Good morning from Paul & Graham!

Today's report is now finished.

Sorry we didn't get round to doing everything, it's just too busy at the moment, so we have to prioritise.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul's Section:

Firstly, 3 stragglers from yesterday:

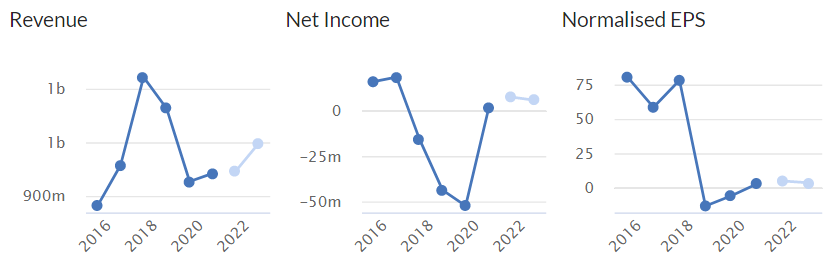

Staffline (LON:STAF)

33p - market cap £55m

Summary: FY12/2022 slightly ahead, cashflow lots ahead, 2023 outlook cautious. Broker slashes 2023 profit forecast by half.

FY 12/2022 underlying operating profit guided at £11.6m (up 13% on 2021), which becomes adj PBT of £9.0m, or 4.7p adj EPS.

Net cash £5.0m (but large working capital, so this could swing about a lot, I reckon - average daily net debt/cash would be more meaningful to report the true picture).

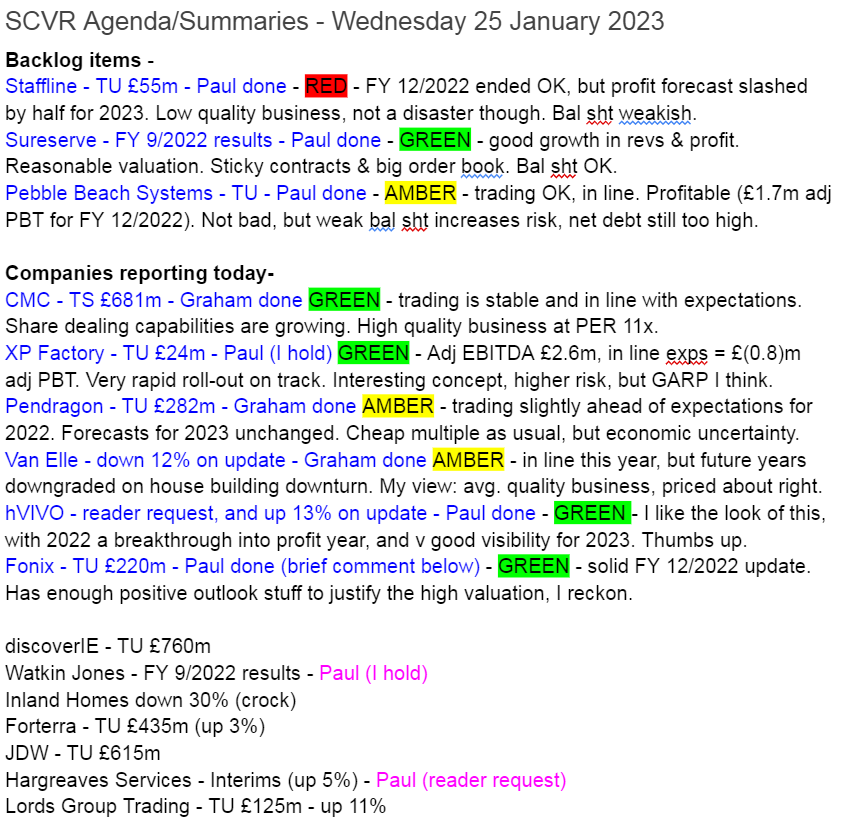

Claims balance sheet is strong, which it isn’t (so how can I trust anything else they say?) - last reported NTAV was negative at £(2)m. Zeus appointed to join Liberum as joint broker - why? Fundraising maybe? Altman agrees with me, not STAF management, with a Z-score that is alerting us to a weak balance sheet -

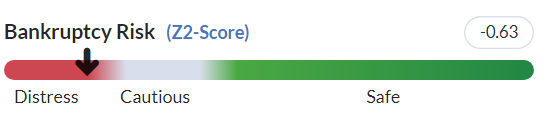

All was looking reasonably good, until I read broker update today - FY 12/2023 forecast slashed by almost half! (from 5.8p adj EPS to 3.1p) - a tiny sliver of profit, PBT margin is under 1% of revenues.

Says that macro conditions are worsening.

