Good morning, it's Paul here.

I was looking into the horrible case of Fusionex International (LON:FXI) over the weekend, after a friend flagged it to me. It joins the long list of overseas companies which listed on AIM, and ended up being disastrous for UK shareholders.

I cannot stress enough how investors can protect ourselves by having a default setting whereby we decline to invest in overseas companies on AIM. The reason being simple - because many or even most of them end up being disastrous investments. Exceptions can be made sometimes, particularly where the country risk is lower (e.g. USA, or W.European countries), but I'll cover that in more detail at the end of this article.

As with Globo, and the Chinese AIM frauds, the warning signs were not difficult to spot - they were obvious. As I researched Fusionex over the weekend, the red flags were blatantly obvious. So people who get caught on this type of disaster stock really need to drastically improve their stock selection procedure, whilst they've still got some money left.

We all lose money on some shares, it's a normal part of equity investing. However, returns greatly improve if you have a process which weeds out the obvious wrong 'uns before they blow up. One of my key aims here is to help investors focus on better quality stocks, and avoid the junk. Although in a roaring bull market like this, plenty of junk stocks are doing very well (for now) - so there are opportunities for shrewd traders, nipping in & out of junk stocks for a quick gain. Getting out before the music stops is the tricky bit!

Anyway, on to today's results & trading updates.

Kainos (LON:KNOS)

Share price: 229.25p (down 4.5% today)

No. shares: 118.0m

Market cap: £270.5m

Preliminary results - for the year ended 31 Mar 2017.

This company (HQ in Belfast) describes itself as;

...a leading UK-based provider of digital services and platforms

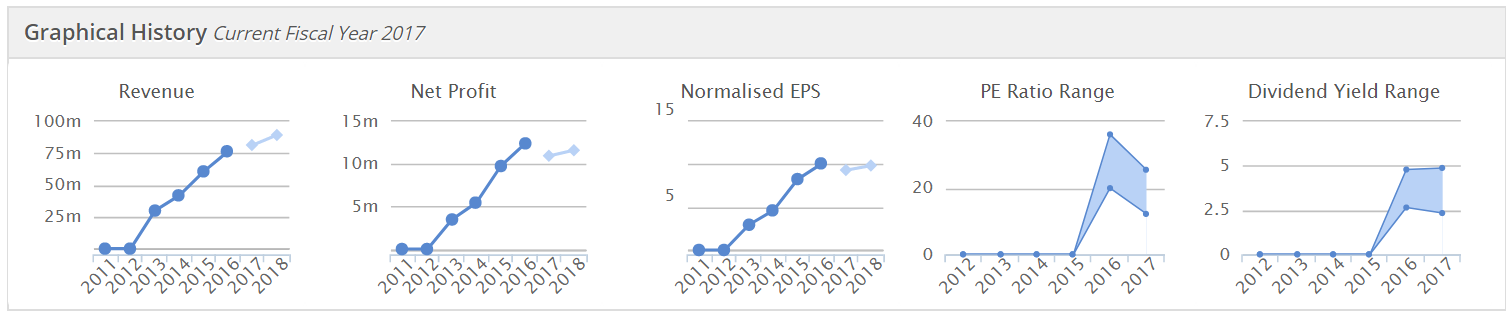

Whatever that means? Checking back on my previous notes, it seems to be an IT company that specialises in UK public sector work. This is quite topical, given recent hacking & blackmail on the NHS (and other) computer systems. It's achieved superb growth in the past, as you can see from the Stockopedia historical graphs;

As usual, we can glean an awful lot from these simple graphs.

Graphs 1,2 & 3 - strong historical growth, but note that forecasts (the lighter blue blobs) are suggesting a slowdown in revenue growth. Profitability looks to have peaked - and is even forecast to fall slightly. So has the company gone ex-growth? It looks like that to me.

Graphs 4 & 5 - note that the very high PER is coming down (understandably, given growth fizzling out), and that divis became more meaningful from 2015. The company listed on the main market in Jul 2015.

