Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

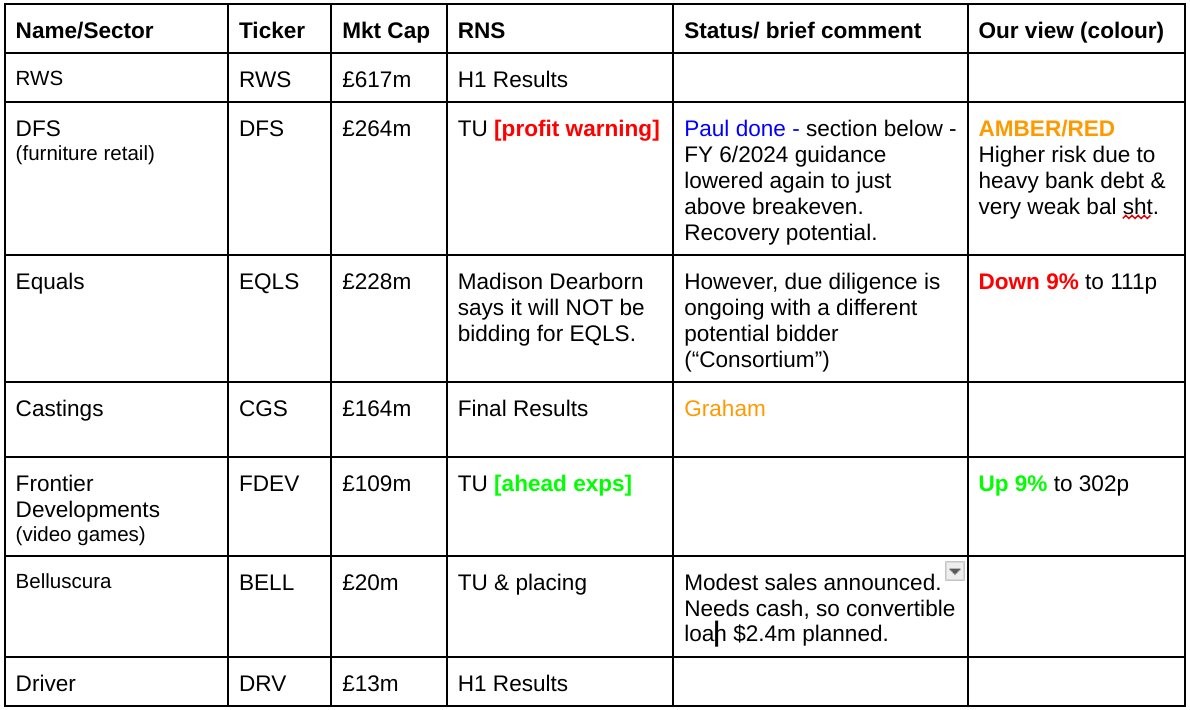

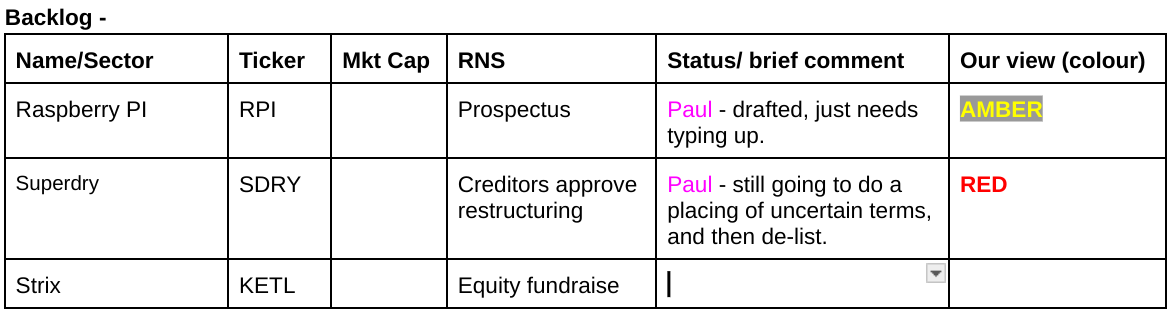

Companies Reporting

Summaries

DFS Furniture (LON:DFS) - down 8% to 103p (at 08:29) £243m - Trading Update [profit warning] - Paul - BLACK (PW), on fundamentals AMBER/RED

