Good morning from Paul! Graham messaged me in the night to say he's unwell, so let's hope he gets well soon. As luck would have it, I prepared some backlog sections yesterday evening, so I'll still get a full report out for you today. Roland is helping out, as we've got many decent companies to look at today.

We'll leave it there for today.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

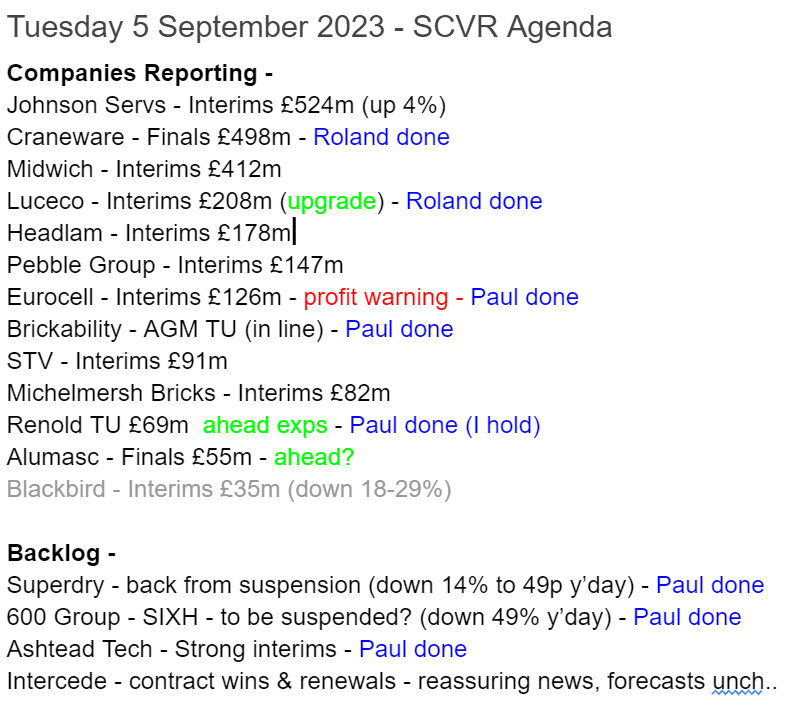

We'll probably manage about half of these, very busy today -

Summaries

Luceco (LON:LUCE) - down 5% to 124p (£205m) - Interim Results - Roland - AMBER/GREEN

Half-year results (to June 2023) from this electrical parts manufacturer show a smaller revenue decline than expected. Full-year profit guidance has been upgraded. I like the core business but have mixed views on the group’s acquisitive growth strategy. The shares look fairly valued to me.

Eurocell (LON:ECEL) - Down 9% to 102p (£115m) - Interim Results (profit warning) - Paul - AMBER

I still see this as a fundamentally decent business, but tough macro is hurting it right now - softer demand, lower gross margins, higher costs, have badly squeezed H1 profits. And another profit warning (as we expected here on 25 July) has been announced today. Decent balance sheet protects the downside. At some point the market is likely to start pricing in a recovery, but it feels to early to jump in.

Craneware (LON:CRW) - up 4% to 1,445p (£489m) - FY 2023 results - Roland - AMBER

Today’s results from this healthcare software business are in line and I can see plenty to like here. However, I’m puzzled by the apparent low profitability and a sizeable cash movement. I’d need to do more research to take a positive view, given the stock’s current rating.

Paul’s Section:

Ashtead Technology Holdings (LON:AT.)

Up 7% to 420p (£335m) - Interim Results - Paul - AMBER/GREEN

Dec 2021 float, has done really well, with shares hitting a new all-time high yesterday.

I’ve looked at the numbers before, and was impressed. Although previously I was puzzled how an equipment hire business for the offshore energy industry could generate such big profits, from such a small asset base?

Ashtead Technology Holdings plc (AIM: AT.), a leading subsea equipment rental and solutions provider for the global offshore energy sector, announces its unaudited results for the six months ended 30 June 2023 ("HY23" or "the period").

Fantastic H1 results here -

Revenue up 57% to £49.8m, 41% is organic growth.

