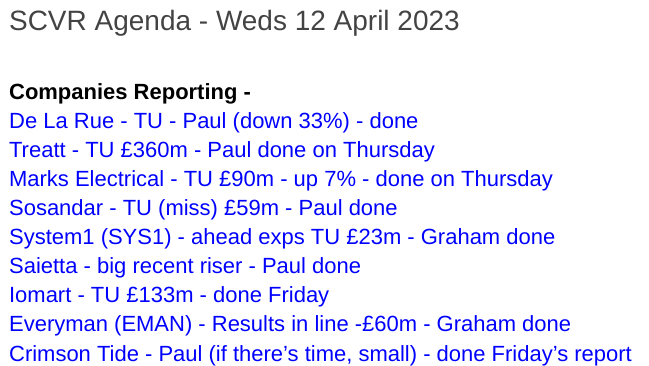

Good morning from Paul & Graham!

Signing off for today at 13:08

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Summaries of main sections

(more detail below)

Sosandar (LON:SOS) - FY 3/2023 TU - unch at 23.5p - (market cap £59m) - Paul - GREEN

Revenue in line with expectations, but PBT is c.£1.6m, a shortfall from £1.9m forecasts. Blamed on accelerated growth spending (eg. some key new hires). Now pushing ahead with international expansion via partner(s), which I think is more important than a slight profit miss. Plenty of cash, following another fundraise recently. Ambitious, capable management. I think risk:reward is now better than it's ever been, with the company now profitable & international expansion starting.

System1 (LON:SYS1) - ahead of expectations TU - up 14% to 185p - (market cap £23m) - Graham - AMBER

Profitable in H2 and for the year. Shareholders must now decide on a proposed management shakeup. As usual, SYS1 looks frustratingly close to long-promised success.

Saietta (LON:SED) - 70.5p (market cap £73m) - Paul - RED

A very strong share price rebound in recent weeks has caught my eye. Unfortunately, I think this looks like a speculative bubble at this stage.Negligible revenue and gross profit to date. Very heavy cash burn means I suspect another fundraise is highly likely, despite the company's denials. A key customer looks very small & weak. High risk & entirely jam tomorrow. Speculative upside could come if it lands some more significant deals with large manufacturers. No sign of that yet, but it says 11 projects are in the pipeline. Just a risky punt at this stage. Thumbs down.

Everyman Media (LON:EMAN) - Results in line - up 0.8% to 66p (market cap £60m) - Graham - RED

This cinema chain is pleased with an improvement over the Covid-impacted 2021. However, the 2022 results are still poor and choosing to expand rather than consolidate looks risky.

De La Rue (LON:DLAR) - Profit warning - down 23% to 38.4p (market cap £75m) - Paul - RED

More problems reported, with a slowdown in the larger bank note printing division, and low order book. This looks seriously risky now - discussions with bank to amend covenants, request to defer nearly £19m in pension deficit contributions. Another equity fundraise looks a high probability I think now, and could be on horribly dilutive terms, if it can be done at all. The outcome here could range from multibagger, to going bust, so it's impossible to value. Too risky at this stage, I think.

Paul’s Section:

De La Rue (LON:DLAR)

38.4p (down 23% at 11:01)

Market cap £75m

DLAR’s share price is volatile this morning, after yet another bad news release from this bank note printer & security authentication products group.

The turnaround plan, which looked promising a while ago, clearly hasn’t worked, and the share price is now back down to where it had to do an emergency fundraise when covid first struck in spring 2020.

As you can see below, this used to be a solid, blue chip company, now it’s a penny share -

Dilution hasn’t helped, but nor has it been ruinous - the share count was 112m in 2017, and is now 195m. But will it need to do another dilutive fundraising, I wonder? The share price is telling me that the market must consider more dilution to be a serious risk.

Brokers have been steadily, and substantially lowering expectations before today’s update -

Here’s today’s news -

De La Rue plc (LSE: DLAR) ("De La Rue", the "Group" or the "Company") today announces a trading update on the financial year ended 25 March 2023 (FY23).

The Group is also updating guidance for the financial year ending 30 March 2024 (FY24).

FY 3/2023 - if I’m reading this correctly, it seems to be saying adj operating profit will be about 5% (“mid-single digit percentage”) below market expectations - but then refers us to Numis & Investec research notes, which of course private investors don’t get access to. Great.

