Good morning from Paul & Graham!

That's it for today!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

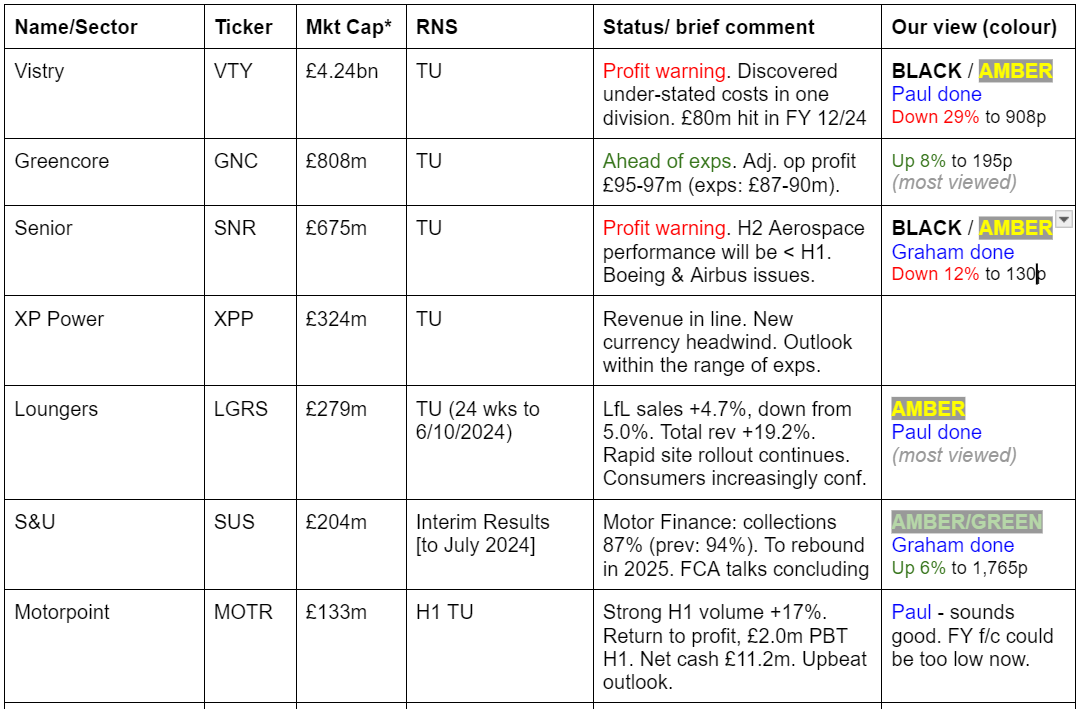

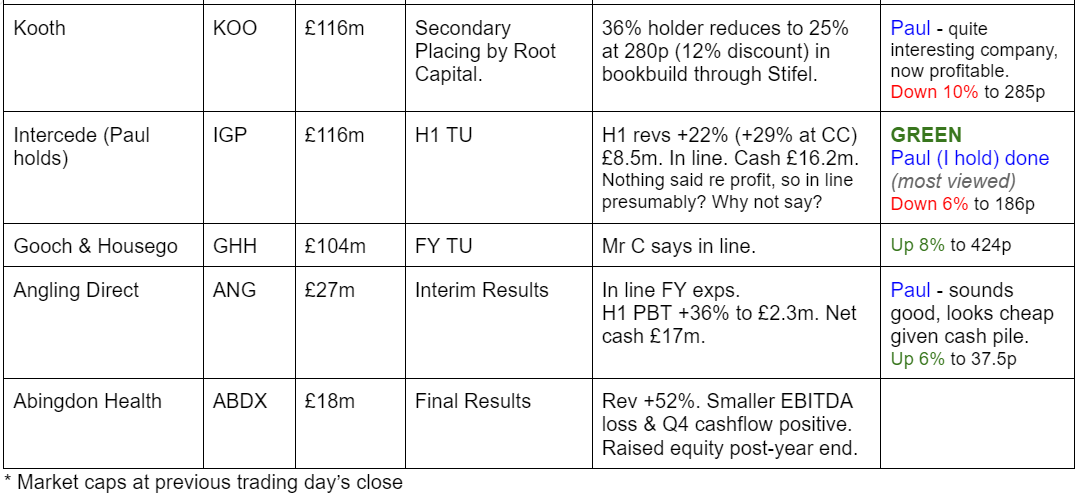

Companies Reporting

Summaries

Intercede (LON:IGP) (Paul holds) - down 9% to 180p at 08:23 (£106m) - Trading Update - Paul (I hold) - GREEN

