Good morning from Paul & Graham.

Many thanks for your kind comments yesterday re my new small caps podcast. I'm happy to keep making these, on Saturday mornings, since there's clearly an appetite for them from you. The idea is to recap on the week's best (and worst!) small cap announcements. Then a bit of general macro/market musing. I think it helps me try to make sense of things too!

If we can spread the word, and drive some newcomers (and lapsed former members) to Stockopedia subscriptions (where there's more detail than in podcasts), then that will help keep the wolf from the door too. When markets plummet, many people disappear without trace, only to pop up again when the sun is shining again. Yet in the past, I've found that the work I do during bear markets tends to line up the big winners of the future (and avoid things that could go bust in the meantime).

Agenda -

Paul's Section:

Saga (LON:SAGA) (I hold) - a reassuring trading update, with proper guidance this time (£35-50m underlying PBT - much improved from circa breakeven for last 2 years combined). Insurance division is set to become less profitable per policy, due to a decline in new business. Travel continuing to recover, with good forward bookings in cruise. Debt is fine, with long maturities, and loose covenants. For long-term investors, I think there's plenty to like here, and am encouraged by this update, as the plummeting share price made me wonder if bad news was on the way. Turnaround taking longer than expected though, but it is happening.

Supreme (LON:SUP) - a profit warning that's confined to the lighting division, where customer de-stocking has triggered a significant drop in expected profit for FY 3/2023. Divi payout ratio is being cut in half, but I'm satisfied that's not from weak finances, it's to prioritise M&A. Balance sheet is sound. Today's drop in broker forecasts is a bit shocking, so I'll need more time to have a think on this share, but for now the share price reaction looks about right after a bombshell warning today out of the blue.

AO World (LON:AO.) - a response from the company to negative press comment came out yesterday afternoon. It reassures that things are OK, until the last sentence, which reintroduces doubt over whether it might need to do a placing. I'm steering well clear, as it's too risky for me.

DFS Furniture (LON:DFS) - many thanks to MrContrarian for spotting this trading update, buried within an RNS about the CFO moving on. It's a good update, with profit for FY 6/2022 at the top end of guidance. As always, the deal-breaker is its horrendous balance sheet. Don't expect the divis & buybacks to continue in a consumer downturn, as they're already on a flimsy financial foundation. High risk, due to balance sheet weakness.

Graham's Section:

Mercia Asset Management (LON:MERC) (£133m) - final results from this fund manager and investor show a strong improvement in adjusted profits, and more exceptional gains on business disposals. This looks too cheap against earnings, suggesting the market is sceptical that these exceptional gains can be repeated any time soon. But supporting the valuation are balance sheet net assets of £200m, including the unrealised gains on Mercia’s investments.

Kitwave (LON:KITW) (£105m) - this food and drink wholesaler was listed on AIM in May 2021, and is a new stock for us to look at. Trading has picked up very strongly in the post-Covid environment, and brokers have materially raised their earnings estimates. The stock is cheap against forecast earnings but the company is carrying some debt and is likely to engage in further M&A, so there is an element of financial risk involved.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Saga (LON:SAGA) (I hold)

167p (before market open)

Market cap £234m

Trading Update (AGM)

Saga plc (Saga or the Group), the UK's specialist in products and services for people over 50, provides the following update on trading covering the period from 1 February 2022 to 4 July 2022.

PR headline -

Saga on-track to return to underlying profit

It’s worth noting that some of us were unhappy about the previous guidance given to the market, which was very vague, just saying they expect a profit this year, but not how much!

Management justified this on a webinar by saying there are significant uncertainties. Sure, but most companies can still manage to give a range of profit guidance, so I don’t see why SAGA couldn’t too.

Main points -

Insurance -

There’s been a decline in new business.

Profit per policy (home & motor) slightly down, “broadly maintained” at £73.

Margins expected to fall to £60 per policy next year (FY 1/2024), to drive growth.

Travel -

Current year FY 1/2023 - load factor now 73% for cruise, to rise to 75% (was 68% in H2 LY)

“Exceptionally strong” cruise booked load factor for this summer (no number provided).

Daily rate £319 (up 6.7% from £299 last year), which I imagine would recoup most increased costs (and fuel is hedged at start of each season).

Outlook for cruise sounds encouraging -

Strong launch of 2023/24 Cruise season with bookings representing a load factor of 34% and per diem of £312, both well ahead of expectations.

