Good morning, it's Paul & Jack here with the SCVR for Tuesday.

Appalling market conditions continue, there's not really a lot we can add to all the commentary out there. Obviously the Ukraine situation is just terrible in human terms. In economic terms it's triggered a deepening fuel problem, and as has been widely reported there are other commodities which are also spiking in price due to possible curtailment in supply from Russia/Ukraine. Therefore the inflation problem is likely to get worse, and squeeze many companies' earnings (and household disposable incomes) probably. Hence there is logic to falling markets, although overlaid on that is clearly plenty of panic selling too.

Anyway, we'll keep plugging away here on trading updates/results, because even if you're not ready to buy yet, it pays to be prepared with a list of bargains when the turning point is reached. I wish we knew when that is likely to be, but your guess is probably better than ours.

Agenda -

Paul's section:

Headlam (LON:HEAD) - Management changes are announced, but of more interest is an "in line" current trading update. Looks a bargain to me.

Nwf (LON:NWF) - a positive trading update from this agricultural & fuel distributer. A key point is that it has been able to pass on cost inflation to customers. A very resilient share, in a sea of red, in recent months.

Tasty (LON:TAST) - a micro cap restaurant group. It's traded through covid, thanks to Govt support. It's not clear how the business is likely to perform in future, once Govt support measures have ended. Market cap = net cash (even after normalising for stretched creditors) which does look interesting in valuation terms.

Jack's section:

Made.com (LON:MADE) - revenue up 50% but freight costs hit gross margin and adjusted EBITDA, which has declined from -£5.1m to -£14.3m. The group has some bold FY25 targets but the near term risks have obviously increased. Consumer confidence is most likely poor right now, and the group no longer expects helpful market conditions in the year ahead. Shares have fallen a lot already, but that is understandable given the immediate outlook.

Robert Walters (LON:RWA) - record results and strong trading across all markets. This is an international recruitment specialist, with 81% of revenue coming from outside of the UK. Positive conditions might change at some point, but for now the outlook is more robust that the recent share price falls might otherwise suggest in my view.

H & T (LON:HAT) - recovering results, with further progress forecast for FY22. The prospect of a strong gold price and higher demand for H&T’s services due to the higher cost of living suggests scope for upgrades, so at the current valuation I think there’s potential for a rerating.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Headlam (LON:HEAD)

330p (Monday’s close) - mkt cap £282m

Headlam Group plc (LSE: HEAD), Europe's leading floorcoverings distributor…

Interim CEO, Chris Payne, has been appointed permanent CEO.

An interim CFO is expected to be appointed.

The Chairman is stepping down at the AGM in May 2022, being replaced by an existing NED, Keith Edelman.

Final results for FY 12/2021 are being published tomorrow, with profit “slightly ahead of expectations”, as previously announced in Jan 2022.

Current trading - this is the most interesting bit, saying -

…trading performance in 2022 has continued to be in line with plan.

My opinion - it’s a bit disconcerting that the 3 top Board positions have seen departures of late.

However, the statement that current trading is in line, is very reassuring, given that the share price has plummeted in recent days.

Anyone brave enough to buy HEAD shares now, is locking in an excellent, well covered dividend yield of about 5.5%. HEAD also has an excellent balance sheet, with freehold property making up over a third of the market cap.

A turnaround plan has seen lots of operational improvements made, and the business has been recovering well from the pandemic.

Looks an excellent bargain to me, on a forward PER of 8.9, if you’re brave enough to buy when the shares are cheap.

.

.

Nwf (LON:NWF)

209p (Monday’s close) - market cap £103m

NWF Group plc ('NWF' or 'the Group'), the specialist distributor of fuel, food and feed across the UK, today announces a trading update for the current year ending 31 May 2022.

Good news for shareholders here -

As set out in the interim results on 1 February 2022, the Group delivered a very strong performance in the first six months of the year and carried over positive momentum going into the second half.

Since then, overall trading performance has continued to be strong, with demand conditions in the Fuels business accelerating to the extent that we now anticipate full year results will be significantly ahead of the Board's previous expectations.

Cash generation remains strong with lower net debt anticipated at year end.

Cost inflation - this is exactly the kind of comment that investors should be looking for -

…In Feeds with price increases continuing to be implemented, cost inflation has been recovered

I seem to recall that the fuels business is a mark-up on cost anyway, so passing on price rises there is automatic.

