Good morning from Paul & Graham!

That's it for today, we've covered in good depth the top 3 most important companies that readers are viewing the most.

Explanatory notes -

A quick reminder that we don’t recommend any shares. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech, investment cos). Although if something is newsworthy and interesting, we'll try to comment on it. Please bear in mind the "list of companies reporting" is precisely that - it's not a to do list. We typically cover c.5 companies per day, with a particular emphasis on under/over expectations updates, and we follow the "most viewed" list of readers, so if you're collectively interested in a company, we'll try to cover it. Obviously with the resources available, we can't cover everything! Add you own comments if you see something interesting, and feel free to discuss anything shares-related in the comments.

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to, if they are using unthreaded viewing of comments.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. And/or it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Others: PINK = takeover approach, BLACK = profit warning, GREY = possible de-listing.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom), Video update of results so far, June 2024.

Frozen SCVR summary spreadsheet for calendar 2023.

New SCVR summary spreadsheet from July 2023 onwards.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Phil Hanson's data analysis measuring performance of our colour-coding system in the SCVRs, from July 2023- Mar 2024 (with live prices). My video explaining/reviewing it.

My other video (June 2024) - How to screen for broker upgrades on Stockopedia.

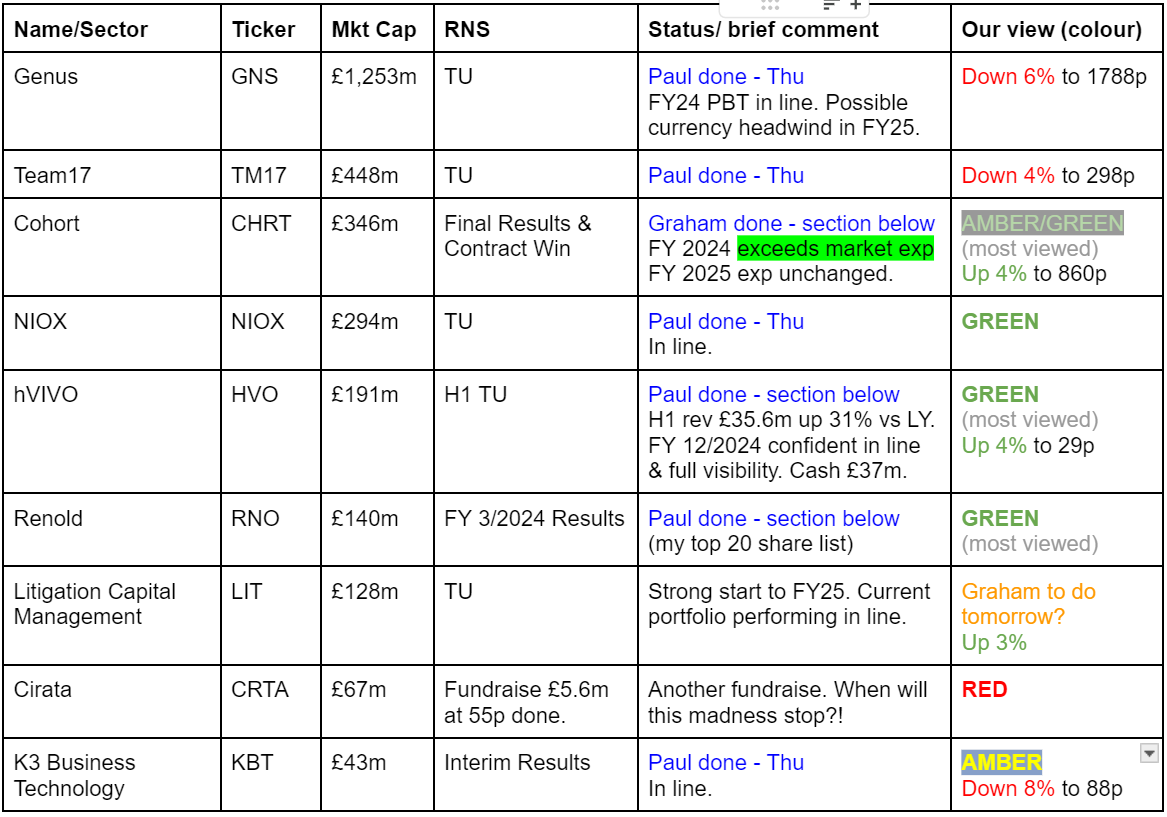

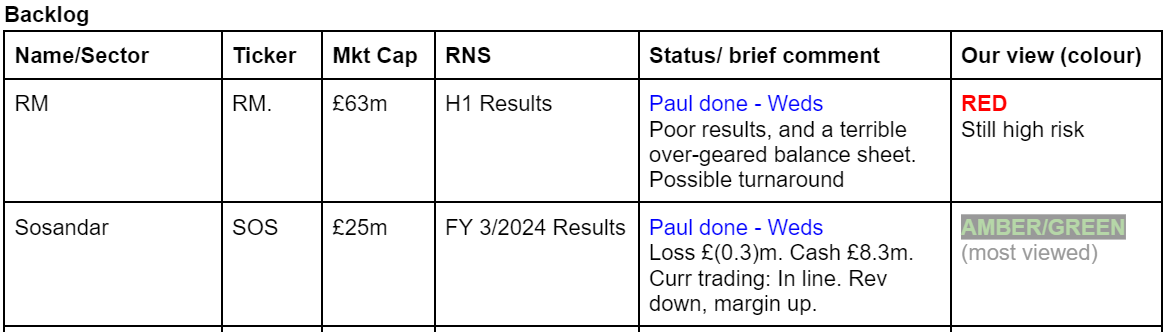

Companies Reporting

Summaries

RM (LON:RM.). - down 11% to 75p y’day (£63m) - Interim Results - Paul - RED

Harwood are talking about a good turnaround here, so it could become interesting. However, the H1 numbers look bad to me - especially the over-geared balance sheet. It jumps through hoops to get a clean going concern statement, with covenants very tight in a downside scenario. Considerable risks, so I'm flagging that with a continuing RED. Risk:reward doesn't work for me at the moment, but I'll keep a close eye on it. Sometimes risky situations can pay off.

Sosandar (LON:SOS) - unch 10.25p y’day (£25m) - FY 3/2024 Results - Paul - AMBER/GREEN

FY 3/2024 was a disappointing year. Originally planned to make £3.1m, profit, it ended up at a £(0.3)m loss. Strategy of reduced discounting & much higher margins has kicked in for Q1 2025, I think it's only working due to steep cost cutting. On the plus side, balance sheet is bulletproof, with a third of the market cap in net cash, and excitement could be triggered by imminent opening of 2 physical stores. So I reckon there could be a trade here for a bounce maybe? Longer term, the jury's still out.