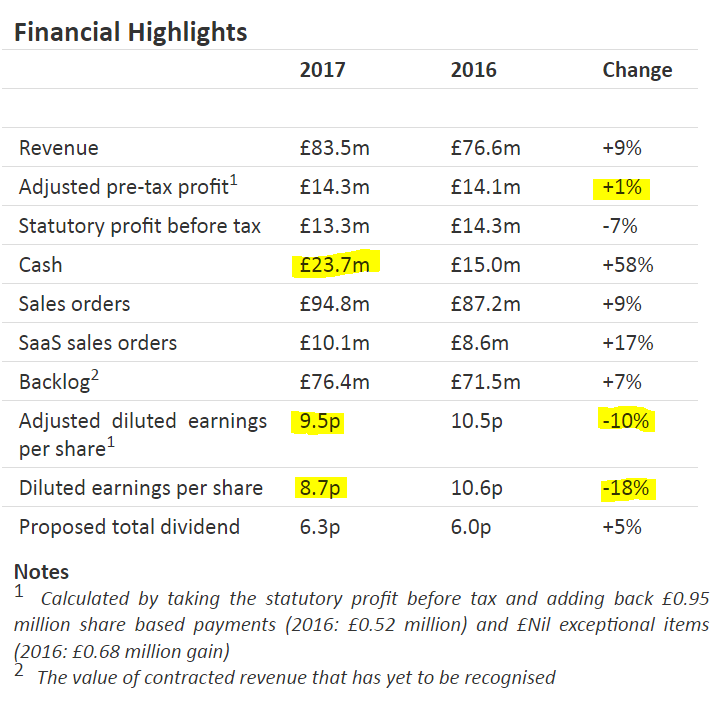

Turning to the results for y/e 31 Mar 2017, I'm surprised that the share price hasn't fallen more today. The numbers are OK, but the growth seems to have fizzled out, as you can see from the highlights section;

Working down the table, I've highlighted a few points;

- Adjusted pre-tax profit only up 1% - not very exciting, is it?

- Cash has risen well, to £23.7m. There is no debt, so that's a net cash figure.

- Why hasn't the increased revenues fed through to higher profit? Higher overheads - staff numbers have increased by 135, to 975. Plus R&D spending was doubled, to £4.6m (and this is all expensed as incurred, hence comes straight off profits).

- EPS has fallen due to a higher tax P&L charge compared with last year.

Dividends - note that the company pays out most of its earnings as divis, which reinforces that the cashflow is good, and genuine. Although due to the share price being high, this does not translate into a high divi yield.

The total divis for the year are up 5% to 6.3p - a yield of 2.7% - not madly exciting.

Balance sheet - is excellent. They don't capitalise any costs into intangibles, which is good.

The working capital position is healthy, with a current ratio of 2.31

There's £23.7m of net cash, and no interest-bearing debt.

Overall, very solid, so no concerns at all.

Cashflow statement - similar to the balance sheet, this looks very clean.

The business generates plenty of cash, some of which is paid out in divis, and the rest retained within the business. This is a very capital light model, with almost no capex - clearly a positive model.

Outlook - this is a bit waffly, although it does suggest that more growth is possible;

The directors believe that the Group remains well placed to deliver growth in the coming years. The Group's Digital Services division continues to benefit from the UK government's digitisation programmes, and from the strong and sustained growth of Workday.

In the Group's Digital Platforms division, Smart remains in a commanding position as the only automated testing product for Workday globally, and Evolve IC has passed a significant milestone with the successful deployment in 38 hospitals in the US.

While the opportunity for Evolve EMR in 2018 is muted, the directors remain confident that it is well positioned to capitalise on its lead in the NHS marketplace in the medium term.

In summary, the Group sees continued stability and growth opportunities for its Digital Services division and is encouraged by the strong position of its Digital Platform SaaS offerings globally. Going forward, the Group will remain focused on providing exceptional careers for staff and exceptional digital products and services for its customers.

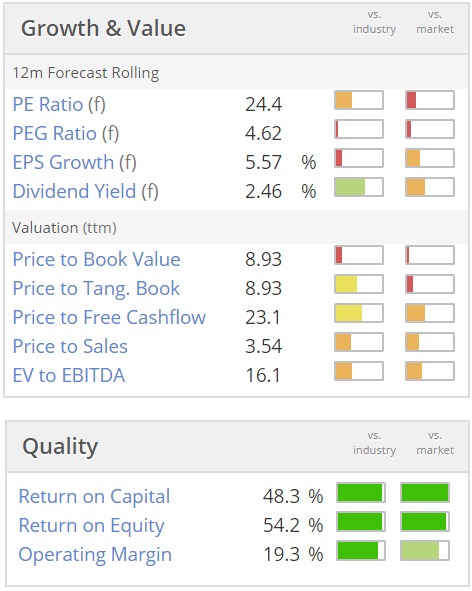

Valuation - this stock looks expensive to me, given that adjusted EPS has just fallen, and forecasts are for only a modest increase in 2017/18. So why on earth is it rated on a growth company PER of 24 times?

As you can see, it has very high quality scores.

My opinion - this is clearly a good quality company, with a terrific financial track record.

However, earnings actually fell in 2016/17, and there's not much earnings growth forecast. So I cannot see how this is worth a PER of 24 times. That looks significantly over-valued to me. The only justification would be if the broker forecasts are too conservative, which is often the case with apparently highly rated shares.

