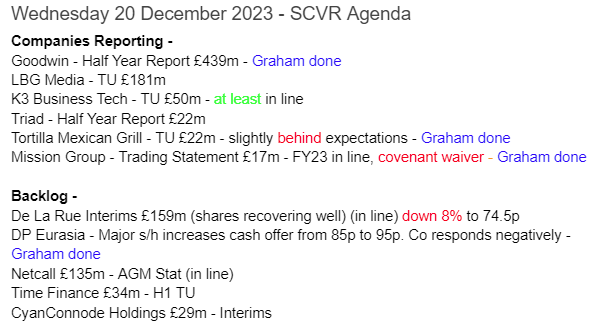

Good morning! Graham here. We have several interesting updates to look at today.

That will do it for today (1.20pm). Thanks for dropping by!

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Thanks to everyone for your helpful comments yesterday, especially on Cavendish Financial (LON:CAV). Since I've been positive on this one for a while, I wasn't unhappy to see that the shares were up by c. 20% by midday!

DP Eurasia NV (LON:DPEU)

- Share price: 95p pre-market (+8.5% yesterday)

- Market cap: £139m

We've had further developments in the attempt by DPEU's major Indian shareholder to take it private.

See our coverage earlier this month, when we reckoned that the surprise 85p bid was "the bare minimum".

Jubilant Foodworks, up until recently a 49% shareholder, has increased its stake further to 54.67%.

Even if it had not already signalled its intention to bid for the company, its further purchases would have triggered a mandatory bid anyway.

Let's get up to speed on the latest state of play.

Dec 5th: DPEU's management reiterate that they are "extremely disappointed" that Jubilant went public with a bid instead of approaching them first. They go on to say:

The Board has evaluated the Jubilant Proposal with its advisors and believes the financial terms fundamentally undervalue the Company and its prospects.

The Board has received feedback from a significant proportion of the Company's shareholders, indicating that they are also overwhelmingly of the opinion that the Jubilant Proposal fundamentally undervalues the Company.

I agree! Each DPEU store was being valued at only around £180k (roughly speaking, the 85p bid is an attempt to buy c. 700 stores for £125m). That compares to a market value of £1.2m per store in the UK and Ireland (we'll speak more about relative valuations in a minute).

Dec 19th: Jubilant goes public with a higher 95p bid, "following consultation with DP Eurasia's shareholders" (I note that they say shareholders, not management!)

Other major DPEU shareholders include an individual investor based in the Cayman Islands, and a US-based hedge fund.

The new 95p bid raises the valuation to £139m although Jubilant is already a majority shareholder, so it would only have to pay a fraction of this.

The new bid is a 38.7% premium to the share price just before the original bid announcement. This strikes me as being a more normally sized premium to pay over a prevailing share price.

Dec 19th: DPEU management respond to the new bid as follows:

...the non-conflicted members of the board of the Company (the "Board") have determined that [the 95p bid] is significantly below what they consider to be the fair value of the DP Eurasia business and its prospects, particularly considering its continued strong performance as detailed below.

I imagine that the atmosphere is a bit prickly on the board now, as the DPEU board members who are not affiliated with Jubilant are taking the opposite stance to the "conflicted" Jubilant representatives!

