Good evening/morning, it's Paul here.

There's no rambling introduction today, pondering life, the universe & everything!

Mello Derby

I'm getting into a frenzy, trying to prepare for Mello Derby. I think there might be a handful of tickets left, so if you can join us, here's the link.

The quality of the companies presenting is far higher than any other investor show. The reason being that David Stredder hand-picks companies that are known to be decent. Also, he refuses entry to the spivvy junior resource stocks which usually want to come along to investor shows. So the theme with Mello is very much quality, ahead of commercial considerations. Isn't that refreshing!

Someone said that a lot of the speakers are the same as in 2014. That's true to a certain extent, but we're not going to be saying the same things! Graham and I will be dragged on stage at 9am this Thursday & Friday, to do Small Cap Value Reports live. Whose idea was that?! Grrrrr! Still I'm sure we can have some fun, providing I'm supplied with enough coffee & bananas.

My main presentation will be a review of the last few years in small caps - things I've learned, interesting themes, opportunities & threats, etc. Hopefully that should be interesting too. Although at this stage I only have 2 pages of rough notes, so need to flesh that out into a proper talk very soon.

As I'll be preparing for Derby, and travelling there tomorrow, this report will have to be a bit shorter than usual.

A big thank you to those of you who kindly donated to Brian Basham's prostate charity London Marathon donations page. He emailed me today to say how much he appreciates our support. Also, I'm delighted that readers here chipped in a decent amount, so thank you from me too.

Boohoo.Com (LON:BOO)

Share price: 177.6p (up 15% at 08:26)

No. shares: 1,149.5m

Market cap: £2,041.5m

(at the time of writing, I hold a long position in this share)

Final results - for the year-ended 28 Feb 2018.

This is a leading online fashion group, currently with 4 fast-growing brands - BooHoo, PrettyLittleThing, Nasty Gal, and BooHooMan.

This share occupies a special place in my heart, as it was a stupendous performer for me, and many readers, when we spotted the wonderful buying opportunity at 24p, in Jan 2015 - after a profit warning.

Today's results are sparkling, and look well ahead of market expectations.

Adjusted diluted EPS came in at 3.23p, well ahead of forecast of 2.78p

There's a broker update note on Research Tree, which confirms the out-performance. It also raises its current year forecast by 12% to 3.68p.

Given that the company has a history of beating forecasts, sometimes by a lot, then I imagine the out-turn for this year (ending 02/2019) would probably be nearer 4.0p EPS.

If I'm right about 4.0p EPS for this year, then at the current price of c.177p, the PER is 44.3 - expensive by normal standards, but good value for a rapidly-growing, decently profitable eCommerce company. It's cheaper than Asos (where I have a short position), which doesn't make any sense to me - given that BOO is growing faster, cash generative, and makes a much higher EBIT margin than Asos.

Other key points;

Balance sheet is strong, with net cash of £133m

Warehouse automation is coming in, with quick payback. This should drive margin improvements in future. Criticism of working conditions sounds wide of the mark;

We have also opened substantial employee welfare facilities at the distribution and customer services centre, which includes a gym, exercise studio, leisure facilities and subsidised canteen.

Cash generation is very good, but flattered by favourable working capital movement (increase in trade creditors). The business model has an inherently positive cashflow bias, because goods are sold online for cash, before the suppliers have been paid. So growth actually improves working capital.

International growth is impressive - especially in the USA.

Outlook - sounds encouraging;

Trading in the first few weeks of the 2019 financial year has made a strong start. Group revenue growth for the next financial year (FY19) is expected to be 35% to 40% with adjusted EBITDA margin between 9% to 10% and capital expenditure of £50 to £60 million.

GDPR - these new regulations, over data privacy, are coming into force shortly.

Worries about this could well be behind the considerable fall in BOO shares since last summer. Although looking at the chart, it strikes me that the price overshot in what was then a raging bull market;

I put the question to BOO management today, and was reassured that they're on the case with GDPR. They don't see it as a worry, although didn't give me any specifics on how they're dealing with it.

My opinion - I'm kicking myself for reducing my position size recently, over GDPR worries, and also the downward drift in the share price. Other investors may not be aware of how incredibly ambitious this group is. They're seriously disrupting the High Street, with lower prices, and a much faster product cycle of "test and repeat". I think there is still a role for High Street clothes shopping, as it's more instant, and enjoyable as a leisure activity. However, the best online operators such as BooHoo are grabbing more market share, which is bound to cause some weaker High Street operators to disappear over time.