Adj PBT up 88% to £14.3m - rapid growth, and a strong profit margin.

Statutory PBT is only a little lower, at £13.2m.

Adj basic EPS 14.2p (up 71%)

High demand from offshore oil/gas, and renewables.

Net debt (excl leases) looks OK at £26.4m.

Claims to have the largest independent fleet in a highly fragmented market.

Outlook - expects FY 12/2023 to be “comfortably ahead” of forecasts - the StockReport is saying consensus is 26.4p, so at a guess maybe we’re looking at c.30p for the full year? That would be a PER of 14x, which looks fair to me.

Growth rate expected to moderate in H2, due to tougher comparatives, so let’s not get carried away!

Balance sheet - fairly lightweight once intangibles are removed, with only about £14m NTAV - so hardly any hard asset backing here.

Paul’s opinion - superb numbers. However, I remain confused at how it is possible to generate such stellar profits from a small asset base? Maybe depreciation is super-conservative, and the book value has been written down for assets that still have a good rental life remaining?

It sounds like this company is really in a sweet spot, having the right equipment at the right time, with a resurgence in demand occurring, something we’re hearing from other oil services companies.

Ashtead Tech looks to be doing really well, but I worry that it’s enjoying a sweet spot that might not last more than a couple of years, because other companies are bound to spot the opportunity to make lucrative profits from an under-supplied market. So the risk I see is that feast could turn into famine in future.

In the meantime though, shareholders are enjoying a bumper period. Will it last though? That’s the key thing to research. Does Ashtead Tech have any defensible moat? Or is it just enjoying a nice patch from being in the right place at the right time?

I don’t know, am just flagging up the key questions to ask.

In the meantime, I cannot ignore such strong numbers, so have upped my personal opinion from AMBER, to AMBER/GREEN.

Superdry (LON:SDRY)

Down 14% to 49p yesterday (£47m) - resumption of trading - Paul - RED

See Friday’s SCVR here for my take on the pros & mostly cons of this troubled fashion retail/wholesale business. In a nutshell -

Bull points - receipt of £35m windfall from selling brand rights in the Far East is evidence that the brand still has value. Cash/debt position OK for the time being.

Bear points - moved into losses for FY 4/2023, and Q1 2024 trading sounds grim, especially wholesale (50% down), so forecasts now look pie in the sky. High cost seasonal borrowing facilities from specialist lenders Bantry Bay & Hilco (vultures circling?). Large deficit on IFRS 16 lease entries indicates many shops must be heavily loss-making. Tired brand that’s had its day?

Paul’s view - I hope they turn it around, and think this autumn/winter season could be make or break for this brand. On current performance, I don’t think it’s likely to survive throughout 2024, but you never know. Tenacious management might pull off a surprise, I’ll keep an eye on it for tangible signs of progress (completely lacking so far). So this share is now purely for gamblers I think.

600 (LON:SIXH)

Down 49% y’day to 2.85p (£4m) - Update - Paul - AMBER/RED

It’s below our usual mkt cap lower limit now, but I’ve followed 600 Group for years, and am curious as to why it plunged by half yesterday (Monday).

We last looked at it in Dec 2022, when Graham couldn’t see any reason for it to continue with a stock market listing, having sold off a division to reduce debt, leaving not much behind - a small, loss-making business with too much central overhead.

This announcement was issued after the market closed on Friday last week, which is clearly what triggered the 49% fall on Monday. Key points -

Audited accounts for FY 3/2023 won’t be ready by the 6 month, 30 Sept deadline, should be ready in October.

Shares will be suspended, with the last day of trading being Fri 29 Sept 2023.

Hoping to lift suspension on publication of Annual Report in Oct 2023.

Trading update - conditions continue to be difficult. H1 loss expected (no figures provided). Goodwill impairments will be needed (which doesn’t really matter).

However, this does matter, a lot -

The Group is considering various financial alternatives to its existing debt facilities which currently expire on 30 November 2023.