Renold (LON:RNO) - 62p (pre market) £140m - FY 3/2024 Results - Paul - GREEN

Strong results, slightly ahead of substantially increased forecasts. This chains maker is turning into a nice quality business, after a multi-year turnaround. Still quite modestly valued, but I raise a flag about seemingly excessive share options (12.2% potential dilution). The pension scheme remains cash hungry. Balance sheet and cashflow are both fine. Modest divi introduced. Outlook comments are too vague.

Cohort (LON:CHRT) - up 4% to 861p (£355m) - Final Results - Graham - AMBER/GREEN

Fine results from this defence stock as had been well-flagged by prior trading updates. The outlook for 2025 is unchanged although the company did announce some fresh contract wins from a UK government customer in a separate RNS this morning. It’s undoubtedly an impressive defence stock but at a PER of over 20x I think it might be greedy to expect further large gains from this level.

hVIVO (LON:HVO) - up 3% to 28.7p (£196m) - H1 Trading Update - Paul - GREEN

Strong H1, thanks to full utilisation, and completing contracts early, with a softer H2 expected. Reiterates full year guidance, but Cavendish raise forecast profit due to better than expected margins. Plenty of cash thanks to customers paying up-front. I continue to like this GARP share, still reasonably priced.

Paul’s Section:

RM (LON:RM.)

Down 11% to 75p y’day (£63m) - Interim Results - Paul - RED

RM plc (‘RM’), a leading global educational technology (‘EdTech’), digital learning and assessment solution provider, reports its interim results for the six months ended 31 May 2024.

Strategic plan driving strong progress in contract wins and business transformation

I last looked at this troubled company almost a year ago, when it issued a profit warning, had too much debt, and issued a “material uncertainty” warning with H1 results here on 9/8/2023. So I had to flag it as high risk with a RED, at 50p back then. Please do remember our colour coding is not meant to predict the future, but RED is just a flag that something serious is wrong. Armed with the facts, you can then decide if you think risk:reward is good or not.

In aggregate, REDs under-perform, but within that some do recover and do well. So for more risk tolerant investors, there can be opportunities amongst the REDs, and AMBER/REDs, if you know what you’re doing.

RM shares traded sideways until April 2024, then a strong rally started, although it’s now given back about half of those gains, including a sharp 11% drop yesterday when its latest H1 results came out.

