Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

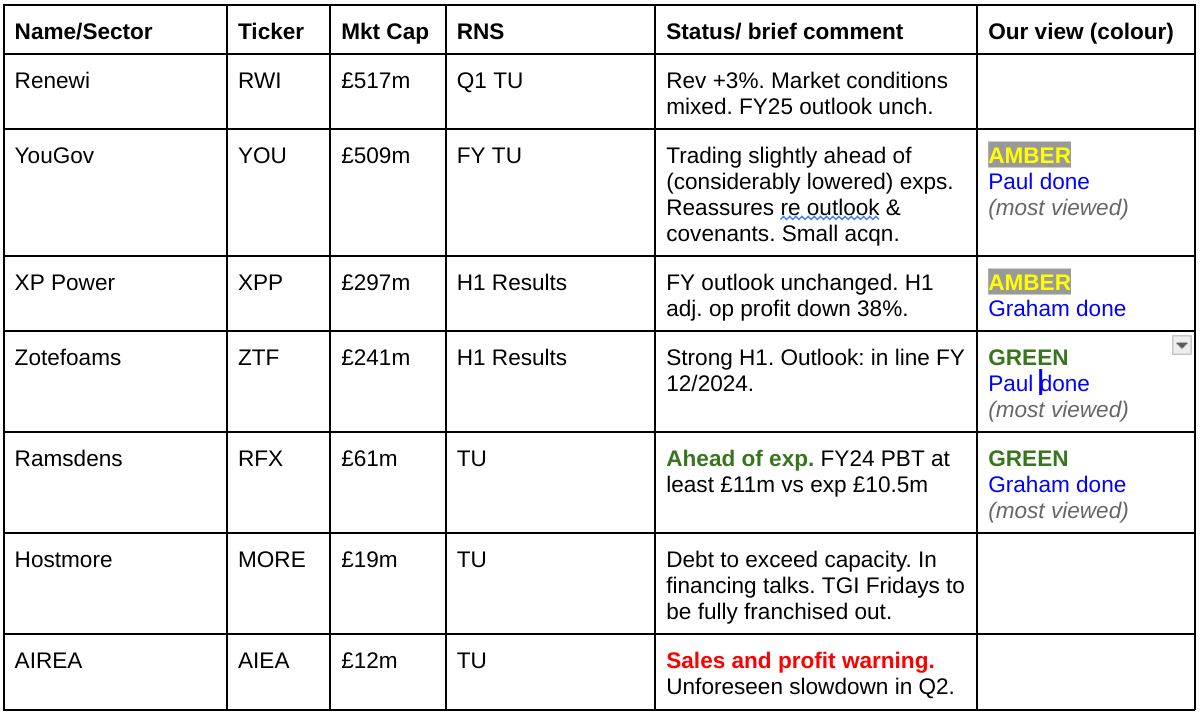

Companies Reporting

Summaries

Ramsdens Holdings (LON:RFX) - up 7.5% to 206p (£65m) - Trading Update - Graham - GREEN

Great news from this diversified financial services provider: the sustained high gold price has continued to boost profits from precious metals purchasing. Other divisions are also performing well (although foreign exchange seems to be under a little pressure), and this year’s PBT forecast increases from £10.5m to £11m+. I’ve been a fan of this one for some time and continue to see value here.

YouGov (LON:YOU) - up 22% to 535p (£621m) - Full Year Trading Update - Paul - AMBER

A big rebound in share price today, despite the update only being "slightly ahead" of previously slashed forecasts (after its 20/6/2024 profit warning). Cost-cutting means profit should now rise in the new financial year FY 7/2025, and it confirms trading is in line. Hideous balance sheet, with too much debt - not disclosed today, but we are reassured that it has headroom on bank covenants. I'm less concerned than I was, so move up from amber/red to AMBER as things seem to be stabilising.

XP Power (LON:XPP) - up 1% to 1263p (£306m) - Interim Results - Graham - AMBER

Very poor results have been baked into the forecasts here but H1 profits are slightly ahead of the Board’s expectations and the company is set up well to meet full-year expectations. Management deserve some credit for controlling the damage caused by very poor market conditions. A potentially interesting recovery play.

