Good morning, it's Paul here.

Please see the article header above, which shows the companies I intend reporting on today - quite a lot to cover, so it would be helpful if we could keep reader requests to a minimum.

FCA review of CFDs

This is an interesting RNS. It's the FCA's findings from its review of CFD/Spread Bet companies. The prices of spread bet company shares have dipped this morning in response to this report, which is critical of the sector, although it doesn't name the worst offenders.

What puzzled me is that, at the start of this RNS from the FCA it says;

We recently carried out a review of the CFD market. It looked at where firms offer these complex, high-risk instruments to retail customers on either an advisory or discretionary (including limited power of attorney) portfolio management basis.

As far as I'm aware, the vast majority of CFD/Spread Bet accounts are execution-only, hence would not fall within the scope of this review. Therefore, maybe it's a storm in a teacup, and could be a buying opportunity? There are some nice dividend yields available, e.g. with IG Group (LON:IGG) it yields just over 4.5%, and CMC Markets (LON:CMCX) (in which I have a very small long position) yields about 5.0% currently. These companies have very strong balance sheets too.

The FCA is very critical of the processes, but short of any draconian penalties, it's difficult to see how this will actually harm earnings at these companies.

Crypto-currencies (again!)

Spread bet companies must be coining it in (geddit?!!) with crypto-currencies. I know personally that I've handed wads of money to IG on a plate, punting unsuccessfully on Bitcoin (no current position). I've now given that up as a bad job.

The trouble with these ridiculous crypto-currencies, is that they're so volatile that you just constantly get stopped out, if you punt on them via spread bets. So they're ideal (i.e. highly profitable) instruments for the spread bet companies to offer to clients, as the provider is usually the big winner, scooping profits from people who are long or short, as prices violently spike up & down. Both long & short punters tend to have very strong opinions on the value (or not) of crypto-currencies, which again is ideal for the spread bet companies, as punters are more likely to hang on to losing positions where their conviction level is very high (I'm speaking from experience here!).

The whole area is best avoided, in my view, as the inevitable collapse in crypto-currencies looks increasingly likely, and on the horizon, in my view. NB please note I am specifically talking about the value of crypto-currencies here. I am not rubbishing blockchain technology, which looks potentially very interesting. So the most likely long-term outcome, in my view, is a collapse in the value of pretty much all current crypto-currencies - a good thing, as the environmental impact of "mining" is scandalous - apparently Bitcoin now consumes more electricity than Denmark. This is shameful, at a time when we should be doing everything we can to reduce emissions.

When this area could get interesting, is once banks & credible Governments start launching blockchain currencies. With the asset & tax-raising powers of Governments behind it, a new official digital currency could perhaps become viable? Although it would need to achieve a stable valuation, rather than attracting the stampeding herd of mainly naive millennials, speculators who are currently having a field day with existing, fundamentally worthless crypto-currencies such as Bitcoin. (and yes I'm sure we're all secretly wishing that we'd joined them, and 10-bagged our money this year!!)

Eventually, some formula will probably be created which makes blockchain-based money a reality. Although you could legitimately ask why is that needed? We already have digital money, on which the whole banking system is based. I don't see the power of Governments & central banks to print more money as being a problem for all major currencies. We all know that money gently depreciates over time, which is why we buy assets which correspondingly appreciate, rather than holding cash for long periods of time. The main purpose of crypto-currencies is to by-pass laws and regulations, and anonymise criminal transactions. Once those loopholes have been closed by Governments, then criminals will probably just go back to using bundles of cash, and/or fake identities.

Online Blockchain (LON: OBC)

Talking of which, this company (a dormant minnow which owns a stake in ADVFN is one of the more amusing episodes in the whole blockchain mania. If you fancy a good laugh, I urge you to watch this hilarious video where Clem Chambers explains why he changed the company's name, causing the shares to 10-bag recently.