It's another profit warning, caused by very weak demand, and delays/costs of shipping. I can see the upside case when demand begins to recover, but for me it's the terrible highly geared balance sheet that's a deal-breaker, requiring us to take too much risk to access the upside potential. It could work out well in a recovery, but just be aware you're being asked to take a fair bit of risk, given how high bank debt has become.

Castings (LON:CGS) - down 0.5% to 368p (£158m) - Final Results - Graham - AMBER/GREEN

Today’s outlook statement reflects the continuation of an existing trend, with lower demand from truck customers than previously and no immediate signs of an improvement. EPS downgrades can be found in the broker notes. I’m switching to AMBER/GREEN as the stock is not as cheap as I previously thought.

Frontier Developments (LON:FDEV) - up 8% to 300p (£118m) - FY24 Trading Update - Graham - AMBER

This is great news with adj. EBITDA beating expectations by over £5m and the cash balance also beating expectations, reversing the cash drain seen in H1. I would like to be more positive on this video game developer but it’s still in recovery mode and is still not expected to generate any real profits until FY May 2026.

Paul’s Section:

DFS Furniture (LON:DFS)

Down 8% to 103p (at 08:29) £243m - Trading Update [profit warning] - Paul - BLACK (PW), on fundamentals AMBER/RED

DFS Furniture Plc, ("DFS" and "the Group"), the market leading retailer of living room and upholstered furniture in the United Kingdom, announces the following update on recent trading through to 11 June 2024 of the 53 week period to 30 June 2024.

PR headline tries to put a positive spin on this profit warning -

MARKET SHARE GAINS AND COST BASE ACTIONS PARTIALLY MITIGATE A WEAK TRADING ENVIRONMENT

Background - I last covered DFS on 19/3/2024, when it issued a profit warning too, alongside soft H1 results showing little profit, and reduced the full year PBT guidance by £10m to £20-25m. Soft order intake in Jan & Feb, and Red Sea shipping delays were mentioned back then. I marked it AMBER/RED due to the dreadful, over-geared balance sheet - not a good setup, where management recklessly geared up the balance sheet to pay divis they couldn’t afford. On the positive side, DFS is market leader, and should see an upturn in demand from improving disposable household incomes and rising consumer confidence.

On to today’s news -

Consumer demand has “remained challenging”.

Red Sea shipping issues has delayed products, and increased freight costs.

Revised guidance, is down again - this is for FY 6/2024 -

Further down it calls the upholstery market “very weak”, demand down another 10% on weak prior year, to a “record low”.

Gross margins are actually up 140 bps, despite shipping problems.

Cost-savings of £25m implemented, it doesn’t say what these are. I suppose the big controllable costs would be marketing, and staffing.

Bank debt looks far too high, for a business trading barely above breakeven - management seem oblivious to the risks of their reckless financial strategy - paying unaffordable divis and buybacks in recent years, funded with bank debt. With the market cap not c.£240m after this morning’s 10% drop, the level of bank debt below (this doesn’t include leases remember) is clearly much too high - so covenants would need checking, to see if there’s a danger of it needing to do another emergency equity raise, like the one it was forced to do during the pandemic - obviously no lessons were learned from that -

“Net bank debt at the end of the period is expected to be £165-170m (total facility size £250m).”

Outlook -

Recent trading and outlook into FY25:

We have been encouraged by an improving trend in our Group order intake, which is up over +9% in our fourth quarter to date, in line with our expectations. The recent improvement comes as we annualise weaker prior year comparatives and also following successful initiatives to strengthen the product ranging and pricing in Sofology and reintroducing 4 year interest free credit at select times to maximise revenue and profit in this difficult trading environment.

