Morning!

A few updates which have caught my eye:

- Wey Education (LON:WEY) - interim results. "...we remain on track to meet our expectations for adjusted profitability for the year although this is likely to be achieved on lower than previously planned revenues."

- Cambria Automobiles (LON:CAMB) - interim results. "The Board remains confident that Cambria will maintain its momentum in the second half and deliver a financial performance in line with market expectations for the year as a whole."

- IDE Group (LON:IDE) - final results for 2017. "Profitability in 2018 is expected to be significantly lower than 2017, but is expected to improve steadily throughout 2018 and beyond following implementation of the operational review."

- Bloomsbury Publishing (LON:BMY) - Bloomsbury and Spotify announce audio storytelling partnership.

Thanks for your requests, specifically Treatt (LON:TET) and Tern (LON:TERN). I will cover them if I have time.

Wey Education (LON:WEY)

- Share price: 20.5p (-25%)

- No. of shares: 126 million

- Market cap: £26 million

A strongly negative reaction to this interim report, despite the company reiterating that it would meet expectations for adjusted profitability for the full-year.

Wey is an educational provider which runs an online secondary school and provides teaching materials to schools. It made a UK acquisition last year ("Academy 21", or "A21") and is now planning to expand its international activities.

The bad news today can be summarised as: UK growth not as high as originally hoped, lots of costs anticipated from international activities, and an operating loss after all is said and done.

"Core" revenues (i.e. excluding the acquisition) are up 23% year-on-year. Not bad, but it is difficult to support a market cap of £30 million+ with trailing twelve month sales in the region of £3 million.

Investors are asked to be patient:

In accordance with the strategy adopted at the time of the Company's £5 million placing in November 2017, emphasis has been put on development of the Company's business for the medium term at some short-term cost.

There's nothing wrong with that, but I think that investors had already shown a lot of patience by awarding a valuation of 10x sales to the stock.

The company is hoping to teach English language courses in China through a joint venture with a small Chinese partner.

I've been trying to find out more about its Chinese partner. I think that this is its website, translated into English using Google.

I would see this as a highly speculative activity. Defending your intellectual property in China is hard enough. And learning/teaching English is a commodity activity for everyone involved. Maybe Wey's course will be special in some way, but I don't see how they could prevent it from being replicated by others.

The other problem is that due to China's approach to economics, Wey will not have full control over its joint venture. Success will be dependent on the goodwill of its Chinese partner.

Perhaps the attempt to move into Nigeria will meet with better luck - I don't know.

The other noteworthy feature of today's results is the adjustment to the results: adjusted profits of £145k versus a statutory loss of £150k.

A reader in the comments below suggests that the adjustments are too much, and I agree:

Adjusted profits were £145,000 (2017: £75,000) in line with our expectations for the first half. The figure represents profit before tax adjusted for share based payments (£18,000), amortisation of intangibles (£95,000), acquisition costs (£43,000) and the higher than trend expenditure on marketing and other matters flagged up at the time of the November placing to substantially boost group revenues and underlying profits over the next three years (£143,000).

"Marketing and other matters" is a bit too broad as a category. Any old expenses could be chucked in here, and investors would be none the wiser.

So for a variety of reasons, I remain very wary about investing in this one.

Last time I covered it, I said the valuation looked too punchy, relative to the company's size.

I now also have concerns around probable difficulties in China, and the heavy adjustments to the results. Good luck to everyone invested in it, but it's definitely not for me.

Cambria Automobiles (LON:CAMB)

- Share price: 60.5p (-1%)

- No. of shares: 100 million

- Market cap: £60.5 million

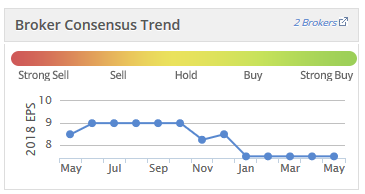

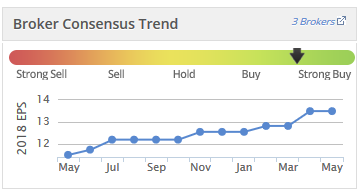

Motor dealers generally are trading at lowly valuations, and Cambria is no exception. One of the valid reasons for this is that earnings expectations have been reducing:

Today's highlights:

- Revenue reduced by 4.5% to £295.1m (H1 2017: £309.1m)

- Underlying profit before tax down 14.3% at £4.8m (H1 2017: £5.6m)

- Rolling twelve month return on equity of 17.4% (H1 2017: 21.8%)

The return on equity result sounds good in the circumstances. It uses "underlying profit after tax", rather than statutory net income, but the adjustment made is only worth £300k. So the statutory numbers are nearly as good as the adjusted numbers.

