Good morning, it's Paul & Jack here with the SCVR for Wednesday.

Timing - I'm working at a glacial pace today sadly. Sometimes it flows, other days it has to be forcibly extracted! Still, there's nothing else to do, and it's tipping down with rain, so I'll keep writing until about 4:30pm. Today's report is now finished. I'll start off tomorrow's report with the 2 backlog items left over from today.

We're hoping to look at the following results/trading updates today:

Paul:

Foxtons (LON:FOXT) (I hold) - done

Somero Enterprises Inc (LON:SOM) - done

Beeks Financial Cloud (LON:BKS) (from yesterday) - done

Photo-me International (LON:PHTM) - see tomorrow's report

Restaurant (LON:RTN) - placing - see tomorrow's report

Jack:

Kin And Carta (LON:KCT) - done

Fingers crossed we can get through that lot, we've started work on it now!

.

Paul's Section

My thoughts on re-opening & inflation

I tend to be too optimistic, but am still firmly in the roaring twenties camp, where I think enough people could be eager to get out and spend, to boost the economy nicely as this year sees re-opening of the locked down parts of the economy.

However, I’ve also been listening to opposing views, and wonder if I’m possibly too optimistic, based on my personal circumstances (my portfolio has done very well, so I’ve got plenty of money, unlike maybe some other people in more regular jobs).

Listening to the utterly brilliant Grant Williams podcasts (thank you to several readers here who recommended them, they’re terrific. I’ve even paid a subscription to listen to them, something I’ve never done before), last night I listened to one about inflation. Why hasn’t the huge amount of money-printing triggered inflation? One economist that Grant interviewed, called David Rosenberg, was saying that stimulus money funded by QE has generally been used to pay off debt, and saved. He’s referring to USA here, but it’s probably similar here. Meanwhile, he’s sceptical about the re-opening trade because consumers have just shifted spending from holidays, eating out, etc, to buying exercise equipment, revamping their homes, and online shopping. So when re-opening happens, consumers could just shift their spending back again in the other direction - netting off. That’s an interesting idea. It’s not a given that overall consumer spending will increase, but could just shift from one area to another.

Rosenberg’s other idea is that most people had very little in savings before covid, but it has shocked people into realising that they need to save for a rainy day, because we don’t know what’s around the corner. This all means that, despite vast QE (money printing), there’s still little to nothing in inflationary pressure in the US economy anyway, at the moment. He mentioned the old monetarism formula which I remembered from my University days:

Monetarist theory is governed by a simple formula, MV = PQ, where M is the money supply, V is the velocity (number of times per year the average dollar is spent), P is the price of goods and services and Q is the quantity of goods and services. [source: Google]

Rosenberg’s idea is that QE has hugely increased M, but because people are being cautious about spending, and instead paying down credit cards, and hoarding cash, then V has reduced by a corresponding amount, and he provided some data to back this up. Meanwhile Q remains largely unchanged, therefore the end result is that P, prices, stay the same, despite massive money printing.

I thought that was such an interesting idea, that it was worth putting it in this report.

Inflation - The hot topic of the day seems to be whether inflation is now likely to hot up? As always, the only opinion I can give, is that I have no idea! I can only go on what companies say in their trading updates. Several companies we cover here have mentioned inflationary pressures of late, with raw materials costing more, or there being shortages (e.g. steel, semiconductors), and of course extra costs associated with soaring container shipping costs (a big, but hopefully temporary problem mentioned recently by Shoe Zone (LON:SHOE) (I hold)). So a rise in inflation does seem a potential risk, which could be negative for shares on high ratings particularly, since discount rates would rise, used in valuation, making it harder to justify racy PERs.

Also if we look back at the 1970s, when inflation was high, share valuation multiples were low, so the empirical evidence seems to suggest that higher inflation & higher interest rates should in theory be bad for share prices, or at least cause PERs to reduce somewhat perhaps, from current very elevated levels.

More recent evidence has been very clear from the Fed's limited attempts to normalise interest rates in recent years - every time it tried to ease in higher interest rates, it crashed the stock market and they had to reverse course. The argument therefore seems to be that the Fed cannot, or won't raise interest rates, even if inflation does rise. That underpins equity prices, and seems a widespread belief, that the Fed has got investors' backs.

