Good evening/morning, it's Paul here with Tuesday's SCVR.

Estimated timings: I'm aiming for 2pm finish. Edit at 13:37 - make that 3pm, some companies are taking longer to work through than I anticipated.

Update at 15:10 - today's report is now finished.

.

Reminder for Mello Virtual

This is coming up, this Fri & Sat, 10-11 July. It will be just like a normal Mello investor event, but online.

I've been roped in to comment about small caps in a panel discussion, so am looking forward to that.

David has kindly provided Stockopedia subscribers with a 50% discount code: SCVR50

Sorry if you've already paid full price (which I have too), but it's so cheap anyway, it's not worth getting into a lather about it either way.

There are some stand-out speakers, including quite a coup getting Sir Martin Sorrell as a keynote speaker! His very forthright views should be illuminating.

Pub re-openings, part 2

Expert industry sources (mostly Mark Brumby of Langton Capital) told me that the pub/restaurant re-opening is being phased, and that some operators had decided to defer Super Saturday to Manic Monday instead. Therefore, out of duty to my readership, I felt compelled to research what was happening in Bournemouth once again this Monday evening.

Pleasingly, Bigdish (LON:DISH) dining app (in which I have a >3% holding) seems to have done a soft relaunch, as I successfully booked a table for 1 (under the name of Billy Nomates!) at Nativ - a small, and basic African themed independent takeitaway/diner. To say that staff were welcoming is an understatement! They welcomed me like a long-lost friend, which was wonderful. Mind you, I have been re-reading the Dale Carnegie classic, "How To Make Friends & Influence People", which reminded me to smile and be generally affable. The results of doing that are genuinely remarkable - people respond so well to warmth. This is probably my new favourite book, having slightly eclipsed Superforecasting, which I've read twice now.

As my old PE teacher, Tim Hall, at Poole Grammar, used to say in a broad Dorzet accent, "Yer get out, what yer puts in!". He applied that to sports. He was right. I put in nothing into sports, and got nothing out. Chasing balls around a field has always struck me as mindless, and always will. But his general philosophy of getting out, what yer put in, is very true in other areas.

Oh yes, I got 25% off my delicious grilled chicken & prawn skewers at Nativ, and I recycled my 25% discount into 2 pints of Nigerian lager (excellent actually), and some fried plantain. The manager said they had been open right throughout the lockdown, and takeitaway business had been good. Which reinforces a point we were discussing yesterday - restaurants have to do takeitaway well, in order to survive until dining in returns properly.

Next, I decided to revisit the 800 to 100 capacity O'Neills across the road. As luck would have it, the burly but affable doorman with the bushy beard from Saturday, was also working today! I said, Hello again, and he remembered me, invited me to sanitise my hands, then took me to a table outside. As he led the way, I said, "You appeared in my stocks & shares blog this morning. I described you as burly but affable". Without hesitation, he affably retorted, "I'll take that. My mother calls me far worse!". I was about to make another joke, speculating what insults his mother might use, but thought better of it.

Many businesses forget that the person at the front, interacting with your customers, IS your business in their eyes. Put someone bolshy there, and they do incalculable damage to your business's reputation & longevity, something that many business owners seem oblivious to. That very point is told via a story about surly Dept Store staff in the Dale Carnegie book actually.

I had to download yet another drinks ordering app, but was rewarded with a crisp, bubbly pint of Peroni, in the evening sunshine outside O'Neills, which was bliss. I read another chapter of my biography of Cecil Rhodes, as unlike many millennials, I like to acquaint myself with the facts, before virtue signalling about the past. Blanket memo to millennials - people in the past were all nasty! Get over it.

After that, I decided to have another go at the Slug & Lettuce. It did occur to me that my previous mishearing of "buggy" might have meant a mobility scooter? After all, when offering ID to prove I was over 18, some sarcastic doorman in Cheshire did once tell me that "We don't take bus passes, Grandad!" to the hilarity of my niece & nephew at the time. That was at Christmas.