The Harwood stable have a chunky 15% holding, and the shareholder register is quite concentrated, with the top 6 holders holding c.75% - hence deals of some kind (eg disposals, takeover, etc) would be easy to organise here, as only 6 phone calls would be needed to strike a deal. As we know, Harwood is highly effective at getting things done at problem/turnaround companies, and RM has been mentioned positively (as having upside potential) in interviews, eg with Richard Staveley.

RM has had big problems. Eg this extract from the FY 11/2023 results, published 14/3/2024 gives a flavour -

H1 highlights this time are more like lowlights - note these numbers are for continuing operations, so a disposal must have happened -

H1 revenue down almost 10% to £79.2m

Adj PBT is negative £(3.7)m, although improved from £(6.7)m in H1 LY.

Adj net debt is still worryingly high at £52.7m, which has increased from £45.6m at the last year end, Nov 2023.

Current trading and outlook

Reflecting the shift to longer-term recurring contracts in Assessment, leading to revenue on H1 contract wins being accounted for in future periods, and uncertainty regarding the timing of a general election having impacted UK schools’ spending in H1, the Board now expects full-year revenue to be broadly flat year on year (excluding Consortium)

Trading in H2 to date has started on an upward trajectory in line with our expectation for like-for-like revenue decline in H1 to be offset by H2 performance

Adjusted Operating Profit for the full year is expected to be in line with market expectations

During FY24 we fully expect to operate within our banking covenants, allowing for working capital and capital expenditure required to fund our future growth plans, alongside continuing interest payments and committed pension contributions

Some positive signs on pipeline & order book -

“we have grown the pipeline of assessment platform customers by 70% to £170m, and the Assessment contracted order book by 50%.”

Use of the term “stakeholders” is a good reminder that this company is financially distressed -

“This is an exciting period for RM, and although it will take time for the financial benefits to flow through, I am confident that our strategy for growth will deliver for all our stakeholders.”

Bank facilities - good news that the £70m facility is extended to July 2026. New covenants look non-standard, and too complicated for me to assess -

“Since the year end, the Group has secured an agreement with Lenders, which extends the existing £70.0m bank facility to July 2026. The fixed charge over the shares of each of the obligor companies (except for RM plc), and the fixed and floating charge over all assets of the obligor companies granted previously to Lenders, remains in place. Under the amended facility covenants have been reset as follows:

A quarterly LTM EBITDA (excluding discontinued operations & Consortium) covenant test from February 2024 to November 2025, which is then replaced by a quarterly EBITDA leverage test and interest cover, which are required to be below and above 4x respectively from February 2026; and

A ‘hard’ liquidity covenant test requiring the Group to have liquidity greater than £7.5m on the last business day of the month, and liquidity not be below £7.5m at the end of two consecutive weeks within a month, with a step-down period applying from 15 September 2024 to 24 October 2024 and 1 January 2025 to 21 March 2025, during which the minimum liquidity requirement is reduced from £7.5m to £5.0m.”

Dividends - can’t be paid for now, due to the bank facility blocking divis until net debt is down to 1x EBITDA for 2 consecutive quarters. Again, a reminder this is a financially distressed company.

Pension deficit - good news here, that the cash hungry pension scheme is nearly sorted out -

“The deficit recovery payments of £4.4m per annum will continue until the end of 2024, before reducing to £1.2m until the end of 2026 when recovery payments cease.”

Going concern - in note 1 is a lengthy explanation of why they think going concern should still be adopted. So it no longer contains the material uncertainty phrase that we saw last year. However, I read lots of these things, and this one seems to me quite weak. Included within note 1, it says that in a downside scenario there could be no headroom left on a key bank covenant at Dec 2024, which would require mitigating actions such as stretching creditors (which it admits has been done before) - eg negotiating longer payment terms from suppliers, and withholding staff bonuses. Those are desperate measures only taken by companies close to insolvency. So my view is that the financing situation is clearly tight, and RM does not have much financial headroom to survive an unexpected downturn in trading, were that to happen. So RM remains risky - with an elevated chance of an emergency placing being required, or even insolvency, if trading doesn’t go as planned. So investors need to monitor trading closely, and I would suggest selling on the first sign of things deteriorating. Although to be fair, it’s very rare for listed companies of this size to actually go bust.

Balance sheet - this is the deal-breaker for me, it’s terrible!

NAV is £12m. Deduct £45m intangible assets, and £15m pension surplus (as it’s not really a surplus), gives me negative NTAV of £(48)m. That big hole in the balance sheet is similar to the net debt figure of c.£53m. I think sooner or later, RM will need to repair this balance sheet with an equity raise of about £30-50m. That depends on what profit (if any) it can make once the turnaround measures have taken full effect? IF RM becomes decently profitable in future, then it could support some level of debt, but not this much.

