Good morning from Paul & Graham!

I have to leave it there today, so today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk.

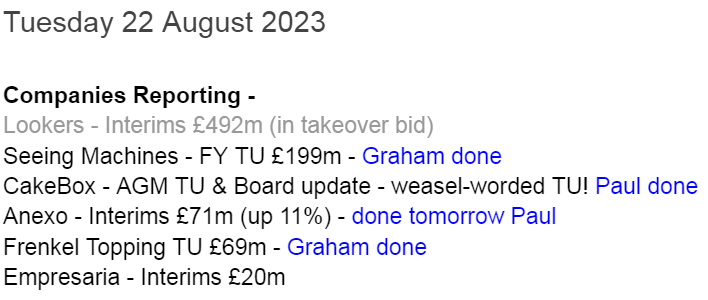

Agenda - quiet today, but we'll see what we can do -

Summaries of main sections

Seeing Machines (LON:SEE) - down 1% to 5.8p (£241m) - Trading Update (revenue ahead) - Graham - RED

These shares are lower despite revenues being ahead of expectations. The cash balance is down and the company has borrowed more from its lender and business partner. Working capital should unwind but I am uneasy with how the company presents continued cash burn.

Frenkel Topping (LON:FEN) - up 5% to 56p (£72m) - Trading Update (in line) - Graham - AMBER

This diversified professional services group provides an H1 trading update: it is tracking in line for full-year profit expectations. There are many subsidiaries and services to study but the overall track record is quite good and the stock may be fairly valued at this level.

Cake Box Holdings (LON:CBOX) - Up 6% to 160p (£64m) - AGM Statement - Paul - AMBER

An acceleration in store revenues is reported, and a reduction in the cost of some food ingredients, sounds positive. All rather spoiled by a refusal to indicate if profitability is in line with expectations or not, which is a change from the equivalent announcement this time last year - which obviously raises questions. Not a good move, when the company has had previous trust issues. In other respects, there are some positive aspects of this share.

Paul’s Section:

Cake Box Holdings (LON:CBOX)

Up 6% to 160p (£64m) - AGM Statement - Paul - AMBER

Board update - the non-exec Chairman is stepping down after 5+ years.

AGM Statement - the current financial year is FY 3/2024. Figures today are for the 17 weeks (c.4 months) to 30 July 2023.

Cake Box Holdings plc, the specialist retailer of fresh cream cakes, announces a trading update ahead of the Company's annual general meeting, being held at 11.00 am today.

Store LFL (like-for-like) revenues have accelerated from +5.4% previously reported for the first 11 weeks, to +6.8% for the first 17 weeks. Many thanks to Liberum’s analyst Wayne Brown, who crunched the numbers, and deduced this means +9.4% in the most recent 6 weeks - very good, and keeping up with inflation (slightly above actually). Although note that the prior year comps were soft (down 2.8% in the equivalent report for 2022 vs 2021).

Remember the stores are operated by franchisees, so this doesn’t directly come through into CBOX’s numbers (hence why revenues are only small at CBOX, but profits are good). It's a good business model, I think.

Input cost inflation - good news here too, with “some improvements” mentioned, eg. fresh cream prices falling, which has been passed on to franchisees, hence not a benefit to CBOX’s figures.

Marketing spend has been increased, no figures provided.

Cash - reported at £7.9m as of 30 July 2023, up a little from £7.4m reported at 31 March. I’m surprised it’s not up more actually, especially as the £2.2m dividend payment is noted as having been paid more recently, on 29 August. So really the figure now is likely to be about £5.2m. That’s enough cash though.

Note there is £1.3m of mortgage debt, although freeholds were valued at £8.7m, so I think it’s fine to ignore the small mortgages when reporting cash.

Overall the balance sheet is fine, when I’ve looked at it before.

Stores - 7 new franchised stores have opened so far this year (4 months). Total is now 212 at 30 July.

Outlook - I strongly object to the weasel words highlighted below. Note how it only talks about revenue being in line with market expectations. What about profit? It dodges the issue, and presumably hopes that nobody notices. This raises questions. Have brokers downgraded profit expectations on the quiet? No, forecasts seem unchanged.

As a result of the above progress on trading and strategy, the Group is on track to deliver year-on-year revenue growth, in line with market expectations.

Looking further ahead, with a strong balance sheet, underpinned by a highly cash generative business model, the recent investment in professionalising the Group's functions and its baking and distribution facilities along with the strengthened sales and marketing functions, the Group is well positioned to deliver shareholder value in the short- to mid-term.

Paul’s opinion - for me, what should have been a positive update, has been ruined by someone trying to be clever and only confirming that revenues are in line with expectations. The whole point of trading updates, is that they’re supposed to inform the market as to how profitability is performing vs market expectations.

Dodging that question makes me wonder whether profits might be slightly under what the market expects, or that they're not confident of achieving the full year profit forecasts? Note that in the equivalent trading update last year (31 August 2022), it said this (specifically reporting on profitability vs market expectations) -

Accordingly, due to the worsening outlook and increasing cost of living pressures on the consumer, the Group now expects full year profitability to be significantly below current market forecasts. [NB. last year, 31/8/2022]

So clearly the change in reporting this year, to reference revenues vs market expectations is a deliberate fudge. I see that as rather deceitful actually, not helpful given CBOX’s chequered history.

Forecasts are for only a marginal increase in adj EPS from 10.6p LY, to 10.9p this year (FY 3/2024). So the fact that it today deliberately dodged the question of confirming whether or not it was in line with profit expectations, raises a question over whether it can achieve any profit growth at all this year.

For that reason the PER of 14.7x doesn’t look particularly attractive to me - given the risk of a profit miss, implied by today’s wording of the TU.