I still can't decide whether he deliberately made this comedic to attract more views, or whether he's really as bonkers as he appears! Anyway, it's a great advert for the increasing lunacy of the whole crypto-currency space, where fast bucks are being made (on paper at least), and where collapse is looking more & more likely, precisely because so many opportunists are jumping on the bandwagon with half-baked concepts.

It's all strikingly reminiscent of the dot.com bubble. I joked on Twitter last night that we'll know the timing of the bubble's top when Mark Slater launches a crypto-currency investment fund! (he famously jumped on the dot.com bubble just as it was starting to crash, and [to his credit] didn't actually squander any of the funds he raised, unlike other similar ventures at the time).

Having 10-bagged its share price with a name change, and a lot of hot air, the company has announced a placing at 100p (the share price closed last night at 152p). This is all absolutely classic market mania stuff - exactly the same as we saw in 1999. The dot.com bubble burst shortly afterwards, in Mar 2000 onwards. So I'm expecting the crypto-currency bubble to pop fairly soon, maybe March 2018?

Long-term, I'll be curious to see what applications blockchain distributed ledgers are used for. It could be very exciting, and the scope seems to be there to disrupt many sectors. Maybe instead of issuing worthless coins, there might be a small fixed fee for every transaction, for people who manage the distributed ledger? The method used needs to be sustainable anyway, and not result in vast and unnecessary electricity consumption, and speculative bubbles in ultimately worthless virtual coins.

Fascinating stuff! Feel free to agree/disagree/ignore my ramblings on this issue, it's just interesting to discuss it, and is certainly the hot topic of the day.

OK, on to some small caps.

QUIZ (LON:QUIZ)

Share price: 151.75p

No. shares: 124.2m

Market cap: £188.5m

QUIZ, the omni-channel fast fashion womenswear brand, is pleased to announce that Christmas trading was in line with expectations with a 31.9% (31.2% constant currency) increase in Group revenue for the seven-week period from 19 November 2017 to 6 January 2018 (the "Period") against the comparable period last year*. This strong performance reflects continued good growth across the Group's omni-channel business model as well as the increasing awareness of the QUIZ brand.

The strong revenue growth is due to increasing store numbers, international expansion, and excellent online growth (up an excellent 119%).

Gross margins also in line with expectations - due to strong full price sales.

International sales up 51.1%

Outlook - nothing specific said, but optimistic-sounding tone of comments.

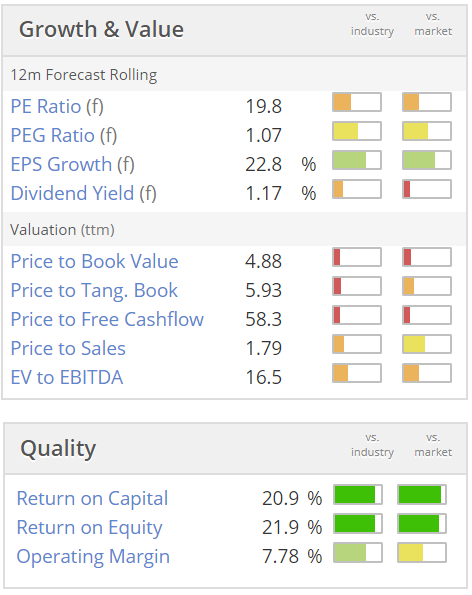

Valuation - looks reasonable, for a growing company;

My opinion - on the numbers alone, this looks a very good GARP stock.

However, I can't quite shake off an uneasy feeling about this stock. Maybe it's because the IPO was priced aggressively, and that the founding family cashed in a lot of their chips at the time? So on balance, I'd probably like to see more of a track record of strong performance before buying back in. The trouble is, that risks missing the boat, if the shares suddenly move up strongly. Also, I'm not convinced about the strength of the brand, and the physical stores look a little dated to me.

