Good morning from Paul & Graham.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

Summaries of main sections below

National Milk Records (OFEX:NMRP) Up x% (£y) - 215p agreed cash takeover - Paul - GREEN

Food giant ABF is bidding 215p cash (an 87% premium!) for this obscure little company that Graham last described here as a "High quality, under the radar stock". An excellent deal for shareholders.

Team17 (LON:TM17) - 350p (pre-market) (£510m) - CEO appointment - Graham - AMBER

This developer and publisher of independent video games announces that it has chosen the successor to its longstanding CEO. I’m leaning towards Green on this one but not quite able to give it the thumbs up yet.

Oxford Metrics (LON:OMG) - up 13% to 111p (£134m) - Interim Results - Paul - GREEN

Superb H1 results, and an ahead of expectations outlook statement, reinforced with a bulging order book. The net cash pile is almost half the market cap too. Loads to like here, and I think the shares are still cheap - but that requires management to use the cash pile wisely, and assumes continuing strong demand for its products.

Chemring (LON:CHG) - 280.5p (+4.5%) (£796m) - Interims - Graham - AMBER

H1 results are in line with expectations at this defence group, and expectations for H2 are unchanged. But there is more to be said as the order book surges to a record high and their “intelligence” services go from strength to strength. An interesting moment for the company.

Quick Comments

Gooch & Housego (LON:GHH)

Up 2% to 568p (£140m) - Interims - Graham - AMBER

This “specialist manufacturer of optical components and systems” announces strong H1 numbers. Revenues are up 32% to £71m and adjusted PBT improves to £4.5m. Full-year expectations are unchanged.

The company is in turnaround mode after it fell into unprofitability last year, and has just completed a review of strategy.

Its bloated order book has been addressed by additional capacity, with “good progress” in reducing order book arrears.

Input cost inflation remains a major factor but as the order book arrears are being dealt with, new orders should hopefully reflect the new environment. G&H are running a “structured programme to increase our prices on new quotes issued to customers wherever the competitive environment allows us to do so”.

The new strategy is titled “Delivering sustainable margin growth”. The company admits that it’s retaining parts of the existing strategy, “but with better execution and greater focus on achieving the desired outcome”. There are “areas where we need a different emphasis and new direction”. It sounds very much like evolution, not a revolution!

Graham’s view - this reputable industrial company continues to offer investors an interesting turnaround story. Brokers finnCap are forecasting adjusted PBT of £9m in the current financial year and £12m next year.

Zotefoams (LON:ZTF)

Up 2% to 348p (£169m) - NIKE contract extended - Paul - GREEN

Details are not given, due to confidentiality. However we are told that an exclusive agreement with NIKE is being extended to end 2029. All other terms (which we don’t know about) are unchanged.

The reason I’m flagging this announcement, is because it deals with my biggest worry about possible downside risk - given that NIKE is such an important customer to ZTF, the client concentration risk was high. Hence news that NIKE seems happy to commit for another >6 years, strikes me as very encouraging. A key risk has probably just been removed.

Paul’s opinion - one of my favourite shares, with a decent core business, plus exciting blue sky potential for its food/drink recyclable packaging, thrown in for free. The valuation is still looking a bit toppy, even after a recent fall from 400p to 350p. Risk:reward has today improved nicely, with news that the key customer contract has been extended considerably.

Paul’s Section:

National Milk Records (OFEX:NMRP)

115p (pre market open)

Market cap £24m

Shareholders will be celebrating today, with a very generous 215p (87% premium!) agreed cash takeover bid, from foods & Primark group, Associated British Foods (LON:ABF) .

It looks more of a strategic move, than a value investment, with the price being paid about 21x PER. It had never achieved that sort of valuation from the public markets, so there must be some strategic reason why ABF is prepared to pay more than the public markets.

Nobody can complain about this - the 215p agreed bid is well above previous all-time highs for NMRP shares -

AB Agri (the ABF subsidiary which is buying NMRP) is already active in dairy products, so this looks a strategic move.

NMR seems to have a tight grip on a niche, which might be what ABF sees as attractive?

NMR regularly collects a milk sample from virtually every dairy farm in Great Britain, positioning it as a highly respected and present voice across the breadth of the national dairy sector. NMR's success has been largely driven by strong collaborative relationships with key industry players, including dairy farmers, vets, milk processors, third party suppliers, and major retailers.