The wheels fell off in 2019 (pre-pandemic) as you can see below. Just after the former CEO had exited, banking his £10m at 1020p per share - not a typo (31x the current price!) leaving behind what turned out to be a shambles. See EPS graph 3 below - this is unlikely to ever recover to previous highs, because there are now 166m shares in issue, up from 34m in 2018, after a series of emergency placings to keep it afloat. Plus a generous taxpayer loan was key during the pandemic (deferred VAT, which has since been repaid).

My opinion - initially it looked interesting, but the mode I dug, the less attractive STAF seems. Overall, this looks a poor quality business, with no pricing power. Are they just busy fools? Historically there were loads of problems, and it’s not paid divis since 2018. There are much better shares in this sector to hold long-term, but as a short term trade, it might bounce at some point, who knows? On fundamentals though, I have to give it a thumbs down I’m afraid.

STAF shares have not participated in the recent everything rally, and note the deteriorating StockRank too -

Sureserve (LON:SUR)

87.5p (up 4% y'day) - mkt cap £146m.

I have a generally positive impression of this share. Although reading Graham’s brief notes here from Oct 2022, he reminded us that it’s a low margin business, in a competitive sector. Also the business (formerly called Lakehouse) had a lot of historic problems, which emerged about a year after its 2015 float. That's now receded into history though, it seems a better business now.

Results for FY 9/2022 are out.

Big increase in revenues, up 27% to £275m

Low gross margin

Few adjustments to headline numbers - good

PBT (continuing operations) £15.6m - up 41%

Discontinued operations £2.0m loss (vs £2.3m profit LY)

EPS diluted, continuing ops 7.8p (LY: 5.6p) - PER of 11.2x - looks priced about right.

Net cash £23.3m

Huge order book of £594m

Average contract length now 6 years - doesn’t seem to tie in with above numbers, revenues £275m, and order book of £594m is just over 2 years’ contracted work, surely?

Going concern statement - is fine.

Contracts mostly have inflation-linked cost clauses.

Current trading is said to be good.

Outlook - Board remains confident for FY23.

Balance sheet looks fine to me, ungeared, and with £19.3m cash. Clients are mainly local authorities, and housing associations, which tend to be good payers, and little to no customer insolvency risk. Sticky clients too, probably.

Dividends - historically divis were small, so it hasn’t got much of a track record of cash generation, but that’s improved in the last couple of years. So it should have the capacity to start paying divis, although not huge ones, judging from the cashflow statements. Nothing was paid in divis during FY 9/2022. The results commentary doesn’t mention dividend policy, which is a surprising omission.

My opinion - no strong view either way. The revenues & profit growth are impressive, and I like the longer contracts being signed, which should give dependable income streams, and thus (hopefully) profits that repeat reliably, and hopefully continue growing. So is this a GARP (growth at reasonable price) share? I’d say it’s looking that way, so I’ll be more generous than Graham, and go green with my current view of this share.

Pebble Beach Systems (LON:PEB)

8.5p (up 6% y'day) - market cap £11m

Does software for broadcasters. FY 12/2022 TU - is in line with market expectations. Guidance: £11.2m revenue (up 6% on 2021), adj EBITDA £3.3m (LY: £3.2m), which the broker says is £1.7m adj PBT.

Order intake in H2 up 24% on H1, as trade shows opened up again. “Excellent visibility” for 2023, due to strong order book, and recurring revenues (no figures given). Bank debt has been too high previously, coming down, but still hefty for size of company at £5.8m net debt - but refinanced in H1 to Sept 2024. Expecting this to reduce further in 2023.

Last balance sheet is really weak, with negative NTAV of £(7.7)m, so it’s totally dependent on the bank, and really does need to raise fresh equity at some stage. So quite high risk, especially if trading were to deteriorate.

My opinion - if it didn’t have the debt, it would be much better. But it looks a decent enough, profitable company. The weak balance sheet does increase risk though. Revenue has been fairly static for 6 years, so it needs to scale up the growth to drive a big share price rise, in my view.

hVIVO (LON:HVO)

17.3p (up 16% at 09:59)

Market cap £116m

hVIVO plc (AIM & Euronext: HVO) (formerly Open Orphan plc), a rapidly growing specialist contract research organisation (CRO) and world leader in testing infectious and respiratory disease products using human challenge clinical trials, announces a trading update for the period ended 31 December 2022.

I don’t know anything about this company, or sector, so am approaching this with trepidation, and I’m purely looking at the numbers.

Historically, this company was a loss-making cash burner, and increased its share count 11x from 60m in 2017, to 671m now.

Scanning through the RNS, there have been 8 announcements about £multi-million contract wins in the last year, so something interesting seems to be going on here.

For background, here’s my quick review of the H1 results to June 2022 (published Sept 2022) -

H1 revenue £18.9m (down 19%)

FY 12/2022 guidance was for £50m revenues (as announced on 8 Sept 2022)

H1 EBITDA up 10% to £2.3m, a margin of 12.1%

Cash of £15.9m at 30 June 2022.