I was impressed with management, when I met them at the time of the IPO. They seem hard-working, experienced rag traders, who have also grasped the eCommerce side of things, and are growing that strongly (albeit from a small base).

Overall, this one's quite high on my watchlist. If the share price continues drifting down, then I'd probably buy some, but haven't decided at what level yet. Will just play it by ear.

This chart looks like a case of IPO-indigestion - i.e. brokers usually seem to float new companies with large blocks of shares dished out to institutions. That then means the aftermarket is very illiquid, so if any institutions want to sell, there isn't a liquid private investor following for the company yet - that can take a year or two to develop. Hence the share price drifts down. That in turn turns off many private investors, who generally like buying shares which are in a rising trend.

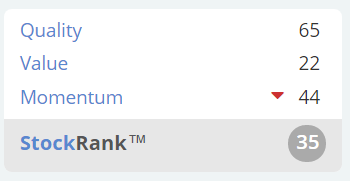

The StockRank seems very low. I suspect this might increase over time, so we could perhaps anticipate an improvement in the StockRank?

With positive news out today, I imagine the share price probably isn't far off finding a low point, so I'll keep an eye on it & might pick up a few at some point. Today's news seems encouraging anyway.

Superdry (LON:SDRY)

Share price: 1905p (down 6.6% today, at 12:16)

No. shares: 81.6m

Market cap: £1,554.5m

(at the time of writing, I hold a long position in this company)

Half year report - covering the 26 weeks to 28 Oct 2017, and an update on peak trading.

This is an international, branded fashion chain, website here. It's a larger market cap than we usually cover here, but as it's retail, and a lot of readers like it, I'll reviews its interims.

I don't understand why the share price has fallen today, because the interim results are in line with expectations, and the full year outlook is also in line. Perhaps some investors were expecting something better?

... Having traded through our peak trading period, the Board remains confident in delivering full year underlying profit before income tax in line with the range of analyst expectations5 and in the quality of the sustainable financial performance we can deliver."

The footnote is very helpful, in specifying what expectations are. All companies should do this! If they don't, then it's deliberately leaving private investors in the dark, which is not acceptable.

5. The Board considers market expectations for the financial year ended 28 April 2018 are best defined by taking the range of forecasts published by analysts who consistently follow the Group. The consensus of underlying PBT forecasts as at 5 January 2018, of which the Board is aware, is £98.9m with a range of £97.7m to £100.6m.

There's a strong H2-weighting to profits, so the full year EPS forecast shown on the StockReport is 95.8p. A broker update I have this morning shows a whisker over 100p EPS forecast for this year, so I'll base my numbers on that round sum. The valuation for the current year ending 04/2018 is therefore a PER of 19. I think that's good value, for such a strong, growing, international brand, with an excellent growth track record, and seemingly more to come;

Current trading - I'm wondering if this section might have unsettled some investors?

Group retail LFL sales growth is reported at +4.7%. That's good, but down on the exceptionally high prior year comparison of +14.9%.

Payback period - on new stores has lengthened from 23 months, to 25 months.

Online sales - are now 25.2% of total retail revenue (up from 21.6% a year ago) - clearly this channel is now very important to the company.

My opinion - I'm being pulled from pillar to post today, with various things going on, so I've not had time to properly sit down quietly to read the narrative & digest the numbers properly. So more work is needed.

However, since the interim results are in line with expectations, and recent trading is also in line, then I've been buying more, adding to my existing position. This is one of my favourite growth shares at the moment. Unless there's something bad that I've not spotted yet, then I think this could be a good buying opportunity.

Note also that the company is forecast to generate substantial free cashflow over the next few years, which should allow the company to greatly increase its dividends.

The balance sheet is strong too. So overall, this one gets a firm thumbs up from me - I see this as a credible GARP share.

Moss Bros (LON:MOSB)

Share price: 74.3p (down 17.4% today, at 13:26)

No. shares: 100.8m

Market cap: £74.9m

Trading update (profit warning) - bad news today for shareholders in this menswear retail & hire business. Today's update covers the 23 weeks from 30 Jul 2017 to 6 Jan 2018.