Zotefoams (LON:ZTF) (Paul holds) - up 4% to 513p (£251m) - Interim Results - Paul - GREEN

Good H1 results, boosted by strong demand for NIKE products in an Olympic year. Outlook is confident, and I suspect it's limbering up to beat FY forecast, despite it saying in line. Debt is up, but still at reasonable levels. The ReZorce development project excites me, and sounds close to commercialisation - that's like a call option on what could be a very important new fully recyclable (mono material) drinks carton.

Paul’s Section:

Zotefoams (LON:ZTF) (Paul holds)

Up 4% to 513p (£251m) - Interim Results - Paul - GREEN

6 August 2024 - Zotefoams plc ("Zotefoams", the "Company" or the "Group"), a world leader in cellular materials technology, is pleased to announce its interim results for the six months ended 30 June 2024.

Strong sales and HPP growth drives record H1 profit

Good results in H1 -

Quite a big jump in net bank debt, up 31% to £35.1m (excl leases), but the leverage ratio looks fine at 1.4x.

Note that the £8.3m PBT figure above is after taking into the losses of £2.2m in H1 at the MuCell extrusion (MEL) division. I think it’s fine to strip out this loss, taking adj PBT to £10.5m, on the basis that MEL is mainly the ReZorce development project. The outcome is binary, so if it for whatever reason doesn’t work commercially, then the losses would stop. If it does work, then we could potentially be quids in, which is an appealing possibility.

As mentioned before here, what I like about ZTF is that the core business is good, and we get the ReZorce project thrown in not quite for free any more, but it was when I put ZTF shares onto my top 20 share ideas list for 2024. So far, so good anyway.

ZTF has been quite resilient in the recent market macro wobbles too, suggesting to me that shareholders are committed to the story, and won’t panic sell on general jitters that are just part of normal markets. I’ve been a bit surprised at the extent of private investor anguish in the last week or so. Markets do this type of thing from time to time, and we have to be resilient, and not get thrown off course by normal market volatility, which can be considerable at times.

It does caution that the growth is largely a one-off benefit from the NIKE relationship this year -

“Group revenue grew by 10% to £71.1m, driven primarily by exceptional demand from Nike, where underlying platform growth was amplified by an Olympic year and inventory build at Tier 1 suppliers.”

Dividends - are modest at c.1.6% yield.

Strategic highlights - I like the prominence being given the the ReZorce (fully recyclable drinks cartons, in development) project, and it seems to now be at an advanced stage. If this takes off, then it could be a catalyst for a serious re-rating here. Or it might not, I don’t know.

Outlook comments sound positive, but my take on this below is that they’re trying to keep us grounded, in terms of not expecting growth to accelerate further in the short-term -

“We enter the second half with positive momentum and with the expectation that market trends seen in H1 will remain largely consistent going into the latter part of the year. Footwear demand is expected to normalise over the coming months, as some of the near-term factors benefiting H1 work through, which will free up capacity to supply markets in both North America and Europe. We will continue to focus on cost efficiency, supported by a stable outlook for energy and polymer input prices.

The Board is delighted with the Group's continued progress, with the benefits of our diverse market profile providing both stability and opportunities to unlock growth in a mixed economic backdrop. We remain confident that the Company will deliver a full year performance in line with market expectations, underpinned by the strong first half performance, and optimistic that we will continue our positive momentum in the medium term."

Any mention of “medium term” tends to be cautionary I think! Which makes me wonder whether the jump in broker consensus from 22p for FY 12/2024 to 29p for FY 12/2025 might be too large? Although looking at Singers (very helpful, thank you!) update note today, it only has £14.7m adj PBT for FY 12/2024, but I’m using the £10.3m H1 adj PBT (stripping out ReZorce losses), so that leaves only £4.4m to achieve in H2. Maybe the Singers note leaves in the ReZorce (MEL) losses? It could be heading for say £18-20m adj PBT, if we strip out MEL losses, so I think there could be good upside on the 2024 forecast. So I imagine instead of 22p, we might be heading for 26-30p EPS for FY 12/2024, if you’re happy to ignore MEL losses. That makes me much more comfortable with the 2025 forecast, so I’m happy overall with this.

