Good morning, it's Paul & Jack here with the SCVR for Tuesday.

I (Paul) have a crazy day today, as I realised my passport did not have sufficient (time) range to cover a forthcoming trip to Malta next week. So I had to fast track my renewal application, which involves driving from Bournemouth to Newport (South Wales) and back this afternoon!

Electric Cars

Using an electric car means carefully checking that it will have the range necessary, which it does thankfully for my trip today. I've already discovered that public chargers cannot be relied upon, because they're often out of service, or already being used, with someone else waiting to use it next. You also have to sit in the car whilst it charges, to ensure nobody else presses stop on the charging machine, and then puts the other plug in their own car (unlikely, but possible). Disputes are common.

For these reasons, a recent weekend trip to visit family in Cheshire (240 miles each way, easily done on one charge with 13% remaining) was blighted by me having to spend 4 hours at a service station, to re-charge the car for the return journey! It wasn't too bad, as the sun was shining, and the family brought some picnic chairs, and we sat on the grass verge by a Co-Op petrol station, having some Greggs and a natter! But it wasn't quite what I had planned for a family weekend.

My conclusion being that electric cars are fine for people who mainly do shortish journeys, starting and ending at home, but for people who routinely need to travel 250+ miles in a day, forget it! The charging infrastructure is woefully inadequate to make that a viable option at the moment. For two car families, having one electric, and one petrol car could make a lot of sense.

The driving experience of the car itself (a Porsche Taycan) is just stunning. Prodigiously quick, and it handles like a go-kart, yet as easy to drive as a Golf. There's instant, bucketloads of torque available at any speed, making overtaking hilariously easy, and fun. I miss the lovely sound of a powerful engine though, but the near-silence of each journey (apart from a bit of tyre rumble), and the ease of driving, means that you don't feel at all tired, even after a long drive. This is definitely the future, but we need hundreds of thousands of public chargers to make electric cars an easy option for everyone.

Agenda -

Paul's Section:

Eckoh (LON:ECK) - from yesterday. In line trading update. Are the shares cheap, having halved from last year's peak? In a word, no, but you can at least justify the valuation. So not over-priced any more. It's a tech company that has demonstrated little organic growth in recent years. So wouldn't be my top pick for a tech share.

Beeks Financial Cloud (LON:BKS) (I hold) - a £15m fundraise announced last night, has been successfully completed at 165p, only a 3% discount. This goes to show that institutions will support fundraises from companies which are delivering rapid growth & good news. Beeks looks superficially expensive, but I think this is the most exciting & credible small cap growth stock on the UK market right now. I'm very bullish on the long-term prospects of this company, given its rapidly accelerating, record order book.

Intercede (LON:IGP) (I hold) - issues a profit warning caused by delays to contract signings. Being almost 100% gross margin, this completely wipes out expected profits for FY 3/2022. Clearly a setback, but the finances are sound, and a market cap of only £27m now looks attractive to me. Recurring revenues cover almost all fixed costs, but investors just have to accept that timing of licences is not something IGP can control, so profitability is volatile.

Moonpig (LON:MOON) - not a bad trading update, although the boost to revenues has come from omicron, hence is hopefully temporary. Shares have dropped a lot from the inflated IPO price, but are still only coming into reasonable range. Weak balance sheet too. So it's not for me.

Jack's section:

Property Franchise (LON:TPFG) - I hold - strong results, as previously conveyed to the market. The shares remain modestly valued in my view, considering the resilience of the hybrid business model. Rising interest rates will be a concern for sales transactions, but this is offset by rental income, and I think there’s a good growth opportunity here over a longer timeframe.

Quixant (LON:QXT) - encouraging results from a smart UK small cap that supplies hardware and software to some much larger companies. There’s been a strong H2 recovery, with good visibility for FY22 and with order intake ahead of current year revenues and prior year order book. Notes from meeting with management have now been published.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Eckoh (LON:ECK)

40p (up 5% at 16:19)

Market cap £116m

Trading Update & Product Update

Eckoh is a global provider of customer engagement security solutions, supporting an international client base from its offices in the UK and US.

Our secure payments products help our clients take payments securely from their customers through multiple channels.

