Good morning!

Lots of announcements to look at today - since most of them are just trading updates, I will keep my comments briefer than usual.

- Purplebricks (LON:PURP)

- Kape Technologies (LON:KAPE)

- Begbies Traynor (LON:BEG)

- Treatt (LON:TET)

- Surface Transforms (LON:SCE)

- Distil (LON:DIS)

- Koovs (LON:KOOV)

Financial Archaeology

In among today's trading updates, I noticed that the Financial Reporting Council has delayed its complaint procedure in relation to a financial executive at Autonomy (AU), the British software business acquired by HP. He is currently facing trials in the US.

What's remarkable about this is that the alleged misdeeds took place up to and including 2011.

How can it take eight years for the authorities to investigate these matters? A rhetorical question.

Short-seller Jim Chanos described Autonomy as "one of his absolute favourite shorts" back in 2012, and admitted that he was crushed by HP's acquisition of it for £7.4 billion, causing its share price to surge by 78%. He went on to make some money shorting HP.

(Autonomy was a "roll-up" of software businesses which made heavy use of merger accounting - something to keep in mind.)

Even though Chanos lost money on the trade, he deserves credit for spotting the story in real time, along with some other short-sellers. He described the funny business as "hard to miss, if you just looked at the accounts".

Indeed, a few brave sell-side analysts were public about their concerns, too. Paul Morland at Peel Hunt published a note with the headline "Accounting Red Flags" in June 2009. Ten years ago next month!

By contrast, the regulators are still bumbling along nearly a decade later, trying to figure out what happened.

We might also consider the famous case of Quindell (now Watchstone (LON:WTG) ), where the man at the heart of the story has within the last year threatened to put a new company on a major stock exchange.

As far as I know, the Serious Fraud Office is still investigating events at Quindell from around 2011-2013. At least the FRC came to a decision on this one last year.

Their extraordinary slowness is why regulators are sometimes referred to as financial archaeologists - they study things in the distant past, not the present day.

Another metaphor I quite like is that they are pathologists. Instead of being the policeman who races to the scene of a crime and shoots the bad guy, they prefer to turn up later, count the dead bodies and figure out the cause of death. They don't want to be blamed for the collapse of a company, so they will nearly always let it collapse on its own first.

Last week, Tesla (in which I have a short position) raised $3 billion from investors in the following circumstances:

- Its CEO had committed a massive securities fraud in the prior year and then, in my opinion, Tesla had ignored the settlement agreement with the SEC which had been designed to prevent future fraud.

- The prospectus filings for the capital raise presented a very different picture of the company in comparison to the rationale presented to investors during the private conference call. In the call, Elon Musk said that Tesla's existing businesses were just "a backstop of value". But the prospectus filings did not even mention the words "autonomy" or "self-driving", which were the basis of his claims in the conference call of future value creation.

- Involvement in c. 600 legal actions (total count, including historical cases), according to PlainSite.org.

My concern is that this could turn out to be another Autonomy, or even another Quindell (which also got bought out). While I don't think that Tesla will get bought out, my main concerns for holding a short position in it are that:

1. To the extent that the company or its officers are guilty of any criminality, the authorities may turn a blind eye, ignore it for as long as possible, and/or treat it with kid gloves. Crime may go unpunished.

2. For as long as prosecutions are delayed or non-existent, the company will be free to raise money indefintely. The SEC will not stand between Tesla and the capital markets.

The simple lesson we can take away is that shorting is very difficult! But sometimes, it's hard to resist.

Purplebricks (LON:PURP)

- Share price: 129.3p (-4%)

- No. of shares: 303 million

- Market cap: £392 million

Trading Update and Directorate Changes

I've been a long-term bear on this one and I'm afraid that I don't see any particular reason to think that it should bottom out soon.

Revenues for FY April 2019 are within guidance and cash finished the yeat at > £62 million.

- UK - "out-performing the market", though growth is likely to be unexciting.

- Canada - "in line with expectations".

