Good morning, it's Paul here with the SCVR for Wednesday.

Timing - I'll leave it there for today, as Countdown is about to start on Channel 4 (a nice way to de-stress after 7 hours of market & writing stress). I managed to get all but one of the numbers rounds right yesterday, and both conundrums too (pressing pause helps!). So I declare today's report duly finished.

It's quiet for newsflow today, but I've got some backlog items that I'll write about, so you won't be short-changed! In all honesty, I haven't really got anything else to do today that is pressing, so I'm quite happy to do some writing here instead.

.

Live Xmas harp recital, tonight (and tomorrow)!

Last chance for a unique, live Christmas harp recital (45 mins), from my sister-in-law, Lauren. We got very positive feedback from everyone who joined in her last harp recital of Xmas carols, live on Zoom. It's a really nice, feel good thing to do, with your friends & family., even if you just have it as beautiful, soothing background music (there's no audience participation, so everyone can relax!)

Goodness knows we need something to get us into the Christmas spirit, and if this doesn't, then nothing will!

Tickets are here. It's only six quid. I'd be very grateful for your support for my family, a struggling, but incredibly talented musician. It's not really about the money, she could just do with some moral support right now, with almost all her usual gigs having been cancelled this year.

The arts is a sector that's often overlooked, but the people in that sector have been devastated by covid/lockdown, destroying their livelihoods. To be blithely told to re-train isn't very helpful (a Govt website suggested my brother, a professional saxophonist, should re-train to be a bomb disposal specialist. Seriously!). Lauren applied for jobs in supermarkets, stacking shelves, to make ends meet, but didn't even get an interview. So it's not easy for middle-aged people steeped in the arts, to switch to something else.

Boohoo (LON:BOO)

First, our daily Boohoo (LON:BOO) (I hold) update

The Guardian are at it again, with yet another article highlighting low wages & poor conditions in a factory (this time in Pakistan) which seems to have been an unauthorised subcontractor, making garments for BooHoo. No doubt the factory makes garments for other brands too, but the Guardian likes to pretend that only BooHoo clothing is made in sweatshops, whereas of course it's a sector-wide, global problem.

BooHoo has suspended the supplier while it investigates. On the positive side, it sounds like the factory had been audited, but that the auditors had been fobbed off, possibly?

From the Guardian's short video, it does look like the factory in Pakistan might be dangerous, with what looks like scaffolding standing on bricks, supporting something above (the roof maybe, it's not clear), motorbikes stored indoors (although it looks like they are just inside, in what looks like a loading bay), and a rather grubby stand/squat hole in the ground type of toilet, like the ones they used to have in French bars until quite recently. Not very nice, but not altogether surprising in a poor country.

As we saw from the recent Parliamentary hearing, which BOO management asked to testify to, the company is clearly making serious, and strenuous efforts to clean up its supply chain. Rome wasn't built in a day, and it's incredibly difficult for retailers to police global supply chains, particularly because so much work is subcontracted, often without the retailer's knowledge, to poor countries with lamentable standards of safety, hygiene, and low wages.

I suppose you could look at this 2 ways;

1) Well done to the Guardian for investigating, and reporting on a shoddy setup overseas, or

2) Why the obsession/vendetta with persecuting BooHoo, when it has admitted failures, and is making strenuous efforts to fix the problems, which are endemic in the entire industry, not just for BOO?

This issue has been ongoing since May 2018 - I've just found a copy of the FT magazine which highlighted "Britain's Dark Factories". Journalists have rehashed the story repeatedly ever since. I'd like to see some balance, with all the other retailers challenged about their suppliers working practices. It's not clear why BooHoo seems to have become the lightning rod for the whole sector.

Will it impact the share price today? There's no reason why it should, because this is a known issue, and the company has already explained its detailed & serious plan of action. At this time of year though, with thin trading, anything can happen.

.

Hedging again?

I'm starting to get jittery again about the shorter term market outlook, so have put an index short on as a hedge, to help me sleep at night a bit better. So I thought it might help concentrate my mind, if I jot down the bull & bear points for the markets overall;

Bull

- According to the press, the likelihood seems to be that Oxford/AstraZeneca vaccine may be approved imminently - very bullish for many companies in problem sectors, since it would allow a rapid roll-out, and vulnerable people protected by (or before) Easter, allowing lockdown restrictions to be lifted permanently

- Brexit deal could be agreed any day the problem areas sound surmountable. Surely some face-saving (for both sides) compromise can be thrashed out? EU always seems to reach deals/fudges at the last minute, this is normal

- Huge Govt stimulus, so even in downside scenarios, Rishi is likely to hose down problems with cash, which is exactly what he's done so far. All funded by QE, so no issue with Govt debt - which is a total red herring (BoE owns £845bn of c.£2,000bn National Debt). This means any spike down on bad news is only likely to be temporary, much like March 2020 covid crash

Bear

- Covid cases rising fast, new more transmissible strain, news likely to get much worse before it gets better, race against time to vaccinate the vulnerable

- More severe lockdowns from now until maybe March, could do a lot of fresh economic damage possibly?

