Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

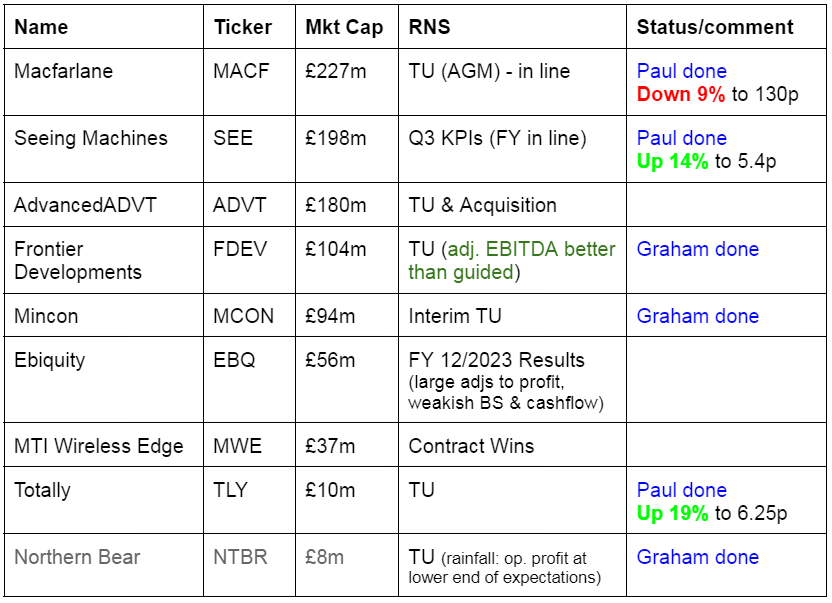

Companies Reporting

Other mid-morning movers (with news)

Totally (LON:TLY) - up 19% to 6.25p (£12m) - Trading Update - Paul - AMBER/RED

“... pleased to report improved performance…”. Expects FY 3/2024 to be £106m revenues (down 22%), and EBITDA of £2.3m (doubled from £1.1m last year). Only gives gross cash figure of £2.3m, says net debt unchanged from H1 (wasting our time having to look it up - it was £800k at 30/9/2023 - cash less a £2.5m bank loan - with headroom on covenants it says). The last balance sheet was weak, with NTAV negative at £(11.4)m, so I’d say placing/dilution risk here is high. Cashflow in 2022 & 2023 looks alarming, with a £15m cash pile having largely disappeared (due to £5m contingent consideration, £2m divis [now stopped] and adverse working capital movements). Cost-cutting done, to save £3.5m in annualised costs.

Paul’s opinion - chance of a turnaround maybe? The track record is so weak, as is the balance sheet, that’s it’s not something I’m interested in. It’s not clear if it’s even a viable business, and seems to be permanently either in restructuring, or seeing contracts go wrong, or cancelled. Could be a speculative punt for the brave though?

Nexxen International (LON:NEXN) - up 7% to 239p (£334m) - New $50m share buyback - Paul - AMBER/RED

Checking my notes, this $50m buyback was previously announced on 15/3/2024 (seeking authority for $50m buyback). Management tells us today that the shares are under-priced. Rightly or wrongly, I’m steering clear of this share, as I saw red flags (see SCVR 17/8/2023).

Northern Bear (LON:NTBR) - down 4% to 56p (£8m) - Trading Update - Graham - GREEN

It is a mild profit warning from NTBR. However, given the extent of rainfall experienced in recent months, the company still considers it a very good result - implying an obvious mismatch between forecasts and reality! In any case, the share continues to trade at a level that should get value investors interested.

Seeing Machines (LON:SEE) - up 13% to 5.35p (£224m) - Q3 KPIs - Paul - AMBER/GREEN

This driver-monitoring systems company has a June year end, so we get a Q3 update today, Jan-Mar 2024. The growth rate has sharply accelerated, of vehicles produced with SEE technology installed in them. Lots of detail is provided, the key part being this -

“As we see our high-margin royalty revenues increase, we reiterate we are on track to meet FY2024 expectations and achieve a cash break-even run rate during FY2025.”

