a note, leaving forecasts unchanged, but describing them as “well underpinned”, which implies to me the most likely move could be a beat against forecasts, it’s always nice to hold shares in that position.

Canaccord has 2.3p estimate for FY 12/2024, rising to 3.0p next year.

What PER to apply? If unprompted, looking at these figures without knowing the company, I would say a PER of 20-30x would be justified. That takes me to a valuation of 46p - 90p, using 2024 & 2025 forecasts within my 20-30 PER range. The actual share price is 40p, suggesting to me that this share could have attractive upside.

Paul’s opinion - I’ve been a bull on this share for a while, due to its tendency to report decent organic growth, at an attractively cheap valuation. That is coming from a core product (Slingo) that customers like, and keep buying more of it, alongside plenty of new customers, globally. So a very simple, and attractive business model. I can’t think of any negatives, leave a comment if I’ve overlooked any concerns.

Cash is piling up nicely too, so I think we need divis, or a credible use for the cash. Bolt on acquisitions might make sense, if management are experienced in successful acquisitions in their previous lives?

It has to be another GREEN from me, as before, multiple times.

Foxtons (LON:FOXT)

Up 1% to 68p (£206m) - H1 Results - Paul - AMBER/GREEN

Foxtons Group plc (LSE:FOXT), London's leading estate agency…

Just a very quick look at H1 results. I’m impressed, there’s good progress being made here, with both adj operating profit and PBT up 24%. Adj EPS is up 36% to 1.9p.

The strategy here has been to grow the less cyclical lettings income, with an impressive 70% of revenue now non-cyclical & recurring streams.

I like the turnaround strategy here from newish (2 years) CEO Guy Gittins, which seems a no-nonsense back to basics approach.

Outlook comments reassure -

“Through continued market outperformance, the Group's expectations for the full year remain unchanged and the Group is on-track to deliver its medium-term target of £25m to £30m adjusted operating profit.”

"Momentum can be felt across every aspect of the business and I am very excited about the second half and beyond as we work hard to deliver excellent results for the property owners of London and our shareholders."

Broker update - an interesting note from Singers is most welcome, thank you.

It has an unchanged 4.2p forecast for FY 12/2024, but makes it clear in the commentary that this could be upgraded. That’s a very good increase on actuals of 3.0p in 2022, and 2.8p in 2023.

If I assume that it does 4.5p in 2024, then the PER is c.15x, which looks about right to me.

Although more acquisitions of lettings books could drive inorganic growth further, so I don’t see forecasts as either a ceiling, nor wishful thinking.

Balance sheet - still has some odd, legacy items on there. Maybe Gittins could have a clean up of the balance sheet? In most respects though, it looks an OK balance sheet. Modest net debt is easily supported by earnings & cashflows. Lease liabilities are obviously quite large, from its network of physical offices, but as long as they’re all earning their keep, then that shouldn’t be an issue.

Overall then, the balance sheet is adequate, not strong.

Paul’s view - keeping this brief, Graham was GREEN last time on 18/4/2024 at 53p. We’re now 28% higher at 68p, and with the valuation now looking more up with events, rather than outright cheap, I’m going to stay positive, but moderate a little to AMBER/GREEN due to the big share price rise. Things like this often continue rising once they have momentum though, and with macro now moving in the right direction, I think staying positive seems the right call.

Somero Enterprises (LON:SOM)

Down 14% to 305p (08:07) £166m - Trading Update - Paul - AMBER/GREEN

Somero is a vendor & servicer of laser-guided concrete laying equipment, mainly in the US. It’s been listed on AIM for many years, and has traditionally been cash generative & generous with divis.

H1 this year has been tough, resulting in a profit warning today -

“trading in North America continues to be impeded by project start delays and pauses caused by elevated interest rates, labor shortages and concrete rationing, as previously reported in the 20 June 2023 announcement. This has been coupled with significant inclement weather in H1 2024. As a result, H1 2024 trading in North America is expected to end below the comparable H1 2023 period.”

Improvement in H2 is expected -

“The Company anticipates an improvement in H2 2024 over H1 2024 driven by a combination of new product revenue growth, including the launch of a third new machine, and an expectation of improved weather conditions.”

