Good morning from Paul & Graham!

We have to leave it there for today.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Summaries

On Beach group (LON:OTB) - 104p (£173m) - FY 9/2023 Trading Update - Paul - GREEN

A positive sounding update - traded in line for FY 9/2023, but better finance income means PBT at top end of analyst range (but not stated what that range is!). Bookings for winter 2023 and summer 2024 sound well up. Overall, I'm guessing that a 10-20% share price rise could be on the cards here, as the existing forward PER looks much too low at only 7.1 (written before the market opens, so let's hope I don't look an idiot if it goes down!!!)

Supreme (LON:SUP) - up 2% to 96p (£112m) - Response to media speculation - Paul - AMBER

This concerns media reports of a possible ban on disposable vaping products. SUP's update doesn't really say a lot, and looks like PR to me, emphasising that vapes can be used as a smoking cessation product. Usefully though, it does confirm current trading remains in line with expectations. Will update on possible impact of disposables ban, when more information is available. I'm sitting on the fence overall, keeping my amber view, as there seems merit in both bull and bear cases.

Equals (LON:EQLS) - up 6% to 113p (£210m) - Interim Results (upgraded estimates) - Graham - AMBER

This fintech company providing services primarily to B2B customers issued strong results and had its full-year estimates upgraded. It also signalled an intention to pay a maiden dividend. I remain neutral but the financials are interesting and it may be worth a closer look.

Frontier Developments (LON:FDEV) - down 1% to 304p (£120m) - FY 5/2023 Results - Paul - AMBER

Poor results, but the loss is all due to a non-cash impairment. Just above breakeven excluding that. Balance sheet looks adequate, with a cash buffer that may be adequate. I really dislike this sector - horrible visibility, with large up-front development spend for unknown returns. On the upside, if it can return to former profitability levels, then there might be nice upside from a share price that's down 90% from the early 2021 highs. Probably just for sector experts, and complete punters only!

Duke Royalty (LON:DUKE) - up 3% to 33p (£139m) - Trading Update - Graham - GREEN

Another solid update from Duke, confirming £6m of recurring cash revenues in Q1 and guiding for £6.2m of recurring cash revenues in Q2. I continue to view this one most likely being undervalued at the current level, although it’s still early in its evolution.

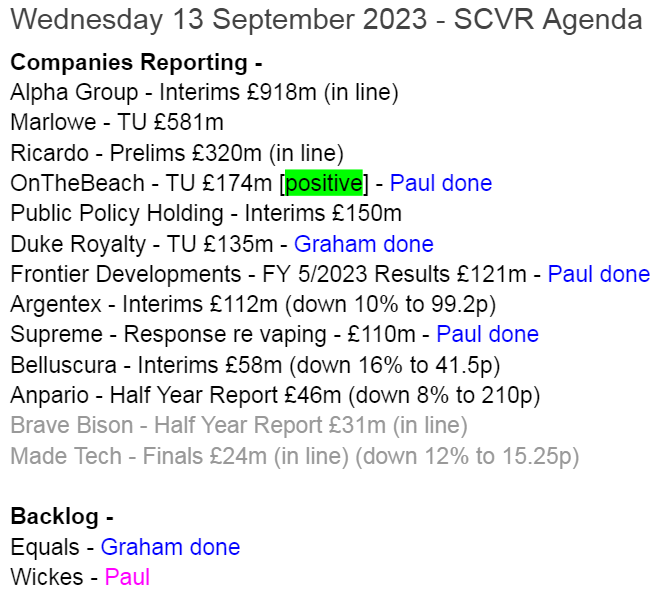

Here's today's list. As usual we'll prioritise ahead/behind updates, so won't cover the in lines unless there's something particularly interesting about them & enough time -

Paul’s Section:

On Beach group (LON:OTB)

104p (£173m) - FY 9/2023 Trading Update - Paul - GREEN

This one caught our eye at 95p on 14 August, when the founder (now a NED) bought £2.5m of shares in the market, which triggered us going GREEN here - Director buys of that size usually happen for a good reason!

