Good morning from Paul & Graham!

Today's report is now finished at 12:14

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

I don't suppose we'll get through everything on this list today, but we'll have a good go at it!

Update - that's it for today. I think we covered the most interesting, and price-moving announcements.

Summaries of main sections:

(more detail below)

Eckoh (LON:ECK) - 42.5p (£124m) - FY 3/2023 trading update - Paul - AMBER

A good update, slightly ahead of expectations. Although strong growth seems to have come from an acquisition. Is there much underlying organic growth I wonder? N.America is doing well, but how about elsewhere?

hVIVO (LON:HVO) - 16.5p (£112m) - FY 12/2022 Results - Paul - AMBER

Very impressive organic growth, and a breakthrough year into significant profits. I like the bull case, but also have some questions & reservations below.

ASOS (LON:ASC) - down 6% to 598p (£598m) - H1 Results 2/2023 - Paul - RED

Paul is seriously unimpressed with poor H1 numbers, and a rapidly weakening balance sheet with too much debt. If its turnaround plan works, then Asos might recover, but it looks a tall order to me, so I'm steering clear.

H & T (LON:HAT) - down 1.5% to 405p (£197m) - AGM TU - Graham - GREEN

Trading is in line with expectations at this large pawnbroker as positive momentum from 2022 continues. With record lending taking place, I think these shares could be underpriced.

Treatt (LON:TET) - 650p (£392m) - Interims - Graham - AMBER

The outlook at this ingredients manufacturer is “in line” and they are on track to complete the transition to their new UK facility. But I don’t know how to justify the current market cap.

J D Wetherspoon (LON:JDW) - up 7% to 799p (£1,026m) - Q3 Trading Update - Paul - AMBER

A reassuring update, at top end of (lowered) expectations. This sector seems to be coming alive again, and JDW shares have now doubled in 8 months. Price possibly up with events now? There might be better, more overlooked bargains at the smaller end of the hospitality sector.

Quick Comments

Tclarke (LON:CTO)

Up 9% to 142.5p (£63m) - AGM Trading Update - Graham - GREEN

I gave an overview of the attractions of this share in March. Note that in November and again in January, its positive-sounding updates were both accompanied by broker downgrades. So I think it’s essential with this share (and with some other shares) to find a broker note if you want to know what’s really going on, and not to simply trust that the RNS is being 100% transparent about what is happening.

The broker note to go with today’s news does thankfully leave 2023 estimates unchanged, and the stock market has issued a collective sigh of relief and sent the shares up by 9%, despite an only “in line” trading update. Revenues are on track to exceed £500m this year for the first time but more interestingly the forward order book has surged to £720m, implying continued strong growth after that. The broker is now guiding for £600m of revenue in 2024.

The company reassures that it maintains its “strict selective approach when it comes to tendering”; remember that it’s targeting an operating margin of 3%. It also says that the visibility of its revenues outside London has improved thanks to growth in the healthcare sector and larger projects.

I don’t often give stocks in this sector the thumbs up but I’m going to very tentatively and cautiously do so here. I strongly believe that this sector should be valued at dirt-cheap levels. TClarke does have that cheap valuation, and yet it also has a good track record of profitability, cash on its balance sheet, and impressive growth prospects.

Vertu Motors (LON:VTU)

Up 4% to 60.25p (£210m) - Final Results 2/2023 - Paul - GREEN

Vertu Motors, the UK automotive retailer with a network of 189 sales and aftersales outlets, announces its final results for the year ended 28 February 2023 ("Year").

Everything looks good with the results - slightly ahead of upwardly revised expectations.

Key numbers -

Revenues £4.0bn

Adj PBT £39.3m (down a lot, as expected, from LY’s bonanza of £80.7m)

Diluted EPS (from broker notes): 8.7p

Forecasts from Zeus & Liberum average 9.85p for FY 2/2024 - a PER of only 6.1 - still too cheap in my opinion.

NTAV (company’s calculation) is 65.3p, above the share price.

