Good morning!

Things I've been looking at:

- Pebble Beach Systems (LON:PEB) - trading update

- Harvey Nash (LON:HVN) - takeover offer

- Pendragon (LON:PDG) - half year report

- T Clarke (LON:CTO) - half year report

- Domino's Pizza (LON:DOM) - interim results

Pebble Beach Systems (LON:PEB)

- Share price: 3.7p (-1%)

- No. of shares: 125 million

- Market cap: £5 million

We used to cover this when it was known as Vislink (VLK), so I'm curious to see how the story will end.

It now claims to be a world leader in broadcasting software.

I see that it issued final results for the year ending 31 December 2017 on 25 June this year - terrible.

H1 revenues this year are lower than last year (£3.9 million vs. £4.6 million). The backlog and pipeline will hopefully lead to an improved H2. There is no reference to performance versus expectations.

When I saw the wheels come off at Vislink, I assumed that it was going to go bust. Miraculously, it has avoided that outcome (through disposals) and even managed to avoid diluting shareholders. The share count has barely increased in recent years.

But that doesn't mean the existing equity is worth terribly much. Net debt of £10 million was recorded at December 2017 (twice the current market cap) .

I don't consider this investible at present but I'll keep an eye on it, to see if any signs of life will emerge now that it has been restructured.

Harvey Nash (LON:HVN)

- Share price: 130.5p (+17%)

- No. of shares: 73.5 million

- Market cap: £96 million

A takeover offer for this international recruiter from Dbay Advisors, its largest shareholder.

Note that Dbay appointed a Director to the board of Harvey Nash last year, so he is not independent when it comes to this proposal.

The offer is at 130p plus an interim dividend of 1.75p that would have been paid in November anyway.

To go ahead, the shares not already owned by Dbay will have to vote in favour of the deal, with a majority of at least 75%.

Dbay are based on the Isle of Man and describe themselves as value investors.

"Our goal is to provide our investors with superior risk-adjusted returns while prioritising preservation of capital by focusing on investments with a high margin of safety."

Harvey Nash has indeed been a fairly safe investment for the past decade. The dividend has grown every year and the overall trajectory for operating profit has been upwards.

It's been cheap, too. Recruiters trade at cheap multiples and Harvey Nash has been one of the cheaper recruiters. Yesterday, it was trading at a forward P/E multiple of less than 8x.

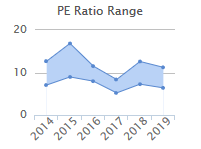

Let's remind ourselves of its P/E range of recent years, using Stocko data:

The cheapest multiple was 5x, while the most expensive was 17x.

This offer values it at something like 9.5x its current-year (FY 2019) forecast earnings.

As others have said, this doesn't look particularly generous, at first glance.

The share traded at a P/E multiple of 17x in FY 2015 but have also traded close to 13x a couple of times in recent years.

It's not up to me, since I don't own any HVN shares. However, I would expect that HVN shareholders will need to think carefully about this, and it would not surprise me if some of them voted against the deal.

After all - if the share price occasionally reaches a higher multiple than the takeover offer represents, then is it really necessary for a small shareholder to accept it? I suppose if the institutional shareholders with large holdings want to liquidate their investments, then they may feel more inclined to accept.

Everyone's position will be a little different, for liquidity and also for psychological reasons.

For example, if you bought the shares in early 2014 at 120p, to get a long-term dividend stream, then would you really want to exit now at 130p?

On the other hand, if you bought it in early 2017 at 60p, with the intention of capital gains over a 1-2 year horizon, then you may be delighted by this offer.

I think that if I held the shares, I might feel a bit let down by this paragraph in today's announcement, which could be seen as unnecessarily talking down the prospects for HVN in order to justify the sale of the business:

The Independent Harvey Nash Directors believe Harvey Nash would continue to have a strong future as an independent listed company. However, the Independent Harvey Nash Directors also recognise that Harvey Nash's financial performance is in part dependent on the economic cycle, and whilst the Company now is better placed to react to any changes to market conditions, there remain significant political and economic uncertainties in the medium and longer-term which may impact Harvey Nash's future performance.

While it is undoubtedly true that there are political and economic uncertainties facing the business, the same is true for any recruiter and the below market average earnings multiple attached to the shares could be seen as pricing in this uncertainty.

If Dbay are right then the shares are worth at least 130p. So I am not surprised to see this trading at a small premium to 130p today, especially considering the interim dividend that is also due to shareholders.

Pendragon (LON:PDG)

- Share price: 24p (unch.)

- No. of shares: 1410 million

- Market cap: £338 million

This vehicle retailer came to my attention recently when I was looking for some new investment ideas.

I've done well over the past year or two with companies at cheap valuations who have bought back their own shares. So that is something I'm keen to do more of - find companies doing buybacks at cheap prices. Pendragon is one of those companies buying back its shares.

Today's report and the outlook are in line with expectations.

The strategic objectives are well laid out and Pendragon shows the actions taken to achieve them so far.

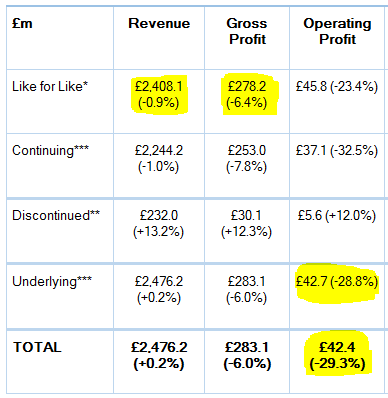

Numbers are a mixed big. A small decline in UK like-for-like revenue and deteriorating margin have caused a large drop in underlying profits.