Overall, I'm very happy to hold, and will be adding more to my position if the price drifts back down again.

I'm listening to the results webinar now. Lots of interesting points;

- Low customer churn is impressive, at only 13% p.a. - so this group has a loyal customer base - which reduces my concerns about GDPR hurting the business.

- Use of celebrities, musicians, bloggers, etc - reach customers in new & engaging ways.This is also a barrier to scale for competitors, as they can't afford to pay top celebrities.

- Instagram is becoming very important, and customers can now buy product through it.

- "Well on our way to dominating this space in the UK" - i.e. youth fashion.

- Investing in many areas - distribution, IT, product designers

- Burnley warehouse(s) will be able to handle £1bn net sales by end of this year, plus big new extra capacity for PrettyLittleThing in Sheffield, with Clipper Logistics.

- Longer term plans to grow to £3bn annual sales

- 35-40% sales growth expected this year

- Medium term growth - at least 25% p.a., and 10% EBITDA margin

- Adjusted EBITDA margins 9-10% this year

- "Only scratching the surface of our potential in international sales" - better & faster delivery, and hassle-free returns - "massive opportunities overseas".

- Re-platformed websites to "demandware"(???)

- We're taking market share by being so competitive on price, but we still have good gross margins

- Long Q&A session, but not a single analyst asked about GDPR! Very surprising

Warpaint London

Share price: 192.5p (up 1.3% today, at 9:54)

No. shares: 76.7m

Market cap: £147.6m

Warpaint London plc (AIM: W7L), the specialist supplier of colour cosmetics and owner of the W7 and Technic brands, is pleased to announce its audited results for the year ended 31 December 2017.

These figures don't look madly exciting.

- Pro forma adjusted EPS is up 8.0%, to 9.4p - this seems behind forecast, of 9.8p

- This gives a historic PER of 20.5 - seems expensive for limited earnings growth

- Forecast for 2018 is 13.1p EPS, which reduces the PER to 14.7

- Very good operating profit margin of 22.8% (pre-exceptional)

- A large acquisition ("Retra") was made end Nov 2017, which is probably why earnings forecasts for 2018 show stronger profit growth. Retra is heavily weighted to H2, which will affect group results in future (increased H2 bias)

Positive outlook comments -

"After a successful first year as a quoted company, we look to the future with considerable optimism. We have had a promising start to the current year, in line with the Board's expectations, and with a sound financial base, including net cash, prospects are encouraging.

I believe we are well positioned to continue to deliver increasing shareholder value in 2018 and the outlook for the Group remains positive."

Balance sheet - is excellent.

Intangible assets have shot up, due to the acquisition, from £1.9m to £18.6m.

NAV: £40.4m

NTAV: £21.8m

Current ratio: 5.5 - this is extremely high, which I think is probably distorted by the acquisition made near the end of the year. This is because the acquired company's inventories & receivables are included in the year end balance sheet, but there wouldn't have been much impact on the P&L.

Share capital has risen, indicating that new shares were issued. Checking the archive of RNSs, in Nov 2017 the company did a placing of £21.2m (before costs) to fund the acquisition. I like this, it's a nice prudent way of doing things. Although an increased share count will inevitably dampen EPS in future years, compared with if the acquisition has been debt-funded.

My opinion - I can't get excited about this share - possibly because I know nothing about its market.

It looks a reasonably good business - with a very strong operating profit margin, and a great balance sheet. If it achieves 2018 forecast earnings, then the PER would be reasonable.

Overall then, it might be worth a look, if you understand the sector.

Clipper Logistics (LON:CLG)

Share price: 456p (up 3.6% today, at 10:57)

No. shares: 100.4m

Market cap: £457.8m

Trading update & new contract win

Clipper Logistics plc ("Clipper", "the Group" or "the "Company"), a leading provider of value-added logistics solutions and e-fulfilment to the retail sector...

It's an in line update;

Clipper is also pleased to announce that trading for the year to 30 April 2018 is expected to be in line with the Board's expectations, with continued growth in revenue, operating profit and net earnings. Results for the year are expected to be announced in July 2018.

