Hi, it's Paul here with the SCVR for Tuesday.

Today's report is now finished.

To get you started today, I wrote 4 more sections to yesterday's report in the afternoon, covering:

Tt Electronics (LON:TTG)

Solid State (LON:SOLI)

Actual Experience (LON:ACT)

Speedy Hire (LON:SDY)

It's good to see the first 2 companies in that list trading relatively well, despite covid.

Cerillion (LON:CER)

Directors sold a hefty lump of shares yesterday;

- 2.74m existing shares, or 9.3% of the company sold to institutions

- 255p per share, a deep discount to the 319p share price

- Guy O'Connor is selling his entire holding, of 2.39m shares (retirement-related)

- Oliver Gilchrist is selling half his holding, and retains 1.2% of the company

Graham introduced me to this share, and we both think the company is very good. This disposal of shares by Directors is mainly retirement-related, which seems a reasonable explanation.

EDIT: Just to clarify, Graham's just messaged to say that he doesn't have a strong view on CER, and that "it doesn't particularly stand out to me at all". So my apologies for putting words into his mouth which were inaccurate as it turns out, hence the strikethrough above. End of edit.

I'm a bit concerned at the placing price, being only 255p, which suggests that the market price of 319p could be a bit toppy perhaps? Although when buying an illiquid stock, I understand why instis want a discount, as they're locked in for the duration.

.

Sosandar (LON:SOS)

Share price: 8.75p

No. shares: 192.3m

Market cap: £16.8m

(I hold a long position, at the time of writing)

This online ladieswear brand provides an update for FT 03/2020, and on current trading.

Current trading (April & May) - this section reads well. Key points;

- Revenue up 62% vs LY - although bear in mind this is up against soft comparatives LY. It demonstrates that the heavy marketing spend late last year has continued to benefit sales this year, which is what the company indicated it believed would be the case.

- Growth achieved despite marketing spend down 69% on LY

- Returns down to c.33% - that's a huge reduction from c.50% in the past. Explained by selling more stretchy fabrics (e.g. focus on denim), and other styles which are less dependent on having a perfect fit. This was a stated aim of management when we last spoke, so good to see this is working well

- Loss for the 2 months reduced by 55% (no figure given)

EDIT: a friend has kindly messaged me to point out that the low returns rate in April/May could have benefited from Sosandar's more flexible returns policy, and customers not wanting to venture out to the Post Office or Collect+ branch. I checked its website, which says;

Extended Returns Policy – COVID-19:

The last thing we want you to be worrying about during these uncertain times is how you will return your Sosandar order! So to help we’ve extended our returns policy.

For any orders placed on or after 1st June, you will have 30 days from receipt of your order to return for a refund.

For orders placed between 23rd March - 31st May, you will have until 30th June to return your order for a refund. We will of course make additional exceptions on a case-by-case basis where necessary.

This strikes me as important, in that there could be a backlog of customer returns between now and the end of June, thus driving the returns rate back up again, from an abnormally low level reported today, possibly. Many thanks for pointing out this important point. End of edit.

Next/ John Lewis - Sosandar is going live on their online platforms from this autumn. This could be very significant longer term, if Next/ John Lewis heavily promote Sosandar product to their existing customer databases - especially Next, which is huge.

Klarna extended payment option added to website - might help sales, but probably only in a small way, as Sosandar's customer base is probably quite affluent, so wouldn't need extended payment terms.

Margins - promotions & discounts used to kick-start sales in early part of lockdown. Since moved back to full price.

All the above sounds good to me. Now on to the not so good stuff;

Cash - was £5.2m at 31 Mar 2020 year end. Fell to £4.4m a month later, as stock had to be paid for. Flat in May, which is encouraging. Says it can continue running the business at this significantly reduced cash burn level.

Cash burn is the big issue with Sosandar. The original business plan drastically under-estimated how much cash would be required to drive growth. Growth has been impressive, but it's come at a heavy cost. To be fair, several things did change - e.g. factories are now reluctant to give credit, due to UK retail insolvencies. Hence cash is now required up-front for purchases of inventories. Also, marketing spend was cranked up heavily in 2019 to accelerate growth. In reality though, this has just hauled growth back up to what was originally planned, instead of a shortfall occurring.

