Good morning, it's Paul here with the SCVR for Tuesday.

Reader comments - can I echo a repeated request here from other readers. If you're going to comment on any company, please include the ticker, or company name, in every post. Otherwise some readers won't know which company you're talking about, hence your comment is pointless to many readers. It depends which version of the site & comments layout people are using.

I've started a bit late today, so am aiming for a 3pm finish time. The first couple of sections should be up before midday. Update at 16:51 - today's report is now finished.

Agenda - this is what has caught my eye today, and taking into account reader requests too (which I try to do where time permits);

Bloomsbury Publishing (LON:BMY) - Interim results

Aa (LON:AA.) - Extension of deadline re takeover bid(s)

Hunting (LON:HTG) - Q3 Trading update

Quiz (LON:QUIZ) - (I hold) - Results FY 03/2020

Revolution Bars (LON:RBG) - Launch of CVA in subsidiary entity

.

Bloomsbury Publishing (LON:BMY)

Share price: 243.5p (up 16% at 11:10)

No. shares: 84.1m

Market cap: £204.8m

As usual, my first step when looking at all companies, is to review my previous notes. In this case, I reported here on 21 July 2020, when BMY issued a positive AGM trading update. This said Mar-June trading had been strong, with sales up 18%, ahead of expectations. Liquidity was strong. It reminded us that trading is H2 weighted, and the outlook was uncertain.

Moving on to today’s interim results;

Bloomsbury, the leading independent publisher, today announces unaudited results for the six months ended 31 August 2020.

It looks good, here is the CEO’s summary;

"Bloomsbury experienced excellent trading in the first half with year-on-year profit growth of 60% to £4.0 million. This has delivered our highest first half earnings since 2008 and exceeded the Board's expectations.

Obviously this is good, but we should bear in mind that the full year needs to be a lot higher than H1, to meet expectations. For context, full year adj PBT was £15.7m last year, so a £4.0m profit in H1 this year is still quite modest. Hence I’m more interested in the full year outlook comments.

We have continued to trade well during the first six weeks of the second half. In previous years, our revenue and earnings have been weighted towards the second half, with sales of trade titles rising for Christmas and sales of academic titles being strongest at the beginning of the academic year in the Autumn.

We are confident about the future of publishing. The short-term is difficult to predict because of the pandemic.

The commentary lists the new release schedule for H2, which sounds promising, including a J K Rowling book, which has been a big contributor to profitability for many years.

Acquisitions - “actively considering” opportunities.

Balance sheet - is fantastic, amazingly strong. Note that the very high receivables figures includes advances to authors. The cash pile is over £44m now, so it has plenty of ammunition to bolt on acquisitions, and now might be a good time to do so, with all the covid uncertainty.

Dividends - good to see these resuming, with a modest interim divi, flat vs last year, at 1.28p

As you can see below, there has been a lovely, long-term progression in the divis. The short bars are the interim divis, with the tall bars being the much larger final divis.

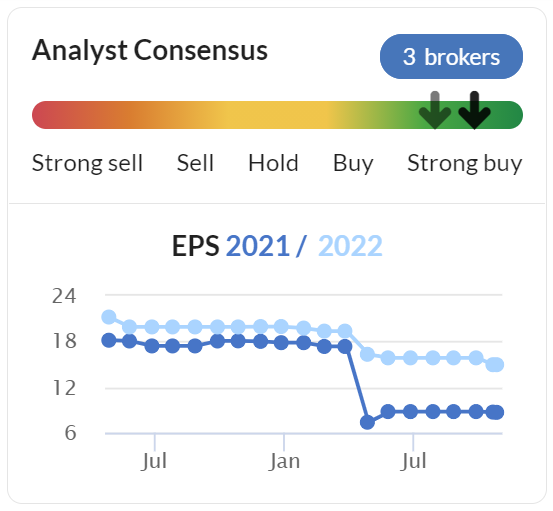

My opinion - the broker consensus forecasts (see graph below) are looking too pessimistic, although we won’t know until the Xmas trade is in the bag. Reduced orders from retailers possibly, but increased orders online? That would be my guess.

