Good morning, it's Paul & Jack here with the SCVR for Wednesday.

Agenda - (also known as, what fresh nightmares will be visited upon us today?)

Paul's Section:

Vertu Motors (LON:VTU) (I hold) - adj PBT guidance is raised again, from £70m to £75m, for FY 2/2022. As the outlook comments make clear, this year is a one-off bonanza, due to a shortage of supply pushing up used car margins. Next year profit is set to more than halve, but the shares look very cheap, even on future reduced profits. Great value.

Revolution Bars (LON:RBG) (I hold) - interim results from yesterday look encouraging. RBG has moved back into profit, holds net cash, and is in expansion mode again. 2 new concepts have been successfully trialled. Shares have not yet reacted to the turnaround, and are barely above the placing price of 20p which refinanced the business during the pandemic. Stronger reasons than ever to be bullish here. I see 50%+ upside.

Musicmagpie (LON:MMAG) - share price is down 27% today, on wobbly outlook comments accompanying in line results for FY 11/2021. I can't see anything interesting here, and like many recent IPOs, it still looks expensive, even after plunging on a profit warning.

Jack's section:

Hotel Chocolat (LON:HOTC) - good H1 performance, with profit and EPS up c50%. Management is certainly ambitious here, targeting £500m of revenue by FY25E and investing to grow into a £525bn global addressable market. So there is a long term opportunity. But the stock remains expensive and I’m not that comfortable with the valuation at present.

Foxtons (LON:FOXT) - revenue and profits up, while cash inflows have increased. The company is returning to dividend payments and has been buying back shares. It has also been winning market share and is positive on the outlook. Things did go wrong here, and shares remain well down on IPO levels, but this update is more positive than the languishing share price might suggest.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Vertu Motors (LON:VTU) (I hold)

57.6p (pre market open) - mkt cap £207m

Vertu Motors, the UK automotive retailer with a network of 159 sales and aftersales outlets, announces the following update with regards to the five-month period to 31 January 2022 (the "Period") ahead of its preliminary results for the year ended 28 February 2022 to be announced on 11 May 2022.

It’s yet another upgrade -

Trading Update: Further Upgrade of Expected Trading Performance for FY22

"I am pleased to report that the Board now expects the trading result for the year ended 28 February 2022, at an adjusted1 profit before tax level, to be not less than £75m…

The trading results have been aided by sector tailwinds and limited vehicle supply leading to augmented margins. In addition, recent acquisitions have contributed at a higher level than initially envisaged due in part to a swift and successful integration process."

This is a £5m upgrade to £75m profit for FY 2/2022, guidance was previously £70m.

There’s lots more detail in the announcement, which I won’t regurgitate here.

Outlook - stressing that FY 2/2022 is a one-off bonanza year, as we already know -

FUTURE PROSPECTS

The strong balance sheet, experienced leadership team and strong systems capability of the Group ensures it is well placed to capitalise on the significant opportunities for growth that exist within the UK automotive retail sector. The Board considers that scale is a vital success factor in the sector given the need for strong brands and investment in digital developments and continues to have ambitious growth aspirations for the Group in the next few years.

Without doubt, FY22 has seen extraordinary trading conditions which have driven the exceptional financial performance. Whilst the outlook remains uncertain for FY23, it is clear that these highly favourable trading conditions are unlikely to recur. The FY23 financial outcome is likely to be some way below FY22, although we certainly expect performance to be well ahead of periods prior to FY22. As the year progresses, we will update the market accordingly. Significant increases in operating expenses such as payroll, energy and investment in digitalisation and related marketing are evident. In addition, rates and vehicle expenses are expected to normalise. The enhanced vehicle sales margins seen in FY22 are anticipated to continue but at a reduced augmented rate as supply in new and used cars normalises in the year ahead. Considerable uncertainties remain over new vehicle supply and the timing of market normalisation. In addition, consumer confidence will be critical in the months ahead as cost-of-living inflationary rises become apparent and geopolitical uncertainty arises. These matters could impact vehicle sales.

The Group is now in a better position to maximise aftersales revenues due to higher resource levels following pay reviews and a recruitment drive. Aftersales margins are likely to reduce, as seen in the latest Period, with a potential offset with revenue growth. The last two-year decline in new vehicle sales will lead to a softening in the market for service and repair work in the UK for vehicles under three years old, the traditional core market for franchised retailers servicing. Increasing market share in the older vehicle service and repair market will be a critical objective to seek to offset this softness.

