Good morning, it's Paul & Graham here!

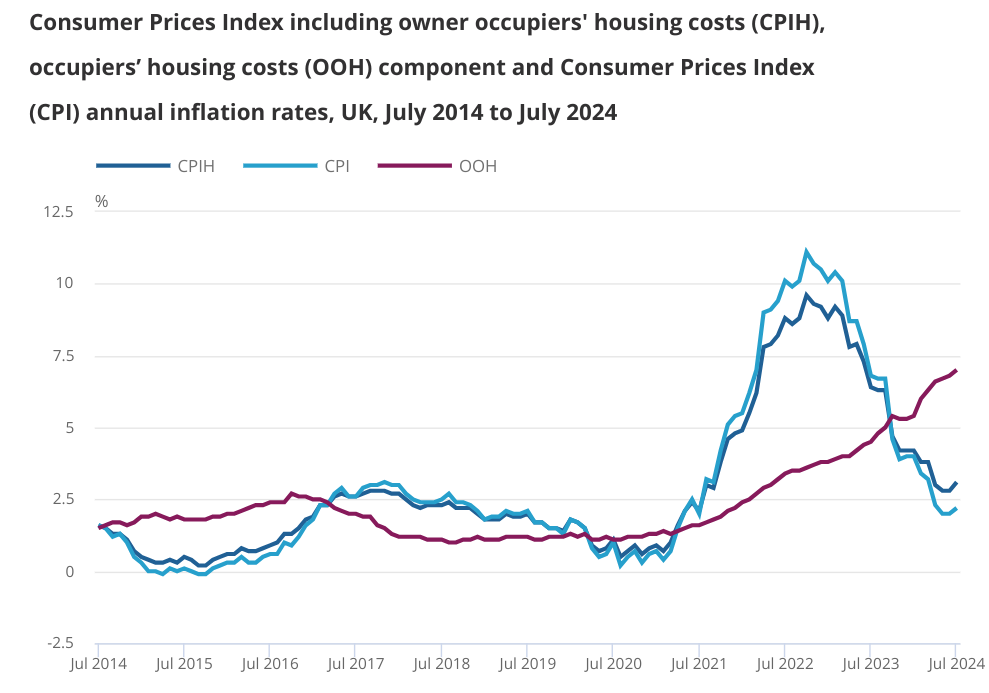

July 2024 ONS Inflation Report

Key points -

"The Consumer Prices Index (CPI) rose by 2.2% in the 12 months to July 2024, up from 2.0% in June 2024."

(a rise was expected by analysts, according to the BBC)

"The largest upward contribution to the monthly change in both CPIH and CPI annual rates came from housing and household services where prices of gas and electricity fell by less than they did last year; the largest downward contribution came from restaurants and hotels, where prices of hotels fell this year having risen last year."

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

Companies Reporting

Other mid-morning movers (with news)

Playtech (LON:PTEC)

Up 19% to 639p (£1.98bn) - Response to media speculation - Paul - NO COLOUR, but looks interesting!

This is all I’ve got in our archive for this gambling technology group -

Sky News revealed at 10:14 this morning that -

“Flutter Entertainment is in detailed talks to buy Snaitech, a deal that would leave owner Playtech as a pureplay B2B operation…in a deal that could be worth about £2bn”

Is this really how price sensitive information should be revealed - by the press, during market hours? The regulatory rules are clearly unsatisfactory.

£2bn is an eye-catching figure, given that PTEC’s entire market cap is c.£2bn after today’s 19% rise.

Playtech has been forced to respond with this RNS today - key points being -

- Yes it is in talks with Flutter.

- PTEC has granted Flutter a period of exclusivity to do due diligence & finalise documentation.

- No certainty a deal will proceed, nor as to the terms (standard wording).

Paul’s view - this sounds like a well-advanced potential deal, which should have been disclosed to the market previously, thus they have created a false market in PTEC shares by withholding price sensitive information from investors. Imagine if you'd sold 20% lower, unaware that seemingly advanced bid talks for the largest business unit were in progress?

