Good morning, Graham here. The RNS feed is light on news so I'll leave it there for today. See you tomorrow!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Graham's Section

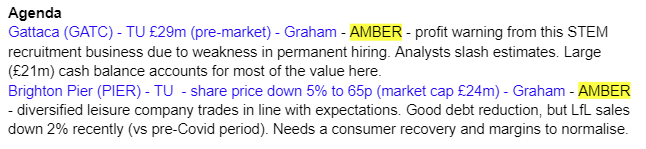

Gattaca (LON:GATC)

- Share price: 90.5p (pre-market)

- Market cap: £29m

Paul normally covers this one but I’ll take a quick look at it this morning.

Gattaca is a STEM recruitment business with an uninspiring financial track record:

The main attraction with these shares seems to be the strong balance sheet, rather than its financial performance.

Here are the key points from today’s trading update, which relates to the six months ended January 2023.

Although it doesn’t explicitly say so, this is a profit warning, and analysts have downgraded forecasts

H1 net fee income +5% year-on-year to £22.7m

“Core sectors” seeing double digit growth, weakness elsewhere.

Permanent hiring shows “signs of weakness since the turn of the year”.

Net cash rises to £21m as of January 2023, vs. £12m in July 2022, thanks to the collection of receivables (N.B. this is not a measurement of profitability).

CEO comment highlights the weakness in permanent hiring:

As we enter the second half, we are conscious of softening in some external sectors, and perm is likely to be impacted by a level of restraint around hiring, shifting candidate sentiment and, as such, slightly longer hiring cycles. Despite this we continue to see demand for STEM skills in our core sectors and the shortage of candidates plays to our key strength of deep knowledge and understanding of our sectors and niche skills."

Estimates - thanks to Equity Development for sharing their forecasts.

Their adj. PBT estimate for FY 2023 falls from £2.5m to £1.8m.

Their adj. PBT estimate for FY 2024 falls from £5.9m to £4.25m.

The analysts at Liberum do likewise, getting the same number for FY 2023 and a slightly lower number for FY 2024.

My view

I can think of few examples of recruitment companies that turned out to be high-quality investments, and it would surprise me greatly if Gattaca turned out to be one.

The track record isn’t there, and the “new” management team isn't really new: the CEO has been with the company for 20 years, and was previously Group Business Development Director.

The CFO was previously (since 2018) Gattaca’s Group Director of Financial Planning.

Today’s profit warning is probably not their fault, but it doesn’t really matter: either way, it goes to show how unpredictable the company’s profits are.

Given the lack of a track record, it doesn’t surprise me that the shares trade at only a small premium to the company’s cash balance.

I can’t take a negative view on the shares since the lack of quality should already be priced in at this level, i.e. any turnaround in performance could result in a valuation uplift. But neither can I take a positive view on a company that appears to lack any attractive investment characteristics, beyond its cash balance.

Brighton Pier (LON:PIER)

- Share price 65p (-5%)

- Market cap: £24m

Brighton Pier today gives us a most unusual trading update, which refers to the 78-week period ending 25th December 2022. In other words, it’s an 18-month trading update.

Changes to the accounting reference date nearly always bother me. Part of that stems from laziness - they make my job harder.

But they also make me wonder why the company didn’t have the right accounting date in the first place. For example, Brighton Pier argues that moving the accounting date from June to December will help to avoid splitting the peak summer season in two, and it will also result in the audit process being less of a distraction to staff during summer.

This explanation makes perfect sense and I can’t argue with it. But then why did the company put up with a June accounting date for so long?

In any case, here is the key point from today’s trading update:

Overall, the Group performed well, and continues to trade in line with market expectations having ended the 18 month period with a stronger balance sheet. In the first 12 months, the Group benefited from COVID-19 related government assistance and pent up demand as the UK emerged from lockdown, while the final 6 months witnessed a decline in consumer confidence and increased costs across the sector.

Compared to the equivalent 18-month pre-Covid period ending December 2019, like-for-like sales are up 9%.

However, compared to the equivalent 6-month pre-Covid period, like-for-like sales are down 2%. This helps to demonstrate that after the initial expression of pent-up demand, sales have softened in recent months.

We also need to keep inflation in mind, when comparing against performance three years ago.

Balance sheet - net debt has reduced from £13m to £7m over the past 18 months.

CEO comment

"Like many in our industry, we have had to absorb higher costs relating to wages, energy prices and other inputs. However, going into 2023, our businesses remain profitable, well managed and backed by a strong balance sheet and asset base.

We are confident in the ability of our management teams to operate well in our markets, but we remain mindful of the continuing pressures from the wider economic environment in which we trade."

Estimates

We have new estimates for FY December 2023 from Cenkos, suggesting revenues will rise 16% to £38.8m and adj. net income will fall from £1.7m to £1.4m.

Inflation is set to cause higher prices for customers, but PIER will have to take some of the hit themselves. There will also be higher interest rates paid on the reduced debt load, and higher corporation tax.

My view

I find myself agreeing with some of the bullish arguments here. PIER has impressively reduced its debt load, reducing its financial risk.

I am curious to see the unadjusted numbers when they are eventually published, but the adjusted numbers (and the debt reduction) suggest there has been decent profitability during the volatile 18-month period that just passed.

And then, looking forward, there are similar arguments as we’ve seen elsewhere. Will margins “normalise” when real wages start to rise again and the cost-of-living crisis is over? Perhaps. That’s a bet I’m willing to make with other stocks whose profitability is currently depressed.

Pre-Covid, annual net income here was often around the £2m mark,

PIER’s enterprise value (market cap plus net debt) is currently c. £30m. That strikes me as a fair price, given the risks involved. Future capex requirements could be expensive and I would completely ignore the use of EBITDA by this company and its sell-side analysts.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.