Good morning! Big news for us here - Graham's back! Yes, I'm delighted to announce that Graham Neary, who co-wrote the SCVRs with me a while back, has taken up his post again, as we're losing Jack to a career in the City, unfortunately.

I've got to say what an amazing colleague Jack has been - incredibly supportive behind the scenes, and working with him has been an absolute pleasure. Plus of course Jack has created loads of superb content here, which we have in our archive still of course. I'm sure I speak for everyone, wishing him all the best in his career in the City, and keep in touch!

Agenda -

Paul's Section:

Revolution Bars (LON:RBG) (I hold) - trading for FY 6/2022 at top end of market expectations. Looks very cheap, given historic problems have been fixed, and it's now a well-funded roll-out of potentially 4 brands. I don't think macro worries are likely to deter its young customer base from wanting to party.

Crest Nicholson Holdings (LON:CRST) - good interim results, and surprisingly upbeat outlook & management commentary. Govt cladding charges have wiped out double the underlying profits, so that's a concern if more costs emerge. Superb balance sheet, and the market cap is below NTAV. I think there's a lot to like here, and discuss how inflation might pan out (total guesswork of course, but it's interesting to bounce ideas around).

Vianet (LON:VNET) - Final results for FY 3/2022 look good at first sight, but the profit disappears once you take into account capitalised development spending. Trading is set to improve as it recovers to pre-pandemic level, expected this autumn. Previously generous divis are on hold for now, with debt reduction being prioritised. Overall, I can't get excited about VNET, as the growth potential has never materialised, so far anyway.

Brief comments (no sections below):

Eneraqua Technologies (LON:ETP) - Many thanks to fred9566 who flagged this recent float in the reader comments below, with a synopsis which caught my eye. So I've had a quick look at the results, and started reading the AIM Admission Document. That's going to take hours, so just a quick initial view here. Its results out today look superb, with a huge rise in revenue & profit, beating very ambitious-looking forecasts. The order book is also large, and multi-year, so this looks like more than a one-off bumper year in FY 1/2022 reported today. Balance sheet is OK. The float only diluted existing holders a bit, and was to repay a modest amount of debt. Mark Slater is the only institutional holder over 3%, all the other big shareholders are individuals, looks like mgt. That's a very good sign, that they didn't want to sell out (much) on IPO. It seems to be in a sweetspot for heat pump installations. Looks intriguing, and worth a closer look. [no section below]

Xeros Technology (LON:XSG) - there are a couple of interesting announcements today from this bombed out share, which has given it a remarkable shot in the arm, up 138% today to 77.5p which moves the market cap from £8m to £18m. I don't have enough information to value the company, and none is provided re the deal announced today. It looks potentially interesting though, and with revenues commencing in late 2023, maybe there's hope? Although as I noted in my last review (Mar 2022), cash is running out, so another placing looks likely. Could be worth a fun money punt maybe? Although often big spikes up on good news rapidly reverse in this bear market, so more than ever, caveat emptor! [no section below]

Graham's Section:

Frontier Developments (LON:FDEV) - this games developer and publisher announces ahead of expectations revenue for FY 2022. It is comfortable with expectations for FY 2023. Progress already made combined with an interesting pipeline for the current and future years suggests that risk/reward has improved for shareholders.

OnTheMarket (LON:OTMP) - results announced with breakeven for the year, and the outlook is in line with expectations. Share price reaction is flat. While revenue growth is strong, it’s still unproven with respect to profitability and much smaller than its competitors, and there’s a real threat of ongoing dilution.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Revolution Bars (LON:RBG) (I hold)

15.2p (pre market open)

Market cap £35m

Revolution Bars Group plc ("the Group"), a leading operator of 67 premium bars, trading mainly under the Revolution and Revolucion de Cuba brands, is pleased to announce a trading and property-related investment update for the financial year to date, ahead of the Group's 2 July 2022 year end.

Business is going well -

We are pleased to report continued strong performance across the Group, particularly from our refurbished bars, and continued guest enjoyment in all of our brands.

Whilst not being immune to the widely reported inflationary headwinds in the UK, we continue to manage and control costs tightly wherever possible.

Following positive trading over the Jubilee Bank Holiday, the Board is confident of delivering adjusted EBITDA after rental charges (on an IAS 17 basis) slightly ahead of the top end of market expectations, which currently stands at £10.0 million.