The next step for investors would be to do a spreadsheet to work out how much each part of the business is worth (or see if a broker has done it for you!). That should be fairly easy, as looking at the last accounts, it splits out Snaitech's EBITDA of 256m Euros in FY 12/2023, so convert into sterling at 1.17, gives £219m. Hence a £2bn valuation looks to be an EBITDA multiple of 9.1x. That’s assuming it’s done on cash/debt-free basis. Is that a fair price? I don’t know, maybe any M&A specialists could tell us if that’s the sort of multiple to be expected in this sector?

The Stock Report shows the entire group’s EV/EBITDA as 6.78x, so a disposal at a usefully higher ratio could add value maybe?

As mentioned last time, PTEC has a large & complicated balance sheet, so I can’t readily determine what the debt levels are other than to repeat the 283m euros shown as net debt in the 2023 accounts highlights. Suggesting that a £2bn disposal would leave it with tons of surplus cash.

That’s as far as I can go with it, without spending the rest of the day getting into the detail, so I’ll conclude with a “looks interesting, worth taking a closer look” conclusion.

Another thing to bear in mind is that quite a few bid approaches this year have fallen through, so the downside risk is you end up buying into a spike upwards, but as always that’s your call.

Flutter Entertainment (LON:FLTR)

Up 9% to 15,965p (£28.3bn) - Q2 Results - Paul - NO COLOUR

I can’t see any separate announcement from Flutter re the potential deal with Snaitech - please post a link if you find anything from them.

FLTR if you recall moved its main listing to New York (FLUT) but still seems to also be listed in London (FLTR).

FLTR has a horrendous balance sheet, with giant goodwill and intangible assets. Strip those out, and it’s NTAV is something like $(9)bn negative. There’s a lot of net debt too, at $5.5bn, a leverage multiple of a fairly high 2.6x.

Which raises the question, how is Flutter intending to finance the deal to possibly buy Snaitech for almost $2.6bn, given its already high debt?

There’s a gulf in valuation between FLTR (shares look over-valued), and PTEC (shares look cheap), so this looks again like the US-UK mismatch in valuations coming to the fore.

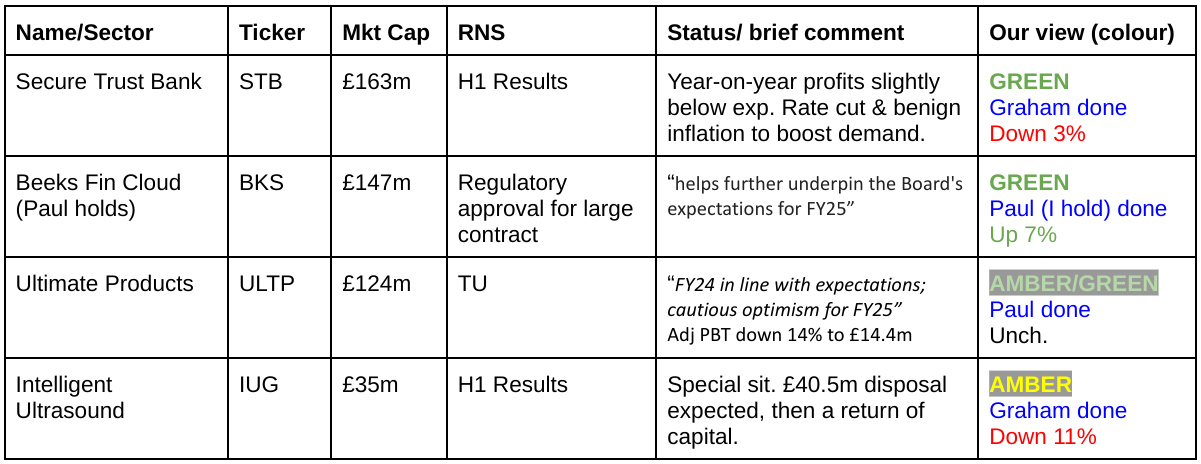

Intelligent Ultrasound (LON:IUG)

Down 6% to 10p (£33m) - Half-Year Report - Graham - AMBER

I would personally be inclined to stay away from this one as it’s a complicated situation where the underlying businesses don’t seem to be very good. IUG is selling its largest business for an enterprise value of £40.5m, and it then intends to make a “material return of capital following a review of the growth potential and capital requirements of the post-transaction business and taking legal and tax advice on the structure of a return”.

