Good morning from Paul & Graham!

Today's report is now finished.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Agenda

Warpaint London (LON:W7L) - I've been impressed with performance last year, reporting on it here positively several times. So I approached the company about interviewing their CEO. This is booked in for 2pm today, so the audio will hopefully be up on my website late afternoon, I'll add a link here once it's published. EDIT: Now published, my audio interview with Warpaint's CEO.

Here's today's to do list. We're going to try something new, and gradually change these to one sentence summaries, once we've done each section below:

There are lots at the bottom that we didn't get round to looking at, sorry about that. I might check out a few later, for tomorrow're report.

Paul’s Section:

Firstly I did 3 backlog items last night -

ITM Power (LON:ITM)

89p - mkt cap £563m

I have to mention this update, published earlier this week, as there are some staggering numbers in it! It’s a profit warning for FY 4/2023, from the new CEO.

… it has become clear that the outcome for the financial year ending 30 April 2023 will be materially different from the current guidance, with lower revenue and a higher EBITDA loss.

Various problems have arisen, which is says are “surmountable”.

Net cash is staggering (for a blue sky, AIM company) £318m, but that’s as of 30 Oct 2022. It’s burning cash prodigiously, so a more recent number should surely be provided too? Otherwise it looks like they're trying to mislead us.

Guidance provided in Sept 2022 for FY 4/2023 was -

- Revenue of £23-28m

- Adj EBITDA loss of £(45)m to £(50)m

- Capex £30-40m

- Cash burn of £110-135m for the year!

So presumably with a profit warning this week, these figures are likely to be even worse?

My opinion - none, as I’ve not researched it. This looks an incredibly ambitious project, for a UK AIM-listed company. The one saving grace is the massive cash pile, which should last 2-3 years if the current pace of cash burn continues.

It seems to do energy storage, which is a key theme globally, to allow renewable energy to be stored, and not reliant on intermittent generation from solar or wind. Whoever cracks that market is likely to make squillions, if they can defend their IP. That’s probably the attraction with this share.

If you’re going to do something blue sky, I like the concept of going big! Although ITM is probably small fry compared with other (especially USA-based) organisations that are bound to be tackling this same area. In my experience, very few blue-sky projects that list on AIM reach commercial success at all, and the ones that do - it usually happens years late, and after lots of ruinously dilutive placings. The early investors hardly ever make any money. Let's hope ITM is different, as the UK badly needs some ambitious, big technology breakthroughs, particularly in energy.

Spectral MD Holdings (LON:SMD)

31.5p - mkt cap £43m

A new share for the SCVR. It floated in June 2021 (uh-oh!)

A positive update this Monday said -

Unaudited cash, revenue and loss for the year expected to be ahead of expectations

I started doing some digging, and it’s very unusual, in that all the revenue of c.$25m pa seems to come from grants in the USA, from BARDA.

So it looks as if this share is a binary outcome research organisation. It’s developing a machine to investigate diabetic foot ulcers.

There’s about $11m cash in the business, and of course the whole thing seems to completely rely on the grant funding continuing, which looks high risk.

Two individuals seem to own 59% of the company.

My opinion - neutral obviously, but it might be something interesting to look into. I don’t recall ever seeing something quite like this before. Which begs the question why was it floated, so the Admission Document would be the first port of call for further research.

It’s not the type of thing where I can add any value, or opinion. I just wanted to take a quick initial view, so we’ve got some facts & figures in our archive, for future reference.

EDIT: There's another update today, which seems to be saying that its diabetic foot ulcer device works well. It's too technical for me to understand, but the comments seem to make it sound positive. The trouble with this type of share, is that your average investor (you and me) can't really judge whether it's going to be a commercial success or not, it's pure guesswork. As a punt though, I do think this share looks potentially interesting. That the whole thing is being funded by grants (not tapping shareholders) does appeal to me. But I would only ever treat this type of share as a gamble, with money I can afford to lose.

Boku (LON:BOKU)

156p (up 6% y’day) - mkt cap £465m

Trading Update - FY 12/2022

It talks about “strong underlying growth”, but actual revenues are only up marginally at $63.3m, although it says this is due to adverse forex, with constant currency revenues up 14% on 2021. So I’m assuming it must generate revenues mainly outside the US, in weaker currencies, but reports in US dollars.

I last looked at this mobile payments IT company about 3 years ago, and filed it in the too difficult tray. Its shares have doubled since then - impressive considering there’s been a tech market crash in the last year.

Adj EBITDA is at least $20m ("in line with market expectations"), which I wrongly assumed we could take with a pinch of salt. But a note from Edison shows that adj EBITDA does largely turn into real profits (adj PBT anyway!) of $17.8m.