Nothing to get excited about here, it’s an in line with expectations update (and a helpful footnote) -

The Group expects results for the year ended 31 March 2022 to be in line with consensus market expectations* and will provide more detail in its pre-close trading update in early May 2022.

* Eckoh believes that consensus market expectations for the year ending 31 March 2022 are currently revenue of £32.1 million and Adjusted Operating profit of £4.9 million.

Recent acquisition is going to plan - which looks material, at £31m cost, relative to Eckoh's £116m market cap -

Eckoh, the global provider of customer engagement security solutions, is pleased to announce that the integration of Syntec, the payments solutions provider acquired for £31m in December 2021, is progressing well. Syntec's contribution to revenue and profits in the three months since acquisition are expected to be consistent with management's projections at the time of the transaction, and the initial steps towards realisation of market, product portfolio and cost synergies are proceeding on plan.

Product development is explained in some detail, which I won’t repeat here.

Broker updates - there’s good coverage of Eckoh, from quality brokers, Singers and Canaccord, so many thanks for their updates today.

Adj PBT has flat-lined for 3 years, which highlights the lack of organic growth. Cost-cutting is expected to give a boost to FY 3/2023, along with a boost from the Syntec acquisition.

FY 3/2022 is expected to deliver 1.4p adj EPS (PER of 28.6), rising to 2.0p adj EPS for FY 3/2023 (PER of 20.0)

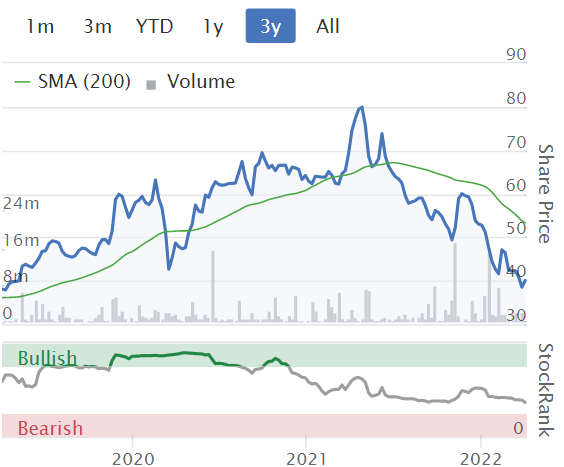

My opinion - Eckoh shares have halved from the (I would say irrational) high a year ago of c.80p. That’s now brought the forward PER down to about 20 - which is probably about right for a company that has struggled to show much organic growth in recent years.

Eckoh looks a decent quality business, that generates decent profit margins, and real cashflow.

However, the days of racy valuations for anything just because it’s tech, look to be behind us, or at least on pause. Therefore I can’t see any reason to chase Eckoh shares up in price, other than as a short term trade, which could be worth considering. Lots of things are bouncing right now.

ECK reminds me a bit of DOTD, with both being strongly cash generative businesses, but struggling to demonstrate organic growth. Maybe both are now a little old hat? Hence more likely to be valued as mature businesses, than growth businesses? Who knows.

The last 3 years has been a round-trip from 40p. Maybe it could bounce from that level again?

.

Beeks Financial Cloud (LON:BKS)

177p (up 3% today, at 09:19)

Market cap £116m (based on enlarged share count of 65.4m)

A £15m placing was announced last night, together with a Primary Bid offer for retail investors. The trouble is, why would I want to apply via Primary Bid, when they didn’t set a price? Would you buy anything else not knowing what the price is?!

Normally, when companies announce an accelerated book build, then it’s already a done deal, because a roadshow with institutions will have been carried out in the preceding fortnight or so.

This morning we got confirmation that the fundraising has been successful.

Terms -

- £15m raised (before fees)

- 165p per share, a modest 3% discount

- Placing: 8.79m new shares

- Primary Bid: 303k new shares

- Total new shares: 9.09m at 165p = £15.0m

- Existing share count was 56.3m, so this is enlarged by 16.1% to 65.39m shares

- Vendor (Gordon McArthur, founder/CEO) sale of 1.7m existing shares, raising £2.8m for him personally (no money to the company).