Also, a new contract with PrettyLittleThing (part of BooHoo group) is announced, for a large warehouse in Sheffield.

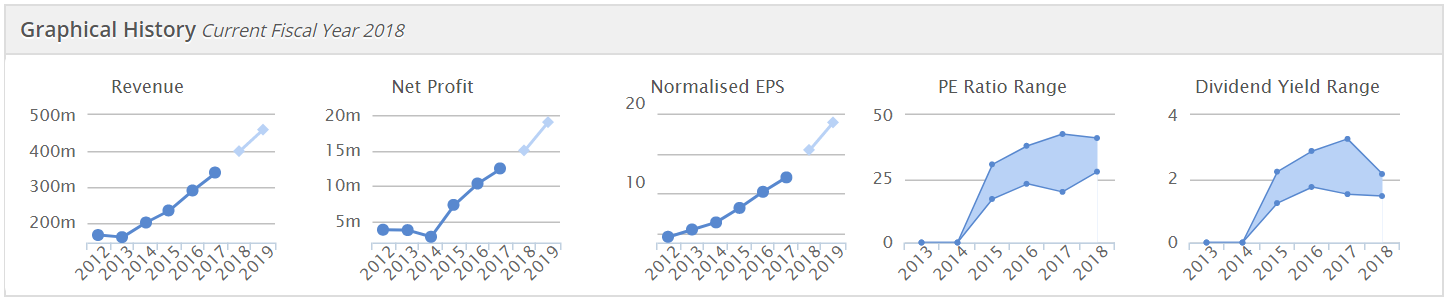

Clipper has an excellent track record, as you can see;

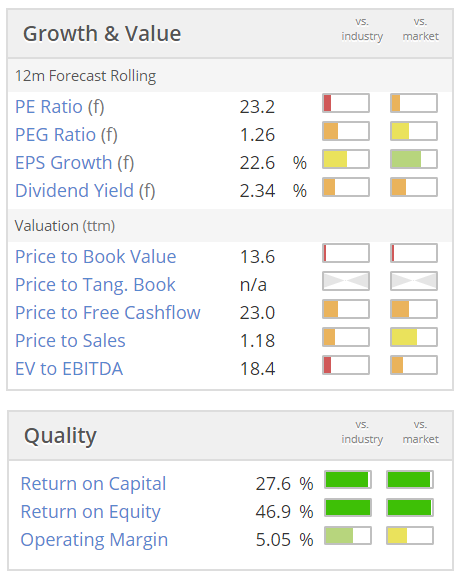

As you would expect, a strong track record means the shares are not cheap;

My opinion - this company seems to be providing services which are attractive to retailers, and eCommerce businesses. Therefore the growth of the latter gives a lovely tailwind to Clipper's figures, as its customers grow strongly.

The PrettyLittleThing contract win is impressive, as it's a shrewd customer.

Logistics is becoming an interesting area, as it's seeing increased automation. This means that small companies with manual procedures are likely to be driven out of business by more sophisticated operators like Clipper.

It's looks interesting, and is one I'll keep an eye on.

Begbies Traynor (LON:BEG)

Red flag report - rather a strange report this quarter. The writer seems to have decided to use the report as a way of blaming all company problems on Brexit. It may be a factor affecting some companies. However in reality, I think many companies in financial distress are actually suffering from;

- over-capacity, particularly in sectors like hospitality & retail

- online disruption - which is harming many traditional sectors, including estate agents, retailers, etc

- slow payment by large customers, damaging cashflow

- insolvency of Carillion, which hit many smaller subcontractors

- Government & EU regulations, creating never-ending red tape

- Rising business rates

- Above-inflation increases in minimum & living wage, plus apprenticeship levy, and workplace pensions

Many smaller businesses are focused on those issues, and don't give 2 hoots about Brexit.

If Begbies has decided to politicise its red flag reports, then I won't bother reading them in future.

Anyway, whether Article 50 is the main factor or not, the figures are not good;

According to Begbies Traynor's Red Flag Alert research for Q1 2018, which monitors the financial health of UK companies, 477,210 businesses were experiencing 'Significant' financial distress at the end of March 2018, up 33% compared to when Article 50 was triggered on 29 March last year (Q1 2017: 358,943).

I have to leave it there due to time constraints.

Hopefully see lots of you in Derby!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.