Unfortunately the post-transaction business is not doing very well. Today’s income statement shows continuing operations with H1 revenues of £4.5m (down from £5.8m) and an operating loss of £1.4m (H1 last year: operating loss £0.6m). The cash balance has fallen by £2m in six months to just £1m. Based on these figures, I’m not convinced that IUG shares offer much value here. A significant chunk of the disposal proceeds may be needed to fund their remaining activities.

Silver Bullet Data Services (LON:SBDS)

Up 11% to 86p - New Contracts - Paul - AMBER/RED

As others have commented, it’s impossible to draw any meaningful financial information from today’s buzzword-infused update (eg AI mentioned 6 times). These sound more like partnership deals, than sales contracts. No indication is given of size, other than it all sounds terrifically exciting, in huge & rapidly growing markets that SBDS might somehow be involved in.

Note also that it’s appointed Zeus as joint broker. I take that as a sign that another equity fundraise is possibly being planned, and a fresh set of investors are needed, but that’s obviously just educated guesswork rather than firm fact at this stage.

A reminder that the last accounts (see SCVR 29/5/2024) contained a “material uncertainty” going concern warning - clearly flagging that more equity is needed. I don’t care what anybody says, when you have a material uncertainty warning, combined with a new joint broker being added, that points strongly towards a likelihood of another placing. It's anybody's guess what the size, and price would be.

On the plus side, SBDS does sound quite interesting, but personally I’d want to know it’s financially secure before investing, which it isn't at the moment, due to that going concern note.

Punters love the story here, and it 8-bagged from mid 2023 low to Feb 2024 high - it’s since halved. So there’s scope for the same story to fire up investors again, if some meaningful (as opposed to today’s rampy-sounding) announcements are released. I do like the rapidly rising revenues, and shrinking losses though, so am happy to keep an eye on this potentially interesting company. But it needs more cash, so for the time being it has to remain at AMBER/RED, to flag the dilution risk, sorry to anyone infuriated by that. I'm happy to take a fresh look once it's properly refinanced.

IXICO (LON:IXI)

Up 37% to 9.0p (£5m) - Trading Update & Contract Win - Paul - AMBER

Some signs of life here, with a better than expected trading update, good order intake, and a contract win.

I previously flagged that this looks quite an interesting company, but then demand dried up. If it can rebuild revenues, and stem the losses, without running out of cash, then it could recover a bit maybe? Historically it was profitable.

Paul’s view - not a bad little company, but too small to be listed probably.

Distil (LON:DIS)

Down 32% (£2m) - profit warning & needs more funding. Paul - RED

Sales have almost completely dried up.

“This backdrop has created an immediate short-term funding need within the business and the Board is currently exploring funding options to address this need.”

Looks like it’s heading for zero I’m afraid. Who in their right mind would want to refinance this company, given its long & dismal track record? Maybe it could sell its brands for something, who knows? There's also a £3m "financial asset" on the balance sheet, which seems to be building a whisky distillery at Ardgowan - could this be sold to raise cash, or mortgaged perhaps?

Maybe DIS can survive, but it doesn't show any signs of being a viable business, and has spent over 20 years trying, as a listed company.

Summaries

Beeks Financial Cloud (LON:BKS) - (Paul holds) - Up 8% to 238p (£158m) - - Exchange Cloud Contract Approval - Paul - GREEN

Excellent news that regulatory approval has been achieved for a major new contract. Expect further upgrades to forecasts.

Secure Trust Bank (LON:STB) - down 2% to 836p (£160m) - Interim Results - Graham - GREEN

An unusual picture for STB shareholders as they see a mild profit warning for the current year offset by upgrades to forecasts for future years. STB are positive on the economic outlook and very positive on their ability to hit medium-term targets. While I don’t know if I share their confidence, I think the risks are priced in at a PER of 3x.

Ultimate Products (LON:ULTP) - down 1% to 139p (£123m) - Trading Update - Paul - AMBER/GREEN

A profit warning in May 2024 knocked confidence, but things seem to have settled down now, with an in line FY 7/2024 year end update today. Valuation seems reasonable, balance sheet is fine with only modest debt, and there's a useful dividend yield too. I'm happy to move up a notch to a moderately favourable view.