- Brexit chaos if no deal?

- Global logistics problems & cost of freight rising, and slowing down - could trigger profit warnings?

.

There are probably other things that I've forgotten. I'm bullish medium term, but am worried about the short term outlook. The above sounds like a recipe for potentially (maybe extreme) volatility. Hedges could easily be stopped out, even if you get the ultimate direction right.

Conclusion - I've fully hedged my portfolio with a short on the Dow (not particularly logical, but it's what I always do, so am comfortable with it), for now. I wanted to strip out the Brexit volatility, hence why not using a UK Index short.

If the market goes through the roof, then my index short will just get stopped out, for a loss of about 2% of my total portfolio. But my longs would probably go up more than 2%, because they're mostly things that are geared to a recovering economy.

I have looked at using Put Options as hedges, but they're ludicrously expensive. You have to be right not only about the direction, but also the timing of a big market move, because the daily decay of time value element of options seems quite high I've found when using them. There's a good case for using index options just before some major event, e.g. an election, or referendum, because they seem to be priced on recent historic volatility, not anticipated volatility. But that sort of options stuff is probably best left to the experts!

.

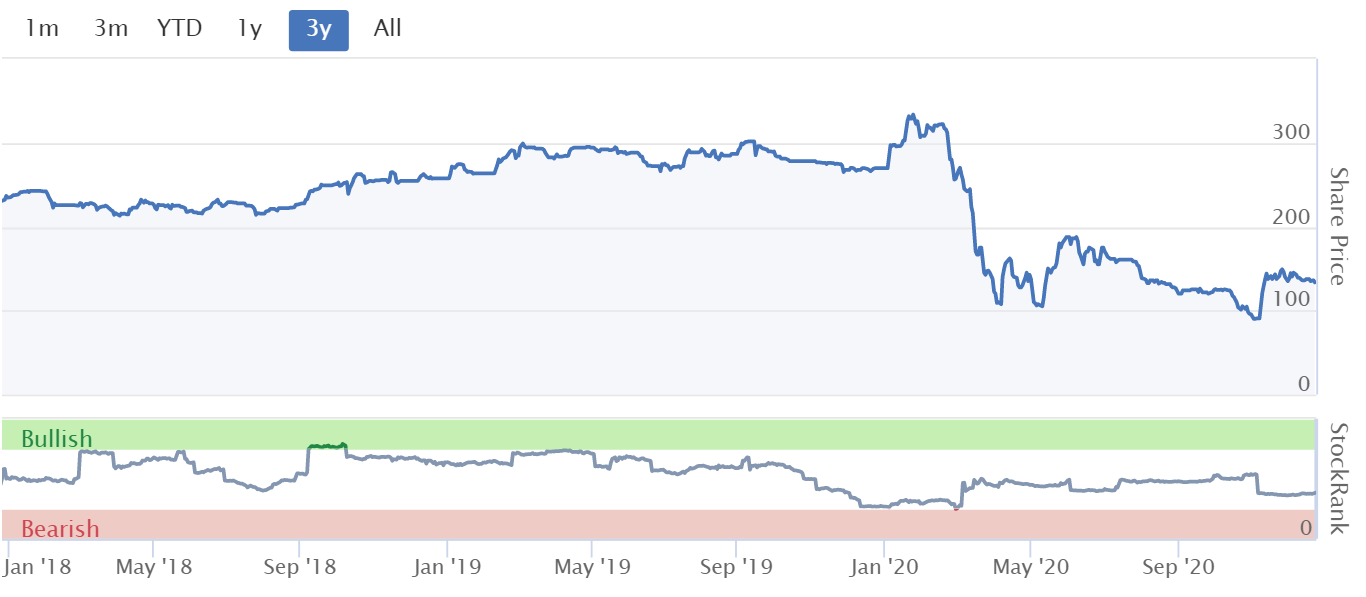

Avation (LON:AVAP)

135p (up 1%) - mkt cap £84m

I've not looked at this passenger aircraft leasing company since covid struck. Obviously its share price has been slammed, and barely recovered so far. Could it be a recovery candidate? Or, could struggling/insolvent airlines drag it down?

.

.

