Good morning, it's Paul & Graham here!

Reminder for this evening - Forensic stock analysis masterclass: How to get the most out of the StockReports in 2024.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps (usually) between £10m and £1bn. We usually avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced. OR it's such deep value that we see a good chance of a turnaround, and think that the share price might have overshot on the downside.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or serious problems, so anyone looking at the share needs to be aware of the high risk. Sometimes risky shares can produce high returns, if they survive/recover. So again, we're not saying the share price will necessarily under-perform, we're just flagging the high risk.

Links:

Paul & Graham's 2024 share ideas - live price-tracking spreadsheet (2 separate tabs at bottom),

Paul's 2023 share ideas, with live prices.

New SCVR summary spreadsheet from July 2023 to date, updated at weekends (very useful quick reference tool, search for ticker using CTRL+F). Hover over cell for pop-up notes.

Frozen SCVR summary spreadsheet for calendar 2023.

Paul's podcasts (weekly summary of SCVRs & macro views) - or search on any podcast provider for "Paul Scott small caps" - eg Apple, Spotify.

Other mid-morning movers (with news) -

Windward (LON:WNWD) - up 7% to 120p (£103m) - RNS Reach (ie marketing rather than regulatory) says INTERPOL started using WNWD’s services (AI for maritime) in H2 2023. Interesting company, and highly relevant given attacks on shipping. Jam tomorrow in terms of numbers, with heavy losses each year so far, so impossible to value at this stage. It’s been a nice punt so far, with shares in a strong up-trend. Good TU on 17/1/2024, ahead exps with losses reducing, and $17m net cash. Could be an interesting trade for the adventurous?!

Shield Therapeutics (LON:STX) - down 46% to 3.05p (£23m) - FY 12/2023 TU - reveals third party data errors that caused growth in prescriptions to be over-reported previously, esp in Q4. Also looks like it’s running out of cash - had $13.9m end 2023, but is cutting costs. Aiming to reach cashflow positive in H2 2025, which says to me it’s gonna need another placing before then. So I’m wary of this. Pity, as its key product (iron deficiency treatment) is being commercialised now. Might be worth a look once it’s raised more cash, but too risky for me before that - existing shareholders are often lambs to the slaughter.

Croma Security Solutions (LON:CSSG) - up 7% to 71.5p (£10m) - FY 6/2024 - H1 Results - in line, and “promising start” to H2. Disposal proceeds of £5.8m scheduled to be received instalments Mar 24 - Jun 26 - highly material risk if not received. NB the buyer, M&W Security (SC753198) was a newly created company, with no published accounts or track record. So there has to be some doubt over whether the instalments will be paid.

H1 figures very small, £362k PBT (a quarter came from interest received). Strong balance sheet with c.£10m NTAV, but about half is the dubious receivable for disposal. Too small to be listed. Maybe priced about right? See reader comments for more discussion.

Arcontech (LON:ARC) - up 7% to 93p (£12m) - Interims - tiny niche software company - H1 revs £1.45m, but very high margin (adj PBT £535k up 45% - most of the increased profit came from finance income earned on cash pile. NTAV: £6m, including net cash of £5.7m. Dividend yield of 4.4%.

Paul’s view - I can see the interest from value investors, due to excess cash pile, divis, and decent profits. Key question is whether the core business can scale up, then you would have a big winner on your hands maybe. In the meantime, mkt cap is strongly asset backed, so probably limited downside risk. Main risk is that its services might be legacy deals that gradually wither away? Worth a closer look though, I think.

Aquila Services (LON:AQSG) - down 34% to 12.1p (£5m) - Delisting - we’ve never looked at this share here. It reversed into a cash shell in 2015, and has really gone nowhere since. It’s a specialist consulting business, with most shares owned by individuals (management?) It says trading continues to go well, but that the listing isn’t delivering value for shareholders - fair point, I agree, it’s wasting probably hundreds of £k pa with a pointless stock market listing. Last H1 results were just above breakeven. Bal sht was fine, so this is not a distressed delisting. We need a mass clear out of tiny companies from the stock market, where having a listing provides no benefit, but lots of costs & hassle.