This bit isn't too bad;

The Group continued to make progress, growing retail sales against a very challenging consumer backdrop but due to lower footfall than anticipated during December, particularly in stores, the business expects to report a full year profit before tax performance within a range of 6.5m to 6.8m, which is slightly below current market expectations.

The year end is end-Jan 2018, so the company will know the full year picture with accuracy by now.

More concerning is that recent trading has shown a sharp deterioration;

We have seen volatility towards the end of the period, with Aug-Nov store sales performing markedly better (+1.2% LFL) than the period since the beginning of December, to date (-8.0% LFL).

A swing that large, from positive, to heavily negative LFL sales, suggests to me that something is going wrong internally. That's not market conditions, that's not having the right product offering and value proposition, to attract enough sales.

Ecommerce sales are up 12.3% in H2 - good, but well below the eCommerce growth rates that lots of other companies are reporting.

Gross margins - a big fall here, of -3.0% in H2 to date. This is much worse than the -0.7% in H1. Lower sales, and lower margins, is a nasty mix. Again, it's indicative of something going wrong with the product offer & pricing.

Cash - is still plentiful, and material to the market cap of £74.9m;

The Group continues to maintain a healthy cash balance as it is strongly cash generative and expects to end the 2017/18 year with net cash of c. 17.0m (19.5m as at 28 January 2017).

Outlook - the key bit is worrying;

... Given that we expect these challenging retail conditions to continue for the foreseeable future, the Board anticipates that this will impact anticipated profits for FY2018/19...

My opinion - menswear generally is very difficult. There's a reason that you hardly see any standalone menswear stores on the High Street - because it just doesn't generate enough sales per square foot to cover the rent, rates, wages & other overheads. Hence why menswear is usually sold in lower rented parts of bigger stores, like the basement or first floor within Next, M&S, etc. It's the womenswear that's the big earner for them. Men just don't buy anywhere near as many clothes as women. Also many of us are largely oblivious to the appearance of our clothes, and feel most comfortable in the same old, battered clothing that we've worn for year. Whereas women tend to be more fashion-conscious.

MOSB only makes a smallish operating profit margin, and they're clearly now under pressure, so the margin will be shrinking going forwards. Hence broker forecasts will be coming down, and the big dividend yield won't be covered by earnings. The company continue paying out big divis, and deplete its cash pile, but that obviously cannot carry on forever.

I can't see any reason to get involved here. It would need to be 40p or below to start to interest me. The StockRank of 92 is likely to fall now, so it's important to disregard the StockRank for any company immediately after a profit warning, as the bad news might take a few days to be reflected in the broker forecasts, etc.

Shoe Zone (LON:SHOE)

Share price: 160p (down 1.2% at market close)

No. shares: 50.0m

Market cap: £80.0m

Shoe Zone plc ("Shoe Zone", the "Company" or the "Group"), the leading UK value footwear retailer, is pleased to announce its Preliminary Results for the 52 weeks ended 30 September 2017.

Revenue fell 1.3% to £157.8m. This fall reflects net store closures. Unfortunately, the company doesn't seem to disclose its LFL sales performance, which is a pity.

Loss making stores now make up only 6% of the Shoe Zone portfolio, having been 11% three years ago. Overall store numbers reduced by a net 14 branches to 496 at the year-end (2016: 25 branches closed leaving a total of 510).

The flexible store portfolio, and short leases, is a key strength of this business. Also, the low capex required to fit-out a shoe shop is another advantage. Therefore SHOE doesn't get lumbered with problem, loss-making shops - it can exit from them very easily - a big advantage. The company should therefore be a beneficiary of falling High Street rents in many towns, in a way that many other retailers will not benefit (due to them having longer leases, with upward-only rent reviews). Short leases are absolutely critical at the moment, for retailers to maintain their profitability.