Holidays (i.e. the rest of travel division) - running at a “small loss”, “much improved” from last year. “Encouraging early signs” for recently launched next year bookings.

New guidance - I take it all back, about vagueness! We now get proper guidance for this year, which looks OK to me -

The Group expects to generate 2022/23 Underlying Profit Before Tax of £35-50m and grow future earnings from this level.

The expected outcome for 2022/23 is in line with the range of analyst expectations and compares to a prior year Underlying Loss Before Tax of £7m.

Actually, I’m really encouraged by this. The share price has been in free fall, so I was dreading this update, imagining that the roof might be falling in. Instead we have a reasonable outcome guided for this year, in what was always going to be a partial recovery year. Although note broker estimates have been reduced a lot (that's why the share price has fallen so much) -

Balance sheet & liquidity - a brief update -

The Group's balance sheet remains resilient with significant available liquidity; simplified revolving credit facility with reduction in commitment from £100m to £50m.

The important thing to note here, is that SAGA’s admittedly heavy debt is secure. It’s mainly 2 loans to finance its 2 owned (nearly new) cruise ships, so there’s a corresponding tangible asset, very much like HP on a van.

The other debt is a £150m [sorry, earlier typo corrected] (remaining) bond due for repayment in May 2024 (fixed rate 3.375%), and £250m newer bond, repayable in July 2026 (fixed rate 5.5%).

The 2 ship loans were £516m at Jan 2022, and are repayable in recently resumed instalments, ending in June 2031, and Sept 2032.

On top of which, SAGA maintains a big cash buffer, which was £187m at Jan 2022. So there’s enough in the kitty to pay off the first bond in full, and still leave a comfortable cash buffer. This is absolutely not a distressed situation.

The bank facility has not been used, and isn’t needed. So the available facility reduction from £100m to £50m makes sense, and probably lowers fees.

Therefore, I see SAGA’s debt (and hence equity too) as safe - no maturities, or interest rate risk in the foreseeable future. What a good thing it refinanced during the pandemic, with an equity raise (cornerstoned by Sir Roger de Haan, founder's son & long-serving former CEO), and a bond refinancing that looked unnecessary at the time, but has locked in ample, relatively cheap, fixed rate debt. So a very canny move, as it turns out. Compare that with larger rival Carnival, which is having to issue fresh debt at 10%+ interest rates. One broker even said recently that Carnival could go bust, in the worst case scenario.

Covenants (I looked at these again recently in the comments here) are fine - only applying to the ship loans, and set at a level where the group would have to be loss-making to trigger them. Since we’re guided today to a profit of £35-50m, then the ship loan covenants are not an issue.

Video of SAGA’s growth plan is here.

My opinion - I’m rather encouraged by this, in the context of a plummeting share price.

The main downside today is that insurance is becoming less profitable, probably due to changes in the rules on pricing, which we already knew about.

Travel seems to be recovering.

There are no issues at all with debt or covenants - that’s a complete red herring, as explained above.

I remain firmly of the view that this is a nice 2-year turnaround, and it looks like things are on track, although note that broker forecasts have been lowered considerably. So the turnaround is slower than I had originally hoped, but still very credible I think.

In the context of a market cap down to only £234m, this share looks very good value to me.

It’s been dragged down by Carnival (LON:CCL) recently I think, where debt issuance is looking distressed. SAGA doesn’t have any issues of that kind, with secure, and cheaper debt than Carnival.

Don’t expect miracles overnight with SAGA, but as a long-term hold, I think there’s a lot of potential here. I’m certainly more bullish today, than I was yesterday.

My hunch is that a reassuring update today, with proper guidance, could put a floor under the share price, after big recent falls. Who knows though, anything could happen in current volatile markets.

.

.

Supreme (LON:SUP)

87p (down 31% at 09:03)

Market cap £101m

I’ve had a generally favourable impression of this company, checking back through my notes:

10 May 2022 - company updated re McColls, and said it was “trading well”

12 April 2022 - strong trading update for FY 3/2022. Outlook was for another positive year for FY 3/2023, although tempered by cost increases.

7 Dec 2021 - interim results & outlook looked good to me here.

Clearly there’s a bombshell within today’s results statement, to have caused shares to drop 31% this morning.

Supreme (AIM:SUP), a leading manufacturer, supplier and brand owner of fast-moving consumer products, announces its audited final results for the year ended 31 March 2022 ("FY22").