- CEO stake reduced from 26.29m shares, to 24.59m shares (37.6% of enlarged share count - still a very large founder’s stake). New 12 month lockup on his remaining shares.

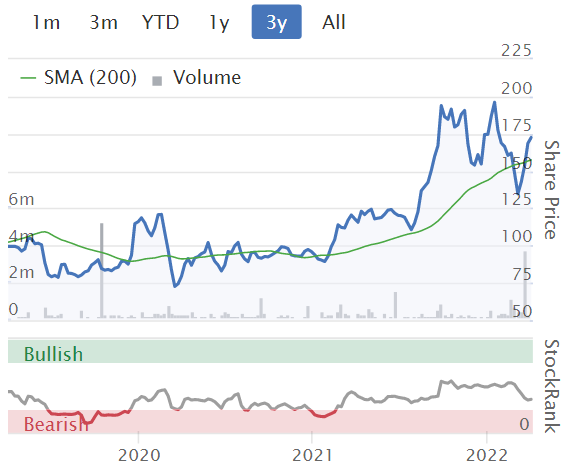

My opinion - it’s no surprise at all that Beeks has done a fundraising. I mentioned in my last review that the balance sheet clearly needed strengthening, especially as rapid expansion is underway, with very strong organic growth.

Indeed, in a recent webinar, management sounded completely relaxed about funding, saying “Our balance sheet does need strengthening, that’s fairly obvious!” - if only all companies were so transparent.

Even so, this £15m equity fundraise is much bigger than I was expecting, although the 16% dilution isn’t excessive. Therefore, any concerns some investors may have had about funding, are now resolved.

Management today comments that it has a “huge opportunity ahead”, and that in a nutshell sums up the investment case. It’s too early to value Beeks on a PER basis (which is only suitable for mature businesses). The organic growth here is exceptional, which is why BKS shares are my current favourite growth company, and it’s now my second largest personal portfolio holding, so bear in mind I’m not impartial - the organic growth here really excites me, and is rarely seen.

A company adviser told me that the size of the fundraise is indicative of the scale of the expansion opportunity that BKS has before it. The business model involves some up-front capex to buy more servers, etc.

Also, some of the funding is being used to accelerate R&D projects. That’s fine by me - Beeks seems to have first mover advantage in moving connections to international financial exchanges onto the cloud. Demand is soaring (last quarter saw record contract wins, at 3x previous record quarter) - when you have that kind of opportunity, it needs to be maximised, with short-term profitability becoming irrelevant. Particularly because contracts won then lock in clients in long-term recurring revenues.

Over-analysing historic numbers misses the point in my view, this is all about stellar growth, and what should end up being a highly profitable company that could even dominate this global market. Imagine what that could be worth, long-term? If things work out as I hope, then it’s not fanciful to see this becoming a 10+ bagger over say 5-10 years, but let’s not get too excited at this stage.

Valuation - for now, Beeks shares look expensive, there’s no doubt about that. So it’s not a share for value investors. Instead I see this as probably the best small cap growth share that I’ve come across lately, as it has such a big market opportunity, and orders are rolling in at an accelerating pace.

Management commented on the recent webinar that orders with large international tier 1 clients generally start off on a trial basis, which might be say £1m p.a. recurring revenues. As the clients gain in confidence, repeat orders then typically follow, with the first £1m p.a. client now having expanded to £6.5m p.a.. Therefore growth is strong, even before recruiting new clients, from existing clients expanding their purchases.

Another comment from management in the last webinar was, “Deal sizes we’re quoting for now dwarf what we’ve done before”. A big capital raise to fund expansion, backs this up.

I think this is a very exciting growth share, which is in my coffee can, and I’m looking to buy more when funds are available. Although it would probably need more upgrades to expectations to propel the shares on to the next stage, who knows? It’s tricky to value, and can look expensive or cheap, depending on how you look at it.

.

.

Intercede (LON:IGP) (I hold)

46p (down 21% at 08:45)

Market cap £27m

Trading Update (profit warning)

Intercede, the leading specialist in digital identity, credential management and secure mobility…

A disappointment here, with a profit warning for FY 3/2022.