Outlook -

"Despite the impact of persistent challenges and poor weather conditions on trading in the first half, the non-residential construction market remains fundamentally sound. Importantly, the long-term growth drivers remain intact and we are working hard to expand our product offering and build our presence internationally to capitalize. As those factors outside our control abate, we would expect performance to improve. In the meantime, Somero is built to withstand challenging conditions. We have a solid track record of adapting to changing conditions and then emerging strongly."

Cost cutting - workforce is being reduced by 15%, alongside other “strict cost controls”, to “partly offset” the impact on profit.

Revised guidance - very clear here -

“In consideration of the aforementioned factors, the Company now expects FY 2024 revenues of approximately US$ 110.0m (compared to the previous market consensus estimate of US$ 120.7m), EBITDA of approximately US$ 30.0m (compared to the previous market consensus estimate of US$ 34.0m), and year-end cash of approximately US$ 27.0m (compared to the previous market consensus estimate of US$ 31.7m). “

Paul’s opinion - I’ll add more detail to this section in a little while, once I’ve read the broker update. Initial reaction is that this is disappointing, but not a disaster. However, with the trajectory of earnings now in a downward trend, the share price is likely to take a significant hit today (written just before 8am). Assume the brace position, holders, if you're not trying to sell on the opening bell (probably futile).

EDIT: Many thanks to Cavendish for updated numbers. New vs old forecasts are shown for FY 12/2024. What strikes me, is that a 9% drop in revenue has only caused a 13% fall in adj PBT and EPS - I would normally expect to see a much larger, operationally geared impact on profit. So clearly the rapid cost-cutting response has softened the blow, albeit at the expense of employees - cutting 15% of the workforce is quite a savage thing to do, and is bound to have an effect on morale, and maybe on operations as demand returns?

On valuation, the new FY 12/2024 forecast is 37.6 US cents, so 29.2p. The share price is currently (08:14) 300/310p bid/offer, so taking the mid-price that's now a PER of only 10.4x - given that Somero is also comfortable for cash, this looks a modest valuation. So my conclusion is that the shares now look quite attractively cheap, and I'd be surprised if there's much further downside below 305p. Given that the factors behind the profit warning look temporary, I'd be inclined to look at this favourably as a potential purchase if it continues falling below 300p. I think I'll go up to AMBER/GREEN, based on the now quite attractive valuation. The factors which caused this profit warning could reverse in future, leading to growing demand in H2 and maybe in 2025. If that doesn't happen, then I would be worried, as that could indicate SOM might be suffering competitive pressures, something we've questioned here before.

Graham's Section:

A G Barr (LON:BAG)

Up 0.6% to 634p (£710m) - Trading Statement - Graham - GREEN

A.G. BARR p.l.c., the branded multi-beverage business with a portfolio of market-leading UK brands, today announces a trading update for the 26 weeks ended 27 July 2024.

The owner of IRN-BRU and other soft drinks and brands has issued an update for H1.

H1 revenue growth is 5% to c. £221m, within which soft drinks revenue growth is 7%.

The Boost acquisition is being integrated as planned, with “margin realignment” underway as production is insourced (Boost has negatively affected BAG’s margins in the short-term).

Each of the main brands seems to be doing fine. Rubicon is the stand-out performer, growing at double digits, while IRN-BRU is enjoying volume growth and market share gains.

Comment from CEO Euan Sutherland:

"I am pleased to report overall H1 revenue growth of c.5% with Soft Drinks growth of c.7%, against strong prior year comparatives. The strategic margin rebuild programmes are on plan, guidance on revenue and margin remains unchanged, and we are on track to meet FY expectations...

Our four power brands - IRN-BRU, Rubicon, Boost and FUNKIN - have clear paths to long term growth…

We have a clear and focussed UK based growth strategy with simple KPIs of Net Revenue, Operating Margin and ROCE."

Outlook: in line. The company is “committed to improving our profit margins”, with positive earnings momentum for H2 and beyond.

Estimates: Shore Capital have left their forecasts unchanged, expecting FY Jan 2025 PBT of £57m and EPS of 38.1p.