Share based payments stand out as repeatedly excessive over the years, whilst divis have been nil. So it’s abundantly clear for whose benefit this company is run! (the Directors). Take a look at the Director dealings page, where you can see that Directors are using this as a personal cash machine.

Balance sheet - the last one looks OK, with a healthy cash pile. This has since gone up to $116m, but only $50m of this is Boku’s own cash, the rest being customer cash in transit. Still, it seems to have ample liquidity.

My opinion - overall, this company has come on greatly in the 3 years since I last looked at it, when it was speculative. Now it’s grown into a proper, profitable business, with solid finances. Growth looks to have slowed down a lot, although maybe that could accelerate this year due to forex movements (at least partially) reversing? Also, it’s close to 100% gross margin, so there’s operational gearing from additional revenues, which could get exciting if serious growth is achieved.

Valuation looks aggressive, on a fwd PER of 44.3, and note that broker forecasts have been coming down - not a good combination (high valuation & reducing forecasts).

So it’s not for me, at this stage, but it could be worth a look if you do tech/growth shares.

On to today's news, and starting with a positive update -

Midwich (LON:MIDW)

492p (pre market) - mkt cap £437m

Midwich Group plc (AIM: MIDW), a global specialist audio visual distributor to the trade market, is today providing a trading update for the year ended 31 December 2022.

There’s an attractive headline -

Record revenue of £1.2 billion, with profit before tax ahead of expectations and the Group well placed for the year ahead

Revenue growth is impressive, up 40% (half is organic) to £1.2bn

Gross margin “broadly in line” (so slightly below, why can’t they just say so?) with 2021. (note that gross margins are low, as it's only a distributor)

Adj PBT “comfortably ahead of market expectations” , with a lovely footnote to assist us -

*Market consensus based on an average of £40.8m and a range of £40.1m to £41.2m, as at 17 January 2023

I haven’t seen any revised broker notes yet, and looking on Research Tree, there don’t seem to be any proper ones at all, because MIDW uses two brokers who ignore private investors altogether - Investec, and Berenberg. How does the company expect to attract private investors, if they don’t let us see any research? Bit of a schoolboy error for a small cap - which need the liquidity that comes from an active private shareholder base.

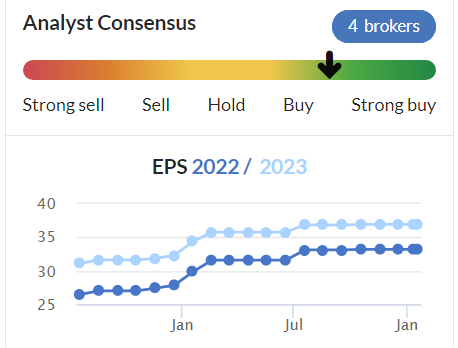

Valuation - the StockReport shows broker consensus of 33.2p for FY 12/2022, which is well above pre-pandemic levels. If they’re “comfortably ahead”, then this might mean say 36p actual, at a guess? The 492p share price gives us a PER of 13.7 - which looks reasonable. A nice trend here with forecasts -

Although bear in mind that the group carries a fair bit of debt, on a weakish balance sheet (only modest NTAV), and of course debt is becoming more expensive these days.

My opinion - this has historically been awarded a high earnings multiple, so maybe this is an opportunity to buy it on a reasonable PER of 13.7? It sounds confident about its markets for 2023 too, although recessionary risk needs to be taken into account. Overall, with rising forecasts, a beat today, sunny outlook, and reasonable valuation, I’ve got to give Midwich a thumbs up.

Eagle Eye Solutions (LON:EYE)

540p (up 3% at 10:15) - mkt cap £155m

We didn’t cover the last full year accounts here, for FY 6/2022 published on 21 Sept 2022, probably because there were no surprises in the numbers (as you know, we prioritise the most price-sensitive updates, good and bad). Looking at those numbers now, the key points for me are -

Very impressive revenue growth, up 39%, and 76% is recurring.

Adj EBITDA up 54% to £6.5m

BUT, as I always point out with EYE, it hardly makes any real profit, because the EBITDA numbers are inflated through capitalising a ton of its internal costs onto the balance sheet (almost £5m, per the cashflow statement).

This table from the FY 6/2022 results (LH column) and 6/2021 (RH column) demonstrates the point that after rewarding Directors, and paying for development spend, it’s barely making any genuine profit at this stage (the hope is that in future, rapid growth would create operationally geared high profits) -

.

