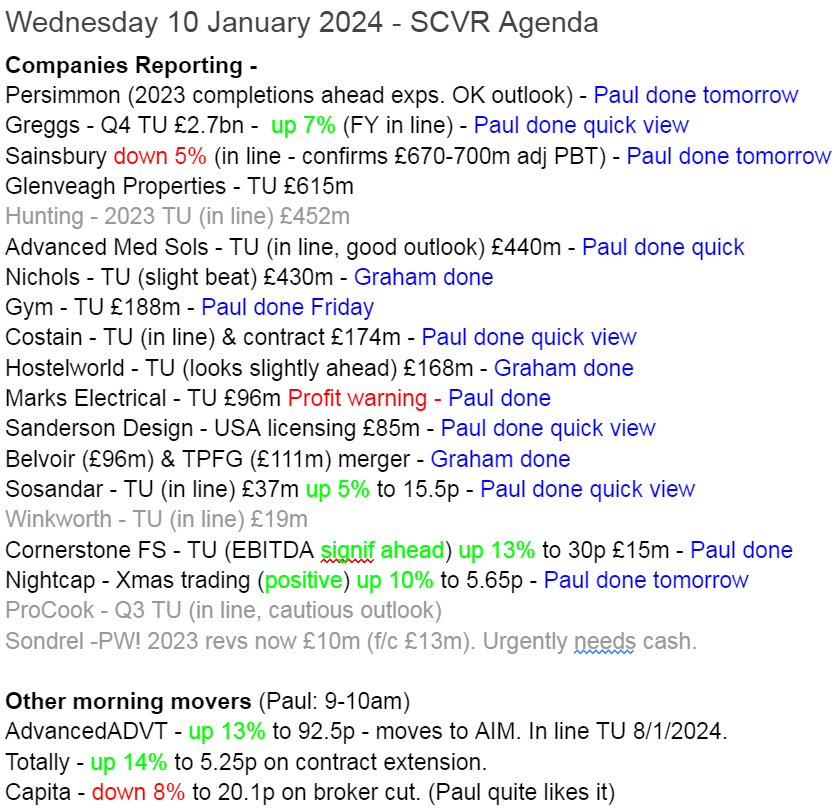

Good morning from Paul & Graham!

Today's mammoth report is now finished!

I've finally finished my long form article with my top 20 2024 share ideas, here's the link. It's the same shares as I put on my 2024 spreadsheet, originally linked to in the SCVR for 2/1/2024, so nothing's changed, I've just gone into a bit more detail about my selection process, and I reviewed each share in more detail to make sure I'm still happy with them. It's quite surprising how, only a week into the new year, we've already had some significant movers both up and down.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Live prices tracking spreadsheet for Paul & Graham's 2024 share ideas (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs) - search on any podcast provider for "Paul Scott small caps", or web link here.

Summaries

Jupiter Fund Management (LON:JUP) - down 16% to 74.7p (£407m) - Fund manager leaves, trading update (profit warning) - Graham - BLACK (PW), GREEN on fundamentals

A double blow for Jupiter shareholders as a “star” fund manager departs to set up on his own, although his replacements are already waiting in the wings. These shares are extraordinarily depressed; the market is pricing in disaster but I still see value to be had.

Marks Electrical (LON:MRK) down 28% to 66p (at 08:06) £69m - Trading Update (profit warning) - Paul - BLACK (PW), AMBER/RED on fundamentals

A nasty profit warning, caused by already low margins going even lower, due to consumers being very price-conscious, and selling third-party electrical brands has zero pricing power. Forecast EPS almost halved to just 2.59p, and who knows if/when margins might improve? Still looks significantly over-valued to me.

Belvoir (LON:BLV) - up 4% to 266.65p (£99m - Recommended All-Share Merger With TPFG - Graham - GREEN

Big news for estate agents as the two major listed franchisors announce that they wish to merge in an all-share deal (i.e. no cash is being paid, only a share swap). I was already a fan of both companies and believe that this is an excellent development for both of them.

Nichols (LON:NICL) - up 5% to £11.84p (£432m) - FY23 Trading Update - Graham - GREEN

There is a “slight” beat of profit forecasts here for 2023, as closing down unprofitable accounts in the Out-of-Home segment has led to benefits earlier than anticipated. A new member of the Nichols family joins the Board, and my positive stance is unchanged.

