Good morning, it's Paul & Graham here today.

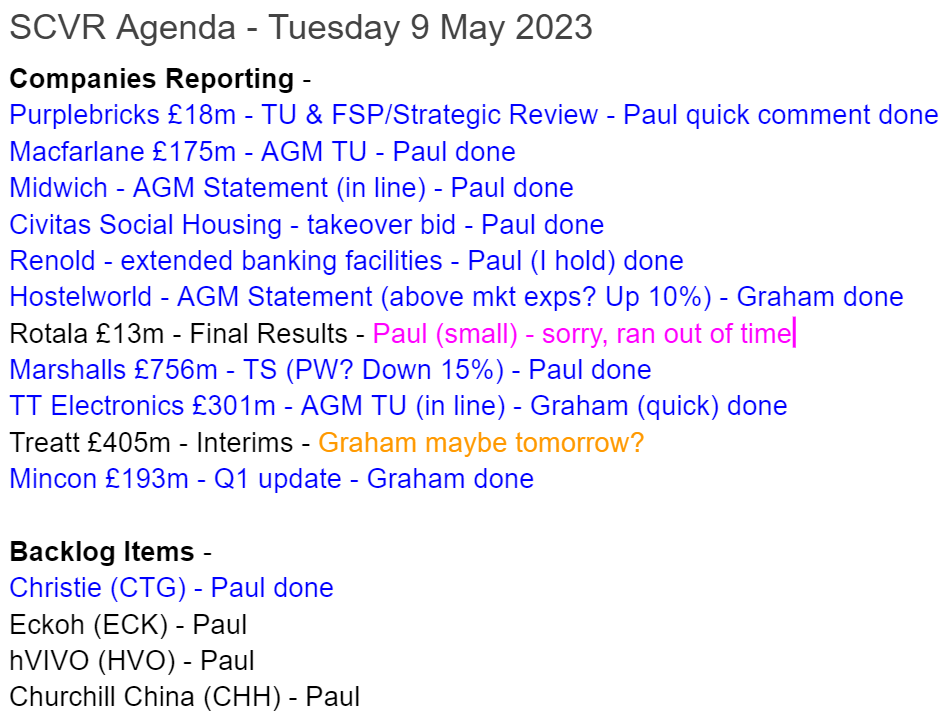

Today's report is now finished, at 13:02

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Summaries of main sections below

Mincon (LON:MCON) - 90.75p (unchanged) (£213m) - AGM TU - Graham - AMBER

Broker estimates are unchanged this morning (pencilling in 7% growth) despite news that Mincon’s mining-related revenues are suffering from an exploration slowdown. I want to give this stock the thumbs up but news flow remains very mixed. It stays on the watchlist for now..

Marshalls (LON:MSLH) - down 15% to 252p (£641m) - Profit warning - Paul - AMBER

Lowers expectations, but declines to give any specific guidance, and no broker updates available. So we're in the dark. Blames macro factors, slowdown in housebuilding, and slower discretionary house repair/maintenance. I'm struggling to reconcile this with upbeat recent comments from brick sellers. Maybe best to avoid the whole building supplies sector for now? Or anticipate a recovery later? Debt is also a concern at MSLH after a major, ill-timed acquisition of Marley in April 2022.

Hostelworld (LON:HSW) - 140p (+8%) (£170m) - AGM statement - Graham - AMBER

Profitability is ahead of expectations at this hostel-focused online travel agent. Bookings continue to recover and bed price inflation is also significant, leading to record revenues. The company has refinanced its onerous debt facility and now looks much more investible.

Christie (LON:CTG) - 135p (£36m) - FY 12/2022 results (released 24 April) - Paul - AMBER

A backlog item, I looked at it over the long weekend, my notes are below in a main section. It looks quite good, and looks set up to produce better 2023 results than 2022's OK numbers, as a loss-making stock-taking subsidiary is now back in profit. Might be worth a look, but doesn't excite me enough to go green.

Quick comments:

(no additional sections below)

Purplebricks (LON:PURP)

5.5p (pre-market) (£17m) - Update - Paul - RED

A disastrous update today from this declining online estate agent (of sorts), so expect maybe a 50%+ share price collapse today.

Key points today are - shareholders have refused to put in more cash. Sale process needs to be concluded quickly before it runs out of cash. Only £9.1m cash remaining end April. Customer finance provider is getting difficult & withholding some cash. “Small number of parties” in discussions over a takeover deal, but would be “materially below” current share price, if at all.