Valuation - many thanks to Zeus for publishing an update note this morning, on Research Tree. It has pencilled in 15.8p for FY 2/2022 - a PER of 3.6! This is best ignored though, because it’s a one-off.

Next year, Zeus has profit more than halving, to £35.4m, anticipating sales conditions normalising, and higher overheads. This is the more relevant figure to value the shares on, in my view. So at 7.5p, this is a forward PER of 7.7 - which looks highly attractive to me.

Particularly when you also factor in that the balance sheet has net cash, and is full of freehold property.

My opinion - as shown above, even if we adjust out current extremely positive market conditions, VTU shares still look very cheap.

The current share price is at a discount to NTAV, which doesn’t make any sense to me. That implies that the company is making unproductive use of its assets, which is clearly not the case. So I think the market price for Vertu shares just looks wrong (ie. too low).

The dividend yield is about 3%, plus VTU is buying back its own shares, thereby enhancing EPS, with another £3m buyback announced today.

There has also been takeover activity in this sector, so further upside could come from that.

There’s so much to like here, so I remain a firm holder.

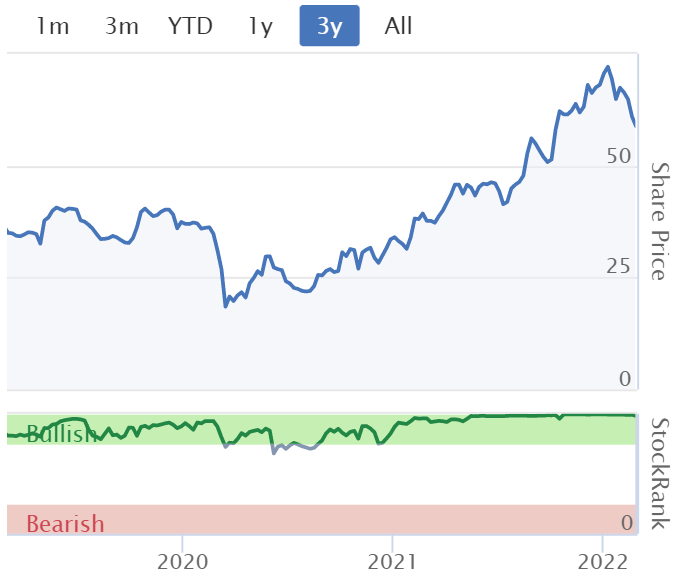

Looking at the chart below, I might usually consider banking some profits. However, the fundamentals are so good, that it doesn't make sense to sell a share which is this cheap.

.

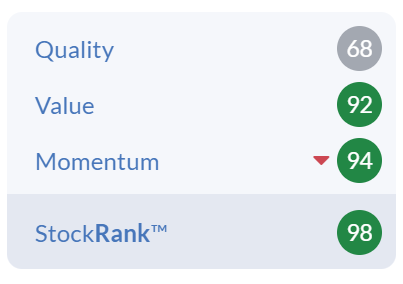

Stockopedia's algorithms love VTU too -

.

Revolution Bars (LON:RBG) (I hold)

21p (yesterday’s close) - mkt cap £48m

Interim Results (published yesterday)

Revolution Bars Group plc ("the Group"), a leading UK operator of 67 premium bars, trading predominantly under the Revolution and Revolución de Cuba brands

Dramatically improved performance is now evident, for the 26 weeks ended 1 Jan 2022.

The 6 months was still affected by covid, at the start, with restrictions only being lifted on 19 July 2021, and then towards the end, when omicron hit the peak seasonal trading hard. In between there was a strong recovery though. LFL sales were up +14% for most of the period, but omicron reversed most of this, with LFLs being +1.4% from re-opening to H1 period end.

Therefore, we should see further upside on these numbers, if no further covid restrictions occur.

Offsetting that, H1 benefited from £1.3m in business rates relief.

H1 revenues £74.1m, adj EBITDA £7.6m, Profit Before Tax £4.3m - I think this is a good performance in the circumstances.

