Good morning from Paul and Graham!

Agenda:

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section

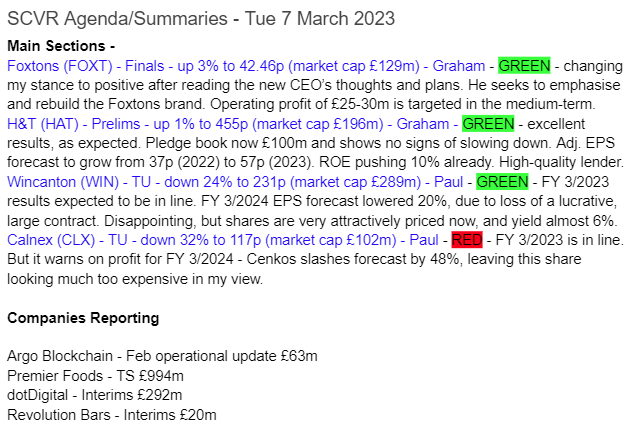

Wincanton (LON:WIN)

- 231p (down 24%)

- Market cap £289m

Trading Update (profit warning)

Wincanton plc, a leading supply chain partner for UK business, today provides an update on its trading performance and outlook.

FY 3/2023 will be OK, with results to be in line with expectations (PBT up >5%, despite headwinds)

Net cash expected to be £0-10m at 3/2023 year end.

Problems have emerged for FY 3/2024, specifically the loss (on retendering) of a large and high margin HMRC contract, which will now end June 2023.

“More challenging external environment” is also mentioned.

Revised guidance - FY 3/2024 profit will be “materially lower than current market consensus” of £63m PBT. I usually take “materially” to mean at least 10%.

Many thanks to Liberum for crunching the numbers for us, and making them available on Research Tree, this is incredibly helpful -

FY 3/2023 is 41.5p

FY 3/2024 is now dropped 20% to 30.4p, so the PER is now only 7.6x on the reduced forecast, which strikes me as good value, for a fundamentally sound business.

My opinion - this is a disappointment, but not a disaster.

It just goes to show how external investors don’t really know what’s going on at any company. We like to think we do, but (as I mentioned, coincidentally in my last podcast), there can be lucrative contracts that underpin profits, which we’re not aware of (as companies don’t disclose commercially sensitive information like that). Disclosure on client concentration tend to only focus on revenues, which is obviously nowhere near as important as profitability.

So I suppose losing a contract like this is just an inherent risk within any logistics company.

The downside is that this has clobbered the positive story of WIN being resilient, and passing on cost increases to clients. The nice trend of rising EPS has now broken, with the FY 3/2024 revised 30.4p EPS taking us back to 2017-18 levels. Hence it can’t really be seen as a growth stock any more.

That said, on the upside, the valuation was already cheap, and is now 24% cheaper.

This should also increase the dividend yield to almost 6%, providing divis aren’t cut, which they shouldn’t be, as dividend cover is still good, even on the lowered forecasts.

Overall, I’ll stick my neck out here, and say that I think it’s sufficiently good value that I’ll remain green in my opinion. Indeed, I’ve been looking for an opportunity to buy this share, and so might use today’s plunge as a chance to open a starter size position. Trouble is buying on profit warnings can be a mistake, so maybe we should have a cooling-off period before hitting the buy button? I think in time, this share should recover, and in the meantime it should pay generous divis, so although this is a disappointment, I think the value is now strong.

Calnex Solutions (LON:CLX)

- 117p (down 32%)

- Market cap £102m

Trading Update (profit warning)

This morning’s 32% share price plunge has wiped £48m off yesterday’s market cap of £150m - ouch, my commiserations to any holders here.

Calnex Solutions plc (AIM: CLX), a leading provider of test and measurement solutions for the global telecommunications sector, provides an update on the Company's trading performance for the financial year ending 31 March 2023 ("FY23") and the outlook for the following year to 31 March 2024 ("FY24").

FY 3/2023 is in line with expectations, with “solid” trading noted in H2.

Revenue & profits are up “double digits”.

FY 3/2024 is now expected to see lower profits. It blames this on macroeconomic uncertainty, leading to its telecoms customers being more cautious, with orders described as “subdued”.

An H2 weighting is mentioned, which can sometimes be a precursor to another profit warning, if the expected recovery doesn’t happen.

Cenkos updates us (many thanks) with FY 3/2024 forecasts really slashed, down from 7.0p EPS previous forecast, to just 3.6p. At 117p, the share price looks expensive, so the current share price assumes that profits are going to recover considerably in future years.

My opinion - this is such a big reduction in forecasts, that I’m not interested in buying this share. It’s not an attractive proposition, where you’re having to assume a big rebound in future earnings, in order to justify the current price (let alone any upside). So it’s a thumbs down from me unfortunately. Risk:reward just doesn’t seem attractive to me at the current price.

Graham's Section

Foxtons (LON:FOXT)

- Share price: 41p (pre-market)

- Market cap: £125m

We discussed Foxtons only yesterday, but they are back this morning with full-year results for FY December 2022.

The headline numbers are very encouraging and include contributions from various acquisitions.

Revenue +11% to £140m

Adj. operating profit +56% to £14m

PBT +115% to £12m

Earnings per share 3p, total dividend 0.9p.

Lettings revenue grew 17% as the company emphasised this side of the business. Interestingly, lettings volumes were actually down 7%. But in a sign of inflationary pressures, the average revenue per lettings transaction increased by a quarter.

In sales, it’s the opposite: sales volumes nudged up slightly, but average revenue per sales transaction softened..

Looking ahead, they have a “medium-term growth ambition to deliver £25m to £30m operating profit”, to be achieved through growth in all three divisions (lettings, sales and financial services).