Summarising today's update;

- AGM being held on Zoom at 9am today

- "Satisfactory" results for FY 06/2020 (revs $135.3m, PBT $14.7m)

- Fleet is now 46 aircraft, 19 airlines, 15 countries, newish planes (4.5 yrs avg)

- Pandemic - AVAP supported airlines with deferred payment terms ($13.7m), and agreed amended terms with AVAP's lenders (rescheduling $26.5m of loan repayments)

- Airlines returning to service, but sector remains challenged & debt collection challenging - likely to remain difficult, even with vaccines rollout

- Phillipine Airlines restructuring - could reduce income for AVAP & impair assets - no figures given

- Bonds maturing May 2021 - negotiating with bondholders to extend maturity. Could involve increased costs. Company "stands ready to explore all alternatives" if negotiations fail

Outlook - optimistic in the medium term, looking for "opportunistic purchases" of aircraft

We have an opinion that air travel passenger movements will exceed previous levels when a treatment or vaccine is deployed, and passengers perceive air travel to be safe. Therefore, post COVID-19 we remain optimistic and expect significant opportunities for a rapid return to growth."

My opinion - the main risk here seems to be the negotiations with bondholders. It would be a good idea to check the price of the bonds, to see how distressed the bond market thinks they are. In this type of situation, a lot hinges on who owns the bonds. If they've been bought up by aggressive funds, who intend to play hardball, then things could get messy. Or, if the bondholders are co-operative, and want a quiet life, then things could work out fine. That's key information I don't have, so I can't value this share, or assess the risk.

Therefore it needs to be seen as a special situation type of investment.

The other thing to consider is whether the aircraft need to be written down in value on the balance sheet? What happens if customers go bust or restructure? Airlines generally have taken a battering, and with often shattered, highly indebted finances, they don't exactly make the most appealing sector to be leasing assets to. There again, planes can be re-let to new customers. As aviation recovers in the coming years (and I expect a big bounce from Easter, as people are likely to be craving holidays, having been denied them in 2020), then business could gradually recover. That would potentially give decent upside on the current share price.

If you know what you're doing, in terms of researching bonds, and financing generally, then this share could be an interesting one to look into. I'm neutral on it, as it's much too complicated for me to research properly in the timescales available here. Hopefully I've flagged the main issues above.

.

Immotion (LON:IMMO)

3.79p (up 15%) - mkt cap £15m

I've not looked at this company before, so give me an hour or so to read up on it...

This company is involved with virtual reality headsets. I'd love to try out one of those, they look great, but apparently can cause motion sickness. IMMO listed in July 2018, on AIM. Raised £1.2m before fees, 30m new shares in a 4p placing recently (Nov 2020). Mgt bought 12.5m of those placing shares, a good sign of commitment.

It seems quite early stage, with small revenues.

July 2020: £62k

Aug 2020: £339k

Sept 2020: £305k

[taken from RNS 19 Nov 2020]

Trading update today -

Immotion Group, the UK-based immersive entertainment group, is pleased to update the market on current trading.

Adding to the above revenues;

Oct 2020: £369k (launch of "Let's Explore Oceans" in mid-Oct)

Nov 2020: £573k

An improving trend there.

The home product looks interesting - it's cheap because it uses your smartphone to do the graphics. Have a look at this. Has anyone tried out this product? If so, I'd love to hear more about it - warts & all.

Since the launch in mid-October 2020, sales of the Home Based Entertainment product, LEO have exceeded expectations with total units sold up to and including 22 December, of over 11,000 generating total retail sales, including VAT, exceeding £800,000.

Following the recent placing, announced on 19 November 2020, the Company has now secured further stock, as well as identifying an outsourced fulfilment facility, allowing it to target a launch of the product in the USA in the second half of February 2021.

The product is now manufactured entirely in China, with complete boxes being supplied direct to our fulfilment houses. This process will significantly reduce product costs as the Group moves forward.

Location Based Entertainment - this seems to be another part of the business, with installations in several countries, as well as the UK. Covid lockdowns are forcing some closures.

It says demand will be very strong when "any sort of normality returns".

IMMO also sells disinfection cabinets called Uvisan. It's recommended by Hewlett Packard.

Summary - 2020 has been a tough year, impacting LBE revenues. Hoping for a strong bounceback in 2021. Cash of £1.9m at 21 Dec 2020, remains vigilant on costs, which it says are at a sustainable level. Enough cash to reach profitability.

My opinion - it looks moderately interesting. There must be so many companies active in this VR sector around the world, I'm not sure what is unique, or sustainable, about this company to make it worth focusing on? This type of tech tends to develop fast, which can often leave behind small, modestly funded companies, even if they have some early success. So it's probably not for me, but good luck to holders.

.

All done for today, see you tomorrow (half day usually on Xmas Eve).

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.