Good morning from Paul & Graham!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

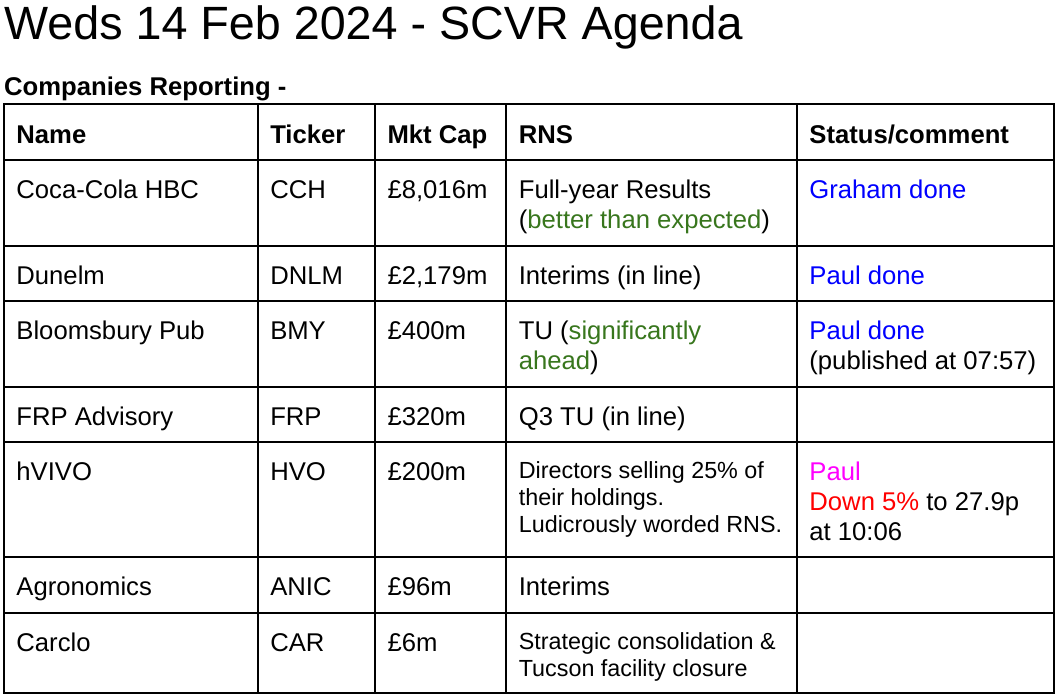

As it's quiet again today for small caps, we've reviewed a couple of mid caps that interest us too -

Other mid-morning movers (with news) -

Works co uk (LON:WRKS) - up 9% to 24.25p (£15m) - appoints 2 new NEDs, unusually these are non-independent, being the CEO & CFO of active, but tiny investment company Kelso group (LON:KLSO) (mkt cap £11m), which owns 5.1% of WRKS (paid 33p). Speculation of some kind of corporate deal maybe? KLSO is pushing WRKS to do buybacks, see here. WRKS looks a very marginal business to me, with little (if any) equity value, but might benefit from higher consumer spending as 2024 progresses? Although April 2024 sees big wage cost hike.

Summaries

Bloomsbury Publishing (LON:BMY) - 492p (£401m) - Trading Update [ahead] - Paul - GREEN

This book publisher delights us with another out-performance update. Pity they don't explain how much they're ahead, and only the privileged have access to broker notes that will tell them how much ahead the company is. That's wrong, but it doesn't dampen my continuing enthusiasm for this excellent company - still priced reasonably, even after a (justified) good run upwards. One of my top 20 share ideas for 2024, and I remain very positive on BMY shares.

Coca Cola HBC AG (LON:CCH) - up 6% to £23.31 (£8.5 billion) - Full year results (ahead) - Graham - GREEN

Strong numbers from Coke HBC which it reports as being stronger-than-expected. Volume growth (1.7%) is minimal but price increases help to insulate shareholders from inflation. I view this as one of the most impressive big-caps in the market and the PER is only c. 12x.

Dunelm (LON:DNLM) - down 1% to 1077p (£2.17bn) - Interim Results - Paul - GREEN

Decent enough H1 figures, considering the tough macro backdrop. Cost increases have been recouped through higher gross margins. Outlook in line for FY 6/2024. No concerns over balance sheet or cashflow. A key feature are generous divis (incl. specials), due to plentiful cash generation. I like it, as a decent quality, long-term investment with a nice income too for shareholders.

