Good morning from Paul & Graham!

Budget Day today 12:30 - I’ll watch it on TV and quickly type up the main points here. A reminder that we don't do politics here - just facts & figures of interest to investors.

My notes from the Chancellor’s speech

(not comprehensive, I’ve just noted the biggest points, hopefully accurately)

For investors the most important points by far are re pensions -

Tax-free allowance for what we can put into our pension pots goes up from £40k to £60k p.a.

Pensions Lifetime Allowance, which caps the size of pension schemes has been abolished altogether! (currently c.£1m. It was rumoured to be going up to £1.8m). This makes our SIPPs very much more attractive, and could be good for equity markets. The reason it’s been done is to stop incentivising more experienced workers to leave the labour market with early retirement (especially senior doctors). Although will the next Labour Govt reverse this change I wonder? Note that the maximum tax-free lump sum will remain at £268k.

Corporation Tax - 19% rate didn’t generate enough investment. So sticking with the increase to 25%, but introducing 100% capital allowances (for 3 years, then hopefully permanent) for IT, plant & machinery spending. Worth £9bn p.a. to businesses that invest. Most generous capital allowance of any European country (large country, he might have said?). Sounds good for shares in capital-intensive sectors.

Enhanced allowances for life sciences, and creative sectors (TV/film mentioned as largest in Europe & expanding)

Other points -

OBR says the UK will not now enter a technical recession this year (did he mean 22/23 fiscal year, or 2023 calendar year? Will have to check the OBR forecasts directly)

OBR forecasting inflation will fall from 10.7% (Q4 2022), to just 2.9% by end 2023.

Energy price cap of £2,500 (typical usage) will be extended for another 3 months for households, saving £160 extra.

Prepayments meters for utilities - prices will be reduced to match direct debits. Pause on enforced installations.

Pubs - alcohol freeze for draught beers, etc. “Our beer may be warm, but the duty is frozen” - very droll!

Fuel duty again frozen, including continuation of 5p previous cut.

Combined, these measures knock 0.75% off inflation.

Govt debt - 92.4% of GDP next year. Then goes up a bit, before coming down a bit. Reducing by 5th year of forecast. Underlying Govt debt to GDP will be 3% lower in 5 years.

Govt annual deficit - will be under 3% of GDP by 5 years. Will be 5.1% of GDP in 2023/4. Sounds OK, nothing to worry about there.

GDP growth - previously the OBR expected -1.4% in 2023. Now forecasting -0.2%, still weak, but less bad than before. +1.8% forecast for 2024, and over 2% pa thereafter.

Unemployment expected to rise, but remain low, reaching 4.4% (up <1% from now)

Defence spending to rise.

Levelling up - 12 new enterprise zones will be created. Innovation clusters. More local regeneration projects. £200m extra for potholes.

Energy supply - renewables doing well, and nuclear will be prioritised too, hoping to reach 25% of our electricity production by 2050. Interested in small modular reactors.

Enterprise - saved SVB UK. Looking to unlock pension fund assets, and make London more attractive stock market for listings.

Deregulation of high growth sectors planned, including life sciences rapid drug approvals.

Artificial Intelligence being supported.

Disabled benefits/support being overhauled to get people into work without being penalised.

Childcare - much more generous free childcare will be phased in, to help more people (especially mothers) return to work.

For more detailed & accurate coverage, see tomorrow’s papers! Just thought I’d share my personal notes quickly. Let me know if you spot any errors.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