Broker updates - nothing available.

Paul’s opinion - broker consensus data on the StockReport shows a return to profit in FY 11/2024, then tripling in FY 11/2025. IF that’s achieved, then the shares could re-rate. But remember that the net debt of £53m is not far short of the market cap at £63m, therefore I would only put this share on a low PER of say 7x FY 11/2025 forecast, which comes to 53p. The current price is 75p, so I feel this share remains over-priced, as we’re being asked to pay up-front for a turnaround that hasn’t even started to come through in the numbers (it’s still loss-making). Although mgt do explain why they think better numbers could come through in H2.

Good luck to holders, but it strikes me as a complicated, and high risk turnaround situation. The team at Harwood are the experts at this type of thing, so their research is much more detailed than my superficial reviews of the figures. They could be on to something here, who knows, but for me, the risk:reward balance isn’t right. I don’t want to take this level of risk in the hope that turnaround actions might work.

The terrible balance sheet, and excessive debt, means it has to be a continuing RED from me. IF strong numbers come through in H2, then that would be the time to consider improving it to amber/red, but I need more proof first. Support from the bank, extending its facilities, is a positive development though, although those covenants look tight in a downside scenario. It won't be cheap either, I bet the bank have taken their pound of flesh on interest rates and fees.

Remember also with Harwood, that when things get tough, they have been known to screw over small shareholders, eg with onerous convertible loans, heavy dilution, delistings, etc. So they’re not looking out for anyone’s interests other than their own. Hence I find them a double-edged sword when I see them on a major shareholder list.

Sosandar (LON:SOS)

Unch 10.25p y’day (£25m) - FY 3/2024 Results - Paul - AMBER/GREEN

Sosandar PLC (AIM: SOS), one of the fastest growing fashion brands in the UK, creating quality, trend-led products for women of all ages, is pleased to announce its financial results for the year ended 31 March 2024.

They might need to re-think that description, as it’s not really growing any more - due to a (previously announced) strategy to focus on higher margin, full priced sales, instead of chasing revenue growth through discounting.

It traded at around breakeven for FY 3/2024, with an H2 weighting to profits -

Bear in mind, it made a maiden profit of £1.6m a year earlier FY 3/2023, so the 2024 result is a big step backwards on profitability, back to c.breakeven. But it’s not a disaster, SOS is still in the game, and has robust finances.

Physical stores - the first 2 are set to open in Sept. They are likely to trade well initially, as new stores usually do. Locations are Marlow and Chelmsford. I think a bullish RNS on the initial trading results from the first stores could give a boost to this share price from 10p, so there could be a nice trade here for 10p buyers over the next 2-3 months.

Balance sheet - NTAV is £18m, which includes £8.3m of cash, and no borrowings.

This is very strong, as there are negligible fixed assets.

Current assets are £22.0m, all liabilities are only £5.7m - a very strong position.

Tangible net asset backing is 72% of the market cap.

Inventories seem too high at £10.9m, albeit that is down from £12.4m a year earlier.

Current trading - a striking rise in gross margin, as SOS stops discounting, to achieve high margin, full price sales. It’s gone up a whopping 670bps to a high 63.4%. However, that has come at the price of Q1 2025 sales down a fairly alarming 28% to £8.2m.

Yet they claim a significant improvement in Q1 profitability. That doesn’t make sense to me, so I’ve put the known numbers into a spreadsheet, then a formula to work out costs, as the balancing figure. This shows (below) that Q1 losses reducing can only have come from a large reduction in costs -

As you can see, gross profit fell 19.6%, so the improved gross margin (up from 56.7% to 63.4%) only recouped about a third of the lost gross profit from sales being down 28%.

I wonder what costs they slashed to achieve this reduced loss in Q1? There would be some useful savings in variable costs from lower revenue, eg lower post & packing, lower warehouse costs for dispatches and returns, but I reckon there must have been a lot less marketing spending too.

So it’s not clear to me from these figures that the less discounting, higher margin strategy is working. That’s a difficult strategy to implement, as I’ve had first hand experience of. You can try to sell everything at full price, but if customers refuse to buy it, then you have to discount it, to shift the product, and avoid a ruinous build up of inventories (as has eg happened at Dr Martens (LON:DOCS) ). It’s ultimately customers who decide how much discounting retailers have to do.

Paul’s opinion - do we see SOS half full or half empty? I think there are strong arguments for both a bull and bear view actually.