I've looked back through the last year's RNSs, and this is how it panned out;

Cash as at 31 Mar 2019: £3.6m

July 2019 fundraising at 15p: £7m

Cash used in H1: £(3.7m)

Cash as at 30 Sep 2019: £6.9m

Feb 2020 fundraising at 17p: £5m

Cash used in H2: £(6.7m) - big marketing spend (e.g. TV ads)

Cash as at 31 Mar 2020: £5.2m

That's an eye-watering £10.4m of cash used in the FY 03/2020. That seems extremely high, and I had to double-check my figures. However, there are 3 things to bear in mind;

- Fees relating to the two fundraisings are likely to be about £1m of the cash burn, and

- Inventories rose significantly, and trade creditors likely to have come down (as credit not available from suppliers). Hence I estimate these working capital movements might have absorbed c.£2m cash over this period.

- Marketing spending was deliberately cranked up big time in autumn/winter 2019, to drive sales growth - which was a policy decision, and has since been reversed.

The operational cash burn is therefore less than £10.4m, and is probably something like £7-8m for FY 03/2020 - still a scary number, given that there's only £4.4m cash left at end May 2020. Therefore, yet another fundraising looks likely for later this year. Each time they raise more cash, it dilutes existing holders, and the share count is likely to be about double what it was when Sosandar floated, once the next fundraising is done. Plus fundraisings hurt the share price.

This wording below clearly leaves the door open to more fundraising at a later date. Still, at least there is no immediate funding problem, in terms of the next few months anyway. I suspect more cash would be needed in order to fully stock-up ahead of the busiest autumn/winter season;

Given this and the strength of its balance sheet, the Company is confident that its existing finances are sufficiently resilient to withstand the current crisis and means it is well placed to resume investment in growth at the appropriate time.

Cost reductions - these are surprisingly drastic;

- Big reduction in planned marketing spending. Focus is on repeat orders from existing customers. This is the big advantage that online retailers have - the cost base is mostly variable.

- Carefully managing stock levels

- Discretionary spending frozen

- c.60% of staff furloughed - this is a surprise. The company must be running on a skeleton staff, and my worry is that this might impact plans for the autumn/winter season, and possibly harm customer service

- Unspecified reductions to Board remuneration. The key people (Julie Lavington and Ali Hall) were not paid very much to start with, so I hope they don't lose their motivation

.

Trading update for FY 03/2020 - Sosandar announcements tend to try to bury the bad news at the end. I don't like that. Hence the reverse format of today's update (current trading & all the positive things at the start) suggest there's likely to be a sting in the tail.

Revenue of "at least £9m". This is over 100% up on LY, but below original forecast, as indicated in the profit warning on 18 Mar 2020, which said;

The current expectation is that, given recent developments, this trend will continue in the immediate future and the Company's performance in March will be well below forecast. Accordingly, for the year ended 31 March 2020, the Company expects its revenue to be between £9.0m and £9.3m and net loss for the year to be between £6.5m and £6.8m. [from RNS dated 18 March 2020]

Returns were 50% for the year. Hence the recent reduction to 33% in Apr-May 2020 is very good (see edit above - this is likely to have benefited from the relaxation of returns policy due to covid), but possibly not sustainable at that level, once dresses become a larger part of the sales mix in A/W season, maybe?

Stock provision - an "increased and prudent stock provision" is presented as if it's something to do with covid-19! This seems misleading to me. I noticed in the last accounts that inventories seemed unusually high, and was fobbed off with unconvincing explanations. After further probing, it transpired that there was an overhang of unsold autumn/winter 2019 stock, which was being mothballed in order to re-introduce it for sale in autumn 2020.

Clearly the auditors must have looked at the inventories, and decided that the company should make a provision against this unsold stock. That has nothing to do with covid-19. It's more a case of trying to bury the bad news at the end of the RNS, with a lame explanation. Much though I like the people at Sosandar, I cannot help feeling that the over-embellishment of the company's announcements is counter-productive, and undermines investor trust, by trying to gloss over bad news, instead of being honest.

I much prefer the approach of getting bad news out early, and clearly, then move on. Not concealing the bad news, and it then only becoming transparent later. Investors tend to respect an open approach, with balanced presentation of newsflow, not a one-sided version of events, buffing up the positives, and covering up the negatives. Let's hope future announcements are more balanced.

Here's the sting in the tail, right at the end of the announcement today;

The discounting used during the initial period of lock-down and stock provision, alongside the planned first order discounting following the period of intense customer acquisition in Q2 & Q3, is expected to result in the Company reporting a gross margin decrease of 555bps.

The Company also saw higher than anticipated returns on sales immediately prior to the announcement of the lock down.