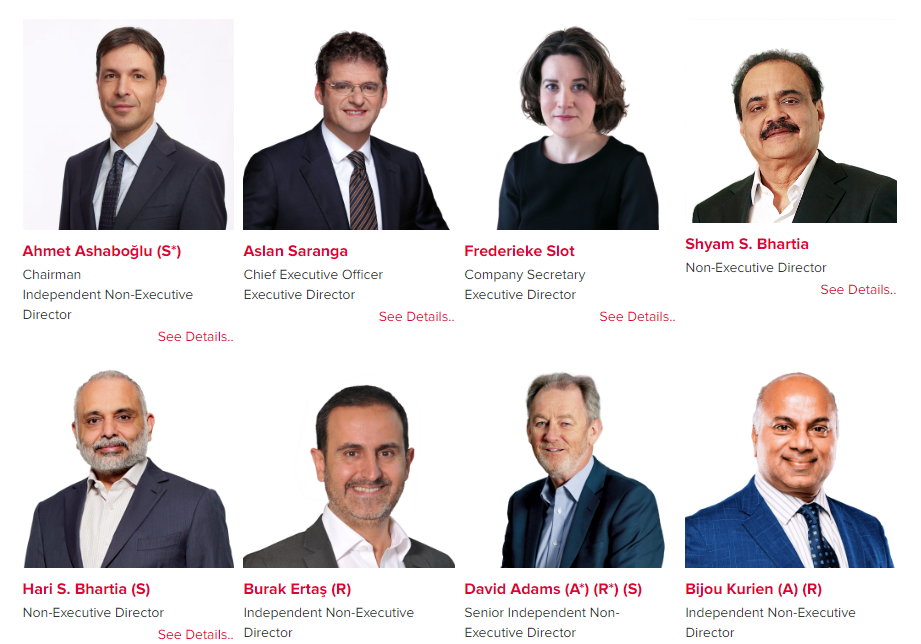

The entire DPEU board is shown below. On the top right and the bottom left are the co-Chairmen of Jubilant:

The Dec 19th announcement by DPEU also raises profit guidance:

- now expects to marginally exceed EBITDA guidance of 696 million Turkish lira (this guidance given recently, on 28th November).

- FY 2023 EBITDA now expected at 713m Turkish lira (c. £24.1m).

- FY 2024 EBITDA expectation is 1,245m Turkish lira (c. £30.7m).

- FY 2023 year-end net debt expected at 653m Turkish lira (c. £17.8m).

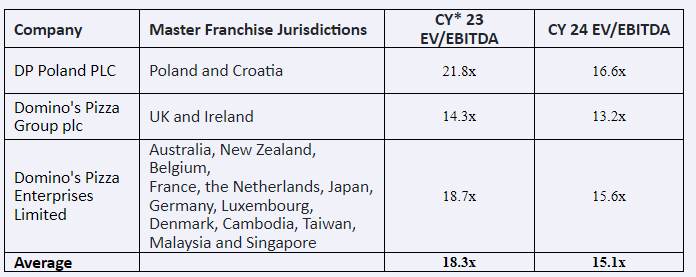

Based on the above, they provide valuation multiples for their international peers:

They then compare this to the valuation at the 95p bid:

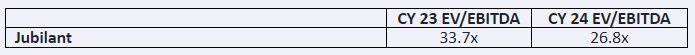

And also to the valuation of Jubilant Foodwords:

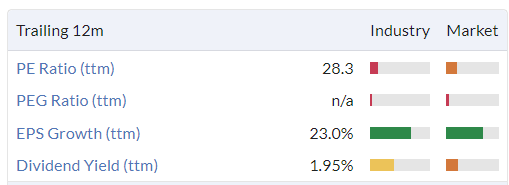

As you can see from the above, DPEU is rated much more cheaply than its European peers, even at the higher 95p bid, and despite the very high expectations for EBITDA growth next year.

Jubilant's StockReport can be found here, if you're interested.

DPEU's board acknowledges that the hyperinflation in Turkey does complicate this analysis, and that the economic situation in Turkey could justify a lower valuation for DPEU compared to its European peers. But they still argue that they are being undervalued at this level.

By doing a store count, I came to similar conclusions earlier this month in the SCVR, noting that a DPEU store was being valued at one sixth of the value of a store in the UK & Ireland.

In EBITDA terms rather than in terms of store count, the valuation discrepancy is less extreme, but DPEU is still only being valued at around half of the UK & Ireland (based on current year earnings).

And given the growth prospects for next year outlined above, the discrepancy doesn't seem to be fair. But then there are additional risks in Turkey (especially political risks) that are more difficult to analyse from abroad.