Headline numbers look fine -

Revenue £130.8m (guidance on 12 April was >£130m)

Adj EBITDA £21.1m (guidance: >£21m)

Adj PBT up 6% to £17.4m

Adj EPS 12.8p (up 7%)

At today’s 87p per share, the PER is only 6.8

Net bank debt is modest, at £1.9m.

Divis - 3.8p final to be paid end Sept, 2.2p interim already paid = 6.0p total, yield of 6.9% - same as the PER, you don’t see that very often - but divis are set to reduce from 50% of profits, down to 25%, implying the future divi yield would drop at least half, down to maybe 3%, once we take into account lower profits and the lower payout ratio.

Outlook/ Current Trading - this is what has clearly spooked the market.

Profit warning -

The Group expects to deliver another solid, profitable year in FY23 but revenue and EBITDA are both expected to be below FY22 levels and below previous market expectations, driven by a recent marked decline in the Lighting category following a slow-down in sales compounded by customer overstocking in FY22.

Following discussions with its key customers the Group believes this slowdown in sales and profitability will be temporary and limited to the Group's Lighting category due to specific customer over-stocking in the past 12 months.

That’s a very interesting point about customers overstocking - Luceco (LON:LUCE) said something similar in its recent profit warning, so this looks like it could be a more widespread problem unwinding this year.

However, in this case, the problem sounds ring-fenced in one division, and temporary, so maybe not that bad? Although it does imply that FY 3/2022 results would have been boosted by over-stocking by specific customers, so we should probably be reducing the forecasts on which we value this share.

Actually, I hadn’t realised that lighting was an important category, but this note from the accounts shows it’s the second most profitable product category, after vaping -

.

Visibility is said to be good for the lighting category, due to long lead times. Profits are expected to improve again in FY 3/2024.

Vaping - outlook is strong, with +30% revenue growth expected in FY 3/2023. It surprises me that this won’t be enough to offset the weakness in lighting.

More acquisitions are planned.

Overall -

In spite of the short-term trading challenges in Lighting, the Board remains confident that the Group has a long runway of growth ahead and is increasingly excited by the prospects for growth in the vaping division.

Presentation - is tomorrow, 6 July, at 11:00 - register here.

Balance Sheet - looks fine, and has notably strengthened in the year, due to retained profits.

The current ratio is strong, at 1.95.

This looks a well financed business, and I don’t have any concerns at all about solvency or dilution risk.

The cut in dividend policy therefore looks genuinely motivated by a desire to focus cashflows on funding M&A, rather than a forced cut due to stretched finances, which is clearly not the case. Although I do wonder if perhaps the bank might have indicated they prefer to lend for acquisitions, rather than bumper divis?

Broker update - Equity Development updates its forecasts today, with 9.3p pencilled in for FY 3/2023. That’s down a hefty 25% on FY 3/2022 actual results.

At 87p per share, the forward PER is now 9.4 - quite good value, but as we now know that the lighting division profits are more flaky than imagined, a lower PER does make sense.

My opinion - oh dear, another company that’s saying demand was pulled forward during the pandemic, and supply chain problems. Although this only impacts one product category at SUP, and it does sound temporary.

Has the market over-reacted, with a 30% share price fall, on top of an already steep decline previously? Or is this a disaster, with an immediate sell being the best option?

My view is that, based on the information provided, this is certainly not a disaster.

However, it’s a significant change in outlook. Previously, this share looked like a steady growth story, augmented with organic & acquisitions growth. However, we now know that last year’s profits were probably peak earnings for the time being - the same is likely at many companies, I reckon.

I don’t currently hold, but still think this is a fundamentally good business. Although vaping does carry some product risk, say if some awful news about the long-term health impact were to appear. And nicotine is a hideously addictive, pointless drug (no upside, only downside).

On balance then, I still like the share, but less so than yesterday, because the facts have deteriorated.

The 30% drop in share price is probably reflecting the new, less appealing reality. Hence I think it remains sensibly priced.

Providing nothing else goes wrong, then long-term holders should get their money back eventually, I imagine.

.

.

AO World (LON:AO.)

48p (down 13% today at 11:15)

Market cap £232m

Response to Recent Press Reports

AO World plc ("AO" or the "Company"), a leading online electricals retailer, notes today's share price movement following press reports over the weekend…

This came out at 13:53 yesterday afternoon, but I’d already downed tools here after a busy morning.

