Good morning! It's Paul & Graham on duty again today. Thank you to everyone for the warm welcome back for Graham, and the kind words for Jack. All very much appreciated. Today's report is now finished.

Agenda -

Paul's Section:

Motorpoint (LON:MOTR) (I hold) - excellent results for FY 3/2022. Outlook is obviously more cautious for the current year, as everyone should have anticipated, due to consumer caution. However, this is a super-competitive business, offering low prices on nearly new cars, so I see it continuing to win market share, especially as new entrants (e.g. Cazoo) are now retrenching as they run out of cash. I think this is now a good entry point, for an ambitious, expanding business at a modest valuation. Sector consolidation very likely.

Bloomsbury Publishing (LON:BMY) - I have a rummage through its results for FY 2/2022. Looks a good business, at a reasonable price. So a thumbs up from me.

WANdisco (LON:WAND) - late 2021 results are out, the figures are mind-bendingly awful. Yet it's got another fundraising away today, at a premium! I just don't understand the valuation here, and why investors keep pouring in more cash, despite 10 years of heavy (worsening) losses & huge cash burn? Surely the clock is ticking now, since tech markets have plunged, and any more cash might be difficult to impossible to raise. Will investors pull the plug at some stage?

Graham's Section:

Idox (LON:IDOX) - Acquisitive public sector software group is preparing to engage in more M&A. Seems to be getting the balance wrong between shareholder reward and management incentives. Lacks organic growth. Has many of the familiar issues we have seen before with highly acquisitive organisations.

Castings (LON:CGS) - A dividend hero with a track record of profitability stretching back decades. Most Covid issues are now behind it, except for the lingering supply chain issues affecting customers. It’s also learning to deal with high inflation for raw materials. The company announces a special dividend today and is looking forward to the future with confidence.

Dewhurst (LON:DWHT) - this supplier of elevator components issues a profit warning for the full year. The main problem with this one is the share structure: are the non-voting DWHA shares much too cheap, or are they a trap? Perhaps the voting DWHT shares are simply overpriced. A real conundrum.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Motorpoint (LON:MOTR) (I hold)

226p (pre market open)

Market cap £203m

Motorpoint Group PLC, the UK's leading independent omnichannel vehicle retailer, today announces its final results for the year ended 31 March 2022 ("FY22").

Background - I like MOTR’s business model, which is a car supermarket - i.e. selling nearly new cars at fixed (no haggle), low prices, from large, out of town sites, with lots of land. So it’s all about ramming through volume. They don’t get involved in new car sales, or servicing, as far as I’m aware.

American shareholders urged management to step on the gas, and be more ambitious with expansion plans. MOTR also has a successful online operation.

Used car prices have been massively distorted (upwards) in the pandemic, due to a shortage of supply, a knock-on effect from reduced new car production, itself caused mainly by shortages of semi-conductors. As we’ve seen, this has led to conventional car dealers making extraordinarily high profits, a situation that clearly won’t last.

To further muddy the waters, we’ve also seen a lot of well-funded startups, who imagine they can somehow disrupt the used car market online, seemingly oblivious to the fact that existing car retailers also have online offerings. This has caused intense competition for buying the limited supply of used cars, and has also helped push up prices.

My view is that a lot of these upstarts are doomed to failure, and the CEO of Vertu Motors (LON:VTU) (I hold) has delivered several withering demolitions of the likes of Cazoo, which has a ridiculous business model of running a huge loss, in order to grab market share. That’s all tech boom nonsense, and it will be interesting to see how many of the former darlings of tech investors won’t get follow-on funding, and end up footnotes in history. It all reminds me so much of the tech bubble back in 1998-2002, which burst in spectacular fashion. Good article here on a dot.com collapse called Boo.com (nothing to do with boohoo!), and I’ve mentioned it before, but the book “Boo Hoo: a Dot.com Story” is a riveting, entertaining, disaster story. Essential reading now, given that I reckon we’re heading very much in the same direction again. Plenty of attempted disruptors are likely to simply run out of money, and go bust. Leaving market share & higher profits for the traditional operators that survive.