Slug & Lettuce is another Stonegate chain, which is probably regretting its debt-fuelled acquisition spree now. Anyway, the doorman was very professional - he looked a bit like a semi-retired wrestler, with a neck which was considerably wider than his head. But he couldn't have been more welcoming, and explained the one-way system to get to the toilets, etc. Then some drunk girls came in, and said they had a reservation for 8. Then one said, "No, it's not 8. It's 6 people, plus two". They were going the wrong way around the one-way system, which took a while to resolve. A bit like me on a boris bike.

After that, I went somewhere else, where was it? Oh yes, the Moon & Pig, yet another Wetherspoons, in the Square. This I'm afraid was a bad experience. The doorman sounded Italian, was wearing a clear plastic visor, and seemed quite agitated. His dictatorial tone, stand here, do this, do that, immediately put my back up, so I started challenging him. My standard phrase now is, "Relax, I'm immune", and then wave my antibodies test result at them. This generally does not go down well, so I might stop doing that. In fact, it's always gone down between quite, and very badly.

In the end, I asked the agitated doorman, why he's so agitated. "Because I'm high risk, I'm diabetic", he replied. Oh I see, well I quite understand. You shouldn't be on the door, I quietly commented. "I can't afford not to work", he explained. Food for thought, isn't it. Life can be complicated. Anyway, the Area Manager of 'Spoons probably needs to reallocate him to other duties pretty damn quick, before he alienates the rest of their customers.

Inside the Moon & Pig (where chavs tend to congregate), it took 12 minutes for my pint to arrive, by which point I was ready to leave, having to endure the mindless cackling of some drunk women opposite. I did notice, whilst leafing through the Wetherspoons in-house magazine on the table, that it had a short section condemning our hero, Mark Brumby of Langton Capital! It turns out that Mark had inadvertently chosen his words incorrectly, and the full force of Tim Martin's wrath seems to have descended upon Langton Capital, resulting in an apology. Fair enough I suppose, if commentators get things factually wrong, we have to put it right asap. There's no shame in that, it's good practice.

Are there any additional points learned from tonight's rigorous research?

1. The new rules need to be handled in a firm but fair way. Nobody likes being told what to do. So pubcos please note - a door Nazi security person, is a very quick way to send customers to your competitors.

2. Eating out again, in any kind of restaurant, is pure joy! I've missed it so much. Tip the staff well, and smile a lot. It's stressful for them too.

3. Ordering apps - is it an imposition having to download & use multiple apps for different pubcos? Not really. A lot of them seem to use the same QR code as you enter, to register your visit, for tracing purposes. The drinks/food apps only take maybe 5 minutes to set up. I don't have a problem having 4 or 5 different ones on my smartphone. They all work in much the same way. I'm sure things will become more slick as time progresses.

4. Pubs were quite busy on a Monday. So it looks as if the public are already getting the point that we need to spread our socialising out during the week, and not all rush into town on a Saturday night. Maybe that is easy when half the workforce is on furlough? Things might change again when people go back to work, or are made redundant?

5. Staffing - the burly but affable doorman told me that staffing had been reduced. Hence he was more upbeat about profitability, despite reduced customer numbers. He struck me as pretty intelligent, so maybe we need to get some data about that from trading updates in the next few weeks, before drawing a conclusion?

.

Overall - I think the stock market could be correctly balancing risk:reward at the moment. I don't see hospitality shares as being particularly cheap, but that's fair, given that 2021 should see a return to normality, against poor results for 2020. Maybe the stock market could be correctly weighing up risk:reward? It looks about right to me.

That's probably enough about pubs for this week!

On to today's news.

.

Sosandar (LON:SOS)

12.4p (up 20% today) - mkt cap £23.8m

(I'm long)

Q1 Trading Update (relates to Apri, May & June 2020) - I went through the last update with a fine tooth comb here on 9 June 2020. Current trading sounded quite good, and spending was slashed because of covid, to preserve the dwindling cash pile. We all know Sosandar's going to need another fundraising later this year, it's obvious, whatever management say.