On the Beach Group plc (LSE: OTB.L) today provides an update on trading for its financial year ending 30 September 2023 ("FY23"), in advance of announcing its preliminary results on 5 December 2023.

This summary below sounds OK, it’s basically traded in line with expectations, but had a boost from higher than expected interest income on cash balances -

The StockReport shows a forward PER of just 7.1, so to be slightly ahead of that is very pleasing, and could trigger a re-rating from this bombed out PER, I imagine (writing this before the market opens).

Outlook comments - forward bookings (this sounds like passenger numbers, so revenues could benefit beyond these numbers due to price rises, possibly? It’s not entirely clear -

The Group expects Summer 23 passenger numbers to be 11% ahead of Summer 22, with Winter 23 currently 26% ahead of the prior year. Notwithstanding that it remains in its early stages, bookings for Summer 24 are also significantly ahead of the prior year…

Following our strong second half performance we will exit FY23 with the momentum of a record forward order book and demonstrable progress in strategic expansion areas, which we are excited to build upon in FY24."

Paul’s opinion - rushing this out just before 8am, I think this share is likely to put in a nice increase today.

I can’t find any broker notes unfortunately, so it will be interesting to see how much brokers increase forecasts for FY 9/2024? It sounds as if the numbers are likely to be increased, but currently a jump in EPS from forecast 11.5p in FY 9/2023, to 14.8p in FY 9/2024 is already anticipating a considerable improvement.

We’re in the dark re forecasts, but with a positive-sounding update today, I suspect this share is likely to attract buyers. It’s fun to guess! I reckon a 10-20% share price rise today could be on the cards, so a good candidate for an opening bell purchase, possibly?

We also got a good update from midcap Jet2 (LON:JET2) recently. Could this sector be a nice area to find oversold shares? I think it might be. Although given what happened in the pandemic, some investors might want to permanently avoid the travel sector, as we now know it could get completely shut down again at any point if another virus appears. So possibly PERs should be lower than they were historically, given this increased risk?

Supreme (LON:SUP)

Up 2% to 96p (£112m) - Response to media speculation - Paul - AMBER

Supreme comments this morning on media reports of a possible ban on disposable vapes.

My summary of key points -

- Emphasises that its vaping products help people stop smoking.

- Govt formal consultation still taking place.

- Supreme believes that, if banned, users of disposable vapes would switch to other vaping products (which Supreme makes/sells).

- Rechargeable “pod system” set to be launched - better for environment vs disposables.

- Trading in line with market expectations (aEBITDA of £25.6m), FY 3/2024.

- Will do comprehensive review “to measure the impact” of any legislation changes, once clarified.

Paul’s view - it’s difficult to say, but the last point seems to imply there might be some possible downside impact on Supreme from a ban on disposables? Why else use the word “impact”? As mentioned yesterday, the trouble is that the more Supreme is known as a vaping company (it does other things too though), then the more likelihood there is that many investors won’t want to get involved at all. So all this publicity on vaping is probably not helping. Hence a low PER on an ongoing basis seems likely to me, regardless of the financial outcome of the possible ban on disposables. The rest of today’s response from Supreme strikes me as a PR release.

I can see merit in both bull and bear cases, so will remain at AMBER.

Thin end of the wedge, or a buying opportunity?

A sea of green for SUP on most of the Stockopedia metrics. That 6% dividend yield looks tempting, now that inflation is coming down, and interest on cash may not be so generous next year, if/when interest rates come down. So locking in 6%+ yields could be a good strategy, possibly? (if they're sustainable) -

Frontier Developments (LON:FDEV)

Down 1% to 304p (£120m) - FY 5/2023 Results - Paul - AMBER

This share came up at Mello Monday this week, as something potentially interesting for us to look at.