Full year FY 6/2022 profit guidance for FY 6/2022 - top end of market expectations, of £8-10m adj EBITDA (on IAS 17 basis)

Net cash of £4.2m, so the company has plenty of firepower for expansion into new sites. 2 placings at 20p generated £34m of fresh cash, which has transformed the financial position, but also heavily diluted - there are now 230m shares in issue, compared with 50m pre-pandemic. Therefore to get the same upside, we have to buy a lot more shares than before, and realistically the share price is unlikely to return to anywhere near the previous highs.

New sites - 2 for this year, and 6 planned for next year. There’s scope to do more though, and I think the ending of the rent moratorium could throw up additional opportunities on attractive rents.

Refurbishments - now underway in earnest, with 19 planned for this year. Excellent 2-year payback. This should be a big driver for sales growth, and hence allow the company to absorb cost increases in other areas (e.g. wages, energy, ingredients).

Exited poor sites during the pandemic, and got rent reductions, so this is a better business now, compared with pre-pandemic.

Dividends - for technical reasons, probably won’t be until Nov 2023.

Going concern note says material uncertainty due to covid. This has nothing to do with the company’s financial position, which is now strong, with net cash, very strong actually compared with a lot of highly geared competitors (some of which are likely to go under when rent moratorium ends shortly).

Balance sheet - NAV is negative at £(20.9)m, but this is due to the big deficit on IFRS 16 lease liabilities. That doesn’t make sense to me, because the problem leases have been ditched. So we should expect this deficit to reverse in future, as the Right of Use Asset figure rises to reflect improved trading post-covid. So not a concern.

New formats - two have been trialled, with strong performance so far. An old site in Northampton has been rebranded as Playhouse with arcade style games combined with cocktails & pizza. Looks good, and it has positive reviews online. Also a site in Swansea is trialling another new format called Founders & Co, which I also like.

My opinion - this is now looking very good, and the shares are cheap, in my opinion.

All the historic issues have now been solved, and I think market perception of RBG could radically improve once investors twig that this is now a well-funded, well managed, expanding, multi-brand speciality bars group.

Despite industry-wide cost pressures, RBG has some good growth potential, from the refurbs, and new sites.

Yet the share price is only 5% above the placing price, which I think provides an attractive opportunity to possibly bank a c.50% profit over the next year or two. The facts have changed very much for the better, but investor sentiment has not. That's a buying opportunity in my book.

.

.

Musicmagpie (LON:MMAG)

119p (down 27%, at 10:13) - mkt cap £128m

This has cropped up on the top fallers list for today, so I’ve taken a quick look.

This company floated on AIM in April 2021, and is joining the long list of over-priced, underwhelming IPOs, many of which were online businesses that floated on the back of an unsustainable profit boost from the pandemic. As that growth stalls now, share prices tank. Often IPOs are mainly done as a lucrative exit route for selling shareholders.

It’s my first comment here on MMAG, but I do recall skimming through its Admission Document last year, and thinking the business looked a bit old hat (especially its “legacy” CD/DVD reselling, and books businesses). The more modern part of the business refurbishes & resells (or rents) consumer electronics. Again, not an interesting business model to me.

Full year results - for FY 11/2021 are out today.

In line with expectations, the company says.

Revenues £145.5m (down 5.1% on LY)

Adj PBT £7.9m (down from £9.2m LY) - as pandemic boost receded.

Why are the shares down 27% today then? It’s got to be the wobbly-sounding current trading comments -

· FY21 ended strongly with record sales in the UK and US during the Black Friday period across the business. This sales momentum continued as we entered the current year, however, as the first quarter of FY22 has progressed, volumes and trade-in activity levels have moderated in line with consumer trends

· Consumer Tech revenues for the first quarter of the year have been in line with management expectations, but a trend towards lower sales volume at a higher average selling price and an increase in the proportion of products sourced from intermediary wholesale partners, is currently expected to compress the gross margin on outright sales in the category in the current year by c.4.0 percentage points compared to FY21

· The rental subscription service is continuing to grow, with c.19,000 active subscribers at the end of Q1, with a forward contracted order book of £2.2m (2021: £0.4m). 15 per cent. of outbound Consumer Tech volumes on musicMagpie store are now rental sales versus 4 per cent. in 2021. The introduction and success of rentals to our business model is expected to have a short-term compression on the Group's headline revenue growth as we move from upfront to monthly revenue recognition. This area of the business is expected to earn higher revenue and EBITDA over the life of a device, as opposed to a one-off sale, underpinned by a contracted recurring income and cash flow stream and will become more visible in the Group's performance in the medium-term

Dividends - none.

