Good morning from Paul & Graham!

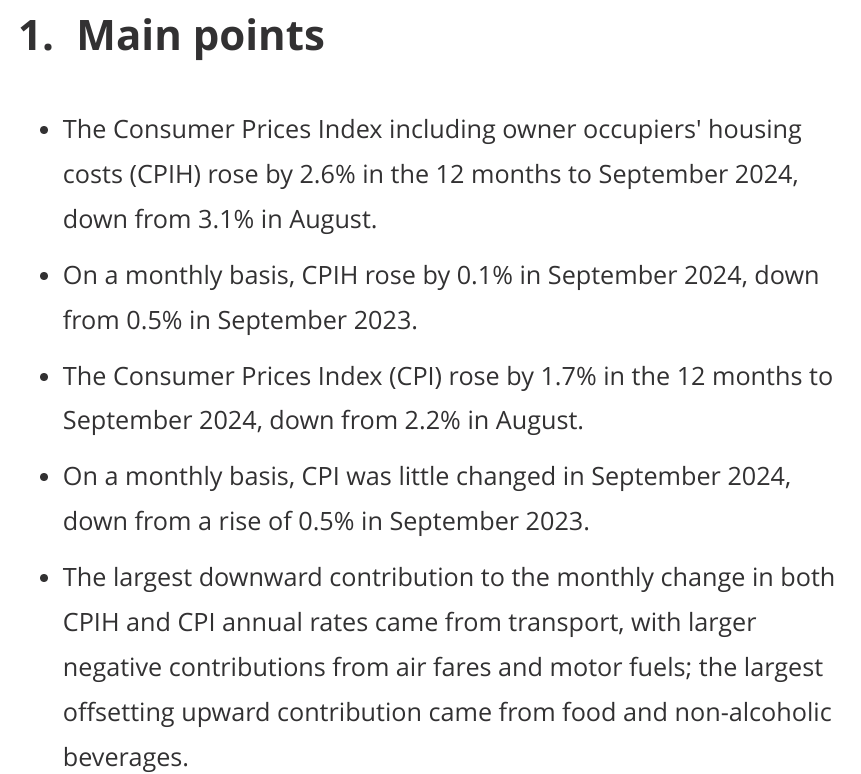

UK Inflation Falls

ONS data out this morning shows that CPI inflation data for Sept 2024 shows a sharp fall to 1.7% (due to a sharp rise last Sept dropping out of the comparatives). As the press are reporting, this probably makes it more likely that we'll see further interest rate cuts - which should be good for equities of course.

Excerpt -

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

** New SCVR summary spreadsheet for calendar 2024 ** This is the live one! (updated 6/9/2024)

Archive - SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia. More stock screening strategies here (possible bargains?) - 21/9/2024.