I really wish I’d shorted both Cazoo & Carvana, as we discussed here last year how they had hopeless business models, and vastly inflated share prices. Both are now down 80%+, and laying off staff to conserve cash. It was so, so obvious, but in a roaring bull market we all get swept along with it. I shorted things (mainly indices, as a hedge last year) loads of times, but was too early, and lost money on nearly all of those trades. I think it’s all about timing - maybe shorting is best left to specialists, and/or people who can get their timing right every time - like all those geniuses on Twitter with a 100% success rate, possibly aided by a long delay in reporting their trades?! ;-)

So lots of moving parts here.

Strong growth in revenues & profit, but obviously it’s operating on a tiny profit margin of 8.0% gross, and just 1.6% net (at PBT level). Many people dislike very low margin businesses, but I’m more open-minded - if you can ram through a load of volume, and undercut the competition on price, then that can be a very good business, longer term, as you mop up market share and competition withers.

EPS is up a remarkable +123% to 18.7p (in line with broker expectations of 18.8p) - that’s a PER of only 12.1

EDIT: a broker note has just come through from Shore Capital (many thanks, very helpful), which has dropped its FY 3/2023 EPS forecast considerably (down 35%) to 11.7p. That's probably why the share price dropped sharply initially. Generally speaking I'm in favour of cutting forecasts for the current year, given that we know it's a tough consumer environment, so it makes sense to lower forecasts. That doesn't in any way alter the long-term value of the business, which is what the share price is supposed to reflect!

Why are some investors still surprised, when companies say that conditions are getting tougher? Do they not watch the news? This is the reason shares prices have already fallen a huge amount for cyclical businesses, anticipating a tougher year (or longer). Maybe the market turning point comes when share prices stop dropping on (entirely predictable) bad news? That will be something interesting to watch out for. Or, prices recover strongly after an initial drop. I'm looking out for that type of thing.

Hopefully there's upside on Shore's lower forecast, but at around 200p at the time of typing this, the PER would be 17.1 - not bad considering this is anticipated to be a tough year, but this is a growth company, which has tended to be on a higher rating than conventional car dealers for that reason. End of edit.

How much of the profit surge is due to increased used car prices? Since the gross margin has actually fallen from 8.7% LY to 8.0% this year, then actually the profit growth is mostly down to volume growth, not exceptional profit margins (which is what has driven bumper profits for conventional car dealers).

Outlook - this is all very interesting, so here is the whole section, with my bolding added as usual. Nobody should be surprised by anything in here, unless you’ve been living under a rock recently!

The impacts of rising inflation and worldwide vehicle supply chain challenges are likely to continue to affect our markets and all industry participants.

In general, rising inflation is putting increasing pressure on discretionary spending power and consumer sentiment, and this position has worsened since the start of our new financial year. This is very likely to reduce overall sales and transactions in our markets.

Further, supply chain shortages will continue to limit new car production in the near term, which in turn constrains the supply of used cars that fit our nearly new criteria. The precise extent to which these factors will impact consumer behaviour and our markets is increasingly difficult to predict.

At the same time, the used car market is evolving rapidly and becoming more complex. Many traditional competitors are changing their models, refocusing and diversifying, while several other large and well-capitalised players are entering our markets and competing aggressively, albeit not all of them are proving successful business models. The Board sees further consolidation as likely over time as changing market dynamics continue to play out.

Within the context of this uncertain environment and evolving competitive landscape, Motorpoint has continued to perform strongly and made substantial progress towards its medium term strategic goals. We have a strong track record of gaining market share in difficult times, since price leadership is crucial and continues to serve us well, both now and will continue to do so in the future.

We have demonstrated that our strategy is working and will continue to invest in our customer proposition in order to gain market share in a relatively weakened competitive landscape. Given the Group's proven track record of profitability and proactively responding to market conditions, alongside our capital light model and robust balance sheet, the Board is confident in its decision to continue to progress towards its medium term strategic goals. This continued investment, much of which is variable and hence adaptable to market conditions, will position the Group in a stronger position with a bigger market share when the current macro headwinds subside.

The key point there for me, is that MOTR’s customer value proposition, puts it in a relatively strong position, now demand is likely to soften. Plus the so-called disruptors are now running out of money, and re-trenching.