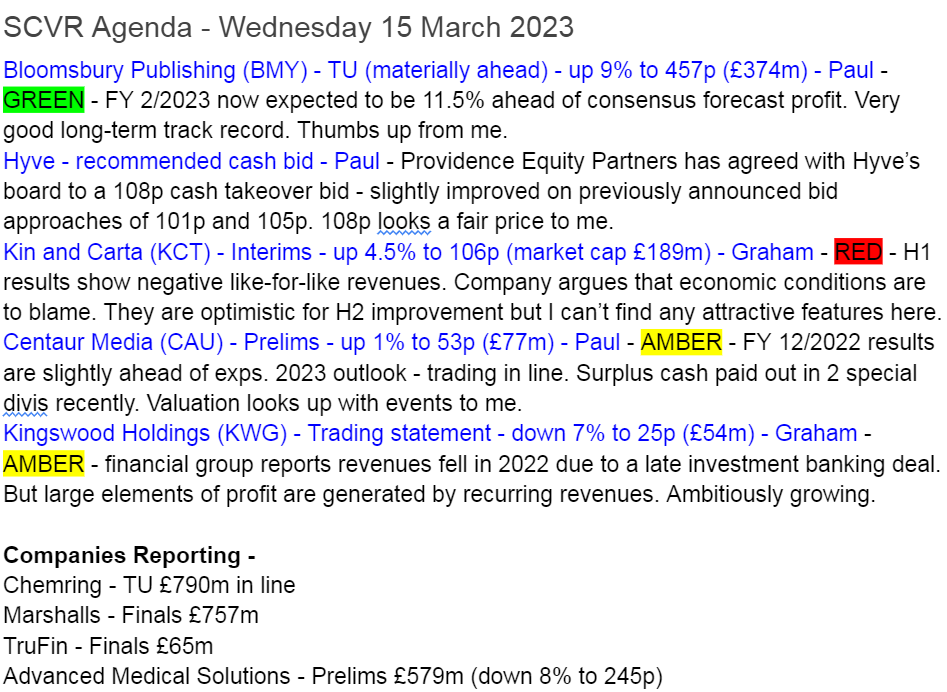

Bloomsbury Publishing (LON:BMY)

457p (up 9% at 08:35)

Market cap £374m

Bloomsbury Publishing Plc (LSE: BMY), the leading independent publisher, today announces a year-end trading update for the 12 months ending 28 February 2023.

Revenue comfortably ahead and profit materially ahead of expectations.

Revenue is now expected to be over £260 million and profit before taxation and highlighted items is expected to be some £30 million for the year ended 28 February 2023.* This follows strong trading at the end of the year.

* The Board considers current consensus market expectations for the year ending 28 February 2023 to be revenue of £242.6 million and profit before taxation and highlighted items of £26.9 million.

A model of clarity above, allowing us to quickly see that profit is £3.1m (11.5%) ahead of expectations. Coming right at the end of the year, that’s really encouraging, given that many other companies are struggling to hit their numbers due to the well-known negative macro factors.

There’s some further commentary in the announcement, but nothing that gives any useful financial information. In particular, I think investors need to know how much of the group’s profit comes from the Harry Potter books? I’m not sure that has ever been disclosed. Also, what deal is J K Rowling on, i.e. could she jump ship to another publisher? Maybe that’s too sensitive to publish, but it’s the sort of risk information that investors need to know, I’d say.

Do add a comment below, if you’ve looked into this aspect of BMY shares.

I’ve had a look through the “Principal Risks and Risk Management” section of the last Annual Report here, pages 93-98, and it doesn’t seem to mention authors. Instead when referring to “talent” it seems to be talking about its own staff!

Broker updates - nothing that I can see.

Stockopedia shows broker consensus of 25.4p EPS for FY 2/2023. So if we increase that by 11.5% (today’s beat in the RNS), that becomes 28.3p.

The live share price (at 08:35) is up 9% to 457p, so the PER is 18x which seems about right to me, and looks to be in the middle of the historic PER range (see graph 4 below).

The forecast blobs below are as of yesterday, so will be revised up as new forecasts flow through into the data. That will give the “Normalised EPS” graph below an almost exponential look, showing that the 6-year track record of BMY really has been superb -

BMY has achieved this excellent profit growth with very little dilution of shareholders. Over this 6-year period, the share count has only risen from c.77m to 81.6m shares in issue. Hence it’s been largely self-funded growth, and paying divis along the way too.

All in all, a really impressive long-term performance I’d say.

The share price went to sleep for years, but has performed much better since about 2018.

Balance sheet - is strong, with last reported (31 Aug 2022) NTAV at £93m, including £41m net cash. But note the huge receivables number of £115m, which is too high. It includes £31.6m in “Royalty advances”. I'd worry that book retailers/distributors might be potential bad debts, so a good question to ask management would be if the receivables book is insured? Also, what is their largest customer exposure, and what credit control measures are used to prevent bad debts from customers? BMY is clearly financial stable, so there’s nothing here to worry about, in my view.

My opinion - it’s got to be positive, since BMY is trading well, has comfortably beaten expectations, and is valued at a level that is reasonable given its superb long-term track record. We don’t know what the future holds of course, so the share price will move about in response to future performance. Overall, a thumbs up from me.

As you can see below, in the chart within the chart, the StockRank (green line) is consistently high.

Centaur Media (LON:CAU)

53p (up 1% at 09:04)

Market cap £77m

I’ll take a quick look at this, as it’s being discussed in the reader comments below.

Centaur Media Plc ("Centaur"), an international provider of business intelligence, learning and specialist consultancy, is pleased to present its preliminary results for the year ended 31 December 2022.

This gives more detail on what the company does -

The P&L is quite complicated, with adjustments, and I’ve been trying to work out which number I’m happy to use for valuing the shares.