I think the best way to avoid this inflation risk is just not to buy or hold anything on an overly toppy rating!

Are readers worried about inflation and higher interest rates? Or is this something we shouldn't waste time pondering, as we don't know what the future holds?!

.

Foxtons (LON:FOXT)

(I hold)

59p (pre market open) - mkt cap £193m

The share price here has been volatile of late. It’s participated in the general rally since vaccines started in November, but the market doesn’t seem to be able to make up its mind, as you can see from the chart below (note the high StockRank). I’ve zoomed out to 2 years, because we’re starting to annualise the covid crash as I’m calling it, in Feb-Mar 2020.

.

Foxtons is an estate agents, focused mainly on London. Hence the huge drop in share price when covid started a year ago, as people were apparently leaving London to live and work from home in the countryside.

Newspapers have been saying more recently that, after a year, many people are getting fed up with working from home, and want to at least spend some time back in the office. With shops, then restaurants and bars re-opening in April/May, it will be fascinating to see how this all pans out. It’s a very different ball game once adults have been vaccinated, because I think some people will then be prepared to take the risk of returning to a more normal way of life, but at this stage we don’t know exactly how it all pans out. That could result in a pickup in activity for Foxtons maybe, as London comes alive again?

Foxtons Group plc, London's leading estate agent, today announces its results for the year ended 31 December 2020.

I’m hampered by a lack of available broker notes.

Jack reported here on 11 Dec 2020, when the company said its performance was improving, and guided to £1-1.5m adj operating profit for FY 12/2020.

Today it reports £1.9m adj operating profit, so that’s a modest beat against expectations.

I don’t use operating profit any more, because it’s been distorted by IFRS 16. Hence I’ll measure performance on a statutory profit before tax basis, was a loss of £(1.36)m

Net cash is a healthy £37.0m

Taxpayer support included £2.5m in business rates relief, and £4.4m in furlough funding for staff. Without that support, the company would have been loss-making and probably been forced into making staff redundant.

Stamp Duty holiday has undoubtedly helped bring forward transactions, but logjams in the legals

Outlook - I’d describe this as encouraging -

Following the recovery of profitability in the second half of 2020, Foxtons' financial performance has continued to improve into 2021. Group revenue for the first two months of 2021 is well ahead of 2020 (and 2019) and continued tight cost control has resulted in significant growth in Group operating profit over that period.

The sales commission pipeline started 2021 more than 30% higher than prior year and has led to much improved revenue growth in the first two months of the year. Despite the significant increase in units sold to date, the value of the pipeline has remained stable over this period at levels last seen in early 2017.

Stock levels in lettings are also well ahead of 2020 and, although a relative excess supply of rental properties in London has driven down average rents by 12% versus prior year, we have so far been able to fully mitigate the impact on average commissions through greater volumes as tenants look to take advantage of more attractive prices. Mortgage broking has also started the year well with higher new purchase activity, driven by the stronger sales market.

Acquisitions - Foxtons has been using surplus cash to buy other estate agents, and lettings books, no new information is given on that today.

Balance sheet - dominated by intangibles, but still looks OK even once these are written off. Note that lease liabilities are quite hefty, as you would expect from a company with a network of London offices. Overall it’s healthy, with decent net cash, so I’d say insolvency risk looks negligible.

My opinion - this all looks quite encouraging. How to value the shares? That’s the tricky bit, as Foxtons is only trading around breakeven, with Govt support, but showing an improving trend, and decent current trading/outlook. With no broker forecasts available, and Stockopedia showing broker consensus of around breakeven again for 2021, there’s really nothing to go on.

When the Stamp Duty holiday ends, that could slow down sales activity again.

In the boom years in 2014 & 2015 it made about £35m p.a. profits. But it was then loss-making in 2017 and 2018. So this is a tricky one to forecast.

Overall, I’m flummoxed by this, and don’t really know how to value the shares. All we can do is guess that trading will probably improve from 2020, so Foxtons should return to profits, but we really don’t know at what level.

I think I’ll sit tight on my shares here, because I reckon London should start coming alive again in the next few months, hence sentiment alone could take Foxtons shares higher. Cities do come alive again after disasters. I remember visiting New York just after 9/11, and it was eerily quiet. A year later, it was back to normal. Could covid be the same? Probably, in my view. People have quite short memories.