The point about sector consolidation is something else to emphasise. Again, the CEO of VTU made it clear in a recent webinar, that he sees sector consolidation as inevitable, so expect a wave of takeover bids/mergers in this sector, which could be nice for investors.

A quick check of the other numbers-

Balance Sheet - adequate. NTAV is £39m. Large working capital, as is normal in the sector.

The main difference between MOTR and conventional car dealers’ balance sheets, is that MOTR doesn’t have a huge freehold property asset base, as companies like VTU (I hold) do. Hence little in the way of asset backing here at MOTR. Properties seem to be mainly leased.

Cashflow statement - is negative, and it’s taken on £29m of new bank debt in the year. This is to fund much higher inventories. The business is expanding (14 to 17 sites, plus internet growth), so I don’t see that as a particular problem.

Car dealers are mainly financed by supplier loans anyway, so the bank debt tends to be a minor consideration compared with those credit facilities.

My opinion - I really like the business model here, and am happy to hold long-term.

Competition is likely to reduce, as the new entrants run out of cash.

MOTR should be recession-proof, as it’s a price leader, operating on thin margins, but that works because it has low overheads & flexible costs. Although obviously current conditions are likely to be tougher, as consumers perhaps rein in big ticket purchases?

I see from note 3 that £62.9m revenue came from “motor related services & commissions”, so I’d like more clarity on what that is, and if there’s any risk (e.g. mis-selling claims)?

I see the share price has opened down 16% at 185p, which looks a mistake to me, so this could be a good buying opportunity for long-term investors.

.

.

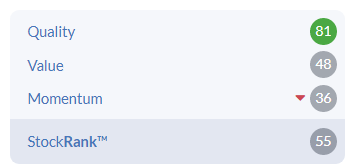

Stockopedia awards it a medium StockRank, and highlights the high quality scores - in particular there's a high ROCE & ROE, due to the modest fixed assets. Although personally I prefer the huge freehold property assets of conventional car dealers. Sometimes an "inefficient" balance sheet, laden with cheap assets, can make investments much safer, and provide hidden upside that attract takeover bids. As always, there's more than one way of looking at things.

.

Bloomsbury Publishing (LON:BMY)

400p (up 5% at 08:15)

Market cap £326m

Bloomsbury, the leading independent publisher, today announces audited results for the year ended 28 February 2022.

Very good results here, no wonder the share price has completely shrugged off the recent bear market in most other shares.

There’s a neat summary here from the company -

"Bloomsbury achieved its highest ever results with sales up 24% to £230.1 million and profits up 40% to £26.7 million. Sales were up 41% and profits up 70% from two years ago. Both the Consumer and Non-Consumer divisions gave outstanding and resilient performances, highlighting Bloomsbury's unique strength in combining general and academic publishing.

Adj diluted EPS shows a lovely progression -

FY 2/2020: 13.4p

FY 2/2021: 18.7p

FY 2/2022: 25.9p (PER of 15.4)

Note that adjustments (called “Highlighted items”) boost profit by 20% or £4.55m. £1.7m of this are legal & restructuring costs re acquisitions. The balance of £2.8m is amortisation of acquired intangibles (i.e. goodwill). Both of these are customary adjustments, widely used in order to present the underlying performance of the business. So I’m fine with that, but it’s always worth checking.

What’s interesting, is that the company says interest in reading books has continued, and wasn’t just a pandemic thing -

The question on all of our minds was: would the pandemic surge in reading continue? We now know the answer: reading has become a reacquired habit and continues to thrive. The pandemic made us all re-evaluate how we spend our time and this has resulted in an increase in sales of books that enable us to explore our hobbies and personal interests such as cooking, fitness, history and reading novels for enlightenment and escape. Our Academic sales have benefitted from the structural shift to online learning.

PERs are a clumsy measure, because it all depends what future earnings are going to be. If BMY is right, and there’s a permanent shift to reading books again, then a PER of 15.4 looks a reasonable (maybe even cheap?) rating. However, if they’re wrong, and readers slowly drift away and return to their kindles, then who knows, the shares could turn out to be expensive. That’s a call we all have to make individually, when deciding whether or not to own this share. I don’t have any particular view either way. Although we have seen pandemic boosts fall away for many eCommerce companies. That hasn’t happened at BMY, which reinforces the credibility of what its management is saying, that books are enjoying a permanent revival.