Summaries of main sections below

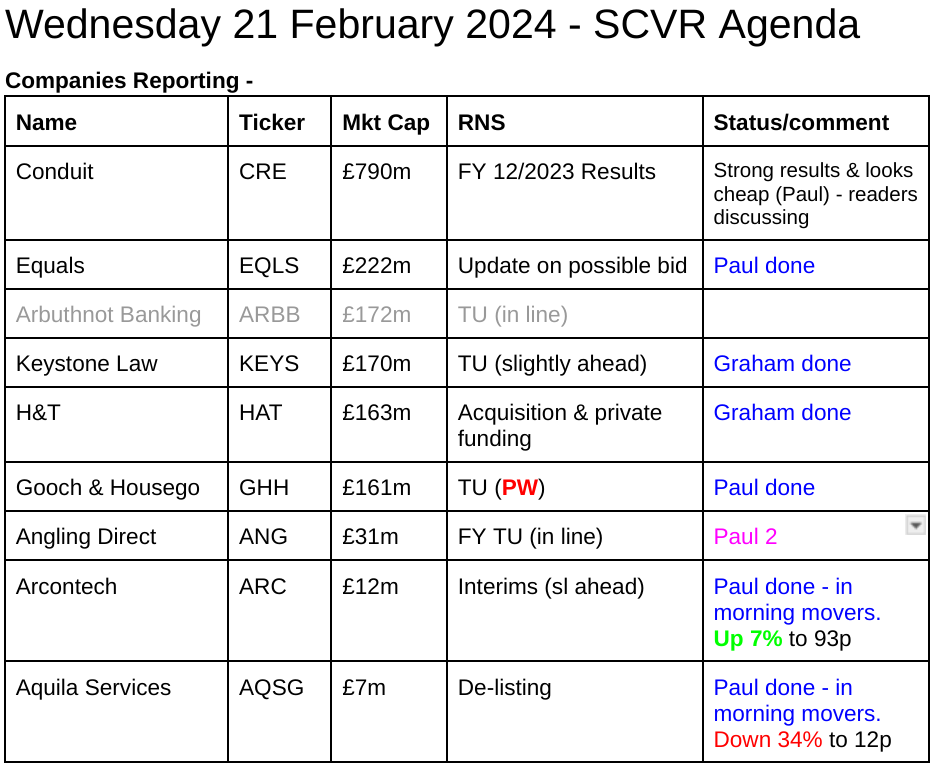

Gooch & Housego (LON:GHH) - 610p (pre-market) £157m - AGM Trading Update - Paul - BLACK (profit warning) - AMBER on fundamentals

Profit warning, with FY 9/2024 broker forecast EPS cut by 24%, so expect a similar % drop in share price today. Blamed mainly on customer de-stocking - why wasn't this anticipated? Also mentions some positives. I can't see any reason to get involved at this stage.

H & T (LON:HAT) - up 3% to 380.6p (£167m) - Acquisition and Additional Financing - Graham - GREEN

Interesting update from the country’s biggest pawnbroker as it buys a “posh” rival’s pledge book and takes over its Essex-based store. It also borrows £25m from a large international lender, not due for repayment until 2029-2031. Remarkably cheap if business stays strong.

Equals (LON:EQLS) - down 4% to 114p (£214m) - Strategic Review Update - Paul - AMBER

Today's strategic review update confirms discussions ongoing with Madison Dearborn, and the PUSU deadline is extended for the 4th time. It reassures that current trading continues to be in line with expectations. Shares look fairly valued to me, but I hope shareholders get lucky with a takeover bid, but after this length of time (since 1/11/2023) I wonder if the probability of a deal happening might be receding somewhat?

Keystone Law (LON:KEYS) - up 7% to 580p (£183m) - Trading Update - Graham - AMBER

This challenger law firm says that it has “slightly” beaten expectations for 2023, those expectations including adjusted PBT of £10.9m. It looks expensive for a law firm but the founder-CEO has achieved impressive growth without dilution in recent years.

Paul’s Section:

Gooch & Housego (LON:GHH)

610p (pre-market) £157m - AGM Trading Update - Paul - BLACK (profit warning), AMBER on fundamentals

Gooch & Housego PLC (AIM: GHH), the specialist manufacturer of photonic components & systems…

It’s another company blaming customer de-stocking for a downturn, this is becoming a widespread theme from many companies at the moment -

"Further order book growth but near-term demand impacted by destocking"...

… This period of inventory adjustment is proving to be deeper and more prolonged than previously anticipated.

Our semiconductor market customers have reduced near-term demand but still expect strong growth in the medium term. We have also received customer notification that certain US A&D programmes will no longer go ahead or have been deferred.

Impact on profit is about £3m - pity they don’t state what their previous (or revised) profit expectations actually are -

As a result, the Group's trading for FY2024 is expected to be more weighted to the second half and profit growth for the full year to be lower. Adjusted profit before tax is anticipated to be circa £3 million below management's previous expectations.

Broker update - Cavendish helps us by crunching the numbers, many thanks.

It puts through a 24% reduction in FY 9/2024 forecast EPS to 29.8p.

That makes the PER too high at 20.5x, so I would expect this share to take a tumble of 20-30% today (writing this at 07:46).

Outlook -

Given the strong medium term customer demand demonstrated by a growing order book, recent operational improvements and the Group's strategic focus, we believe we remain extremely well placed to respond quickly and benefit as several key end markets recover…

… Our review of the Group's product portfolio is well advanced and near-term actions in this area are expected to support the future profit margin improvement of the Group, especially in our A&D business.