Wrapping up, the DPEU board has this to say:

The Company suffers from extremely limited minority protection rights in takeover situations due to the fact that it is neither subject to the United Kingdom's Takeover Code nor to any EU takeover provisions despite its listing in the United Kingdom and being incorporated in the Netherlands. In addition, despite being a good commercial partner, Jubilant has sought to exploit this to its advantage by seeking to take full control and de-list the Company without offering fair value, to the detriment of minority shareholders. Furthermore, by virtue of its representation on the board of the Company, the Board believes that Jubilant is well aware of just how much growth potential exists.

20th December: Jubilant have hit back today, defending their offer as fair based on "historic share price performance, DP Eurasia share liquidity, a peer group of comparable quick service restaurant companies, the wider macroeconomic environment and intensifying competition in Turkey".

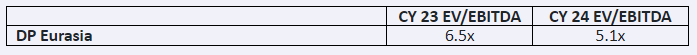

They also point to the valuations of emerging market peer companies:

Graham's view

Jubilant have made a strong argument that emerging market fast-food stocks tend to trade at cheaper multiples. However, I imagine that most DPEU minority shareholders (I used to be one myself) are involved for the potential re-rating that would occur when DPEU becomes solidly profitable, reduces its leverage, and the economic situation in Turkey stabilises.

DPEU shareholders are also more likely to think of Domino's as a premium brand that is worth more than, for example, Burger King (one of the brands operated by companies in the table published by Jubilant).

And for whatever it's worth, the DPEU IPO was at 200p all the way back in 2017:

Since then, despite all the struggles that the company has experienced, it hasn't diluted its shareholders and the share count is virtually unchanged.

Russia turned out to be a disaster but growth has been seen in Turkey and recent positive updates suggest that it might be about to generate some genuinely strong financial numbers, with excellent short-term growth prospects.

There are some risks that concern me, however. In particular, there is the risk of a delisting. Jubilant could attempt to cancel the listing even if they don't succeed in a full takeover. If they had 75% of the votes, it is something they could achieve, leaving minority shareholders without any liquidity and perhaps in a precarious situation, holding shares in a private Dutch company.

Therefore I'm going to stick with a neutral stance here, for the simple reason that the majority shareholder doesn't want to keep the listing. For investors who don't care about liquidity at all and don't mind the possibility that they could find themselves holding shares in a private company, maybe holding on here would make sense. Personally, I would learn the lessons from the experience and get out at 95p, even though I think this price probably does undervalue the business and its prospects.

Goodwin (LON:GDWN)

- Share price: £54.24p (-8%)

- Market cap: £407m

Paul look at this engineering group's full year results in August.

Today we have interims. Key points:

- Revenue £97.6m (H1 last year: £89.3m)

- Pre-tax trading profit £11.2m (H1 last year: £9.1m)

Note that Goodwins has two divisions - "Mechanical" and "Refractory". Within these, there are a large number of capabilities and operating subsidiaries. Feel free to explore them here.

As mentioned by Paul in August, Goodwin's large order book seems to be a key reason for the punchy valuation:

On that point, the outlook for the rest of the year sounds good, the company saying:

...we anticipate a continuation of this increased performance for the rest of the financial year, with a current forward order book of £266 million.

The order book was last reported at £271m, so perhaps it is stabilising a little? Although it's hard to read much into a six-month movement. Also, revenues could keep growing for a while even if the order book stabilises, as orders are fulfilled.

On orders currently being received, the company says: the slow pace of third party decision making has been a source of frustration. Nevertheless, we are well prepared to capitalise on these opportunities as they arise.

As the company works through its orders, it has seen a temporary drain of cash. Net debt rises to £54.6m (a year ago: £46.1m), which is said to be in line with expectations. The gearing ratio is therefore 47.8%, but this is expected to fall back to 30% within 18 months.

One key product owned by Goodwins is AVD, which has been designed specifically to extinguish fires caused by lithium-ion batteries. In a world of mass adoption of electric vehicles, this is a useful invention! Here's the latest exciting news on this product:

There is ever-growing interest and adoption that extends way beyond the automotive sector, encompassing a diverse range of applications worldwide. To support this demand, proactive measures have been taken to expand AVD manufacturing capacity. The Group has acquired a 2.5-acre site with a 5,000 square metre industrial building, conveniently located close to Dupré Minerals Limited's primary manufacturing facility in Staffordshire. The site is ready for immediate use with the planned commissioning date of the new, higher-capacity AVD manufacturing line set for April 2024.