A vague update today that only mentions H1 revenues (up 22%), not profits. Slightly disappointing, in that I had hoped for an ahead of exps update today, given the strong newsflow. Although Cavendish make it clear that beating exps in H2 looks likely. Plenty of cash. The growth story looks one of the best in the UK market, in my view - hence why I own this personally.

Senior (LON:SNR) - down 13% to 128.2p (£538m) - Trading Statement (profit warning) - Graham - BLACK / AMBER

I’ve been caught out here as I thought the valuation at c. 150p was interesting earlier this summer. However, problems at Boeing and Airbus have damaged the short-term outlook at Senior’s Aerospace division. The problems could be fixed by next year, but a neutral stance appears most sensible now.

Vistry (LON:VTY) - down 29% to 910p (£3.01bn) - Trading Update (profit warning) - Paul - BLACK (PW) / AMBER on fundamentals.

Bombshell announcement of an £80m black hole at its Southern division, due to 10% understatement of costs. Raises a lot of question marks now over the reliability of group-wide financial control. But a 29% share price fall could be creating a buying opportunity for this well-financed, and successful housebuilder. I need more information to firm up, so am sitting on the fence for now, whilst being tempted to have a little trade for a bounce on it, I must admit!

S&U (LON:SUS) - up 6% to £17.54 (£213m) - Interim Results - Graham - AMBER/GREEN

I’m bravely giving this an upgrade to AMBER/GREEN as it appears that talks with the FCA may at last be concluding. Perhaps it’s a risky call but these shares are trading below net asset value (£233m) when they previously traded at a substantial premium.

Loungers (LON:LGRS) - up 3% to 274p (£284m) - Trading Update - Paul - AMBER

An annoying trading update that doesn't tell us how it's traded relative to market expectations, but in other respects sounds positive. LfL revenues have fallen slightly, but are still well above inflation. Rapid site roll-out continues. I think it's a good business, but in a tough sector. Shares are too pricey to interest me, and I think JDW (I hold) is better value for money, both the shares and the products!

Paul’s Section:

Loungers (LON:LGRS)

Up 3% to 274p (£284m) - Trading Update - Paul - AMBER

Loungers, a leading operator of all-day café/bar/restaurants across the UK under the Lounge, Cosy Club and Brightside brands, today announces a trading update for the 24 weeks ended 6 October 2024.

Continued market-leading like for like sales growth, and 17 new sites opened during the period

This is another “trading update” that ignores the key requirement that investors have - to be told whether or not it’s trading in line with expectations!

We’re left to deduce what’s going on.

I note that the analyst consensus graph on Stockopedia shows forecasts for both FY 4/2025 and 4/2026 has been trimmed by 4-5% since June, so maybe that’s why they don’t want to directly confirm market expectations - instead quietly reducing expectations in the background, and then no doubt meet/beat the lowered forecasts in early 2025?

Is that deceitful, or just good expectations management? That’s up to you to decide, I’m just pointing out the facts we have available -

Broker notes - from Panmure Gordon and Equity Development are available to us today, very helpful.

Both have similar forecasts, of 11.7p and 11.2p for this year, FY 4/2025. Strangely this is well below the consensus figures above, of 13.3p, which means the PER is actually higher than the Stocko figures. I’ll go with the specific broker numbers today, so at 274p we have a PER of 24x the average of the two broker forecasts. That strikes me as much too high given this is a horrible sector, although LGRS does seem to be regarded as best in class operator, and is quite rapidly expanding through its self-funded roll-out of new sites.

The other bull point is that margins are improving, and LfL revenue growth is now well above inflation, with some costs moderating, so there’s an interesting case to look at the hospitality sector with fresh eyes, as there could be some operationally geared profit improvements in this sector.