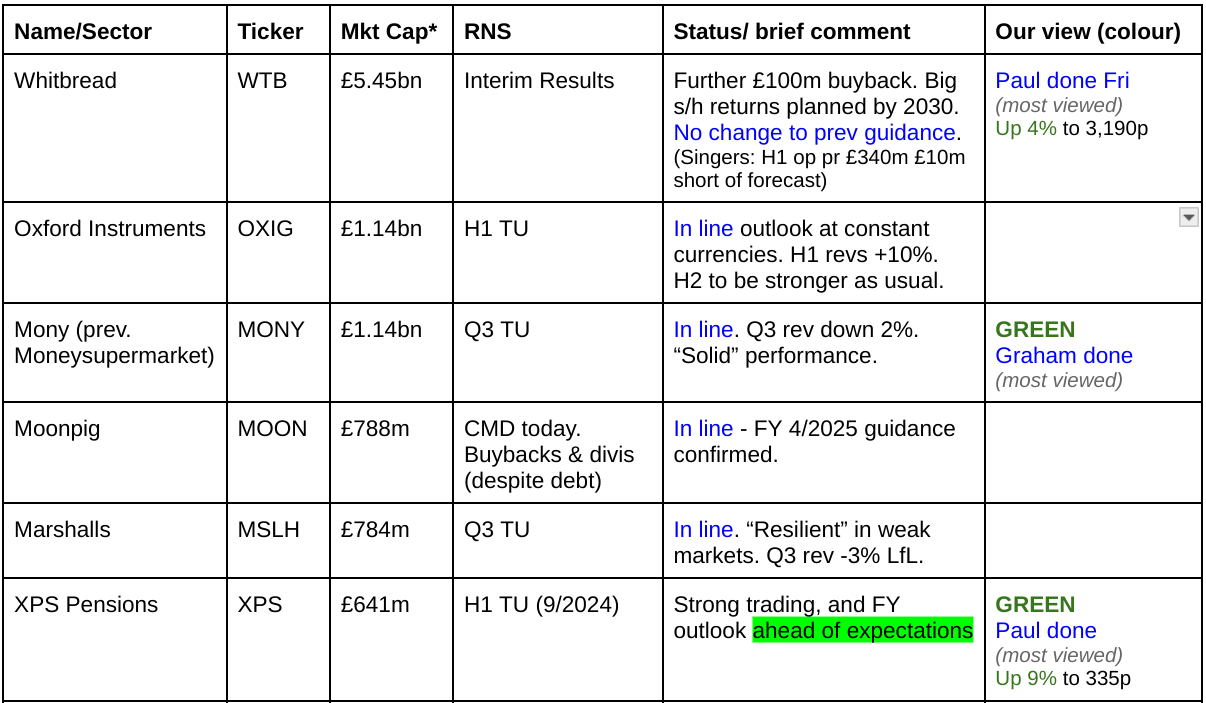

Companies Reporting

Summaries

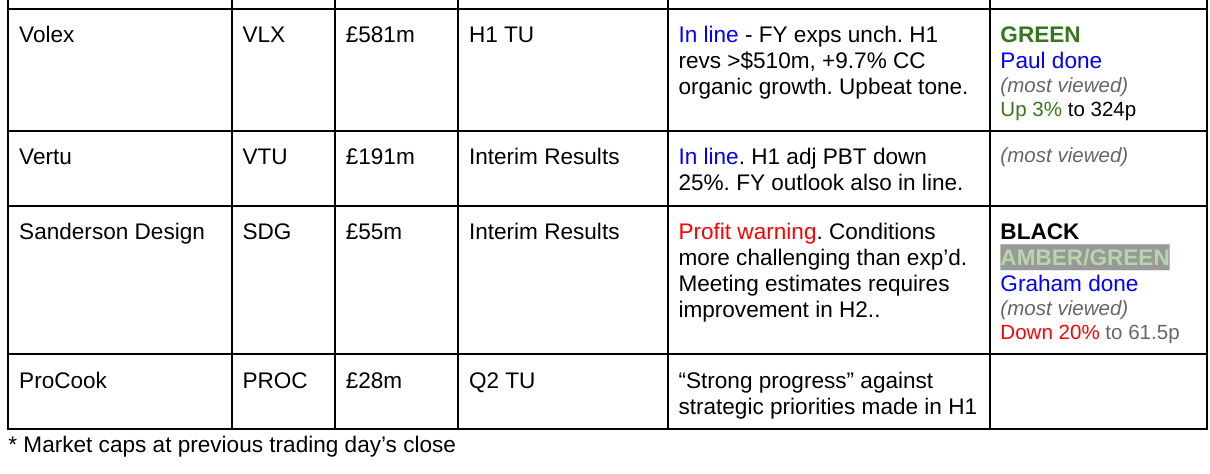

Volex (LON:VLX) - up 3% to 324p (£586m) - H1 Trading Update - Paul - GREEN

This buy & build electrical connectors group reassures us once again, with a positive sounding update, and trading in line with expectations. I continue to view this share favourably, as a reasonably priced, good quality, well managed business, that seems to be executing a series of worthwhile acquisitions.

Gulf Marine Services (LON:GMS) (Paul holds) - 17.7p (£191m) - Call with management - Paul (I hold) - GREEN

I was able to have a Q&A with GMS management yesterday, with some useful points covered. Hopefully my notes below are reasonably accurate. It reinforced my view that this is a very good investment idea (I hold) where rapid deleveraging looks set to continue rewarding equity holders. Positive demand/supply situation looks set to continue. Divis likely to start next year.

Sanderson Design (LON:SDG) - down 18% to 62.85p (£45m) - Interim Results - Graham - BLACK (profit warning) AMBER/GREEN

SDG says that hitting prior expectations “is reliant on a predicted improvement in trading” after a tough H1. The analysts take a more pragmatic approach and reduce estimates: new revenue forecasts are 2% lower and adj. PBT 5% lower. I’m leaving the stance unchanged for now, as it is possibly in deep value territory.

XPS Pensions (LON:XPS) - up 9% to 335p (£697m) - H1 Trading Update [ahead exps] - Paul - GREEN

Impressive H1 TU, ahead of expectations. I think the 9% rise in price today looks justified, and valuation still looks reasonable.