Frontier Developments plc (AIM: FDEV, 'Frontier', the 'Company', or the 'Group'), a leading developer and publisher of video games based in Cambridge, UK, publishes its full-year results for the 12 months ended 31 May 2023 ('FY23').

Revenue down 8% to £104.6m

Hefty operating loss of £26.6m, but that includes a £28.7m non-cash impairment charge.

Cash of £24.8m recently, end August 2023, down from £28.3m at May year end.

Outlook -

The Board continues to be comfortable with market expectations for FY24, with consensus revenue at £108 million and consensus Adjusted EBITDA* loss of £9 million.

The Board is confident that the Company can return to attractive levels of financial performance over the medium-term, based on the strength of its existing portfolio and planned new releases, underpinned by the refocusing of its strategy.

* Adjusted EBITDA is earnings before interest, tax, depreciation, and amortisation charges related to game developments and Frontier's game technology, less investments in game developments and Frontier's game technology, and excluding impairment charges, share-based payment charges and other non-cash items.

Balance sheet - seems OK with c.£32m NTAV, including net cash of £28.3m at May 2023.

Strong balance sheets are particularly important with games development companies, because they incur the heavy spending up-front to develop games, then the success/failure of the game has a dramatic impact on the future returns. Hence they need a big cash buffer I think, to tide them over if games flop.

Paul’s opinion - lots of listed games developers floated at high valuations, and have since disappointed, including this one. Is FDEV a bargain now, having fallen c.90% from its peak in early 2021? It might be, but I can’t tell, because it all depends on whether its new releases of games in development are successful or not.

Although I see from its track record, that FDEV has been decently profitable in the past. So it might just be going through a bad patch perhaps? There might be an issue with profitability - eg. tinyBuild (LON:TBLD) flagged that online platforms are being less generous with their payments to games developers.

Anyway, it’s not something I would want to gamble on, because I don’t have any insights into the games, and there’s so little forward visibility that me punting on it would just be complete guesswork.

That said, if FDEV is able to return to prior levels of profitability, then the upside on the shares from this level would probably be considerable.

There was also takeover interest in the sector during the last boom. David Braben has 33%, so effectively controls it. I see Tencent Holdings is the next biggest holder, at 8.6%.

Unless you’re a sector expert, then surely there are better sectors to look at?

I’ll put this in the “don’t know” tray, so AMBER for me. I don’t see anything particularly bad in the numbers though - i.e. insolvency/dilution risk looks quite low at this stage.

Quite a rollercoaster ride here. Note that the share count has only gone up a little, so theoretically former glories might be achievable, if profitability were to soar again -

Graham's Section:

Equals (LON:EQLS)

Share price: 113p (up 6% yesterday)

Market cap: £210m

This is “the fintech payments group focused on the Enterprise and SME marketplaces”. Its vision is “the simplification of global money movement for business customers”.

It announced interim results (to June) and a trading update yesterday.

Paul Hill also released a Vox interview with the company, which is very helpful.

Here are the interim highlights:

The impressive growth is explained by the CEO in the interview as simply the result of “winning new business all the time… our addressable market is growing… it boils down to winning new new business [sic], particularly the larger end of new new business”.

As we discussed in this report in July, Equals made a small Belgian acquisition which gave it regulatory licences and banking relationships across Europe. The integration of Oonex (“Equals Money Europe”) is “proceeding according to plan”.

CEO comment in the RNS:

"This is an outstanding set of results with record revenues combining with improved gross profit retention to yield enhanced profitability. These results, coupled with our continued cash generation, enable us to announce our intention, conditional, inter alia, upon the completion of the proposed capital reduction, to pay our maiden dividend of 1.5 pence per share in respect of the financial year 2023, while continuing our growth strategy.

Current trading and outlook

This sounds positive:

In Q3 2023 to date, revenues continued to perform strongly reaching £63.6 million on a year-to-date basis as of 8 September 2023. This is 39% ahead of the same period in 2022 and represents revenues per working day of £370k compared to £265k per day in the prior year.

