Good morning, it's Paul & Jack here, in what is turning out to be a very busy week! Today's report is now finished

Agenda -

Paul's Section:

Accrol Group (LON:ACRL) - I review interim results. Poor balance sheet presentation makes it look highly geared, but it isn't once you strip out lease liabilities, confusingly shown as "borrowings". As mentioned last week, when it warned on profits, EBITDA does not translate into much profit, and the business model seems fundamentally flawed to me.

Hostmore (LON:MORE) (I hold) - I interviewed the CEO & CFO here - audio, 25 minutes - hopefully this is a good introduction to the company, and I challenge them on product quality & customer reviews. (no section below)

Best Of The Best (LON:BOTB) - H1 figures look solid, in line with expectations. But the H2 outlook is poor, with the big problem being increased marketing costs again. That results in fewer new players, and reduced profits. I'm braced for another share price fall today, which looks inevitable.

Pci- Pal (LON:PCIP) - a positive trading update. Very impressive growth in high margin, recurring, sticky revenues. Patent infringement legal case against the company is the fly in the ointment though.

Christie (LON:CTG) - a strong trading update, but difficult to quantify with no specific figures, and no broker research available. Looks to be family controlled. I have a stab at valuation, which looks reasonable, and it looks like market conditions for its niche might remain positive in 2022. Difficult to see much upside though.

In Style (LON:ITS) - an in line Xmas trading update, in terms of revenues. However, supply chain problems result in profit falling below expectations, so broker estimates are reduced today. It's a small player in a very crowded space, but so far is holding its own. Not something I would want to own though.

Eve Sleep (LON:EVE) - still loss-making. Still has cash, but it's almost halved in the last year. I suspect the chances of commercial success look slim now, and am stopping coverage now, unless something positive happens.

Jack's Section:

Midwich (LON:MIDW) - another profit upgrade from this audiovisual reseller, which has rebounded encouragingly from Covid disruption and is now reporting record levels of revenue and profits. I remain neutral as I think it’s a tough business model over the long term with low margins against a backdrop of generally rising costs, but the past few updates have certainly been positive.

Science In Sport (LON:SIS) - strong momentum online and underlying EBITDA growth to £2.2m. Net cash down from £10.5m to £4.9m, so still in the cash burn phase and investing for growth / scale, although it does look like breakeven is approaching. A good update on the whole, but it needs to be as the valuation remains quite rich.

Appreciate (LON:APP) - Signs of stabilisation, with the possibility of earnings upgrades once Q4 figures are received. The valuation is modest as the share price has collapsed, so it’s worth scoping out the chances of a rerating, but that same share price fall suggests a degree of skepticism.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section

Accrol Group (LON:ACRL)

23.6p (down 2%, at 13:08) - mkt cap £75m

I reported on ACRL’s profit warning here last week. The main problem is the 3-month time lag in passing on greatly increased input costs to customers. The company tries to persuade us that this is just a timing issue, but I see a deeper problem with its business model - volatile input prices, combined with low gross margins, and ruthlessly cost-conscious customers, makes it extremely difficult to predict profitability. To make things worse, the company is also capital-heavy, needing expensive equipment to turn large rolls of tissue into smaller rolls of tissue. Why would anyone find that an attractive business model to invest in?

The solution could be open book pricing with customers, i.e. charging customers on a cost plus basis, but customers may not be prepared to agree that. Supermarkets only make a wafer thin margin themselves, so are not known for their generosity in agreeing decent margins for their suppliers.

Also, ignore EBITDA here, because it translates into very little real profit. As I pointed out last week, the anticipated £9.0m EBITDA this year (FY 4/2022) would become only £2.2m profit before tax(PBT), due to heavy depreciation and finance charges which are ignored by EBITDA.

Interim numbers today repeat a lot of the situation, but what I want to focus today on the balance sheet.

On the face of it, the situation with “borrowings” looks alarming, and working capital looks weak (current liabilities a lot more than current assets) -

.

Note that intangibles can be written off, which takes NTAV down: £82,726 NAV, less £60,408k intangible assets = £22,318k NTAV - which looks adequate.