Net debt is down slightly, but sounds quite substantial -

The Group's financial position remains strong. Working capital levels have been reduced in the first four months of the financial year and net debt at the end of January 2024 stood at £30.5m (Sept 2023: £31.7m).

EDIT: I've reviewed the last balance sheet at 30/9/2023, and it looks fine to me. NTAV is £60m. Strangely, the company scores an own goal by including lease liabilities in its net debt figure of £31.7m at 30/9/2023. Net bank debt was about a third lower, at £20.9m, and doesn't look stretched. I think inventories & receivables look a bit too high, so if I were the CFO my priorities would be to tighten up on cash collections from customers, and to get those inventories down. I reckon that could halve net debt, and hence save a fair bit on interest costs too. Anyway, I don't have any worries about solvency or dilution risk, so its balance sheet gets an overall clean bill of health from me.

Paul’s opinion - there are some positives in today’s update too, including strong order intake, with the order book having risen to £128.5m (9/2023: £124.1m). Operational improvements in its factories are mentioned, together with a review of product lines to improve future margins, and subcontracting out some products to lower cost producers (which does raise questions about GHH itself).

GHH shares have de-rated considerable in the last few years, and today’s update certainly won’t help.

I’m happy on the sidelines, waiting to see where the dust settles, but don’t feel particularly motivated to want to research this company further - why get involved?

Snapshot at 09:00 -

Equals (LON:EQLS)

Down 4% to 114p (£214m) - Strategic Review Update - Paul - AMBER

Today’s update provides little new information, but is a neat summary of the events so far. Here’s my summary of their summary! -

Strategic review announced 1/11/2023, triggering start of offer period under the takeover panel rules.

Deadline (“PUSU”) has now been extended for the 4th time (in 28-day periods) to 20/3/2024.

Ongoing discussions with Madison Dearborn Partners LLP.

It’s not clear if there are any other interested parties involved in discussions, none are mentioned as being currently involved, but we don't know for sure.

Current trading - continues to be in line with the Board’s expectations.

They say confident in long-term growth prospects of the business.

Paul’s opinion - I don’t have any data to support this view, but my inkling is that when takeover discussions drag on this long, the chances of a deal actually happening tend to reduce.

So smaller shareholders (who can get in & out whenever they want) are no doubt weighing up the pros and cons of selling in the market, or holding. Anyone selling now could miss out on a takeover bid premium. Or they could avoid a plunge in share price if deal talks fail.

I’m still not entirely comfortable with why management seem so keen to sell, if the business has such good prospects?

It looks fairly valued to me, on a fwd PER of 17.1x, and on about 16.7x tangible book value, so very little asset backing. I’m not sure why it should be valued any higher, either by the stock market, or a private buyer?

Payments/forex companies had a great run over the last few years, since the larger banks have allowed smaller competition to have some market share by being more competitive on price. Also, companies like EQLS seem to have innovated and built an interesting suite of services, and technology. So the bull case is persuasive, and the financial results speak for themself. Although ultimately customers are mainly driven by what forex rates are offered, so logically I imagine it would be a race to the bottom on price, hence erosion of margins seems inevitable, no matter what bells & whistles are offered on service, tech "platform", etc.

I think EQLS looks fairly priced at the moment, so it doesn’t interest me as something to open a new position in now. I will however be keeping my fingers crossed that shareholders get lucky with a bumper takeover bid hopefully! Meanwhile, the in line trading update today reassures.

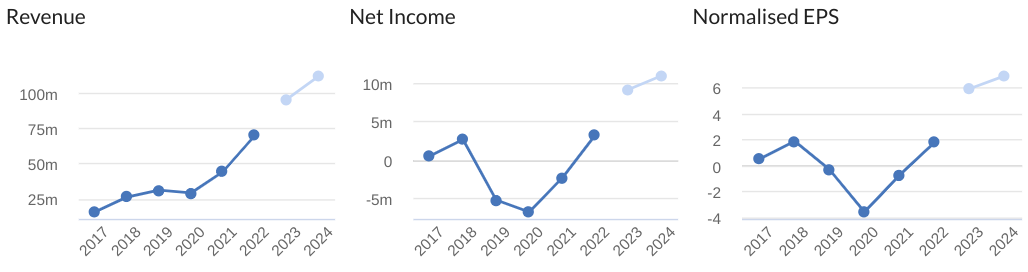

Very strong growth, but profitability is a recent phenomenon - flash in the pan (bear), or the start of a long-term bonanza (bull)? You decide! (I don't have a strong view either way).

Graham’s Section:

H & T (LON:HAT)

Share price: 380.6p (+3%)

Market cap: £167m

No trading update from HAT, but news of an acquisition and additional financing.