LfL revenue growth YTD has moderated from 5.0% to 4.7%, implying that the most recent 13 weeks was below that, maybe nearer 4%? That’s enough anyway I think, given that general inflation is now low at c.2%.

Total revenue is up 19.2%, reflecting all the new sites it’s opened.

“Loungers has opened 17 new sites during the period (H1 FY24: 16 new sites), taking the total portfolio to 273 sites as at 6 October 2024… A further 18 sites are scheduled to open in H2, continuing the increased roll-out programme following the 36 new sites opened in the previous financial year.”

I’m not aware of the total market potential for LGRS, but by way of comparison, cheaper competitor JDW (I hold) recently reported having about 800 UK sites, and sees potential for c.1,000. So I suspect LGRS potential size is similar, meaning the ultimate size might be about 4x its current size, which certainly makes it an interesting investment proposition.

Consumer confidence comments are encouraging -

“From what we are seeing across our sites, UK consumers are feeling increasingly confident and want to go out and enjoy themselves across all parts of the day. That confidence, combined with the variety, breadth, flexibility and relevance of our all-day offering, is reflected in our continued sales success."

Non-property net debt of £12.2m is modest, almost negligible given the good cashflows, so no issues there. Although its claimed “strong” balance sheet only has c.£42m of tangible net assets, unlike a lot of bar operators which own their freeholds (but have hefty debt usually), LGRS does not - it leases property. Capital-light, and more flexible, but leaving them subject to rental increases out of their control when rent reviews happen maybe? Personally I much prefer lots of freeholds, and hedged debt (as JDW has structured itself - I hold).

Paul’s opinion - I still baulk at the valuation. LGRS looks a good business, but in a horrible sector, where it’s very difficult to make money. Eg the ED note shows it's forecast to make only £16.1m adj PBT this year on revenues of £402m, only a 4% margin. Although it hopes this could rise to 5.1% by FY 4/2027. There should be some economies of scale from purchasing more keenly, especially from breweries, as more sites open and purchasing volumes rise, so that sounds credible to me.

ED forecasts big increases in EPS from 11.2p this year, to 14.8p and 18.5p in subsequent years. Although at 274p/share, I’m being asked to pay 14.8x the forecast profits 2 years in the future! Whereas I can buy better funded JDW on 14x this year (FY 7/2025) forecast earnings, and get much better tangible asset backing, and recently reintroduced divis. Although slower growth.

On balance then, I’m happier holding JDW, as I’m getting value for money today (a bit like its meal + pint deals at £10.37!). I’ve mystery shopped several LGRS sites, and they’re nice, but nowhere near the value for money at ‘Spoons, albeit with a different customer base - probably people driving BMW 3 or 5 series, whereas 'Spoons customers are more likely to be driving a Transit, or catching the bus!

Conclusion - LGRS is clearly a good business, in a tough sector, but I don’t think the shares offer enough value to tempt me in, in a market which regularly throws bargains at us right now. AMBER again.

Since listing - all those new sites opened, but no shareholder value created -

Vistry (LON:VTY)

Down 29% to 910p (£3.01bn) - Trading Update (profit warning) - Paul - BLACK (PW) / AMBER on fundamentals.

A bombshell announcement from this leading housebuilder, which has a differentiated business model of building houses in partnership with typically public sector organisations - very much a positive thing in my view, as it hasn’t been impacted by the last 2 years’s slowdown in the private housing market.

Summarising today’s bombshell -

Accounting problems discovered at its South division.

Affects 9 out of 300 (total company) developments, but some are large-scale.

Build costs understated by c.10%.

Profit hit £80m FY 12/2024, £30m FY 12/2025, and £5m FY 12/2026.

Revised adj PBT guidance of £350m FY 12/2024.

“We believe” that problems confined to South division, and mgt changes underway.

Independent review launched to “fully ascertain the causes”.

It reassures on other matters -

“The Group continues to expect to deliver total completions in excess of 18,000 units in FY24 and continues to target a net cash position as at 31 December 2024 (31 Dec 2023: net debt £88.8m). The Group remains committed to the £130m share buyback programme announced on 5 September 2024.