Delays to a number of large new opportunities -

Whilst the number of new deployments is the highest in recent years, delays have been experienced with a number of large new opportunities that had been expected to close this year and consequently there has not been a substantial license order received during the year ended 31 March 2022. Furthermore, COVID-19 has continued to impact trading outside the US market.

Guidance -

- Revenues for FY 3/2022 expected to be £9.9-10.0m (9% below last year, or 4% down on constant currency)

- Company remains profitable (only just!)

- Recurring revenues largely cover the fixed cost base - which de-risks things largely

- Gross cash £7.8m - also, remember that the old borrowings on bonds are gone now, so the liquidity position is fine, no worries about solvency, given the high level of recurring revenues. Although the company is heavily reliant on one large, long-term contract in the US.

- $0.3m contract win announced today, looks a bit of a fig leaf.

Broker update - thanks to Finncap for an update note today. It’s not pretty, because of the operational gearing from contract wins, dropping straight through to the bottom line - lovely when it's growing, but brutal when it's slowing.

Revised forecast -

Revenue £9.9m (down from £11.5m)

Adj PBT £0.0m (down from £2.3m)

If these are genuinely delays, not cancellations, then FY 3/2023 could in turn be a bumper year, with the benefit of contract wins deferred from FY 3/2022.

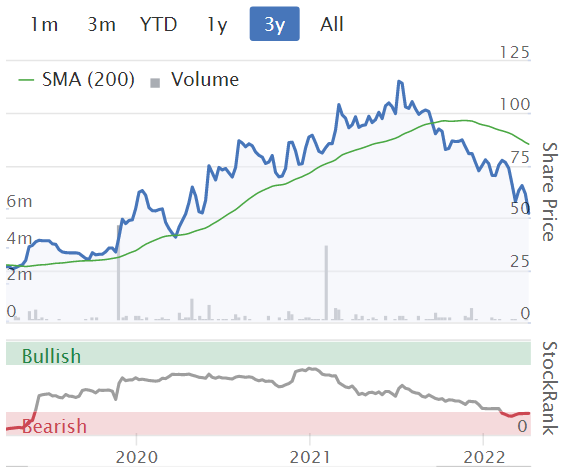

My opinion - clearly this is a setback. Lumpiness of contracts is still an issue, and this announcement reminds us how nasty the operational gearing can be, when close to 100% gross margin software companies fail to close expected contracts by year end. It's a pity, because this disappointment obscures a lot of good work which has been done behind the scenes to improve the company.

I’m disappointed that growth has stalled, but the share price looks to me like it’s overshot on the downside. £27m market cap now looks far too low, hence I’d be inclined to add to my position, rather than sell. Although I’m also realistic that the company hasn’t managed to demonstrate sustainable growth yet, so investors understandably take a dim view of that.

As you can see below, the share price has now scrubbed off most of the gains from the 3-year turnaround. It's a brutal market for small caps right now, so lots of charts look like this. But, the truth is clearly that performance has disappointed considerably, so the price deserves to fall - this is what happens when companies miss forecasts.

EDIT - I've just had a quick call with management, key points -

- They're frustrated & disappointed at contract delays, but not something they can control, when dealing with huge organisations, such as US Federal agencies (not able to disclose the name, for security reasons)

- Some large customers don't want to buy all the licences up-front, so the silver lining is that IGP gets follow-on orders, as they scale up new projects.

- Extremely sticky customers, very low attrition.

- Most business is in USA, with RoW (rest of world) almost shut down due to covid for 2 years, but signs now improving, as these markets are opening up again.

- Some of new contracts are displacing competitors - shows strength of Intercede's offer.

- New business being won through selling partners.

- Clear plan to develop the business in the next 3-4 years, Board remain very motivated. Apologise & take responsibility for this disappointment, but it's one bad half year, after 7 positive half years. Hope to have a more positive meeting in June, if delayed contracts are signed in this new year.

.

.

Moonpig (LON:MOON)

240p (up 1%, at 10:14)

Market cap £806m

This is one of many over-priced companies which floated on the growth boom fuelled by the pandemic, which has since crashed in valuation, almost into our usual (arbitrary) £700m top end for the SCVRs. I’m curious to take a look - will this be a one-off visit, or is MOON coming to stay with us for the long term, here in small caps land?