.

Somero Enterprises Inc (LON:SOM)

350p (down 1.4% at 11:44) - mkt cap £196m

Click here for details of the results webinar at 1pm on 15 March.

I covered the FY 12/2020 year end trading update here on 21 Jan 2021 - reading my notes back, this was an excellent update, guiding to $26.0m adj EBITDA, up 24% on previous guidance. Net cash was also ahead of target at $35.0m. Very impressive.

The outlook comments were more hesitant, pointing to a planned “meaningful” increase in sales & support staff. Share price come down from 380p to 350p in the intervening time. I concluded in January that Somero shares looked good value at 30p more than the current price.

Moving on to today, we have -

Somero Enterprises, Inc. reports its annual results for the twelve months ended 31 December 2020.

The figures are in line (a whisker ahead actually) of previous guidance, so that’s all fine.

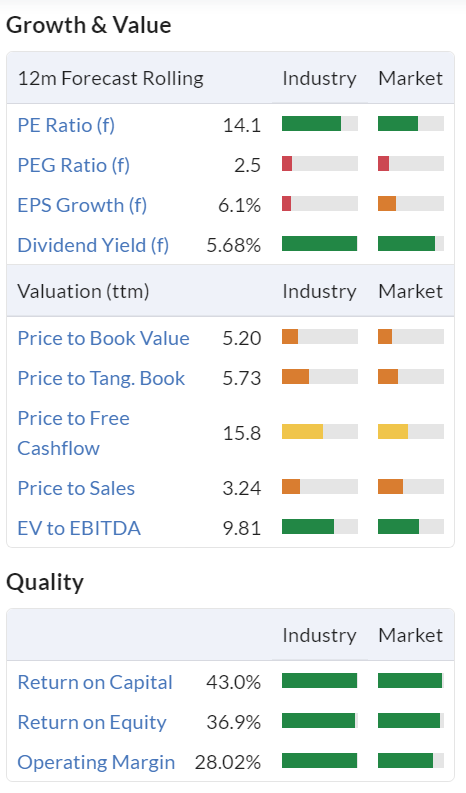

A few key numbers (these are in US dollars remember, which has weakened a fair bit against sterling lately, which is a drag on the sterling denominated share price) -

Revenue $88.6m (down 1% on 2019) - impressive considering 2020 was so badly disrupted by covid lockdowns

Profit before tax $24.6m (down 9%)

Diluted adj EPS 0.33 cents (£1 = $1.387) or 23.8p = PER of 14.7 - good value

Dividends converted into sterling are 12.1p ordinary, plus 13.0p supplemental - check with your broker about US taxation, as this can require a form to be filled in, to get paid the full divis without a US tax deduction. Taking both divis together, that's 25.1p, a yield of 7.2% although that might not be necessarily maintained next year in full.

Outlook comments -

The Board is confident in the outlook for 2021 supported by solid momentum in the US carrying forward from the strong finish to 2020 and reinforced by customers reporting project backlogs that span well into 2021....

Solid opportunities for growth in international markets

Confirms increased costs in 2021, above the usual +$2m increase (rather vague, how much above?) - to benefit future years growth

Specific guidance - 2021 revenues to grow in “mid-single digit percentage”. EBITDA “growing modestly” in 2021, due to cost of extra sales & support staff.

Balance sheet - is never a problem with this company, it’s very strong indeed, and stuffed with cash. Note that receivables are extremely low, as indicated in the commentary, the company benefited from a one-off boost to cash by customers paying early by the looks of it. That could reverse in 2021, but it’s not a concern.

Cashflow statement - this also shows how a $5.5m fall in receivables boosted cashflow somewhat, which is likely to reverse next year. Capex is quite modest at $3.7m. Dividends paid is the biggest outflow, at $13.9m. Despite those outflows, cash still rose from $23.8m to $35.4m, demonstrating what a prolific cash generator this business is. It’s really a very good business. If it could turbocharge growth outside of the USA, then the shares could re-rate, but that has been elusive over the years.