In yesterday’s report I flagged the worrying Sunday Times article, saying that trade insurance had been cut for AO, which could trigger a cash crunch.

AO’s response made these points (I’ve summarised) -

- Current trading, and financial position, “remain in line” with mgt expectations, and guidance provided on 29 April.

- One credit insurer “rebased” (i.e. reduced) cover for some suppliers, reflecting slower business post-pandemic.

- To date, this has had no impact on liquidity, which is in line with exps.

- German closure update - previous range of £0-15m was wide, due to uncertainty over lease exit costs (useful info). Now expected to be at lower end - good news.

- Bank facility (RCF) of £80m is available until April 2024.

- Everything sounds quite good up to that point.

However, as is often the case, it’s the last sentence that undoes the reassurance, and introduces uncertainty over whether this means a placing is being planned?

In addition, the Company continues to consider and implement a number of ongoing initiatives and further actions to strengthen its balance sheet while optimising its focus on profit and cash generation against the uncertain macroeconomic conditions in the UK and the continuing global supply chain challenges.

My opinion - I think that last sentence was a really bad idea. It sounds as if a placing might be coming, which is likely to be at a discount - who would want to refinance a struggling electrical retailer facing a consumer downturn & ongoing supply shortages? Maybe the founders might buy it back? I’ve tried to find the original prospectus from 2014, but no joy. It would be useful to find out if founders took out a lot of cash in the original float, as that would affect how they might be inclined (and how rich!) now.I think there was press speculation about a possible attempt to take it private.

Anyway, my view is unchanged, I wouldn’t touch it. In more normal markets, and if they had omitted the last sentence, then I think this share might have bounced. Unfortunately not, as the price has continued sliding today.

Too risky for me.

.

.

DFS Furniture (LON:DFS)

150p (down 2% at 12:31)

Market cap £382m

Director Change (and trading update)

The CFO is to leave, but it sounds amicable.

He’s to join B&M European Value Retail SA (LON:BME) which is bigger than DFS, so it’s clearly a career move, hence not necessarily something for DFS shareholders to panic over.

An orderly transition is planned too, which also reassures that there probably hasn’t been a massive bust-up.

If a company puts out a trading update, then it needs to be headed accordingly, and put in the right category on the RNS, which this wasn’t. This update is just titled “Directorate Change”, so it doesn’t appear on the trading updates list. Many thanks to MrContrarian for spotting it, hence alerting me to have a look.

Trading update today - looks like nobody checked this for typos! (sloppy) -

Further to recent our [sic] Trading update and the successful completion of expected deliveries to our customers prior to year-end we now expect profitability to be in the upper half of the range for underlying profit before tax and brand amortisation previously indicated.*

*range previously disclosed on 9 June 2022 for full financial year underlying profit before tax and brand amortisation of £57-£62m.

My opinion - this looks surprisingly good. The main problem with furniture retailers hasn’t been demand (so far, anyway), it’s been actually getting the product made and delivered to customers.

Therefore, it sounds as if supply chain issues might now be easing somewhat?

Although I seem to recall furniture was one of the big categories showing a slowdown in spending, in some recent economic data, can’t remember the source.

DFS also has a reckless share buyback going on currently, which I think is complete madness, given deteriorating macro conditions, and DFS’s desperately weak balance sheet.

When last reported, DFS had NTAV of negative £(255)m! They’ve spent the customer deposits, and run up bank debt on top of that.

The current ratio is terrible - current assets of £103.7m, but current liabilities of £387m! That’s a current ratio of just 0.27 - one of the worst I’ve ever seen. Although do bear in mind the furniture retail sector does run on negative working capital, but even so this is really extreme.

If I were a BME shareholder, I’d be seriously worried about what the new CFO is going to do to its balance sheet!

If there’s a severe, and lasting consumer downturn, then DFS would be very vulnerable potentially. As orders dry up, then positive working capital would unwind, worsening the cash position, as well as profits dropping.

DFS had to do an emergency placing when covid struck, and was lucky to have had keen support from major shareholders. Yet mgt didn’t seem to learn from that experience in 2020 - that its balance sheet is too weak to withstand an unforeseen crisis (or a recession). Instead they’ve been splurging the cash on more buybacks and excessive divis again.

For that reason, I would not rely on the high divis continuing at DFS.

I reckon that an incoming CFO might well want to pull the divis immediately, if they properly understand risk, and a deteriorating consumer backdrop.