As far as I’m aware, there may not be any upside baked into forecasts for ReZorce. So I’m assuming the upside from ReZorce, if it works, would be additional to existing forecasts. Obviously we’re all hoping that it turns out to be a blockbuster product, in which case the sky’s the limit. At times like this, when I can feel a surge of excitement, I remind myself of a renowned fund manager’s words that blue sky projects typically take 7-8 years to reach commercial success. Note that some development costs are capitalised onto the balance sheet.

Costs - some useful detail here, sounds generally OK -

“In the period, the average cost of low-density polyethylene (LDPE), our main raw material, was slightly below the long-run historical average polymer pricing after falling significantly in 2019 and 2020, rising from 2021 and peaking in Q2 2022. Energy prices have stabilised and are similar to the average of the prior year comparative. In the current year, labour costs across all geographies are likely to represent the largest inflationary component within our cost base.”

Balance sheet - looks fine to me. £120m NAV, less £11m intangible assets, gives a very healthy £109m NTAV.

I’m not worried about the net debt of £35m, because the leverage ratio is well within normal range, and ZTF owns the freeholds to most of its factories, providing strong asset backing. A modest pension deficit costs around £850k pa.

Cashflow statement - almost half of profit was absorbed by working capital increases. That’s not a problem, as the cash is only temporarily tied up, it hasn’t vanished as is the case when companies report trading losses.

Capex has increased, and it’s a fair comment that ZTF is a fairly capital intensive business. It makes stuff, so it needs factories full of machines, especially when it’s expanding.

Put it all together, and cash outflows exceeded inflows in H1, hence net debt rising. I don’t see that as a problem - it’s an expanding business, which requires capex in the short term.

Paul’s opinion - I need to wrap this up, and get it published by 13:30, as the InvestorMeetCompany webinar starts then.

I think it’s a mistake to over-analyse the numbers, when the bull case here is so simple - we’re getting a decent business at a fair price. With a call option for ReZorce, which seems to have exciting upside potential.

So I’m very happy to keep holding, it’s a GREEN from me.

YouGov (LON:YOU)

Up 22% to 535p (£621m) - Full Year Trading Update - Paul - AMBER

Small acquisition - of a New Zealand AI company called Yabble, for £4.5m cash + earn out.

The market has lapped up today’s trading update (far more important news than the small acquisition also announced), adding over £100m to YOU’s market cap this morning.

Checking my previous notes -

12/10/2023 - 880p AMBER - Superb FY 7/2023 results. Although I flagged some concerns, including taking on too much debt for an acquisition.

20/6/2024 - 440p - AMBER/RED - Shares almost halved on a profit warning. Making it worse, there was inadequate information, so I decided to avoid this share until more info became available. Also I noted that companies of this size usually recover from profit warnings. This is an interesting conclusion from the data on our spreadsheet kindly created by my friend Phil Hanson. I’ve added a market cap column, and filtered it to just show profit warnings.

As you can see below, there’s a very strong correlation between recovery of a share after a profit warning, and market cap. Generally the larger market caps recovered, or only suffered a further small fall after a profit warning. Whereas the shares which subsequently went on to continue plunging in price were all sub-£100m market caps. Here’s a screenshot sample of the shares which recovered after a profit warning - so being brave and buying on bad news is sometimes profitable -

And here’s the opposite end at the bottom - shares which continued falling after profit warnings to now (live prices), are all micro caps sub-£100m market cap. So this seems to clearly be telling us to consider bottom fishing after a profit warning, but not at the smallest companies, where more bad news tends to continue. So a very clear message from this data - don’t give minnows the benefit of the doubt when they disappoint, as they usually continue to disappoint, quite striking results here, hence why I thought it would be useful to share it with you - some horror stories at the bottom, notably Saietta (bust), Superdry (delisted, almost bust), Surface Transforms (enough said!) and the disaster that is Sondrel (also delisting).

As you can see below on the 5-year chart, the 20 June 2024 profit warning absolutely clobbered YOU shares, a previous high flyer with a good long-term track record -

Confidence seems to be returning today, hence why I’m keen to look at it. Coincidentally I made a list of potential buys after yesterday’s plunge in global markets, and YOU was on my potential buys list.