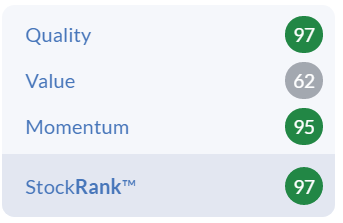

My opinion - we’ve always liked Somero here at the SCVR, and so do the Stockopedia computers -

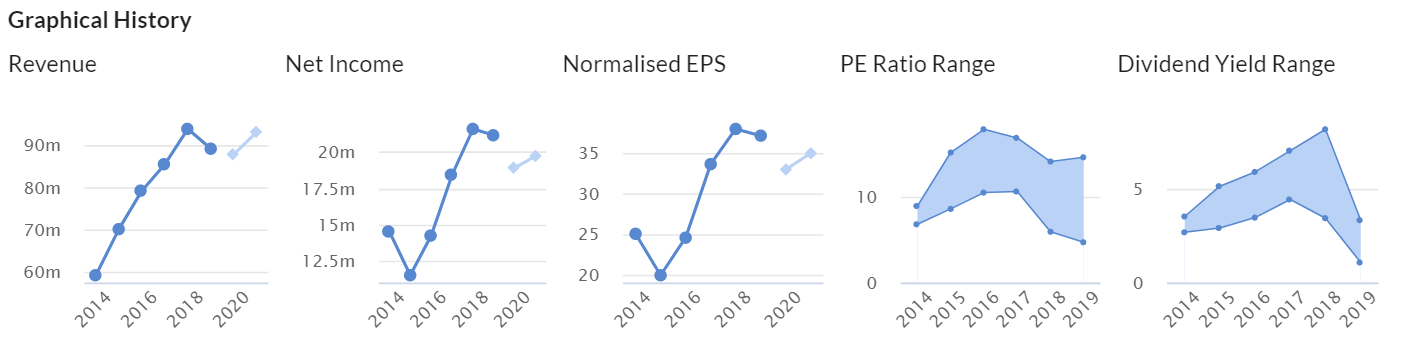

That said, the graphs below show that profit growth has stalled in the last few years, so that’s probably why the market ascribes quite a modest PER to this share. You can see from graph 4 below how modest the PER tends to be for this share. Does that mean it’s dead money? No, because there’s a lovely flow of divis, including supplementary ones.

I think shareholders here might need to be patient, and wait until 2022 and beyond for growth to pick up, with new products & the time lag from additional sales staff being recruited in 2021 to delivering results.

That said, SOM often surprises on the upside.

It’s a cyclical business, but with major stimulus & infrastructure spending likely in the its main market, the USA, then I would have thought the outlook seems favourable.

Overall, this looks a decent value share, suitable for patient investors, especially income seekers. I continue to like it, but am not expecting any explosive upside on the share price, unless someone bids for it.

As you can see below, this share stands out for both high quality metrics, and high value scores too, quite an unusual combination. Stockopedia rates it s "Super Stock".

.

Beeks Financial Cloud (LON:BKS)

109p - mkt cap £57m

Here is my review of the FY 06/2020 results, which is a useful refresher of the main points. I like this company, but concluded at 92.5p on 15 Sept 2020 that it looked priced about right - not cheap, but it’s an interesting little growth company, so deserves a punchy rating. Since last autumn practically everything in the small caps space seems to have shot up 50-100%, so the fact that BKS is now only up 18%, means it’s a relative laggard over the last 6 months.

The graphical history below is interesting & tells the story very well. Strong (mainly organic I think) revenue growth, but profitability & EPS have been somewhat disappointing, because costs are rising all the time.

As we’ve been discussing recently in the comments here, UK investors seem to prioritise profits & divis, which forces UK small caps to grow more slowly once they list, and get left behind potentially by better funded competitors, which might be able to run at a loss, with financial backers looking to the longer term, bigger picture.

Personally I’d rather see companies like Beeks prioritise growth, and maybe run at breakeven. That makes it hard to value the shares though, because PER becomes useless.

Maybe companies like this could publish a range of forecast figures, with the various options of slow, medium & fast growth, and how that would pan out over a (say) 5 year period, to show investors what they are aiming for, and why.

Investor Presentation - 2:00pm 11 March, on InvestorMeetCompany - signup link here. Management always present very well I think.