Cornerstone FS (LON:CSFS) (I no longer hold) - up 17% to 31p (£18m) - Trading Update - Paul - AMBER/GREEN

A modest beat against FY 12/2023 forecasts, which had already been raised considerably. Transformation year, moving from losses into a decent profit of £0.8m adj PBT. I've moderated my view from green to AMBER/GREEN simply because the share price has 5-bagged since May 2023, and the valuation now looks up with events I think. That said, 100% revenue growth in 2023 is startling, and if stellar growth continues, on high margins, then the numbers could go through the roof. I'm not terribly confident about payment/forex companies.

Hostelworld (LON:HSW) - up 6% to 141p (£174m) - FY23 Trading Update - Graham - GREEN

Hostelworld beats expectations as it continues to enjoy lovely momentum in trading in this post-Covid era. The balance sheet has been fixed with net debt remaining of less than 1x EBITDA. I admire the company’s progress greatly but valuation continues to look full.

Quick comments from here onwards

Greggs (LON:GRG) - up 7% to 2658p (£2.7bn) - Q4 Trading Update - Paul - AMBER/GREEN

Still expanding fast food chain, now with 2,473 shops (80% company, 20% franchised).

Strong Q4, and a strong year, with FY 12/2023 LFL sales up 13.7% - above inflation.

Confirms FY 12/2023 “in line with our previous expectations”.

“Inflationary pressures reducing”

Net cash £195m

Paul’s opinion - terrific business, and I like the sector for possible margin expansion, as food/energy prices might recede? But high wage inflation won’t help from April 2024. Very popular with subscribers here, hence why I’ve looked at it today. Maybe priced about right on c.PER 20x?

Sanderson Design (LON:SDG) - up 3% to 123p (£88m) - Licensing Agreement in USA - Paul - GREEN

A long-standing SCVR favourite value share. 2023 saw weaker demand for the core business (high end fabrics & wallpaper), but buoyant licensing income from its extensive historic design archive.

Today’s non-regulatory (Reach) contract announcement is not material overall, but I see it as encouraging, since SDG’s strategy is to increase its presence in the large US homewares market. The deal is for William Morris designs to be used on homeware products. Product launches are mid-2024, and £0.7m (almost pure profit) advance licensing income will be recognised this year FY 1/2024.

Paul’s opinion - this reinforces my positive view of SDG. Shares are edging up now, so we could be over the worst maybe? It was on my 2023 top ideas list, but didn’t quite make it onto 2024, but was a strong contender. Looks good value, and lovely balance sheet too.

Costain (LON:COST) - up 8% to 67.8p (£187m) - Trading Update - Paul - AMBER/GREEN

We gradually warmed to Costain in 2023, as the newsflow improved, turning green on 23/8/2023 due to cheap valuation, strong balance sheet, and improved forecasts. Although not a sector we like (low margin contracting).

Today it announces another “significant win” in the water sector.

Overall trading for FY 12/2023 is said to be in line. Net cash at year end is significantly above expectations, at £164m.

Paul’s opinion - looks quite interesting, PER only 5.4x. Note pension scheme (covered in our archive). Not my cup of tea, but providing they don’t screw up any big contracts, then it might be a share worth looking at. Small divis seem to be resuming this year.

Sosandar (LON:SOS) (Paul holds a few) - up 3% to 15.25p (£38m) - Trading Update - Paul - AMBER

This fashion brand dropped a bombshell on 18/10/2023 with a striking change of strategy to full price only sales, and has decided to open some physical shops. Trouble is, it also revealed that instead of a £3.1m forecast PBT for FY 3/2024, it would only be £0.1m. That completely threw me, and I’m amber on this share now (only holding a few personally, it’s not a conviction share for me at the moment).

Today it reveals a solid peak quarter’s trading (Oct-Dec 2023) - revenues up 23% vs LY. Gross margin is high, and up, at 58.3% (LY Q4: 56.8%) - includes lower margin wholesaling, so retail margin is higher still.

Net cash of £7.7m at Dec 2023 looks healthy, but bear in mind they’ll be depleting that for store fit-outs once physical sites begin to open. My guess is c.£150-250k capex per site, depending on size and condition, probably assisted by landlord incentives. They only need to do a handful of stores to see if the concept works or not. First site opens soon, spring 2024.