Paul's Section:

XPS Pensions (LON:XPS)

Up 9% to 335p (£697m) - H1 Trading Update [ahead exps] - Paul - GREEN

Ahead of expectations updates are quite rare at the moment, so thanks to IanB who flagged this in the reader comments below - it eluded us, in our initial scan of the RNS. Some companies seem to use a different reporting method, as Moonpig (LON:MOON) also slips through the net too every time they report.

I think XPS is very good, and gave it a GREEN at 283p on 21/6/2024 with impressive FY 3/2024 results & outlook. It wasn’t cheap, but I concluded that the shares were worth the price.

It’s continued powering ahead, with shares making a new all-time high today on another positive update.

XPS Pensions Group plc ("XPS" or the "Group") is pleased to provide its post-close trading update (unaudited) for the six months ended 30 September 2024 ahead of its interim results on 21 November 2024.

Continuing operations revenues up an impressive 23% in H1.

I won’t repeat all the detail here, but suffice it to say that everything sounds positive. Key drivers of strong performance are lagged price rises from high inflationary period, and ongoing regulatory changes in the pensions advisory/management area.

Outlook -

“The Board is pleased with the Group's performance in the first half of the year and, notwithstanding an even tougher comparative period in H2 is confident of achieving full year results ahead of its previous expectations.”

Broker update - thanks to Canaccord, with a brief update note today. It has held back on updating forecasts, given that we need to find out what the Budget says. So no upgrade today, but it points out that 51% of FY revenues have already been achieved in H1, so the forecasts are likely to be raised a little.

Paul’s opinion - yes I like this one, it seems a good quality company, growing profits remarkably quickly. Which does raise the question whether profit growth might be benefitting from one-offs, so checking that growth is sustainable would be a key area of focus if I decided to invest here.

Note that the balance sheet NTAV is negative, as it’s done a lot of acquisitions. Debt was mostly cleared from a disposal last year, so nothing to worry about there.

Whatever it’s doing, is clearly working, so the profit & cashflow growth at XPS are impressive.

It was priced on a forward PER of 16.8x last night, and a 3.8% yield. Shares have gone up c.9% today, but earnings forecasts are also likely to rise somewhat, so valuation is still likely in the same ballpark.

The news is good, and valuation still looks reasonable, so I’m happy to stick at GREEN.

Volex (LON:VLX)

Up 3% to 324p (£586m) - H1 Trading Update - Paul - GREEN

Volex (AIM: VLX), the specialist integrated manufacturer of critical power and data transmission products, today releases a trading update for the 26 weeks ended 29 September 2024.

As usual Nat Rothschild’s acquisitive group pleases with a reassuring, and quite upbeat-sounding H1 trading update.

Instead of the waffle we often get from many companies, this update gets straight to the key point -

“Strong momentum sustained through the first half; full year expectations unchanged”

Note that broker forecasts have been gently eased down in recent months, so this looks like good expectations management by the company -

My summary -

H1 trading in line with expectations.

H1 revenue >$510m

Organic revenue growth (constant currency) impressive at +9.7% - I’ve queried before whether this is flattered by high inflation in Turkey, but I think readers thought it would probably be invoicing in dollars or euros, which sounds credible. Maybe someone could ask if Volex do another webinar?

The five sectors Volex supplies have nicely balanced each other again, with growth in EVs (electric vehicles) and consumer products mentioned, offsetting some softness elsewhere.

Margins good, but vague on specifics. Just says within target 9-10% range.

Continuing to invest in increasing capacity & efficiency measures.

Outlook - reassures -

“Volex delivered strong growth in the first half of the year, despite a challenging macroeconomic background. This is a testament to the Group's strong positioning in specialist markets delivering critical connectivity for customers. The Group is benefitting from a diversification strategy targeting structural growth markets and leveraging strong customer relationships, and is well positioned to continue the current momentum through the second half of the year, with full year expectations unchanged.”

Diary date - 15/11/2024 for H1 results.

Broker updates - nothing available, but I imagine given this is an in line update, there would probably be no changes.

Valuation - the StockReport has 34.4 US cents for FY 3/2025. Convert at £1 = $1.30, gives us 26.5p, and at 324p the PER is 12.2x, which I think looks reasonable. Remember to factor in that VLX has increased debt a fair bit, to help fund acquisitions, and this was $121m (excl leases) at 3/2024.