On to today’s news -

Eagle Eye (LSE: "EYE"), a leading SaaS technology company that creates digital connections enabling personalised, real-time marketing, is pleased to provide an update on the Group's trading for the six months ended 31 December 2022 (the "Period").

The headline says -

Continued strong trading and confident outlook reflecting the growing global demand for personalised loyalty and promotional programmes

Key points -

H1 revenue growth looks good at +32% to £20.0m

Recurring element is higher, at 78%

Adj EBITDA (just for a half year remember) is up 50% to £4.7m

Net cash of £5.7m (up from £3.6m 6 months earlier) - after paying for recent acquisition.

Managed inflation pressures within budget - good.

Pipeline strong

Outlook - FY 6/2023 trading in line with expectations.

Acquisition of Untie Nots has recently completed, going as planned.

Broker update from Shore (many thanks, very helpful) - seems to have set the FY 6/2023 forecasts very low, with £7.6m adj EBITDA, despite it having already achieved 62% of this at £4.7m in H1. So it looks set up nicely to produce a series of ahead of expectations updates over the next 6 months - great, I like it that way around!

Shore seems to be adjusting out the excessive share options cost, which I’m sceptical about, so its £2.5m actual for FY 6/2022 needs to be seen in the context that the real profit (including share option costs) was only about £700k!

Shore’s FY 6/2023 forecast is adj PBT of £3.4m, but I reckon there’s good upside on that figure, so £4m+ looks more likely, less what management decide to help themselves to in share options.

My opinion - I’ve followed this company since it listed, with the concept always looking interesting, but the valuation seeming too stretched to interest me.

However, the fundamentals are improving considerably now, and it’s clearly got a great product, proven by winning & retaining contracts with major retailers, globally.

I’m adding EYE to my potential buys watchlist, as the sort of share that I’d be happy to buy on any general market panic sell-off. It seems to me a share to tuck away and forget for a few years, and try to avoid being shaken out by market volatility.

Overall then, not a value share, but I can see the potential, and am happy to give it a thumbs up.

As you can see from the long-term chart below, EYE promised jam tomorrow for years, but we're actually now able to taste the jam, and put a dollop of cream on top too (or the other way around, depending on how you like your scones!)

Graham’s Section:

H & T (LON:HAT)

Share price: 493p (pre-market)

Market cap: £216m

Following on from the update we got from Ramsdens Holdings (LON:RFX) yesterday, today brings an update from larger pawnbroking rival H&T. It’s in line with expectations.

H&T has a much larger pawnbroking operation than Ramsdens, but it doesn’t have the level of diversification into other services that Ramsdens does, particularly foreign exchange.

And H&T stores are spread out nationally, while Ramsdens is only just moving into the South-East (I wonder if there will be much head-on competition between them?).

Anyway, let’s catch up with this trading update for H&T’s performance in FY December 2022:

Trading performance remained strong through the fourth quarter of the year, continuing the momentum seen across the business throughout the year. Demand for pawnbroking loans, in particular, was buoyant. This performance resulted in the pawnbroking pledge book growing to c.£99m as at the end of December 2022 (December 2021: £66.9m). Demand for pledge lending in early January 2023 has remained strong.

Note that H&T’s pledge book is huge compared to Ramsdens - about 10x the size!

And we can see that in these difficult circumstances for many households, the need for pawnbroking loans is higher than ever. But at the same time, H&T’s retail sales are holding up:

December was a record sales month after a slightly quieter than anticipated November, with watch sales being a particular December highlight. Full year retail sales rose over 30% to c.£48m (2021: £36.2m)

The store network has grown by ten in 2022, and there are another nine in the pipeline for 2023. Over-ambitious growth would scare me, but those numbers doesn’t strike me as overly aggressive.

My view

I’ll wrap this up here, as at the end of the day it’s an in-line update. The estimates are unchanged for adjusted EPS of 36p in 2022, rising to 58p in 2023. The pledge book is much larger now, and I do expect a fantastic result in 2023.

Like any lender, H&T is subject to some economic forces beyond its control. If inflation subsides, for example, then perhaps the current extraordinary levels of demand for short-term credit might soften.

Similarly, the level of competition it faces in the short-term credit space is not something that H&T can control - but I personally think the prospects there remain excellent, as the regulatory environment is unfriendly to new entrants.

Overall, I remain a huge fan of this business. My only criticism is that its return on equity could be higher - but hopefully 2023 will see a return to it earning high ROE.

Team17 (LON:TM17)

Share price: 440p (+7%)

Market cap: £640m

We covered two profit warnings from video games companies recently. These warnings resulted in pressure on the Team17 share price, who responded that same day with their own reassuring RNS (see here).