Total divis 2.15p, a 3.6% yield, but covered by earnings about 4x

Share buybacks are a notable feature at VTU - the share count has fallen a lot, from 398m in 2017, to 349m now, enhancing shareholder value.

Current trading in Mar & Apr 2023 is good, up on last year.

Reiterates full year market expectations (brokers indicate upgrades are likely).

Sector consolidation underway, with VTU making some hefty acquisitions, but note goodwill only rose from £105m LY to £130m now - so it’s mainly buying net tangible assets with the acquisitions - enhancing the attractiveness of an acquisitive strategy.

Supply of new cars improving, and VTU says it has a high margin order book.

Pension schemes - fully funded, no cash contributions required, good.

Balance sheet £341m NAV, less £130m intangibles, gives NTAV of £211m, very healthy. Dominated by freehold property, and of course huge working capital debits & credits, which net off as is usual in this sector. No issues I can see, it looks very solid.

Note that £1.3m interest received, now interest rates have risen from zero. Although interest payable has also risen (by more).

Paul’s opinion - I think it’s too cheap, and should be priced maybe 100-120p per share. But for the time being, the market isn’t interested in bargain car dealer chains. For patient investors, I think this remains an excellent opportunity, and sooner or later there’s likely to be a flurry of takeover bids.

There’s a good argument for buying a basket of UK car dealers, as they’re all cheap, that way you’re more likely to receive a takeover bid premium.

Thumbs up from me, Vertu looks as solid as ever. And really cheap.

Paul’s Section:

Eckoh (LON:ECK)

42.5p

Market cap £124m

This update was issued on 25 April, and has triggered a nice move up in the share price, which has stuck. So I thought it would be interesting to check it out.

Eckoh plc (AIM: ECK), the global provider of Customer Engagement Security Solutions, is pleased to announce a trading update for the year ended 31 March 2023.

What does that mean? A slightly clearer description is included further down the announcement -

Our solutions enable payment transactions to be performed securely and help protect sensitive personal data across any customer engagement channel and device the customer chooses.

Protected by multiple patents, our solutions remove sensitive personal and payment data from contact centres and IT environments, as the best way to secure data is not to collect it. This allows organisations to be not just compliant but secure, increase efficiency, lower operational costs, and provide an excellent customer experience. This is our specialism.

It sounds similar to what PCI- PAL (LON:PCIP) does, but ECK is bigger, and profitable.

What’s the latest?

FY 3/2023 latest guidance is:

Revenues £39m, well up on £31.8m LY), but below forecast of £40.3m.

Adj operating profit £7.6m, slightly ahead of market expectations (of £7.5m), and well up on £5.2m LY.

Net cash £5.7m is £0.5m ahead of forecast, and well up on £2.8m LY.

That all looks pretty decent, but not spectacular, it’s only slightly ahead of expectations after all.

N.America region showed an impressive +34% organic growth in ARR (annualised recurring revenues) -although note this $15.9m mentioned below is only about a third of total revenue, so it's a highlight, rather than the full picture -

Excellent progress was made in the key North America region with Security Solutions exit ARR2 up organically 34% to $15.9m (FY22 $11.9m), driven by the Group's increasing focus on its largest growth market, which resulted in further large contract wins, increased cross-selling and strong renewals in the region. Growth in total contracted business of more than 50% during the year, together with a continued shift to cloud, underpins Eckoh's future ARR growth and demonstrates the increasing revenue visibility in the Group's business model going forward.

Positive commentary re products.

See update note from Singers (on Research Tree), many thanks to them for sharing this with us.

Valuation - Singers reckons EPS for FY 3/2023 will be 2.0p, so the PER is 21x

No change in EPS forecast for FY 3/2024, which I imagine is being prudent, showing no earnings growth.

Paul’s opinion - in a higher interest rate environment, an earnings yield of below 5% (PER of 20+) is more difficult to justify, and I am worried that investors have still not adjusted to lower valuations yet.

However, in this case, Eckoh is delivering strong growth. I wonder if it won some contracts just before the year-end, because broker consensus forecast was cut sharply in April, but now appears to be going up again?