Overall, I think this looks a decent company, with a good long term track record, a fantastic balance sheet, and priced reasonably. Therefore it gets a thumbs up from me, as worthy of deeper research.

.

.

Aa (LON:AA.)

Share price: 23.3p (down 2%, at 12:05)

No. shares: 622.3m

Market cap: £145.0m

Here are my notes from 4 Aug 2020, when the AA announced it was in takeover talks, considering an equity raise, because it has £913m of debt falling due in the next 2 years. That is part of its ludicrously high £2.65bn debt mountain.

It sounds as if there’s still the possibility of a takeover bid;

On 24 September 2020, AA announced that it had consented to a request from TowerBrook Capital Partners (U.K.) LLP and Warburg Pincus International LLC (together the "Consortium") to explore the possibility of a consortium offer for the entire issued and to be issued share capital of the Company.

Commercial discussions and due diligence are progressing with the Consortium….

The Takeover Panel has granted an extension of the deadline from 27 Oct to 24 Nov 2020.

So it’s still a live situation.

My opinion - for me, the risks are far too high to want to punt on this. The AA’s balance sheet is shot to bits, with equity being little more than a call option on a good outcome. Why would a bidder be generous to equity holders, when it’s the bondholders who matter?

There’s a range of possible outcomes, from a generous bid for the shares (seems unlikely to me, but who can say?) to a wipe out for shareholders if the bidders do a deal with bondholders. Anything could happen.

With such a wide range of possible outcomes, and a dangerously over-leveraged balance sheet, I cannot see the attraction of risking my money on this. It's an interesting situation though, so the outcome will be good to watch (from a safe distance).

Market sentiment, as measured by the share price, seems to be pointing towards a poor outcome, as you can see below - terrible value destruction from its balance sheet being wrecked by financial engineers. For a while this was a sister company of Saga (LON:SAGA) (which I hold), but their balance sheets are poles apart. Saga has recently refinanced, and looks secure for now. Once its cruise ships can sail again, there's scope for a serious re-rating of in my view. Whereas the AA is in serious financial distress in my view, with insurmountable debt. Hence I wouldn't touch AA shares, far too risky.

.

Hunting (LON:HTG)

Share price: 134.5p (down 4% today, at 12:50)

No. shares: 164.9m

Market cap: £221.8m

I don’t seem to have covered this company for 5 years, probably because the market cap was too high, but it’s fallen into my remit again, as the share price chart demonstrates;

.

.

Hunting PLC (LSE : HTG), the international energy services group, today issues a Q3 2020 trading update.

It’s not clear to me whether the trading update below is for Q3 in isolation, or Q3 YTD. (although this is clarified further down, see below)

"In the most challenging environment ever faced in our industry decisive actions to resize the Group have been successful leading to a broadly break-even EBITDA result, a continued strengthening of our balance sheet, and an ongoing commitment to deliver industry leading service and technology to our customers.

Outlook for Q4;

Given the prevailing levels of activity, management believe that the revenue run rate for Q4 may be slightly lower than Q3 due to the usual seasonal slowdown.

Cost-cutting - has been deep;

"Our efforts to resize the Group in response to prevailing market conditions have resulted in annualised cash savings totalling c.$74m, with the global workforce reducing by c.30% from the 2019 year-end.

Balance sheet & possible acquisitions;

"Our strong balance sheet and improved net cash position also allows the Group optionality to explore further bolt-on acquisition opportunities. The growth of our subsea segment over the past 14 months demonstrates the success and rationale of this strategy.

I’ll check out the last published balance sheet now. This is from the interim results to 30 June 2020;

.

.

As you can see, goodwill & intangibles have been reduced this year, so I’ll write them off completely. That gives us NTAV of $789.9m - that’s a lot, for a company currently valued by the market at £221.8m.