Ukraine - the first such statement that I’ve seen, no doubt we’ll see many more of these in relevant sectors -

Impact of the conflict in Ukraine

Since the start of the conflict on 24 February the impact to date has been most significant in Fuels, with the price of Brent Crude over $120 per barrel and with very significant volatility leading to elevated levels of demand. To date, there have been no major supply issues and we continue to meet demand across the country.

Feeds commodity prices, including wheat and barley, have increased to unprecedented highs, but with most raw materials now purchased for the winter period this impact will be most keenly felt as we move into May and the summer trading period.

My opinion - this share has been remarkably resilient in dire small caps market conditions.

What I’m searching for at the moment, are companies which have pricing power, and are hence able to pass on inflationary pressures. That does seem to be the case with NWF.

Incidentally, I attended an investor lunch last week, and sat next to a farmer. I asked him about market conditions, and he said that fertiliser has doubled in price, and that would feed through to much higher prices for food later in 2022. Similar comments have appeared in the press recently too.

.

.

Tasty (LON:TAST)

4.75p (down 5%, at 09:18) - market cap £6.7m

Tasty (AIM: TAST), the owner and operator of restaurants in the casual dining sector, announces the following unaudited trading update for the 52 week period ended 26 December 2021.

Tiny market cap, but a reader asked me to take a look and I’ve covered it before.

It’s very difficult to draw conclusions from this update, because it was a year heavily disrupted by covid, and further distorted with Govt support measures (e.g. grants, business rates relief, temporary VAT reduction, etc).

I think we need more information to determine what the future holds.

On the upside, TAST has survived, albeit with a higher share count - now 141m shares in issue, up considerably from 62m in 2018. Note that the business was already in trouble pre-pandemic, with heavy losses. So it’s really not a very good restaurant format, in my view. I’d rather invest in something that has a firm track record of profitability (e.g. Hostmore (LON:MORE) [I hold] which now looks stunningly cheap).

On the downside, the whole sector could be vulnerable to consumers reining in discretionary spending, as we have a very obvious squeeze on household incomes beginning (average wages rising by about 4%, but inflation heading for maybe 8%, or even higher?)

TAST generated positive adj EBITDA (on the old basis, before IFRS 16 messed up the figures) of £3.9m. It says £1.9m was from Govt grants in a footnote, but it’s not clear if that is the only Govt support, or if additional support helped the numbers.

Net cash was £11.0m, including the benefit of stretched creditors, but adjusting for those it still had £6.8m net cash - the same as the market cap! The commentary talks about some new sites, and head office recruitment, so this doesn’t sound like a business on the back foot.

My opinion - it’s a pretty low quality business, but priced at par with net cash, the valuation does look interesting.

The key question, which I don’t know the answer to, is whether this is likely to be a profitable business once everything has normalised?

.

.

Jack's section

Made.com (LON:MADE)

Share price: 69.4p (-2.8%)

Shares in issue: 391,499,661

Market cap: £271.7m

Preliminary results for the year to 31 December 2021

Against a backdrop of indiscriminate selling pretty much across the board, it’s notable that Made shares were up 5% yesterday, ahead of these results.

This is a furniture retailer, but a digitally native one, with a more agile business model that allows it to stock smaller, quirkier ranges that it can change more quickly given its small-batch production model.

That sounds good on paper, but it’s not all been plain sailing. Supply chain issues led to a revenue warning a couple of months ago. Couple that with the present conditions, and the result is a c65% decline in share price since IPO. Yet another in a long list of what look like poorly priced floats, and just one example of the brutal small cap conditions, unfortunately.

Revenue is up 50% for the year to £371.9m but gross margin has fallen by some 694bps to 46.3%, resulting in adjusted EBITDA of -£14.3m (FY20: -£5.1m) and a loss before tax of £31.4m (FY20: -£14.6m). That means basic earnings per share has reduced by 5.3p, from -2.6p to -7.9p.

Net cash was £107m at the end of the period. Free cash flow was -£32.1m, compared to £22.2m in 2020 as inventory intake normalised towards the end of 2021.

Gross margin was impacted by global freight inflationary pressures. Excluding freight costs, gross margin excluding freight would have been up from 56.5% to 58.5%.

This and supply chain disruption impacting revenue recognition timing during the final quarter of 2021 are the two main drivers of the negative performance.

Outlook

Perhaps the most important part given the share price drop. Is it worth buying in, or is there more pain to come?