Paul’s Section:

Ultimate Products (LON:ULTP)

Down 1% to 139p (£123m) - Trading Update - Paul - AMBER/GREEN

Ultimate Products, the owner of a number of leading homeware brands including Salter (the UK's oldest houseware brand, est.1760) and Beldray (est.1872), announces its trading update for the financial year ended 31 July 2024 ("FY24").

FY24 in line with expectations; cautious optimism for FY25

For context, we need to remember that it issued a profit warning in May 2024. Here are my notes from 10/5/2024 - with my summary below -

“Profit warning unfortunately, due to continuing softness in demand and customer de-stocking. Broker forecast is dropped by 21%, quite a hefty miss. Outlook for FY 7/2025 sounds better though, with order books improving. I think this deserves a c.20% drop in share price, as previous growth must have been flattered by customers stocking up.”

Hence “in line” today is actually c.20% below the original forecasts for FY 7/2024. So it’s not good, just that things haven’t deteriorated further.

Key numbers (draft, subject to audit) for FY 7/2024 -

Revenues 6.5% to £155.5m

Reasons given for softer trading - this is consistent with what they’ve said previously -

“supermarket ordering held back by overstocking, weakened consumer demand for general merchandise, and strong prior year comparatives having been bolstered by the exceptionally strong demand for energy efficient air fryers in H1 2023.”

Clear guidance - I like that they’ve included both EBITDA and adj PBT - keeping everyone happy -

“In line with market expectations, unaudited adjusted EBITDA* decreased by 11% to £18.0m (FY23: £20.2m) and unaudited adjusted PBT* decreased by 14% to £14.4m (FY23: £16.8m).”

Net debt is absolutely fine, no issues here -

“At the year end, the Group had a net bank debt of £10.4m (FY23: £14.8m), which represents a net bank debt / adjusted EBITDA ratio of 0.6x (FY23: 0.7x), well within the Group's capital allocation policy of 1.0x.”

Outlook - interesting comments for wider read across re Red Sea shipping costs -

"Trading at the start of the current financial year is in line with market expectations. The significant increase in shipping rates, arising from disruption in the Red Sea, has seen some recent stabilisation and is leading supply chains to adapt to a new normal. While this process takes place, the Group's commercial teams are working hard, as they did in the previous shipping crisis, to mitigate the short-term impact on gross margin.”

"Our FY24 performance was not without its challenges but I am pleased to report that many of the temporary headwinds are now easing, as reflected in a healthy FY25 order book. As we look ahead to FY25 with cautious optimism, we are confident in the proven resilience of our business model and the ongoing demand for our fantastic range of leading homeware brands."

Broker updates - we’re spoiled for choice, with 3 brokers updating. I go to ED first, as that’s effectively the company’s forecast, as follows -

FY 7/2024: EPS 12.3p, divi 6.1p (PER 11.3x, yield 4.4%)

FY 7/2025: EPS 14.5p, divi 7.2p (PER 9.6x, yield 5.2%)

Those valuations look reasonable to me.

Paul’s opinion - I don’t feel motivated to rush out and buy this share, but for a plodding type of portfolio, where you just want to own reasonably OK companies at fair prices, and receive a decent yield, and with a sound balance sheet, then this could be a contender.

In recent years management have demonstrated an ability to tackle whatever crises are thrown at them, from covid, through energy, and various shipping & supply chain disruptions.

Pre-profit warning I used to be green on this share, but then moderated to amber on the warning. Things seem to have stabilised since, and the valuation is quite attractive (assuming it achieves the rebound in earnings forecast for FY 7/2025), so I think AMBER/GREEN looks fair at this stage.

Please remember as always that is just my assessment of the facts, figures, and forecasts as of today. It’s not a prediction about what may or may not happen in future. We have to keep reminding people of that, as when something unexpected happens in future, they sometimes tell us that we got it wrong. My reply is always, no we didn’t get it wrong. The facts have just subsequently changed, which is what tends to happen in life!