It is targeting 20 new stores in 2018 - 10 of which are the new "Big box" warehouse format.

Gross margin is very strong, at 63.2% (up from 62.0% last year). This compares favourably with most fashion retailers, which tend to achieve a gross margin of around 55%. This is achieved by direct sourcing product from China, and I imagine that stock loss (i.e. theft by customers & staff) would be lower for footwear than for clothing.

I'm very impressed that the amount of stock sold at markdown prices is only 7.6%. This figure is not normally disclosed by retailers, but in the fashion world it is generally much higher than this. So ShoeZone is clearly pricing its product competitively, with customers happy to buy at full price.

Profit before tax fell 8% to £9.5m. The company says this is;

... primarily due to the adverse impact of foreign exchange on imported goods into the UK

That doesn't make sense to me. I would have expected higher cost of imported goods to flow through into a lower gross margin. In this case gross margin is higher, but it seems that some product cost has gone through administration expenses, which sounds peculiar to me. Maybe the gross margin actually fell, if forex losses had been put through cost of sales?

EPS fell by 6.5% to 15.8p. This gives a PER of 10.1, which seems about right to me. It's cheap, but that's because earnings have fallen.

Dividends - a final divi of 6.8p is flat against last year. The interim divi was 3.4p (paid in Aug 2017), giving total divis of 10.2p, a attractive yield of 6.4%. The divi income is the main reason for holding this share.

Note that shareholders were also paid special divis of 6p in Mar 2016, and 8p in Mar 2017. It sounds like there won't be a special divi in 2018;

The board remains committed to delivering positive dividend growth to shareholders. In recent years, the strategy has been to pay out around 60% of post-tax earnings as a normal dividend and any surplus cash above £11m as a special dividend.

For the year ended 30 September 2017, the board is proposing to pay out 65% of post-tax earnings as a normal dividend. The £0.8m surplus cash over and above the £11m that is required for the business to operate effectively will be reinvested in the business. This results in a final dividend of 6.8p per share (2016: 6.8p), giving a total dividend for the year of 10.2p (2016: 10.1p) per share.

This is a model of clarity, so well done to the company on that. It is managing investor expectations very well, and generally I find its accounts & narrative crystal clear. Excellent stuff - if only all companies could do things this way! Mind you, ShoeZone is a simple, and cash generative business, so they have nothing to hide.

eCommerce - revenue rose a creditable 34%, and this contributed £2m towards profits in 2017 (before central overheads). So this is becoming significant to profits, although it's only 5.3% of total revenues, at £8.3m. I would like to see this growing faster, which might then drive a future re-rating in the share price, perhaps?

Outlook - sounds alright;

Shoe Zone has made a solid start to the year and trading is in line with expectations. We are making good progress against our strategic objectives and the board remains positive about the outlook for the Group for the remainder of the year.

This is despite mentioning "challenging" & "difficult" economic conditions. Although being at the value end of the market, SHOE should prove more resilient than others, if consumer spending does fall.

Balance sheet - is strong.

NTAV is £31.2m - very healthy for the size of company.

Working capital - looks good, with a current ratio of a healthy 1.67 (for retailers, which don't have much in the way of debtors, anything over about 1.0 is normally fine).

Net cash is £11.8m

Pension deficit has come down sharply, from £13.1m to £7.1m, reflecting higher bond yields. It might well be worth looking at companies with pension deficits now, as the trend should now be downwards, due to interest rates starting to move up.

Cashflow is excellent, with £13.9m cash generated from operations, flat against last year.

Capex rose by 61% to £5.1m, reflecting the cost of new stores. The big box stores must cost a lot more to fit out than regular stores.

Dividends of £9.1m were paid out, which was not covered fully by cash generated (after capex), so the cash balance fell from £15.0m to £11.8m. Not a concern, but worth noting.