For me, font size is a problem, and I find most paperbacks too difficult to read. That’s where Kindle is so useful, in that I can adjust it to a huge font size, which makes reading more relaxed, and causes great hilarity to friends looking over my shoulder!

Acquisitions/Organic - several have been made, but the larger consumer division still reported strong organic growth of +18% revenue, and +24% profits.

The non-consumer division also reported strong organic growth, of +10% revenue, and +40% in profit. Costs must have been well controlled, and/or margins increased, to achieve that positive gearing to profits.

Outlook - sounds solid -

Trading for 2022/23 has started in line with the Board's expectations.

Bloomsbury aims to deliver continued success, given the strength and resilience of our proven strategy, combined with our strong financial position, which enables us to invest in continued organic growth and further acquisition opportunities.

Digital sales continue to materially increase and are a growing proportion of both revenue and profits.

Balance sheet - is still good, but intangible assets are growing considerably, and now total £88.2m, which if we write them off, reduces NAV of £169.0m to NTAV of £80.8m. This includes a net cash pile of a healthy £41.2m - which gives scope for more acquisitions, to enhance future earnings.

Receivables of £104.9m looks very high, compared with annual revenues of £230m. Checking note 9, of this, £65.3m is trade receivables, which looks a but more reasonable (still high-ish though). Note the £3.55m bad debt allowance, which highlights that there is an elevated risk of bad debts from retailers/distributors selling books possibly going bust. So a good question to ask management is to explain their credit control procedures, and bad debt risk. Also, who are their top 5 customers, and what is their financial stability like? Does BMY have trade credit insurance? How are overdue receivables managed? All good questions to ask mgt.

The other big item in receivables is £28.7m royalty advances (to authors I presume)

Ah, I’ve just seen partial answers to my questions! Although it would still be worth asking for more colour in this area, in a webinar -

Trade receivables principally comprise amounts receivable from the sale of books due from distributors. The majority of trade debtors are secured by credit insurance and in certain territories by third party distributors.

A provision is held against gross advances payable in respect of published title advances which may not be fully earned down by anticipated future sales. As at 28 February 2022, £7,145,000 (2021: £7,260,000) of royalty advances are expected to be recovered after more than 12 months.

Cashflow statement - cash generation was good last year, and is outstanding this year. That’s been helped in both years by big increases in trade payables, so that might unwind in the new financial year perhaps?

There’s still plenty of cash generation to go round, which has been used to pay mainly for acquisitions £22.9m, and divis of £15.2m. Also note £4.5m was spent buying shares for the Employee Benefit Trust - which looks OK to me, given how well the business is trading.

Overall then, this is a strongly & genuinely cash generative business, I believe.

My opinion - we’ve always liked BMY here at the SCVR, and that positive impression is reinforced with smashing numbers today. It sounds as if strong performance could continue as well. The valuation looks reasonable. So a thumbs up from me!

Note below that the StockRank (the line in the section below the share price) seems jammed on maximum for BMY - usually an encouraging sign.

.

.

WANdisco (LON:WAND)

263p (up c.4%, at 12:02)

Market cap £163m

Another year, another shockingly bad set of numbers from this niche software company. The story has always been that it has unique software for managing data, that nobody else in the world can do it, etc. Yet sales have been tiny, and have actually been falling each year since 2017. Meanwhile the rest of the world seems to function fine without WAND’s software.

See for yourself -

.

Fundraising - amazingly, people are still prepared to keep pouring in more cash. It’s raised $19.8m today, at 270p, a 6% premium -

The proceeds will be used to support our sales and marketing programmes and to provide growth working capital.

FY 12/2021 results - very late, maybe due to going concern issues, resolved by the latest fundraising?

Revenue is just $7.3m, down 30% on 2020

“Cash overheads” of $41.5m, up 12% on LY

Loss after tax (rebate) was $37.6m (worse than $34.3m LY)

There was $27.8m cash at end 2021, presumably most of that has probably gone by now.