International - “successful launches” through partners in Canada & Australia. Strategic goal of £100m+ revenues, and 10%+ PBT margin sounds ambitious, but I wouldn’t bet against them achieving it. Overall - trading in line with expectations, which is basically at breakeven (£0.1m PBT).

Paul’s opinion - I’m keeping an open mind here, no strong view either way at the moment.

Advanced Medical Solutions (LON:AMS) - up 5% to 213p (£452m) - FY 12/2023 Trading Update - Paul - AMBER/GREEN

Winsford, UK: Advanced Medical Solutions Group plc (AIM: AMS), the world-leading specialist in tissue-healing technologies…

In line with expectations for FY 2023 and poised for strong growth in 2024

The Group is pleased to report Full Year 2023 results are expected to finish towards the middle of its published guidance ranges of £124-127 million for revenue and £25-27 million for adjusted profit before tax.

Furthermore, following the successful completion of a number of key strategic marketing initiatives and product launches during 2023 across the Group, AMS is primed to generate strong double-digit growth in 2024.

That’s all self-explanatory, and sounds quite good to me.

AMS warned on profits on 4/9/2023, but the 25% drop to 185p looked quite interesting, and I flagged that it might be worth a closer look here. The cash pile was 20% of the market cap then too.

Paul’s opinion - it looks quite good I think. Forward PER is almost 20x, but that comes down if cash is adjusted out. EV/EBITDA is 11.6x, not excessive for the sector. Previously a massive multibagger, but profit growth fizzled out over the last 6 years. If growth is now resuming, then things could get interesting again perhaps? I wonder if it has any key patents that it relies on to generate fairly high profit margins? Nice quality scores. I think I’ll up my view to AMBER/GREEN.

Paul’s Section:

Marks Electrical (LON:MRK)

Down 28% to 66p (at 08:06) £69m - Trading Update (profit warning) - Paul - BLACK (PW), AMBER/RED on fundamentals

Marks Electrical Group plc ("Marks Electrical" or "The Group"), a fast-growing online electrical retailer, provides a trading update for the nine months ended 31 December 2023 ("the period").

Bad luck to holders here. Today’s news is a continuation of the trends noted in its last profit warning that I reviewed here on 13 Oct 2023 - good revenue growth (now 22%, 9 months YTD), but margins under further pressure.

Today it says -

In a challenging trading environment where consumers remain highly price-conscious, our gross product margin did not increase to the levels we expected, and despite proactive action on other controllable costs, the impact of this in the peak trading period has had a material impact on our full year profit guidance.

Revised guidance - but no mention of what previous guidance was, which is so annoying and wastes our time having to look it up -

…we now expect our full year revenue to be in the range of £115-118m with EBITDA in the range of £5-6m

Broker updates - thanks to Canaccord and ED, both issue updates.

Canaccord drops FY 3/2024 EBITDA from £8.0m to £5.0m, down 38%. This ignores the £1.64m depreciation charge, so adj operating profit is only £3.36m.

EPS is more useful to me, that is now forecast at only 2.59p (adj, diluted) - almost halved from the c.5p achieved in the last 3 years.

Forecast gross margin dropping from 19.4% in FY 3/2023, to only 15.4% in FY 3/2024.

Equity Development has exactly the same forecast EBITDA and EPS.

Outlook doesn’t sound great either -

… remain cautious on the speed of recovery in consumer buying patterns, which we expect to temporarily impact the recovery of our gross product margin…

As we work tirelessly as a team to enhance our gross product margin in the remaining months of FY24 and into FY25, I also know from 37 years of trading that margin fluctuations are inevitable, they present us with an opportunity to learn, and will ultimately enable the Group to deliver long-term value creation and position us as the UK's leading premium electrical retailer."

Paul’s opinion - this looks bad, and I don’t think we can just assume that the margins will improve in future. As MRK says, consumers are “highly price-conscious”, and sector retailers have zero pricing power, because the products are not their brands. Hence many (most?) consumers just shop around for the best price online, once they have identified which product they want.

Good service helps I’m sure, but ultimately it’s all about price. That’s what a lamentable 15% gross margin is confirming.

Previously I thought MRK stood out as the best UK electricals retailer, due to its efficiency, and penny-pinching owner/manager (far too large shareholding at 74%). However, I think now its forecast earnings have halved, obviously due to competitive pressures (from a resurgent AO. maybe?), the sheen has really come off MRK shares.

We reviewed it a lot previously, liking the business, but only seeing it as amber (2023: 13/4, 14/6, and 10/8) due to the shares being too expensive each time.