My opinion - as you've probably gathered from the above, I like this company. The figures are simple, and easy to understand. It is decently cash generative, and above all has a very flexible store portfolio with short leases. So it can adapt to market conditions, and has only a short tail of loss-making shops.

We're in a bull market, where people are chasing growth companies. So this has left behind a lot of value shares like this. Therefore there might only be very limited upside on the share price? So this share is more of interest to long-term shareholders, seeking a reliable high dividend stream. The divi yield here is excellent, at 6.4%, and that looks sustainable to me - due to being reasonably well covered by earnings, and the company having a strong balance sheet with net cash. Plus shareholders get special divis every now & then (but don't expect anything in 2018).

Overall then, for income seekers, I think this share could be an attractive option. As always that's subject to you doing your own due diligence on the share. I'm not recommending anything here, just giving my personal opinions - which are sometimes right, and sometimes wrong.

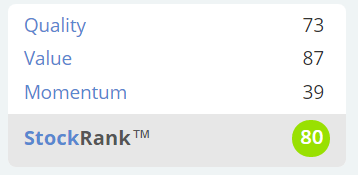

Stockopedia also looks favourably on this share, with a decent StockRank. I always like to sense-check my own research & view, by having a look at the StockRank - it's an excellent way to make sure I haven't got the wrong end of the stick. I visualise the StockRank as having a Warren Buffett type figure leaning over my shoulder, pointing at the screen saying, "Be careful here, have you thought about xyz, etc"!

Focusrite (LON:TUNE)

Share price: 347p (up 3.6% today, at market close)

No. shares: 58.1m

Market cap: £201.6m

AGM trading update - the company has a 31 Aug 2018 year end, so it's just over a third of the way through the current financial year. Description;

Focusrite Plc (AIM: TUNE), the global music and audio products company that trades under the Focusrite and Novation brands around the world

Today's update just gives a general impression, rather than any specifics;

"In November 2017, at the time of our final results announcement, we updated the market that our revenue and cash had both grown further since the year end. I am pleased to confirm that this strong growth has continued in November and December."

I think this is too brief. The company should have given an indication of where its performance is versus full year market expectations. Whilst that is tricky to do early on in the financial year, they could have said whether performance is consistent with full year expectations or not. I think the company and its advisers should consider being a bit more open with investors.