Expansion of Tier 1 customer deployments - a separate announcement 2 days ago.

Including a global private cloud contract expansion to over $2m in annualised revenue… 8 March 2021 - Beeks Financial Cloud, a leader in cloud computing, connectivity and analytics for financial services, is pleased to announce continued strong progress against its land and expand strategy, as also described in the Company's interim results released today.

That’s impressive, and material to the overall revenues.

Further details are given of these 2 large customer contract extensions. This should underpin future growth. Client concentration might become a greater risk though.

8 March 2021 - Beeks Financial Cloud Group plc (AIM: BKS), a cloud computing and connectivity provider for financial markets, is pleased to announce its unaudited results for the six months ended 31 December 2020.

Key points -

- Good revenue growth +24% to £5.29m

- Recurring revenues are 91% of total - very good, I like shares in companies which are building a sticky recurring revenue stream

- Annualised run rate for revenues is £12.0m, giving good visibility of further growth (increased further to £12.8m pa by end Feb 2021)

- Gross margin is only 49% - not great for a cloud software business, but it depends what costs are being absorbed into that figure

- Underlying profit before tax is only £0.55m in H1, down 8% on LY H1 - so the revenue growth is being used to fund extra overheads - your attitude to that is key to whether you like the investment case or not.

- Underlying basic EPS is down 7% at 0.94p in H1. Full year would be double that, so about 2p, hence a PER of c.55 - but PER isn’t necessarily the right way to value a small growth company.

Valuation - rather than using PER, maybe it’s better to try to forecast where the business is going longer term, and what your investing time horizon is? Then decide if the current price offers an attractive price or not.

A recent note from Progressive Equity Research forecasts 2.7p adj EPS this year (FY 06/2021), rising to 3.9p next year. That brings the PER down to a more palatable 40.4 and 28.0 times respectively. Still high, but that can be justified for the growth, if it is achieved, and doesn't get swallowed up in extra overheads again.

Net debt is £2.05m, worsened from a net cash position of £0.7m a year earlier. Given the recurring revenues, I don’t see this as a problem.

Balance sheet - a little weak, I’d prefer to see a bigger cash pile, and no debt. But given the nature of its recurring revenues, the risk isn’t great. A small top up placing could be done any time, one of the big advantages of being a listed company.

Outlook - sounds reassuring -

Solid sales pipeline, including further Tier 1 opportunities

· Continuing to see an increase in the number of financial services organisations take advantage of the benefits of cloud infrastructure

· Increase in new business sales in recent months, trading for the current financial year is positive and remains in line with the range of market expectations

· Revenue and margins expected to benefit in H2 FY2021 and beyond from growth in both existing and new customers

Cashflow - note that development costs of £868k were capitalised in H1, over 4 times the size of H1 LY. Contingent consideration of £1.0m was paid out. Plus physical capex (for computers, I expect) was £1.18m in H1, so it’s not a particularly capital light business model.

My opinion - I do like this market niche, and management. However, given that the company is so small, and not yet really profitable or cash generative, it’s a long-term investment proposition. If you’re prepared to buy the shares, and wait say 5 years, then I reckon this could be a considerably larger business, and generating decent profits. It seems to operate in a good growth niche, and have sticky customers generating recurring revenues - lots to like there.

At this stage, I really can’t work out how to value the shares. It certainly doesn’t look cheap, but in 5 years’ time we could be kicking ourselves, saying why didn’t we pay up for it when it was small? Tricky one. On balance, I’d say I’m leaning towards being moderately bullish with a long-term view.

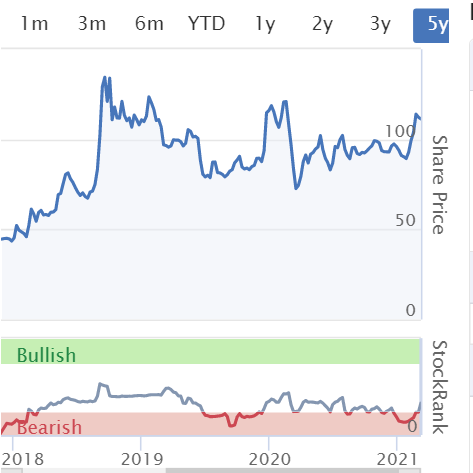

After a burst of excitement in 2018, the share price has since drifted down/sideways. Note also the Stockopedia algorithms aren't impressed at this stage, with a lowish StockRank.