Paul’s opinion - that last bit, about financing options, sounds ominous. Could this mean a discounted placing, delisting, or distressed sale of the business? Who knows. I’d be surprised if SIXH survives in its current form. Net debt was only small at $2.5m (excl. leases) at Sept 2022, but might have increased since, I don’t know. The last balance sheet had adequate NTAV, but far too much cash was tied up in inventories and receivables. So reducing those, to repay the relatively small debt, could provide an exit route enabling it to survive perhaps? With inadequate information, I probably should mark it red, but the decent balance sheet NTAV makes me lean towards AMBER/RED - so serious concerns, but it might be able to pull through.

Renold (LON:RNO) [Paul holds]

30.75p (pre market) £69m - AGM Trading Update - Paul - GREEN

This industrial chains group with a big pension scheme, provides us with a 4-month update for FY 3/2024 to date (Apr, May, Jun, Jul 2023).

The short version - it’s a positive update -

As a result of the continued positive trading momentum, and an increase in activity from the recently announced Davidson acquisition, the Board now anticipates achieving results for the year ending 31 March 2024, higher than previously expected.

Detail -

Revenue is up 17% to £85.1m in the first 4 months, or 9% organic growth.

Order book at July 2023 is down 14%, due to supply chains, and hence order intake normalising.

Net debt at July 2023 looks OK, at £23.3m (only 0.6x EBITDA), and down £6.5m in 4 months. This will rise by H1 (Sep 2023) due to £4.9m acquisition related payments, and £2.6m earlier pension scheme payment.

Markets uncertain, with labour & materials inflation still high by historic standards.

Broker upgrade - many thanks to Finncap for an update note. It increases FY 3/2024 forecast aEPS by 6% from 5.2p to 5.5p. aPBT rises from £16.1m to £17.1m. Note there are no divis, as Renold is focusing capital on bolt-on acquisitions (and pension scheme payments).

At 30.75p per share, the PER is only 5.6x - very cheap for a decent quality business. However, part of the reason is the significant cash that the pension scheme demands, which of course doesn’t go through the P&L account, which is why companies with cash-hungry pension deficits should be trading on a low PER. Even so, I think the discount at Renold is looking too large.

Paul’s opinion (I hold) - really encouraging news, and it’s impressive to be achieving an out-performance (helped partly by an acquisition last year that is now kicking into this year’s numbers) in tough macro conditions.

Renold has impressed me a lot in recent years with an effective turnaround, debt reduction, and now it’s on the front foot buying other complementary businesses, in a fragmented sector.

Renold showed its strengths by sailing through both the pandemic, and also the energy/inflation issues more recently, so I think this is now proven to be a quality business with pricing power. It’s cheap too, and I think could end up as a bid target for a larger industrials group, possibly.

I’m encouraged to continue holding, as one of my core personal value shares.

You can see below how EPS is settling at more than double pre-pandemic levels.

Eurocell (LON:ECEL)

Down 9% to 102p (£115m) - Interim Results (profit warning) - Paul - AMBER

There have only been a handful of small trades this morning, so I don’t think we can determine much so far from the share price reaction to this profit warning.

Eurocell plc, the market leading, vertically integrated UK manufacturer, distributor and recycler of innovative window, door and roofline PVC products, today announces its half year results for the six months ending 30 June 2023.

Actions taken position the business well for when markets recover

As you can see below, Eurocell hasn’t been the best performer since it listed in 2015. Although if you add on generous divis, things are not as bad as they seem. Note the dip for covid, then the strong recovery from the lockdown DIY boom, then an absolute plunge ever since. Surely it’s getting into oversold territory? I’m about to find out!

H1 numbers - poor results, although it says as expected (and clearly anticipated by the share price) -

Revenue down 2% to £184m

Gross margin well down, from 50.7% to 46.0%, with competitive pressures mentioned in the commentary.

Adj PBT down 62% to £6.0m - a very nasty drop, but still profitable.

Statutory PBT down 78% to £3.5m. Adjs of £2.5m mainly restructuring costs.

Adj EPS in H1 down 63% to 4.3p

Interim divi of 2.0p - encouraging that it’s still paying a divi, but this is well down from 3.5p interim divi last year.