Q1 revenues are up 54%. This is good, but down from the 62% previously reported for April & May. So it looks like growth slowed somewhat, I make that +38% growth in June alone. Not bad, but the effect of reduced marketing spend looks like it's starting to be felt, with slowing growth (cunningly obscured in the RNS today). Q1 last year is a soft comparative, as it was before the big marketing spending splurge started in autumn 2019.

Profitability - this sounds a lot more encouraging;

As a result of the growth in sales together with a significantly decreased marketing spend, the Company has seen losses in Q1 reduced by c.70% compared to the same period in the prior year.

In June, the Company's monthly sales performance improved again, with a strong gross margin from a shift back to full price purchases following some promotion and discounting in early April. As a result, the Company recorded results very close to breakeven in June.

That gives the impression of an increasing sales growth trend, which is not true, as demonstrated above, sales growth was slower in June than in April + May. Being very close to breakeven in June is excellent news. However, bear in mind that the company was operating on a skeleton staff, having furloughed many staff, and having slashed marketing spending. Those are not normal conditions. However, it does show the excellent flexibility of an online business model - in tough times SOS can dial down its costs drastically, in a way that physical retailers can't so much.

Marketing - spend has been greatly reduced, but they've still managed to in crease new customer numbers by 24%. That does beg the question whether previous marketing spending was wasted money, at least partially? If growth can still be achieved at a respectable pace without much marketing spend, then I'm all for that. "Controlled and careful" new customer acquisition (i.e. marketing) will resume in the busy season from Sep to Dec.

Cash burn - April seems to have gained an extra day!

Cash at 30 June 2020 remained broadly flat at £4.4m, showing only a very marginal decrease since 31 April 2020. Whilst the Company remains prudent in its approach to discretional spend, carefully monitoring KPIs and cash management, it expects to cautiously increase marketing spend and investment in new products going forward in order to accelerate top line growth.

This is reassuring, but is being boosted by the furlough scheme, and probably VAT deferral, although that is not mentioned. Can it reach breakeven without another fundraising? Extremely unlikely in my view. I think it's likely to need another £4-5m fundraising later this year, or early next year. That's not necessarily a problem, because breakeven is at least in sight now (maybe next year?), and we know it can slash costs if needed. But it does mean that shareholders should probably brace for another c.20% dilution.

My opinion - I had rather cooled on this share, after a poor update earlier this year. It seemed to be going off the boil. But fair play to the team in Wilmslow, they're a tenacious bunch, and you certainly can't fault them for determination to make this work. Once scale is achieved, then things could get very exciting, but it's still well short of the c.£20m p.a. revenues needed to reach breakeven.

Overall, I think the current price is reasonable, and I'm happy to hold. I have lightened the load somewhat along the way, so it's no longer a huge outsized position for me, it's now a regular mid-sized position. That was because the increased dilution from repeated fundraisings has reduced the % upside, hence why I don't want to be massively overweight in this share any more.

.

.

Halfords (LON:HFD)

167p (down 6%) - mkt cap £332m

Preliminary results - for the 53 weeks to 3 April 2020.

Halfords has suffered less than some other retailers through this crisis, because it was classified as an essential retailer, hence allowed to keep its stores open. It also benefited from the trend towards cycling (likely to continue, as people seem reluctant to get on buses, trains, or tube).

Underlying EPS was almost flat against last year, at 24.3p (adjusted for 52, instead of 53 weeks). The company says that underlying profitability is ahead of guidance. At 167p per share, this is a lowly PER of 6.9

Free cashflow is said to be £54.6m - impressive.

Net debt of £73.2m doesn't seem excessive.

Large adjusting item of £32.1m relates mostly to an exit from Cycle Republic.

Current trading & outlook - the FY 03/2020 results are good, but include very little disruption from the covid lockdown, which began in late March. Recent trading for the 13 weeks to 3 July, is -6.5% on a LFL basis. This shows a much better trend, since LFL sales were down -23% in the 4 weeks to 1 May. It's a pity the company didn't provide a table, with more granularity on the sales throughout Q1, but the trend seems to have strongly improved within the quarter.