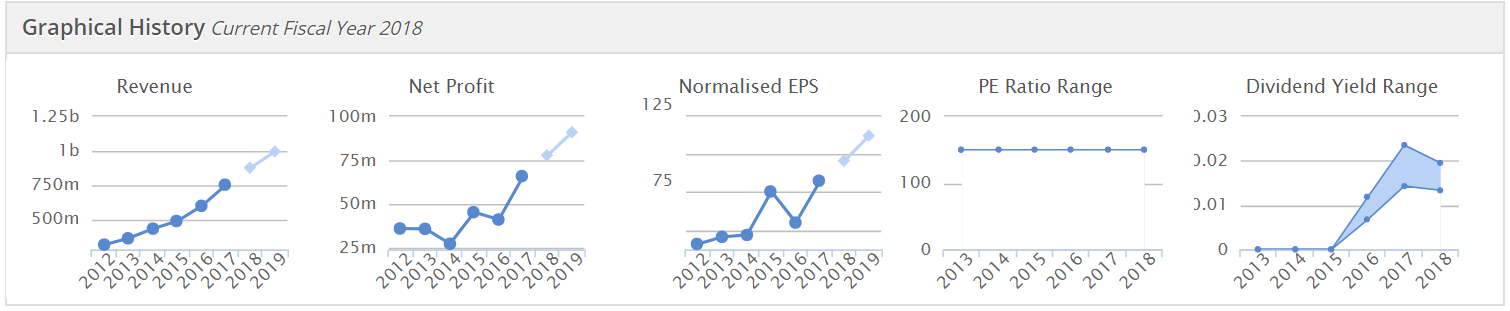

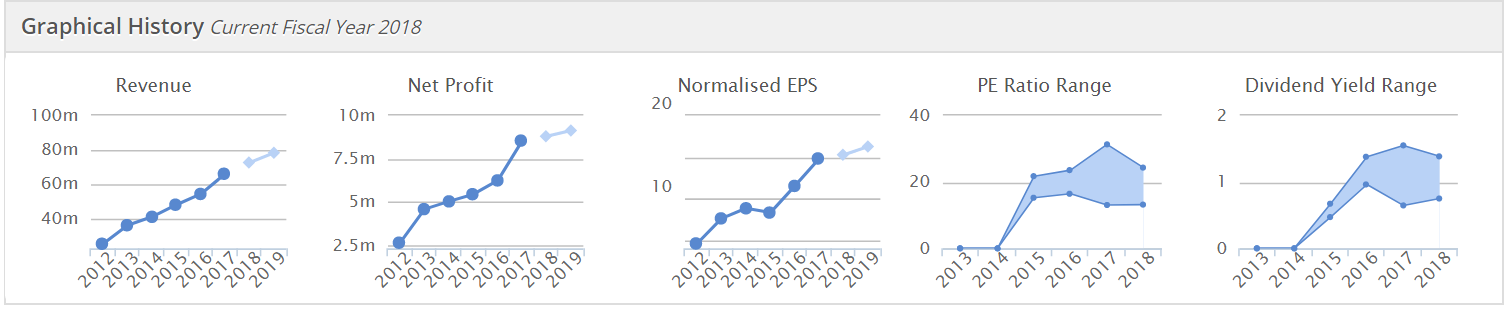

My opinion - I've written positively about this company in the past. It seems a high quality company, with an excellent track record, as you can see from the Stockopedia graphs here;

Although the valuation is high (forward PER of 22.2), this seems justified, given its excellent track record. Although that's no guarantee of future performance, of course.

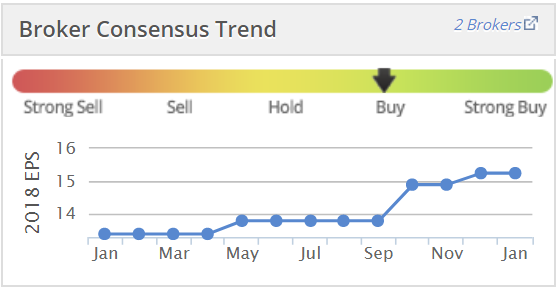

Brokers are routinely pushing up earnings forecasts, which suggests that the company might surprise on the upside in future;

Overall, if your own research suggests to you that profits are likely to continue rising in future, then this share could be worth considering. I'd want to understand its market, and competitors more before considering a purchase myself.

Cambridge Cognition Holdings (LON:COG)

Share price: 127.2p (down 15.8% today, at market close)

No. shares: 20.7m

Market cap: £26.3m

Trading update (profit warning)

Cambridge Cognition Holdings plc, (AIM: COG), the specialist developer of computerised tests for detection and monitoring of neuropsychological disorders, announces a trading update for the year ending 31 December 2017.

It's a profit warning, on delayed contracts, unfortunately;

The Company had expected to sign two large contracts with a combined value of approximately 2.3m in the last quarter of the year, and whilst the contracts are at an advanced stage, they are now expected to commence in the first half of 2018.

Consequently, revenue for the full year to 31 December 2017 is expected to be marginally below the 6.9m reported in 2016 with the sales order pipeline value as at 1 January 2018 up 56% on the prior year.

The Company now expects to be broadly break even for the year at the EBITDA line (before share based payment charges).

My opinion - quite an interesting company, which is taking a long time to move into profit, now delayed again. There could be something interesting here, if it can make a major breakthrough into the pharmaceuticals testing market. I'm keeping a vague eye on it, but don't see any imperative to buy any at the moment.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.