Following the softness of consumer demand so far in 2022, we are no longer anticipating any tailwind from the market in 2022. Growth will be driven by our dramatically improved customer proposition, through improved experience, broader product choice and through enhanced reach. On this basis, we expect gross sales £500-540m (~+15-25% year-on-year), with higher growth in H2 than H1 due to 2021 comparative phasing.

So growth is still targeted across a range of metrics, but a reduced rate of revenue growth and the language has softened. Made wants to increase SKUs fromc9,500 to c11,500 and is looking for a 25-35% increase in revenue to £465m-£500m with adjusted EBITDA of between £5m and £15m (assuming normalised supply chains but ongoing higher freight costs).

Its ambition to achieve £1.2bn in gross sales and low teens adjusted EBITDA margin by 2025 remains unchanged ‘as the large and underpenetrated furniture and homeware market shifts online’.

Conclusion

The CEO comments that ‘We have seen a meaningful shift of consumption moving online during the pandemic, especially in our home furnishings category.’ But I think there’s a question there. Other furniture retailers have said that consumers still want an in-store experience, so that they can see and feel the product before buying.

It’s in their interest to say that, but we’ve seen before that we can’t just assume lockdown dynamics will persist in normal periods.

It’s hard to argue with Made’s revenue growth so far though.

And the group has more than £100m in net cash post-IPO. Cash burn is significant but hopefully the £42.3m increase in inventories is a one-off, in which case the group has a few years runway to grow revenue and reach profitability.

I’m not sure the market is in the mood to entertain loss-making growth stocks at the moment though. With the macro picture finely balanced and rapidly changing, I can understand why you might be wary of big ticket retail. Consumer confidence was falling before Russia-Ukraine, and it certainly won’t have improved over the past couple of weeks.

The group’s FY25 target of £1.2bn in revenue and a mid teen adjusted EBITDA margin (implying roughly between £150m and £200m) would make the shares very attractive if we could be sure of meeting those expectations. So there is material potential upside which means it is worth keeping tabs on.

But it’s unlikely to be a smooth ride in this sector over the next few months to a year. Made is already a loss-maker, so any further deterioration in consumer confidence could easily derail the group’s medium term ambitions. The net cash provides some security, and a lot of downside is now priced in. My concern is that, given the conditions, this is now justified by the increased risk.

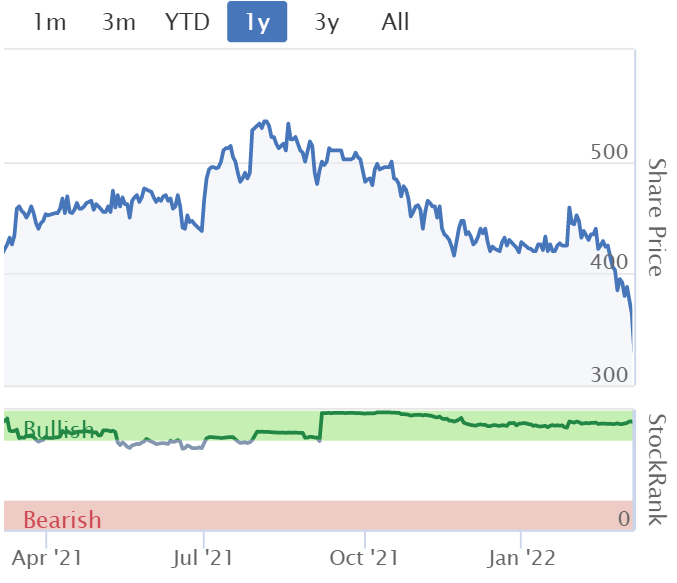

Robert Walters (LON:RWA)

Share price: 577.08p (+6.47%)

Shares in issue: 76,633,030

Market cap: £442.2m

Results reported on constant currency basis.

- Revenue +6% to £970.7m,

- Gross profit (net fee income) +21% to £353.6m,

- Operating profit +285% to £54.1m,

- Profit before tax +339% to £50.2m,

- Basic earnings per share +482% to 46.3p.

The proposed final dividend per share is up 36% to 15p, and RWA spent £12.3m on share buybacks in the year. After year-end, a further 363,723 shares were purchased at an average price of £7.50 for £2.7m.

Group headcount increased by 11% to 3,484 (2020: 3,147).

FY21 is a record performance for the company, with operating profit at an all-time high.

Fierce competition for talent and significant wage inflation across all geographic locations and specialist disciplines.

This is an international business, with 81% (2020: 78%) of group net fee income now derived from overseas.