The 5-year chart below isn't amazing, but there have been decent divis on top, so total shareholder return not bad, especially considering all the macro chaos over this period -

An importer of Chinese-made small household products isn't what I personally would consider a high quality business, but the Stockopedia computers just look at the numbers, and give it an almost maximum quality score - and a very high overall StockRank -

Beeks Financial Cloud (LON:BKS) - (Paul holds)

Up 8% to 238p (£158m) - Exchange Cloud Contract Approval - Paul - GREEN

“Beeks Financial Cloud Group plc (AIM: BKS), a cloud computing and connectivity provider for financial markets, is pleased to confirm that the conditional contract with one of the largest exchange groups globally (the "Exchange"), announced on 6 February 2024, has now received regulatory approval.”

This is very important news I think. Exchange Cloud is the name Beeks gives to its largest size contracts, where it provides white label computer connectivity services for large customers such as the Johannesburg Stock Exchange. They then sell services via Beeks to their own customers, generating revenues for both.

We had previously been told that another large contract was in the offing, going through regulatory clearance. The good news today is that approval has been received, and the contract is beginning to be implemented. I heard a rumour that it might be one of the large US exchanges, possible the NYSE, but I don’t think the client has been specifically announced yet.

EDIT: A google search has revealed this fascinating document, showing that (see footnote 9) the major exchange client is NASDAQ. This is already in the public domain. This document also explains quite well the advantages for traders, hedge funds, etc, using the NASDAQ/Beeks service, instead of having to go through all the cost, and complexity (and maintenance) of installing their own servers at the exchange. Once Beeks is installed, new clients can sign up and be actively using the service in hours. We'll just have to wait and see what level of take up there is, before forecasts can reliably be increased. It all looks very interesting to me, and a mkt cap of around £150m doesn't seem a lot for a company achieving this kind of success. Plus all the follow-on pipeline deals with other exchanges alluded to in the comments today. I am talking my own book of course, but am genuinely quite excited about the potential here. End of edit.

There’s a bit more detail here -

“Following receipt of regulatory clearance, the deployment of services and recognition of revenue has commenced. A further announcement will be made by both the Company and the Exchange when the full platform is available for customer deployments in due course. The deal helps further underpin the Board's expectations for FY25 and marks the initial phase of an intended multi-year partnership between Beeks and the Exchange.

This deal marks the third international exchange to sign up to Exchange Cloud, Beeks' multi-home, fully configured and pre-installed physical trading environment fully optimised for global exchanges to offer cloud solutions to their end users. With a proven ability to secure contracts with the world's largest exchanges, Beeks remains highly confident in fulfilling the product's transformational potential.

The Exchange Cloud pipeline continues to build, with advanced discussions taking place with other major Exchanges across the globe.”

What’s interesting about these deals is that they’re difficult to secure, taking several years of preparatory work, and proving up to the client that the service is bulletproof. Once installed, there’s no incentive for the clients to look at replacing Beeks, so it should lead to many years of reliable recurring revenues, which grow over time (land and expand). There is up-front capex, which is unavoidable, but the key point is Beeks is achieving rapid compound multi-year growth, and has now passed the tipping point where it’s profitable and beginning to generate cash. Each big new contract is another reference site, thus building Beeks' reputation. Importantly Beeks didn't suffer any outages in the recent worldwide IT glitch.

Hence I think valuing Beeks on conventional value measures is missing the point, due to the rapid growth. Whilst a value investor at heart, I can also appreciate that when you find an exceptional growth situation, it’s worth pushing out the boat in terms of valuation. Takeover deals, and bank financing, are done on multiples of EBITDA, or even multiples of sales for tech companies.

Importantly, the existing forecasts do not include anything for this latest contract win, as my understanding is it was deemed prudent to hold back until the regulatory approval was achieved. Hence we should now see further upgrades in broker forecasts.

I imagine we should see a 10%+ rise in share price today, and continuing rises. Although you never know how much has already been anticipated by the market, and there has been considerable volume in the last week or two. [EDIT: so far my optimism has not been shared by Mr Market, with only a 3% rise by 09:04).

See a new note out this morning from Canaccord, which gives some helpful valuation comparisons with global sector peers, suggesting BKS is still relatively good value.

Graham’s Section:

Secure Trust Bank (LON:STB)

Down 2% to 836p (£160m) - Interim Results - Graham - GREEN

They don’t lead with this as a headline, but this statement includes a slight profit warning:

We are still targeting significant growth in year-on-year profits, although slightly below our previous expectations.