Adj operating profit was £9.3m in H1, if that’s any help. There were large adjustments - costs relating to restructuring in H1, so the H1 statutory loss before tax was £(23.8)m. The accounts are quite complicated to understand, I find, especially without sight of broker forecasts. But it looks like a modest profit miss for FY 3/2023.

Net debt at 25 March is expected to be in line with market expectations, whatever that is?

Looking back through old RNSs, the last reference I can find to net debt guidance was provided with the interim results, on 23 Nov 2022, indicating expected net debt of £88-92m as at year end (Mar 2023). This is net bank debt, and excludes lease liabilities.

Checking back, I don’t seem to have reviewed DLAR’s interims in Nov 2022, as they were so complicated, and it got kicked into the long grass.

I note there’s a “material uncertainty” going concern statement though, which is obviously a worry, more so today, given that performance appears to have again deteriorated below expectations.

Combined with hefty bank debt, I think we clearly need to treat this as a higher risk, special situation - which could be a great recovery share, or could turn into a complete disaster (it’s most of the way there already for existing shareholders).

So far, the announcement doesn’t sound too bad for FY 3/2023.

Moving on to:

Guidance for FY 3/2024 - this is where it gets uglier - mentioning a “downturn in currency”, affecting the “wider industry” not just DLAR, is “causing a significant degree of uncertainty”.

Demand for banknotes is lowest in 20 years, and DLAR’s order book low - no figures given. I suppose that does make sense, given that so many of us are now using cards to pay for everything, not cash.

It sees signs of a recovery, and “a significant number of new tenders actively underway”. Great, but tenders are not orders. And timing is said to be uncertain.

Authentication division sounds mixed, but no figures on profitability are provided for either division.

We do get guidance on total group profitability at the adj operating profit level, which is “in the low £20m range”. That’s a single number not a range, but I presume they mean low twenties of millions of pounds.

I don’t recognise adj operating profit as a valid metric - because it ignores the finance charges, which will be quite substantial given the level of bank debt & higher interest rates, which it mentions as an issue.

Bank covenants - in discussions with banks, seeking amendment of the covenants. Oh dear, this is getting worse with each paragraph.

Pension deficit recovery payments are huge, as we’ve reported here before. The company has requested deferral of the next £18.75m payment (it doesn’t say when this is due). It’s a big number. Pension trustees are normally pragmatic on this, but it can’t be guaranteed that they'll cooperate.

Put all that lot together, and I think another equity raise is now looking a big risk. In the circumstances, equity holders should be prepared to stump up more funding. Banks are not there to provide risk capital, and nor should the pension scheme have to compromise itself just because the company is having cashflow problems. Although if bank & pension trustees don't compromise, they might kill off the formerly golden goose.

Not mentioned in today’s update is the shareholder revolt underway, and legal problems that have recently arisen re Kenya and India.

Paul’s opinion - DLAR is obviously a can of worms, and has been for a while.

It could be a multibagger, if it manages to avoid dilution from an equity raise, and trading improves from new orders.

Worst case? It could go bust. Or next worst case might be heavy dilution from a deeply discounted placing, greatly diluting existing holders. Private investors may or may not get access to such a fundraise, if it were to happen. So why get involved at this stage?

Banks have previously been happy to give time to companies to recover, when interest rates were zero. That’s not the case any more, so I don’t think we can assume banks will necessarily play ball. With interest costs accumulating, they might insist on a placing as the price for continued, reduced support maybe? It would be good to talk to someone senior in banking, and get a handle on what the sector is likely to do, generally.

Does DLAR have any assets tucked away that it could sell to reduce debt? That might be worth looking into.

It’s a lot of business for a modest market cap, especially when you look back on previous levels of profitability in its heyday.

For me though, it’s just too uncertain, and too high risk. Hence I don’t have any choice but to report on it with a thumbs down. RED on our traffic lights system.

Risk takers might get lucky though, so only time will tell how this pans out.

Sosandar (LON:SOS)

23.75p (pre market open)

Market cap £59m

Trading Update & Progress on Growth Strategy

Sosandar PLC (AIM: SOS), one of the fastest growing fashion brands in the UK, creating quality, trend-led products for women of all ages, provides the following trading update for its financial year ended 31 March 2023.