MOON’s year end is 30 April 2022.

Moonpig Group plc (the "Group"), the leading online greeting card and gifting platform in the UK and the Netherlands, today provides an update on its trading performance in the current financial year.

Revenue guidance is raised, but a refreshingly honest explanation is provided, that this is a temporary, omicron-related boost -

Trading performance has remained strong. We now expect that Group annual revenue in the financial year ending 30 April 2022 will be around £300 million, with the upgrade reflecting the temporary impact of Covid-19 on customer behaviour in late December and January. Our expectations for underlying revenue in FY22 remain unchanged at approximately £265 million.

Outlook - this is a little awkwardly-worded, it could have been clearer what they mean -

Trading in February and March has provided further evidence that supports our previously announced expectations of a permanent uplift in customer cohort frequency compared to before Covid-19. Accordingly, we remain confident in our existing expectations for the next financial year…

… we remain confident in the outlook for the year ahead. Moonpig Group has delivered a permanent step change in scale over the past two years, with a larger customer base displaying higher loyalty than pre-pandemic. The long-term opportunity remains vast, and we have never been in a better position to deliver against Moonpig Group's strategy to become the ultimate gifting companion."

Operations & IT are being expanded to handle expected future growth.

Medium-term target is annual revenue growth in the “mid-teens” - pretty good, if they can achieve it.

Margin “remains resilient”, and adj EBITDA target is 24-25% - sounds high, but it depends what they’re capitalising onto the balance sheet, which by-passes EBITDA completely.

“Very successful” Mothers’ Day recently (my mother insists that this has nothing to do with her, or any other mothers, it’s originally a religious celebration between local clusters of churches. No idea if that’s true, but she’s usually right on everything, as I have reflected in my choice of fridge magnets).

.

My opinion - this update sounds pretty decent to me.

I like the fact that the valuation has crashed, as it makes a more interesting potential purchase.

There’s no available research on Research Tree, but going on the Stockopedia consensus for FY 4/2023, EPS is 12.0p - giving a PER of 20. If it can achieve the mid-teens growth target, then that looks a fair valuation.

Massive advertising spending means that many people will know the name, and you’re probably already humming the Moonpig-dot-com jingle! (Ha! If you weren’t, you are now!). There are competitors though, and we’ve seen from other online companies that online marketing can become prohibitively expensive, as the likes of Google and Facebook grab the profits for themselves by price-gouging customers.

Moonpig had a horrible balance sheet at Oct 2021, with negative NTAV and too much debt.

On balance then, think I’ve talked myself out of this one. A share that started off over-valued, and has only just come into reasonable territory (if it hits growth targets) doesn’t appeal to me in a market when there are so many other obvious bargains.

It might appeal to traders though, if the current bounce continues, there might be a 10-20% profit to be had, who knows?

.

Jack's section

Property Franchise (LON:TPFG)

Share price: 349.8p (+1.1%)

Shares in issue: 32,041,966

Market cap: £112.1m

Final results for the 12 months to 31 December 2021

(I hold)

Highlights:

- Network income +67% to £157m (17% like-for-like increase to £110m),

- Group revenue +118% to £24m (26% LfL increase to £13.9m),

- Management service fees (MSF) +57% to £14.7m (+19% LfL to £11.2m),

- Adjusted EBITDA margin of 81% and adjusted operating margin of 40%,

- Profit before tax +35% to £6.4m and adjusted EPS +61% to 27p,

- Net debt down from £8.8m to £2.7m despite £12.5m borrowed to fund Hunters acquisition,

- Total dividend up from 8.7p to 11.6p.

Like for likes exclude the impact of the acquisition of Hunters/Mortgage Genie and Aux Group disposal. Hunters in particular was a material acquisition.

We have increased our revenue every year since IPO and this was our eighth consecutive year with revenue up 118% to £24.0m (2020: £11.0m) largely driven by the acquisition of Hunters which contributed £9.8m.