Paul’s view - this now looks like it could be a zero, or close to zero, for shareholders. Why would a bidder take on all the liabilities? Much easier to wait for it to go into administration, then just buy the brand name for peanuts, with no liabilities. Bad luck to any holders. It’s staggering how much cash the company has burned through, but it’s clearly just not a viable business model. Time to salvage whatever cash you can, and move on, I'd say.

Renold (LON:RNO) (Paul holds)

27.5p (pre-market) (£62m) - Extension of banking facilities - Paul - GREEN

Renold, a leading international supplier of industrial chains and related power transmission products, is pleased to announce it has reach agreement for the extension of its core banking facilities that were due to mature in April 2024.

Bank facilities enlarged from £61.5m to £85m + £20m accordion for acquisitions.

Santander has joined the existing banking syndicate (now 4 , instead of 3 banks)

3-year term to May 2026, with a 2-year extension option.

Key covenant (Net debt: EBITDA) loosened from 2.5x to 3.0x.

Paul’s opinion - I bought some Renold earlier this year, as I think the long-running turnaround has worked well, and this share looks a good quality business now, at a modest valuation. Remember the big pension deficit outflows are part of the reason for a low rating though. More debt brings more risk, but also allows Renold to expand its way out of the pension deficit problem (i.e. diluting it in a larger group, once more acquisitions are done).

Overall then I view this share positively, as does Stockopedia, with a StockRank of 90, and clearly also the banks see it positively too.

TT electronics (LON:TTG)

169.8p (pre-market) (£301m) - AGM TU - Graham (quick) - GREEN

We have an AGM update from this electronics manufacturer: the important news is that expectations are unchanged as “momentum from last year has continued”. As I noted when I initially turned bullish on this stock, the cheap earnings multiple attached to this one belies some robust underlying growth trends. Revenues for the first four months of 2023 are up 16% year-on-year (at constant FX), with a record order book and this year’s forecast revenues (£629m) now “almost fully covered by orders”.

Among TT’s priorities, mentioned today, is free cash flow. TT did become temporarily overleveraged last year, but that situation now appears to be under control. An old pension fund is no longer going to drain it of any further cash, and the leverage multiple should move below the 2.0x level which is the company’s stated upper limit. I’ll continue to give this stock the green light while it has a single-digit P/E ratio, hoping to see 2023 results emerge with much lower impairment and restructuring adjustments.

Macfarlane (LON:MACF)

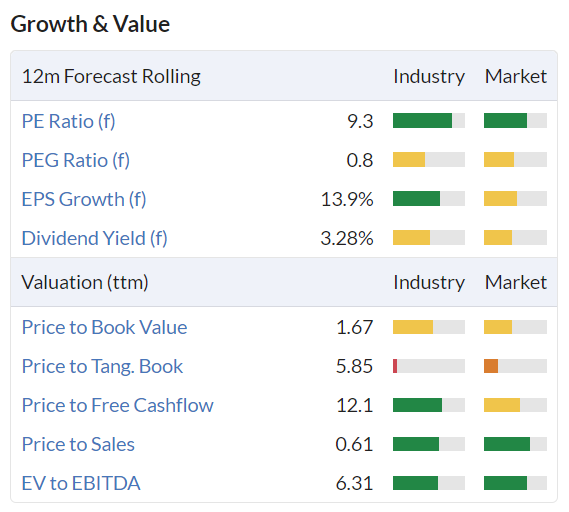

112p (unch) (£177m) - AGM Trading Update - Paul - GREEN

Headquartered in Glasgow, MACF makes & distributes packaging materials.

Today it says -

Solid start to 2023 - on course to meet full year expectations

Acquisitions are being self-funded - 2 made so far in 2023.

Negligible bank debt of only £0.1m, with a facility of £30m.

Paul’s opinion - valuation measures below look very attractive to me. This seems a decent business, at a modest valuation. Patient investors could do well here, I reckon.

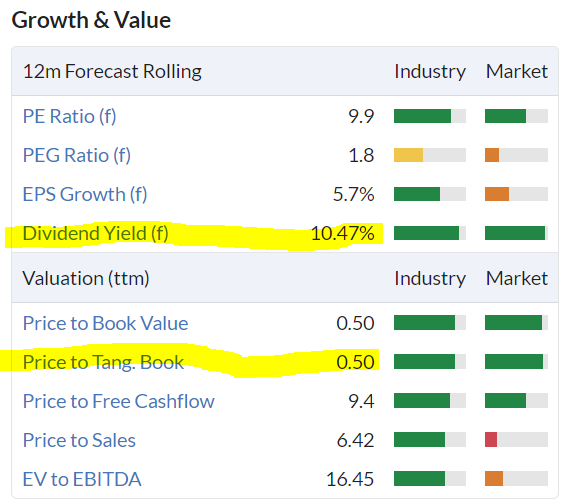

Civitas Social Housing (LON:CSH)

Up 43% to 79p - recommended cash offer - Paul

Not a share we cover (because property REITs take a long time to research), but well done to any holders. Although this agreed 80p cash bid does possibly look opportunistic? The bidder seems to be a Hong Kong based investment company.