Outlook - bookings are up, but still tiny relative to overheads. It needs a step change in revenues, e.g. putting a zero on the end, to make this a viable business.

My opinion - is there really something special here? If so, how come it has only achieved such small sales in the 10 years since it listed? (nowhere near enough to cover overheads).

I appreciate, from talking to Gordon McArthur at Beeks Financial Cloud (LON:BKS) (I hold), that it takes years to build a track record, and convince large companies to sign contracts for business-critical software. Maybe that has impeded WAND?

BKS has also spent about 10 years establishing itself. However, BKS is now achieving revenues turning exponential, and it’s only burned a small amount of cash, and is now around breakeven. Plus it's valued at about half the price of WAND.

Whereas WAND consumes vast amounts of cash every year, and has gone backwards, with small, declining revenues in the last 5 years. Why would anyone want to back that?

Looking at the bottom part (reserves section) of the balance sheet, which shows where the net assets have come from, shareholders have in total put in $222m of cash, and the company has destroyed $186m of that in total retained losses. Leaving equity of $34m remaining at end Dec 2021, which has probably mostly gone by now, through continuing trading losses in 2022 -

.

.

I do wonder if some of the placings might have been linked to career risk for fund managers - i.e. letting it go bust would get them sacked? Who knows? Better to keep it afloat, and continue arguing that great things are on the horizon. That’s just idle speculation though.

At what point do investors eventually pull the plug? Going back to what I was saying above, about the end of the TMT boom & bust back in 2000-2002, we saw so many tech darlings with jam tomorrow promises end up being allowed to fail, as investors just ran out of cash & conviction to keep funding their losses.

If we’re returning to conditions like those, then the clock is very much ticking for WAND.

That’s obviously a negative view, backed up by the facts - appalling historic performance, which remained terrible in 2021.

However, things could change for the better. We occasionally see that happen with jam tomorrow shares - e.g. Audioboom (LON:BOOM) disappointed for many years, then suddenly took off, with much improved trading recently.

Hence I don’t know whether WAND is likely to succeed commercially or not, but the numbers look diabolical over the last 10 years, so it would take something game-changing to happen to make the shares worth any more than zero, as things currently stand.

It could happen, who knows, but why take the risk on something so unlikely happening?

.

.

Graham’s Section:

Idox (LON:IDOX)

63.6p (up 4% at 09:29)

Market cap £285m

This is a software company, providing solutions to government (e.g. local councils) and to industry. From what I can gather, much of the business revolves around regulatory compliance.

So it’s perhaps not the most exciting business. It has been covered from time to time in the SCVR, never generating much enthusiasm from the writer!

Before delving into today’s numbers, let’s remind ourselves why its results have been so erratic:

2018 is the year that put a huge hole in the company’s historic performances.

Idox suffered massive impairments that year (around £40 million) and also had to restate its results for 2017, following the disclosure of accounting irregularities.

The new Chairman, writing in the annual report, also acknowledged that the company had paid “a very full price” for the £35 million acquisition of company providing software to the NHS. (Did he read the SCVR? I used the same phrase when commenting on the acquisition!)

So what we have here is a company suffering from the familiar problems which acquisitive businesses often do: overpaying for acquisitions, suffering impairments, struggling with the complexity of trying to integrate new businesses into a larger group and, to add insult to injury, getting its accounting wrong.

Anyway, results have improved since then, and the company was nearly acquired last year, with bids of up to 75p per share. Let’s see what we’ve got in today’s interims:

• Continuing revenues +7% to £33.2 million, of which recurring revenues are £19.8 million.

• Recurring revenues increase their share of the total from 57% to 60%.

• Operating profit +3% to £4.3 million.

• Profit before tax falls from £3.7 million to £3.6 million.

Net debt reduces to £3.8 million.

Borrowing facilities of £45 million are “in place to fund M&A”. They are serious about making more deals:

We have increased our focus on further acquisitions and continue to look for accretive, synergistic opportunities that support the long-term focus on software and which complement the existing portfolio.

Outlook is fine, with “good revenue visibility for the remainder of FY22”, and trading in line with expectations.

CFO review - You have to travel quite a long way down the results statement before you find the most interesting numbers.