Also, note that it made a £31m acquisition of Syntec in Dec 2021, which will I imagine have boosted the FY 3/2023 results. So investors need to check the figures carefully when they're published, to understand what growth is organic, and what is acquired. Prior to this acquisition, growth at Eckoh had been anaemic. Indeed, I’ve been following Eckoh for many years (it floated 22 years ago) and it had a great run from 2010 to 2014, but has really just oscillated sideways since. So I question whether it really is a growth company? Something to think about there!

Overall I’ll say I’m neutral, amber.

hVIVO (LON:HVO)

16.5p

Market cap £112m

This company claims to be a world leader in human trials for new drugs.

Revenue up 30% to £50.7m (all organic growth)

Healthy cash position of £28.4m, but has mostly come from customers paying up-front.

Big growth in operating profit: £6.0m for 2022 (LY: only £0.6m) - is this sustainable? All profit wiped out by £7m impairment in associate investment.

Adj diluted EPS 0.9p = PER 18.3x (LY small loss)

Contracted order book up 65% to £76m, giving very good visibility.

Special dividend of 0.45p/share, costing £3m, to be paid on 9 June 2023.

3 non-core assets being abandoned.

Big increase in EBITDA margin.

Guidance - 2023 revenue £55m, with full visibility from existing orders. EBITDA margin mid to high teens for 2023.

One recent contract cancelled.

Balance sheet - NTAV only £14m.

Cashflow - note £1.5m R&D tax credit received.

Paul’s opinion - I did buy some of these earlier this year, but kept finding myself top-slicing it to buy other things that I preferred (my current strategy is to hold only 10 positions, and not use any gearing), and ended up selling all of HVO in stages (not planned!). Also, after a really bad experience with WAND, I didn’t want to hold another share where so much of the valuation rests upon contract win announcements (which may not necessarily turn into reality).

That said, seeing the FY 12/2022 results come out in line, and with a nicely grown cash pile, I'm more comfortable now, and don’t think it’s another WAND.

Other questions I have - what insurance, at what cost, does the company have in case it inadvertently kills or seriously injures one of the human volunteers in its trials? Secondly, has it perhaps benefitted from any covid-related stimulus to its activities, since growth seems to have suddenly accelerated around the time of the pandemic?

I’m tempted to buy back in, as this does look an interesting company, and if it thrashes forecasts (as the CEO is fond of indicating on webinars), then the shares could do well.

HVO claims to be a world leader in its field. I wonder if we can get any third-party confirmation of that?

IMC webinar recording from 25 April 2023 might be worth viewing.

I think we’ve got some enthusiasts for HVO here amongst subscribers, so do post a comment if you have anything to add to my comments above.

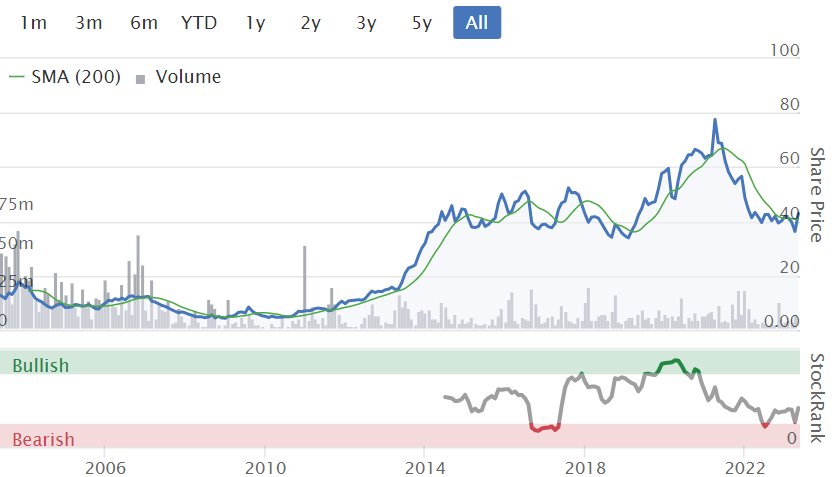

Note how the shares have disappointed & then soared in the past -

ASOS (LON:ASC)

636p (pre market)

Market cap £636m

H1 results from this former eCommerce glamour stock look awful to me. Although it had previously indicated that H1 would be weak, with a turnaround plan for H2 onwards providing the jam tomorrow hope/hype.