NMR provides milk recording and testing services, invoicing upwards of 3,000 farms every month. In addition, NMR provides milk payment testing services to the majority of the UK's milk processors. Through its laboratories, NMR also provides disease testing services for individual animals and whole herd analysis. NMR continues to differentiate itself by developing new products and services and investing in alternative technologies, notably genomics and GenoCells.

It’s likely to sail through, with 69% support already indicated for the deal.

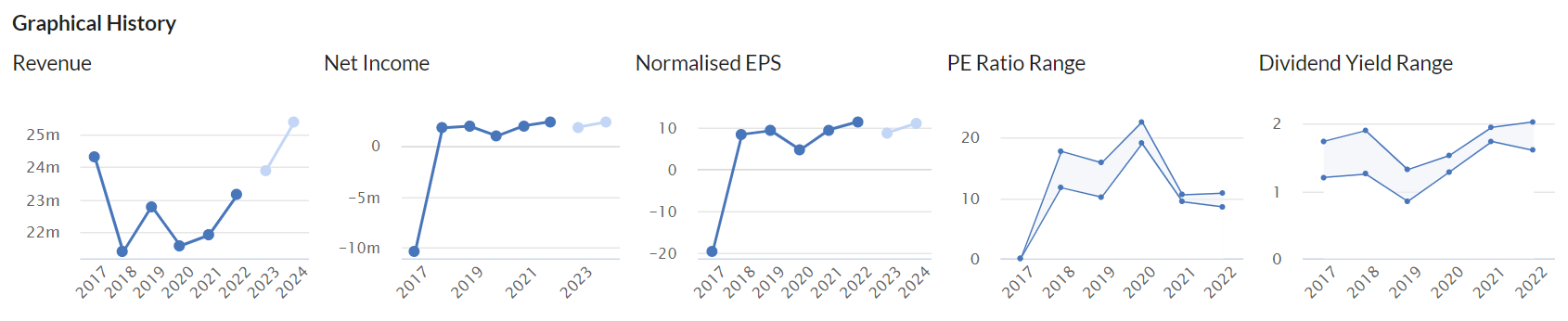

Paul’s opinion - a terrific outcome for shareholders, well done! I'd be interested to hear from any NMRP shareholders as to why you held this share? Nothing jumps out at me from the historical track record below -

Graham last looked at NMRP on 22 Feb 2023, seeing it positively, concluding "High quality, under the radar stock".

Oxford Metrics (LON:OMG)

Up 13% to 111p (at 08:08)

Market cap £144m

Oxford Metrics plc (LSE: OMG), the smart sensing software company, servicing life sciences, entertainment and engineering markets, announces unaudited interim results for the six months ended 31 March 2023.

We get 4 headlines at the top of the RNS today - my bolding -

Strongest ever half year revenue performance

Healthy order book provides confidence for the second half

Investing organically whilst actively pursuing the right acquisitions

Well placed to deliver full year performance above current market expectations

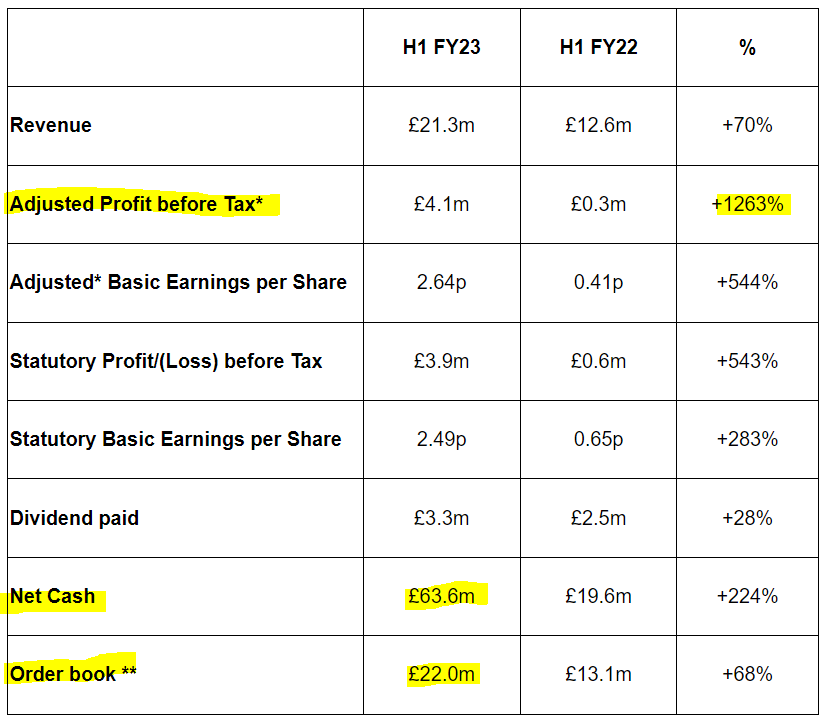

These numbers look terrific, and demonstrate how well operational gearing can work, when high margin products meet strong customer demand. Although note there was some benefit from delayed orders slipping from FY 9/2022 into the latest financial year (due to previous supply chain problems).