Cycling is the stand-out sector, with +57.1% revenues in Q1. That's offset by reduced motoring spending.

Cautious outlook due to macro & virus uncertainty.

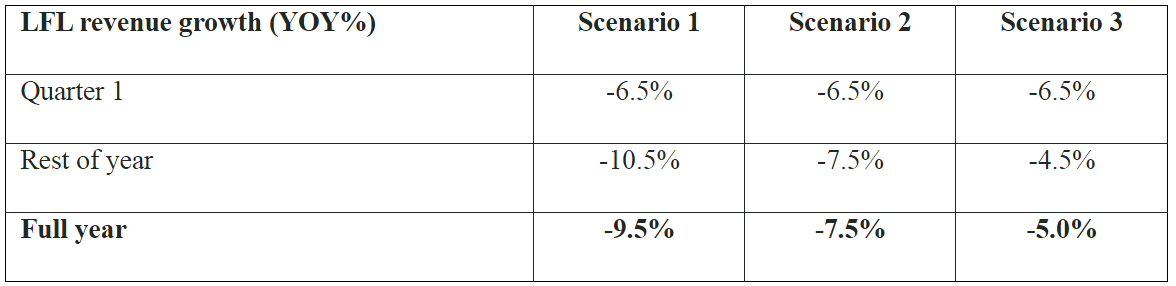

Scenario planning - this section is absolutely excellent, and shows what all companies should be doing to guide the market (but very few actually are). Here are the company's range of scenarios, moving from left to right, I would characterise these scenarios as: bad, middling, and OK;

A second table is then provided to show how each scenario translates to full year profits;

.

The way I look at this, even in a downside scenario where sales deteriorate from the -6.5% LFL achieved in Q1, it only results in a small loss, or breakeven overall result. I suppose that could present problems with bank covenants, but it doesn't look in any way threatening to the survival of the company.

We have a range of profitability from -£10m to +£20m above. That compares badly with the £55.9m underlying PBT just reported for FY 03/2020. Hence make no mistake, FY 03/2021 is going to be poor in comparison. That's why this share is rated on a low historic PER.

Balance sheet - is weak. NAV of £365.8m, less intangibles of £395.7m, gives NTAV negative, at £(29.9m)

Is the company at risk of going bust? Probably not, but with current year trading looking to be not much above breakeven, then the bank might be questioning if they want such a large potential exposure? Hence I'd say there's a more than 50% chance of Halfords doing an equity fundraise to strengthen its balance sheet. That would be a very good idea actually, as its shares have done a lot better than most retailers. So fixing the roof when the sun is shining is always a good idea. My invoice is in the post!

Note the big lease liabilities on the balance sheet. Unfortunately, IFRS 16 doesn't give us the information we actually need - i.e. which leases relate to profitable shops (where the lease liability is irrelevant), and which lease liabilities relate to loss-making shops (these are the problem leases).

Liquidity - sounds fine;

Our positive trading performance in Q1 and the additional measures we have taken give us confidence in our ability to trade through the pandemic and end the year in a sound financial position.

It has over £200m of liquidity available from bank facilities, plus £25m contingency funding under CLBILS. That's fine, as long the bank remains happy to extend such large borrowing facilities.

My opinion - Halfords is doing OK, in difficult economic circumstances.

I can't see any reason to rush out and buy the shares. It looks priced about right, and I wouldn't be inclined to chase the price up any higher.

.

.

