Good morning from Paul & Graham.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda/Summaries

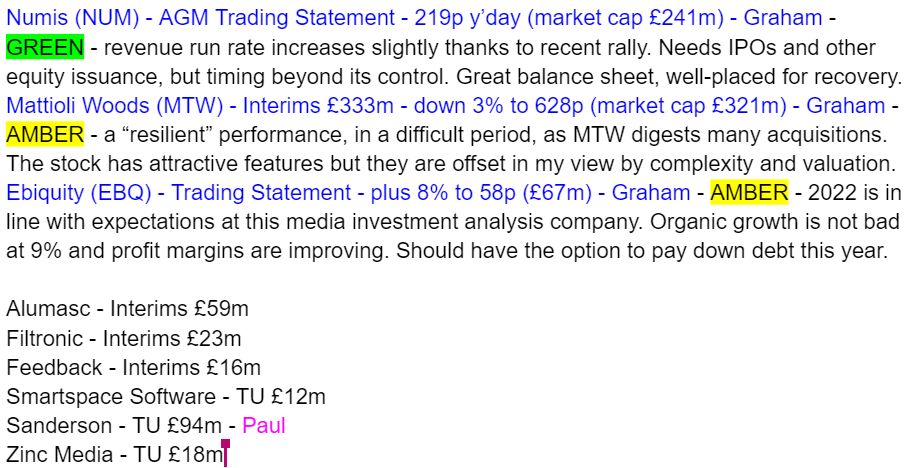

Graham’s Section:

Numis (LON:NUM)

Share price: 219p (pre-market)

Market cap: £241m

This investment bank was another member of my top ten list for 2023, so let’s check out its AGM statement!

The statement covers the first four months of its financial year, i.e. from October to January inclusive:

The first four months of our financial year have seen a continuation of the difficult market conditions experienced throughout FY22, with very subdued levels of equity issuance and corporate activity. Our revenues for the period were consequently similar to the second half run-rate of FY22.

It’s interesting that markets have recovered noticeably from their lows, but this has not yet translated into the sort of dealmaking which the smaller investment banks rely on.

For example, here’s the FTSE-350 over the past six months:

And the AIM Index over six months:

Things are even better in big-cap land. The FTSE-100 made a fresh all-time high a few days ago.

But despite the improved sentiment, we are not yet in an environment where companies wish to IPO en masse. A nice sign that valuations are still very much at the cheap end of the spectrum!

Let’s get back to the specific performance of Numis.

The market recovery did lead to a slight improvement in revenue, as commissions must have improved slightly:

Our equities business has delivered revenue slightly ahead of the second half run-rate of FY22, helped by the significant rally in UK small and mid-cap indices during the period and a general improvement in investor sentiment.

And strategically they are active on a number of fronts:

Focused on M&A transactions in their advisory business with a “strong” near-term pipeline.

Opened a Dublin office for EU transactions and selling to Europe.

Selectively hiring and open to “opportunities which may emerge across the industry during this period of uncertainty” (i.e. possible takeover deals?)

My view

I have little reason to change my tune on this one. I again refer to its net assets of £185m (September 2022 balance sheet) with good liquidity, including cash of £106m.

The share price has risen by 20% since I originally noted its cheapness, and it no longer passes the Ben Graham value screens. However I still see scope for further upside as earnings are currently in a trough.

Mattioli Woods (LON:MTW)

Share price: 622p (-4%)

Market cap: £318m

I restarted our coverage of this stock last month. It provides a very wide range of financial services, and describes itself as “a leading provider of wealth management and employee benefits”.

The QualityRank is still very high, at 86 (this is what originally piqued my curiosity).

Let’s see how the company has fared in the six months to November 2022. Here are the interim results highlights:

Revenues +10% to £54.9m.

Modest organic revenue growth of 2.2%.

Small decline (2%) in client assets. This includes the assets at Amati Global Investors (MTW owns 49% of Amati).

Adjusted PBT £13.5m, reported PBT £4.8m.

The impact of gloomy market conditions is further highlighted by a 4% decline in what the company calls its “discretionary” assets under management, despite enjoying small net inflows.

Outlook - in line with expectations.

CEO comment by Ian Mattioloi - describes H1 as a “resilient trading performance”.

Acquisitions - the company has made a remarkable eight acquisitions since 2021, and they seem to be performing as hoped. This has come at the cost of a greatly increased share count.

Balance sheet - £38m of cash, and no financial debt. The interim dividend increases to 8.8p per share.

My view

There are a lot of moving parts involved with this one, but I think investors can continue to take comfort, as I noted last time, from the involvement of co-founder and significant shareholder Ian Mattioli. Trusting the motives and the ability of management is a great start, when you’re trying to form a view on a complicated company!

As for the numbers, today’s adjusted PBT figure of £13.5m can be defended if you’re willing to add back the usual “exceptional” items - amortisation of intangibles, acquisition related costs, etc.

Singers have left their earnings forecasts unchanged this morning, although they do note that meeting their forecasts will require an uplift in profitability from MTW in H2. So today’s results do, in my opinion, lay the foundation for a possible miss when it comes to full-year expectations.

These expectations are for adjusted PBT of £30.8m, and then rising to £33.3m in FY 2024.

I’m going to take a neutral stance on this one. Some positive points:

Strong balance sheet.

Founder-led.

M&A strategy is working for now.

Plenty of demand for its services, regardless of the bear market.

Adjusted profit margins are good.

I can’t take an outright positive stance because very heavy M&A activity always makes me nervous: it makes a business more difficult to understand, it increases business risks, and it makes the financial statements resemble even more the subjective opinion of the company and its accountants, rather than objective facts.

I also think this company is vulnerable to profit warning later this year. And the £300m+ market cap is going to require much higher profit numbers, sooner or later.

Ebiquity (LON:EBQ)

Share price: 58p (+8%)

Market cap: £67m

This calls itself “a world leader in media investment analysis”. On their website, they say:

We harness the power of data to provide independent, fact-based advice, enabling brand owners to perfect media investment decisions and improve business outcomes.

Here’s the financial track record - not too inspiring so far:

Today’s trading update for the full-year 2022 is in line with expectations.

Revenue growth was 20% (total) and 9% (organic). It sounds like the company has made real progress:

Profitability has improved significantly from the prior year with the underlying operating margin expected to be 12%, four percentage points higher than in 2021. This reflects the contribution of recent acquisitions and improved operating efficiencies, as well as the continuing strong growth of our higher margin digital media solutions business.

One of its recent acquisitions has performed better than expected, and this is likely to result in a higher earn-out payment (no bad thing).

Net debt improves to £8.9m. It was £12.9m the last time I checked.

The CEO comment is positive, referring to momentum and progress against their strategic plan.

My view

This stock wouldn’t suit my investment style (I think it’s a consultancy business, at the end of the day), but I won’t take a bearish stance on it because it does appear to be building up a head of steam.

Analysts at Edison are looking for the company to generate an adjusted PBT of £11.5m in FY December 2023. The adjustments will be significant but the cash flow flowing from that performance could be decent, reducing the debt load.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.