That RNS promised only that FY 2022 was “at least in line with market expectations”.

Today we get the full reveal: it turns out that revenues and profits for FY 2022 are significantly ahead of market expectations!

As I keep saying, video games companies should try not to use the economic big picture as an excuse for poor performance. Good video games will be purchased regardless of the economic environment, because they provide hundreds of hours of entertainment (and are therefore much cheaper than most other forms of paid-for entertainment).

Perhaps one of the few exceptions to this rule relates to the Covid era, when lockdowns artificially boosted demand for home entertainment, and the ending of lockdowns took away that temporary demand.

But Team17 has not needed any excuses: it has continued firing on all cylinders each year. Here’s the explanation of its strong performance in H2 2022:

We are pleased to report that the Group traded strongly in H2 2022, with multiple new first and third-party games released, extended games distribution to wider platforms and strong support across the portfolios with additional new content updates. Careful lifecycle management of the diverse portfolio of growing games and apps across the Group combined to complete a strong FY 2022 performance for the Group.

Debbie Bestwick MBE (CEO) says:

"We look forward to 2023 with an exciting pipeline of releases and updates as well as ongoing ROI from the investments we have made in people and products."

Estimates

According to Stockopedia, the existing forecasts for 2022 were for revenues of £127m, and net income of £33m.

The forecasts for 2023 were for revenues of £138m, and net income of £36.8m. Based on the current market cap, that puts the shares on a 2023 P/E multiple of 17x.

My view

While I have to admire Team17’s financial performance and growth, I must admit that I do find it a little surprising. It's difficult to find any mainstream blockbusters in its catalogue of games. The long-standing Worms franchise is still, after all these years, the only title that really stands out to me.

But it’s hard to argue with the company’s numbers and the leadership is also very impressive when you read about how the CEO was involved in creating the company (and she is still a 21% shareholder, so there’s very good alignment with other shareholders).

Overall, I’m a fan of this company, but I’m inclined to think that it could be fully priced at this market cap.

Alpha International (LON:ALPH)

Share price: 1820p (unch.)

Market cap: £767m

This company’s market cap has reached tremendous heights in just a few years. I last covered it in March 2020, on the day when a disastrous RNS saw its value fall to just £142 million!

But here we are, after a slight change of name from Alpha FX to Alpha Group, and with much better results.

Today brings a trading update for FY 2022:

…trading has remained strong: we expect revenue for the full year to increase 27% to approximately £98m (2021: £77.5m), operating profit to be in-line with expectations and profit before tax (including interest) to be ahead…

Moving into 2023, we find ourselves in the fortunate position of expecting exceptional growth in absolute earnings and cash generation, driven by a combination of expected strong revenue growth and interest income.

The point about current-year performance is that it is in line with expectations, except when it comes to “other operating income” - this is interest earned, mostly on client money, and it’s coming in at £9m instead of the £6m forecast.

In a period of higher interest rates, we’ve got to remember to look out for companies that are able to earn a yield on cash balances! And so do the analysts.

So Alpha’s PBT for 2022 is ahead of expectations, purely because of this higher interest income.

2023 estimates - the revenue forecast increases 5% to £120m, and the interest income forecast increases from £18m to £24m. The PBT forecast is now £71m (previously £65m).

Let’s go back to today’s update, and see what the company plans to do with the windfall of unexpectedly high profits it is generating:

…it would be a missed opportunity to not bring forward investment in our operations (in particular in our Alternative Banking Solutions division), originally planned for 2024/25 and beyond. This investment is already underway and is focused on accelerating future revenue growth and strengthening the long-term scalability and sustainability of our business.

Additionally, if operating profit exceeds expectations in 2023, the company will spend those gains on “discretionary initiatives (e.g. marketing campaigns)”, in order to push growth even faster.

My view

After reviewing my notes from 2020, I’m keen to see some evidence that the mishaps which occurred back then will not repeat. Alpha does reassure that its FX Risk Management division has seen “a reduction in overall client concentration”. So there is some reassurance on that front.

This FX division is expanding to Madrid - it’s nice to see international growth, and they already have Spanish-speaking clients which reduces the risk of this expansion failing.

The “Alternative Banking Solutions” division, on the other hand, is still young, and has a long way to develop. But it’s an interesting project and I can see why an FX specialist might have the expertise to build this type of business (opening bank accounts and processing international payments for corporations and institutions).

In summary: I think this is an impressive company. Again, it’s led by a founder-CEO who is also the largest shareholder with 16% stake. So there’s a lot to like. Is it possibly too expensive at this level? That’s for you to decide; I’m neutral at this valuation.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.