Paul’s view - I’ve previously been critical of the poor financial track record, multi-year losses, and heavy dilution from multiple fundraises. However, I turned positive on SEE shares after management explained to me that European legislation is now driving adoption of its driver-monitoring systems. SEE gets a modest royalty per unit fitted to each new vehicle. IF the bull case plays out, then this could rapidly grow into a lucrative, high margin income stream for SEE. I think it looks interesting.

Summaries of main sections

Frontier Developments (LON:FDEV) - up 6% to 280p (£110m) - Trading Update - Graham - AMBER

This trading update is ahead of expectations, and I am happy to maintain my amber stance. FDEV’s back catalogue, including the launch on consoles of a previously PC-only game, along with cost cuts, have reduced the scale of their losses. But they do remain loss-making and in desperate need of a big hit.

Macfarlane (LON:MACF) - down 8% to 131p (£208m) - AGM Trading Update - Paul - GREEN

Weak Q1 performance is announced, but expecting a recovery in H2, so FY 12/2024 expectations unchanged. My enthusiasm for this value/GARP share isn't significantly dented though, it remains appealing value in my eyes.

Mincon (LON:MCON) - up 2% to 44.85p (EUR €98m) - Interim Trading Update - Graham - AMBER/GREEN

Small signs of green shoots here as Mincon gives investors positive commentary on both mining and construction; subdued demand from the mining industry has been one of the biggest headwinds here. I’m cautiously and tentatively going AMBER/GREEN, hoping that good financial results will follow.

Paul’s Section:

Macfarlane (LON:MACF)

Down 8% to 131p (£208m) - AGM Trading Update - Paul - GREEN

Through its two divisions, Macfarlane Group services a broad range of business customers, supplying them with high quality protective packaging products…

The current financial year ends Dec 2024.

“Challenging” Q1 - sales down 9.5% vs 2023, due to weak demand and price deflation, partly offset by strong gross margins, and benefit from acquisitions.

FY expectations unchanged though, as it expects an improved H2.

Cash position looks fine at 31/3/2024, with net cash of £4.7m (up from £0.5m at 31/12/2023), although it would have been more useful to be told the average daily net cash/debt figure. A one-day snapshot of cash is of little use. Lots of headroom, with £35m bank facility until Dec 2025.

Valuation - Shore Capital has an undemanding forecast of 12.5p adj EPS for FY 12/2024 (down slightly on 12.8p actual for 2023). That puts MACF on a PER of only 10.5x, which looks good value to me. The forecast dividend yield is 2.9% after today’s drop in share price - not bad, considering MACF is also self-funding bolt on acquisitions too.

Paul’s opinion - today’s update strikes me as a moderate negative, so the 8% drop in share price seems about right. I’m not keen on H2 weightings, as that increases the risk that tough conditions might continue. Although the UK economy does now seem to be starting to resume growth, and it mentions customer de-stocking, which is only temporary.

Overall, I’m happy to stay at GREEN as it’s a decent business, at an attractive valuation in my view.

Graham’s Section:

Frontier Developments (LON:FDEV)

Up 6% to 280p (£110m) - Trading Update - Graham - AMBER

This troubled video games developer issues an update for FY May 2024.

I don’t think it’s controversial if I say “troubled”, given the 3-year chart:

The most recent trading update in April offered some reassurance that the company’s cash pile may have stabilised and that the company was trading well.

The company has refocused on its “creative management simulation” games, such as Jurassic World Evolution 2 and Planet Zoo, and these have performed “particularly well”.

Planet Zoo continues to sell well on consoles (previously PC only).

The company’s financials are therefore better than expected.

Revenues for FY24 are now expected to be at least £85m: according to a note from the broker Liberum, the consensus figure was £83m, while the StockReport suggests £84.2m.

Adj. EBITDA is unfortunately still negative, with a loss of “£5m or better”. However, it could have been much worse as Liberum had pencilled in a £13m loss.

FDEV is benefiting from a higher gross margin percentage as they sell more of their own intellectual property instead of publishing the work of other developers, and they have been cutting costs.

CEO comment:

"I am pleased to announce that our expectations for our financial performance in the current financial year have improved following the excellent reception to Planet Zoo's arrival on console and a good ongoing performance from our other CMS titles. We are making strong progress following the reset of our strategy during 2023 and I'd like to thank our people for their support during a difficult period in Frontier's thirty year history. We look to the future with renewed confidence."