The share price has also been boosted by apparent takeover interest from an Australian suitor, which was mooted at about 160p. Given that it’s owner/managed, I’m struggling to see why the founders would sell at this sort of level? (it peaked at c.400p in late 2021, before the accounting scandal emerged, and note that Directors had sold multiple millions-worth of shares before those problems emerged, which is why I still don’t trust this company I’m afraid - not helped by today’s update’s wording).

All of this is a pity, because I see CBOX as a fundamentally sound business, with good roll-out potential. If we’d had a nice clean update today, saying trading in line with expectations (profits!), then it might have been tempting. But for me, today’s update raises questions, at a company that I already had trust issues with. It’ll probably all turn out fine, and there might even be a possibility of a takeover bid, but for me that’s not enough to tempt me into this share - but there’s a fairly decent bull case for it, so overall I’ll go with AMBER.

You may not share my concerns of course, I'm only expressing a personal opinion as always. But at least it means we can have a range of opinions here, and investors can then make an informed choice on how to weigh the various factors.

Graham’s Section:

Seeing Machines (LON:SEE)

Share price: 5.8p (-1%)

Market cap: £241m

We last covered this one in March.

It is “the advanced computer vision technology company that designs AI-powered operator monitoring systems to improve transport safety”. It benefits both from regulatory safety requirements and from the voluntary adoption of driver assistance systems.

Today it publishes a full-year trading update. Highlights:

Revenue $57.8m is “ahead of the top of end market expectations” (sic).

Annualised recurring revenues $13.6m

Cash $36.8m.

Cash as of December 2022 was much higher at $52m (not mentioned in today’s RNS). The company says in a footnote that due to the timing of deliveries, both inventory and receivables have increased. But it reassures that this is temporary:

Inventory levels are sufficient to support demand for H1 FY2024 and will unwind along with receivables in the first half of FY24.

Even more importantly, the figure shown is “Cash”, not “Net cash”. Seeing Machines has the unusual tendency to report in this way.

Net cash is much lower: the company has a convertible note outstanding, which matures in October 2026. The conversion price is 11p so unless the share price improves, the note will need to be repaid in the normal way.

How much is outstanding for the convertible note? I thought it was $30m. However, a broker note from Cenkos says that the full amount has been drawn down under this facility, which is $47.5m.

Seeing Machines could have simply stated that they drew down the additional $17.5m that was available to them. Instead, in today’s update they refer to the complete $65m funding package from the lender, who is also their business partner (Magna).

With $47.5m outstanding in a convertible note, I think it’s reasonable to treat Seeing Machines as having a net debt position.

CEO comment:

We are very pleased with the progress made during what was a record quarter, and throughout the year, across both our Automotive and Aftermarket divisions. Crossing the 1 million threshold for the numbers of cars on the road with Seeing Machines' technology installed, up 143% year on year, represents a major milestone and a great achievement. With supply chain constraints now easing, our Guardian business continues to go from strength to strength, with over 51,000 heavy vehicles now connected, an annual growth rate of 30%. We can now expect Aviation to be a meaningful contributor to the Company's revenue and looming regulatory deadlines are driving the rapid adoption of Driver Monitoring Systems by automotive manufacturers. Our per-unit, margin accretive royalty model leaves us well positioned to capitalise on the opportunities ahead.

Graham’s view

I have been thinking about turning neutral on this stock, as its revenue and operational progress seem very impressive. The forward price to sales ratio is about 5x, which could be reasonable for a quality business with excellent growth prospects.

Up until now, I’ve been bearish, due to heavy cash burn and losses. Over the past two years, the chart has mostly agreed with me:

Today, I’m going to remain bearish. Some might consider this petty, but the deciding factor is that I don’t like the way that the company has dressed up a large reduction in its cash balance and a shift into a net debt position.

Sometimes you have to go with your gut, and my gut is telling me that this company is trying too hard to convince investors of its financial strength. So I’ll stick with my bearish view for now.

Frenkel Topping (LON:FEN)

Share price: 56p (+5%)

Market cap: £72m

This is “a specialist financial and professional services firm operating within the personal injury and clinical negligence marketplace”.

It releases an H1 trading update, with a table that looks good - revenue up very strongly, and profits rising with it. Not all of this is organic growth:

The range of services and group companies is vast for a small company.

Outlook - in line with expectations.

The business goes into the second half of the year carrying real momentum from H1, benefiting from the diversification of revenue and encouraging growth in transactional revenue. We do expect financial markets to remain challenging, which will continue to moderately impact AUM growth and the Company's recurring revenue generated from this. However, the Board maintains confidence in the full year outturn and its expectation for the year which are tracking in line with management's expectation.

Graham’s view

I don’t know enough about this one to speak with any authority on it. Back in February 2020, Paul noted the involvement of Harwood Capital and I see that they are still here with a 29.6% stake (just below the figure that triggers a mandatory takeover offer).

The involvement of Harwood isn’t necessarily good or bad news for private investors; it might be a decent and undervalued company but there is also an element of delisting risk to consider.

The overall financial trajectory of the company looks quite good (bear in mind that the share count has almost doubled over the period from 2017 to 2023):

For me personally, this isn’t a sector that excites me very much: whenever I read the words “professional services” and “personal injury”, I tend to look away.

However, Frenkel does own an investment manager - Ascensia - which has been developed “for Clients who have been awarded a settlement as a result of clinical negligence or personal injury”. The fees generated by this investment manager should be recurring and high-quality in nature.

At a PER of 11x-12x (depending on how you measure it), and with average “quality” metrics (ROE/ROCE), my working assumption must be that Frenkel Topping is fairly valued here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.