Photo-me International (LON:PHTM)

54.8p (up 1%) - mkt cap £207.2m

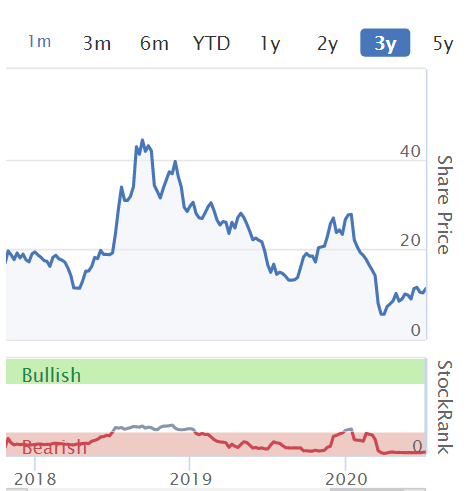

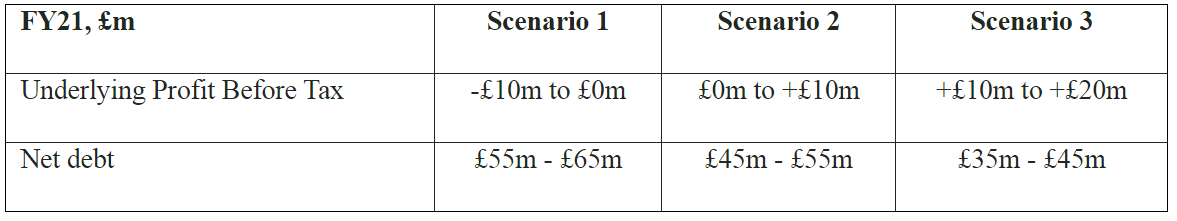

I hadn't realised this share had dropped so much, not having recovered much from the crash in March, which suggests things are not going terribly well at the company;

.

.

Results for FY 04/2020 - this is an unusual year end, so being April, it takes in more of the covid crisis than other companies which are mostly reporting end March year ends at the moment.

Underlying PBT is down 35.6% to £28.4m

The company blames covid/lockdown for the shortfall, and it's useful to have the impact quantified;

|

There's also quite a hit from exceptionals, of £23.7m. this takes reported PBT down to only £4.1m (down 90.4% on LY)

COVID-19 has severely impacted each business area and early indications are B2B, children's rides and, to a lesser extent Identification, will be the most challenging from which to recover... "The pandemic has and continues to have a significant impact on all the Group's end markets, resulting in lower consumer demand. The Board believes that activity levels could take some time to return to pre-COVID-19 levels.

I think that's blown it for me, I'm not interested in investigating this any further.

The other problem with this company, is that it doesn't split out profit by division. That makes it impossible for me to analyse the figures meaningfully.

Uncertainty over whether photo booths will still be needed in the future for passport/ID photos, etc, has been a question mark hanging over this company for many years.

My opinion - I don't know how to work out what this share is worth, as we don't have enough information. Also, who knows whether photo booths will still exist in say 10 years' time? It strikes me as a dated activity that may not be necessary in future. Maybe this share is a fag butt type of share?

Dividends can't be paid under the terms of the French Govt support scheme, if I'm reading that correctly?

Overall, I feel there are too many uncertainties about its business model, and not enough financial information to assess whether the growth areas of launderettes, and other kiosks, are worthwhile or not.

The severe impact of covid, and outlook comments which sound subdued, are making me feel that the depressed share price is probably justified.

.

Reach (LON:RCH)

77.6p (down 13% today) - mkt cap £232m

Trading update - this newspaper group (formerly Trinity Mirror) has suffered quite badly in the covid crisis. Revenue for Q2 is down 27.5%, slightly improving to -23.9% in June, still really bad.

Restructuring - there's another wave of cost-cutting & redundancies (12% of workforce), to reduce costs by £35m annualised, at a cost of £20m.

Digital revenues are also falling, which is very disappointing, as the upside case for this share is that it can transform itself into a digital advertising company, as the newspapers gradually die off.

Dividends - suspended currently, will keep under review.

Pension schemes - are huge, and funding them is a big drain on cashflow. Recent falls in interest rates makes the problem worse, due to increased liabilities, although asset values will have also probably increased.

My opinion - the fall in revenues is too large for me to want to get involved here. They say that covid has accelerated many existing long-term trends, and that seems to very much be the case here too. That said, as we've discussed many times before, RCH has proven an amazingly cash generative business over many years, despite shrinking circulations. That's partly through constant cost-cutting, but also from cheap bolt on acquisitions, being a consolidator of struggling print businesses.