Therefore a key feature of this share, is that it’s trading at a deep discount to NTAV. That’s the market telling us that it doesn’t think the assets have much productive value. On the upside, it means the shares look solidly underpinned, and there could be hidden value here.

Look at the $429.7m positive working capital position - that’s huge. It does make me wonder whether it might be a breakup situation possibly - i.e. to wind down operations, turn the assets into cash, and liquidate the group, or parts of it? Maybe the shares could reach a low point where asset strippers, or takeover bids from competitors, might appear?

Outlook - very dependent on demand for oil;

"Client activity should improve during 2021, but a sustained recovery in the market will be a function of the decline in COVID 19 driving positive global economic activity. The effects of the pandemic continue to depress demand and weigh heavily on oil price sentiment."

Trading year to date -

In the year to date, Group EBITDA has been c.$28m, with Q3 2020 EBITDA showing a broadly break-even result. The Group continues to report a strong cash position of c.$69m, before lease liabilities, as at 30 September 2020, as working capital improvements continue to generate cash.

Dividends are still being paid -

On 23 October 2020, $3.3m was absorbed following payment of the second interim dividend in 2020, which totalled 2.0 cents per share.

My opinion - I’ve only scratched the surface of this, to get an initial idea of whether it’s worth doing more work on this. There’s more info in the RNS.

It does look interesting actually. I love the deep discount to NTAV, and the strong balance sheet. It’s struggling re trading, being in a very difficult sector, but has down-sized already, and is not bleeding cash.

I think this looks a potentially interesting special situation. Like it or not, the world still needs oil & gas. Therefore, it’s likely that demand could rise again, and if the oil price rises, then producers might want to buy more stuff from Hunting, possibly?

.

Quiz (LON:QUIZ)

Share price: 7.5p (up 4% today, at 14:46)

No. shares: 124.2m

Market cap: £9.3m

(I hold)

QUIZ, the omni-channel fashion brand, announces its unaudited preliminary results for the year ended 31 March 2020 ("FY 2020").

This is a special situation, because the company did a pre-pack administration of its 80 standalone stores, which I reported on here on 10 June 2020. It is crucial to understand how the pre-pack worked, to understand where things are now.

Therefore the historic results for FY 03/2020 are now irrelevant, because the company has dramatically changed - the loss-making shops are gone, and the remaining stores have been renegotiated onto turnover rents. Turnover rents are an absolute dream for a retailer, as it largely de-risks the store portfolio. Rent is paid at typically c.8-12% of turnover, monthly, and flexes up & down according to how the store is trading (subject to a base rent, usually set quite low). In this way, all the remaining shops should now be profitable, or at least close to it. That’s a game-changer for future financial performance, hence why the historic numbers are now not relevant.

Quiz has done a pre-pack administration before, in the 2008-9 Great Financial Crisis. Wind forward to 2017, and that business was floated on AIM at a valuation of £200m! The founding family took out £92.1m as part of the float - not a bad return from a business that had gone bust just 9 years earlier. It’s a good demonstration of how a pre-pack administration can lay the groundwork for a highly successful business in future, unburdened with loss-making sites, and with freshly renegotiated low rents. It’s worked once, I reckon is likely to work again.

Therefore focusing on the historic poor performance is missing the point completely. This is a turnaround, with a clean sheet, and lowered rents. Plus of course it has a decently successful online business. Once growth returns there (if it does), that could be another trigger for a re-rating.

Quiz focused on special occasion wear, which is a great pity, and unlucky, given that special occasions have largely stopped this year. Accordingly, the company has pivoted more towards casualwear this year, but performance is bound to have suffered if your key specialism suddenly becomes unnecessary for customers.