The valuation measures that look particularly cheap (see below) are an amazing dividend yield, and a price of only half tangible book value. These numbers always have to be manually checked, because there might be a reason for them (eg. something has gone wrong more recently, that won’t be reflected until the next published accounts).

I see another company with “social housing” in the name is up 17% today, Triple Point Social Housing REIT (LON:SOHO)

It certainly looks as if the REITs sector could contain some other oversold bargains? Worth having a trawl through, to look for big discounts to NTAV, and very high divi yields, perhaps? Although avoiding basket cases with too much debt is the main risk factor with property shares.

Boohoo (LON:BOO)

Down 5% to 44.3p (£560m) - press reports - Paul - RED

I noticed weekend press reports that Boohoo is said to be demanding 10% discounts from its suppliers. This is always a bad sign, in my experience, of a business that is struggling. Hence I'm wary of this share for the time being, and it's been a long time since we last had a trading update.

Paul's view - the ESG stuff has all just been background noise. The reason the share price has collapsed, is because profits and growth have collapsed. Can they turn things around? Maybe, but as time goes on, I'm increasingly wondering if the golden era for fast fashion eCommerce may be over? Although lots of competitors have gone under, so maybe more market share for BOO, and lower marketing costs possibly? There should also be positive margin tailwinds from lower freight costs. But I don't want to be in the business of hoping, and guessing, that didn't work well in the past! So this is an avoid for me, until we have an up-to-date trading update, when we can look at it with fresh eyes.

Midwich (LON:MIDW)

Down 1% to 446p (£407m) - AGM Statement - Paul - GREEN

A growing distributor of audio-visual equipment, internationally.

Today it says some markets are challenging, but overall trading expectations are unchanged. That sounds fine to me, and I like the valuation here too, forward PER of 11.6x, and a 4% yield. The general tone of today’s update sounds fairly confident, I can’t smell a future profit warning between the lines!

Graham reviewed it in March, and was a little tight only going amber, so I’ll push the boat out and give a green opinion on this, taking a medium term view, as always - we don’t know what share prices will do in the short-term of course, that’s down to sentiment. I imagine this share could re-rate to a higher PER in a bull market.

The balance sheet isn’t the best I’ve seen, but it’s not terrible either.

Paul's Section:

Marshalls (LON:MSLH)

Down 15% to 252p (£641m) - Profit warning - Paul - AMBER

Marshalls is a UK manufacturer of stone, concrete, and other landscaping, building, and roofing products. Today’s update is for Jan-Apr 2023.

LFL revenue is down -14%, although the large acquisition of Marley took overall 4m revenue up 12% to £227m.

Reasons given: uncertain macro, reduced housebuilding, and lower repairs/maintenance. This is strange, as the brick manufacturer/distributors have recently reported solid trading. So it’s not clear to me what’s going on.

In the first quarter of the year, National House Building Council new housing starts were 27 per cent lower than 2022, which had an impact on the performance of all the Group's reporting segments.

Actions taken - cost-cutting, and production efficiency improvements.

Some clarity is provided with the divisional performance statistics -

Landscaping products (the largest division) - revenue down 21%, hit by reduced new housebuilding, and reduced discretionary spend.

Building products - revenue down 9%. Bricks, masonry & mortar only down modestly. Drainage & aggregates held back by deferred housebuilding starts.

Marley roofing (acquired last year) - revenue down 6%. Integration is going well.

What to make of all that? I find it confusing! Why would some product categories be down a lot, but others not?

Belgian subsidiary disposed of in April 2023, was trading at a slight loss.

Net bank debt has risen £29m to £220m since Dec y/end, due to seasonal working capital. It is prioritising debt reduction. This looks too high for comfort.

Outlook - short-term challenging. Year-to-date trading below expectations.

It doesn’t quantify, or give any indication at all, as to how much worse 2023 is now expected to be compared to its original budget.

Paul’s opinion - there are no broker updates on Research Tree, so I can’t take this any further, and am not able to value this share.

Bank net debt of £220m looks worryingly high, now that profit is missing target. So that’s enough to scare me away for the time being.