I've highlighted the numbers I think are most important in yellow:

When you drill into the results at the company's various divisions, you see a huge disparity in performance between the UK motor division and everything else (leasing, software and US motors). All of the other divisions are stable or growing. Unfortunately, the UK motor division is by far the largest piece of the pie.

Net debt closed the period at £107 million, down by £17.5 million as very strong operating cash flow was offset by taxes, interest payments, capital expenditure, dividends etc.

I agree with the company's assessment of its borrowing levels as being rather low, at 0.8x EBITDA or 0.24x its balance sheet equity.

So it has the flexibility to go for additional capex, to buy its leasehold properties or to extend more shareholder returns in the form of dividends or capex.

My impression is that management are very thoughtful about how they allocate capital, so I'd be inclined to trust that they would make sensible choices.

And it sounds like they could be swimming in cash very soon:

"We anticipate the sale of our US business to realise in excess of £100 million"

"A further £74 million of capital will be released through a mixture of disposal proceeds and investment not deployed in the UK"

Despite being profitable, paying dividends, buying back its own shares and earning acceptable ROE of c. 13% (according to Stocko), Pendragon is trading at a deep discount to book value of £448 million.

So I'm interested to keep researching this and would strongly consider adding it to my portfolio.

I suppose things could get a lot worse for UK motors, if GBP depreciates again and if new car sales keep falling. But if the car market stabilises, I think this could end up looking very cheap.

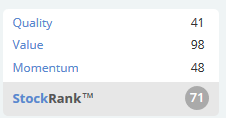

StockRanks agree with me when it comes to the Value on offer. They aren't convinced about Quality or Momentum, however:

T Clarke (LON:CTO)

- Share price: 85.9p (+3%)

- No. of shares: 42 million

- Market cap: £36 million

TClarke plc ("the Group" or "TClarke"), the Building Services Group, announces its half year results for the six months ended 30th June 2018.

This is a small-ish construction engineering company. Margins are notoriously low in this industry: T Clarke is trying to progress towards an underlying operating margin of 3%. It has most recently achieved 2.6%.

Turning down low-margin work means allowing the order book to reduce. It has fallen from £392 million a year ago, now down to £370 million.

I suspect that contractors have been bidding too cheaply for projects in recent years and not giving themselves enough headroom for things to go wrong. We should never stop mentioning Carillion (delisted: CLLN) in this regard. It's a good thing that T Clarke is turning its back on projects that don't give it at least a little bit of headroom.

At the end of the day, there is no point trying to fulfill a contract cheaply if it means the contractor goes bust half-way through or never makes a sustainable profit.

Anyway, T Clarke appears to be performing well and is likely to be worth a look for anyone who is comfortable investing in this sector.

Results are in line with expectations:

- H1 revenues up 7%

- net cash of £4.7 million (gross cash £9.7 million, bank loans £5 million)

- underlying PBT from continuing operations +47%

- interim dividend +10%

Outlook - "cautiously optimistic" about future prospects.

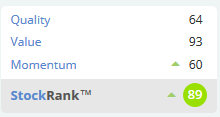

My view - The shares look cheap, and the Value Rank >90 confirms this (but do bear in mind that there is a £19 million pension deficit, requiring annual payments of £1.5 million from next year).

I choose to invest elsewhere as I find this sector too unpredictable and labour-intensive. If you have the risk tolerance for it or some particular insight into T Clarke's prospects, it could be priced attractively.

Domino's Pizza (LON:DOM)

- Share price: 287p (-10%)

- No. of shares: 476 million

- Market cap: £1,369 million

Clearly not a small-cap, I'm having a look at this because a) it is a high-quality company, by many metrics, and b) I own some shares in DP Eurasia NV (LON:DPEU), and want to understand how the brand is doing internationally.

DOM is responsible for the brand in the UK, Ireland, Switzerland, Luxembourg and Liechtenstein (there probably aren't too many branches in Liechtenstein), and has controlling stakes in Iceland, Norway and Sweden.

It has been buying back its own shares and could now be priced at a level where someone like myself, who has been hoping for a chance to buy into it, should be seriously considering a purchase. The shares are at the lowest level since September 2017.

EPS is forecast this year at 16.4p and next year at 18.2p, allowing for multiples of 17x and 16x, respectively.

Underlying PBT growth in this latest H1 period has been rather anaemic, however, up only 2.5% for the group as a whole.

This is blamed on "investments for the long term" in Norway and Sweden, along with higher interest costs.

Net debt has grown by almost £100 million to £182 million, driven by dividends, share purchases and acquisitions.

It's not an extraordinarily heavy level of debt for the group to carry.

To help put it in context, £31 million of net cash was generated from operating activities during the six month period reported today. Of course the company has less flexibility now than it did before, and will need to exercise care in managing the debt load.

Good growth

To get a big picture view of the brand's popularity, let's find some like-for-like sales numbers:

- UK: +5.9% (hindered by hot weather, boosted by World Cup)

- Ireland: LfL sales not given, total sales +2.5% in local currency. Value perception damaged by a marketing campaign at the start of the year.

- Switzerland: +6.8%

- Iceland +2.9%

- Norway +5%

Remember that these are like-for-like sales increases. Total sales are growing faster wherever new stores are opening, e.g. Switzerland total sales are up 13% in total.

The LfL numbers strike me as pretty good overall, and indicate that the brand enjoys robust popularity across a range of markets.

My view

I've only touched the surface when it comes to analysing this interim report but I'm intrigued that we could have a nice buying opportunity on our hands.

It has a lot of the characteristics I look for in a stock, and I think people might be selling it out of impatience rather than any fundamental deterioration in its long-term value. Worthy of further research!

That's all for today. Thank you for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.