Adj EBITDA of £8.5m (up 33%) looks impressive, but seems to omit significant costs related to rents on leases. So I’m ignoring this number as unrealistically high.

Adj PBT of £5.2m (see reconciliation below) looks more sensible to me, although that includes a £806k boost from ignoring share based payments.

Hence I would add back share options charge, to get at real world (the way I view it) PBT of £4.4m. That’s not enough to justify a £77m market cap, in my opinion.

Other points -

CAU is earning interest on cash deposits now - helpful.

Balance sheet is mostly intangibles (goodwill on acquisitions). NAV of £48.8m becomes NTAV of only £5.0m - that’s fine for a capital light business model like this.

Cash comes partly from favourable timing differences - i.e. up-front customer payments, before a service has been provided, so depending on how you look at it, it’s not really surplus cash. But this business model, providing subscription services, is a favourable cashflow way of operating, so I see this as positive.

Net cash of £16.0m looks good, but remember that £8.9m of it (the deferred income creditor) has come from customers paying up-front. A good question to ask management would be how the cash pile & deferred income figures vary during the year. An average daily net cash figure would be useful to smooth out any seasonal factors (often year end cash is a seasonal peak at many companies).

Special divis are noteworthy - 3.0p was paid in Feb 2023, a cost of £4.3m, and another 2.0p, or £2.9m will be paid shortly. So that’s a combined £7.2m coming off the £16.0m year end net cash, taking it down to £8.8m, which is almost the same as the deferred income creditor. So the way I look at it, this means the company’s surplus cash has now been paid to shareholders, just leaving what is effectively customer’s cash. Hence I wouldn’t necessarily expect any more special divis for now. If they do pay more special divis, then that would be questionable use of customer cash, in my view.

Outlook - sounds OK, in line -

Centaur remains on track to meet its MAP23 objectives despite the uncertain macroeconomic outlook, and the Group's trading has started the year in line with the Board's expectations.

MAP23 refers to its “Margin Acceleration Plan” to get adj EBITDA to 23% in 2023 (from 20% in 2022, and 16% in 2021).

My opinion - this looks OK, not madly exciting numbers. It’s demonstrated a nice recovery from the pandemic, which has been reflected in a good boost to the share price.

Adj diluted EPS was 2.6p, so at 53p/share the PER is 20.4x - that looks high enough, or maybe a bit too high, to me. So anyone holding this share is clearly expecting 2023 numbers to rise strongly from 2022. Stockopedia currently shows a 2023 forecast of 3.3p, which would bring the PER down to 16x - still not particularly good value to my mind.

Overall then, I’m just neutral on this share, but bear in mind this is (as usual) just on a fairly superficial review. There might be more exciting things in prospect that are not reflected in these numbers maybe?

The long-term track record looks lacklustre - so the key question would be, what has changed (management, strategy, etc) to turn a long-term under-performer into something more exciting? I don't know, as that's beyond the scope of these reports, over to you!

Graham’s Section:

Kin and Carta (LON:KCT)

Share price: 102.8p (pre-market)

Market cap: £183m

The market cap of this company has approximately halved since I examined it in October 2022.

Paul also studied it when it issued a profit warning last month.

Both of us seem to find this company’s communications problematic. I have found the level of adjustments to its accounts more than excessive.

This is a consultancy business, offering a range of services to its corporate customers. It had the rather boring name “St. Ives” before changing its name in 2018. It then became “a pure-play digitally native DX consultancy” (yuk!) (DX means “digital transformation”.)

Let’s see how it performed in H1 (August 2022 - January 2023):

Revenue growth +15% to £98.7m

Like-for-like revenues (i.e. excluding acquisitions/disposals) down 6%

Performance in Europe was particularly poor. Like-for-like revenue down 16% “due to a challenging UK economy” (UK is 81% of revenue from this region).

Adjusted operating margin of 7.6% (last year: 8.5%) reflects “volatile trading conditions and planned higher investments in systems and technology partially offset by margin enhancing nearshore delivery and efficiencies in operating systems”.

I remember the last time I studied this company, I got bogged down with it for hours. No doubt I was googling to make sure that I understood terms such as “nearshore delivery”.

Let’s see if I can pick out the key points from this announcement without spending several hours this time.

Order backlog rises to £124m (last year: £106m).

Net debt £11.8m (last year: net cash £6.2m).

Client base consists mostly of large global enterprises and public sector entities. 90% of revenue is generated from 50 large customers.

Outlook

I’ll quote this liberally since it’s important:

Organic growth and profitability are expected to improve in H2... However, we are mindful of the macroeconomic challenges that continue to evolve.