Investors would need to be very confident that Kainos can beat forecasts, otherwise you could be over-paying. Also this company is heavily reliant on contract wins. Whilst the pipeline sounds strong, profit warnings can happen with this type of company if a gap appears in the order book. Why take that risk, especially when the upside looks limited given that the valuation is so high already?

It's not for me at this price. Although it will go onto my list of quality stocks to potentially buy much cheaper a few weeks after a profit warning.

Blancco Technology (LON:BLTG)

Share price: 175.5p (down 5.7% today)

No. shares: 64.0m

Market cap: £112.3m

Chairman resigns - yet another red flag at this accident-prone company.

The Chairman, Rob Woodward, has announced that he intends to resign "at around the time of the Company's results for the year ending 30 June 2017, in October 2017".

This is surprising because he only became Chairman in Mar 2017. Although he was on the Board since 2013.

My opinion - I don't like this share one bit. Unexpected Director departures are something I'm going to pay a lot more attention to, in future. The learning curve for me recently was 2 CFO departures at Revolution Bars (LON:RBG) . Of course the company insisted everything was fine, but then we were slammed with a profit warning, caused mainly by cost over-runs and poor budgeting.

So in that case, people who were cynical, and played it safe by exiting the share, dodged a bullet. I was a bit too gullible perhaps, and as a result am nursing a hefty paper loss.

As regards BLTG, there are way too many red flags here, and I can't shake off the feeling that there could be more bad news to come. The Chairman's unexpected decision to resign, with no explanation given (not that anyone believes them anyway!)

The senior NED says today;

"Rob has contributed a great deal to Blancco and I would like to thank him for his professionalism, clear stewardship and counsel. The Board regretfully respects Rob's decision to step down and he will leave with our best wishes.

"We remain confident in Blancco's prospects. It is a market-leading business with considerable opportunities for continued growth."

Reading between the lines, that sounds to me as if there might possibly have been some disagreement over something. Personally, I wouldn't stick around in this share to find out. Again, why take the risk?

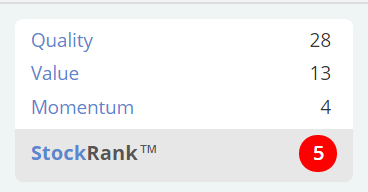

The Stockopedia algorithms are also sounding a loud warning klaxon, with a pitiful StockRank of just 5, and a losing style of "Sucker Stock" - I agree.

Some quick updates to finish off with;

Fastjet (LON:FJET) results, which look diabolical.

It's not worth wasting any time on this. The figures are just a joke.

I can only imagine that the repeated fundraisings are more about fund manager careers and egos, than commercial outcomes for their investors.

Fusionex International (LON:FXI) - delisting debacle - i.e. yet another overseas AIM companies shafts UK investors.

How could people have avoided the 64% loss today, from the company announcing it intends to de-list?

1) Don't buy shares in any Malaysian companies that list on AIM - they're probably dodgy as hell. Similar to Chinese companies that decide to list on AIM. I would widen that, and say don't buy any Asian or African companies that list on AIM - if you do, chances are that you're the patsy. Why take the risk, when the odds are against you?

Why would these companies come half way round the world to list on AIM? Probably because they're thinly disguised scams, and they've worked out that London has enough mug punters, and a sophisticated apparatus of smooth-talking liars (low level PR people & brokers) who will rip-off the likes of you and me, in order to earn a dishonest living.

We need to drive these shameless scumbags out of business, by refusing to participate in their deceptions.

2) Look at the accounts - Fusionex accounts are dripping with red flags - the usual culprits;

- capitalising a huge amount of costs into intangible assets, in order to create artificial profits

- unusually, it did actually pay a dividend. However, scrutiny of the cashflow statements show that this was a mirage - it didn't generate cash.

- respected bears such as Lucian Mears wrote scathing articles about this stock over a year ago, pointing out the numerous red flags in its accounts. Ignore this sort of thing at your peril - the best bears are usually right, eventually. Lucian is very smart, and a good guy.

- profits collapsed in 9/2016.

- Director shareholdings are TOO BIG. It's good for Directors to have plenty of skin in the game, but if they are above c.25%, then that starts to become risky, if they are unscrupulous characters.

- Fusionex shares are now effectively worthless. Many holders will be forced sellers, so this is really a way of scamming UK shareholders, forcing them to sell, so management can buy out the company on the cheap. It's a scam basically. I would sell, and move on, and learn the lessons.

De-listing should only be a last resort, if a company is about to go bust. Listing on the stock market is not a temporary measure, it is a long-term commitment. Even if the market rates your shares lowly, then it's the job of management to improve performance, thus earning a higher rating.

Fusionex management clearly either don't understand this, or are just con artists - having extracted funds from placing(s), now they don't need the listing any more, so they're off.

Good riddance to yet another pile of crap. Just don't fall for these overseas AIM scams. Enough is enough.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.