Shareholder relations: Goodwins strikes me as having the culture of a private, family-owned business (as previously highlighted by Paul, most shares are held by insiders and their relatives). However, as its valuation has increased, it perhaps needs to start acting a bit more like a conventional, publicly-listed company. This means longer and more frequent reports for shareholders. The Chairman says:

After due consideration, from listening to shareholder enquiries at the AGM, we recognise the importance of providing more frequent updates. Considering our Group's diverse and complex operations, we have decided to introduce quarterly trading updates to keep our investors more informed.

I'm sure many US companies would be amazed to learn that there were UK companies who had to be persuaded to published quarterly updates for their shareholders!

Outlook

Here's an excerpt from the outlook statement:

The Group's increased levels of activity that have occurred in the first half of the year are expected to continue throughout the second half of the year, generating a similar level of profitability as was achieved in the first six months...

If a few of the notable contracts that are expected to arrive over the coming months do not get delayed again for the Mechanical Engineering Division, the forward workload will be further increased by the year end.

Graham's view

The main point for me going into today's results is that Goodwin was already on a hefty PER, so any shakiness in the outlook could have a negative impact on the share price. That's the context in which we have an 8% fall today.

The order book should increase again by the end of the year, but it's clearly possible that it won't, if there are further delays from Goodwin's customers. So if we end up with an order book that hasn't grown for a year, it might be more difficult to justify a PER of nearly 30x.

The net debt position also makes for a share price that is more sensitive to any doubts on trading performance. In isolation, today's cash flow statement isn't very good - there is negative net cash from operations, due to large increases in receivables and "contract assets" (economically similar to receivables). On top of that outflow, there was modest capex. Hopefully the cash performance will improve very soon, as indicated by the company.

Goodwin moved up the risk spectrum in H1 by borrowing an additional £12.5m and paying out more than that amount to shareholders in the form of buybacks and dividends.

Therefore, while I don't doubt that this is a company with excellent culture and heritage (going all the way back to the year 1883!), and it has a tremendous track record of profitability, I think the valuation and the risk profile might be in territory where the shares will be vulnerable to any trading setbacks and where new investors at the current price might need to have a great deal of patience.

In general, I expect to see engineering companies trading at modest or even below-average multiples. With Goodwin, I do see mention of intellectural property and interesting patents. Along with the track record and the positive culture, I'm inclined to think that it's worth a considerably more expensive rating than the average engineering stock. But I would be neutral at the current level.

Please note that there is still no proper analyst coverage of this stock, so it is left to us to come up with our own forecasts of future performance.

Tortilla Mexican Grill (LON:MEX)

- Share price: 49.05p (-11%)

- Market cap: £19m

Tortilla Mexican Grill PLC, the largest and most successful fast-casual Mexican restaurant group in the UK, provides a Trading Update for the financial year ended 31 December 2023 to date ("FY23" or the "Period").

This is a 2021 IPO, a restaurant chain with 87 sites.

Its share price performance is predictable enough:

Paul last covered it in July. Today brings a trading update for FY Dec 2023.

Key points:

- Revenue +13.8% to £65.7m, but UK life-for-like growth is more modest at +3.7% (or +5.0% adjusting for VAT).

- Performance is slightly behind previous expectations due to subdued consumer confidence, particularly in Q4.

- Underperformed on high streets (lower footfall) and in smaller tertiary towns and cities where brand awareness is lower.

Deliveries are stable at 31% of total revenue. Margins were impacted by partnering with multiple delivery companies. This strategy is under review.

Overall, the adjusted EBITDA margin improved in H2 vs. H1, in line with guidance. Paul has previously criticised this company for promoting EBITDA, when real profits get eaten up by lease payments and depreciation.

(Note: we need to be extremely careful with EBITDA these days, as the accounting rules put the cost of renting sites into interest and depreciation which are excluded from EBITDA.)