Reflecting comments on the strength of the housing market made by Belvoir yesterday, TPFG’s sales agreed pipeline is up some 73% to £26.5m. A big chunk of this increase presumably results from the Hunters acquisition as well.

CEO Gareth Samples comments:

We experienced a surge in demand for residential property in 2021, reaching a level I have not experienced before during my 30 years in the sector.

How sustainable is that? The company is expecting 2022 to be much more like 2019 but anticipates growth regardless.

Looking ahead, we see an exciting period of further development for all our franchisees in 2022. While we expect over the year we'll see sales activity return close to 2019 levels, so far we have seen continued high levels of demand for both sales and lettings, well above pre-pandemic norms. Aside from market conditions, we have great confidence that the execution of our strategic initiatives, alongside the benefit of a full year's contribution from our acquisitions, will underpin continued growth this year and beyond.

The number of managed rental properties has increased from 58,000 to 74,000, while EweMove has had a record year, with 58 new territories sold compared to just 11 last year. On rents:

Typically, rent increases of 6% to 8% were seen during 2021, a trend that is continuing into the current financial year.

TPFG also launched a five year strategic partnership with LSL in April 2021 for the group’s financial services division.

The chairman (Richard Martin) is resigning soon and his commentary this year is particularly interesting:

Martin & Co opened its doors for trading in May 1986 in South Somerset. My franchisor epiphany came when in 1993 I read a copy of 'Behind the Golden Arches', the story of how Ray Kroc succeeded in building McDonald's into the world's largest franchise network. In the months that followed I set about designing the systems and procedures of our franchise model.

And:

Being a multi-brand franchisor, we felt the time was right in 2017 to re-brand to The Property Franchise Group. We thought we had a resilient business model and, when put to the test, by Brexit and Covid-19, it behaved in that way. In March 2021, we acquired Hunters, Country Properties and Mullucks. Then to support an expansion into financial services across a network heading towards 600 outlets, we signed a five-year strategic partnership with LSL Property Services in April 2021 and acquired a mortgage broker, Mortgage Genie, in September 2021.

I think these two quotes touch on two key points: the strength of the group’s franchise-led business model, and this more recent second phase: using that resilient, cash-generative business as a platform from which to diversify into other avenues of what is a very large UK housing market.

Outlook

Whilst we appear to have weathered the worst of the pandemic, none of us currently understand the implications of the conflict in Ukraine and the increasing cost of living. However, what we do know is that the Government has thus far been supportive of our sector, rental inflation is happening, and we are seeing greater sales activity than we were expecting so far this year.

So, possible upgrades should the current conditions persist for longer than expected. There’s a live private investor presentation on Wednesday 6 April 2022 at 12:30. You can register using the following link: https://bit.ly/TPFG_FY_webinar... results and a transformational year, probably reflected in the recent share price strength.

But TPFG’s valuation remains fairly modest given the business model and growth prospects.

As noted yesterday, the health of the housing market is a huge variable. TPFG’s business model should see it weather any downturn, but it could still be a consideration for those looking to time an entry into the stock.

House prices have increased drastically as a multiple of median earnings over the past few decades, and it looks like we’ll be getting interest rate rises going forward. It’s clear that there could be rockier moments in the years ahead.

However, the group comments:

Looking forward, I continue to believe that the housing market represents a strong investment opportunity. The UK government has demonstrated that the housing market is integral to a strong economy and that it will implement initiatives to support its continued strength. We need further properties to rent to satisfy our labour shortages and ensure capacity exists where that labour is required. Demand for rental properties remains strong and returns should increase. In addition, early evidence in 2022 suggests a healthy appetite remains to buy homes to satisfy post-covid lifestyle changes.

The fact that the UK government is supportive of the sector due to its importance to the wider economy is an important point. We’ve seen over Covid that governments are prepared to intervene these days in order to prevent short term economic pain.

However the sales market plays out, TPFG still derives a large part of its revenue through rent. Macro considerations aside, I think TPFG’s prospects are bright in terms of the group’s business model and ability to grow both organically and via acquisition.

We now have a Group which is capable of more rapid scaling up and we believe our network of local business professionals will soon challenge the largest of the corporate networks. Our year-on-year financial performance and returns are testament to the capital-light strength of our franchise model and, as it has in the US, we believe that franchising will become the dominant model in residential agency with TPFG augmenting our position as a leading player.