Bull

SOS management have created a new brand from scratch, and reached breakeven in a very challenging market.

Very strong balance sheet, with ample cash.

Potential profitable trade from first store openings, if early trading is positive (which it should be).

Low valuation, only £25m, 72% backed by NTAV.

Commercial, hard-working, passionate, and proven management.

Capital-light business model, with hardly any fixed assets, outsourced distribution.

Successfully selling through third parties, such as Next, M&S.

Data - knows exactly where its existing (online) customers live, so should be able to choose ideal physical sites.

Bear

Big profit warning on 18/10/2023, forecast profit fell from £3.1m to £0.1m, and they missed even that, at £-0.3m actual.

Maiden profits in FY 3/2023 have disappeared, only now trading c. breakeven.

Unrealistic (I think) medium term targets of £100m revenues & 10% PBT margin.

Will they squander cash pile on physical store fit-outs (est £200-400k per site)?

Horrible sector, very difficult for smaller players to make money.

Fashion risk, as we’ve seen demonstrated by SDRY, Burberry, etc.

Overall, I’ve historically liked SOS, but that doesn’t matter - we look at every share with fresh eyes every time. I was green on 14/7/2023, but the 18/10/2023 big profit warning shocked me into moving down to AMBER. Then AMBER again on 10/1/2024, and on 16/4/2024.

With the share price now about 20% lower at c.10p, and a reminder today of just how strong the balance sheet is, I’m going to push the boat out a little, and edge up to AMBER/GREEN. I think there’s a reasonable chance of a fizz of excitement when the first physical stores open. That could give a possible 30-50% bounce in share price, I reckon, within 3 months. So it could be a nice little trade. There’s also the chance the market could factor in a full store rollout, if the first few shops do well. And what immediate downside risk is there? Very little I think, considering that robust balance sheet. Longer term, I’m uncertain, the jury is still out.

Renold (LON:RNO)

Down 3% to 60p (£136m) - FY 3/2024 Results - Paul - GREEN

Renold (AIM: RNO), a leading international supplier of industrial chains and related power transmission products, is pleased to announce its audited results for the year ended 31 March 2024 ("FY24").

Record trading performance, significant earnings growth and strong cash generation, dividend resumed

This industrial chains & gearboxes group is a long-standing SCVR favourite. It’s on my top 20 share ideas for 2024, currently up 77% YTD. Actually RNO was also on my top 20 for 2023, and that’s up 190%, so it’s been a good one to stick with.

Very good profit growth, driven entirely by higher margins (increased efficiency from more capex), on almost flat revenues -

At 62p/share the PER is 7.9x - RNO shares are always cheap because of the large pension deficit. However, this ignores 12.2% dilution from options -

Share options - note that Cavendish uses a lower 6.9p adj diluted EPS figure, so it looks like there are a lot of share options. Yes, here we are note 5 says there are 27.5m nil cost share options, that’s 12.2% dilution, which looks very high. I normally prefer share options to be in low to mid single digit %, so 12.2% seems excessive. We should be valuing this share on the 6.9p diluted EPS number, taking the PER to 9.0x

EDIT: I nodded off, so missed the management webinar today. But apparently mgt said that the share options are not dilutive, because they are paid out of shares held in treasury. Although as we can see from the cashflow statement, the treasury shares have been bought in the market, using shareholder's cash. So that's cash spent on buying shares which could have otherwise been paid out in dividends. It's strange that the results contain the diluted EPS number, and that it's not made clear that there won't be new shares issued.

Dividend - a small divi of 0.5p is introduced, first one since 2005! It’s actually had dividend-paying capacity for a couple of years I think, but has previously preferred to focus on acquisitions instead. This is only a 0.8% yield, but it’s a start!

Adjustments to profit are small, and statutory profit is slightly higher than adjusted profit, unusually.

Net debt is down usefully, but it’s not stretched at only 0.6x EBITDA. Debt has been under control for a while now.

Order book & intake -

Order intake of £227.5m (FY23: £257.5m), impacted by a shortening in duration of the order book in H1, reflecting improved supply chain conditions. H2 order intake up 7.5% over H1 (8.4% at constant exchange rates)

Closing order book consistent with the half year position at £83.6m

I can accept that explanation - it seems reasonable that with supply chains improving, customers would revert to more normal ordering patterns, instead of over and early orders when supply was constrained.