Paul’s Section:

Bloomsbury Publishing (LON:BMY)

492p (£401m) - Trading Update [ahead] - Paul - GREEN

Bloomsbury Publishing Plc (LSE: BMY), the leading independent publisher, is pleased to announce the following update on trading.

This looks like an unscheduled good news update, for the almost finished FY 2/2024 - overview -

Revenue and profit significantly ahead of upgraded expectations.

As you can see from my favourite graph below, forecasts for FY 2/2024 had previously been substantially increased, so to be “significantly ahead” of these higher estimates is really impressive -

How much ahead is “significantly ahead”? It doesn’t say, but does tell us what the existing forecasts are -

The Board considers that the consensus market expectation for the year ending 29 February 2024 is currently revenue of £291.4 million and profit before taxation and highlighted items of £37.2 million.

Broker updates - nothing has landed on Research Tree yet, nor my inbox. BMY doesn’t seem to arrange for any broker notes to get through to pond life like us, I just cannot understand why some companies have this silly blindspot in their investor (lack of!) communications.

So we’re forced just to guess. It was 36p before today, so significantly ahead could mean say 40p? Maybe more, who knows? Well the company knows, they’ve just declined to tell us. Also the company probably wants to keep it vague to allow for any audit adjustments. Only people who pay for access to the top broker notes will now have the unfair advantage of getting this inside information of the likely outcome for FY 2/2024 profits.

Author Sarah J Maas (mentioned in the past by BMY trading updates) seems to be the star performer, with fantasy fiction being a strong selling genre -

The Consumer division has delivered exceptional growth driven in part by the publication on 30th January of Sarah J. Maas novel House of Flame and Shadow which reached Number 1 in the US, UK, Australia and many markets around the world.

The publication of her latest novel has also driven demand for her previous 15 books which Bloomsbury has published throughout the world in the English language. Bloomsbury has a further 6 titles under contract with Sarah J. Maas.

Nigel Newton, Chief Executive, commented: "I am overjoyed to report an exceptionally strong period of trading, principally driven by the increasing demand for fantasy fiction. Sarah J. Maas is a publishing phenomenon and we are very fortunate to have signed her up with her first book 13 years ago. Her books have a huge audience which continues to grow backed by major Bloomsbury promotional campaigns, driving strong word of mouth recommendation, particularly through TikTok and Instagram channels."

Valuation - with a terrific track record, and repeated out-performing updates in the last year, I think BMY is a growth company priced like a value share.

If it’s heading for say 40p (my guess) EPS in FY 2/2024 then the PER is only 12.3x

Providing you think this higher level of earnings in sustainable, and growth can continue, then surely a higher PER makes sense? Maybe 15-20x ? That would suggest a price of potentially 600-800p could be justified, nice upside from the current 492p. We should see a nice gain today, at a guess something like maybe 520-530p? (writing this at 07:42, it’s just for fun guessing!)

Downside risks? Nothing with the balance sheet, which is bulletproof with £100m NTAV and plenty of cash within that. The only risk I can foresee is if fantasy fiction goes off the boil, and strong growth this year cannot be replicated in future years. Although as we’ve seen with J K Rowling, once an author becomes highly popular, that popularity seems permanent rather than fleeting. BMY seems to have a knack of finding such authors early, and that in itself is a good reason for paying a higher multiple for this share.

Paul’s opinion - BMY was already one of my favourite GARP (growth at reasonable price) shares, and is on my top 20 ideas list for 2024. With another ahead of expectations update out today, the bull case has just been refreshed again.

So it’s a wholehearted GREEN from me again today.

There’s a very good earnings trend, which has been reflected in a lovely uptrend in share price too -

The forecasts (lighter blobs) below are pre-today’s upgrade, so are likely to rise. Note the FY 2/2025 forecasts are very modestly set, anticipating a drop in earnings. That doesn’t seem likely to me, given the trend has been so positive to date - so more upgrades to come, is more than 50% probability in my view. Hence overall I see nice risk:reward here, but nobody can reliably predict the future, so as with all shares, it’s educated guesswork!