Cash pile – a very unusual feature of this share, which was obtained from selling off a part of the business that wasn’t performing well, at an amazing price. Net cash of £63.6m is 49p per share, getting on for half the market cap (130.2m shares in issue), so this is highly significant in valuing the shares.

It’s good to see that management hasn’t let the cash pile burn a hole in its pocket. The plan is to make acquisition(s) - so both risk and opportunity depending on what management decide to buy. With tech valuations now a good bit lower, the delay has probably been helpful.

Also note that finance income was £547k in H1, and on a £63.6m cash pile, that could increase to say £2.5m pa, if 4% could be achieved as interest received on the cash pile.

Balance sheet - is very strong. NAV is £78.4m, less intangible assets of £9.8m, gives NTAV of £68.6m, which is nearly all net cash. So a lovely position to be in!

Cashflow - not great, but the commentary explains that this is deliberate, building up inventories to ensure it can meet H2 sales. That’s fine I think - fast-growing companies do need to temporarily tie up working capital, it’s not necessarily a negative thing.

Outlook - I really like the strong order book of £22m, which means the full year figures should be achievable. Indeed, it says performance is now expected to be “above current market expectations”.

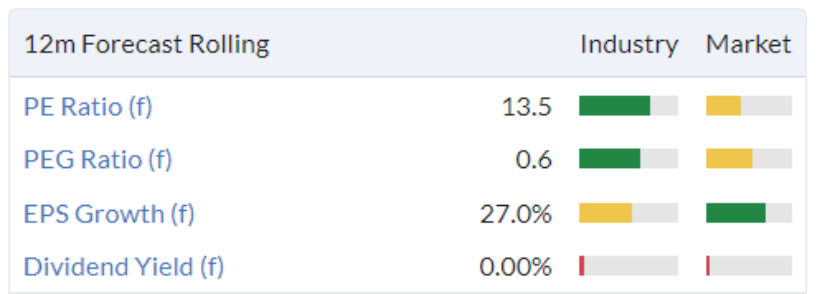

Progressive have issued a research note this morning, with PBT slightly revised up to £6.1m. That looks a very soft target, given that £4.1m has already been achieved in H1. With higher corporation tax, that results in adj EPS of 4.0p.

Personally I’d be surprised if the company achieves less than 5.0p EPS this year FY 9/2023, so expect another “ahead of expectations” type of update later this year.

My opinion - superb results, and a strong outlook, plus a massive cash pile, there’s lots to like here! So clearly I’ll be maintaining my positive view of this share, at green. OMG shares made it onto my “runners up” watchlist for 2023, so it’s good to see it continuing to perform well.

The big question is whether strong performance can be maintained? Doing a bit of googling, OMG’s main business, Vicon, seems to supply high end cameras. I recall a few years ago there was another company doing that, called something beginning with V, which made nice profits for several years, but then fizzled away and eventually delisted. The market just moved on, with better products being launched by competitors. So if I were researching OMG in more detail, I would focus on the question of how sustainable its competitive advantage is? It might just be in a sweet spot that competitors could erode over time? Although it’s good to see OMG spending plenty on R&D, which is vital for future success, as technology moves so fast these days.

In the meantime, the valuation looks quite reasonable to me. At 111p per share, I would first deduct the 49p per share cash pile, giving 62p valuation for the actual business. I think it’ll do at least 5.0p EPS this year, so a PER of just over 12 - it looks a bargain to me, if those profits are sustainable.

The other key point is what management does with the cash pile. Downside risk - they overpay for something. Upside risk - they buy something excellent at a good price. So this share is very much a bet on two things - strong demand for products continuing, and management using the cash pile wisely.