Today’s TU should have provided an up-to-date net debt figure, so that’s a gap in the reporting. Better still, companies should report their average daily net debt, to give us the full picture. I’m not concerned about Volex’s debt, but would like to be better informed as to what the numbers are, as we need that info to properly value its shares.

Paul’s opinion - I’m pleased with this update. I remain of the view that Volex has established an excellent track record as a reasonably-priced buy & build share. I’m not holding personally at the moment, as mentioned in a previous podcast, I sold them temporarily due to wanting to lower my exposure to AIM during this volatility over Budget measures. My view on the the fundamentals at VLX haven’t changed at all, it’s still a positive view, so another GREEN. I suspect once UK small caps are out of the doldrums, this share could enjoy a useful re-rating. Meanwhile management are quietly getting on with doing a good job, despite challenging macro conditions. That should mean stronger growth once economies recover. It could also benefit from reshoring closer to Western economies, and I also like that it is positioned well in structurally growing markets. So it’s another thumbs up from me. I hope to rejoin holders as a small shareholder myself, in due course!

Despite all the multiple crises of the last 5 years, VLX shares have tripled -

Gulf Marine Services (LON:GMS) (Paul holds)

17.7p (£191m) - Call with management - Paul (I hold) - GREEN

I had a call with management yesterday, as this share interests me, and I wanted to ask about several queries raised by me, and other investors.

As usual, this is just my recollection of the gist of what was said, so apologies if anything isn’t quite right.

Background - I’ve covered GMS shares a lot over the years. The investment case is that it’s a highly cash generative, deleveraging investment situation. Previously excessive debt is now rapidly reducing, with the upside flowing to equity holders.