The items which alarm me are called “borrowings”, which looks like excessive debt. However, note 9 shows that this is mostly IFRS 16 lease liabilities, which can be safely ignored - because they are future years’ operating costs, which shouldn’t be on the balance sheet at all, in my view.

Therefore the debt position is actually fine. Poor presentation of the balance sheet rings a false alarm, and the company really should change how it displays lease liabilities, as 2 separate items on the balance sheet, not rolled in with bank debt, since the two things are completely different.

.

.

Strategic review - as mentioned last week, but the company sounds vague about what the purpose is. I wonder if the bank wants the company to de-gear? In which case I worry that an equity fundraising might be on the cards? At the current low share price, that could bring dilution, especially if a deep discount has to be offered, to entice shareholders to support an equity fundraise. I can’t imagine shareholders would be thrilled about propping up the company again.

Although there does not seem to be any problem with the bank covenants, so it could be OK -

The Group continues to operate well within its existing banking covenants and has more than sufficient liquidity to meet its existing and future needs.

The share count has more than tripled since ACRL floated in 2016, from 93m to 319m -

.

.

Do remember that these are annual averages, on the StockReport. So we also need to check the current share count, which is further down, near the bottom of the StockReport.

.

.

Maybe I’m barking up the wrong tree, thinking an equity raise might be needed? But what does the company expect, if it puts out vague talk about a strategic review?

My opinion - this share seems tainted, because the much vaunted turnaround hasn’t really worked, due to cost inflation. The business model seems fundamentally flawed to me.

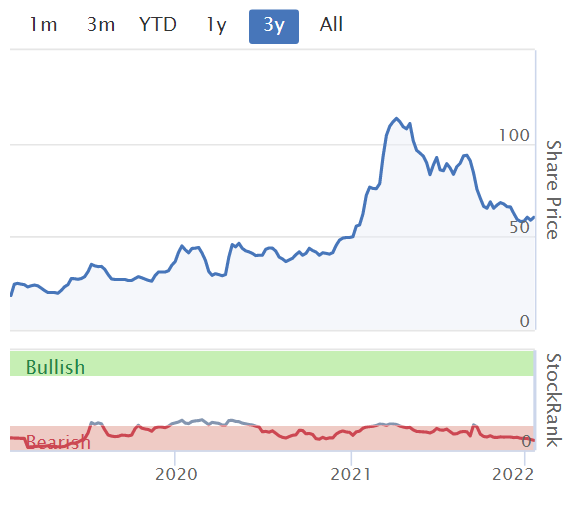

That said, once it has passed on price rises, then profitability should rise. If input costs eventually fall, then profits could soar, which is what happened in the period before the company listed in 2016 - funny that - before crashing into 4 years of losses -

.

.

I’m satisfied that there’s no issue over solvency, as the bank debt is quite modest, so shouldn’t be a problem, but we can’t be certain of that.

For me, the upside is too uncertain, so it’s not something that interests me. The £75m market cap seems too high, given the very poor track record since it floated in 2016, with numerous problems, and hardly any divis paid over that time. The long-term chart since it floated in 2016 says it all (below).

Maybe there is recovery potential here, but it’s too uncertain for me to want to own any ACRL shares. There are better, simpler opportunities elsewhere I fell.

.

.

Best Of The Best (LON:BOTB) (I hold)

608p (pre market open) - £57m mkt cap

Interim Results (and H2 profit warning)

Best of the Best plc runs competitions online to win cars and other prizes.

Company’s summary -

Operational gearing, higher customer acquisition costs and increased prizes have reduced margins on broadly stable revenues

The highlights look good, in the context of a share price that collapsed after profit warnings last year -

.

.

What’s interesting, is that the big jump in revenues from the pandemic has largely held up. So the problem is not that business has returned to pre-pandemic revenues. The problems stem from higher costs (especially digital marketing), which seems might have been caused by increased competition, possibly bidding up the cost of relevant online ad words?

I’ve highlighted the underlying trend below, which still looks like a growth company to me, albeit with a one-off bumper year due to the pandemic.

.

Outlook - this is not good. Continued increases in the cost of marketing, means guidance for H2 is negative - given that H1 produced £3.0m PBT, this suggests H2 will only be £1.25-1.75m PBT -

.