Overall, I'd only be interested in having a punt on this, if the share price revisited the 25p levels where we got involved (very profitably) a few years ago. At 3 times that level now, I don't see any attraction to this. Although it's surprised the market before, and might do so again, you never know.

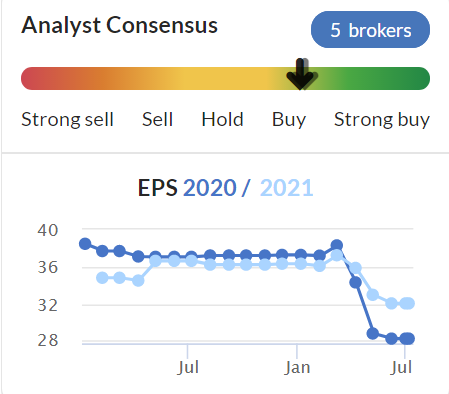

I'm wondering if the broker forecasts might be too ambitious, even though they've already been reduced somewhat:

.

.

Finncap (LON:FCAP)

22.5p (up 7%) - mkt cap £38m

Results for FY 03/2020 are out today, and are poor. Adj EPS was only 0.8p (LY: 2.86p). That's a pricey PER of 28, but to be fair market conditions were bad, so a poor result was expected. Brokers are cyclical businesses, and a lot depends on deal flow. Therefore I'm more interested in the outlook, because fees should be abundant at the moment, due to so many companies needing to raise fresh equity to strengthen balance sheets.

Outlook & current trading - looks good, with Q1 (April, May, June) revenues of £9.8m (LY Q1: £6.5m). Cost base "significantly reduced", and good cash generation. Cash position is strong.

.... In the shorter term, our pipeline of deals for the first half remains good and we will continue to deliver on our strategy for growth."

My opinion - I find FinnCap an absolutely excellent broker. For small caps in particular, they encourage company management to see active investors, not just institutional investors. What FinnCap get, and some other brokers fail to understand, is that in small caps it's the private investors who create the liquidity, and therefore set the market price. Therefore, brokers should be encouraging and developing contact between investors and companies. FinnCap are great at doing this, whereas others such as Numis and Peel Hunt are diabolical in that regard (but good in other respects).

Because FinnCap is so helpful to private investors (also making its research freely available through its own portal, and via Research Tree), and arranging numerous company meetings which I often attend, then I'm pleased to see it is trading well at the moment, with a good pipeline of deals. I see it has recently moved offices, although wonder how much longer brokers will need offices at all, given that working from home has worked seamlessly for many of them.

Are FinnCap shares attractive? I can't get madly excited about them, since the market cap is small, and earnings tend to be erratic from smaller brokers, hence you can't necessarily rely on the divis. Therefore I'm probably neutral on this share, but a big fan of the people & the approach they take towards being so helpful to private investors. There might be a possibility of FinnCap consolidating the sector, as most people seem to think there are too many smaller brokers, chasing the same business. I'd be delighted if a few of the stuffy & haughty old brokerages that look down on private investors were to disappear, and get swallowed up by FinnCap.

.

Pci- Pal (LON:PCIP)

41p (up 2% today) - mkt cap £24.2m

(I'm long)

I have a small long position here, because a friend who is a sector expert reckons it's good. He usually gets it right, which is good enough for me. I'm not going to try to blag it, but instead admit that I don't fully understand what the company does. It's something to do with software that allows customers to make payments by card over the phone, whilst keeping their card details private.

PCI-PAL PLC (AIM: PCIP), the global provider of secure payment solutions, is pleased to announce a trading update for the year ended 30 June 2020.

Trading update today - sounds good;

The Group continues to build strong momentum and has made further significant progress across its key growth metrics.

The Board confirms that trading for the year ended 30 June 2020 was in line with current market expectations.

Therefore it looks like a business which is not particularly vulnerable to covid issues, obviously a positive. Although it does mention a dip in call volumes, which are now recovering.