I went a lot more negative with the sneakily concealed profit warning of 13/10/2023, slipped out via broker updates.

For me, today’s update has ruined everything. I would say the new base for EPS is probably around 3p, not 5p previously. It doesn’t deserve a PER of more than about 12, in my view. Hence I’m getting to 36p valuation - almost half today’s already reduced price.

Why would we want to gamble on it increasing future margins, given that we know this is a horribly competitive low margin sector? They might be able to improve margins, but probably not by much, is my guess. So upside could be 4p EPS, and a PER of say 15 - so 60p if I’m being generous. Today’s 66p share price is therefore asking us to pay up-front for both a partial earnings recovery, and a highish PER for a very low margin business. Why would we want to buy that scenario?

So sorry to bulls, but I’m turning more negative on this, it’s AMBER/RED.

There are no solvency concerns though, and you can’t beat the motivation of a 74% owner/manager to turn it around. So patience might pay off here in the long run, but in the shorter term, I think it’s still significantly over-valued. Should it be listed, or taken private?

Heading back towards the autumn 2022 lows -

Cornerstone FS (LON:CSFS) (I no longer hold)

Up 17% to 31p (£18m) - Trading Update - Paul - AMBER/GREEN

Cornerstone FS plc (AIM: CSFS), a foreign exchange and payments solutions company offering multi-currency accounts to businesses and individuals through its proprietary technology platform, is pleased to provide an update on trading for the year ended 31 December 2023…

We’ve only looked at CSFS once, here on 4/12/2023 I was GREEN - flagging a series of positive trading updates which had reduced risk and transformed profitability, and its then modest valuation. It’s since doubled in price in just 5 weeks, so that’s been a nice little trade. For disclosure purposes, I sold mine recently to raise cash for more purchases of Tortilla Mexican Grill (LON:MEX) which is a pity as I missed today’s 17% further rise. Never mind!

Annoyingly the company quotes EBITDA, but Shore Capital translates for us - it raises FY 12/2023 adj PBT from £0.7m to £0.8m - a small beat. It’s a tremendous improvement on the PBT loss of £(1.3)m in FY 12/2022. The driver seems to be a doubling of revenues to £9.6m in 2023, and an effective sales team apparently.

Cash is £2.3m at Dec 2023, but the company forgets to mention that there are £2.2m of loan note liabilities, so net cash is only £0.1m.

Paul’s opinion - looks interesting. Shares have risen a lot, so I expect there are others who like me were happy to bank the profit. To reflect the big rise in valuation, I’ll shift down a gear from green to AMBER/GREEN

Graham's Section:

Jupiter Fund Management (LON:JUP)

Share price: 74.7p (-16%)

Market cap: £407m

This is a grim update from Jupiter, a fund manager which I’ve been positive on but which I did not consider for my 2024 list of best ideas.

Jupiter has experienced a very long stream of outflows; its share price reflects a failure to compete in the modern investment environment where there are so many ETFs, international funds, and specialist asset classes to choose from:

I’ve been positive on the stock due to a valuation which has at times seemed absurdly cheap, and a new CEO with plans to streamline operations.

But today’s news does not inspire confidence.

Firstly, the company is losing Ben Whitmore, the current manager of funds with £10 billion of AuM (nearly a fifth of Jupiter’s entire AuM).

He is leaving “in order to pursue his ambition of establishing an independent value equities boutique in due course” - i.e. to create a business that could ultimately compete with Jupiter.

The blow is softened by the appointment of a new fund manager from JO Hambro. Two other recent hires will also be able to take over management of particular funds. There will be “an orderly and collaborative transition process”.

Additionally, Whitmore has agreed that “his new boutique, once established, will not compete with Jupiter for a period of two years from his leaving date in relation to both the UK Equity Income sector and the non-UK open-ended UCITS market”.

Secondly, we get a poor trading update for 2023:

…a delay in the funding of some institutional mandates combined with weaker than anticipated retail sentiment in October and November 2023 has led to an incrementally more negative flow outcome than we had anticipated. Total net outflows for 2023 are expected to be £2.2bn

Jupiter started 2023 with £50 billion of AuM, so about 5% of this was withdrawn during the year.

Retail/wholesale investors seem to be pulling out £1 billion each quarter, while institutional investors have been helping to offset this with some inflows.