The last balance sheet at Dec 2022, which includes the big Marley acquisition is very top heavy with goodwill (at £560m), and long-term bank debt of £247m stands out as being too high. So it looks as if they made a mistake with a badly mis-timed, large acquisition. Is it terminal? I’d say no. The balance sheet still shows NTAV of £102m, and I imagine the bank is likely to play ball, and give MSLH time to generate the cash to get bank debt down.

All of that does put a question mark over the valuation of equity though. Should we be cautious because of the problems this year, or look through it as an aberration caused by the mini budget last year, and anticipate improved trading maybe in later 2023, or 2024? That’s your call, I don’t have a strong view either way.

Overall then, I just see this share as neutral, AMBER.

It does raise questions about how we should be seeing other building products shares? I was keen on the brick makers/distributors, which have reported OK trading of late. But with MSLH reporting a slowdown, then surely it’s only a matter of time before the brick companies follow suite with slowdowns? I think on balance maybe it’s best to avoid shares of companies selling building-related products for the time being?

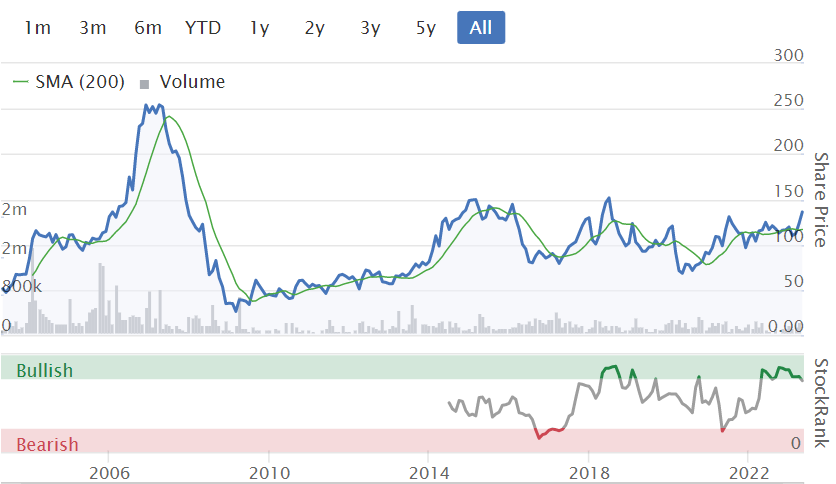

Amazingly, MSLH's share price is back down to where is was 20 years ago. Although there have been dividends received along the way, so the total shareholder return would look better than just the share price chart below.

Christie (LON:CTG)

135p (Friday’s close)

Market cap £36m

StockRank: 73 - Fwd PER 9.4 - Divi yield 3.5%

Lord Lee flagged up this share to me, he reckons it’s really cheap, and has a disclosable stake so is backing his judgement with his money, a good sign in my view! So I took a look over the long weekend. Here are my notes.

April 24, 2023 - FY 12/2022 Results published.

Various divisions, with most important one being 38 offices which provide commercial property valuation & sale of businesses. Also a loss-making stock-taking division.

2 pension deficits eliminated now, making £1m pa cash savings in future, allowing an increase in divis perhaps?

Net cash position improved to £7.2m at 12/2022(was £4.6m a year earlier)

Total divis for 2022: 3.75p

No dilution over covid: 26m shares in issue last 6 years.

One major shareholder: Philip Gwyn owns 28%, and other Gwyns about 5%. Ruggs own 11% (Ch & CEO). Who are they, and what are their intentions? Lord Lee holds 4.2%. Unusually, no institutions hold over 3% - strange, why not? De-listing risk?

FY 12/2022 PBT £4.4m (up from £3.9m in 2021)

Corp Tax charge up a lot, £1213k in 2022, vs £316k in 2021, hence PAT & EPS fell in 2022.

Diluted EPS 12.15p (LY: 13.3p), so PER is 11x - looks about right?

Pension changes - look odd, needs investigation - eg. £20.6m actuarial gain, less £13.9m cost of “asset ceiling” - what is this?

Balance sheet is adequate at £5.5m NTAV - fine as it’s asset light (only £1.1m fixed assets).

Onerous leases perhaps? There’s a £3.6m deficit on IFRS 16 entries.

Not particularly cash generative.

Trading has now returned to normal, after covid disruption.

Loss-making division (stock-taking & inventory) made a £2.1m operating loss in 2022, but this could be eliminated in 2023, thanks to covid disruption not repeating, and new client wins (eg Stonegate & other pubs groups).

Outlook - expects H2 weighting in 2023. Hoping to improve on 2022 operating margin of 7.9%.