Apart from this short term decline we experienced little impact on our expected recognised revenues for FY20.

Although it does warn about an adverse impact in FY 06/2021;

In terms of new business sales, we have seen some delays in decision-making and contract signing as a result of prospective customers prioritising their own handling of the pandemic. The majority of these instances have not resulted in lost sales, rather a delay to anticipated close dates. This has naturally had an impact on our Q4 new sales which would have been even stronger than reported above but for the pandemic.

These delays will though have a knock-on impact in reducing recognised revenue in FY21 due to the nature of our revenue model.

Revenue of £4.4m for FY 06/2020 looks ahead of forecast. that's good, but I'm a bit concerned at the scale of losses - FinnCap has (on cue!) published an update today, forecasting adj PBT of £(4.2m) for FY 06/2020. Clearly the company needs to grow its revenues fast, to get anywhere near breakeven, let alone profits.

Details are given about contract wins, so there seems to be more growth in the pipeline. This share is all about growth happening, and losses reducing.

Cash - it raised £5.0m in March 2020, so should be OK for liquidity into 2021, I imagine.

Outlook - this sounds like a mild profit warning below, but revenue growth of 50-60% is still pretty stunning!

As we start FY21 with a strong level of TACV, and as referenced above, some of the ongoing delays in decision-making and contract signing have inevitably created some degree of uncertainty as to the timing of both new deals being signed and implementation timing of new and recent contract wins. Whilst we remain confident of delivering significant year on year growth in FY21, given the current environment, it is prudent to adjust our market guidance downwards for the year to account for these factors. As highlighted above, we are confident in the long term strength of our market opportunity and now expect to grow revenue by between 50 to 60% in FY21.

My opinion - a bit of a mixed update. Strong growth, but it's still heavily loss-making.

I need to learn more about this company. Diary date - 3pm this Thursday (9 July) - the company will be doing a presentation plus Q&A on the excellent InvestorMeetCompany platform. It's open to all, register here.

.

Altitude (LON:ALT)

22.6p (down 21% today) - mkt cap £15.5m

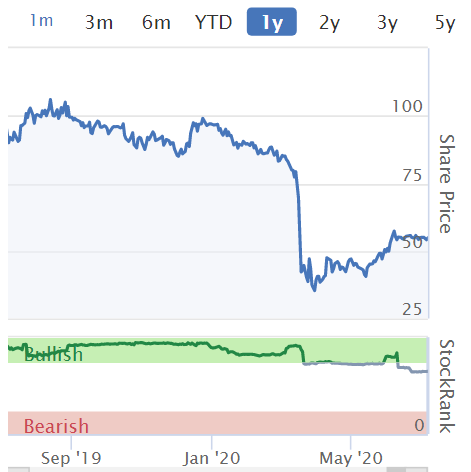

Investors got very excited about this company for several years, believing that its online platform for promotional goods would be the next big thing. It started to go wrong in Aug/Sept 2019, and has now come most of the way back down again. Here's the 5-year chart;

.

The number of shares in issue has gone up from 43m in 2015, to nearly 69m now.

Reading through today's update, it sounds as if cash is getting tight, hence I would work on the basis that it might need another placing, resulting in further dilution.

As you would expect, its market has been clobbered by the covid/lockdown situation, the company can't be blamed for that.

Liquidity - this is self-explanatory;

However, subject to continued steady recovery in transactional volume through 2020 in the promotional products market, we believe the Company has sufficient financial resources and liquidity to see the business through to more normalized market conditions.

OK, maybe it won't need a placing after all? But it sounds finely balanced to me.

My opinion - neutral. I'd want to see some figures, but the 31 March 2020 results won't be released until end Sept 2020. Plus of course, that won't reflect much of the covid period, which mainly hit in April onwards.

Overall - too uncertain, so I'm not interested. I wasn't 100% convinced about its business model to begin with, but have punted on the share in the past.

.

Right, that's it for today, thanks for reading & commenting (well I haven't read the comments yet, so I'll reserve judgement on that!). See you tomorrow :-)

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.