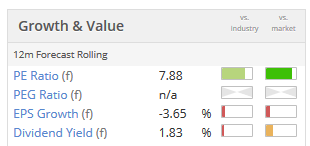

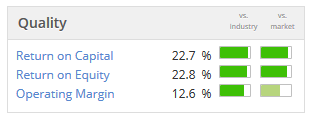

Stocko confirms that ROE is strong:

The operational highlights show plenty of movement in the portfolio. There are new or acquired Bentley, Lamborghini and McLaren dealerships.

New vehicle sales are down 14.1% like-for-like. Fortunately, margins improved both for new and used vehicles, and aftersales revenue was up 6.1% like-for-like, so the end result was ok.

CEO comment:

I am pleased that the Group has delivered a solid financial performance in the first half which gives us confidence that wewill maintain momentumin the second half and deliver a financial performance which is in line with current market expectations for the year as a whole. This is a notable achievement given the economic backdrop, consumer uncertainty, diesel demonisation and cost pressures.

I can also get behind the strategy:

Cambria's medium term ambition is to create a £1 billion turnover business with a balanced Brand portfolio producing attractive returns on capital.

It has been a super steward of shareholder capital:

Since the Group's inception in 2006, it has remained focused on driving growth for shareholders, taking the original £10.8m of share capital, with no further equity raised subsequently and reinvesting the earnings in property and franchises.

Balance sheet

Cambria finished the period with cash of £16 million offsetting gross debts of £16.5 million, so the net debt position was close to zero.

There are capital commitments of c. £20 million to fund property projects, and Cambria has a new £40 million credit facility to help pay for this.

Overall, the balance sheet is strong but the debt facility looks like it will play an important role in the upcoming projects.

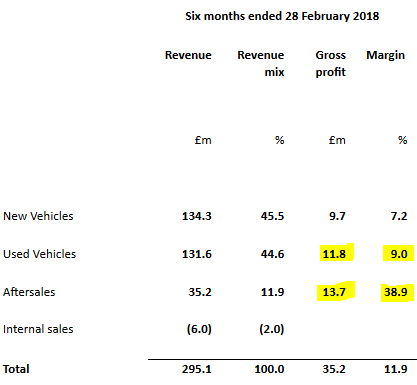

Importance of aftersales

I thought I'd paste this table here. It illustrates how aftersales produces more gross profit than each category of vehicle sales, thanks to vastly higher margins:

Hopefully, the aftersales category can remain resilient even if car sales (especially new car sales) remain difficult. There is a presumably a knock-on effect to aftersales when car sales are weak in the short-term, but I'm guessing that it's a delayed effect and perhaps small relative to the entire aftersales result.

The stock has a Value Rank of 91 from Stocko. If I didn't already own a couple of shares which are exposed to the auto market, I would be open to the idea of opening a position in this:

IDE Group (LON:IDE)

- Share price: 14.5p (-3%)

- No. of shares: 201 million

- Market cap: £29 million

This is a special situation with an operational review ongoing and likely Board changes coming up.

It has two divisions: Platform Services (cloud hosting, communications, etc.) and traditional Managed Services.

Bringing out 2017 results in May seems rather late - not a great sign.

I am mentioning it only for the reason that change is afoot and maybe it will be worth revisiting during or after the changes. The Chairman stepped down (for health reasons) in January, and the CEO moved on in March.

Cash generation has been disappointing and Q1 closed with net debt at £10.3 million.

The "going concern" statement references the support the company has received from equity investors, implying that this support may be called upon in future:

Based on the level of support demonstrated by the equity raised to acquire 365 ITMS and consolidating bank facilities during the year, the Directors have a reasonable expectation that the Group has adequate resources to continue in operational existence for the foreseeable future.

I don't see any reason to invest currently, but I like to keep track of special situations so will watch out for the result of the operational review.

Bloomsbury Publishing (LON:BMY)

- Share price: 179.25p (+1%)

- No. of shares: 75 million

- Market cap: £135 million

Bloomsbury & Spotify announce partnership

This is perhaps not a significant announcement in the grand scheme of things but an astute fellow investor mentioned this company to me some time ago, and I am trying to keep up to speed with its developments.

Bloomsbury is an independent publishing house with a diversified set of interests in adult publishing, children's, professional/academic, etc.

This announcement helps to showcase how publishers can do well in the digital age - in this instance, by publishing some short books on Spotify, the music streaming service.