Whilst the economic outlook remains hard to predict we expect the widely predicted lower inflation and interest rate environment to have a positive impact on upholstery market demand levels with the declines experienced across the last three years starting to reverse and the market slowly recovering in our FY25 period. We are well placed to capitalise on any market recovery given our market leadership position, the operational leverage in the business and the progress we are making on our cost base.

Paul’s opinion - obviously this is another disappointment, but not a disaster. A bullish view might be that it’s still just about profitable, despite very weak market conditions. Hence operationally geared upside to profits should just be a matter of time as consumer spending recovers.

Shares are at/around an all-time low, and as we saw from a similar low in the pandemic, the recovery in share price was strong, albeit didn’t hold due to the wider impact of higher inflation & supply chain problems.

If DFS had a strong balance sheet with net cash, I’d say it would be a good punt for a recovery. However, it actually has a terrible balance sheet with way too much debt. So for me that remains a big problem that puts me off, so I’ll stick at AMBER/RED. If you’re not worried about the debt, and are happy to assume the bank will remain co-operative, then who knows, you could see a good recovery in this share as recovery (hopefully) begins to kick in.

Cheap equity could make it a bid target too. So for more adventurous investors, this might be worth considering as a recovery idea maybe. Could it be the next McBride (LON:MCB) and come roaring back from near-death? Just be aware you’re taking a lot of balance sheet risk, which could end badly in a downside scenario.

Not a good track record as a listed company -

Castings (LON:CGS)

Down 0.5% to 368p (£158m) - Final Results - Graham - AMBER/GREEN

This is a remarkably short final results statement, but that’s normal for Castings.

Key points for FY March 2024::

Turnover +12% to £224m

PBT +27.5% to £21.3m

“Despatch weight” (i.e. output or sales volumes) fell 5%, with the implication that the growth in turnover/PBT is a result of price increases and cost control, not underlying growth. The company points out that last year’s despatch weight was the highest since 2014.

Inflation: it was a year “of relatively stable input prices” (the same can’t be said of the prior year). A fixed price electricity contract ended in Sep 2022, but the additional power cost that followed was surcharged to customers.

Demand: the financial year started with an “unprecedented level of demand”, due to post-Covid backlogs, but it finished more quietly:

As we entered the second half of the year it became apparent that the OEMs had satisfied the backlog demand and we started to see schedules at a lower level. This was especially evident in the final quarter of the financial year and these reduced levels have continued into the new financial year. We are currently operating at a level approximately 20% below the highest point in 2023/24.

Foundry business: the absolute level of profits was broadly flat but the profit margin fell from 7.3% to 6.4%.

For one thing, the profit margin was impacted by lower volumes, due to the loss of production efficiencies.

Additionally, the profit margin was hurt by the increase in the cost of electricity, although with customer surcharges offsetting this increased cost, the absolute amount of profit was unaffected.

A new production line is planned to increase capacity by 15% in June 2025.

CNC Speedwell (machining): “a very good performance” with high volumes and sales up 36%. Note that only 5% of revenue, or about £2m of revenue, was generated from external customers.

Outlook:

Our heavy truck customers are suggesting that the current lower levels of demand are likely to continue in the short-term with the potential for a slight increase in the autumn. We will continue to develop opportunities with existing customers in areas such as the electrification of lighter trucks and build relationships in other markets such as wind energy, agriculture and in the US.

Dividend: a 5.6% increase in the total dividend for the year to 18.32p plus a special dividend of 7p. So the total yield for the year is about 7% on the current share price (but it’s important to bear in mind that the special “supplementary” dividend is non-recurring).

Earnings per share for the year is 38.45p (last year: 31.66p). So these dividend payments, even including the supplementary dividend, should be easily paid for from this year’s earnings.

Even if that wasn’t the case, the company reports a cash position of £32.5m, with no borrowings. Interest income on this has soared to £1.5m.

Pension schemes: are in surplus and are not shown on the balance sheet.

Balance sheet: net assets £134m, fully tangible and with few liabilities worth mentioning.

