Good morning!

Today I'm looking at:

- Sports Direct International (LON:SPD) / Goals Soccer Centres (LON:GOAL)

- Softcat (LON:SCT)

- 7digital (LON:£7DIG)

- Nexus Infrastructure (LON:NEXS)

Sports Direct (LON:SPD)

- Share price: 317p (-1%)

- No. of shares: 522 million

- Market cap: £1,654 million

Statement re Goals Soccer Centre plc

Mike Ashley's thoughts on the fiasco at Goals Soccer Centres (LON:GOAL) do make for a dramatic RNS.

Goals Soccer Centres is just one of the many poor-quality businesses which Sports Direct has invested in. Goals admitted this year that its accounts were full of errors and that it was "in discussions with HMRC regarding a potential misdeclaration of VAT".

Sports Direct says today that the management at Goals didn't properly engage with them, when they were considering a bid for the entire company.

They go on to make some rather strong statements about what happened. I think it's worth pasting this in full:

"Given the issues within the Goals business, Sports Direct believes that it would be convenient for those concerned if Goals, and its corporate history, disappeared as a result of the AMA process.

[GN Note: AMA stands for "accelerated mergers and acquisitions" and refers to the attempt by the management of Goals to sell the company.]

From the beginning, the attitude of the Goals board made no sense, including proclamations to senior management of Sports Direct that the issues impacting on, and leading to the catastrophic failure of, the business had only been perpetuated by one person.

Sports Direct considers the Goals board members it was dealing with to be intelligent, and anyone with any common sense could tell it could not be only the result of one person's behaviour given the relative size and timeframe over which what would appear to be considerably more than "inappropriate actions" took place. This leads Sports Direct to conclude that the behaviour of the Goals board, and its apparent failure to spot and deal with the issues, amounts to incredible incompetence and ignorance, wilful or otherwise, at the very least and potentially far worse.

Sports Direct continues to believe that all relevant matters should be fully investigated, by both the AIM Regulators and an independently appointed third party, with no scope exclusions, and hopes that any eventual purchaser of the Goals business through the AMA process is not connected to the current management team given the investigations needed.

Yet again, the independent shareholders of a UK listed company get wiped out through the skulduggery of others; as these constant corporate failures show, the current rules and regulations do not do enough to protect independent shareholders or to prevent fiscal irresponsibility"

END

My view

I have some sympathy for Sports Direct and their statement. After all, they've been shafted by a company which published dodgy accounts. That always leaves a bad feeling.

On the other hand, Goals Soccer Centres has looked like a risky share for some time. See the archives and you will note that Paul and I discussed its high debt load on numerous occasions. It looked like it might be worth a speculative "punt" from time to time, but it was never a safe stock. For example, it was forced to stop paying dividends after FY 2012, and never paid another one after that.

The fact that the accounting was wrong only adds insult to injury, of course.

The bit where I take issue is that Sports Direct blames "the current rules and regulations" for what happened.

Instead of blaming the rules, I think it should take responsibility for its investments going wrong.

For example, during the collapse of Debenhams, Sports Direct also took issue with that Board not engaging with it properly.

Instead of blaming Boards of Directors for not engaging with it, it would be better off if it realised that this is a common experience for activist shareholders, and avoided putting itself in this position in the first place.

Being invested in publicly listed companies is risky, and that's particularly true when they are struggling, highly leveraged businesses like Goals Soccer Centres and Debenhams. If they don't blow up at some point, then you should count yourself lucky!

And expecting Boards of Directors to engage with you is unrealistic. Sometimes they will, sometimes they won't. But expecting any more co-operation then you are legally entitled to is setting yourself up for disappointment.

So that's the first reason I take issue with this statement. There is no shame in seeing an investment go bad, but Mike Ashley and Sports Direct should own their mistake, instead of blaming others. Nobody forced them to invest in these companies. And they knew (or should have known) the regulatory framework when they started investing in AIM and the LSE.

The second reason I take issue is a more pragmatic one: I'm sceptical of what changing the financial rules and regulations might achieve.

The statement doesn't spell out what changes Sports Direct is looking for, but I'm going to go out on a limb here and suggest that Goals Soccer Centres might have broken rules which already exist, e.g. as they relate to VAT and financial reporting.

The problem isn't that we don't have enough rules and regulations. The problem is that sometimes they get ignored! And the challenge we face as investors is how to identify those people who are publishing false accounts, as quickly as possible.