Share-based payments - there’s an astonishing £17.4m charge to the P&L, which makes the company heavily loss-making at the statutory level, at a £(14.8)m loss before tax. I don’t like the look of that one bit!

Balance sheet - looks OK.

Cashflow statement - some concerns here. Cash generation fell considerably compared with last year. Also, it capitalised £2.8m in development spending, and had a further £4.4m in traditional capex, which seems quite a lot.

The IPO proceeds of £15.0m was mainly used to pay down debt.

My opinion - MMAG doesn’t appeal to me at all.

It still looks over-valued to me, even after today’s sharp fall.

.

Jack's section

Hotel Chocolat (LON:HOTC)

Share price: 454p (+0.89%)

Shares in issue: 137,278,264

Market cap: £623.2m

Interim results for the 26 weeks to 26 December 2021

Hotel Chocolat is a stock that has always looked expensive. That’s no different this morning.

It has staged an impressive post-Covid rally, however, briefly touching all-time highs of 520p at the start of the year before falling back to today’s price of 454p. That still results in a £618m market cap, so the group has grown substantially since listing back in 2016 at 167p, for a market cap of £167m.

- Revenue +40% to £142.9m,

- Underlying EBITDA +35% to £33.8m,

- Profit before tax +56% to £24.1m,

- Diluted EPS +49.7% to 14.2p

50% of placing (c£40m total from a little over 11m shares priced at 355p back in June 2021) proceeds have been deployed into growth investment.

The group reports a growing brand appeal in the UK, US, and Japan.

The active customer database in the UK has grown by 38% to 2.3m, active numbers are up 119% in the US thanks to digital, and the Japanese joint venture’s sales to consumers have grown by 131%.

Management action on inflationary pressures means profit has grown faster than revenue, although the gross margin has slipped slightly, from 61% to 59.8%.

Net cash flow from operations was £29m (down from £33m in H1 FY21, but up before changes in working capital) and net cash is up from £45.6m to £53.8m.

£13.6m spent on plant, property and equipment, another $4.2m lent to its joint venture, and £1.9m spent on purchase of intangibles make up a £19.7m cash from investing outflow. Then the £40m placing ensured that net cash grew from £10m six months ago to £53.8m today.

If you ignored the placing, there would have been an inflow of £3.5m.

Seems fairly routine. BDO has been in place since 2012 so is being replaced by RSM. Best practice is to replace after ten years or so.

Conclusion

For all the stock’s priciness, I do think there is potential in the brand here. Here’s what the CEO and founder says on that:

Our brand purpose is to make people happy through chocolate. This means bringing happiness to all the groups we connect with, including customers, team-members, growers, suppliers, and local communities. This remains our 'North Star' and by continuing to follow it we will achieve our business goal of becoming the leading global direct-to-consumer premium chocolate brand.

That’s a big prize to aim for, and broker Liberum touts a £525bn global addressable market, but a lot has to go right for it to happen. Hotel Chocolat has paused its dividend programme in order to invest more into this strategy, as well as raising cash from shareholders.

In order to fund an acceleration in growth, the Group raised a total of £60m equity via placings in 2020 and 2021 and paused its progressive dividend policy. The Board are mindful of the potential growth opportunities in the USA and Japan, and the Board will continue to review potential reinstatement of any dividend relative to the potential opportunities for re-investment in service of profitability and growth.

One thing about an extremely expensive share price though, is that share dilution so far has not been that bad. The group IPOd with about 113m shares in issue and today, nearly six years later it has 137m.

In terms of outlook, the group comments:

Since the end of the financial reporting period, trading has continued to be in line with the Board's expectations. The multi-channel performance of the UK remains encouraging, and the new markets continue to show promising potential for growth and profitability.

That sounds fine, but I still struggle with the valuation here. There could be something really valuable at Hotel Chocolat, but a fair amount of this is priced in and so I don’t think the risk:reward is particularly attractive at these levels.