The Group is confident in its unique Partnerships strategy. Notwithstanding the one-off adjustment announced today, we remain committed to delivering a strong increase in high quality mixed tenure housing, our medium-term target of £800m adjusted operating profit, and £1 billion of capital distributions to shareholders."

Valuation - given that new adj PBT guidance is £350m, and it says the impact of this “one-off” understatement of costs is £80m in FY 12/2024, then that presumably means previous guidance was £430m adj PBT. I don’t have access to any broker notes, old or new, so private investors are really disadvantaged in assessing situations like this, whereas the city will get better information from analysts that of course have access to the company that we don’t. Hence why in situations like this, I tend to assume that people selling in the market (especially larger trades) probably know more than me, so it’s risky to do the opposite and buy the dip, without full information.

Given that the above implies a c.19% drop in FY 12/2024 adj PBT, and assuming the same percentage applies to EPS, then I make that a drop from c90p forecast EPS, to c.73p.

The trouble is, they say this £80m profit hit is a one-off, to correct previously understated costs. So I’m not sure what EPS figure we should base our valuation on. 73p is the best guess I have, so that would mean a PER of 12.5x based on today’s lower share price of 910p, which sounds about right to me.

Accounting problems - these can often linger for several reasons. Trust in the whole accounting function is badly damaged by this type of revelation. The job of the central finance team is to pore over the details, and make sure that the individual divisions are getting their numbers right. So £80m of costs slipping through the net without the division or the central finance teams correctly accounting for them is a big deal.

How much financial control is there generally in the group? It sounds to me that it’s clearly not good enough.

We’re told the problems are confined to just the South division, but how do we know that? Lax financial controls tend to be group-wide in my experience, and the central team failed to correct these errors or misstatements previously, suggesting to me that there could be wider problems here. But we have no idea, it’s purely guesswork. I would rather wait until the full review has been completed & reported to the market. Very often other things come out of the woodwork when a bigger review is done.

Paul’s opinion - I previously liked this share, and explained why my view was GREEN on 9/7/2024 - based on it putting out positive trading updates, and completely shrugging off the downturn in the wider sector. Also there has been fabulous growth at Vistry, and its business model is clearly excellent.

Compare this track record below with other housebuilders! (although the forecast net income blob for FY 12/2024 will come down to a similar level to the previous 3 years after today) -

VTY was valued at a price to tangible book of 2.0x. By my rough calculations that should now fall to 1.42x, making it a lot more attractive on an asset value basis.

The forward PER is also reasonable, as calculated above.

Yet we have further downside risk, if this substantial costing error turns out to be a wider problem.

Therefore there’s considerably more guesswork now in valuing VTY shares. It’s up to you to decide if the 29% drop today is excessive, or fair? I would argue that it only takes shares back to their Jan 2024 price, so maybe the bull run this year was overdone?

Given I don’t have enough information, and there’s guesswork involved, I’ve got no choice than to move down to AMBER for now. We could consider moving up again at a later date, once the situation becomes clearer.

Although it is also quite tempting to jump in with a little trade here too, in case there’s a bounce!

Three-year chart picks up today's big fall to c.910p -

Intercede (LON:IGP)

Down 9% to 180p at 08:23 (£106m) - Trading Update - Paul - GREEN

“Intercede, the leading cybersecurity software company specialising in digital identities, today announces the following trading update for the six months ending 30 September 2024 (H1 FY25).”

This is not really a trading update, since it only mentions revenues and cash, but not profits. There are several other companies today which have done something similar, so I hope this is not the start of a trend where the key information that we need (are profits in line with expectations or not?) is dodged. Doing this is counter-productive, as it introduces doubt in investors' minds.

H1 revenue growth has been strong, +22% (+29% at constant currency) to £8.54m -

“This is in line with management expectations.”

Given the strong newsflow of contract wins & renewals this year, I was initially disappointed that today’s update is not ahead of expectations.

However, an update note from Cavendish gives useful extra context, saying that “FY 25 forecasts should be comfortably achievable”, and that each contract win/renewal announcement de-risks the forecasts, making it more likely that IGP will meet or beat expectations later this year - the same pattern it delivered last year.

FY 3/2025 forecast is £16.1m revenues, and £3.0m adj PBT. This is down on FY 3/2024, which benefited from a large, one-off contract win late in the year.