Sosandar’s headline is -

A milestone year, delivering revenue up 44% YoY and first full year of profitability

Quite a detailed update for FY 3/2023, so I’ll just draw out the main points as I see them-

Revenue hit target of £42.5m

Profit before tax looks to be a c.£0.3m shortfall, with “at least” £1.6m PBT actual, versus market consensus (per Sosandar’s helpful footnote) of £1.9m.

Reason for the profit shortfall is said to be bringing forward some “investment” (ie. expenses) into FY 3/2023 that had been planned for the following year.

3 big hires of senior management roles.

Mobile app to be developed & launched in Q2 of FY 3/2024 (quite surprising they haven’t had an app before, which I did ask them about a couple of years ago).

UK wholesale partnerships going well - “extremely strong” trading via M&S, Next, John Lewis, Very, and JD Williams websites.

Sainsburys online launched March 2023. Going into stores (first time) in Aug 2023.

Cash - net cash of £10.5m end March 2023. Raised £5.5m net of expenses in Feb 2023.

Gross margin - strong at 56.1% (up marginally from 56.0% LY), despite increasing mix of lower margin wholesaling. This is a very good overall margin in my view, and with high-ish average order value up to £97, this looks a decent business model, I think - as evidenced by the move into profit for the first time, now it has achieved sufficient scale.

International opportunities - this is the best bit, and could trigger a significant re-rating of the shares once market conditions for small caps are more bullish. I can remember the move from UK-only to international, put a rocket under Asos shares early in its growth phase, and took the share price up to previously unthinkable highs. If SOS gets even part of that effect, the results could be exciting, I think. Although there's a lot less excitement (to put it mildly!) these days about eCommerce businesses & hence valuations.

A deal has been signed with Global-e, for worldwide sales. I’d want to focus on this for further questions with management, as the key area. This goes live in the current quarter ending June 2023.

“Active discussions” are underway with other international partners.

Paul’s opinion - some people might be disappointed with the £0.3m profit miss for FY 3/2023. However, I’m more focused on the longer-term picture, and we have good news today that international expansion seems to be actively starting. To my mind, that’s worth more than the disappointment over a modest PBT miss.

Let’s see what the market thinks!

I wish I held Sosandar shares, and really do want to get back in, when funds allow.

There's an analyst presentation online shortly, I might try to dial in to that.

Looking at the 5-year share price chart below, we can see that it's hardly gone anywhere. How come, since the business a startup, which has since grown exponentially and moved into profit? It's due to large dilution unfortunately - when Sosandar listed (by reversing into a cash shell, which worked well, as it meant there was good liquidity from day one) it had 106.8m shares in issue, and the float price was 15.1p. Today there are 248.2m shares in issue, and the share price is about 23.0p. That said, I think investors today are getting vastly better risk:reward than people (like me!) who participated in the original float, when it was just a tiny speculative startup.

Saietta (LON:SED)

70.5p (yesterday’s close)

Market cap £73m

This share keeps cropping up on the top % risers list, so thought I’d take a look.

Saietta floated in July 2021. It makes electric drives for EVs, where it claims patented IP making its motors perform better & more efficiently than competitors.

Production (little so far) is in Sunderland, with a supply chain in India also being set up with partners (see recent announcements).

So make no mistake, this is a jam tomorrow project, which is highly speculative, and heavily cash burning at the moment.

Graham reviewed it here in Oct 2022 when weak interim results came out (negligible revenues, and tiny gross margin, plus a £10.1m H1 loss before tax). The only saving grace was a £22.7m cash pile at Sept 2022, following a fundraise (£23m at 138p/share) shortly before in Aug 2022.

Sorry, it was the interim results which Graham reviewed in Dec 2022 here. The previous announcement was lowering forecasts, with claims that it was chasing bigger, longer term revenues, instead of maximising short term sales.

Why has the share price taken off recently? It’s bounced from a low of c.20p to be a 3.5 bagger at the time of writing, so well done to anyone who bought near the recent lows -

.

As you can see, it’s still a long way below the c.292p share price peak in Nov 2021.

Looking through the latest announcements, the excitement seems to be due to talking up the Indian supply chain, and a recent £5m follow on order from existing customer in the USA, AYRO, which makes electric delivery trucks.

If we attribute value to contract wins, we have to think about who the counter-party is. Looking into AYRO, it’s a tiny company, listed on NASDAQ, but with a market cap of only $19m! So what we have here, is one tiny, heavily loss-making company, placing an order with another tiny, heavily loss-making company. Hence I wouldn’t attribute any value at all to the £5m contract win announcement. It could easily end up being a loss-making project, is AYRO runs out of cash. In any case, each unit is only being sold for £1.7k (£5m divided by 3,000 units), so I don’t suppose there’s much of a profit margin in there, manufacturing on a small scale in the UK.