It’s a growing business with an intriguing brand proposition and business model. The group is targeting £500m in sales by FY25E. That would be impressive and implies that management is ambitious, with a good vision of where it wants to get to. So I’m not dismissing the prospects, but I would want a lower entry price.

Foxtons (LON:FOXT)

Share price: 35.02p (+1.06%)

Shares in issue: 318,972,062

Market cap: £111.7m

Final results for the year to 31 December 2021

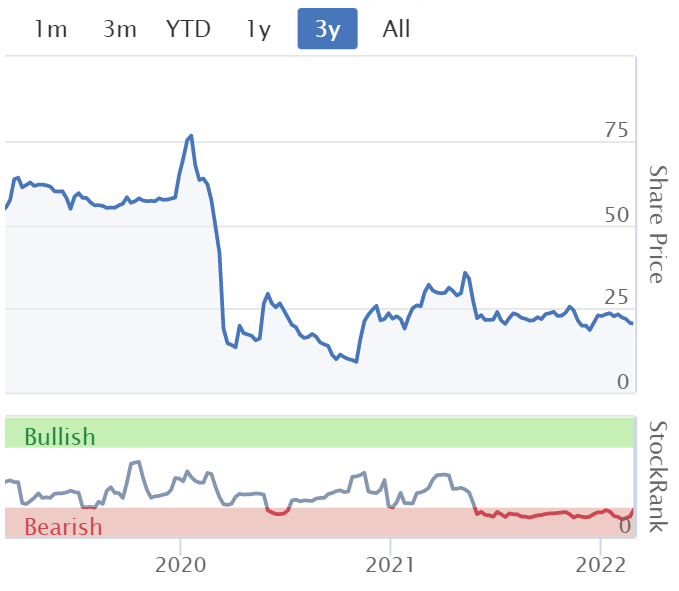

The share price has collapsed here again, giving back all of the gains made as the nation came out of lockdowns.

The London property market certainly seems far more buoyant now, and rents are going up, so I’m curious to see what’s driven that poor relative strength.

Revenue of £126.5m is up on both FY20 (£93.5m) and FY19 (£106.9m). Adjusted operating profit is up to £8.9m, from £1.9m in FY20 and a £0.7m loss in FY19. Reported PBT is up from a loss of £8.8m in FY19 to £5.6m. Adjusted EPS is up to 1.9p from losses in both prior years, although reported EPS remains negative at -0.4p.

Foxtons has also returned to dividend payments, returned £5.7m to shareholders via buybacks, and net cash inflow has increased from -£2.5m in FY19 to £6.6m.

The group also says it has increased its market share in the London sales and lettings market, with the current under-offer sales commission pipeline marginally ahead of 2021.

Outlook

In sales, 2022 began with our under-offer sales pipeline marginally ahead of 2021 levels, and significantly up on the pre-pandemic levels, giving us confidence in a more sustained market recovery. In lettings, London average rental prices are in line with 2019 levels which we expect to be underpinned by strong tenant demand as pre-pandemic behaviour returns, including continued growth in Build to Rent in 2022. We have a good pipeline of further lettings portfolio acquisitions and expect to invest £8m in 2022 to generate attractive returns for investors. In mortgage broking, we expect there to be similar levels of market activity to 2021.

Subject to the geopolitical situation, we expect the trading environment to remain positive, and will take steps to control costs, despite inflationary headwinds, and improve productivity. Overall, we have a clear plan for growth and expect to build on the strong progress made in 2021.

Conclusion

I understand Foxtons has had its issues but I’m struggling to justify the recent share price fall. Perhaps it was just a poor AIM market compounded more recently by Russia’s invasion? And maybe the market remains sceptical as to the duration of the positive sales and lettings environment.

It sounds like the group is doing a decent job of rebuilding momentum.

Growing market share is a priority and it is encouraging that we improved market share in both sales and lettings for a second consecutive year after a period of decline.

If Foxtons can maintain that market share performance and the wider market holds up, then there is potential to grow from today’s modest levels via acquisition of lettings books. I feel as though the market’s been a little harsh on the share price here but clearly there are some significant macro risks to consider.

Additionally, private investors also have access to a number of higher quality sales and lettings operators with franchised business models. The operating track records of the likes of Belvoir are extremely good, so they are probably safer bets. But this update reads more positively than the recent share price performance might suggest.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.