Outlook - Trading in January and February is in line with expectations, but 2023 is expected to be “more challenging than 2022”, due to the obvious factors of interest rates and inflation.

Lettings - currently experiencing low volumes, high rental prices. In the medium-term, Foxtons is looking for organic growth of 3%-5% here, plus 20% return on capital from acquisitions.

Sales - new buyer activity reduced after the mini-Budget and the sales pipeline is still feeling the effects. Over time, Foxtons is looking to grow market share from 3.4% to 4.5%.

Financial Services - refinancing activity is resilient, but new mortgages depend on the wider sales market. 7%-10% revenue growth is the medium-term goal here.

Comment from new CEO (excerpt):

"My operational review is complete, whilst Foxtons has strong foundations, core operational failings have throttled historical performance and prevented significant unfilled potential from being realised.

"Operational improvements are being made at pace to rebuild our competitive advantages, including embedding a more confident articulation of our brand, investing in revenue generating headcount and improving our data platform to fully harness the power of our industry leading database.

My view

I’m impressed by what the new CEO has written today. He has been in post for about six months and has come up with what sounds to me like a clear plan for improvement, along with specific, measurable goals for each division of the business.

He doesn’t want Foxtons to be just another estate agent: he wants their brand to be visible and powerful, and has brought back the Foxtons Mini:

He also wants to “turbocharge a high-performance sales culture”. Sounds like exactly what they need!

This company has been a horrible performer over the years, and there’s no getting away from the labour-intensive and dog-eat-dog nature of the estate agency business. There’s also the highly cyclical nature of property sales transactions to consider (although it is now mitigated by the focus on lettings).

So I’m reluctant to give this company the thumbs up. I don’t consider it to be truly high-quality, for the reasons mentioned above. But the new CEO has done enough to persuade me to cautiously take a more positive stance on it.

H & T (LON:HAT)

- Share price: 455p (+1%)

- Market cap: £200m

The UK’s largest pawnbroker has also published results for FY December 2022.

I covered the corresponding trading update in January.

The results are excellent:

PBT £19m (last year: £10m excluding a non-recurring expense)

Pawnbroking pledge book surges 50% to over £100m

Jewellery sales up 25% to £45m but at a lower gross margin

Forex earnings almost doubled to £5.7m, exceeding pre-Covid levels

What is not to like here?

The company raised £16m of fresh equity in September, to help satisfy the enormous demand for pawnbroking loans. I am generally very happy to see H&T borrowing (rather than raising equity) to fund expansion, but the enormous surge in demand over the past year has been on another level.

CEO comment:

Trading performance continued to build steadily throughout the year, materially ahead of initial expectations. This trend has continued into the new year. January 2023 was a record month, both for lending demand and for online retail sales, the value of which reached £1m in a single month for the first time. As at the end of February 2023 the pledge book had seen further growth and stood at c. £104m. We also continue to see strong demand for our FX services. We continue to believe that FX represents a growth opportunity for the Group.

FCA issue - there was a problem with H&T’s unsecured credit product, which it no longer offers. The company agreed with the FCA a programme of redress for some customers, and 80% of eligible customers have now been given their redress payments. I don’t think this issue needs to be of any concern to investors now.

Pawnbroking - since this pledge book is so large, it’s worth spending a few moments to discuss what’s in it!

Most loans are around £200 and have a contractual term of six months.

85% of loans are redeemed, i.e. the customer pays in full and takes back ownership of the pledged item. On average, customers do this after 97 days (thus saving on interest).

H&T lends 65% of the value of the item. Watches have become more common and are now 15% of the loan book - these tend to be larger loans for longer terms.

The pawnbroking risk-adjusted margin (annualised revenue as a percentage of the pledge book) reduced from 69.5% (2021) to 60.9% (2022).

The company explains this as follows:

We have seen a normalisation of demand across the spectrum of loan sizes, with a growing number of requests for larger value loans. As expected, this has resulted in a moderation of the risk adjusted yield to historic levels, which at c. 61% is in line with the risk adjusted margin reported at the half year.

It makes sense that small loans would need to have the highest profit margins, and larger loans would have lower profit margins.

Store numbers have increased to 269 (last year: 257) and more openings are planned this year. I hope they will do as they promise and open new stores in a “measured and carefully considered manner”, so that they can avoid the perils of over-expansion.

Balance sheet: the company has net assets of £164m, or £137m if you strip out intangibles. It has a small net debt position of £3m.

Broker forecast: EPS is forecast to grow from 37p (2022) to 57p (2023).

My view

It looks like H&T generated a return on equity of 10% for the year (based on a quick calculation), a big improvement on the number currently showing in the StockReport:

I’ve been hoping to see ROE improve here, and it has already - with a continuing positive trend hopefully taking it to even higher levels.

That’s the major challenge for H&T, in my view: they have an asset-rich balance sheet with a vast quantity of gold and other precious metals, jewellery and watches. They have a huge pile of customer receivables. But can they manage these assets efficiently enough to generate an acceptable ROE?

They’ve had double-digit ROCE and ROE before - these numbers are from 2016 to 2021, scrolling left to right:

For me, there’s enough quality at H&T to justify paying a premium to book value. Price to book value is currently 1.45x, after writing down intangibles to zero.

What makes it stand out for me is that it is, by some distance, the largest pawnbroker in the UK. The loan book at Ramsdens Holdings (LON:RFX) is less than 10% of the size. H&T essentially has a lock on this type of lending in the UK and I believe there is value in having that position.

Other types of short-term, non-bank consumer lending face an unfriendly regulatory environment, while competitors in the pawnbroking space lack the deep, specialist expertise of H&T (who now own the watch servicing company Swiss Time Services).

So I’m going to retain my positive view on this one, even after the share price gains seen in recent years:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.