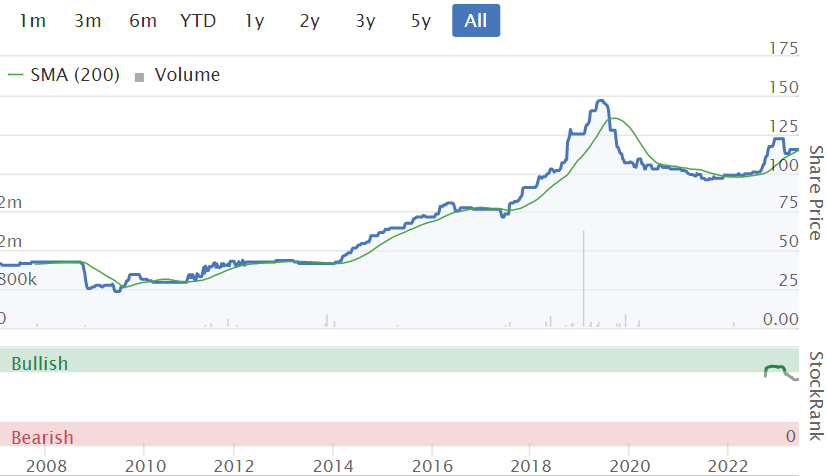

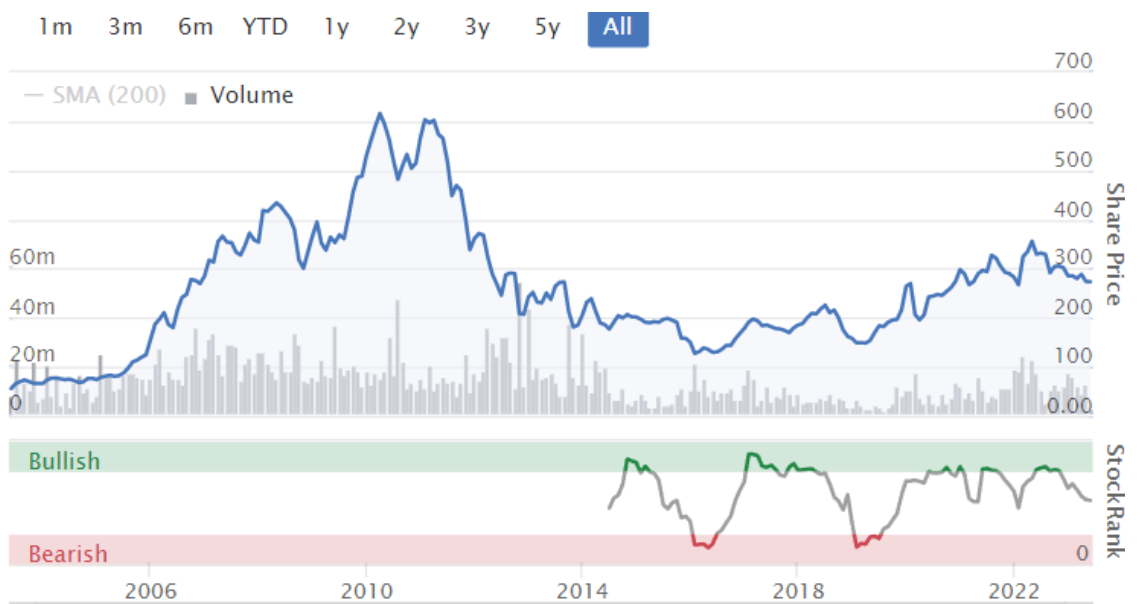

A very nice looking long-term chart below, and a high StockRank too -

Graham’s Section:

Team17 (LON:TM17)

Share price: 350p (pre-market)

Market cap: £510m

We previously reported on the planned departure of Debbie Bestwick, Team17’s talismanic CEO.

Just over two months later, we have a development:

Team17 Group plc, a global games label, creative partner, developer and publisher of independent ("indie") premium video games, educational entertainment apps for children, and working simulation games, is pleased to announce the appointment of Steve Bell as Chief Executive Officer. Steve will join the Board on 4 September 2023 as Group Chief Executive Officer Designate, formally assuming the role of Group Chief Executive Officer from 1 January 2024.

Bestwick will officially remain CEO until 31 December 2023, so the new CEO will have four entire months to work with her and learn about the company before he takes on the role.

It’s a perfect plan for a smooth transition. Remember that Bestwick is a co-founder of the company and 21% shareholder, so it’s in her interest to ensure that the new CEO benefits from her wisdom!

The new CEO joins from a marketing agency he co-founded in 1999, and that now has 1,000+ employees around the world.