Checking the relevant website, I believe many of these books were already available on audible.com and on iTunes. So like I said, today's announcement is not a game-changer.

But for what it's worthy, Bloomsbury passes four Stocko screens - the Screen of Screens (Quality Investing), Low Price to Cash Flow (Value Investing), Earnings Surprise Screen (Momentum Investing) and the Naked Trader-esque Screen (Growth Investing).

So it's worth investigating, I think:

Treatt (LON:TET)

- Share price: 482p (+4%)

- No. of shares: 57.6 million

- Market cap: £278 million

This popular share provides ingredients to the "flavour, fragrance, beverage and consumer products industries".

A nice H1 result:

Constant-currency sales growth is even better than what is shown above: 18%.

The adjustments to operating profit are only worth £200k - no big deal. I don't worry about adjustments which are small compared to the overall result.

Outlook is in line with expectations for the current year:

Whilst there is still much to do to complete the year, and movements in exchange rates or raw material prices can impact results, the Board is currently confident that the Group will meet its expectations for the financial year ending 30 September 2018."

Sales in the "tea" category were up 38.5% in H1 - superb. Sales trends in sugar reduction, citrus and beverage flavouring were all good, too.

Besides building new UK premises at Bury St Edmunds, Treatt is growing its capacity in the US. A £20.8 million share placing has helped to pay for this:

A key part of our strategy revolves around our investment plans to build a scalable business for future long-term growth. Work on our US capacity expansion continues apace with construction work well under way and we look forward to this being completed by the end of 2018 as planned. This expansion will bring on line significant additional capacity for our fast-growing tea and sugar reduction categories as well as expanding and modernising our scientific infrastructure.

ROCE has fallen:

Following the fund raise in the period, capital employed increased by 11% from £56.7m to £62.9m. As a consequence, return on capital employed1,2 for the period was lower than in 2017 at 10.8% (2017: 12.0%), but is expected to grow as the impact from the Group's capital investment programme takes effect.

I'm entirely comfortable with this. When a company raises fresh capital, it takes some time to deploy it and to earn a return.

For factory firms like this, their new equipment tends to depreciate in value rather rapidly, and there is usually some delay before the equipment is used at full capacity. So I would expect ROCE to be poor at first during an investment programme, and Treatt's ROCE to be under pressure for the next couple of years.

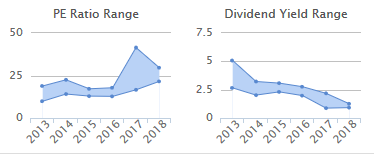

That said, ROCE in six months of 10.8% is still excellent. See the full-year metrics below:

Treatt has grown its earnings per share very strongly over the years - and share price appreciation has resulted in a higher valuation range and a lower yield:

Thank you to readers for mentioning Lord Lee's position in Treatt. He has enjoyed dozens of takeovers in his portfolio over the years and I can imagine that a US food group might find this attractive sooner or later. It will be more visible than ever in the US, from now on.

I could justify opening a small position in this, despite the heavy valuation.

Tern (LON:TERN)

- Share price: 25p (-6%)

- No. of shares: 212 million (before 9.5 million new shares)

- Market cap: £53 million (before new shares)

Tern has raised £1.75 million (gross) at 18.5p - a huge discount to yesterday's share price.

CEO comment:

This Placing provides us with capital to continue delivering on our strategy to add to our portfolio of IoT businesses, and establish Tern as a leading IoT investment company

This might come across as unnecessarily harsh, but I am currently doing my best to avoid buying anything with the following labels or using the following terminology (this list is not exhaustive):

- Internet of Things/IoT

- SaaS/Software-as-a-Service

- Cloud-based

- Technological ecosystem

- Blockchain

My reasoning is simple enough: I believe that there is a substantial cohort of investors who are throwing money at these "hot" ideas, and the contrarian in me knows that staying away from popular sectors is a good way to gain an immediate advantage as a long-term investor.

So it might be unfair on Tern and on others, but a wall of money has been thrown into developing these sorts of technologies and I'd rather find some less crowded trades.

If I close my eyes to the sector it's in for a moment and consider its merits as an investment company only, I am immediately drawn to the last-reported NAV per share of 7.4p (versus the latest share price of 25p).

I would consider paying a premium to NAV for an investment company when NAV is understated and/or when the management team has a brilliant and consistent track record. A 10% or 20% premium would not be extraordinary in those circumstances. But I am immediately very cautious when I see a share such as this trading at a >200% premium to NAV.

Ok, time's up for today. Paul will be back again tomorrow. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.