So achieving £8.54m in H1 means that H2 now only needs to deliver £7.56m. Given that IGP is clearly on a roll, with frequent contract wins, and a successful strategy of selling through channel partners, then I reckon it’s well set up to beat forecasts later this year. That’s a key thing I look for - companies that look set to beat forecasts, rather than promising us an H2 weighting in order to catch up (often a deferred profit warning).

So slight disappointment that we didn’t get an ahead exps update today, but I think it’s likely one is in the pipeline, all being well.

Valuation - is lofty, but that’s because IGP is a credible growth company now. Forecast is 4.2p for FY 3/2025, likely to be beaten, so I’ll go with 5.0p EPS as more likely. At about 180p (down c.9%) in early trades, that gives a PER of 36x - which is quite high, but far from outrageous for a high margin growth company.

Cavendish mentions that IGP tech is best in class. Plus a reminder from me that IGP’s markets are global, reference sites are second-to-none with an astonishing existing client list including numerous US Govt Depts, and some of the world’s largest companies. Demand is also increasing, due to concerns over cybersecurity and the weakness of simple passwords, so online credentials management seems a great growth area to be operating in.

I see a lot of potential in IGP, for a not very expensive £116m market cap. It’s already profitable & cash generative, and has plenty of cash at c.£16m and no debt.

H1 results are due out on 26 Nov 2024.

Paul’s opinion - unchanged. I see a big opportunity here, and so far it’s working out very well indeed.

Today’s update could have been stronger, so I can understand why some short-termers might be banking profits today.

More patient investors should do fine on this share I think, because it’s clearly set up for more positive newsflow in H2.

Shares have 4-bagged in the past year, so some profit-taking & consolidation is probably necessary in the short-term.

Summarised well by the StockRanks - very high quality and great momentum, but not a value share!

Graham’s Section:

Senior (LON:SNR)

Down 13% to 128.2p (£538m) - Trading Statement - Graham - AMBER

Senior plc ("Senior" or "the Group"), an international manufacturer of high technology components and systems, principally for the worldwide aerospace & defence, land vehicle and power & energy markets, today issues this Trading Update for the nine months ended September 2024 (the "Period").

We don’t cover this one too frequently but in August I was AMBER/GREEN at 150p, after some weakness in the share price created a more tempting valuation.

That share price has however dropped lower today after some bad news: the Aerospace division continues to meet complications in its dealings with the major aircraft manufacturers and their suppliers.

Boeing was already a source of difficulty but now Airbus is proving to be a challenge, too.

In the near-term… as has been extensively reported, the commercial aerospace manufacturing industry is facing temporary but significant headwinds.

Boeing: production rates of the 737 MAX have been restricted after the Alaskan Airlines incident early in 2024. Additionally, there is a current employee strike at a commercial aircraft site

Airbus: facing supply chain challenges, particularly on engines and interiors. There’s an “imbalance of supply into different parts of the aircraft”. One of Senior’s customers, a supplier to Airbus, intends “to significantly reduce scheduled deliveries from Senior in Q4 of this year before returning to normal during Q2 next year”.

Senior is responding in what sounds like a highly proactive manner to these difficulties: there are furloughs and permanent headcount reductions, spending cuts, postponed capex, etc.

Separately to the problems in the Aerospace division, Senior’s Flexonics division has seen no major change in its outlook since the interim results.

Other key points:

Group revenue +5% year-to-date, driven ironically by growth in Aerospace.

Outlook for the full year is “broadly unchanged” for Flexonics. In Aerospace, H2 will be lower than H1.

The issues facing the company are “clearly temporary in nature”

Graham’s view

My upgrade to “AMBER/GREEN” here was clearly a mistake. I’ve had a positive impression of Senior for a long time and so when I saw it trading at what seemed to be a level that offered value, my instincts were to take an interest in it.

As far as today’s disappointing news is concerned, I tend to agree with the company that the problems it currently faces are temporary. Strikes and supply chain challenges come and go. They do however serve to emphasise the challenging markets in which Senior operates. As I’ve pointed out before, Senior has struggled to generate a double-digit ROCE and maybe the simplest explanation is that it’s difficult to generate very high returns when a large part of your business is supplying components to Airbus and Boeing.