Outlook -

There are various interesting snippets scattered throughout the commentary, here are some excerpts which seem most important to me -

“The business is now at an inflection point where we are starting to see the compounding impact of the many recent exciting initiatives as they come to fruition. We have a very clear strategy and are executing it diligently. Our continuous improvement initiatives are building an increasingly efficient, productive and resilient business and are providing an ever improving platform to support our commercial initiatives."...

I trust management here, as they’ve been straight in RNSs, tell it like it is, and I’ve also found them straightforward in individual calls that I’ve occasionally had over the years.

“The Group has performed admirably in the face of continued supply chain and inflationary pressures. However, the strong and improving trading and financial performance of the Group, particularly increased cash flow generation, is providing greater flexibility to exploit future organic and acquisition-related growth opportunities, while re-introducing the payment of a dividend to shareholders.”

Current operating environment

The effects of the war in Ukraine, especially in terms of higher prices for energy and materials as seen in the UK and mainland Europe were less marked in FY24, only to be replaced with new economic uncertainties brought about by geopolitical factors, such as de-globalisation and re-shoring, increasing trade tariffs and the continuing impact of general inflation, higher interest rates, and growing pressure on labour rates around the world. The volatile operating environment the Group has faced over recent years abated slightly during FY24, however we remain conservative around our timing expectations of a full return to normal, and expect further headwinds to persist to differing degrees in the new financial year.

We have been carefully developing our acquisitive growth strategy and opportunity pipeline. The scale of the highly fragmented industrial chain market is clear and this is the sole area that we are focussed on for acquisitions, providing us with many appropriately sized and relatively low risk opportunities.

Over recent years the business performance has been on an improving trend despite the many economic and geo-political difficulties. Renold continues to demonstrate the strength and resilience of its business, its market position and its business model. We expect the new financial year to be no less challenging, and we remain vigilant as to the environment within which we operate. However, we start the year from a positive position with good momentum and confidence in the capabilities and fundamentals of the Renold business and the markets we serve.

The continuing review of our capabilities throughout the Group is identifying opportunities for the upgrade and development of existing manufacturing processes across our international locations to create higher specification, higher performance products. This review will also facilitate standardisation across more product lines which, in turn, will enable us to benefit more comprehensively from our geographic footprint and economies of scale. In addition, flexibility between manufacturing locations will support increasing customer expectations for supply chain diversification, for risk mitigation and a changing tariff environment, improving even further our value proposition.

What’s missing? - I always expect to see, from every company, a clear statement on current trading and outlook vs market expectations. That seems to be missing from today’s Renold update, which is bound to unsettle some investors. Fudging this issue with more general commentary isn’t enough, and it raises questions. Less is more - are you trading in line with expectations, yes or no? That's what most investors want to hear.

The commentary seems both confident, and cautious, so it’s difficult to know how to weigh up all the above.

Broker update - thanks to Cavendish for a note this morning, hopefully they can clarify what the outlook is like. It says FY 3/2024 is “slightly ahead of upgraded expectations”, so a tick there.

FY 3/2025 forecast is “slightly increased” by £0.1m to £22.8m adj PBT, so only a very modest 3% increase in profit is expected in this new financial year vs LY. That’s fine, and as you can see below, the trend on broker consensus has been excellent so far - big increases already (helped by acquisitions) -

Balance sheet - NAV is £50.2m, up usefully from £39.1m a year earlier.

Intangible assets total £40.8m, not excessive for an acquisitive group. Remove these, and NTAV is a modest £9.4m. However this includes the hefty £57.1m accounting pension deficit. That’s fine, it’s a manageable long-term liability, so if we remove that, the rest of the balance sheet has NTAV of £67m, which is quite good. Working capital is healthy, with a current ratio of 1.68

Overall, this looks absolutely fine to me. Renold was financially stressed in the past, but it certainly is not now - this is a decent setup, and low risk in my view. We obviously have to adjust the PER downwards by a few points to allow for the still cash-hungry pension deficit, which is what the market price of the shares already does.

Cashflow - I like this simplified cashflow statement below, where I’ve highlighted some key items. This shows what an excellent cash generative business RNO is, despite the drag of the pension scheme, generous EBT purchases, capex, and an acquisition. It still generated free cashflow after all that lot - so in the long run, this has considerable dividend-paying capacity -

Retail investor presentation with Q&A is at 17:30 today - follow this link.

Paul’s opinion - I think RNO looks good still. It’s been a very slow turnaround, taking many years, but the figures show a transformed group, making a healthy 9.2% PBT margin, with a sound balance sheet, modest debt, and a credible buy & build acquisition strategy in a fragmented market, where Renold has a long-standing premium brand name.

It's a quality business, priced like a value share, so I see further potential upside in the share price, longer term.