I’m awaiting broker updates, to see how £10m adj EBITDA translates into real profits, and EPS. Finncap normally issue updates, so when that hits my inbox, I’ll update this section.

Update: many thanks to Finncap for an update note that’s just arrived. It’s bullish too, upgrading forecasts, and setting a 36p price target, upside of 138% (and well above my 30p target).

Forecast adj PBT is up £0.5m to £2.7m.

In EPS terms this is up from 0.2p to 1.2p - so a current year PER of 12.7 - although I would caution that PERs are not necessarily reliable on small & volatile profit figures. Although it’s certainly reassuring to see that the PER is modest, in a year FY 6/2022 that was still disrupted by covid (Omicron hit trading in Dec 2021, as some people stayed away from bars in order to protect family visits over Christmas).

I very much like that forecasts are rising here at RBG, and thought they were set too low originally anyway. Better that way around, than a profit warning from overly ambitious forecasts.

I see upside for Finncap’s forecasts for FY 6/2023 & FY 6/2024, hence the risk of a future profit warning seems low, unless the economy really crashes. This is a crucial point right now, for all shares. If the broker forecasts haven’t been lowered, and it’s a cyclical business (esp. consumer-facing), then the risk of a profit warning is probably high, and it might be best to hold back from buying, unless the valuation is so cheap it can’t be ignored. Even then, it might be best to keep some powder dry. I'm just thinking out loud here, not pretending I've got all the answers. The macro picture is changing every day, and high inflation is not something many investors have ever had to cope with, so it’s particularly difficult right now. (End of update).

As I’ve mentioned here recently, Revs young customers are not really impacted much by the squeeze on disposable incomes, and after 2 years of on/off restrictions, they just want to get out and meet their friends, and enjoy themselves. That was very much the feeling I got too when mystery shopping, and talking to people in my local Revs bar.

My opinion - macro worries have obscured the reality that a lot of positive operational developments are underway at RBG. In my view, this share would have been double the current level in more normal stock market conditions. I reckon it should take higher inflation in its stride, with selective price rises, and winning business from competitors due to the widespread refurbishment programme underway. Higher wages means the customers have (nominally anyway) more money in their pockets. The target younger market should be fairly recession-proof, unless we end up with widespread unemployment, which currently seems unlikely, given full employment & skills shortages.

For anyone who missed it, check out yesterday’s report here, where I wrote up an interesting recent interview with RBG’s CEO Rob Pitcher (who is highly regarded in the sector).

Forget the dismal history, all that matters now is what happens from this point onwards, and I’m very positive on this share, believing it to be significantly undervalued. In dismal markets, it could get cheaper still though, who knows.

Stockopedia isn't convinced though, with a StockRank of 42. Although that's likely to improve, once FY 6/2022 numbers feed into the data.

Heavy dilution (50m to 230m shares in issue) during the pandemic means the business is well-funded, but the share price is not likely to ever recover to previous highs. Still, a doubling in price from here would be more than satisfactory, if I'm right about it being undervalued.

.

.

Crest Nicholson Holdings (LON:CRST)

271p (up 6% at 08:16)

Market cap £694m

I’m not terribly familiar with this housebuilder, so apologies in advance if I miss anything. It occasionally dips into our (arbitrary & flexible!) £700m upper market cap limit here at the SCVR.

I see that the homebuilding & construction supplies sector has sold off a lot this year. There’s a really neat feature here (or click picture below), where you can view a sector in individual company charts, to quickly get a feel for what’s going on. I’ve only just discovered this feature, so will use that more in future - here’s how it looks -

.

.

I’m wondering if we might have some bargains in there? House builders today have strong balance sheets, whereas in previous downturns they were often overly geared, and almost went bust. So that’s a big plus this time around.

On the downside, obviously housebuilders are geared to a downturn in house prices, so profits tend to collapse in recessions, as expensive land purchases collide with higher construction costs and lower selling prices.

It also depends on central bank policy. Real interest rates are astonishingly low still, and with consumers already becoming more cautious, I wonder whether policy makers will need to hike official interest rates much more once inflation has peaked? Who knows, but this is the stuff that determines house prices & profitability of housebuilders - your guess is as good as mine!

CRST has a 31 Oct year end.