Outlook - more bad news, not really a surprise given what macro conditions are like, and similar bad news we’ve already seen from the sector -

Further deterioration in market conditions since July Trading Update means full year performance now anticipated to be below our previous expectations

Broker updates - nothing available unfortunately. So I’ll have to wait until the StockReport updates for changes to broker consensus.

Balance sheet - is very robust, at £93m NTAV.

So shareholders can sleep soundly, safe in the knowledge that Eurocell should be able to comfortably ride out this soft patch.

Net bank debt is £15.2m, hardly changed from a year earlier. It seems to have an excessive bank facility of £75m, so it might make sense to say halve that, to save on arrangement fees.

Cashflow statement - all looks OK, although what stands out to me is that the divis are now looking excessive, with payment of the final divi costing £8.1m in H1. The interim divi has sensibly been trimmed, and I would expect the final divi to also be reduced. Although forecasts already assume a reduction in full year divis to 7.4p (down from 10.7p actual last year). With trading deteriorating, I wouldn’t place too much emphasis on generous divis continuing, they might be cut again I suspect.

Paul’s opinion - we already know this is a really tough sector right now. So the big question is about when, and how much, a recovery in earnings is likely to happen?

In the meantime, demand is soft, and gross margins weaker, whilst costs are naturally seeing upward pressure. That’s a horrible mixture for short term profitability, mitigated somewhat with cost cutting already done.

However, a recovery should see it rebuild earnings to possibly the pre-covid levels of c.20p EPS? There’s little to no risk of dilution either. Someone might bid for it, at these depressed levels, so possible upside there too.

As mentioned previously here, and in my podcasts, it seems to me that a recovery in builders & suppliers is not likely to happen any time soon - I forget which company it was, but someone said they’re not expecting a recovery until H2 2024. Although share prices are likely to start anticipating a recovery maybe 6 months before it actually happens. A sharp drop in interest rates, which is one potential scenario, could trigger a big rebound in housing & related products, possibly? I'd like to get in ahead of that.

Put that all together, I’m happier sitting on the sidelines for now, researching more, and picking my spot, adding to my watchlist, ready to pounce once the value becomes more extreme. It doesn’t feel like we’re quite there yet (but not far off).

Reviewing my previous notes, I mentioned on 25 July here that another profit warning could be on the cards at ECEL. As trading is likely to be tough for some time, I think AMBER is how I’m currently seeing this, although with upside potential once macro conditions (hopefully) normalise.

Brickability (LON:BRCK)

Down 4% to 49p (£147m) - AGM Statement - Paul - AMBER

Brickability Group plc (AIM: BRCK), the leading construction materials distributor…

This financial year is FY 3/2024.

I’ve been impressed with performance at this acquisitive bricks (and other building products) distributor. It’s differentiated by using a drop-shipping business model, meaning it doesn’t carry much inventories. Management impressed me on a recent webinar, giving clear answers to 2 of my questions. My tenure as a shareholder was only brief though, as it soon dawned on me that worries about macro are taking precedence in the short term anyway.

Previous coverage here was -

26/4/2023: GREEN - ahead expectations TU.

17/7/2023: AMBER/GREEN - good FY 3/2023 results, but I have increasing macro concerns. Mystery share for podcast after mgt impressed me on a webinar.

Today’s update summarised -

- Trading has been good, and in line with expectations for April-July.

- Vague about August trading, “typically seasonal”.

- “Cognisant” of volume reductions for housebuilders and manufacturers, due to macro.

- “More challenging trading environment” expected for remainder of FY 3/2024.

- Diversified product ranges mean it hopes to continue doing OK.

Broker updates - prior to today’s cautious outlook, broker forecasts had been trimmed a little, but this strikes me as inadequate, given the scale of the macro downturn (eg. we’ve seen housebuilders talking about order books being down 40%-ish, which is bound to feed through to much lower demand for bricks, it has to). BRCK said on the recent webinar that they had already planned for a 20% downturn in demand in their forecasts, which I suspect may not be enough.

I can’t see any revised forecasts today, but I think it would be safest to work on the basis that FY 3/2024 is likely to get progressively worse - which BRCK is basically telling us in today’s update.