Anyway, I don’t think this share is any good, so I’ll briefly explain why.

H1 revenues £1.84bn (down 8% vs H1 LY)

Loss before tax of £(291)m - which looks disastrous to me.

Adjustments of £204m soften the loss to £(87)m. The biggest item in adjustments is a £128m stock write-off, which to me is not an adjustment, it’s an integral part of trading - i.e. bad product, being cleared at a loss.

Gross margin is too low - which has always been Asos’s problem, and the reason it’s never really made any sustainable profit or cashflow. 42.9% adjusted gross margin is just too low. It needs to be nearer 55% in this sector to make a decent profit. Also, the reported gross margin (after stock write-offs) is even worse, at 36.1% - which simply is not a viable business at that level.

Balance sheet - has taken a battering. NAV of £794m includes £703m intangibles, so NTAV is now only £91m, and falling fast - this could turn negative in future, I reckon.

Inventories look far too high still (more write-offs to come, I suspect), and this is all now funded by debt, which is growing rapidly. Net borrowings (excl. leases) rose to £432m, or £731m incl. Leases.

Bank facility has been extended to Nov 2024 - see note 18.

Convertible bonds - looks a remarkable deal done in 2021, with £500m borrowed, attracting interest of only 0.75% apparently, and unsecured. Scrutinising the terms of all the borrowings is absolutely key to whether the shares are worth anything. Breaching covenants could hand control to lenders, as with any company. Expiry April 2026 buys plenty of breathing space.

Going concern notes give a clean bill of health, but that doesn’t alter the fact that Asos is now entirely dependent on its borrowing facilities.

Outlook - lots of detail given, but the part which jumps out at me is the free cashflow guidance of negative £(100)m, at the bottom of a previously guided range of £0 to -£100m for FY 8/2023.

Paul’s opinion - this looks an absolute mess to me. Are the shares actually worth anything? I have serious doubts. The only value in them now, is hopes that a major turnaround in performance can be achieved. It strikes me that Asos grew way too quickly, which covered up the reality that it was a shambles internally. I’ve been saying that for years, because I knew someone senior internally, who told me that. Also it never really made any profit, because gross margins were too low. The story was always growth, and more growth (in revenues), and profit would somehow follow at a later date, which hasn't happened.

It started at 0, went up to a valuation of £5bn, and now looks as if it could be heading back to zero, in my view. Hence I wouldn’t touch it, unless a really credible turnaround becomes evident in the numbers, which certainly hasn’t even begun yet, as far as I can see from the actual numbers.

I suppose the bull case would be if you think it can turn trading around, and that online fashion might rebound. Chinese behemoth Shein seems to be seriously undermining the incumbents in this sector though.

There could also be positive help from sterling being stronger now, and freight costs reducing, and cheaper marketing costs maybe? On over £3bn annual sales, quite small improvements in margins could drop through nicely to the bottom line. Maybe there is some hope?

J D Wetherspoon (LON:JDW)

Up 7% to 799p

Market cap £1,026m

Shares in this value pubs chain have now doubled from the low in Oct 2022, remarkable stuff.

I reviewed its interim results (c. breakeven underlying trading) here in March 2023.

It’s delivering strong LFL sales vs LY (FY 7/2022) of +12.7% YTD - a bit above inflation, so that should be good for improved profitability.

Net debt is £738m. Remember that JDW cashed in the profits on its interest rate hedges, so financing costs will be higher now. It has plenty of freeholds, not revalued for about 24 years. Liquidity sounds fine, with £241m headroom.

Outlook sounds positive -

"The company expects profits in the current financial year to be towards the top of market expectations."

That’s good, but as you can see below, broker consensus forecasts have been lowered a lot, so then achieving the top end isn’t as impressive at it might first sound.