Cash burn - the £22.7m cash pile at Sept 2022 has dropped alarmingly to £11m by Feb 2023. Despite this, the company says in recent updates that it has enough cash to reach breakeven. Pull the other one! I don’t believe that for a second, based on its historic cash burn. Hence be prepared for the possibility of another fundraise, probably at a much lower price than the last one.

Paul’s opinion - I have to throw an ice cold bucket of value investing over the hot heads buying this share! So far, it’s only achieved tiny revenues, negligible gross margin on product, and is very rapidly burning through its Aug 2022 cash raise from shareholders.

The company is worth nothing as it stands, to a value investor.

So the valuation is based entirely on hopes for future potential. Hence punters need to properly investigate the product, the competition, the strength of the IP, etc. If this really is a market-leading product, and the IP is properly protected with watertight patents, then the company could be valuable.

Jam tomorrow companies like this rarely succeed on AIM. Even when they do, it’s years late, and after numerous highly dilutive fundraises. So the optimists who get in early, end up nursing heavy losses usually.

I could be wrong, but the recent surge in share price just looks a speculative bubble to me, with little substance. Although it says there are 11 live projects in the pipeline, so more contract news could excite the bulls. If a really major contract with a big vehicle manufacturer is announced, or a big licensing deal, then that could change things for the better, at which point I'd reassess things, and change my mind if appropriate, based on the new facts, as is only logical.

I’m just reviewing the numbers here, not the potential, and based on the figures so far, I’ve got no option than the rate this RED, with a thumbs down.

After more than tripling in price recently, top-slicing the profit might be a good way to de-risk things maybe? But it’s your money, so your decision, as always.

Graham’s Section:

System1 (LON:SYS1)

Share price: 185p (+14%)

Market cap: £23m

This marketing research company provides a trading update in some unusual circumstances. Certain shareholders (who also happen to be former company executives) are attempting to change the makeup of the Board.

Before I get into that drama, let’s take a look at today’s Q4 update for the period January to March 2023.

The company has increased the level of detail it provides when breaking down its sources of revenues. I’ll try to summarise the key points:

Data revenue rose to £4.1m in Q4, so that data revenue for FY March 2023 was £13.7m (previous year: £9.7m).

Consultancy revenue is now classified either as “data-led consultancy”, or as “Other consultancy”.

“Data-led consultancy” grew in Q3 and again in Q4, and contributed £3.5m of revenue for the year.

“Other consultancy” was more variable but still contributed £6.2m of revenue for the year (down by about 50% compared to the prior year).

Total revenues for FY March 2023 are £23.3m (previous year: £24.1m).

The company sees this financial performance as a strategic win:

During Q4, the Company made substantial and measurable progress towards the strategic objectives that the board set out following the strategic review, specifically growing our standard Predict Your and Improve Your products (platform-based data and consultancy) to a point where they represented 80% of revenue in Q4.

They note that aggregate revenues from “data” services and “data-led consultancy” were up 38% year-on-year, and contributed 73% of total revenues for the year.

Their strategy is to target the world’s biggest advertisers, who are mostly based in the United States:

Excellent progress was made in the US in Q4 where we won new mandates from 3 of the country's 25 biggest advertising spenders, including the largest. The US delivered its highest half year of revenue since FY21, and standard product revenue increased by 23% for the year as a whole.

Profitability - one of the sticking points for this stock has been the lack of profitability in recent years. It’s all very well running a new strategy, but the stock market is impatient. People want to see profits sooner or later (preferably sooner).

Some good news on this front: management believes that the company was profitable both at the adjusted and the statutory levels in H2 and for the year as a whole.

“the Board now anticipates that profit for the year ended 31 March 2023 will slightly exceed its previous expectations”

It’s true that these were modest expectations to begin with; according to the StockReport, only £0.1m of net income was expected. But hopefully this is a good sign of things to come.

General meeting

As I noted at the top, a general meeting is happening on 21st April. It has been called by Stefan Barden who is a former CEO and Board Adviser to the company, and James Geddes who is a former CFO of the company.

They want the following changes:

The existing Chairman to retire.