Dunelm (LON:DNLM) - down 1% to 1077p (£2.17bn) - Interim Results - Paul - GREEN

Dunelm Group plc ("Dunelm" or "the Group"), the UK's leading homewares retailer, today announces its interim results for the 26 weeks to 30 December 2023.

I’ve long admired this mid-cap household goods retailer from sheds in retail parks - it makes decent margins, and has an excellent long-term track record of growth and decent shareholder returns (note the frequency of special divis, on top of regular divis). So given that there’s little small cap news of interest today, I’m grabbing the opportunity to give these H1 results a quick review.

As an aside, I recently mystery shopped (online) for curtain rails & curtains (called “Berlin”) and was very pleased with the reasonable quality, and low prices. It’s not top end stuff, but affordable homewares, with a very wide range. I imagine almost everything would be cheaply manufactured in the Far East, so it will be interesting to hear what they say about freight cost/delays.

On to the numbers -

Interim Results for the 26 weeks ended 30 December 2023

Strong performance and increasing our broad appeal

Revenue up 4.5% to £873m - not great, as it’s below inflation over H2 of calendar 2023.

Digital sales are 36% of the total it claims, but footnote 1 reveals this is nonsense, as it includes “tablet-based sales in store”! If a customer is physically present in the store, then nothing they buy can credibly be called “digital sales”.

Four new stores opened, total now 183. I make that annualised sales per store (ex VAT) of almost £10m, so these are big sheds, much more efficient than lots of smaller High St stores.

Gross margin is up a useful 160bps to 52.7%, but

Operating costs have offset this margin gain, with a rise of 150bps.

Profit before tax is up 4.8% to £123m (no adjustments is good)

Diluted H1 EPS is 44.6p, down 2.6% probably due to higher corporation tax, which is rarely commented on, but the rise from 19% to 25% has taken a hefty chunk out of most companies earnings.

Overall, I think the above H1 figures are pretty respectable, considering the backdrop of a sharp squeeze in household disposable incomes in 2023 (likely to reverse from April 2024).

Outlook - sounds OK to me -

Helpful footnote, many thanks -

8 Company compiled average of analysts' expectations for FY24 PBT is £202m, with a range of £199m to £207m.

Note that this suggests an H1 bias to profits, as it includes the busy Christmas period.

Freight comments - doesn’t sound any reason for concern here -

There was a net benefit in the half from lower freight rates and adverse foreign exchange movements. For the full year, we reiterate our guidance for gross margin to increase by 100bps. The rate of improvement is expected to slow in the second half due to the combined headwinds of foreign exchange movements and lower freight benefits. We are managing the impact of ships taking longer, more costly routes as they avoid the Red Sea area.

Balance sheet - looks fine to me. NTAV is about £170m.

There’s a bank loan of £48m, but that was offset on 30 Dec 2023 by gross cash of £56m.

I expect there would probably be quite large intra-month swings in cash/debt, depending on when suppliers, landlords, and payroll are paid out. Being a retailer though, the cash flows in on a daily basis, in a highly predictable manner.

Given the strong profits and cashflows, I don’t think it needs a strong balance sheet, and could even take on more debt if necessary. Everything looks fine, so no concerns here.

It looks to be clean, re no pension deficit. The word “pension” doesn’t appear at all in the results statement (doing a CTRL+F to search for it).

Cashflow statement - very clean, although as always IFRS 16 has messed up the numbers by putting rent costs in the wrong place.

Overall, DNLM is consistently cash generative, and this is mainly used to pay generous divis. It looks as if they’re deliberately flexing the divis in order to keep net debt roughly static at a small net cash position (of £6.2m at 30 Dec 2023).

I’d like them to disclose average daily net cash/debt, which would be much more useful than a year end snapshot.

Broker updates - nothing available. Going on broker consensus data from the StockReport, we have 74.6p for FY 6/2024, and 79.7p for FY 6/2025. Personally I imagine there could be upside on the 6/2025 number, given the big rises in real household incomes kicking in from April 2025. So it wouldn’t surprise me if EPS might be on a rising trend to maybe nearer 100p with some patience? Hence the share price of 1077p could have some upside on it. Plus shareholders receive the bulk of earnings in divis whilst you wait.

Paul’s opinion - I think this looks a really decent income share, with built-in inflation protection, and long-term earnings growth likely.