The rest of the update is Tim Martin largely repeating his previous (very valid) points about how much tax the hospitality sector raises, the need for an enterprise economy, rewarding staff, etc.

Paul’s opinion - I think hospitality is a very interesting sector right now, for strong recoveries. JDW has already doubled from the lows, so personally I’d be looking elsewhere in the sector for bombed out smaller companies, which in many cases are still near their lows.

Remember this sector is very operationally geared, with gross margins typically around 75%. So with inflation set to recede, full employment, and private sector wages rising in nominal terms, maybe people are more relaxed about spending in pubs & restaurants again? That's what a flurry of recent sector updates seem to be telling us.

When you zoom out on the chart, the recent doubling in share price doesn't look quite so extreme. Although note there are c.20% more shares in issue now, vs pre-pandemic. Also, look at how the StockRank has shot up in recent months.

Graham’s Section

H & T (LON:HAT)

Share price: 450p (-1.5%)

Market cap: £197m

I am not currently a shareholder at H&T, but I remain interested in this company that I’ve been following for many years - the largest pawnbroker by a wide margin.

I covered their amazingly strong 2022 results in March, when they confirmed that the positive trends of last year had continued into 2023.

This morning brings an AGM update for the first four months of the year. It confirms that trading is in line with expectations.

Key points:

January and March were both record months for lending, as inflation increases the demand for short-term consumers loans (but the general supply of these loans is still constrained)

Pledge book rises to £106.5m at the end of April. It was £100.7m at the end of 2022.

Continued strong demand for pre-owned jewellery and watches; retail sales up 13%.

Retail margins have moderated: the company is increasing its jewellery prices and reducing inventories of certain higher value watch brands, “where we have seen recent changes to the sentiment of some customers towards value”.

In foreign currency, revenues are up 10% year-on-year, “but are yet to benefit from the peak trading period of the summer months”. I noted recently that Ramsdens Holdings (LON:RFX) was moving onto H&T’s turf in certain Southern areas. Could this impact the demand for H&T’s foreign currency services? Or maybe there will be enough customers for both companies to prosper?

Store expansion: seven new stores have been added so far this year, bringing the total to 274. I am relieved that this number is consistent with the “measured and carefully considered manner” with which they said they would open new stores.

CEO comment: he remarks that they “continue to believe that the Group has an opportunity for significant growth in the medium term across all of our product offerings.”

Graham’s view

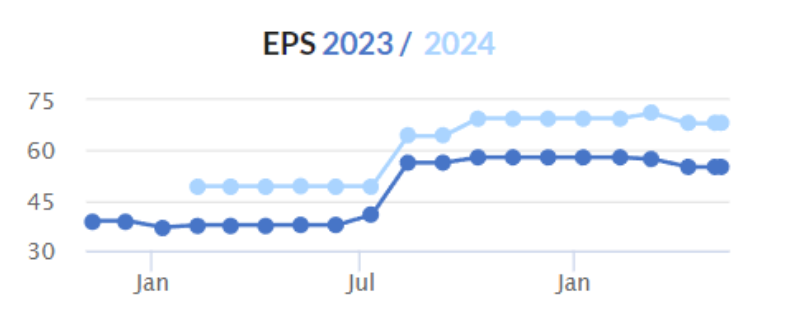

It’s only an “in line” trading update, but remember that the momentum around earnings forecasts with this company is still quite good:

I am slightly concerned by this morning’s comments on the retail operation, where the company needs to be careful that it doesn’t overstock inventories.

But pawnbroking is the main driver of the company, not retailing, and it seems like conditions for pawnbroking could hardly be any better right now. That’s a sad comment on economic conditions, when companies like H&T have to fill a gap left by mainstream lenders in order to help people get by.