There is no doubt in my mind that his experience will be helpful for Team17, but personally I do prefer to see people with industry-specific expertise at the top of companies. In other words, I’d like to see someone with gaming industry experience leading a company like Team17. I want the CEO to understand the point of view of the customer and to have a strong understanding of his or her competitors in the industry.

But I imagine that Team17 did a lot of work before making this decision. Comment by Bestwick:

As a Board, we have run a rigorous process to find a new Group Chief Executive and we are delighted to announce Steve as my successor. Steve's experience as a co-founder of a people-centric business means he understands the importance of our vibrant and inclusive company culture which remains the cornerstone of everything we do across the Group.

Graham’s view

I was previously neutral on this stock at £640m, before the announcement of the CEO departure.

At a £510m market cap, it’s more interesting. See previous coverage (here and here) for discussion of organic versus acquisition-led growth, and the adjustments made to the earnings numbers.

Overall, I’m going to stay neutral on this one, although I am leaning towards green. If they had hired a gaming industry veteran as CEO, then perhaps I’d have taken an outright bullish stance today.

Chemring (LON:CHG)

Share price: 280.5p (+4.5%)

Market cap: £796m

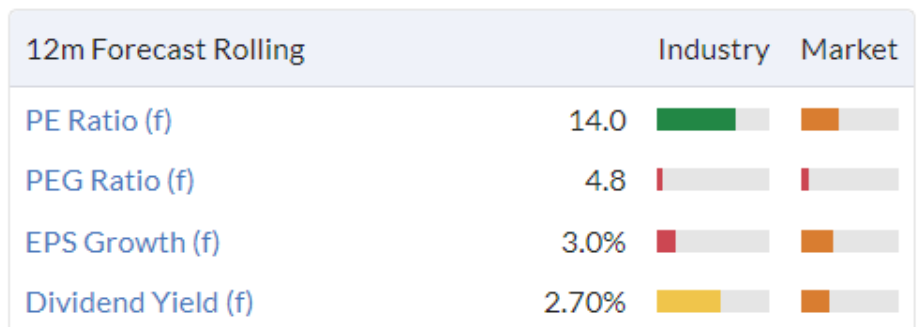

This defence share has been a strong performer over the past five years. But it’s not very easy to get the timing right with this one, as I know to my own cost:

Let’s briefly see how it’s doing currently, with the latest interim results for the period to April 2023.

H1 is in line with expectations. Key points:

Record H1 order intake £338m, plus 81% year-on-year.

Record order book in over a decade at £750m, plus 54% year-on-year. About one third of the order book to be delivered in the second half of the financial year.

The actual H1 results are less impressive than the order growth: revenues down 5% and underlying operating profit down 19% at constant exchange rates.

The US government’s spending difficulties have caused complications:

As previously announced, delays to order intake in 2022 following the extended US Continuing Resolution have resulted in a heavier weighting of trading performance and cash generation expected in the second half of the financial year for the Countermeasures & Energetics sector.

Net debt is only £25m which does not seem meaningful relative to the current size and profitability of the group. Cash generation in H2 should improve “markedly”.

CEO comment excerpt:

The outlook for the global defence market is increasingly positive, with strong growth predicted over the next decade. This growing visibility and the increasing desire of our customers to move to long-term partnering agreements gives us the confidence to continue to invest for the future, balancing short-term performance with heightened long-term growth and value creation. Chemring is well placed to capitalise on its many opportunities and with 90% of expected H2 revenues covered by the order book, the Board's full year expectations are unchanged.

Outlook

Chemring owns a business called Roke that made a big contribution to orders (£81m) and revenues (£78m) in H1. This is what Chemring has to say about its outlook:

…Roke has created an Intelligence as a Service business which combines proprietary datasets, AI, and customer facing platforms to provide nation state level intelligence to both government and commercial customers. Viewed as a key enabler of tactical success, our expectations are that this business can grow at 35% CAGR.

For the group as a whole, H2 expectations are unchanged, with expectations for “robust organic and inorganic growth”.

Graham’s view

I find the defence sector extremely tricky as the customers (governments) and the catalysts (conflict) are by their nature unpredictable. However, I am impressed by Chemring’s diversification into intelligence services. I would also be inclined to think that background conditions will remain favourable for Chemring for at least the next several years.

It can be argued that this is priced in now, after strong share price gains since c. 2019. I’m neutral on the stock but I do think it remains a worthy candidate for further research:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.