Revised forecasts - many thanks to Finncap for updated forecasts this morning -

FY 4/2022 is cut 25% to 39.9p EPS (PER of 15.2)

FY 4/2023 is cut 32% to 43.9p EPS (PER of 13.8)

These forecasts are only slightly above pre-pandemic profitability, but revenues are nearly double pre-pandemic levels. So the problem is very clearly costs - marketing costs.

My opinion - I had hoped that the business was stabilising, and the H1 numbers are quite good in the circumstances. However, the outlook & guidance show a marked reduction in profitability in H2, and the full year, which is obviously negative.

Overall, I’ve assumed the brace position for the market open, and am assuming we probably see a fall to c.500p today.

I’m in for the duration, but won’t be buying any more at this stage. I need to see evidence of a more cost effective marketing strategy. As the commentary says, BOTB clearly needs to find a more cost efficient way of finding new customers, to replace the inevitable churn of existing customers.

We know there is massive operational gearing here, and long-serving management has a track record of fixing problems in the past, so I'm happy to continue holding long-term. It's not a big position size though.

.

.

Pci- Pal (LON:PCIP)

66.5p (up 15% at 09:10) - mkt cap £44m

There seems a general pattern going on at the moment in small caps - most shares have been drifting down, often a lot, since peaking in H2 last year. Then when they report around now, we’re seeing some very large rebounds (e.g. SDG [I hold] yesterday), or they plummet on a profit warning (e.g. GATC yesterday).

There doesn’t seem to be any logic to the price moves downwards - it’s not necessarily a sign of poor fundamentals. That’s making it particularly difficult to pick stocks right now.

If you’ve got a small portfolio, then you have a massive advantage - get up early, latch onto the positive trading updates, and buy them on the opening bell. That’s working very well at the moment, because due to macro uncertainty, there are lots of people sitting on the sidelines in cash, waiting to buy companies with positive updates, so we’re seeing particularly powerful moves upwards on good news.

I’m looking nervously at my portfolio, and trying to imagine which ones are poised to shoot up on good news, and which ones are likely to issue profit warnings.

So far this year, it’s been mostly good, although BOTB didn’t help this morning.

PCIP has shot up 15% today, so the news must be positive.

PCI-PAL PLC (AIM: PCIP), the global cloud provider of secure payment solutions for business communications, announces a trading update for the six months to 31 December 2021.

Company’s summary -

Stronger than anticipated trading with significant revenue growth

Better than expectations, but still loss-making -

The Board is pleased to report an excellent first half of the year. All of the Group's key metrics are either at or ahead of management expectations, and as a result, the Group anticipates that revenue and losses before tax will now be better than the current market expectations for the full year.

Revenue - really impressive growth, up 72% to £5.4m for H1

Annualised run rate of recurring revenues (which they call TACV) is up 37% to £11.4m

New business is mainly coming from reseller partners

Very low customer churn of 3.4% - indicating very sticky recurring revenues, which are the best type of revenues

Cash of £5.5m (not stated whether this is gross or net)

Employee retention “very high” - not many companies report on this very important issue.

Patent claim against the company - this spooked me into selling out, and I won’t be likely to buy back in, unless/until there is clarity on this issue -

Proceedings in relation to the alleged patent infringement being made against the Company are ongoing and the Company is continuing to work towards an outcome that it believes will best benefit the business.

What does that mean? Sounds like a compromise might be being considered? That might involve having to settle in some way, maybe paying royalties to the patent owner, at a guess? Or fight it out in court, at potentially heavy cost?

Outlook - sounds encouraging -

"With the strength of trading shown to date, and a growing pipeline and partner eco-system, we now anticipate that the Group will exceed its current market revenue expectations, resulting in a reduced loss before tax for the financial year. The Board remains confident in the longer-term outlook for the Group and continues to invest in its ambitious growth strategy."

My opinion - this update sounds encouraging. You don’t find organic growth this strong very often, for a high gross margin, recurring revenues company. It’s a great pity the company ran into a legal claim for patent infringement, as that probably introduces too much uncertainty for me to invest.

Therefore anyone holding this share, is necessarily taking a risk on the outcome of the patent case. It might turn out OK, or it might not. Alternatively, that issue has probably reduced the market cap by about maybe £10-20m, which could be enough to cover the risk?