H1 numbers - look good, with adj profits (PBT) up 45% to £52.5m

Hefty exceptional charges of £105m, is double adj profits, turning a £52.5m profit into a £(52.5)m loss - due to the Govt’s “Building Safety Pledge”, which must be cladding/Grenfell related.

Guidance for the full year, FY 10/2022 adj PBT: £135-140m - not bad at all, for a £694m market cap company - so clearly the stock market is pricing in future earnings falls, which makes sense to me given how high house prices have become recently.

Outlook - the all-important outlook comments - management sound optimistic. I don’t know what their track record is like in terms of commentary - do any readers know? Are they perma-bulls, or more cautious previously? That matters a lot right now, for all companies - I take more notice of upbeat management that have a track record of being cautious/realistic, and take upbeat comments with a pinch of salt from mgt who always talk things up regardless of reality (and there are plenty of them around in smaller caps)!

The Board remains convinced that, despite the current global economic and geopolitical volatility, the long-term fundamentals of the UK housing market remain strong. The Group's efficient operating model and highly experienced leadership team position it well in times such as this. In addition, the balance sheet is robust and adequately capitalised to fuel this growth agenda and provide resilience if trading conditions become tougher.

As evidenced by the ongoing improvements to financial performance this year, the Group is pleased to announce that it now expects FY22 adjusted profit before tax to be around £135-140m. The Board remains confident that Crest Nicholson has a unique opportunity to deliver superior returns, by way of strong earnings growth accompanied by an attractive dividend and is committed to giving more customers the opportunity to own a Crest Nicholson home.

Balance sheet - is it “robust”, or are management delusional?!

Actually, I think it’s very robust! So definitely not delusional management, I’m pleased to report.

NAV is £846m. Within that is £29m intangibles, and a £35m pension scheme surplus. So both of those need to come off. That takes NTAV to £782m, about 13% above the market cap. Generally speaking, if you can buy a decently profitable housebuilder at below NTAV, then it’s probably going to have favourable risk:reward for investors. Obviously a sweeping statement there, and NTAV can drop a lot if house prices plummet, leading to land values & inventories/W-in-P having to be written down in book value. We’re miles away from that scenario at present though.

Pension scheme looks to be only a very small problem now -

The Group operates a defined benefit pension scheme. At 30 April 2022 the retirement benefit surplus under IAS 19 was £35.4m (HY21: £8.6m). In February 2022 the Group finalised the latest triennial valuation with the Trustees and agreed that the monthly cash contributions from the Group into the scheme would reduce from £0.75m to £0.13m, effective from the February 2022 payment.

My opinion - this is only a superficial review from me, but I think this share (and probably the whole sector) look worthy of a closer look by value investors.

Worries are obviously that more liabilities could arise from the Govt cladding issue.

Will house prices drop? Maybe, but in previous bouts of persistent high inflation, house prices actually went through the roof over several years, because people’s nominal wages went up so much, compounding over time. An exception I can remember was 1988-95, when we had a sustained downturn in house prices, caused by super high interest rates, and following a previous boom in the 1980s.

If bank base rates go up to 5%+, then all bets are off. But how likely is that? Will the BoE and other central banks really, intentionally, bankrupt half the country? I don’t see it myself, and there’s not much link between inflation and bank base rates any more. How long will it be before central banks stop hiking, and start doing QE again, to revive economies going into recession? Powell of the US Federal Reserve has already clearly stated (giving testimony to congress) that his actions on the next recession would be more QE & lower interest rates. And where the US goes, everyone else follows.

For that reason, my current view (aka. guess!) is that I don’t see the housing market being crippled by higher inflation or higher interest rates. House prices might stabilise, but there’s so much demand, it seems doubtful to me they’ll fall at all, or not much anyway. Monthly mortgage payments are still highly affordable, looking at the still remarkably cheap rates still being offered by banks. In fact, when inflation is running at c.10% for some households, then borrowing against a house purchase, at a fixed rate mortgage of c.3% for 5 years, is an absolute no-brainer! A decent chunk of your mortgage is effectively disappearing every year through inflation.

Hence I think housebuilders could be a very interesting sector to research right now, as valuations have come down so much. CRST looks decent to me, and fully asset-backed too, for safety.

The divi yield is slightly above the PER - not something we see often, especially when more than the market cap is supported by NTAV too. This looks very tempting.