Belvoir reported yesterday, also with good results (quite similar on a like-for-like basis). I find it hard to pick between them really and think the market is large enough for them to both grow using fairly similar strategies. All in my opinion of course, so feel free present an alternative view!

Quixant (LON:QXT)

Share price: 150p (+3.45%)

Shares in issue: 66,450,060

Market cap: £99.7m

Final results for the year to 31 December 2021

Checking back over the notes, this is how we last summarised Quixant, back in January:

looks interesting. Founder/chairman remains largest shareholder. Ran into trouble before Covid, and lockdowns have since impacted. Some signs of quality though, and no equity dilution over what has been a difficult period. Solid balance sheet and possibly conservative forecasts, so could do quite well over the next year or two

It’s a provider of technology products for the gaming and broadcast industries, working as an outsourced technology and supply chain partner for major global industrial electronic equipment manufacturers. All of this is underlined by an encouraging culture of in-house R&D, new product development, and intellectual property.

The group started off in Gaming but has since branched out into other areas such as Broadcast, acquiring Densitron (where some of the management initially left to set up Quixant).

Densitron supplies display components to a wide range of industrial sectors, from which the Board has selected sectors in which there is the opportunity to develop tailor-made products, which are different to those readily available from broad-based technology corporations. We believe the Broadcast market represents such an opportunity, in which we have developed unique solutions which revolutionise the human machine interaction and control of Broadcast equipment. We delivered our second consecutive year of double-digit revenue growth in 2021.

I haven’t checked back in on the stock since the January write up, and see now that I missed an opportunity to take a closer look when the shares fell recently along with the rest of the market.

The shares are up by 6% or so this morning.

- Group revenue +37% to £87.1m (gaming division +56% to £47.3m, Densitron division +19% to £39.8m),

- Gross profit +29% to £25.9m,

- Adjusted PBT +315% to £5.4m and reported PBT up from a loss of £2m to £4.9m,

- Adjusted diluted EPS up from -0.4 cents to 5.95 cents,

- Net cash up a per cent to £17.6m.

Revenue in the second half of the year reached pre-pandemic levels and was the highest revenue performance since the second half of 2018, a strong recovery.

Good order intake through the year and into FY22 gives the group ‘excellent’ visibility of customer demand, while a recovery in end markets and new business wins have driven double digit revenue growth across the two divisions. So it sounds as though the outlook is positive.

There’s a results presentation tomorrow at 4:30pm here.

The group has grappled with electronic component shortages but has largely mitigated this, with a strategic stock purchase programme in January 2021 driving down delivery delays and mitigating against price inflation. This does remain an issue, but management has handled it well so far and there is some evidence it can pass costs on where appropriate.

While the strategic stock investments weighed on working capital, we nonetheless generated cashflow from operations of $4.4m (2020: $4.0m) and grew our net cash balance to $17.6m (31 December 2020: $17.4m). We expect to make continued investment in strategic stock to enable us to satisfy growing customer demand and new business opportunities in 2022 despite ongoing component shortages.

Conclusion

A particularly strong H2 and a positive outlook for the new financial year, backed up by in-demand technological products, intellectual property, and a strong balance sheet. This is a promising company in my view, although component shortages and wage inflation could have more of an impact going forward.

Quixant has grown its revenue very well in the past, although 2019 saw a bit of a dip, before Covid. This was due to underperformance from key customers at a time of higher customer concentration for the group. Since then the revenue base has diversified.

There are signs of a quality company here, but I wonder how large it can become? The group is confident it can target organic growth in a few different ways:

- New customer acquisition in existing markets, further diversifying the revenue base;

- Increase share of customer wallet by providing additional outsource solutions to become a fully integrated technology partner (an example of this is the recently launched range of turnkey cabinet solutions, which enable customers to focus exclusively on game software development and outsource their whole hardware offering to Quixant);

- Focused R&D to move up the value chain, including within the software stack; and

- Identify and target adjacent verticals that do not currently benefit from deep specialist solution outsource providers, such as Broadcast.