Sales since the year end are heavily down, because that covers the lockdown period, and also because only about three quarters of shops were re-opened. So we’re not comparing like with like here. Even so, this is an awful number below, so the company clearly isn’t out of the woods yet. Although the cost base is drastically lower now,with rents slashed, stores closed, and no business rates to pay;

As a result, the Group's total sales in the six months to 30 September 2020 amounted to £17.2m, a 73% decline on the £63.3m revenues generated in the previous year.

Outlook comments are all-important here;

· Despite very challenging trading conditions during the current financial year to date, the Group has taken multiple actions to preserve liquidity and at 26 October 2020 has £4.8m of cash and £3.5m of undrawn banking facilities.

· As a result of the store restructuring undertaken by the Group following the period end, the Board believes that QUIZ has a more flexible and economically viable store portfolio moving forward with an average lease term of 24 months and a significantly lower cost base.

· The Board continues to believe that the QUIZ brand has strong customer appeal and that the Group's omni-channel business model remains relevant and key to our long-term success….

We are confident that the actions we have taken to preserve liquidity and reduce our cost base while continuing to invest in the brand mean that the Group can return to profitable growth as market conditions improve.

Cash - this is all I’m interested in at this stage. Recovering from a pre-pack administration takes time, and is painful. Supplier confidence takes time to rebuild, and often involves having to pay up-front for new inventories, until suppliers gradually regain confidence in the solvency of newco.

As you can see above, Quiz is still sitting on a decent-sized cash pile of £4.8m (down from £6.9m at 31 Mar 2020), plus has unutilised bank facilities (with no covenants) of £3.5m, hence liquidity looks fine for now. That cash pile buys time to see the stores & online trading recover, hopefully. Remember these are experienced rag traders, who know what to do, and have been doing it for a long time - very successfully in the good times, but clearly not successfully when the economy dives.

Rent reductions - this shows just how deeply the rental costs have been cut, giving a very good starting point for rebuilding the business;

With our new store portfolio structure, on the basis of revenues being at similar levels to revenues in the year ended 31 March 2020, the rent payable would be approximately halved on a like for like basis.

My opinion - I’m encouraged by the cash pile & borrowing availability mean that Quiz is very much still in the game, and stands a good chance of being able to rebuild. My main worry was, would they run out of cash? There’s still plenty available, so that point remains OK.

Only time will tell if management is able to rebuild the business, I don’t know for sure what is likely to happen, nobody does. But Quiz is certainly now in a much better position than many of its competitors. All its problem leases are gone, and the stores are now trading on cheap turnover rents.

The market cap is under £10m, and I feel there’s good potential upside on that, once (if!) the business recovers on its new super-low cost base. Experienced management have done it before, so I think the odds of this recovering are more than 50%. The upside could be substantial, I’ve got a rough idea in my head that this could be a 5-bagger, taking a 2-3 year view, if trading moves back into profit. The downside case is that recovery doesn't happen, and the business gradually runs out of cash, and goes bust. I think we would see that coming, hence could exit at maybe half the current share price.

Looking at the chart, it does seem to be forming a base at around 7p perhaps?

.

.

Revolution Bars (LON:RBG)

Share price: 9.65p (down 2.5% today, at 16:14)

No. shares: 125.0m

Market cap: £12.1m

(I hold)

Launch of CVA in subsidiary entity

We knew this was coming, see my article here on 25 Sept 2020, when the company indicated it was looking at options, including a possible CVA.

CVAs are coming thick & fast in the hospitality & retailing sectors, to a point where companies that don’t restructure their leases through a CVA would be at a big disadvantage.

I’m very pleased RBG has decided to do this CVA, as it will;

- Permanently get rid of loss-making, uneconomic sites,

- Reduce rents on viable, but over-rented sites

- Reduce balance sheet lease liabilities

- Increase profitability & reduce cash burn

Hence a very positive development.

These arrangements do not apply to the entire group, but the largest trading subsidiary;

The Group's Revolucion de Cuba branded bars and four Revolution branded bars operated by other entities in the Group are unaffected by the proposal. Furthermore, there is no impact on RBG with respect to its AIM listed status.