Hence I think a profit warning looks increasingly likely, given that current forecasts have only been slightly trimmed, which is not consistent with the macro picture at all.

Paul’s opinion - the share price keeps getting cheaper and cheaper, so clearly investors are taking the fairly positive noises from the company with a pinch of salt. I think that’s sensible. A few months ago, we were looking at a possible H2 recovery in building, but that’s gone out of the window now I think. Hence shares in the sector should be lower.

I remain positive on BRCK as a share I want to hold in a recovery, but as with everything else, it feels too soon to be bottom fishing right now. I’m starting to sound like a stuck record here! So this is one for my watchlist, not my actual portfolio, at this stage.

Roland’s Section:

Luceco (LON:LUCE)

124p (-5% at 9am) (£205m) - Interim results - Roland - AMBER/GREEN

Luceco plc, the supplier of wiring accessories, EV chargers, LED lighting, and portable power products, today announces its unaudited results for the six months ended 30 June 2023 ("H1 2023" or "the period").

I looked at this business a few months ago and was left with mixed views. My general impression is that the core wiring accessories business is market-leading and highly profitable, but some of the other operations are less attractive.

Today’s interim results appear to be slightly better than expected, with a modest upgrade to full-year guidance.

We now expect full year 2023 adjusted operating profit to show clear progress on last year. This is above the current range of market expectations.

Let’s take a closer look.

Financial overview: Luceco’s half-year results reveal a modest fall in revenue and a more sizeable fall in adjusted profits, due to the impact of operational gearing.

Revenue down 5% to £101.1m

Operating profit down by 2% to £9.8m

Adjusted earnings per share down 13.8% to 5.0p

Interim dividend unchanged at 1.6p per share

Luceco’s statutory and adjusted operating profit were quite close – adjustments were not too large.

Pre-tax and after-tax profits showed bigger swings, but these appear to be due mainly to currency effects and related movements in the group’s hedging portfolio. These tend to even out over time, in my experience. I’d be inclined to ignore this factor and focus on operating profitability as a measure of underlying performance.

Profitability: management acknowledges that returns on capital will fall due to the “required investment in goodwill” from regular acquisitions.

I have mixed views on the group’s acquisition strategy but the commentary is certainly correct – organic assets do not result in goodwill on the balance sheet and thus appear to generate higher returns on capital than acquired businesses, where buyers typically pay a premium to asset value (goodwill).

Luceco’s profitability metrics seem reasonable to me and suggest that profitability is returning to more normal levels after the peak seen during the pandemic:

H1 adjusted operating margin: 10.6%

Trailing 12-month ROCE: 14.0% (my calculation)

Free cash flow for the half year was -£8.0m, but the company says this reflects a return to more normal patterns of working capital after last year’s unwind. Net debt is also down to £37.6m (H1 2022: £53.9m), so I don’t see anything much to worry about.

By choosing the interims on the cash flow tab on the StockReport, we can see that Luceco’s cash flow has been stronger in H2 in recent years. The group has generated positive free cash flow across each full year since at least 2017, according to Stockopedia data:

Trading commentary: Luceco’s trading last year was hit by cost inflation and destocking by major customers. The company suffers a certain lack of visibility in its retail and hybrid sales channels, where distributors buy stock in bulk and then sell stock gradually (Luceco has no visibility of this).

As a result, profit forecasts have been cut by c.50% over the last year:

At a group level, trading conditions appear to have stabilised and improved during the first half of this year:

“Customer stocking has appeared to return to normal levels at the end of H1 2023 following post-pandemic destocking

Non-residential demand continues its favourable trend

Despite economic headwinds, revenue decline has been less than expected

Material and freight costs pressures have subsided”

Trading at some more recently acquired businesses also seems to have been positive:

“Operational synergies at DW Windsor [an LED lighting business], within the most recent addition to the Group, contributed a strong first half performance with near double digit operating margin and some key contract wins.

EV business has grown further, with a strong pipeline of new products.”

The impact of improved margins in the LED lighting business was evident in the segmental results.

However, the core wiring accessories business was the only division to deliver revenue growth in H1 and remains far more profitable, with a 17% operating margin vs <10% elsewhere.