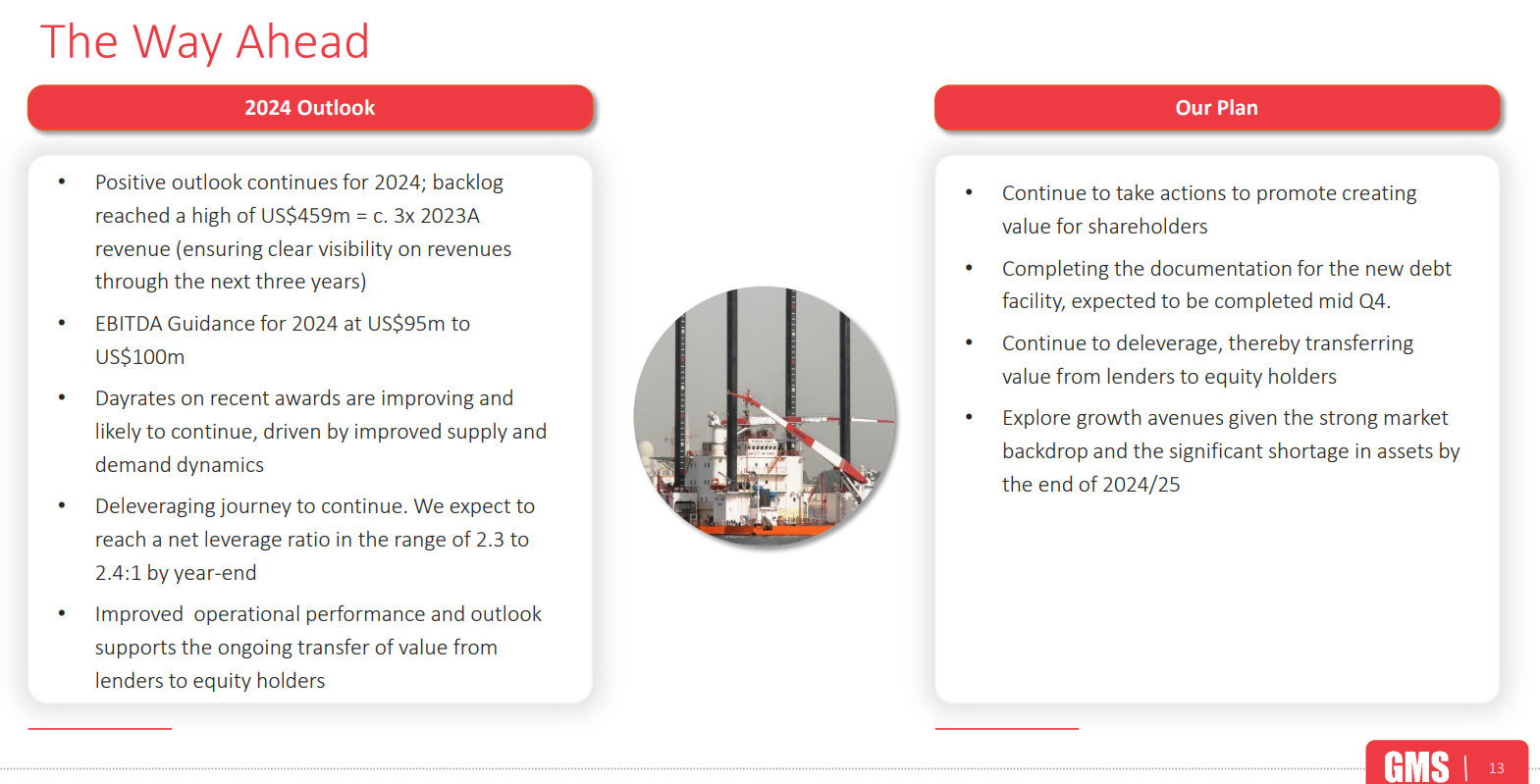

There’s a detailed slide deck from Sept 2024 here on their website.

GMS owns a fleet of 13 modern, well-maintained vessels used mainly in the oil & gas industry, hired out on long-term contracts at daily rates of c.$32k, mainly in the M.East.

Opportunities in the repair & maintenance of offshore wind turbines. One ship does this in N.Sea, and one is being moved from M.East to N.Sea. Existing fleet only need minor modifications to change use from oil & gas, to wind. Also opportunities in additional new geographies (eg. South America) are being bid for. So mgt see good potential for further growth.

The fleet is relatively new (vessels have a life of c.40 years, but GMS depreciates them over 30 years, and their fleet is average 14 years, with one older vessel of 28 years skewing that number).

Slide 7 below shows how previous management saw a crash in utilisation, and daily rates from 2016, which saw net debt soar from 2.2x EBITDA to 8.1x EBITDA by 2020. In the last 4 years, debt has come right down again, and is now only 2.6x EBITDA.

So I focused my questions on the risk of something similar happening again if the market rates once again crashed?

New management are “extremely careful” with gearing now, and are targeting 1.5x or below in future.

Would still be profitable & cash generative even if utilisation were to crash to 60-70% again.

Even if oil & gas market does crash (not expected), these vessels would still be needed for maintenance & repairs.

Utilisation shouldn’t have dropped as low as it did, mistakes were made with not being flexible enough on pricing, hence unnecessarily low utilisation 2016-19.

Market rates are gently rising, with strong long-term demand, and very good order book (c.$500m), growing rapidly.

Contracts are a mix of fixed, with options to extend. Historically, customer options are nearly always exercised.

I asked about new ship capacity being built, and could that lead to a future glut of supply? Mgt ran me through the industry numbers, something like 68 vessels currently in use (so GMS has something like 20% market share). 15-20 new ones are being built. 6-7 in the industry are over 50 years old, so likely to be retired. Industry requires about 30% increase in numbers, so it all balances off, and demand is likely to remain ahead of supply. Which is why operators are keen to lock in supply with long-term contracts, hence GMS’s rapidly growing order book.

Can contracts be cancelled by customers? Some have penalty clauses, but most don’t, but in practice in an adverse market customers are more likely to negotiate price discounts, rather than cancel.

Dividends - as RNSd, being considered, decision will be made next year.

Seafox overhang - when will it clear? Seemed to think the main sellers are done now. Was surprised that Seafox agreed to a discount by selling at 17p, when share price was 20p.

Warrants - related to banks, 2 holders. One has sold some, the other is keeping them for now.

Risk from Arab/Israeli contract? Doesn’t operate in the Red Sea, and no sign currently that any facilities are likely to be targeted, as not in danger areas.

Book value of ships - how does it compare with open market value? Open market value is higher. This makes sense to me. Some bears were suggesting these are overvalued ships, which doesn’t make sense, because they’re generating huge cashflows, so of course they’re valuable, given that demand is still outstripping supply and likely to continue doing so.

Paul’s opinion - I’m very reassured by the above, as all the main risks seem to be fully under control. Management strike me as very open, and gave direct answers to my questions. They’re keen on shareholder engagement.

EDIT: Do have a look at the full slide deck, it's full of useful information. This is the final slide below - which reinforces that the favourable conditions GMS is enjoying look set to continue -

Near-disaster to multibagger, and possibly more to come, the numbers suggest to me -

Graham’s Section:

Sanderson Design (LON:SDG)

Down 18% to 62.85p (£45m) - Interim Results - Graham - BLACK (profit warning) AMBER/GREEN

Sanderson Design Group PLC (AIM: SDG), the luxury interior design and furnishings group, announces its unaudited financial results for the six months ended 31 July 2024.