For these reasons, and despite decent current trading, I’m steering well clear of DFS - too risky. Pity as the actual business is good, but its financial position is too weak.

.

.

Graham's Section:

Mercia Asset Management (LON:MERC)

· Share price: 30.25p (+5%)

· Market cap £133m

This is a regional asset manager which has broken above £1 billion in assets under management.

It manages a mixture of third-party funds and its own funds.

As of March 2022, Mercia has net assets of £200.6m. That gives you an indication of the company’s overall size (and also hints at an opportunity, since the market cap is significantly lower than this!).

Mercia invests across the spectrum from venture capital to PE and private debt.

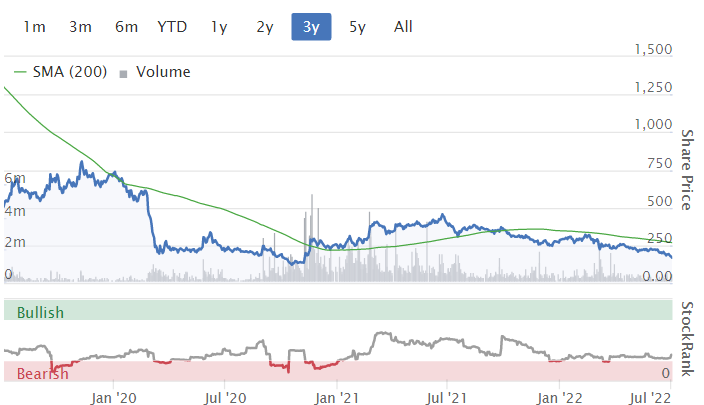

Its share price performance has been unexciting. Like many others, it collapsed in March 2020, then posted a strong recovery. That aside, the share price return has been dull, and long-term investors here have suffered:

I’m wondering has the market left a value opportunity on the table, after many years of boredom with the stock?

Today’s results show a pre-tax profit of £27.4m, down from last year’s £34m but these are enormous figures versus a market cap of just £133m.

Net assets per share were 32.1 pence in March 2020, 40p in March 2021, and now 45.6p in March 2022.

Different ways to measure profits

To help us understand the underlying profitability of Mercia, removing short-term fluctuations in asset values and gains/losses on business disposals, the company provides us with a measure of “adjusted operating profit”.

This profit measurement is much lower than the figures I’ve mentioned above, but it has taken off strongly from a low base: £0.5m in 2020, £3.3m in 2021, and now £8.4m in 2022.

This is Mercia’s profit before performance fees, gains/losses on disposals, and movements in the fair value of investments (and a variety of other things).

I can see the logic in using this measure, but I also think that it’s very conservative. If Mercia is good at what it does, then fair value movements in investments should hopefully be positive, and there should be gains on disposals more often than not! Also, you would hope for a non-zero performance fee.

In addition to all of this, Mercia earns interest on loans to its investees, and this is also excluded from adjusted profits.

It’s true that there is uncertainty around when and whether the investees will pay this interest, but Mercia earned £4.5m from this channel in FY March 2022. That helped to bump up pre-tax profit to the final figure of £27.4m.

In general, I think that the actual profit result should be much higher than adjusted profits. The adjusted profit numbers are still useful, though: they help us to see how the business performs even if there are no business disposals, no unrealised gains or losses, no performance fee, and excluding any interest received! It’s a very basic measure, but nice to have.

Dividend – Mercia has started paying dividends, and increases its final dividend to 0.5p. Total dividends for the financial year are therefore 0.8p, up from 0.4p in the previous year. The trailing yield is a useful 2.6%.

Faradion – the company had a huge win from the sale of a Sheffield-based battery technology company called Faradion in January. Cash of £19.4m was received from this transaction.

This transaction helps to explain the huge discrepancy between large pre-tax profits (which include the effects of selling Faradion) and smaller adjusted operating profits (which leave it out).

The discrepancy is further explained by a big uplift in the valuation of one of its holdings: ndreams, a VR game studio.

This company raised funds at a higher valuation than it had previously achieved, raising the notional value of Mercia’s stake in the business.

Future plans – after generating large amounts of cash from business disposals in the last two years, Mercia’s CEO says “we are unlikely to come back to our shareholders to ask them for more money to fund the Group’s direct investment activities”.

A year ago, Mercia set a target, to be achieved over the subsequent three years. The target was for £20m of pre-tax profit every year, and 20% growth in AUM every year.