For example, continuing revenue growth is 7%, but this includes the effect of acquisitions.

The CFO review, much further down the statement, lets us know that “On a 'like for like' basis the Group delivered £30.0m of revenue, slightly down on the prior period.”

So there is no organic revenue growth to speak of, only growth by acquisition.

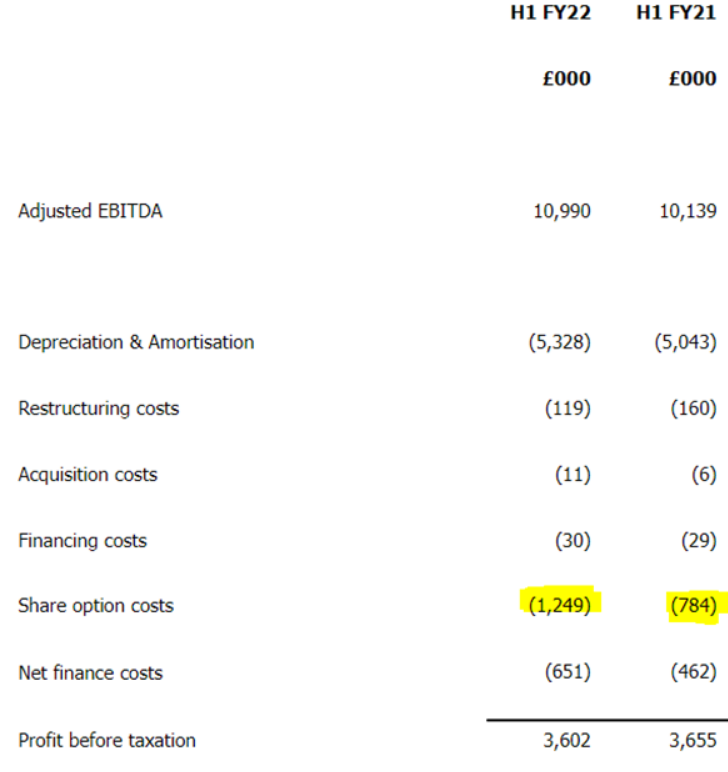

Also, why is PBT down 1% despite “adjusted EBITDA” rising 8%?

The main reason is nearly £500k in additional share option costs from the company’s LTIP:

Balance sheet has net assets of £63 million, including an enormous £91.5 million of intangible assets.

My view – I’m less enthused by this one than I was before. The only thing I can see in its favour is the sticky public sector contracts.

I note that the company paid out £1.8 million in total to shareholders for last year’s performance, while the LTIP has cost the company £1.25 million in just six months.

As it gets ready to engage in yet more M&A, I would steer clear.

.

.

Castings (LON:CGS)

307p (at 9:30)

Market cap £133 million

This iron casting and machining business has been listed for a very long time – since 1994.

Over that time, the company has grown at a slow and steady pace.

And while shareholders have seen limited share price gains, they’ve benefited from a dividend track record that is truly special. Castings hasn’t seen a dividend cut in its entire history as a listed company!

Results

Today’s results for FY March 2022 show a return toward pre-Covid business trends.

I’ll compare these results not to the previous year, but to FY March 2020, which only had one month’s performance affected by Covid.

· Revenue £149 million (FY March 2020: £139 million)

· Adjusted pre-tax profit £12.1 million (FY March 2020: £12.7 million)

There were still some Covid/supply chain problems, holding the company back:

The first quarter saw commercial vehicle customers, which make up approximately 70% of group revenue, taking product at a level commensurate with pre-COVID years. However, from the last two weeks of June 2021 and into the second quarter, the OEMs had to reduce truck build rates to below their order intake levels, due to supply chain restrictions (particularly in respect of semiconductors)… These restrictions continued during the second half of the year.

Paul has already mentioned the issue of the semiconductor shortage, which has affected so many industries.

Castings also mentions the rising price of raw materials, which happens with a costly delay as there is a lag between input costs rising and the Casting sales prices increasing.

If higher inflation becomes a persistent feature of the economy, companies are going to have to become nimbler in order to deal with this. Castings says that it will be passing on future price increases “in a more timely manner”.