My only reservations are that the outlook comments ducked giving us a clear indication of how FY 3/2025 is progressing vs market expectations. That introduces some doubt, together with some caution in the commentary.

That said, forecasts have already been greatly increased, so I think it makes sense to pause for breath and keep expectations grounded for now.

On fundamentals I’m happy to stick at GREEN, but think the short term price is maybe up with events for now?

Also I think we need to challenge management on the apparent overly generous 12.2% potential dilution from share options, although only a small proportion of those have actually vested so far.

Note that the employee benefit trust is now the biggest shareholder, with 12.1% - I like that a lot - certainly a great way to motivate & retain staff, let's hope it's not just management who benefit from this. I’d like to see more companies do this. Although of course shareholders have paid for these EBT shares, whilst only now receiving a small divi for the first time in 19 years! So maybe there’s an imbalance there in terms of who benefits from Renold existing? There again, look at the share price, and I don’t suppose anyone will be complaining at having a six-bagger from the lows. With time, I think it’s going higher too, with 100p looking achievable with patience, I reckon. Providing nothing goes wrong of course.

hVIVO (LON:HVO)

Up 3% to 28.7p (£196m) - Trading Update - Paul - GREEN

hVIVO plc (AIM & Euronext: HVO), a fast-growing specialist contract research organisation (CRO) and world leader in testing infectious and respiratory disease products using human challenge clinical trials, provides a trading update for the six-month period ended 30 June 2024.

Record H1 revenue and EBITDA margin

We like HVO here at the SCVR, and have been consistently GREEN on it this year & last.

It seems a reasonably priced growth company. I reviewed its impressive FY 12/2023 results & outlook here on 10/4/2024.

H1 highlights today -

My comments - very strong H1 revenue growth, although the full year guidance of £62m revenues suggests a slowdown in H2 to only £26.4m, down 26% on H1. That looks odd - does this mean they’ve set the forecasts low to be beaten, or that H1 was an unusually strong period?

Striking increase in EBITDA margin to c.24%, up from 19.1% H1 LY.

Order book actually down 9% from the same point a year ago, which again might point to an unusual burst of activity in H1?

This bit seems to confirm that H1 was unusually good. I don’t understand why moving to the new Canary Wharf site sounds like it’s reducing revenues, surely it should be doing the opposite? -

“During the period the Group was able to utilise its three quarantine facilities to deliver a number of projects ahead of schedule which provided a boost to revenues and margins. This has contributed to a H1 revenue weighting for 2024, from July 2024 the Group will solely operate from its Canary Wharf quarantine site.”

More on that increased EBITDA margin -

“The increase in margins is a positive indicator of the margin achievable in the medium term for the business with the Canary Wharf site expected to deliver improved operational efficiencies.”

Cash - HVO benefits from receiving cash up-front from customers, and it now has £37.1m, flat against £37.0m at end Dec 2023, but up nicely vs £31.3m cash at end June 2023.

Orderbook & visibility - the orderbook gives us advanced notice of trading, and I have to point out that it has fallen - let’s hope this is a blip, and not a sign of demand peaking? Great news that we can relax about FY 12/2024, with the whole year’s revenues now seemingly in the bag -

The Company's weighted contracted orderbook stood at £71 million as at 30 June 2024 (30 June 2023: £78 million), with 100% of FY 2024 revenue guidance already contracted and good visibility into 2025. The orderbook value as at 30 June 2024 reflects the exceptional operational delivery of £35.6 million revenue in H1 2024, including the acceleration of several projects contributing to a faster conversion of contracted work versus previous periods. hVIVO has a broad pipeline of live opportunities, including a number in advanced stages, making the Group well-positioned to increase its weighted orderbook going forward.

Outlook - sounds positive to me - with positive newsflow on contract wins sounding likely -

“The Group reaffirms its full year revenue guidance of £62 million and anticipates that EBITDA margins will be at the upper end of market expectations on the basis of the strong performance in the first half of 2024 and full visibility for the remainder of the year. Its organic growth strategy is also underpinning the Group's medium-term revenue target of £100 million by 2028, the majority of which is expected to be achieved through sustained organic growth complemented by small, strategic bolt on acquisitions.”

“ In addition, the current sales pipeline includes several advanced stage opportunities that we expect to convert in the coming months. “

Brokers - any changes today to forecasts? Cavendish updates us (many thanks).

Forecasts for both FY 12/2024 and FY 12/2025 have been raised by 6% and 3% respectively, due to higher EBITDA margins being plugged into the spreadsheet.