Alongside this could be the occasional strategic acquisition, should an attractive opportunity present itself. All in all, the situation piques my interest so I will be spending a bit more time on it.

On that note, I’ve just left a call with management so will publish the notes below once I’ve tidied them up.

Notes from meeting with management

The gaming market is important and is the group’s heritage, but Quixant is first and foremost a technology business. It works to differentiate itself from bigger corporations approaching its customers, by identifying large niche sectors which are poorly serviced offering from broader manufacturers.

Quixant’s first opportunity presented itself when some of the current management were working at Densitron, where they were making industrial computers. The gaming industry was in transition, from one arm bandit machines to video slot machines, and they started making enquiries to Densitron for this kind of product.

QXT mgmt felt there was a sufficiently compelling opportunity to build a business in isolation, with entirely new IP. From there they built the product and acquired customers, growing the business to 2013, at which point it floated in order to boost its credibility with customers (which were often much larger than Quixant).

The standard PC technology adopted for gaming video slot machines was poorly aligned to the regulatory and feature needs of the market. Quixant’s offering was more targeted and suitable. The customers don’t want to have to worry about the manufacturer of PC platform, they just want to focus on building their games.

Quixant therefore made an off-the-shelf compliant platform, freeing customers up to focus more on game design. There has been good success converting to that model and retaining customers over the years. Customers themselves have seen a very good rebound after Covid.

The group then looked for other markets where it can identify a technological trend, develop products for it, and develop deep sector knowledge from there in order to grow higher up value chain.

Densitron - industrial displays, relatively commoditised and high competition but broad sector exposure. Management can use this base to focus on higher return opportunities, such as the current Broadcast transition to touch screen technology.

Densitron is a ‘wonderful’ business exposed to many opportunities. Broadcast evolved as several companies already there wanted bigger displays for their software and ecosystems. A lot of what these customers use offer no tactility, which is important. Quixant is seeking to revolutionise the adoption of 21st century control mechanisms here, and has recently acquired IDS.

Historically, capex has been spent on gaming but more recently the focus has shifted to Densitron, where Quixant sees continued growth potential.

The group is also on the lookout for acquisitions that will bolster IP. These acquisitions could either deepen exisiting products to increase their value, and broaden the enterprise into adjacent markets. For example, tactile overlays have myriad end markets

Quixant is proud of owning IP and is focused on long term sustainable growth. It develops its own computer boards in house, has patented IP, and combines hardware and software into a unique offering.

Covid has been the key management issue; component shortages won’t ease for next few months but has weathered the storm well so far.

Gaming - still a ‘fabulous’ growth opportunity here, with good work done around customer retention and introducing new customers and revenue categories. There’s a more diverse mix of customers so revenue is healthier (see FY19 profit warning below). The growth engine that investors backed at float still presents a strong growth opportunity.

But then management identified the need for additional sectors. Broadcast has delivered its second consecutive year of double digit growth despite lack of trade shows. Management is attending a US trade show this month to demonstrate the products, which should really drive lead generation.

The group has exited the period with a well resourced and more experienced management team, no deep cost cutting, strong balance sheet, and no equity dilution.

Margin impact from supply chain issues has already seen in 2021. Quixant is passing prices on where appropriate but doesn’t want to profit from it. Structurally margins are intact and the group has worked with customers.

Quixant has used this period of disruption to strengthen customer relations. Customers weren’t interested in new products in FY20, just survival. Quixant was supportive and transparent, building up credibility customer management.

Then last year the situation flipped and Quixant couldn’t supply in full when demand was spiking. The team has been open and transparent with customers. It’s a regulated market so credibility required; retention has been good, doing a better job than others in marketplace. IP and tech remains high quality + strength of BS means QXT has been very helpful to customers.

FY19 profit warning - this was concentration risk on key customers. Gaming is all about quality of game, some customers saw reduced demand which had knock on effect on Quixant. No lost business.

It’s not all about the US market. QXT’s biggest customer prior to FY19 was Australian, so it can meet casino operations regulatory requirements across multiple markets. It has a sizeable business in Europe and a small footprint in Macau (lucrative but not big market for them).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.