Acquisition: H&T is buying “certain assets of Maxcroft Securities Ltd” for £11.3m.

Maxcroft is an Ilford-based pawnbroking business; H&T is buying its £6.1m pledge book and will lease its existing Ilford store.

The value of the £6.1m pledge book is calculated by including accrued interest on the loans but also deducting expected credit losses (“after required IFRS 9 provisions”).

The Maxcroft book has a similar asset mix to H&T’s existing book: gold, jewellery, watches, etc.

However, the big difference is the average size of a Maxcroft loan. It’s over £4,000, about ten times bigger than the average H&T loan.

I did get “posh” vibes when browsing Maxcroft’s website this morning:

Customers are served comfortably in a private area allowing for privacy and a very discreet service.

It almost sounds like you could be served a champagne flute while discussing your pawn loan!

The reason for the large size of the loans is that Maxcroft customers include business owners who need to boost their working capital. This is not a segment that has traditionally been served by H&T.

Funding

H&T has picked up £25m of additional funding from Pricoa Private Capital, a subsidiary of Prudential Financial (not to be confused with Prudential (LON:PRU)).

£10m is due in early 2029, while £15m is due in early 2031. Rates are fixed at c. 8.4%.

H&T’s total net debt at the end of 2023 was £31.6m.

CEO comment:

"We are very pleased to be able to announce these two transactions, both of which underline the Group's focus on growing and broadening its core pawnbroking business and investment in the store estate. We are also delighted to have further diversified and enhanced the Group's funding arrangements through the relationship with Pricoa.

Graham’s view

This all looks like positive news to me, although perhaps taking H&T slightly higher up the risk spectrum.

For example, the addition of £6m of larger loans onto H&T’s existing £131m pledge book shouldn’t make a big difference to the risk profile. But with an average loan of £4000+, and probably including some £20,000+ loans (as advertised on the Maxcroft website), the performance of this pledge book could perhaps be vulnerable to greater volatility than H&T’s existing book.

But I’ve had a brief look at Maxcroft’s documents at Companies House and can’t find anything that troubles me.

As for the funding, I’ve said before that I like it when H&T borrows, because it’s usually a sign that business is strong and that it’s highly profitable.

However, it’s also important to me that H&T doesn’t over-expand. I don’t think it’s doing that yet, but I’m curious to see what it plans to do with this £25m of additional funding - presumably half of it will support the Maxcroft acquisition, but what about the rest?

The positive features of the new loans are that a) they don’t mature until 2029-2031; and b) rates are fixed at quite reasonable rates.

However, against that, they carry similar covenants to the existing Lloyds RCF.

It might be impossible for a company like H&T to borrow meaningful amounts at decent rates without agreeing to covenants such as these, but we all know that these covenants can often be a huge headache for shareholders.

Overall I’m staying positive on H&T, but I do think shareholders need to keep a close eye on it, to watch out for an increase in management’s risk tolerance. If trading remains strong, however, then shareholders will benefit from acquired growth on top of the existing very strong organic growth in pawnbroking.

Value remains compelling:

Keystone Law (LON:KEYS)

Share price: 580p (+7%)

Market cap: £183m

We don’t regularly cover this “network and tech-enabled challenger law firm”. It has a full-year update for FY January 2024, and it’s good news:

Sustained client demand, as well as the impact of new joiners, has generated a better than anticipated revenue outturn. As a result of these factors, in combination with continuing high interest rates, the Board now expects the Group to deliver revenue and adjusted profit before tax for FY 2024 slightly ahead of current market expectations

Kudos to the company and its advisors for letting us know that the prevailing expectations were for revenues of £84.8m and adjusted PBT of £10.9m.

Hiring has been strong with 51 new Principals recruited during the year; the company finished the year with 432 Principals (last year: finished with 398).

Similarly, the total number of fee earners at the end of the year was 549 (last year: finished with 507). “Favourable market conditions” allowed this higher level of recruitment than the previous year.

CEO comment: I think this is the first time I’ve heard a labour market described as “fertile”, but it gets the point across:

"I am delighted to report that Keystone delivered a strong trading performance across the year, further leveraging our unique operating model and market position within the legal profession.

"Our ongoing financial and operational momentum has been accelerated by a more fertile recruitment environment following the challenges of the last couple of years, and we look forward to building on this performance in the year ahead."

Graham’s view

Not a sector I analyse regularly, but Keystone Law seems to be doing something right:

Growth has been achieved with minimal dilution - the share count has held steady since 2019.

Most recent interim results showed the company having net cash of £11m. Tangible balance sheet equity was about the same (~£13m).

Against earnings, it’s highly rated:

The founder-CEO owns c. 28%, which could help to explain the lack of dilution and the conservative balance sheet.

Overall, I have a positive impression of Keystone so far, but I’ll keep a neutral stance. Perhaps it’s fully valued here?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.