I think the share price would probably be a good bit higher, if the patent case is settled on reasonable terms.

PCIP looks a very decent, niche business, growing very strongly, albeit still loss-making - but with a very clear trajectory towards profit, due to rapid growth, and operational gearing.

US markets (with UK markets following) have seemingly taken a decisive turn against speculative growth companies, and are more favourable to value/GARP shares again. Hence I’m keeping that in mind, which makes me reluctant to buy into loss-making companies right now, not that I do very often anyway. There has to be a clear trajectory towards profitability, which there is with PCIP. So is it actually a speculative tech share? Probably not, so it might be worth considering. The market cap of only £44m is hardly extortionate.

As you can probably tell, I’m on the fence with PCIP - tempted to buy back in, but worried about the patent legal action. Tricky one. What do subscribers think?

I'm pondering whether to buy a small position for my SIPP, and forget about it for a few years.

.

.

Christie (LON:CTG)

114p (up 12% at 10:04) - mkt cap £30m

The Board of Directors of Christie Group plc (CTG.L), the leading provider of Professional & Financial Services and Stock & Inventory Systems & Services to the hospitality, leisure, healthcare, medical, childcare & education and retail sectors, is pleased to announce the following trading update:

This is short, and sweet! -

"Following an extremely strong year end performance in Christie & Co, our Business Broking, Valuation & Advisory practice, the Group's operating profit for the year ended 31st December 2021 is anticipated to be very significantly in excess of current market expectations.

We intend to publish the Group's preliminary trading results for 2021 in April."

That’s clearly positive, but not well presented, as it fails to give us either a footnote to explain what market expectations are, nor any numeric guidance on likely profits. Just “very significantly in excess”, which is pretty vague, and could cover a wide range of possible outcomes. Does it mean profit ahead by 20%? 30%? 80%? Who knows? Well the company does, but they’re not telling us.

I don’t see any broker notes available on Research Tree, other than Shore Capital from July 2021, that’s too old now to be relevant.

The only figure I’ve got to work on, is 6.62p EPS broker consensus for FY 12/2021, shown on the StockReport. Christie seems to have made about 10p EPS historically in most years, so perhaps it’s on course to return to that level?

If so, then the PER would be about 11 now, which seems reasonable, for what I see as an unremarkable, ex-growth, cyclical business.

Divis are coming back, so there should be a reasonable income from this share.

My opinion - all rather dull, this share has zig-zagged in a sideways trend for the last 7 years. It’s clearly trading well, because there’s a lot of deal activity going on in retail/hospitality property, and likely to increase further in 2022 when the rent moratorium ends - a lot of properties will be changing tenants when zombie operators are kicked out.

So Christie looks to have a decent outlook I imagine.

Is that enough to tempt me into the shares? In a word, no.

Note the shareholder register, with the Gwyn family looking to be in control. That's fine, and makes it a steady, safe investment. But where's the growth, and valuation excitement going to come from?

.

.

In Style (LON:ITS)

91p (down 3%, at 10:09) - mkt cap £48m

Trading Update (and Board Update)

In The Style, the fast-growing digital womenswear fashion brand with an innovative influencer collaboration model, is pleased to provide an update on Christmas trading for the eight weeks to 31 December 2021 (the "Period") as well as an update on its Board of Directors.

The year end is 31 March 2022.

8 week Xmas net sales £11.2m, up 21.5% on exceptionally good prior year comps (up 226% on 2-year view) - in line with expectations

Returns rate lower than in H1 (Apr-Sept 2021), trying to manage this down further

Gross order value is higher, but I reject this metric, because customers often over-order (e.g. 2 items in different sizes) then return the one that fits worst.

Partywear strong,as indicated by Next & Sosandar (I hold)

ITS thinks it is differentiated by using social media influencers. It’s not, everyone does it.

Wholesale doing well, in line, but most sales are still direct to customer through web, and app

Outlook - in line, for revenues, but what about profits?

Following the positive sales performance during the Christmas period, the Group anticipates achieving strong revenue growth for the financial year ended 31 March 2022 (FY22) in the range of £55m to £57m, in line with market expectations.

Supply chain - continues to incur extra costs & delays.