The numbers published today aren’t pretty. Here’s an excerpt from the table:

The fall in revenue reflects “a challenging market in the UK and elsewhere whilst growth was delivered in North America”.

The collapse in profits is due to the drop-off in ordinary brand product sales but also due to lower licensing income (£4.1m in H1 is this year, vs. £6.9m last year).

For many companies, licensing income is a form of costless pure profit, which means that any reduction can have a dramatic effect on profitability.

On the bright side, SDG says that the lower licensing income in H1 was in line with expectations, and that it still expects to have full-year licensing income that’s “approximately the same as last year’s”.

Net cash has fallen from £16m (Jan 2024) to £10m (July 2024). Reasons: capex, inventory build-up due to lower than expected sales, and a payment to offload a pension scheme.

Interim dividend will be 0.5p (H1 last year: 0.75p).

Chairman comment: makes clear that trading has been “more challenging than expected in almost all territories”, and concludes with:

Delivery of the Board's expectations is reliant on a projected improvement in trading during the remainder of the financial year, which includes our important pre-Christmas selling period."

Instead of saying the above, which implies that hitting previous expectations can’t be relied on, perhaps it would make more sense to say that the company has new (lower) expectations for the year?

Estimates: speaking of expectations, Progressive have published a note with a new FY Jan 2025 adjusted PBT estimate of £7.6m (previously: £8m). That’s a 5% cut.

Their estimate of unadjusted PBT gets a 12% cut, to £5.6m.

Graham’s view

There’s no getting away from the fact that these are terrible results and the outlook statement is poor with the company now likely to miss prior expectations.

However, the collapse in profitability is understandable when you consider the weak environment that has affected so many of the companies we cover in this report. Sanderson has suffered a 14% reduction in product sales in its domestic market - most companies would struggle with this.

There are still reasons for optimism, in my view:

Like-for-like sales of 6% in North America. Sales in North America could potentially catch up with sales in the UK in a few years.

The drop-off in licensing in H1 was only due to the timing of deals. Licensing revenue is often lumpy, but the full-year result is tracking in line with various new deals and extensions signed.

The balance sheet has tangible equity of £60m. As noted by Paul in a text to me this morning, working capital (current assets minus current assets) is £38m. That’s not far off the market cap!

Therefore, despite the implied profit warning in today’s announcement, I’m inclined to leave the AMBER/GREEN stance unchanged - see coverage in August. I don’t view this as a comfortable purchase or a sleep-sound type of investment, but the risk:reward still strikes me as interesting!

Momentum is downhill:

But it is passing lots of value screens: 6, to be precise! For example:

MONY (LON:MONY)

Down 5% to 201.7p (£1.1 billion) - Q3 Trading Update - Graham - GREEN

This update is in line with expectations and the company helpfully informs us that it is expected to produce an adjusted EBITDA of between £135.8m and £142.1m, with an average consensus estimate of £140m.

Last year, MONY made an adjusted EBITDA of £132m, so it’s in line to make a nice improvement on that. The real, after-tax profit figure was £72m.

Here are the Q3 revenue results:

The “Home Services” segment includes broadband, energy, landline and mobile phones. Along with Travel, it’s the main point of weakness. There was “soft demand from customers in broadband and fewer compelling new handset launches in mobile during the period”.

In the Travel segment, there was “lower conversion in car hire”.

The much larger revenue contributions from Insurance and Money held up better, perhaps in a sign that consumers are more focused on saving money than on discretionary spending. Credit card switching was strong, but there were few offers to switch current accounts during the quarter.

Year-to-date, the company has achieved revenue growth of 2%, with 9% growth in insurance making that possible as most other segments declined.

SuperSaveClub now has over 750,000 members with 11 products available to members.

Outlook: confident that it will deliver results in line.

CEO comment: pleased with continued progress.

Graham’s view: we tend not to cover this one any more, due to its size, but I’ve been a fan of this company for a long time and it’s on the “most viewed” list today.

It gets a QualityRank of 99, with fantastic quality metrics arising from the fact that it’s a successful online business that doesn’t need to use much capital to generate its profits.

It was last mentioned in this report back in 2019, when it had a market cap of nearly £2 billion.

Today the market cap is only £1.1 billion. It should generate about the same level of profits this year as it did in 2019 (unadjusted for inflation).

At modest earnings multiple, I would have to say that this looks interesting and so I’ll go GREEN.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.