- Australia - Purplebricks is exiting the Australian market. Orderly run down.

- US - this bit is v. important:

"The Board has materially cut investment in marketing and other overheads to reduce expenditure to sustainable levels and begun a strategic review".

The wording of this paragraph makes it sound to me like this could be the precursor to abandoning the US. We will have to wait and see. It has always seemed a bit crazy to expand to the US, a very different market, while still learning how to make money in the UK.

The Chairman acknowledges this, apologising to shareholders:

"With hindsight, our rate of geographic expansion was too rapid and as a result the quality of execution has suffered. We have also made sub-optimal decisions in allocating capital. We will learn from these errors and will not make them again."

Founder/CEO steps down. Another huge change. Note that he is also an 11% shareholder. He is replaced by the COO.

My view - this would have made for an excellent short, and might still make for a good one. What kept me away from it was the cash-rich balance sheet and the apparent willingness of certain institutions to put money into it at silly valuations.

If it shutters the US and Australian operations swiftly, it might be able to avoid running its cash balance down too low. The company's broker is now predicting an adjusted PBT loss of only £12 million in FY 2020. It had previously forecast an adjusted PBT loss of £37 million.

If it avoids running out of cash, then there is no guaranteed catalyst for share price collapse, and the share price could continue to levitate around the current levels.

But is it worth the current valuation? I can't see how: declining UK growth, mixed reviews from customers, no moat against competition and three of its most important executives have already quit this year. And yet it trades at more than 2x forward revenue.

It's classified as a Sucker Stock:

Kape Technologies (LON:KAPE)

- Share price: 89.5p (-0.6%)

- No. of shares: 144 million

- Market cap: £129 million

Trading is in line with expectations.

Within this, customer subscriber growth has exceeded expectations. Kape provides apps and software designed to protect online shoppers and improve computer performance.

This could be worth researching in greater detail. Total subscribers grew by 14% in the first quarter alone to 945,000, beating management expectations. I guess it takes time for this to convert into meaningful revenues.

Growth in Kape's VPN (virtual private network) products is particularly strong - I know from having lived abroad just how useful these sorts of products can be, and I would think that the overall market for VPN products should have a great long-term outlook.

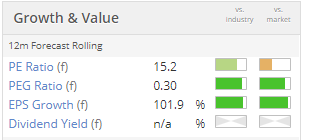

Perhaps this forward P/E multiple is too cheap for a growing company with a good outlook?

Begbies Traynor (LON:BEG)

- Share price: 68.5p (+14%)

- No. of shares: 114 million

- Market cap: £78 million

This multi-skilled insolvency practitioner puts out a positive update: revenue and profits for FY April 2019 will be comfortably ahead of market expectations.

Cash collection was also ahead of expectations, leaving net debt at year-end of £6 million.

Outlook is good too, with a "strong order book and favourable market conditions".

So times are good at Begbies, even if it's not yet enjoying the type of windfall profits it saw in 2009-2011.

I suspect that it is priced about right at the current level, at a low double-digit earnings multiple.

Treatt (LON:TET)

- Share price: 400p (-2.4%)

- No. of shares: 59 million

- Market cap: £235 million

Treatt Plc (the 'Group'), the manufacturer and supplier of innovative ingredient solutions for the flavour, fragrance, beverage and consumer products industries, announces its half year results for the six months ended 31 March 2019.

The historical results don't seem very important, as major growth initiatives haven't kicked in yet: the US site will be fully operational next month, while the new UK site hasn't even begun construction yet.

The outlook sounds good, and full-year results are anticipated to be in line with expectations:

With order books comfortably up on a year ago, we expect the encouraging performance in H1 to continue into H2.

It is heavily exposed to the US (38% of revenues) and says the market there is being driven by premium beverages - another sign of the "premiumisation" of the drinks industry.

My view

The H1 results aren't actually very good, as a non-core business in Kenya has become loss-making. Treatt is now trying to sell this business. Hopefully it won't be a drag on results for much longer.