Late stock intake has caused more discounting.

Still profitable at EBITDA level, but only just -

As a result of these supply chain constraint issues, the Board now anticipates reporting a FY22 Adjusted EBITDA margin in the range of 1% to 2%.

CFO/COO - is stepping down in March 2022, to “focus on his health”. I wish him well, this is a brutal sector to work in. A new CFO is lined up, Richard Monaghan.

My opinion - I covered interim results here in Dec 2021. ITS looks to be holding its own, despite being a minnow, in a brutally competitive sector.

ITS also has plenty of cash on the balance sheet. Although as we’ve seen with private company Missguided, the wheels can very easily come off (Missguided needed a recent financial rescuer to avoid it going bust).

Forecasts are reduced today, on a cleverly disguised profit warning! It's now forecast to make a £(0.6)m loss for FY 3/2022. Not sure how the £48m market cap makes sense.

My worry is that, particularly for the smaller eCommerce companies, the money is made by staff, influencers, and Facebook/Google. That doesn't leave anything for shareholders in many cases.

It doesn’t appeal to me overall, as the sector is overcrowded, and picking a minnow, with me-too type product, doesn’t strike me as a way to turn rags into riches.

.

.

Eve Sleep (LON:EVE)

2.73p (down 23% at 11:50) - mkt cap £7.5m

Probably the last time I report on this seller of comfy mattresses.

FY 12/2021 trading update -

EBITDA loss of £(2.9)m in 2021 - H2 improved on H1

Net cash has reduced from £8.3m a year earlier, to £4.5m at end Dec 2021

Outlook - 2022 has started well.

Reckon they can get the UK& Ireland business to breakeven in 2022 (implying losses in France)

There’s an InvestorMeetCompany recording in the pipeline, which took place earlier today.

My opinion - overall, I don’t think EVE is likely to work. It’s in a very crowded space, and something the CEO said in a previous webinar convinced me to sell my shares, namely - “We’re up against against some very well-funded competition”.

Probably the best investors can hope for, is to be bought out by a competitor. I don’t think the “sleep wellness” strategy is a winner. There might be some value in the brand though, from previous marketing spending, making it a well-known brand?

.

.

Jack’s section

Midwich (LON:MIDW)

Share price: 626p

Shares in issue: 88,735,612

Market cap: £555.5m

Midwich distributes audiovisual (AV) tech to the trade market, with operations across EMEA, North America, and Asia Pacific. It floated back in 2016 and the shares have more than doubled since then, but is currently bumping up against a bit of a ceiling.

It’s a reasonably large enterprise now, with expected FY21 revenue of around £850m and a market cap of £555m.

The group is profitable, cash generative, and growing, though margins are fairly low and this could be a risk in a generally rising cost environment. The pre-pandemic norm was something like 4% operating margin.

Trading update for the year to 31 December 2021

The Board now anticipates reporting adjusted profit before tax not less than £31.5 million for 2021, which is ahead of previous expectations.

Midwich says it had a strong end to the year and now expects to report revenue growth of 20% to £850m (up 23% at constant currency), with an expected improvement in gross margins. The combined result is an upgrade to FY profit expectations. In fact, the group expects to report its highest revenues and net profit in history.

Adjusted net debt is £57m, around 1.5x adjusted EBITDA.

Diary date - final results to be released on 8 March 2022.

Conclusion

Midwich is a reseller. We’ve talked a few times about how much value this type of business, sitting in between providers and users, can add. On the one hand, it can be hard to differentiate your model and generate pricing power. Low margins are the norm.

On the other hand, those same issues mean that players that reach a certain size can create relatively durable scale advantages. This position of relative strength can facilitate acquisitions and further scale advantages, so you tend to see a few larger consolidators stripping out costs and generating synergies.

Midwich looks to be in the latter camp. Trading is again ahead of expectations and the group says recent acquisitions, including NMK, eLink, and Intro have performed well.

Assuming a 20% tax rate, net income might come out at something like £25.2m compared to current consensus of £21.8m, which would be a handy beat. The resulting 28.4p of earnings per share and an FY21 PER of 22x. Not in itself particularly cheap, so the market is expecting further growth.