As a result, the Company now expects to report a loss for the year which is slightly higher than anticipated in its announcement on 18 March 2020.

Slightly higher than the previous range of £(6.5m) to £(6.8m) suggests we're looking at a loss of maybe £(7m) for FY 03/2020. That's a poor result, there's no getting away from it. That's a considerable reduction in gross margin too - although for a small player in this sector, Sosandar's gross margin is still very good.

My opinion - as mentioned previously here, I cooled somewhat on Sosandar after the poor update on 18 March 2020.

Today's update has some good stuff in it, especially the decent sales growth (despite little marketing spend) in April & May 2020. Plus the big reduction in cash burn (neutral in May 2020) is good, but costs are going to rise again once staff come back from furlough. I also like the big reduction in the returns rate, from 50% to 33%, even if that's probably not sustainable for a full year.

Another fundraising seems inevitable, which means more dilution, which limits the potential for the share price to rise.

That said, Sosandar is getting close to achieving the scale it needs to become a viable, self-supporting business. Overall then, I'm happy to continue holding, albeit it's only a medium-sized position in my portfolio these days. I think the stellar upside potential is looking less likely than originally, due to the share count rising from each fundraising.

The update today is an improvement on the last update in Mar 2020, hence I think the share price rise today makes sense.

I appreciate that opinions differ on this one. Some investors are fatigued with repeated misses against forecast & fundraisings. Others can see that there's potential once it achieves scale. I think the current valuation reflects that fairly.

.

.

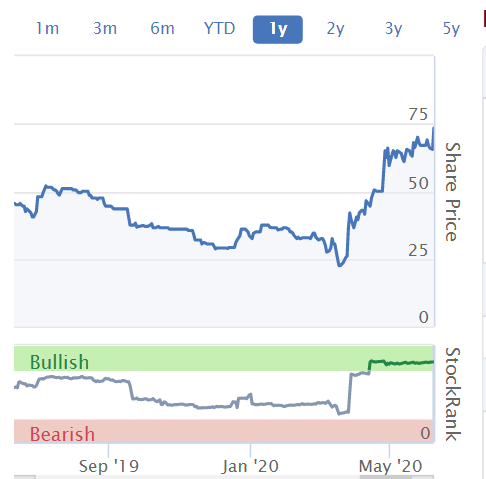

Venture Life (LON:VLG)

Share price: 73p (up 12% today, at 12:45)

No. shares: 83.7m

Market cap: £61.1m

I'm not familiar with this company, but Graham has written about it 6 times, in the archive.

The share price has been a stellar performer recently, so well done to holders.

.

According to the description on the StockReport this company specialises in treatments for the ageing population. So we know where to go when our haemorrhoids flare up, and dentures work loose (it sells products for both, apparently). Incidentally, I've asked for these company descriptions to be updated by Thomson Reuters, as some are showing signs of age).

Today's update starts with a recap of previous updates;

- Positive trading

- Order book significantly ahead of last year

- Exclusive contract with existing Chinese partner for £168m (spread over 15 years), including over £7m orders in 2020. It sounds like the Chinese partner is buying product from VLG, not the other way around, if I've understood that correctly.

- All other areas trading well

- Good demand for hand sanitising gel called Disinpluso

Today's news;

Extended scope of relationship with Alliance Pharma (LON:APH) which runs to end 2026, and

The best bit is next;

Taking these positive developments together, the Company is pleased to announce that it is confident that it will comfortably exceed market expectations for this year.

Excellent news for shareholders.

Broker update - there's a very useful update today from Cenkos, available on Research Tree. I've had a quick thumb through, and it all looks excellent to me. Forecast adj EPS is up nearly 28% today, to 5.45p. That puts it on a 2020 PER of 13.4 - which looks cheap, given the strong growth being achieved.

My opinion - this looks terrific, I wish I'd looked at it a few months ago! Providing nothing goes wrong, then it's probably not to late to buy some now. Earnings upgrades justify the share price move, in my view.

I've also had a quick look at balance sheet, and cashflow, which look OK to me. There is some debt, to fund 2 acquisitions, but it doesn't look excessive. More capex will be needed to ramp up production, but again not excessive.

VLG gets a thumbs up from me. Looks a nice growth at reasonable price type of share. Providing earnings are sustainable of course.

I'll leave it there for today. I had a quick look at Cml Microsystems (LON:CML) results, but they seem lacklustre, and I don't have any knowledge or insights about semiconductor companies.

Signing off, see you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.