Dividend – the dividend gets yet another increase, and to top it off there is a special dividend which approximately doubles the amount paid out to shareholders.

Balance sheet – this is always very strong. Castings has net equity of £131.5 million, with the only liabilities being some trade payables and deferred tax liabilities. Cash sits at £35.7 million.

Outlook – Castings is going to suffer an increase in its electricity costs, and this increase will be passed on to customers. Customers are said to be “more successfully managing the supply of semiconductors and other items in the supply chain”.

My view

This is the corporate definition of a safe pair of hands. Lots of tangible assets, lots of cash, a 30-year track record of profitability that stretches all the way back to 1986 (!), and it’s a dividend hero.

It’s available at a PE ratio of merely 15x (trailing) or 10x (forward, assuming favourable economic conditions this year).

If I had to look for reasons to criticise CGS as an investment, I would say:

· As a heavy industrial business, return on capital is capped. Stocko calculates ROCE for Castings at 8.3%. It can and has done better than this, but the company is unlikely to produce a high ROCE on a regular basis. This holds back its compounding potential.

· Earnings per share for the year is 19.60 pence, which is quite a bit lower than the total dividends for the year of 31.23 pence. So the special dividend is being paid out of the company’s existing cash resources, rather than from profits generated this year.

· As alluded to already, the company can be significantly affected by forces outside of its control, especially those to do with raw material and energy prices. While it has managed these issues well for many years, they’re an important source of uncertainty.

Overall, this remains a very impressive and successful industrial stock.

.

Dewhurst (LON:DWHT)

1250p (unchanged at 11:42)

Market cap £69 million

This is another company with a long history on the public markets. Its main subsidiary is Dewhurst UK Limited, a “supplier of quality components to the lift, keypad and rail industries.”

This is a family business: David Dewhurst is MD, Richard Dewhurst is Chairman, and they are the two largest shareholders. Value investors tend to believe that family businesses make the best investments, so this is a big green flag.

Share Structure

This company has a peculiar share structure: there are 3.3 million ordinary shares (DWHT) and 4.8 million “A” shares (DWHA), the difference being that “A” shares can’t attend or vote at company general meetings. In fact, the “A” shareholders are not even legally entitled to receive notice that a meeting is taking place!

On the other hand, both DWHA and DWHT shares are entitled to receive equal dividends and equal returns of capital (e.g. in a liquidation).

DWHT shares currently trade at £12.50, while DWHA shares trade at £5.75. There would be a huge arbitrage opportunity, if it could be traded (I assume that it’s impossible to short DWHT, so the arbitrage is impossible).

If I were going to buy shares in Dewhurst, I would certainly buy DWHA. Since there is no hope of my vote affecting the company anyway, I would happily enjoy the discount from owning a non-voting share, with the same economic rights as a voting share.

Another way of looking at it is that if you apply the DWHT share price to the 8.1 million total shares outstanding, you get a market cap of £101 million (with voting rights included). But if you apply the DWHA share price, you only get a market cap of £46.5 million! (No voting rights included at that price.)

Results

Given the strangeness going on with the share classes, the results in my mind are of secondary importance. If it’s too difficult to figure out which share class to buy, then it’s just not worth getting involved with this one!

There is evidently a political reason, e.g. to do with control of the Board and/or future plans for the company, which has resulted in the enormous disconnect between DWHT and DWHA.

For what it’s worth, the company’s interim results are as follows:

· Revenue down 6% to £27.1 million

· Adjusted operating profit down 12% to £3.8 million

· PBT up 11% to £3.7 million.

Cash sits at £19.9 million.

Outlook is mixed. Inflation is squeezing margins, before price rises can be passed on to customers. There are worries about UK demand. In addition, the full-year result will be below expectations, due to the effects of a cyber-attack on the company.

The interim dividend increases slightly.

My view

I think either Dewhurst share class could be an interesting speculation. Since I don’t understand the politics behind the company, my instinct would be to go for the much cheaper non-voting shares. It’s possible that you could build a value investing rationale on the basis that it’s a family business, is cash-rich, and the “A” shares are not too expensive versus earnings.

I don’t have conviction in this, but will continue to watch it.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.