As you can see below, forecast for FY 7/2024 took a tumble in June’s profit warning, from c.43p to 26p - unusual for such a large drop in forecast to happen near the end of a financial year - which very much undermined management credibility I think -

On to today’s update, the headline says -

“FY24 results expected to be slightly ahead of revised guidance”

YouGov now expects Group reported revenues for FY24 to be approximately £327-330 million and Group adjusted operating profit to be £43-46 million, slightly ahead of our revised guidance communicated on 20 June 2024.

I’m quite surprised that has triggered a 22% share price rise.

They’ve done it again, and not stated what the previous guidance was! So annoying. Referring back to the SCVR on 20/6/2024, this is what we said on the profit warning announcement -

“What’s gone wrong? Sales are lower than expected, now guided at £324-327m. It had increased costs in anticipation of higher sales in H2. Revised adj operating profit guidance is now £41-44m. Maddeningly, it doesn’t put this in context by saying what the previous guidance was! How ridiculous is that.” [SCVR 20/6/2024]

Today they’re saying £43-46m, up from £41-44m adj operating profit (not a good measure, since it ignores heavy finance costs).

Debt - it’s shy about disclosing the actual net debt (rather deceptive I feel), which is considerable. Net debt excl leases was £160m at Jan 2024. But it does reassure today on covenants - suggesting that the problem of heavy debt is not a crisis -

“As of 31 July 2024, the Group remains well capitalised, with approximately £70 million in cash and cash equivalents on the balance sheet and €16 million of the revolving credit facility remains undrawn. Excluding the impact of IFRS 16, the Group's leverage ratio2 as of the end of the financial year was approximately 1.8-2.0x and the Company remains well within the loan covenants.”

Cost-cutting - it’s found c.£20m of cost savings, with about 70% expected to be realised in the new year, FY 7/2025.

That’s material to profitability, and would up adj operating profit from c.£45m to c.£65m. Assuming of course that there aren’t any harmful effects from stripping out these costs, which there might be.

Outlook - reassures -

“we expect to meet current market expectations for FY25”

Paul’s opinion - things seem to have stabilised, and thanks to cost-cutting it looks as if the rise to 37.9p adj EPS for FY 7/2025 should be achievable. What rating would be put on this share? Given it has a lot of debt, and a weak balance sheet, I wouldn’t go crazy. Maybe 12-15x? That gets me to a share price of 455p to 569p. The actual share price now is 535p, which is within my range. Hence I think it looks priced about right.

Given that we’re reassured today on profits increasing (mainly due to cost cutting) and that the bank covenants are OK, then I’ve got the extra information that I wanted last time. Hence I’m happy to move up from amber/red to just plain old AMBER.

Looking at the 31/1/2024 balance sheet, it’s actually pretty awful, with negative NTAV of £(227)m. Although you could argue that some of the intangible assets here do actually have some value, it’s not just goodwill.

It could take a while for market confidence to return, and I’d be surprised if YOU shares recover to anywhere near their previous (excessive) valuation, after badly blotting its copybook in June this year. So it doesn’t appeal to me, particularly given the hideous, highly geared balance sheet. That’s why it only pays modest divis.

Graham’s Section:

Ramsdens Holdings (LON:RFX)

Up 7.5% to 206p (£65m) - Trading Update - Graham - GREEN

This update is ahead of expectations:

…the Group's good trading momentum has continued into the second half of the financial year to date… the Board now expects FY24 Profit Before Tax to be at least £11m, which is ahead of its previous expectations* (FY23: Profit Before Tax of £10.1m).

The prior expectation was for PBT of £10.5m.

Key points:

The high gold price has increased customer demand for Ramsdens’ gold buying service.

Pawnbroking in line with expectations.

Foreign currency revenues “broadly” in line with expectations.

Jewellery retail “continued to perform well”, helped by a recovery in premium watch sales.

CEO comment:

"Ramsdens' positive trading momentum has continued into the second half of the year, once again reflecting the strengths of our diversified model, trusted brand and the hard work and commitment of our team.

"We continue to benefit from the ongoing investments made in enhancing our multi-channel customer proposition, including our online presence and new Multi-Currency Card, as well as the sustained high gold price, which is encouraging greater awareness and demand for our precious metals buying services."

Graham’s view

This is a stock I’ve been bullish on for some time. I generally tend to like the pawnbroking sector and pawnbroking is one of the four major service categories at Ramsdens alongside foreign exchange, jewellery retail and precious metals purchasing.