Paul’s opinion - I can see there are catalysts for 2023 numbers to improve on 2022. But this share has gone nowhere for 20 years, so I’m struggling to see why it would re-rate onto a higher PER?

Overall though, I see more positives than negatives, so am leaning towards green, but it’s not quite exciting enough, so I’ll stick with amber for now.

Graham’s Section:

Mincon (LON:MCON)

Share price: 90.75p (unchanged)

Market cap: (£213m)

We digested this company’s full-year results for 2022 back in March.

Mincon designs, manufactures, sells and services rock drilling equipment, and updates us this morning with the news that Q1 revenues are “marginally behind” Q1 last year, due to a slowdown in mining exploration activity. More positively, trading with the construction sector remains strong in both North America and Europe.

When it comes to profitability, Mincon has been held back by input cost inflation and also by a large order backlog which necessitated the use of expensive air freight. Thankfully, both of these issues are being tackled and the company reports an increase in gross margin so far in 2023. Higher prices are being passed onto customers and a smaller backlog is enabling the use of cheaper freight options.

Finally, their new hydraulic hammer system “Greenhammer” remains in focus as Mincon tries to ensure that it doesn’t have any more reliability issues with its drill rig. They are now working with “a leading global rig manufacturer” to come up with a solution - I wonder how long this might take?

Broker estimates for 2023 are unchanged this morning (revenues €182m, adj. EBIT €21m), with the expectation that mining revenues will improve as the year progresses.

Graham’s view

I wrote previously that I could turn positive on this stock if news flow turned more positive, but unfortunately today’s update still leaves tricky questions to be answered: how long will the mining slowdown last? And how long will it take until Greenhammer’s rig issues are resolved? I still like this company and the valuation appears to be reasonable, but in my view it hasn’t quite done enough to justify a positive stance.

Hostelworld (LON:HSW)

Share price: 140p (+8%)

Market cap: £170m

This share price has quietly doubled over the past year:

Well done to holders, as they’ve bravely continued to own this share through horrible trading conditions and some poor financial results. The share price is now higher than it was in December 2019, just before Covid struck the travel sector!

The company describes itself as “a leading global social network powered OTA [online travel agent] focused on the hostelling category”. I remain sceptical of the claim that it’s building a valuable social network for people who stay in hostels, but then again I haven’t stayed in a hostel myself for twenty years so maybe I’m just too old to appreciate it?

The Chairman will make a statement at today’s AGM including the following information:

The strong start to 2023 has continued

“Bookings in many destinations are above 2019 levels”

Bed prices are higher than 2019.

With higher bed prices and the number of bookings improving, the result is that Q1 revenues are at a record level. Revenues in 2019 were €81m, while forecast revenues for 2023 as of last night were €86m.

Profit beat: adjusted EBITDA for 2023 is now expected to be within a €16.5 - 17m range, versus prior expectations of €14.6m.

A word of caution: in 2022, HWS reported an adjusted EBITDA profit of €1.3m, but the operating loss was €13.6m.

Debt refinancing: one of the major issues at HSW, from my perspective, has been a debt facility that was too big (€30m) and too expensive (9% + Euribor). In excellent news released today, this “legacy facility” has been fully refinanced.

€10m was paid off

New €10m term loan

New €7.5m RCF

New €2.5m overdraft (undrawn)

The new 3-year facility charges just 3.75% plus Euribor, and the rate reduces as the leverage multiple reduces below 2x.

Chairman statement:

This new facility, with materially lower interest costs, significantly strengthens our balance sheet, represents a strong endorsement of our post-pandemic performance, and consolidates the firm foundations upon which we will drive profitable growth and create shareholder value."

Graham’s view

I’m very pleased for HSW that it has substantially solved its debt issue (of course it will still have to satisfy the terms of its new facility). If we use simple assumptions and put EURIBOR at 3%, the company’s annual interest bill has reduced from €3.6m to €1.3m, i.e. over €2m of savings per year, with further savings to be had if it makes further progress reducing its leverage. There are substantial savings for a company of this size.

This news, combined with a recovery in bookings and revenues, leads me to think that HSW should be able to start generating material profits again before long. It was doing this from 2017 to 2019, before disaster struck.

But now we have Hostelworld 2.0, with a new app designed to help travellers meet up. The company says that this innovation is “proving to be hugely popular and has helped deliver market share gains in key markets”.

I’m tempted to give this stock the thumbs up but I’ll hold back for now, as I wait for adjusted EBITDA to translate to real profits that can justify a £170m market cap. At this valuation, I think it’s fair to say that quite a lot of success has already been priced in here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.