Performance fees for 2023 will be more than £10m, which is higher than previous guidance.

Impairments: prior acquisitions will need to be written down on the balance sheet to reflect “lower asset valuations, muted demand for risk assets from retail clients and a higher cost of capital”.

Graham’s view

Despite worse-than-expected outflows, Jupiter’s total AuM still managed to rise during 2023 (to £52.2 billion), thanks to positive investment returns.

I find it remarkable that fund management companies can be so unpopular with their customers from time to time, and yet their AuM just keeps on rising. The market valuation will paint a different picture, of course - you now get around £108 of AuM for every £1 invested in Jupiter at the current share price. This is a truly distressed valuation in my book.

The loss of someone considered to be a “star” fund manager at Jupiter is of course a blow. However, it strikes me that the remaining investors in Jupiter funds have already displayed a great deal of loyalty (some might call it inertia) and that most of them are likely to stay with Jupiter even through a change of personnel. Some will of course want to follow the fund manager to his new company, but that company does not yet exist and the non-compete clause will provide temporary protection even when it does.

I’ve been positive on this stock and yet the share price has been moving the wrong way - so am I changing my stance? Not yet, no.

The stock has been trading at depressed levels relative to AuM and earnings for some time, but it’s now arguably becoming depressed relative to its balance sheet, too.

The interim statements showed £849m of net assets, including goodwill. That goodwill will get written down, but even excluding all intangibles the company still had a TNAV of £193m, consisting of highly liquid current assets.

That covers nearly half of the current market cap. At this level, shareholders would benefit very quickly if Jupiter stopped trying to be the acquirer and simply allowed itself to be acquired.

Belvoir (LON:BLV)

Share price: 266.65p (+4%)

Market cap: £99m

Property Franchise (LON:TPFG)

Share price: 340p (-1%)

Market cap: £111m

We have big news this morning as these two franchising estate agents have announced that they wish to merge.

It’s a recommended all-share merger so there is no cash payout for either side.

Instead, 48.25% of the new combined entity will be owned by Belvoir shareholders, while TPFG shareholders will hold the remaining 51.75%.

Under the proposals, every Belvoir share will be exchanged for 0.806 new TPFG shares.

It does imply a small premium for Belvoir, valuing each BLV share at 277.4p, which is 8% above last night’s close price.

Belvoir shareholder support: 31% of Belvoir shareholders are supporting the deal, so more votes will be needed to get it over the line under scheme of arrangement rules.

TPFG shareholder support: 56.7% of TPFG shareholders are supporting the deal.

Rationale for the deal

The combined group will have “more than 930 locations, managing approximately 152,000 tenanted properties across the UK (excl. Northern Ireland) and will be expected to sell more than 28,000 properties per annum”.

(GN note: more than 1 million properties are sold in the UK every year, so market share will still be less than 3%.)

Continuing:

As a result of the Merger, the geographic spread of the Combined Group would be enhanced and diversified, which the TPFG Board expects will provide more opportunities for franchisees to serve customers showing an interest in the Combined Group's services via the various platforms.

On top of that, there will be cost synergies including both simple short-term synergies (such as Belvoir’s AIM listing) and medium-term synergies such as “deployment of expertise gained in revenue generation through strategic initiatives”.

Belvoir has a “well-established financial services division” (in partnership with Mortgage Advice Bureau (Holdings) (LON:MAB1)) which will be strategically valuable for TPFG.

Management changes

Key facts:

The CEO and CFO of TPFG will continue as CEO and CFO of the combined group.

The CEO and CFO of Belvoir will step down from their current positions but “will continue to be engaged” for 12 months.

The new eight-person board will have five TPFG representatives and three Belvoir representatives.

Based on the above, we can’t really call this a merger of equals - it is more like a large acquisition for TPFG. Although Belvoir shareholders will own nearly 50% of the combination.

Timetable - the deal is expected to take place in Q1 2024 after votes and legal procedures.

Trading updates

Belvoir: Since 30 June 2023, the Belvoir Group has continued to trade comfortably in line with the Belvoir Board's expectations.

TPFG: Since 30 June 2023, TPFG has continued to trade in line with the TPFG Board's expectations.

Graham’s view

I have been positive on both of these companies and for similar reasons - e.g. here (BLV) and here (TPFG).

They are both highly successful franchisors in the estate agent business, with slightly different points of emphasis. TPFG owns the hybrid agent Ewemove, while Belvoir has a headstart in financial services with 308 advisers in their network.