Year-to-date revenue growth (39%) is therefore slightly lower than H1 growth (43%), but hardly a reason for concern.

CFO review breaks down the cost base and illustrates how higher revenues and gross profits were achieved with a cost base that was fixed in many respects, thereby leading to significantly higher profits. The major change in operating costs was staff costs, up from £6.6m to £9.2m.

One other figure in particular stands out to me, in cost of sales: affiliate commissions. Equals finds B2B businesses who will refer their own customers to become Equals customers, paying out large commissions in return.

Note how affiliate commissions dwarf the commissions paid to staff at Equals itself and also the transaction costs associated with providing the services:

I’m not suggesting that there is anything wrong with this, but it does tell us something important about the business model.

Graham’s view

I’m impressed by the clarity with which the company lays out its amortisation of intangibles, which seems unusually transparent.

Combine that with a quick look at the cash flow statement, where spending on intangibles is not excessive, and the cash performance looks good in the most recent period.

Upgraded estimates at Canaccord see revenues in the current year of £95.5m (previously £88.1m) and PBT of £10.8m (previously £8.1m). As we said back in July, it was sensible for investors to start pricing in upgrades back then, as momentum was clearly very strong and the existing forecasts appeared too conservative at the time.

I’m pleased to see that the company has made it through to achieving substantial profits:

Given that it’s now crossed over into making substantial profits, with continuing high levels of revenue growth, there is plenty of cause for optimism.

However (and this is my own fault, not the company’s), I don’t feel that I understand the competitive advantage here - why do businesses choose Equals over the multitude of other products they could choose when it comes to payments? Is it all about the product itself or has it got a lot to do with the route to market, i.e. the way the company finds its affiliate partners?

I’m going to stay neutral on the stock for this reason but that might be unfair - this could still be an underpriced growth stock even after it has multi-bagged since its Covid low.

Paul adds: Excellent review of EQLS, thanks Graham! Personally, I'm a bit more positive, and would go with AMBER/GREEN, as opposed to Graham's more cautious AMBER. I'm a bit wary of companies that start producing bumper profits out of nowhere (vs prior years), especially in a highly competitive sector. But the figures and broker upgrades have impressed me, and providing nothing goes wrong, then valuation still looks reasonable. Could be good.

Duke Royalty (LON:DUKE)

Share price: 33p (+3%)

Market cap: £139m

This is “a provider of alternative capital solutions to a diversified range of profitable and long-established businesses in Europe and North America”. I’m a former shareholder in the company.

Today brings a Q1 update (April to June) and guidance for Q2.

Key points:

Q1 recurring revenues £6m (as previously discussed).

Total Q1 cash revenues, including one-off transactions, of £7.8m.

Investment income has grown well:

Q1 saw one successful exit from an investment, and two small follow-on investments into its existing portfolio.

In Q2 (July to September), we have already had one large investment into a Texas-based company (discussed here).

The forecast for Q2 is £6.2m of recurring cash revenues, up 17% year-on-year and up by a few percentage points vs. Q2.

CEO comment:

"We are pleased to report another quarter marked by record-breaking cash performance, underpinned by solid growth. This underscores the resilience of Duke's business model, especially in the face of ongoing economic challenges. Looking ahead, we remain confident that the consistent quarterly growth we have generated in recurring revenue will continue, and Duke is committed to working with our partners for their long-term growth."

Graham’s view

I laid out a detailed rationale for my positive view on this stock in early July, so I would refer readers back there for my detailed comments.

At the current level I do view it as offering good value. It is still not back at its pre-Covid valuation, despite not really putting a foot wrong through all of this time:

The yield as calculated by Stockopedia is 9% and it passes the “Ben Graham Deep Value Checklist”.

I’d probably be a seller over c. 45p, but at 33p it seems too cheap to me.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.