Asia Pacific net fee income grew by 32% to £164.2m and operating profit increased by 336% to £36.5m. Europe net fee income increased by 11% to £95.3m and operating profit rose by 192% to £13.7m. UK net fee income was up 3% to £68.7m and operating profit up 146% to £3.3m. Finally, Other International (the Americas, South Africa and the Middle East) net fee income was down 1% (but up 5% at constant currency) to £25.4m and operating profit increased by 43% to £0.6m.

Balance sheet is healthy, with net cash of £126.6m as at 31 December 2021 (31 December 2020: £155.5m).

Robert Walters, Chief Executive, said:

The jobs market is strong, wage inflation is increasing everywhere and candidate and client confidence is high. Together with the Group's strong brand, global international footprint covering both well-established and emerging recruitment markets and blend of permanent, interim, contract and recruitment process outsourcing revenue streams it serves to create clear opportunities across the recruitment market.

We are however mindful of the macro-economic and political uncertainties that do exist. To date, early 2022 trading is in line with Board expectations.

Diary date - a trading update for the first quarter ending 31 March 2022 will be published on 7 April 2022.

Conclusion

Strong trading, diversified markets, net cash, increasing dividends, share buybacks, and the founder still in charge after nearly three decades. Quite a few positive signs here. While recruitment can be cyclical, labour markets remain tight and so tailwinds could remain in place for some time.

You could, of course, take a more skeptical view. The group itself prudently notes ‘macro-economic and political uncertainties’. So for how long wage inflation and tight labour markets persist is a key question. Liquidity could also be an issue for some, with the StockReport suggesting that market makers are only compelled to trade 750 shares at a time at quoted prices.

For now, the group is trading well with the new year in line with expectations following a series of upgrades. Robert Walters looks like one of the better operators in this space. It’s a stock I’m more likely to consider amid the widespread sell off given the share price is now back to pre-Covid levels.

And, for all that talk of market cycles, the company has done a good job of returning cash to shareholders over the years.

H & T (LON:HAT)

Share price: 284.32p (+2.46%)

Shares in issue: 39,864,077

Market cap: £113.3m

Preliminary results for the year to 31 December 2021

£10.0m adjusted profit before tax (2020: £15.6m) in line with expectations ‘with strong segmental contribution from core business of pawnbroking and retail, and a significant recovery from the impact of Covid-19 trading restrictions and reduced footfall’.

Adjusted basic earnings per share was 20.8p (2020: 32.1p), and basic earnings per share was 15.4p (2020: 32.1p). That’s slightly ahead of forecasts, with a continued recovery expected in FY22.

The pledge book increased 38.5% to £66.9m (2020: £48.3m), with demand now back to pre-pandemic levels. Q4 was particularly strong and the group reported record lending volumes in December, so it looks like an improving trend.

The group ended the year with cash balances of £17.6m (2020: £34.5m) after using £16.8m to restore the pledge book.

Retail sales were up 21.5% to £36.2m (2020: £29.8m) with positive momentum across both the store estate and online platforms since May, at improved gross margin of 45.9% (2020: 37.9%).

Net revenue from unsecured personal lending reduced to £4.3m (2020: £8.1m) as the group refocused on growth opportunities within the core businesses.

Balance sheet - net asset value of £136.6m (2020: £134.5m) and NAV per share of 348.9p (2020: 343.9p). You can see the group is trading at around tangible book value currently.

Proposed full year dividend per share of 12.0p (2020: 8.5p)

Regulatory review of the Group's unsecured high-cost short term (HCST) loans business progressed and a provision of £2.1m raised ahead of anticipated confirmation by the FCA that H&T can proceed to implementation of required past book review and subsequent redress programme.

Good to have some clarity there.

Conclusion

I think H & T (LON:HAT) offers reasonable value at these levels, although it has never really been afforded a high valuation. It strikes me as quite a defensive proposition: cash generative, dividend paying, net cash, restrained equity dilution, strong liquidity ratios, and a modest valuation.

It qualifies for two Guru screens - one Bargain and one Value - despite double digit margins and ROCE.

The resurgent gold price is also presumably a tailwind. And, unfortunately, higher inflation could drive more demand for the group’s services. If that happens at sustained higher gold prices, there could be a considerable uplift in profitability.

It looks like the unsecured high-cost short-term loans business review will not materially impact the group. All in all, I think there’s a decent chance of a rerating here in time.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.