The trading momentum is clearly positive though, and it’s a fast recovery from Covid disruption. Midwich has also successfully grown its revenues over a long period of time. So if it can continue along that trend while keeping a lid on costs, then it could continue to do quite well.

From what I’ve seen though, there’s nothing particularly exciting about the business model itself, so I suspect management execution and the pipeline and quality of acquisitions will play a key role. Nevertheless, it has the wind in its sails and this is not the first ‘ahead of expectations’ update it has released recently, so the direction of travel is positive.

Science In Sport (LON:SIS)

Share price: 70.5p (+2.92%)

Shares in issue: 135,100,931

Market cap: £95.2m

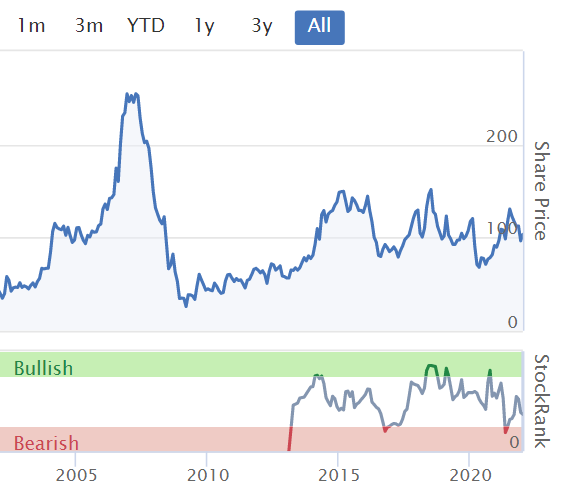

This is an interesting one. For a long time, it looked clearly too expensive for its size, although the management team sounds quite impressive and the sports nutrition market has attractive characteristics with potentially high margins.

SIS describers itself as ‘the premium performance nutrition company serving elite athletes, sports enthusiasts and the active lifestyle community’. It sells things like whey protein for gymgoers.

The CEO used to head the ‘Strategy Planning and Worldwide Business Development Director’ for the Nutritional Healthcare Division at Glaxosmithkline (LON:GSK) , which has always signalled to me that the team in place might know what it takes to make the company’s products mainstream.

The thing is that inkling needs to become quite a large part of your investment thesis here, as so far the group has been loss-making and equity-dilutive, with a sea of red across its Financial Summary. I’ve just never got that comfortable with it.

And you would need a lot of conviction to have held the shares over the years, I feel, given the level of volatility on display. Congratulations to anyone that picked up shares around the 25p mark though.

Trading update for the year to 31 December 2021

Revenue has grown by 25% to £62.7m and underlying EBITDA is £2.2m. The latter measure comes before share-based payments, which may or may not be appropriate depending on whether they are one-off. I see some comments in past SCVRs questioning remuneration policies (here and here), which is something to check.

That aside, it looks like a slight revenue beat on consensus of £60m.

PhD Nutrition is its premium active lifestyle nutrition brand. Revenue here is up by 19% to £29.7m. SIS, an endurance nutrition brand for elite athletes, grew sales by 30% to £33m. Product innovation delivered 32% of revenue growth, which is encouraging, as it signals a certain ambition to bring new products to market.

Gross margins increased slightly from 49% to 50%, driven by supply chain efficiencies, continued sales shift to online, and pricing, ‘more than offsetting commodity price increases’.

The accelerated capital investment programme delivered a new customer data platform, and a new supply chain facility in Blackburn is scheduled to open in late Q1 2022. This should lead to an immediate reduction in logistics costs.

Net cash has fallen from £10.5m to £4.9m as a result of these initiatives.

Online sales rose by 40% to £35m, up 28% on the group’s own platforms and +53% on third-party marketplaces. Great momentum here, with the online monthly sales record broken four times in H2 and a new sales record over peak November trading. Online is now 56% of total sales and is a ‘critical driver of ongoing growth’.

Retail sales - up 12% to £18.1m in the UK and +4% to £9.7m internationally despite pandemic restrictions.

Diary date - final results on 16 March 2022.

Conclusion

I’m typically wary of serially loss-making companies as the odds aren’t good, but some do make it. Science in Sport is a reasonably strong candidate in my view, although that loss-making status does elevate the risks, statistically speaking.