The StockRanks are completely neutral on this one and given that I’ve been caught out by today’s profit warning, I’ll defer to them for now and go back to a neutral stance.

S&U (LON:SUS)

Up 6% to £17.54 (£213m) - Interim Results - Graham - AMBER/GREEN

S&U, the specialist motor and property financier, today announces its results for the six months ended 31 July 2024.

This is another company I’ve been a fan of for many years, but where I downgraded my view after the FCA started taking an interest in its forbearance practices.

The effects of this are visible in today’s financial results. Here are some of the headline numbers:

H1 revenue £60m (H1 last year: £55m).

H1 net income: £12.8m (H1 last year: £21.4m).

And in the motor finance division (“Advantage”) specifically:

PBT £9.4m (H1 last year: £19.1m)

Collection rate: 87% (H1 last year: 94%).

Impairment charge: £18m (H1 last year: £7m).

In S&U’s property bridging division, revenues and profits were both up strongly, from a small base.

So the decline in overall profitability is all down to the motor finance division, with that large impairment charge standing out as the culprit.

I have all the time in the world for Chairman Anthony Coombs, and look forward to his reports. Here is some of what he had to say about the difficulties in Advantage Finance:

On the initial basis of only 10 customer files, a s166 notice (swiftly followed by adoption of "voluntary" restrictions) has significantly constrained Advantage's ability to interact with and manage its traditional customers, with whom it has happily worked for the past 25 years. Strong Trustpilot ratings, an industry-leading uphold rate with the Financial Ombudsman Service and a long record of profitable trading with over a quarter of a million customers historically are evidence of this record. Successful repayment programmes, access to credit and improved credit ratings for these customers have always characterised Advantage Finance.

Happily, patient explanation, better documentation and retraining have now produced a more consistent and stable balance between the FCA's requirements for customer protection and the commercial risk and reward of supplying motor finance.

I note again that yet another public company is using its Trustpilot (LON:TRST) ratings as a key metric that it wants to highlight to investors!

Today’s report doesn’t provide any clear timeline in terms of when the ongoing regulatory intervention might cease, but the Chairman does say: “As negotiations with the Financial Conduct Authority conclude, this hiatus in performance is expected to prove temporary and a rebound anticipated for 2025.”

This wording has changed from previous statements. In August, negotiations were “nearing their conclusion”. In September, they were “actively pursuing a conclusion”. And now, it seems that negotiations are at last concluding!

Funding

S&U was always exceptionally well-capitalised, but its gearing has soared in recent periods. Gearing (the ratio of borrowings to equity) is now over 100%, as net debt of nearly £240m exceeds equity of £233m.

For comparison, gearing was 85.5% in January 2023, and only 55% in January 2022.

The company describes this as “continued relatively low gearing” but I’m not convinced that this is true relative to its own historic track record.

And not only is gearing much higher than before, but the company has used up most of its banking facilities - its total facilities add up to £280m. It says that it has “ample headroom” and that “facilities will be supplemented if required”.

Compared to the rest of the industry, I don’t think S&U are taking unusual risks with their balance sheet. But by their own high standards, the current situation strikes me as unusual.

First dividend will be 30p (last year: 35p).

The Outlook statement includes the following quip:

Appropriately, the last word should therefore go to Harold Wilson, Labour PM in the sixties. "I'm an optimist" he said, "but I carry a raincoat". Accordingly, we embrace the future with our usual cautious optimism.

Graham’s view

This is going to move in the opposite direction to SNR today. I’m going to stick my neck out and suggest that this is worthy of an AMBER/GREEN stance.

As I’ve said before, I believe that S&U/Advantage is a responsible lender, both objectively and by reference to other motor finance lenders. I accept that there’s a lot of scepticism in the comments when it comes to Trustpilot ratings, but for what it’s worth here again is the link to Advantage’s Trustpilot page.

These shares are now trading below book value - something they didn’t do for a long time. Perhaps the FCA intervention will have a lasting effect, and it no longer deserves to trade at a premium. But this is a family-run business with a terrific long-term track record, and I doubt that it did anything terribly wrong. So I’m interested in it again here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.