.

Jack's section

Kin and Carta (LON:KCT)

Share price: 155p (+4.73%)

Shares in issue: 168,845,628

Market cap: £261.7m

Kin And Carta (LON:KCT) is ‘digital transformation’ company that drives value for customers across four key digital elements: data, technology, experience, and organisational change. The group is headquartered in London and Chicago and its platform is made up of three distinct areas:

- Kin + Carta Advise - sector-focused management consultants to the C-Suite,

- Kin + Carta Create - 800+ data scientists, software engineers and designers ‘utilise emerging technologies to create new products and platforms’ for CIO clients, and

- Kin + Carta Connect - MarTech experts help CMO clients implement and optimise modern marketing technology and data platforms.

Glancing down the StockReport, we run into a couple of warning signs. KCT is classified as a Momentum Trap, with low Quality and Value Ranks. Meanwhile the strong Momentum Rank suggests shares have already rerated.

And a look at the Financial Summary shows that four of the past six years have resulted in net losses. Today’s results, for all the optimistic narrative and adjusted figures, clock up another net loss (in fairness to the group, its cash generation has been more robust).

But then we get to financial health: the poor F and Z Scores, a net debt position, a pension fund (in surplus), declining book value per share and increasing shares in issue. None of these signs bode well for shareholders.

But the brokers rate this group a strong buy and profitability is forecast to improve by 54% in FY21 and another 40% in FY22. This manifests in the low forecast rolling PEG of 0.6x.

So perhaps the group is reaching an inflection point.

Kin talks of growing momentum and sequential operational improvement. The 90-day net revenue backlog is 77% larger than the start of the fiscal year and 27% larger than February 2020, pre-pandemic.

In terms of half year highlights, we have:

- Revenue from continuing operations down 10% to £64.1m but with improving momentum and sequential growth.

- Adjusted profit before tax from continuing operations of £2.9m, but statutory total loss before tax from continuing operations of £6.4m.

- Net debt reduced from £31.6m to £22.5m.

- Divestment of Ventures businesses Hive and Pragma for £14m (before adjustments for cash, debt and working capital) and acquisition of Cascade Data Labs, a Portland, Oregon-based data transformation consultancy for an initial consideration of USD $6.9m (£5m).

- Digging through the notes we see that the total consideration payable, including contingent consideration payable which is deemed as remuneration, could be as high as £22.3m.

The difference between adjusted and statutory profitability arise primarily from £2.2m of pension scheme costs, £4.9m in amortisation of acquired intangibles, and £1.7m of contingent consideration to be treated as remuneration.

One concern I have is whether or not management is allocating capital prudently and effectively with its acquisitions, especially when a good chunk of the cost is later expensed as remuneration in the income statement.

M&A is a famously value-destructive way of spending money. A few do tremendously well with such strategies but many more ultimately hurt shareholder wealth. For brokers, of course, empire building management teams are a dream due to the fees they generate.

Conclusion

For all Kin’s talk of sequential improvement I wonder why, as a self-declared digital transformation specialist, customers have not been knocking the door down over the past year. Surely it’s the perfect time for a bit of digital transformation? Or perhaps Kin’s services are non-essential.

The direction of travel may be more positive than it was, but the share price has also rerated aggressively and is trading at a significant premium to pre-Covid levels.

We’re seeing this with a lot of companies, where in my view investors’ optimistic sentiment has overrun and has consequently reduced a good chunk of potential upside. Meanwhile, the outlook for Kin is hardly risk free.

Brokers are forecasting net profits for FY21 - but based on these results, things need to improve far and fast in H2, unless we are to continue relying on the group’s heavily adjusted results.

The bottom line is Kin has a history of trading losses and its balance sheet is weak. Interestingly, management says its ‘balance sheet remains strong’ but frankly I dispute that given the net debt and the fact that it is stacked with intangible assets and goodwill.

This gap between management’s narrative and my own perception of financial health along with persistently large differences between adjusted and statutory results makes me question the shorter term risk:reward ratio here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.