…we expect FY23 net revenue growth to be 8-12%, with organic net revenue declining low single digit percentage from the prior year. We expect adjusted operating margin of 11-12% for FY23, broadly in line with the prior year and supported by increased nearshore delivery and an improved cost structure. Adjusted EBITDA margin is expected to be 12-13%.

We expect a return to more normal growth and profitability in FY24. The Company's medium term guidance of 15%+ CAGR and adjusted EBITDA margins in the mid-to-high teens remains unchanged.

The main point here, in my mind, is the decline in organic revenue. The company says that this is due to the economic environment, but I’m curious to read a fuller explanation - many other international companies can still achieve organic growth in these conditions.

The new CEO doesn’t give too much away, saying that clients became more cautious due to the “challenging” UK and global economies.

Financial performance

There is a statutory net loss of £12.5m, after £5m of “adjusted” profits are combined with £18m of items which the company thinks can be adjusted out.

Even if you’re willing to give the company the benefit of the doubt for most of these items (personally, I am not), I don’t think there is any argument for allowing share-based payments of £2.5m to be treated as an exceptional item. That item alone would take a huge bite out of the adjusted profits, if it was not excluded from the calculation.

My own view is that this company was loss-making in H1 on any reasonably conservative interpretation of the figures.

Here are the pre-tax results:

Balance sheet - tangible equity is negative.

Cash flow - £5m of after-tax cash from operating activities, offset by £1m of capex spending and £5m of acquisition related spending.

My view

This may be controversial and I am aware that we have holders of this company who read this report, but I have to give this company the thumbs down. I don’t like their accounts, I don’t like how they present their accounts, I don’t like how they describe their business, and I don’t think it’s a quality business.

The price to sales multiple is around 1x which is not overly expensive, but companies like this can and do trade at lower multiples from time to time.

Kingswood Holdings (LON:KWG)

Share price: 25p (+9%)

Market cap: £54m

This is a large financial planning company and investment manager, previously known as “European Wealth Group”. We’ve not covered it before in these reports.

This morning brings a full-year update for 2022, and an outlook statement for 2023.

Revenues are down 3.9% to £144m.

Within this, US revenues are down 14% to £110m, “due to lower than expected capital markets activity affecting US investment banking revenues and the timing of a large one-off, high margin US transaction that was expected to be reported in 2022 and that will now be recognised in 2023”.

Investment banking is notoriously lumpy: large, one-off transactions can make or break financial performance every year. But Kingswood also has a traditional financial advisory business in the US, operating in all 50 states. Kingswood owns 50.1% of the US business.

Separately, UK revenues are up 54% to £34m with the help of some acquisitions. The fees generated in the UK are overwhelmingly recurring in nature (87% recurring).

Group operating profit for 2022 will be £8.5m, better than 2021 but below the Board’s expectations (due to the late timing of the US investment banking transaction).

Acquisitions - Kingswood is highly acquisitive. Ten UK acquisitions took place in 2022 and a further two already in Q1 2023.

UK assets under management or administration increased significantly in 2022 to £8.1bn, thanks to the acquisitions and positive net flows. After the acquisitions made already this year, AUMA is now £9bn.

Debt facility - there is a new £50m facility which may be increased to £150m. £25m had been drawn down at the end of 2022.

As of the end of the year, the company had a net debt position of £5m and owed £33m in defcon, so it really does need that facility.

2023 outlook

Our near-term target remains to build our AUM/A to in excess of £10bn in UK&I and £12bn for the Group.

With the full year effect of the acquisitions made to date, current Group FY2023 run rate operating profit is approximately £14.7m. Through organic growth and further acquisitions through 2023 we are building a pipeline to deliver proforma operating profit of £20m. Further upside should also be expected if markets recover, but this is not assumed in our plans.

We continue to enjoy a strong and healthy pipeline of acquisitions and have capacity with our debt facility to support this. However, we are also considering sources of new capital to ensure that we have a full range of options available to us.

My view

I’m starting to get interested in this one. Near-term plans for proforma operating profit of £20m are intriguing when you consider that the market cap is currently just £54m.

Against that, we have to bear in mind that

1) the company is likely to use debt that’s a significant percentage of the market cap - its total maximum debt facility is nearly three times its market cap. Or perhaps it will raise some equity?

2) as with other companies (!), the adjustments to the “proforma operating profit” may be significant.

The StockReport has also noticed some signs of value, but isn’t totally convinced yet:

I have a feeling that this share may be below the radar but I won’t give it the thumbs up just yet. Possibly a good candidate for further study.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.