Thumbs up from me. GREEN.

Graham’s Section:

Coca Cola HBC AG (LON:CCH)

Share price: £21.84

Market cap: £8.0 billion

Coca-Cola HBC AG, a growth-focused Consumer Packaged Goods business and strategic bottling partner of The Coca-Cola Company, reports its financial results for the twelve months ended 31 December 2023.

This is far above the market cap limits for a small-cap report, but as news is quiet this morning I thought I would take a look.

Coke HBC is the bottler/distributor of Coke’s drinks in many European markets. It should not be confused with Coca-Cola Europacific Partners (LON:CCEP) which has a different portfolio. Coke HBC has Austria, Greece, Italy, Switzerland and many other developing and emerging markets in or near Europe (see here).

The company says that 2023 performance was “stronger than expected”.

Headline growth numbers are very impressive, although they are driven by inflation:

16.9% organic revenue growth

1.7% organic volume growth, i.e. the revenue growth has been driven by price increases (15%), not by volume.

FX is a headwind due to weakness in emerging markets, so reported revenue growth ends up being lower at 10.7%.

Profitability: the EBIT margin improves slightly to 10.6%.

Gross profit margin is up 80 basis points, a movement in the right direction after the high inflation of recent years. Last year, gross margin fell by 200 basis points.

ROIC (as calculated by the company) increases to 16.4% - a very good number. I’d be happy to achieve that on average across my portfolio.

Cash flow & net debt: free cash flow (again as calculated by the company) rises 10% to €712m.

This hasn’t led to any major reduction in net debt (€1.6 billion); it seems that the company feels its debt is already low enough. The dividend is being increased by nearly 20% year-on-year, and the company has already launched a €400m share buyback.

It has been buying back shares at a modest earnings multiple:

The company’s confidence in buying back shares is probably justified; the leverage multiple is only 1.1x (net debt to adjusted EBITDA) and most of the debt isn’t due for repayment until 2027 - 2031. S&P and Moody’s both give the company stable investment-grade credit ratings (see here).

CEO comment:

"2023 was another year of consistent execution of our growth strategy. We delivered volume growth, share gains, improved margins and record levels of free cash flow. As a result, we were able to increase shareholder returns, including the launch of a share buyback programme.”

Outlook

Guidance for the current year includes:

Organic revenue growth within the 6-7% medium-term target range.

COGS per unit to increase “low to mid-single digits” due to inflation and FX.

Organic EBIT growth of +3% to +9%.

It’s a wide range of potential outcomes but as I said yesterday, I much prefer to see a wide range of estimates rather than false precision.

No company can be reasonably expected to predict inflation over the course of the next year, and it won’t be possible (or desirable) to fix so many costs as to insulate the company’s performance from it. So we are left with a wide range of possibilities.

Graham’s view

As readers may know, I often find myself attracted to high-quality big-caps and Coke HBC is a typical example of the sort of thing that I’d be comfortable owning.

The numbers are clean: net profits of €636m, up 50% with no adjustments needed.

The business is well-funded with easy access to finance and can afford to buy back shares while also paying out nearly half of earnings to shareholders in the form of the dividend.

Governance is reassuring with the two cornerstone shareholders of Coke HBC being the Coca-Cola Company itself and a private company which previously owned Hellenic Bottling Company (Coke HBC’s predecessor).

I’m inclined to agree with the StockRanks and give this stock the thumbs up at the current level:

Any reasons for concern?

I do think the Deposit Return Schemes could be an issue. The company mentions six countries where these are now active: Croatia, Estonia, Latvia, Lithuania, Romania and Slovakia. Ireland has joined the list. Could this have a noticeable impact on consumer demand? I’ve been wondering the same about the UK soft drinks companies with the prospect of a DRS in the UK over the next few years.

Inflation is the more obvious and straightforward worry. Although I continue to maintain that prices will eventually feed through to consumers sooner or later (It’s one of the most important advantages of equity investing vs. fixed income investing, that you get this inflation protection.) Coke HBC doesn’t seem to have had much difficulty raising prices, with only a modest reduction in gross margin over the past two years.

It’s unlikely that we’ll cover this stock again soon in the SCVR. But for what it’s worth, I’m going to give it the thumbs up. A high quality business at a reasonable price, in my book.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.