One of the existing NEDs to retire.

Stefan Barden to become Executive Chairman.

The Founder and President John Kearon, who has been working in the US “to build the fame of our company and our products alongside the US sales team”, to step back to an NED role.

Private investor and commentator Maynard Paton has been in touch with Stefan Barden and helpfully published Barden’s thoughts on the changes needed at System1.

According to Barden, System1 is still “selling advertising creativity”, when it should be selling an automated platform whose results are “the best, the cheapest and the quickest”, and it should be selling these solutions equally to everyone, not just to the biggest brands.

Graham’s view

Personally, I must say that I like the sound of Barden’s approach. It fully focuses on an automated tech product that has general appeal and aims to sell this product generally to everyone in the advertising business. Under this approach, System1 would no longer provide and sell any particular method of ad creation to its clients.

But this is not to say that System1’s existing strategy is without merit. Focusing its sales efforts on the world’s biggest advertisers is a strategy that appears to be bearing fruit, even if profits are still very limited at this stage. But I do think Barden’s approach is more ambitious.

Which one will shareholders vote for? I don’t know.

As for System1 stock today, the price to sales multiple is 1x and the balance sheet also includes year-end net cash of nearly £6m. The cash burn has stopped for now. So this is by no means an expensive stock, relative to its potential.

I’d love to come up with a more definitive conclusion, but I have to remain stubbornly on the fence with this one. I’ve been following this company ever since the days when it was called Brainjuicer, and always been intrigued by it. Perhaps it is about to come good at last, but there are still so many unknowns.

Everyman Media (LON:EMAN)

Share price: 66p (+0.8%)

Market cap: £60m

This independent cinema company publishes results for FY December 2022.

It previously raised expectations for these results - covered by Paul here.

I don’t think the 2021 numbers are too relevant in the circumstances, and so I won’t bother reprinting them.

2022 numbers are as follows, which they describe as a “strong operational and financial performance”:

Admissions 3.4 million

Revenue £79m

Avg. ticket price £11.29, food and beverage spend £9.34.

Market share unchanged at 4.5%

Operating profit £0.4m.

Note the very low conversion of revenues to operating profit.

Operating profit in H1 was £0.8m, so there must have been an operating loss in H2.

Furthermore, in a post-IFRS 16 world, operating profit does not include the interest imputed on the company’s lease liabilities. These are significant - and they are a real cost, because they are an important component of the lease expense.

In addition to the significant amount of interest charged on lease liabilities, I also note the increase in the interest charged on bank debt:

As a general reminder, it’s very important to check the pre-tax result, rather than the operating result, for companies with heavy leases. You could miss out on a crucial component of the bigger picture - in this case, nearly £3m of lease-related expenses!

Everyman’s pre-tax loss winds up at £3.5m for the year. It’s an improvement on the Covid-impacted 2021 result, but still rather underwhelming to me.

Outlook

Trading in the new financial year has been in line with expectations:

“Admissions in 2023 are expected to benefit from an increased number of wide releases, commitment to the theatrical window from distributors and new investment from streamers.”

“We anticipate continued financial improvement from higher admissions, strong management of costs and new site openings, despite the current difficult macroeconomic environment and its impact on consumer spends.”

“Management is confident of another year of strong operational and financial progress.”

It’s a bullish statement but for me, the tone doesn’t match the numbers I’ve just witnessed on the income statement and in the footnotes. Perhaps management are overly enthused by their adjusted EBITDA performance (£14.5m), which is a nonsense number?

Net debt finished the year at £18.5m.

Two new cinemas were opened, so the estate now stands at 38 venues with 130 screens.

Six new venues will open in the coming months and the company says it is “actively returning to an agenda of managed organic expansion”.

Graham’s view

The company apparently thinks that 2022’s performance was good enough to justify an active expansion strategy.

With that line of thinking, they remind me of the misguided retailer, selling items below cost, who said “we lose money on every trade, but we make it up on volume”.

Balance sheet net assets are £46m, including some intangible assets, so the balance sheet does not provide support at the current market cap.

More worryingly, I feel there is a mismatch between the quality of this latest financial performance and management’s perception of the performance.

If they think that a loss-making, capital-intensive company that is significantly indebted with bank loans and with leases should be expanding, then I have to worry about how this is ultimately going to wind up for shareholders. I don’t think that economies of scale are going to bail them out. So I have to give this stock the thumbs down now.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.