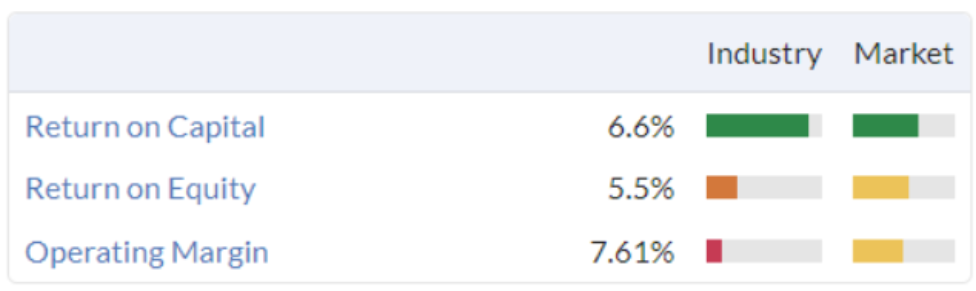

I see that Stockopedia’s Quality metrics for this share have been updated.

In March, the metrics were as follows:

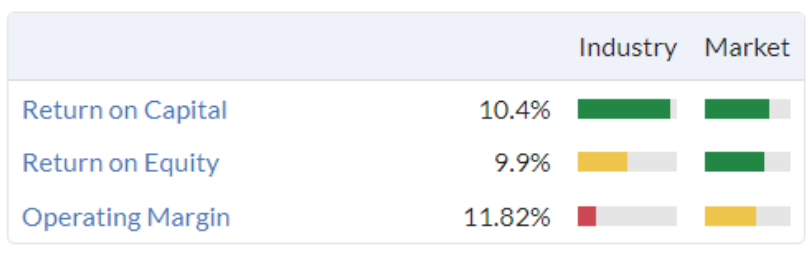

As expected, ROE is now 10%:

I’ll be the first to admit that generating an ROE of 10% indefinitely will be difficult for H&T. But I do think it has good momentum and might be able to do so for the next few years. It can even generate ROE higher than 10% in very favourable conditions. As such I don’t think this market cap (£197m) is particularly generous, and I’m happy to give it the thumbs up at a P/E ratio of only around 8x.

Treatt (LON:TET)

Share price: 650p

Market cap: £392m

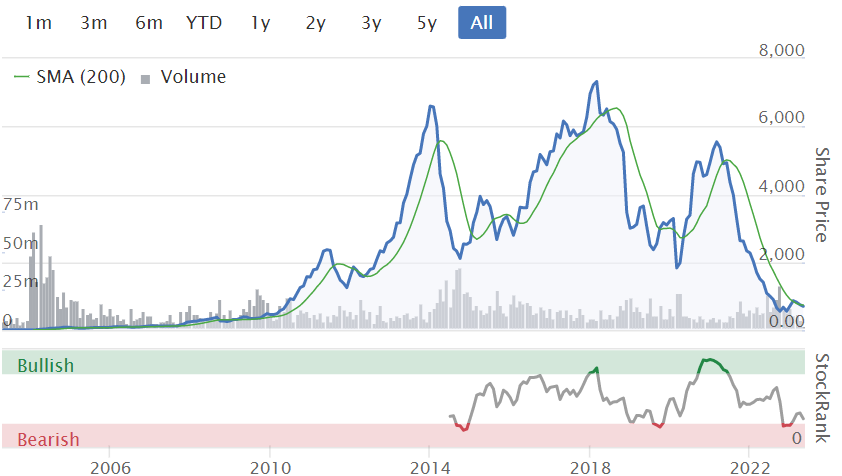

This ingredients manufacturer has given back all of the share price gains it enjoyed in 2021:

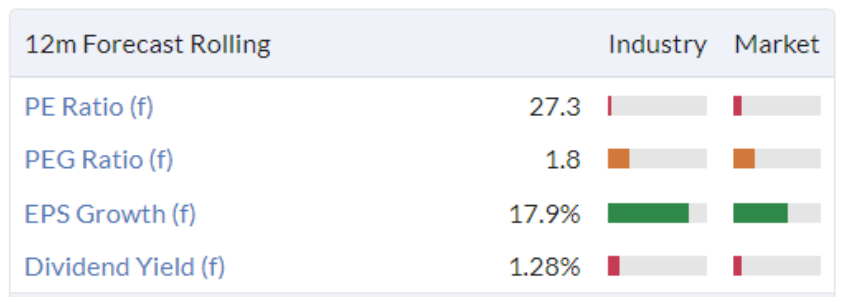

And it remains expensive (net income of only £13m last year):

Yesterday it announced interim results. Perhaps we can find some clues that it might grow into this valuation?