Landlords have already been flexible & helpful it seems;

...a sharing of the rental burden has been agreed by approximately two thirds of landlords for which the Board is very grateful. These arrangements cover a wide spectrum, but many comprise lease extensions or the removal of tenant break options in return for short term rent relief.

Current trading - has been clobbered by the 10pm curfew & local shutdowns;

The Group has reported previously that *comparable venue sales in the 8 weeks from when it commenced the reopening of its bars on 4 July 2020 through to 29 August 2020 were 72.5% of last year, ahead of the level anticipated by the Board at the time of the announcement of its equity fundraising. In the subsequent three weeks, *comparable venue sales remained buoyant at 77.8% of last year, but in the last five weeks to 24 October 2020 have reduced to 49.4% due to the imposition of the 10pm curfew and more recently localised lockdowns, with more severe operating restrictions now affecting many of the Group's reopened bars.

With revenues down by half, the company must be at a point where it would make sense to re-close some of its sites, back into mothball state where cash burn would probably be lower than continuing to trade?

Outlook - as we all know, it’s looking difficult for bars, especially late night operators like RBG, so nothing new here;

Given the latest Government restrictions under which the Group is operating, the Group's trading outlook is uncertain and based on all the information and commentary available, the Board now anticipates that the important Christmas trading period will be severely compromised and any return to near normal levels will not be possible before next Spring at the very earliest.

Paradoxically, that helps make a CVA more likely to be supported by landlords, since they can see how bad the outlook is.

This looks a rather mild CVA, far less drastic than others I’ve seen;

· RBL expects to exit six bars and obtain materially improved rental terms on seven others. Where, improved rental terms are being sought, landlords will have the option to terminate the lease at various junctures over the next two years;

· The remaining 37 bars in the RBL portfolio will not be materially affected. These bars either benefit from Group guarantees, are considered strategic to the brand, and/or rental mitigation has been agreed with landlords in recent months;

Benefit of the CVA - is about £2m p.a. - worth having;

If the CVA proposals are accepted, the Group estimates that its annual cash flows (before one-off costs of implementing the CVA) will improve over the next two years by approximately £2.0m per annum. The CVA will not affect the ordinary course operations of the rest of the Group, which continues to trade as a going concern.

Banking arrangements - the bank is supportive, but monitoring things closely. Remember that the bank has a Govt guarantee over a big chunk of RBG’s facilities, so the facilities should be secure to get the company through to the other side of covid restrictions, I hope (but nobody knows the timings for sure). When things do return to normal, there’s likely to be a lot less competition, so expect an absolute bonanza for RBG at some point in 2021, if it survives.

My opinion - clearly this is now a special situation, which is all about survival until social distancing & other restrictions are lifted. I think that’s visible on the horizon, as quick/cheap testing should be available within months, and vaccines are also apparently close to early stage launch.

After extending the bank facilities, and the equity fundraising, my understanding is that RBG has plenty of liquidity to take it well into 2021.

What would this business be worth, once trading conditions have returned to normal? I reckon 3-5 times the current valuation is about right. It would be able to repay debt fairly quickly, because in normal circumstances, this is a highly cash generative business. Even more so in restructured form, with all the loss-making sites gone. Plus it might have opportunities to snap up bust competitor sites for a song.

At this stage, I think risk:reward is good. Obviously it’s been a disastrous investment so far, because of covid, but that’s irrelevant in terms of making an investment decision to buy/hold/sell today. All that matters is what the future holds. I see favourable risk:reward, because I think the group can get through to a covid recovery world before it runs out of cash, especially given that the rents are now coming down for problem sites with this CVA. This business should be making £15m+ p.a. EBITDA once it can trade normally, in my view. That’s what makes it so interesting. Its customers are young, and want to party. Therefore demand is like a coiled spring, that’s going to be released at some point, we just don’t know when.

.

No chart here, as I can't bear to look at it!!

All done for today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.