Unfortunately, I don't think there is an easy answer. It's a problem of enforcement and incentives: some companies have published fake accounts for years, without anybody blowing the whistle on them. And when they're eventually discovered, the authorities then have the problem of figuring out who did what, proving it, and coming up with appropriate sanctions which might prevent future instances of the crime taking place.

Improving the performance of financial regulators is the real challenge, and I simply doubt that it can be done by the introduction of even more rules.

At the end of the day, there is no substitute for finding good businesses run by trustworthy people. Unfortunately for its shareholders, Sports Direct has been overpaying for businesses which don't meet both of those criteria. It only has itself to blame.

Softcat (LON:SCT)

- Share price: 916.5p (-3%)

- No. of shares: 198 million

- Market cap: £1,817 million

I've never looked at this before, but readers have requested it.

It describes itself as "a leading provider of IT infrastructure products and services".

The solutions it offers fall under headings like "Business Intelligence and Analytics", "Networking and Security" and "Software Licensing".

Results

These results show revenue, operating profit and basic EPS all up by 24%, and healthy increases in the dividends.

Average headcount is up by 15%. A metric which investors might use in this case is revenue per employee. Always nice to see revenue growing faster than employees!

Its "key differentiator", according to Softcat, is "the attitude and ability of our people".

Customer satisfaction is at 96% and profit per customer grew by 17% during the year - good signs.

Net cash at year end is £79 million.

Outlook:

Softcat is in great health and strategically well-positioned. We think the structural drivers for growth in our industry will continue despite current political and economic uncertainty. The Board also remains confident in the Company's ability to gain market share and targets further growth during 2020. Trading in the first eleven weeks of the new financial year has been on track and we look forward to the rest of the year with confidence.

Brexit - the risk of operational disruption is considered to be low. The Board is monitoring developments.

Balance sheet - strong current asset position, mostly in receivables.

Average trade and other receivables were $225 million (see footnote 6), so receivables turnover is 4.4x (revenue/average receivables). This implies that it takes the company 82 days to get paid after it generates revenue.

However, this is complicated by the fact that the company generates far more invoices than it is allowed to record within revenue. So I suspect that the true "waiting time" for the average invoice will be materially lower than this.

My view - my first impressions are positive. It seems to be well-equipped to provide a truly comprehensive range of products and services to customers, making it a sort of one-stop shop for IT. If this has created a durable competitive advantage, then it's far more investable than the typical "managed IT services" business.

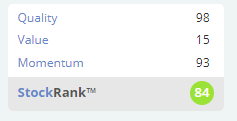

As you'd expect, it's a High Flyer:

7digital (LON:£7DIG)

- Share price: 0.18p

- No. of shares: 2.46 billion

- Market cap: £4.4 million

Contract to provide Music-as-a-Service Platform

I haven't covered this since August 2018, when the share price was 4.5p. So we have a 96% reduction in shareholder value in 14 months (significant dilution has occurred).

Maybe we can turn this into a game. Are there any companies which have used the phrase "as-a-Service" outside of a software context which have turned out positively for investors?

Argo Blockchain (LON:ARB) doesn't count - its recovery has been a consequence of abandoning the so-called "Mining-as-a-Service" strategy!

Nexus Infrastructure (LON:NEXS)

- Share price: 139p (+4.5%)

- No. of shares: 38 million

- Market cap: £53 million

This one has been listed since July 2017. It supplies physical infrastructure services through its three subsidiaries.

Profits for FY September 2019 will be in line with expectations.

The subsidiary with the largest order book, a multi-utility service provider called Triconnex, has seen growth of 26%, while the group as a whole has seen order book growth of 17%. Pretty good! Nexus says that this gives "good visibility of earnings for the year ahead".

Net cash is £22.6 million at year-end, accounting for a significant proportion of the current market cap.

Outlook is good:

The Board believes that the Group is in a strong position to deliver consistent organic growth, aided by the structural undersupply in the UK housebuilding market and Government stimulus for the sector but like many industry suppliers, we continue to experience caution as a result of the continuing political backdrop.

My view

Trailing EV/EBITDA is reported by Stocko to be less than 3x, giving rise to a ValueRank of 98.

I don't know if the stock would pass my quality filters, but it should definitely be of interest to value hunters at this market cap.

That's it from me for today. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.