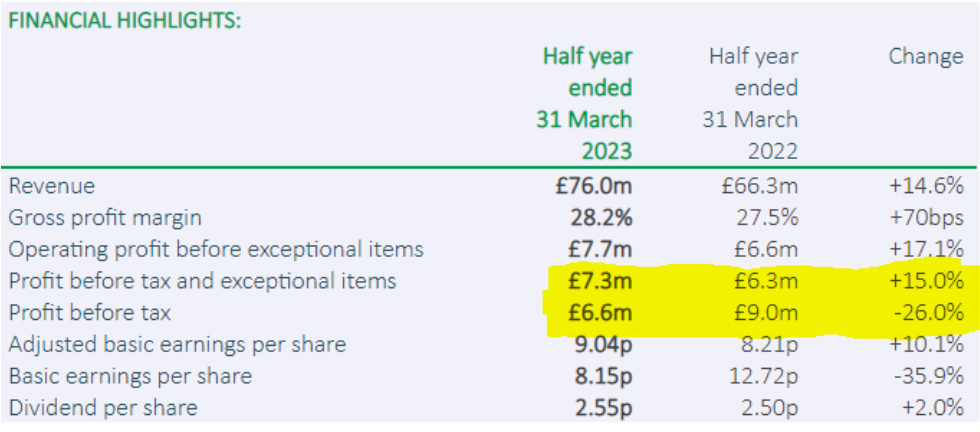

Trading is in line with expectations.

H1 revenues were up nearly 15%, helped by the reopening of China where sales were up 39%.

Revenues were also helped by the strength of the US dollar and other currencies received by Treatt. If you exclude gains from currency movements, H1 revenues were only up by 8.5%, a much more average result.

Adjusted PBT grew by 15% to £7.3m, and actual PBT wasn’t too far behind at £6.6m.

Gross margin strengthened as price increases were passed onto customers, and there were more high-margin sales in the citrus category (this category is now responsible for more than 50% of sales).

Treatt is providing “more complex, higher value, and bespoke citrus solutions for our large beverage customers”. Lower margin products were “actively managed downwards given our strategic focus”.

Net debt falls by a few million pounds to £18m.

CEO comment:

We remain well-positioned to capitalise on prevailing trends in a resilient beverage market. We are winning new customers and deepening our relationships with our existing ones. This has led to a very strong performance in our higher margin citrus category, growth in China following its re-opening and we have also seen some good early wins in the exciting coffee market.

The new UK factory will be completed by the end of this financial year:

Three years post completion, we expect to be generating a 10-15% return on investment ('ROI') from this site, with process efficiencies and initial headcount savings already taking effect.

Outlook:

We are pleased with the strong performance year to date and we have good confidence in Treatt's proposition and its ability to deliver growth, supported by positive market dynamics. Q2 momentum was particularly encouraging and we enter H2 with a strong order book and sales pipeline and trading continues in line with the Board's expectations for the full year.

Graham’s view

I’m not seeing enough evidence of fast growth to get me overly excited about this one. Top-line revenues have been boosted artificially by dollar strength, and without that you only get the 8% revenue growth which I currently consider to be the benchmark performance for decent companies.

The new UK factory should help to drive performance over the next few years, but even there Treatt is only expecting a 10-15% return on investment from this site. That would not be a bad performance by any means, but I’m sure there are many other companies that can generate a 10-15% ROI from their investments. In my book, that’s an average performance from a decent company. It’s not enough to justify a premium rating for the stock.

I’m tempted to give this one the thumbs down on valuation grounds, but I try to reserve the thumbs down for bad companies or companies with major problems. Treatt doesn’t have any major problems that I can see. It’s just too rich for my taste.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.