Still, with double-digit % revenue growth across its products, strong online momentum, and a new logistics facility set to reduce logistics costs in the near future, there could be an inflection point approaching. The group might have a degree of pricing power with its goods (based on comments noted above), and there’s a global opportunity for an experienced management team in this space, so we could see both high growth and margin expansion. Breakeven is in reach.

The cash burn is quite high though and the current net cash balance indicates that positive trends need to continue, otherwise further dilution could be a risk. That risk is probably reducing, but this is a crowded space too, with a lot of competition and M&A activity at the moment.

It’s a good update, but the price is just a little high for what I’d be willing to pay as things stand.

Appreciate (LON:APP)

Share price: 26.28p (11.36%)

Shares in issue: 186,347,228

Market cap: £49m

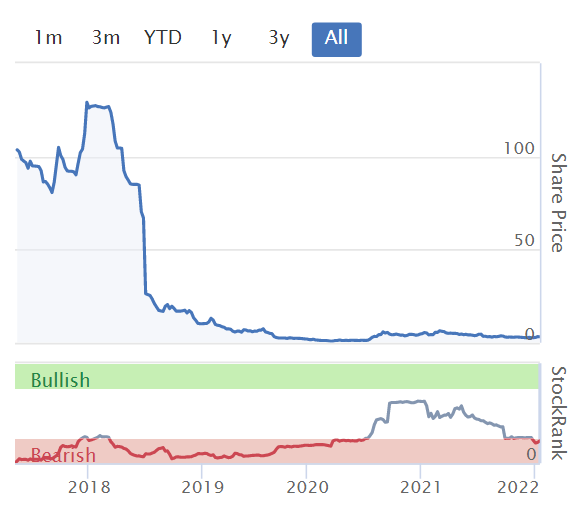

Not one I’ve looked at before, but a potential recovery situation with a Value Rank of 83 after a steep fall in the share price.

The valuation is very modest if the forecast earnings figures can be trusted, with a forecast rolling PER of between 6 and 7x.

Appreciate has a portfolio of brands designed for consumers (savings and giftings) and businesses (corporate rewards), providing vouchers, cards, and ecodes. It’s hoped that the move to digital could accelerate growth and allow it to capture more market share.

The historical core of the business was Christmas Savings (helping cash-strapped, lower income customers to spread to cost of the festive period) but this is now less than half of total billings. Now, the focus is firmly on Corporate billings, so the investment case is shifting.

Q3 trading update for the three months to 31 December 2021

Appreciate says this is a key trading period. FY20 comps are used, in order to strip out lockdown impacts.

Underlying Q3 billings (excluding Christmas savings) was 13% ahead at £96.1m, with December up 41% versus the same month in FY20 at £45.6m, so nearly half of the revenue for the quarter. This has been the group’s best-ever quarter for Corporate business (the most important segment for Appreciate), with billings here of £77.6m.

Total year-to-date billings +8% on FY20. Here’s the quarterly breakdown (presumably the difference in YTD growth figures of 8% and 1% are down to the free school meals scheme).

The first phase of Appreciate’s Enterprise Resource Planning upgrade was completed in January 2022. This replaces the legacy back office systems that support HighStreetVouchers.com.

Outlook - on track to deliver in line with FY expectations, Q3 momentum has continued into Q4 with underlying billings up 8% on FY20 and up 10% on FY21 so far.

Conclusion

The shares look cheap and there are signs of stabilisation, but there has obviously been a collapse in investor confidence.

Appreciate has mentioned a £7bn market opportunity before. It’s not something I’ve looked into, and it pays to be skeptical of large market figures as the addressable opportunity might be a smaller fraction depending on market share and relevant sub-segments but even so, a proportion of £7bn could mean ample room for growth.

Liberum has retained a price target of 66p, so it’s worth noting the scale of the gap between that and today’s share price. Perhaps there are some subscribers out there that can fill us in on the recent history and opportunity?

Paul and Roland have each looked at the company in the past (here and here), both voicing a degree of skepticism. So the business model itself requires a closer look and I don’t know enough to comment right now, unfortunately.

For now, the cheap valuation and stabilising operating figures suggest it could be worth doing some digging here as there is potential for a rerating.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.