.

.

Vianet (LON:VNET)

85.5p (up 4% at 10:20)

Market cap £25m

Vianet Group plc (AIM: VNET), the international provider of actionable data and business insight through devices connected to its Internet of Things platform ("IOT"), is pleased to announce its final results for the year ended 31 March 2022.

PR headline -

Momentum gathers towards a return to pre-pandemic trading levels around mid-year FY2023

Key points -

Strong recovery from pandemic, but still some way to go (at 81% of pre-pandemic revenues)

Decent profits at the adjusted operating profit level, £2.4m - however on closer inspection, this number is inflated, because it ignores £2.0m capitalised development spending, and prior year amortisation of this spending, which will be mainly payroll. So in the real world, VNET is actually trading around breakeven.

Small statutory loss before tax.

Net bank debt of £3.0m

No final divi, to conserve cash (big divis were the main reason to own this share, pre-pandemic)

Outlook -

"With both divisions capitalising on new vertical opportunities and the Group on track to continue strong earnings growth, the Board is confident that Vianet will return to pre-pandemic levels of trading in FY2023 and double-digit growth in FY2024. While the pandemic has thrown its challenges our way, we feel that we have weathered the storm well and that we are now in a position to push forward and make up for lost time.

Balance sheet - adequate, for the size & type of business. NTAV is about £2m.

Gross debt of £4.6m isn’t a major worry, but would be nice to see that reduce, so I’m pleased mgt is holding back on divis for now. Net debt is £3.0m, due to a positive cash balance of £1.6m partially offsetting bank borrowings.

Cashflow statement - profit hasn’t turned into cashflow, because Vianet is captalising a ton of costs onto the balance sheet - note that £2.0m of development costs were capitalised, which together with £465k of physical capex, consumed literally all the operating cashflow.

To demonstrate this point, here’s the middle part of the cashflow statement -

.

My opinion - No dilution during the pandemic, so VNET should get back to say 8-10p EPS this year/next year. That should enable good divis to return.

The operating profit before amortisation of intangibles (development spend) is a bogus profit number to my mind, so ignore that. The business is actually trading around breakeven, both for profits and cashflows, once all cash costs are taken into account.

That should improve though, as trading returns to pre-pandemic levels.

The problem with VNET is that the growth initiatives have been incredibly slow, and delivered very little growth. For that reason I lost interest in this share a while ago, and don’t see anything significant in the pipeline. Remember also that the company has over-promoted its growth prospects in the past, and not delivered on it.

For that reason, I can’t get excited about this, and reckon the current share price looks fully up with events. There seems little upside, unless they can significantly accelerate growth from the vending division, which is probably not likely to ever be a big business either. Brulines should be a decent cash cow, as pre-pandemic, but isn’t an exciting growth story. The much vaunted US expansion doesn’t seem to have made much impact either.

It all feels a bit stale.

.

.

Graham’s Section:

Hi everyone, it’s Graham Neary here!

Many of you will remember me working with Paul on the SCVR from 2017 to 2020.

Firstly, I’d like to congratulate Jack on an excellent two years writing this report. He did a terrific job and will be missed! And we all wish him good luck – not that he needs it – as he moves on to the next stage of his career.

I should probably say a word or two about what I’ve been doing over the last two years.

On a personal level: I bought my first house, got married, and had a daughter (now seven months old).

On a professional level: I set up my first limited company and ran my operations out of it, passed the first exam in the Financial Risk Manager course (which was very interesting!), and caused an awful lot of mischief and generated millions of views on social media.

So I’ve not really been sitting still!

But when Jack contacted me about the chance to come back and team up with Paul again, it wasn’t a difficult decision.

It may take a short while for me to get fully back up to speed – please bear with me! And thanks as always for reading and for commenting. The community we have here is what makes this special.

Best regards

Graham

Macro (by Graham)

A quick word on the macro environment is in order, as no doubt its effects have touched many of your portfolios.

Last week, US inflation beat expectations and rose to a new 40-year high of 8.6%. Electricity, food, fuel, and vehicles all saw huge price increases.

However, the overall inflation rate was held back by the “shelter” category, which was estimated to have seen inflation of only 5.5%. Many real-world estimates of rental price increases are in the high double digits. For this reason, many people believe that real inflation is much higher than 8.6%.