It achieved the first of these, but not the second. AuM only grew by 2%, which the CEO explains as follows:

Although Mercia's assets under management are not open-ended, we have experienced higher than anticipated distributions to investors, ironically as a result of our excellent exit investment performance.

Mercia’s funds aren’t the OEICs (open-ended investments) like you might see from a traditional fund manager, so investors can’t just pull their money out of them whenever they want. However, they do make distributions to investors when there are large gains on disposals, and that is what happened in FY 2022.

My view

The progress made by Mercia has both surprised and impressed me.

When I wrote about it before, back in 2019, I was disappointed to see Mercia raising funds below its NAV, but the risk of that happening again looks to have evaporated.

I was also concerned about portfolio concentration, but I suspect that it has improved on this front.

And there is now far more evidence that the investment process works, and is repeatable.

The main difficulty is that the timing of disposals can’t be predicted, and unless you are very close to Mercia’s investee companies, it’s extremely difficult to predict the success or failure of any particular investment they have made.

So it’s really a question of trusting management and their process, and accepting that results will be lumpy from year to year.

It’s also about valuation: Mercia is trading at a discount to book value, has a worthwhile dividend yield, and is very cheap against trailing earnings. It has come to the attention of Stockopedia’s Ben Graham Deep Value Screen:

Risk factors? Well, if there are no big winners from the investment portfolio over the next few years, then underlying profits from fund management might not be enough to sustain the valuation.

It might also be reasonable to worry about whether the book value of Mercia’s investments would survive a high interest rate investment. This problem is not unique to Mercia, of course.

I’m very pleased to have had the chance to look at this one again. It’s on my watchlist.

.

Kitwave (LON:KITW)

Share price: 150p (+9%)

Market cap: £105m

This is a new stock for us. It listed in May 2021 at 150p, so IPO investors are flat so far. Today, it reports H1 results for the six months to April 2022.

This is a wholesaler with 27 depots supplying confectionery, soft drinks, alcohol, groceries, tobacco, ice cream, and so on.

The last time I looked at a wholesaler, it was Matthew Clark – whose reckless acquisition by Conviviality Group helped to send Conviviality into administration.

Conviviality had terrible balance sheet issues and shockingly poor management. So let’s head straight for Kitwave’s balance sheet and find some reassurance, if we can.

Figures for April 2022 show net tangible assets of £18m. At least this is positive, and might provide a small cushion for equity holders.

Working capital items are huge as you would expect for a wholesaler:

· Receivables £64m

· Inventories £40m

· Cash £6m

On the liability side:

· Payables £78m

· Borrowings £23m

It’s not stuffed with surplus assets by any means.

The company reports net debt of £46.6m, including lease liabilities. I think it’s reasonable to exclude lease liabilities from this calculation, and this leaves a more realistic net debt figure of £17.3m.

This reflects a foodservice acquisition which took place in February 2022, at a cost of £17m.

Overall, the balance sheet could be stronger, but I’ve seen much weaker ones from recently IPO’d companies.

Trading

H2 is running significantly ahead of expectations, and brokers have today revised up their earnings estimates.

Adjusted, diluted EPS is now expected to come in at 21.6p this year (previously 15.6p), then 22.9p next year (previously 17.5p). So the forward P/E on an adjusted basis is 6.5x.

Outlook

Strong comment from the CEO. Excerpt (I’ve added the bold):

With a track record of successfully integrating acquired businesses into the Group and having now executed our first acquisition since the Company's admission to AIM, we look forward to sourcing and acquiring targets that fit within our criteria, in line with our buy-and-build strategy. Meanwhile, efforts continue on converting opportunities for organic growth, such as through the roll out of the web-based trading platforms across the Group. These initiatives enable us to grow revenue and further improve relations with both our brand partners and our customers.

With trading having returned quicker than we expected post-COVID-19, Kitwave finds itself in a strong position to capitalise upon the opportunities available to it.

My view

I tend to think that wholesalers should trade at cheap earnings multiples. Perhaps Kitwave is now too cheap, given the prospects for the year ahead?

If the adjusted profits materialise as forecast, and are mostly converted to cash, that will help to drive down the debt figure and will boost my confidence that this is not another Conviviality in the making.

However, the reference to acquiring more targets in accordance with “buy-and-build” suggests that the balance sheet will be used in a more energetic way.

Careful investors will apply the IPO rule (i.e. wait for the stock to trade at a meaningful discount to the IPO price, before considering it).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.