Let’s review some of the financial highlights:

Loan book up 3.2% year-to-date, up 8.3% year-on-year.

PBT +14% year-on-year to £17.1m

Tangible book value per share up 3.1% year-to-date to £18.36.

The shares trade at an amazing discount to book value, with the potential for the share price to more than double if they traded at par - but deep discounts are the norm.

Medium-term targets: STB remains confident in its medium-term plans.

The loan book needs to grow another 18% to hit that £4 billion target, which should take another few years.

Net interest margin needs to improve a little; it went backwards in H1.

Adjusted return on average equity appears to be the major source of difficulty, with a large gap between current performance (7.3%) and target performance (14%-16%).

STB are confident that they can hit the adj. ROE target when their loan book reaches £4 billion, but I’d like to see a detailed explanation as to how that is possible. We see very few banks/lenders achieving ROE of 14%+, adjusted or not. Will they achieve it through immaculate financial performance or only through adjustments?

Leverage: the CET1 ratio of 12.7% is above target and implies a safe level of gearing.

The trend since the GFC has been for banks to have very safe solvency ratios, and therefore to earn low returns on equity (because they aren’t using enough leverage to boost their returns). In other words, the higher STB’s CET1 ratio is, the more difficult it is for it to achieve a high ROE!

Dividend: a rebased, lower interim dividend of 11.3p will be paid.

FCA/Borrowers in financial difficulty: this is relevant to our recent discussion of S&U (LON:SUS) and the FCA’s interest in how it treats its borrowers. STB is also under the microscope, and following a review, it now offers customers “a wider range of forbearance options to support them through financial difficulties”.

During the review period, STB paused collection activities in Vehicle Finance, with the result that more loans defaulted than normal and the impairment charge was higher than normal. Fortunately, these metrics are trending back towards normal now that the review is complete.

STB also acknowledges that it historically (up to 2017) paid discretionary commissions to brokers. These arrangements weren’t banned until 2021, but there is a risk of retroactive action. Next steps will be communicated by the FCA in May 2025.

Outlook: this is helpful for a read on the current state of the economy:

UK inflation appears to have stabilised around the Bank of England's target level and we saw a first reduction in the Base Rate for over four years in August, slightly ahead of market expectations. The new UK Government has outlined its programme of change to deliver growth, and business confidence is at the highest level we have seen in the last two years. We are therefore optimistic that the trading environment for our business and economic environment for our customers is improving. The Group expects to see further loan book growth in the second half and further progress towards the £4 billion net lending target which will support improved profitability.

Estimates: Shore Capital have downgraded FY24 EPS by 7%, but they have upgraded FY25 and FY26 estimates by 4% and 9% on the basis of an improving UK consumer and the identification of additional cost savings at STB. They think ROE can improve to 11% for the full year.

Graham’s view

We don’t cover this too often. Partly this is because I suspect that most readers find banks quite dull. It’s also partly because I personally prefer to study alternative lenders (e.g. pawnbrokers).

However, we did look at STB back in Nov 2023 (share price: 592p) when I felt compelled to take a positive stance on it. The PER was around 3x, and it was trading at a P/BV of 0.35x.

It’s up by over 40% since then, while paying dividends:

It’s a tough call but I’m going to stay positive on this one again today. Uncertainty never goes away but STB has worked its way through a difficult review period in the Vehicle Finance business and now seems to be on the rebound, and signs are positive that it will at least make some progress towards its medium-term targets, even if hitting them proves elusive.

Pricing remains dirt-cheap, either against the balance sheet or against earnings:

It passes 5 of Stockopedia’s bullish stock screens, including the Ben Graham Deep Value Checklist:

Is it risky? Yes, like any bank. The loan book of £3.4 billion is funded by customer deposits of £3.0 billion. All banks are risky investments, and all of them are difficult to analyse.

Beyond STB’s own actions and decisions, the FCA’s view on historic broker commissions remains to be seen and that is another source of risk, one that is firmly out of STB’s hands.

I’m happy to keep a positive stance on this one but as an investor I have never put all of my eggs in one basket, and I certainly wouldn’t put all of my eggs in a bank.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.