They both earn fabulous return metrics, which are strikingly similar.

BLV:

TPFG:

With two companies that are essentially doing the same thing, only with some differences in geography and expertise, it’s not difficult to justify a merger. The benefits are clear: a merger eliminates any harmful competition that may exist between them (from the point of view of shareholders), while also improving the reach and the capabilities of the combined entity.

I have been positive on both companies and I will remain positive on the combination, which I expect to be even stronger than the sum of its parts.

From a value perspective, it was much more exciting when these shares were trading at single-digit P/E multiples. At their current levels, having risen greatly during 2023, they are not quite as tantalising as they were before. But I do think this deal could help to turbo-charge future performance. In any case, I’m staying GREEN.

BLV share price:

TPFG share price:

Nichols (LON:NICL)

Share price: £11.84 (+5%)

Market cap: £432m

This soft drinks group announces a full-year update.

2023 adjusted PBT will be “slightly above current market expectations”, i.e. slightly above £25.4m. This is a little higher than the adjusted PBT result for 2022 (£25.0m).

The long-awaited improvement in “Out of Home” business has finally arrived, with the company seeing “some of the benefits from the restructuring of our Out of Home (OoH) business earlier than initially anticipated.”

I included Nichols in my 2024 best ideas list, having reviewed its performance in my 2023 list. An improvement in Out of Home trading would go a long way towards restoring Nichols’ profit margins to their former glory, which is what I have been betting on!

Other key points from today’s update:

Revenue up 3.5% to £170.7m. “Out of Home” revenues declined as unprofitable accounts were shut down, while “Packaged” and “International” sales grew.

Gross margins “largely maintained” despite inflationary pressures early in the year.

Cash at the end of the year was £67 million (it was £56m a year ago).

Outlook: the main point here is that Out Of Home “will contribute positively to overall Group performance in 2024”, but this isn’t quantified. The OoH segment was already contributing positive adjusted PBT, so this doesn’t give away much information.

The overall tone is ambitious with management planning “to accelerate the rate of investment in its longer-term development over the next 12 months”.

Family business: we are reminded that this is a family business as Commercial Director Matt Nichols joins the Board as a NED.

Graham’s view

I included this company on my 2024 list within the past two weeks, and it has performed “slightly” ahead of expectations, so I have no reason at all to change my positive stance on this one!

There are many cheaper shares in the market today but few have the heritage and multi-decade track record of Nichols.

At a PER of 19x, it would be overly optimistic to hope for multiple expansion - but I think it is reasonable to hope for an improvement in margins feeding through to increased profitability over the medium-term.

Hostelworld (LON:HSW)

Share price: 141p (+6%)

Market cap: £174m

There’s continued strong momentum at Hostelworld with the following highlights from its year-end trading update:

Record levels of bookings (€619m) and revenues (€93.7m), both up 32% year-on-year.

Bookings up 37% year-on-year

As previously signalled, there is a lower average booking value due to more Asian destination bookings.

When it comes to profitability, adjusted EBITDA of c. €18.3m exceeds the upper end of market guidance (€17.5m - €18.0m).

Net debt further reduces to €12.3m (€22m at the beginning of 2023).

CEO comment excerpt:

Over 2023 we grew market share, delivered record revenues and increased operating leverage through a combination of reduced marketing spend (as a percentage of net revenue) and continued operating cost discipline to deliver EBITDA which exceeds the upper end of our guidance range. In particular, I am also pleased to report our full year marketing costs as a percentage of net revenue fall from 51% in the first half of the year to 50% on a full year basis...

Graham’s view

What started as a post-Covid recovery story has been sustained and seen the company power through its pre-Covid revenue numbers, at least on a nominal basis if not on a real basis.

This is reflected in a share price making steady progress:

Not only have revenues been surging through their pre-Covid levels, the company has been beating profit expectations and upgrading forecasts:

I’ve kept a neutral stance on the stock. While I’ve been greatly impressed by the company’s momentum and how it has fixed its balance sheet, I’ve also been concerned that its valuation may already be up with events.

The market cap equates to over €200 million which is more than ten times a heavily adjusted EBITDA figure. A little more, if we add on the remaining debt figure.

Therefore, while Hostelworld might still be undervalued at this level, it seems to me that there are more straightforward value opportunities to be had. The StockRank may have it right:

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.