At the interim results, the standout performer was that precious metals category with revenues up 35% and gross profit up 25%.

Here’s a 1-year gold price chart from The Royal Mint. After several years of strength, the gold price has surged higher again over the past 12 months:

Latest estimates from Panmure see their 2024 underlying PBT forecast increase from £10.5m to £11.2m.

However, their 2025 forecast is only increased by 3% (from £10.9m to £11.2m), due to expected weakness in FX and upward pressure on the national living wage.

For me, the risks and potential rewards have been priced in at a PER of only about 8x:

I do worry about risks in relation to the company’s expansion plans and its exposure to the gold price, but I’ve had the chance to quiz management on these topics and their answers struck me as sensible and well-reasoned. See the 6th June SCVR for my question on industry competition as the company expands, and the 15th January SCVR for my question on how the company manages gold price risk.

With major risks being well managed (I think!), it should be full steam ahead for Ramsdens and its shareholders.

The company is very proud of the development of its foreign exchange product, especially its multi-currency card, so it is a shame that this market has apparently softened. But with a well-balanced set of income streams, softness in one area can be counterbalanced by strength in another, as is currently happening.

In summary: I’m glad to see the profit upgrades here, and have no reason to change my positive stance.

XP Power (LON:XPP)

Up 1% to 1263p (£306m) - Interim Results - Graham - AMBER

We have interim results from “one of the world's leading developers and manufacturers of critical power control solutions for the Semiconductor Manufacturing Equipment, Healthcare and Industrial Technology sectors”.

The full-year outlook is unchanged as the market was anticipating these very poor numbers.

This stock has been a rollercoaster ride involving financial difficulties, fundraisings, bid interest and profit warnings.

The current state of affairs is that XPP’s NASDAQ-listed suitor walked away (in June) after failing to receive any cooperation from XPP’s Board. The Board are sure that they want to continue as a standalone company, so that is what is happening.

Here are the interim results, using the company’s adjusted figures at constant currencies:

Revenue down 18% to £127m

Book-to-bill at 0.69x, i.e. the order book continues to fall as orders are fulfilled and not replaced.

Order book £149.5m (a year ago: £250m).

Operating profit down 36% to £13.5m.

Net debt fell back to £104m, giving a leverage multiple of 2.2x. This multiple isn’t particularly low but neither is it distressed. The company says that “actions to improve balance sheet resilience are delivering ahead of expectations”.

Outlook:

Confident that our financial performance will improve and reflect underlying operational improvements once channel stock levels reach equilibrium and as demand recovers within the Semiconductor Manufacturing Equipment market

It remains difficult to be precise about the timing of the recovery with channel destocking now expected to continue until the end of the third quarter, longer than previously expected. The profit impact of this is offset by decisive cost actions already taken

Adjusted Operating Profit expectations for 2024 are unchanged, more evenly weighted between each half and generally less sensitive to demand conditions in the second half

Overall this strikes me as a positive outlook statement, in the circumstances. When trading has been so poor, what I’m looking for are signs that trading isn’t getting any worse - and that seems to be the case with the company not relying on a big H2 weighting to meet expectations and with the result “less sensitive to demand conditions”.

CEO comment says “The proactive actions we have taken to reduce cost and working capital have created a solid platform from which to trade profitably and cash generatively whilst we wait for market conditions to recover”.

Graham’s view

It was a bold move to ignore the bid interest in difficult circumstances but management have followed through with a 16% reduction in adj. operating expenses.

Indeed, first half profits were “slightly ahead of the Board’s expectation”, thanks to the extent of the cost cuts.

There has been a broad-based decline in demand from XPP’s sectors: Semiconductor Manufacturing Equipment, Industrial Technology and Healthcare. Unfortunately short-term demand has been much more volatile than anticipated, even if the long-term prospects remain positive.

I think I am going to stick with a neutral stance on XPP. I applaud the company’s success in cost reduction and I believe them when they say they are well-positioned for a recovery. But as with other stocks, the timing of recovery is unknown and the market cap here is not at a level that I would consider to be distressed at over £300m (price to sales is about 1x).

I’m in good company as Stockopedia’s computers also see this one as offering quite average prospects from the current level:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.