ROCE: unlike last year, Treatt hasn't published its return on capital employed. This is disappointing, as I consider it to be a very positive sign whenever companies publish this metric.

Based purely on its track record, growth plans and positive prospects, I think Treatt could generate an above-average ROCE (>15%) over the long-term, potentially making for a good buy-and-hold.

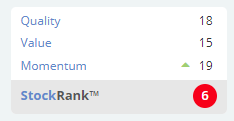

StockRanks agree that is deserves an above-average QualityRank. The algorithms are less enthusiastic about the Value.

Surface Transforms (LON:SCE)

- Share price: 10p (-23%)

- No. of shares: 136 million

- Market cap: £14 million

I am new to this company. This is the description on its website:

Surface Transforms are experts in the development and production of carbon-ceramic materials and the UK’s only manufacturer of carbon-ceramic brakes for automotive use.

It has been listed since 2002 and progress since then has been slow. It expects FY 2019 revenues of c. £1 million.

Three customers have had delays or other problems, and a compensation claim with another customer hasn't concluded yet. The FY 2020 forecast is being reviewed to take into account "the consistent experience of late SOP (start of production) and production delays".

It still expects these contracts to be fulfilled, but cash breakeven is pushed back to mid-2020.

This one is beyond my risk tolerance.

Distil (LON:DIS)

- Share price: 1.9p (-9.5%)

- No. of shares: 502 million

- Market cap: £10 million

(Please note that I have a long position in DIS.)

Superficially this has a lot in common with Surface Transforms: it has been listed since 2001 and is still very small. FY 2019 revenues are forecast at just £2.5 million.

It fits within my risk tolerance, however, because it makes consumer products (spirits) and I anticipate that it will generate profits for investors in the years ahead. It made an operating profit of £100k in H1. The balance sheet is healthy.

Paid-for research published today suggests that adjusted PBT should come in at £160k for FY March 2019, same as last year and in line with expectations.

I was looking for an improvement in the bottom line, given that revenues are set to have grown by some 25%.

On the other hand, you could argue that the precise out-turn is unimportant at this stage! After all, nobody is buying this stock at a £10 million market cap because of its P/E ratio. It's all about whether its labels gain traction and become prized brands in the rum, gin and vodka trade. If they do that, then its long-term profitability is pretty much assured (and it will have the option to sell its brands at a hefty valuation, if it wants to).

Main points from today's update:

- Q4 revenues and volumes down 33% and 32%, as Distil prioritised Q3 for promotional activity. Q3 revenues had been up 29% (it's a much more important quarter than Q4).

- Q4 marketing spend only up 10% year-on-year (Q3 marketing spend was up 51% year-on-year).

- New flavour of Redleg Spiced Rum to launch over the summer (caramelised pineapple!)

(Source: Morningadvertiser.co.uk)

My view

I would prefer if financial progress was faster, of course. On the other hand, the company has managed expectations very professionally and has hit its targets - well done to them for that.

This is one of the very few "early-stage" companies that I've invested in. It's important that I am patient with it and give it the time to grow. Hopefully, in a few years, it will have a pleasant outcome for shareholders.

The StockRanks are poor - most companies at this early stage don't succeed. Though it does have a QualityRank of 80.

Koovs (LON:KOOV)

- Share price: 8.15p (-6%)

- No. of shares: 356 million

- Market cap: £29 million

More dilution on the cards for shareholders at this Indian fashion website.

46 million shares will be issued at 8p, making Future Group a 26% shareholder.

Another 24 million shares may be forthcoming, if shareholders approve the issuance of preference shares. The blended issue price of the entire deal is 15p per share - but I would want to read the small print.

The partnership between Koovs and Future group involves concessions in stores, shared studio facilities and Future group products being sold on the Koovs platform.

In addition to the funding update, there is a trading update for FY March 2019. It makes no reference to performance versus expectations.

I don't like this company's track record and it is forecast by its own brokers to make an EBITDA loss all the way through FY 2022. Still uninvestable.

All done for today, thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.