Graham’s view

I’ve been harping on about various reasons for optimism here - see the coverage in April for a reminder.

But the overarching reason for doubt remains: how to predict the success of a studio that only releases a few flagship games (maybe only one) in a year? Big CMS games such as Planet Zoo take a long time to develop.

On FDEV’s website, the only major game I can see coming out soon is F1 Manager 2024. The previous iterations of F1 Manager have received pretty good reviews, but they have not done well enough to prevent some of FDEV’s worst ever financial results.

For now, performance is resting on the back catalogue and the prospect of a fresh big hit in the CMS genre, at this point in time, seems speculative to me.

The shares are still “cheap” but I can’t go any higher than AMBER for now.

Something that wasn’t mentioned in today’s trading update is the cash balance: forecasts suggest that it is currently falling from its last reported level (£23m). The closer it gets to zero, the more likely it is that I will be forced to change stance to AMBER/RED, unless there is evidence of major title launches coming soon.

Northern Bear (LON:NTBR)

Down 4% to 56p (£8m) - Trading Update - Graham - GREEN

We have an FY March 2024 update from Northern Bear, “the AIM quoted group headquartered in Northern England providing specialist building and support services to customers across the UK”.

We don’t cover this one as often as we could, due to the very low market cap, but it continues to trade at an apparent PE Ratio of about 4x.

However, today’s trading update is a very mild profit warning, due to rainfall.

…the Group has continued to trade well… There has been significantly higher rainfall than normal during H2 FY24, with rainfall in the North East at 153% of the long term average per Environment Agency statistics, and a total of nine named storms. This has inevitably caused some disruption to the Group's site activities, consistent with the wider construction sector.

Results are therefore “broadly in line”, with operating profit at the lower end of expectations, which is “a very positive result in the circumstances”.

Graham’s view

I’ll maintain my thumbs up stance on this share, due to the apparent cheapness.

For the SCVR record, I should mention that we’ve had some changes to the company structure at NTBR in recent times:

Canadian investor Jeff Baryshnik has been trying to exit for some time and there is still an apparent overhang (owns 10.97% as of the most recent filing).

The company repurchased £3m of shares in a tender offer in December.

The largest % shareholder is now a UK-based individual.

NTRB continues to come across as a nano-cap that’s worthy of further research by value investors.

Mincon (LON:MCON)

Up 2% to 44.85p (EUR €98m) - Interim Trading Update - Graham - AMBER/GREEN

This Irish engineering group has faltered in recent times with a major profit warning last October. Demand from the mining industry has been weak, filtering through to lower revenues and lower profits.

Today’s update covers 2024 year-to-date, with the following bullet points:

Q1 2024 revenues “broadly flat” vs. Q4 2023 as the market remains “subdued”.

Order books “have begun to recover”, suggesting optimism for Q2 and the rest of the year.

Positive commentary on the outlook for both mining and construction.

Some other points:

They have further reduced working capital by reducing inventory.

(GN note: they already reduced inventory by 9% from Dec 2022 to Dec 2023. Inventories were €69.7m as of Dec 2023, a very high figure against annual cost of goods sold €111m).

They are closing a carbide (drill bit material) manufacturing business in Sheffield, in order to transition to lower cost sources of carbide supply.

Greenhammer: the elusive project is having an extended test in Arizona, “with positive results”.

Subsea: another named project “has met a number of key milestones with some of the leading developers in offshore wind in attendance”.

Outlook: positive.

Graham’s view: I’m leaning towards a more positive stance on this share today.

For one thing, the share price is 15% lower than it was when I reviewed it last time (in March).

Today’s commentary suggests that mining industry demand has finally stabilised after all the Covid-related disruption, with customer inventories now “largely normalised”.

And the Greenhammer project must, surely, be on the way to mass commercialisation on the back of this extended positive test in Arizona?

Meanwhile, reduced inventories should be positive for cash flow, and result in continued improvement in the net debt position.

I’ll tentatively put this one at AMBER/GREEN, but will have no hesitation in switching back to neutral if good financial results don’t follow soon.

And for those who like an income, this company has paid the same flat dividend for many years, currently yielding 4%:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.