In any case, the official 8.6% inflation rate has spooked equity markets and indeed many other asset classes.

To tackle inflation, The US Federal Reserve will have a decision for the markets on Wednesday, and this may now involve a 75 basis point increase in interest rates.

Cryptocurrencies have weakened significantly in recent days, not helped by the shuttering of a large crypto lender (the “Celsius network”) with $12 billion in AUM.

Bonds have also been selling off. The US 10-year yield hit 3.3%, beating the high seen during the market stress of late 2018 and reaching the highest level since 2011.

Short-term rates have been spiking higher also, leading to “inversion” in the yield curve – often seen as a predictor of recession.

The UK 10-year yield is now around 2.5%, the highest level since 2014. A year ago, it was only 0.2%!

For us here, I think the main point is to own businesses which are strong enough, both competitively and in terms of their balance sheets, to survive an extended period of high inflation and high interest rates. There is no better defence than that.

Even the best businesses can see their valuations battered in this environment. But I think we should be excited! It’s precisely in environments like this, when people are scared, that fortunes are made.

Frontier Developments (LON:FDEV)

1248p (up 16% at 09:14)

Market cap £493m

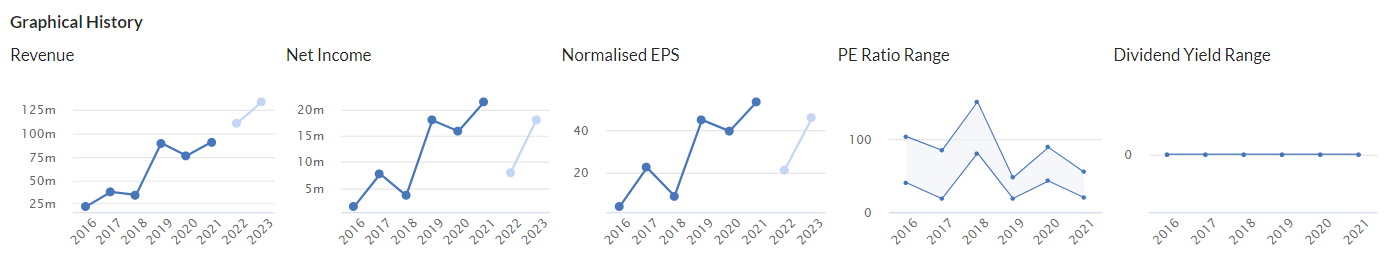

This games developer has a similar share price to when I last wrote for the SCVR. Back then, I thought it was overvalued!

It went on to triple in value, before coming back again to the current level.

The point with a company like this is that its success or failure each year often comes down to the timing of particular releases, and whether or not they capture the imagination of the target audience – which is not easy to predict!

So to invest in these shares, I think you need to have a lot of confidence in the pipeline. Or if you don’t have a lot of confidence in the immediate pipeline, you have to at least believe that there is a long-term growth story and that the risks are priced in.

But the FDEV earnings multiple is usually quite high! According to Stockopedia, its PE ratio has only reached a low of 18x – 20x in recent years. So it has never been something that would come up on a traditional value screen.

.

The accounting can be tricky here, too: lots of development costs upfront, creating intangible assets which later have to be amortised.

Revenue for FY 2022 comes in at £114 million. This looks to be ahead of expectations of £111 million (and FDEV shares are up 16% today at 09:14).

The main games in the pipeline are:

· Jurassic World 2: already released, 1.3 million base game units sold. Add-on packs continue to be released for it, generating additional revenue. Here’s the trailer for the latest add-on pack.

· F1 Manager 2022, launching in August. If this is a hit, then we could look forward to FDEV benefiting from new editions on a yearly basis.

· Warhammer Age of Sigmar in FY 2024.

Other games in the existing portfolio continue to generate revenues, but at a lower level, and there have been some disappointments on that front.

Profitability

I’m disappointed to see FDEV talking about “cash profit” when it means:

Earnings before interest, tax, depreciation, amortisation charges related to game developments and Frontier's game technology, less investments in game developments and Frontier's game technology, and excluding share based payment charges and other non-cash items.

This is a number that I would ignore. For what it’s worth, adjusted EBITDA for FY 2022 will be in line with expectations at £7-8 million (FY 2021: £12 million).