Estimates: I wish the company included some of this detail in the RNS, but broker reports suggest quite a poor earnings outlook for the company. Canaccord (with thanks) have reduced their FY March 2025 and FY March 2026 EPS estimates by 35% and 23% respectively, to 23.9p and 31.1.p.

Based on these forecasts the stock is trading at 15x this year’s earnings, or 12x next year’s earnings.

Graham’s view: I remain very impressed by Castings, as I have been for as long as I can remember following it. My only gripe today is that the company doesn’t give much of a hint about the earnings downgrades in today’s outlook statement. Although it must be said that the company has never published very detailed or lengthy RNS announcements.

As I said in May, it seems that this will be a quiet year for the company with demand somewhat muted. They do not typically enjoy very good visibility on future orders (although today’s statement does show that they are talking with customers about the outlook for demand later in the year).

For me, this is still one of the highest quality manufacturing/industrial stocks I’ve studied. It has a strong tendency to generate an acceptable ROE despite running a conservative balance sheet - impressive stuff. However, to reflect my disappointment relating to the EPS estimate downgrades, and the higher PE Ratios they imply are currently attached to the stock, I’m going to adjust my stance to AMBER/GREEN

Frontier Developments (LON:FDEV)

Up 8% to 300p (£118m) - FY24 Trading Update - Graham - AMBER

Frontier Developments plc (AIM: FDEV, 'Frontier', the 'Group' or the 'Company'), a leading developer and publisher of videogames based in Cambridge, UK, reports provisional financial results for the financial year ended 31 May 2024 ('FY24') ahead of expectations.

We last touched on this share in May, when the company revealed its strategy around future game releases.

But in the short-term, we have results for FY May 2024 to digest. The market wasn’t expecting much from these results at all; here are the key points.

Revenue £89m (LY: £104.6m)

Operating costs cut by 20% in H2

Profitable on an adjusted EBITDA basis in H2 and in the year as a whole (including proceeds from the sale of publishing rights for a game).

The consensus estimate was for an adj. EBITDA loss for the year of £5.1m, so it’s a significant achievement to get a positive result, even if we are using a highly adjusted figure.

Cash improves to £29.5m. This has been a source of concern (as it has been shrinking), but it now bounces back from the £17.1m level seen at the end of Nov 2023.

Outlook reiterates the timetable for new game releases, as initially revealed in May. Additionally:

As well as the unannounced own-IP CMS game coming this financial year, FY25 will also see the launch of Frontier's third F1® Manager game, with F1® Manager 2024 confirmed for release on 23 July 2024 on PC, PlayStation® 5, Xbox Series X|S, PlayStation® 4 and Xbox One.

The Board is comfortable with the current consensus of analyst expectations for FY25 revenue of £87 million, and is confident of being able to achieve profitability in FY25 through a continued focus on driving return on investment and tight cost control.

Previous F1 Manager games haven’t been quite as successful as hoped - hopefully the third instalment will include some improvements.

Estimates: I view these estimates as highly uncertain, but for what it’s worth there are small upgrades to FY May 2025 expectations.

Unfortunately, the broker estimates still suggest negative adjusted EBITDA in FY 2025, e.g. Liberum has an estimate for adj. EBITDA of minus £2.6m (improved from minus £3.7m).

The company is then forecast to achieve real profitability in FY May 2026.

Graham’s view

This is a terrific update, relative to expectations.

The problem is that expectations were already so low. And even after upgrades, the estimates for FY May 2025 remain dismal.

As for the FY May 2026 estimates, I don’t believe that it’s possible to predict the success or otherwise of the company’s game pipeline so far into the future.

With so much uncertainty, and with another difficult year ahead, I’m going to remain neutral on this stock.

Why not RED? Because I do still believe that FDEV are very skilled when it comes to making CMS games (“creative management simulations”), and that’s what they are focused on now. Overall, their track record in this genre is excellent, and they still have cash to fund development in the short-term. So I wouldn’t want to bet against them.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.