Estimates: the new adjusted EBITDA forecast for 2023 is £4.5-£4.6m. According to the broker Liberum, the previous forecast was £5m.

Next year's EBITDA forecast also gets downgraded from £7m to £5.6m.

Importantly, these EBITDA forecasts do include the cost of rent payments.

However, statutory profits, if any, are likely to be minimal. The adj. PBT forecast for next year is cut by 50% to £1.2m.

2024 outlook: negative on the market outlook, due to cost-of-living pressures, especially outside London. Marketing costs will increase to drive brand awareness and offset the weak consumer (I'm not sure if this makes logical sense to me, but that is their plan!).

The living wage will further increase staff costs from April 2024.

More new sites in the pipeline.

Wrapping up:

Notwithstanding the challenging trading environment, the Group is targeting robust Adjusted EBITDA growth in FY24 on the back of the full year benefit of cost initiatives, the sales growth from the marketing investment and the Group's store rollout program.

CEO comment:

"As a management team we are taking proactive actions to adapt to the changing market environment. We know that in buoyant eating out markets where the Tortilla brand is well known, we outperform. We have a strong portfolio of new sites in high quality locations as well as additional franchise growth opportunities. In addition, we intend to increase marketing investment to improve broader consumer awareness of our brand and fresh, value for money proposition whilst also taking action to optimise the profitability and long-term potential of our delivery channel.

Graham's view

It might be better for Paul to cover this one, as he might be able to give a more balanced view.

Personally, I see few attractions here. A pub or restaurant share can generally grab my interest only if if falls into one of the following categories:

- If it owns its own properties, so there is no landlord. This way, if the restaurant business struggles, shareholders still own something of tangible value that can be put to different use. The most recent full-year results from MEX showed lease liabilities with a present value of £37m. I don't believe it has any freehold properties.

- If it has an extremely valuable brand and infrastructure so that restaurant operators are willing to sign up as franchisees, meaning that the brand owner doesn't have to take the risk of operating too many restaurants (McDonald's or Domino's, for example). MEX has some existing franchise partnerships and initiatives but my impression is that they are small-scale for now.

To maintain continuity, I will keep an AMBER rating on this share. It is forecast to have a small net debt position at the end of the current year (excluding leases), but is not in financial distress currently. Hopefully the roll-out is successful and the marketing spend pays off as intended. Though personally, this is not something I'd have any interest in betting on.

Mission (LON:TMG)

- Share price: 18.7p (unch.)

- Market cap: £17m

- Category: RED

Paul looked at this marketing group in October,

Today's brief update lets us know that FY 2023 is in line with the revised outlook after that October profit warning.

Value Restoration Plan - a grand name for "cost saving initiatives, margin improvements and selected possible business disposals".

£5m of cost savings have been identified. For context, last year this company made a "headline operating profit" of £8.7m on revenues of £79.8m. So it's quite believable to me that they would be able to find £5m of cost savings:

An initial £2m of annualised costs savings relating to headcount reduction in certain of the Group's business units have been delivered at a cost of £0.4m. A further £3m of annualised non-agency cost savings have been targeted and are being implemented at a cost of £0.3m.

Additionally, two non-core subsidiaries are progressing towards disposal.

Bank relationship - Natwest have agreed to waive the December covenant. It had already been flagged that a breach was likely, so the covenant waiver is good news. Although it's striking that it took two months to announce this - could it not have been announced sooner, or has the waiver only just been agreed at the last minute?

We remain in constructive dialogue with respect to covenants and maturity of facilities and are confident that through this ongoing support from our Bank, we will have the liquidity and headroom to deliver upon our medium-term strategy.

Net debt remains around £24m.

Graham's view - the net debt position is simply too large in relation to the company's recent (lack of) profitability.

The latest interim results showed revenues of £41.8m translating into a "headline operating profit" of just £2m and reported PBT of £0.1m. Marketing is labour-intensive work!

The share count here has been admirably stable over the years but an equity fundraising might be the best way out of this situation. Therefore I agree that this deserves to go in the RED category.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.