However, operating profit will only be c. £1-2 million, as FDEV will be writing down the value of an underperforming game.

The FY 2022 result doesn’t look good, but I imagine that most shareholders here are a lot more interested in the prospects for FY 2023 and FY 2024. So a poor result in FY 2022 does not matter too much.

Balance sheet

Another reason that current profitability doesn’t matter too much is the cash balance of £39 million (down from £42 million). This company has usually had an excellent cash pile, giving it lots of flexibility to invest as it sees fit.

Outlook

On top of FDEV’s own games, it is also acting as publisher for a range of games which have been developed by 3rd parties.

There is guidance for medium-term growth:

Over the medium term, the Board expects Frontier to continue to grow revenue by around 20% on average per annum, with any annual growth rate variability largely driven by the number and scale of new releases in each year.

And in the short-term:

The Board is comfortable with current analyst expectations for FY23 based on the expected performance of our existing games and the anticipated success with our planned new releases.

My view

I’ve always had a hard time understanding this company’s valuation.

However, I’m now starting to come around to it. The post-Covid sell-off has brought it back to around the same share price it was at from late 2017 to early 2020.

Over that time, I believe the company has made progress, both as a developer and as a publisher.

In 2017, revenues were only £37 million, and profits only £8 million.

In 2023, revenues are forecast to come in at £134 million, with profits of £18 million.

While I’m not ready to hit the buy button personally, this is the best risk/reward that I’ve ever seen at FDEV.

.

.

OnTheMarket (LON:OTMP)

83p (down 4% at 09:48)

Market cap £72m

Disclosure: I am a shareholder at Rightmove (LON:RMV), the main competitor of OnTheMarket (LON:OTMP) !

Let’s catch up with the news at this property portal upstart.

Revenues for FY January 2022 are up 32% to £30.4 million, but it’s still not at the scale where it can make a meaningful operating profit – and indeed the company makes an operating loss for the year (offset by income tax credits, so that the end result for the year is breakeven).

Traffic to the portal is up 6%, total advertisers at year-end is up 8%, and ARPA (revenue per advertiser) is up 32%. That’s an excellent year in many respects.

Business model

OTMP is an attempt by estate agents, i.e. by the primary customers of property portals, to regain some control over the price of advertising property, after many years of (allegedly) getting ripped off by Rightmove.

For example, ARPA at OTMP from estate agents is £204 per month. Monthly ARPA at Rightmove was £1,189 last year, an increase of 9% compared to the prior year.

OTMP says that it offers "a unique proposition to the industry due to our agent ownership of 60%”.

For the ordinary consumer, OTMP uses the slogans “because your property search just got serious”, and “Get Real about Moving. Get OnTheMarket”.

They say they want to be “a must visit site for serious property-seekers”, which I guess is in contrast to the large numbers of people who passively browse the other, larger sites despite not having an immediate need to buy or sell.

One of the ways that OTMP incentivises agents to use the portal is by giving them (some might say gifting them) shares in the PLC.

That’s why we have these “agent recruitment charges”:

Agent recruitment charges relate to share-based charges arising on the issue of shares to agents committing to long-term service agreements, in line with the Group's strategy to grow the agent shareholder base.

During the last year, 460,000 of these shares were issued (740,000 in the prior year). That might not seem very costly, but the company only has 75 million shares in issue.

Under the logic of accounting rules, these recruitment charges had a cost of nearly £2 million during the financial year, or 6.5% of revenues.

Needless to say, the company strips this cost out completely when it calculates adjusted operating profit.

Outlook

The outlook sounds fine:

Positive start to FY23 with current trading in line with the Board's expectations.

The company is now looking to become more than just a portal with strengths in related property software, data and communications/marketing tools.

My view

I can accept that there’s a place for a third property portal, but I’m still doubtful as to whether it can enjoy anything like the profitability of the two main players. The OTMP share price has gone nowhere in four years and leaves the company with a sub-£100m market cap, so I think that it continues to agree with me.

I also have a big problem with the ongoing threat of dilution from these recruitment charges.

In order for shares to become very valuable, it helps if they are scarce – that’s one of the reasons I love buybacks!

Thanks to buybacks, the RMV share count has declined nearly every year, for the past fifteen years. But the way that OTMP is set up, I can only see further dilution in its future.

.

.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.