Graham’s view: I’m pleased to see that the BAG share price has picked up some momentum:

This is a stock I’ve been stubbornly bullish on due to its high cash balance, well-known brands, and (hopefully) an ability to rebuild profit margins as economic conditions improve.

It hasn’t been plain sailing and it’s not going to be, either. A deposit return scheme seems likely to be introduced at some point, although it has been delayed for now. So perhaps BAG can continue to trade without worrying about that for a few more years.

At this stage, I’m not sure if I will want to leave this on my best ideas list for 2025, as the introduction of new management here has made me a little nervous.

Fortunately, profits are still moving in the right direction, and this means that the PER remains at a level which I would see as attractive - and this is before making any adjustment for the company’s strong balance sheet and cash position. So for now I’m going to leave my positive stance on this one unchanged.

Filtronic (LON:FTC)

Down 1% to 72p (£157m) - Final Results - Graham - AMBER

Filtronic plc (AIM: FTC), the designer and manufacturer of products for the aerospace, defence, space and telecommunications infrastructure markets, announces its full year results for the 12 months ended 31 May 2024.

We have a very impressive full-year results table, with significant improvements in every metric.

Revenues are up 56%, operating profit has jumped from around breakeven to a more meaningful figure (£3.4m), and the company’s cash balance has expanded:

For context, here is the share price performance over the past year, a multi-bagging performance:

A review of the news:

5-year strategic partnership with SpaceX. In the new financial year, a follow-on contract with SpaceX has been signed with $9m value.

£3.2m contract from European Space Agency, £4.5m from BAE Maritime Services, £2m from QinetiQ.

King’s Award for Enterprise in Innovation.

Excerpt from the Chairman comment:

The success in FY2024 has given us a very strong basis for our business as we look ahead into FY2025. We continue to prove that we have the technology, products and skills to compete internationally with the best.

Contract wins in FY2024 require us to expand the Group's engineering and manufacturing operations into our growing sales orderbook. At the same time as we develop our electronic communications products and technology in the low earth orbit space sector, we have ambitions to do more in the defence, aerospace and security sectors…

Whilst we wait to see what the new government's UK industrial strategy will look like, we remain confident that in the critical technology areas, including sovereign semiconductor packaging capability, we have a meaningful role to play.

Dividend: an interesting choice to retain cash within the business instead of paying a dividend “after continued dialogue with investors”. Seems reasonable, as hopefully this is just the beginning of the good results for Filtronic, and the cash will be better spent funding growth.

Outlook:

The demand drivers for our business, as I have outlined above, remain strong and the markets we serve are robust. We have increasing confidence in our ability to deliver further growth in the year ahead, but we recognise the need to work fast and not be complacent. We will be matching our resources with the enlarged business that we are now operating, investing in key areas including exceptional and experienced engineering and manufacturing talent, developing opportunities with those in the early stages of their career and leveraging strong commercial relationship builders to deliver greater customer focus and support…

The new CEO expands on the outlook, emphasising the opportunity with SpaceX, a new manufacturing facility in Sedgefield, and the overall scaling up of the business.

Graham’s view

Like Paul, I’m going to have to stick with an AMBER stance on this one, as I don’t have the industry expertise to express a view on whether Filtronic can follow through with its growth ambitions.

Quantitatively, there doesn’t seem to be much value on offer at this market cap: the valuation dwarves the revenue figure, profits and cash.

The ValueRank is only 4:

In a value report, it’s difficult to be bullish in these circumstances.

Looking ahead, brokers are estimating full-year revenues of £36m for FY May 2025, converting to adj. PBT of £6.4m. It’s certainly a huge improvement compared to where the company was before.

I will respect the momentum here and stick to AMBER, as it’s dangerous to be bearish on well-funded, growing, profitable companies. But personally I don’t understand the investment case here, and the valuation would make me nervous.

(Paul adds: I've heard a couple of fund managers talk about Filtronic recently, and I think the bull case rests on a belief that the upside could be considerably larger than the current broker forecasts. I'm with you though Graham, as that's not something I can forecast, it would be pure guesswork for me to get involved now. Well done to the readers here who spotted this opportunity & left comments about it early on in the growth phase).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.