Personally, I question the group’s geographic expansion ambitions. It’s not clear to me if Luceco can gain the scale and competitive advantages it enjoys in the UK in Asia or the Americas:

Outlook: CEO John Hornby appears confident that the worst of the impact of inflation and destocking has now passed:

“Despite ongoing weakness in our core markets, we have made further progress since the July trading update and we now expect full year 2023 adjusted operating profit to show clear progress on last year. This is above the current range of market expectations.”

No explicit financial guidance is provided today. But adjusted operating profit was £22m last year and consensus forecasts I could see to today suggested a figure of £21.6m.

My feeling is that today’s upgrade is fairly modest and is probably already reflected in the share price rally we’ve seen since the start of the year:

Roland’s view: At current levels, Luceco shares trading on 13 times 2023 forecast earnings and offer a useful 3.5% dividend yield.

This valuation looks about right to me. While I like the group’s core wiring accessories business, I’m less convinced by the competitive strength of some of its acquisitions.

I think it’s also worth remembering the apparent lack of visibility on earnings here. Forecasts have been slashed over the last year and are currently around 50% of last year’s levels:

However, I don’t see anything serious to be concerned about here and I accept that the group’s strategy could deliver significant growth if it’s successful. On balance, I’m taking an AMBER/GREEN view.

Craneware (LON:CRW)

1443p (+4% at 9am) (£489m) - Final results - Roland - AMBER

AIM-listed Craneware produces software used by hospitals in the US to help track patient costs and manage their billing efficiently (and accurately).

Healthcare-related software seems an interesting sector to me, with growth potential. I’m currently a shareholder in UK healthcare software group EMIS (LON:EMIS), which is being taken over by a subsidiary of US healthcare giant Unitedhealth (NYQ:UNH). So I’m keen to see if there are any other homegrown software businesses that could provide a new home for my cash.

Graham covered Craneware’s last update in July, when the company reported full-year revenue at the top end of expectations. He suggested the shares could be “cheap through an American lens”, even though they trade on a P/E of around 20.

Results summary: today’s results cover the year to 30 June 2023 and appear to be in line with expectations.

Revenue for the year rose by 5% to $174m, with annual recurring revenue up by 1.6% to $169.0m.

Operating profit for the year rose by 6% to $19.2m, giving an operating margin of 11%. Adjusted earnings were $0.87 per share, versus Stockopedia consensus of $0.84 per share.

Cash conversion was also excellent. I calculate free cash flow of $23.6m on an underlying basis, which represents 120% of operating profit for the year.

However, actual cash generation for the year was boosted by $50m of cash received to be “held on behalf of customers”. This line item was less than $1m last year. I’m not entirely sure what this refers to, so I’d need to do further research to form a view on this.

Profitability: my main concern with Craneware is that its profitability seems quite low. Operating margins have deteriorated sharply as the business has grown – last year’s margin of 11% is unchanged from 2022.

Return on capital employed has also fallen sharply. My sums suggest a statutory ROCE of just 4.1% last year.

Even if I strip out the $235m of goodwill from acquisitions (see my comments on LUCE above), I only get ROCE of c.8%.

By way of contrast, EMIS has ROCE and operating margins in the high teens.

Outlook: chief executive (and 9.7% shareholder) Keith Neilson says that he expects to see “a more supportive market backdrop” in the US, now that the pandemic health emergency has been formally declared to be over (May ‘23).

Mr Neilson cites “a growing pipeline of opportunities” and says the business is “well positioned for FY24”.

However, the outlook statement does not include any fresh guidance on the outlook for profits.

Stockopedia consensus forecasts prior to today suggested only modest growth in earnings this year:

These estimates put Craneware on a forecast P/E of about 20, with a 2.1% dividend yield.

Roland’s view: I can see plenty to like about Craneware’s business. The shares have de-rated substantially from historic highs and I can imagine there might be an opportunity here.

However, I’d need to do more research to try and understand the group’s apparent lack of profitability and its cash situation. For now, I’m going to maintain Graham’s July view and go AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.