12/2024 goes up from 1.25p adj EPS, to 1.32p (PER 21.7x)

12/2025 goes up from 1.48p to 1.53p (PER 18.8x)

Those PERs look reasonable to me, for a nicely growing, good margin, niche business.

Cash is forecast to keep building, to £46m by end 2024, and £57m end 2025.

Balance sheet - is pretty good. At Dec 2023 NTAV was c.£29m, which only supports just under 15% of the market cap. So this share is all about earnings & cashflow, not assets. Remember a lot of the cash pile is timing-related - receiving cash from customers before providing the service, so I’d be careful about using enterprise value figures here.

Dividends are tiny - surely it can now start paying proper divis now the business is more established? Forecast divis for 2024 & 2025 are less than 1% yield, I’d want to see it doing a lot better than this.

Paul’s opinion - unchanged, I see HVO positively, so am happy to give it another GREEN.

It seems a reasonably priced, GARP share (growth at reasonable price).

My only reservation is that big profit margins always attracts competition, sooner or later, if there isn’t a strong enough moat of IP. I’m not convinced the moat here is strong enough to prevent that happening eventually. After all, HVO built this business quite quickly in recent years, so why couldn’t someone else do the same, if they have the expertise and some startup funding? Hence why I think it’s not a share to chase up to expensive levels. Thankfully it’s not expensive, with a 2025 fwd PER of 18.8x, and comfort of plenty of cash sitting in the bank.

So I remain positive, and let’s hope the forecasts are beaten again, which HVO has a history of doing. Yup, it’s GREEN for me!

Graham’s Section:

Cohort (LON:CHRT)

Up 4% to 861p (£355m) - Final Results - Graham - AMBER/GREEN

A powerful headline from this defence stock, for the full-year results to April 2024.

Record revenue, adjusted operating profit and order book of over half a billion pounds. Further progress expected.

The share price has caught up with the story:

And the optimism is backed up by a very strong set of headline numbers published today. Some key bullet points:

Revenue +11% (£202.5m)

Adj. operating profit +11% (£21.1m)

Adj. EPS +18% (42.89p)

Dividends are increasing by 10%, after the company finished the year with net funds of £23.1m.

As noted in the headline and previously disclosed in trading updates, Cohort’s order book is £519m as of the year-end (last year: £329m). The company took in nearly £400m of new orders with long-term delivery dates extending all the way to 2037.

Orders for short-term delivery were strong too, covering “over 90% of current market revenue expectations for 2024/2025”. Since year-end, that has increased to over 95%.

Chairman comment excerpts:

…We have good prospects to secure further long-term orders for our naval systems and support work…

We continue to expect another year of good growth in trading performance in 2024/25. Given planned capital expenditure and expansion in working capital to support our record order book, net funds are likely to decrease.

We are optimistic that the Group will make significant further progress in 2025/26 and beyond, based on current orders for long-term delivery, our continued investment in the businesses and our pipeline of opportunities."

Later, the Chairman emphasises the Ukraine conflict and “persistent tensions in the Asia-Pacific region” as helping to drive global defence spending and in turn driving up Cohort’s order intake.

Earnings adjustments: it’s pleasing to see that there is almost no difference between actual operating profit (£21.1m) and adj. operating profit (£21.1m). A big reason for this is that Cohort benefits from R&D credits (£2.9m), and these offset the cost of amortisation in the list of adjusting items.

Graham’s view

First off, I should say that I have limited knowledge of the defence sector. But there are some traditional pros and cons when it comes to defence stocks such as Cohort:

Pros:

Companies can benefit from long-term contracts, e.g. Cohort’s naval orders.

Customers (governments) are extremely unlikely to default or pay late..

There is always going to be a baseline level of defence spending from Western governments..

Cons:

Contracts are lumpy, i.e. large and unpredictable. For example, the new £135m contract from the Royal Navy which Cohort acknowledges has “distorted some of the value comparatives”.

War and politics are unpredictable, and demand will fluctuate accordingly.

My general assumption is that defence stocks should trade at average or slightly below average P/E multiples.

Stockopedia has noticed this too, and thinks that Cohort’s valuation is quite rich:

The ValueRank is only 29:

Against that, you have a company experiencing wonderful momentum, both in its share price and in new orders. A separate RNS today reveals £21m of orders from “a UK government customer”, for delivery within a year.

When Paul covered this stock in May, he acknowledged that the valuation had reached a fair level, but kept his positive stance due the company’s excellent momentum. The share price then was 807p.

At 861p, I think it’s reasonable to make a slight adjustment. I’m going AMBER/GREEN, as I think the easy money has already been made here.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.