Does EBITDA turn into profit? Not really, with £2.3m EBITDA becoming only £453k PBT in H1.

Balance sheet - is it strong? Not particularly. NAV (at June 2022) was £20.8m. Take off £6.2m intangibles, to get NTAV of £14.6m, and that includes £7.0m “investment in associates”, which would need scrutiny to see if it has any real world value.

There was £15.9m cash, with no interest-bearing debt, but it looks as if this has probably come from customers paying up-front, as it’s more than offset by £23.7m trade & other payables (which is usually deferred income - customers paying up-front, for this type of business). So I would say it doesn’t really have any of its own cash that it could safely spend.

Cashflow statement - note that it puts £724k R&D Credit into other income on the P&L, and not as a negative tax charge, a way of presenting it that I’ve not seen before.

Is it capitalising a lot of costs into intangible assets? Good news here, it’s a no. Also, there was £0.9m of physical capex in H1, which is modest - so it seems a capital-light, know-how-heavy business model. Overall it was roughly cashflow neutral in H1, and the prior year FY 12/2021 figures show £3.5m of cash was used. So it was not a cash generative business, up to June 2022 anyway.

Latest update today - some very impressive stuff here in these headlines -

.

EBITDA of 17% on £50.6m revenues gives £8.6m. £1m of this was one-off cancellation fees, so underlying EBITDA is £7.6m, a 15.0% EBITDA margin, 9% above forecast.

Finncap (many thanks for crunching the numbers for us!) shows adj PBT of £5.3m, making this very much a breakthrough year for profitability - the key questions being (if you know the answers, please post a comment!) -

- How has this been achieved? (serial loss-maker suddenly starts winning loads of contracts & becomes profitable - great, but what’s driving that?)

- Are profits now sustainable?

The good visibility of contract earnings shown above suggests that things might continue to look good.

hVIVO claims to be a world leader - so we would need to know who the competition is, and what HVO is doing better, and will the competition erode HVO's advantage over time? -

The significant growth in revenue provides further validation of the long-term sustainable growth in the human challenge trial market, for which hVIVO is the world leader.

Outlook -

The Group has entered 2023 well capitalised, debt free, and with record visibility into the current financial year. hVIVO is firmly placed to build on the growth in the human challenge trial market and further strengthen its position as the world leader in the field. The growing orderbook from new and existing Big Pharma and biotech clients provides excellent forward visibility with over 95% of forecasted revenue for 2023 contracted, and further revenue visibility into 2024. The Board is confident that the Group will continue to leverage its competitive position amidst favourable market dynamics and maintain its strong operational execution, orderbook revenue conversion and focus on profit generation into 2023 and beyond.

That sounds like 2023 forecasts are likely to be raised, as new contracts are won.

Webinar - tonight at 18:00 on InvestorMeetCompany, so I’ll watch that to find out more.

My opinion - HVO has sparked my interest, so thanks to MrContrarian, richardho, davidjhill, and JanesKerr1 - who all flagged this share in the reader comments below, which is why I followed up on it.

As I know nothing about the sector, I’ll be looking to you for guidance on the company, not the other way around! From my perspective though, I can see potential in these numbers, and am tempted to dip my toe in, with a starter sized opening position. So I’ll go green, and give it a thumbs up.

Note that the very low StockRank is starting to creep up - expect that to rise a lot, I'd say -

Brief comments -

Fonix Mobile (LON:FNX)

Fonix Mobile - down 2% to 219p - mkt cap £220m - FY 6/2023.

H1 Trading Update - this needs to be good, because Fonix shares are quite aggressively priced (based on existing forecasts, fwd PER is 24.6x).

I won’t go into the detail, but this all sounds fine to me. “Largely unaffected” by consumer spending. International expansion is “particuarly encouraging”, and could drive further growth, and it says “incurring minimal additional overhead”. H! EBITDA up 12% to £6.2m. Strong cashflows, so will increase divis. High repeating business, and very sticky clients, as mentioned before here in previous reviews. Significant new clients launching imminently.

Thumbs up from me, this looks good, but remember it’s not cheap, so would probably fall a lot if future performance were to disappoint. So far though, so good!

Graham’s Section:

CMC Markets (LON:CMCX)

Share price: 243.5p (pre-market)

Market cap: £681m

Full disclosure - I’m a shareholder in IG group (LON:IGG) who are CMC’s biggest rival. IG is my third-largest position. You may wish to bear this in mind!

Today we have an update from CMC for the period 1st October to 23rd January. The financial year for the company is at the end of March, so this is Q3 and the beginning of Q4.

The main point is that net operating income is tracking in line with expectations, and expectations for operating expenses are also unchanged.

While net operating income was weaker towards the end of the calendar year, it has recovered strongly in January. Monthly active clients, client money ("AuM") and assets under administration ("AuA") in our investing and trading businesses remain stable versus H1 2023.

I wonder if the World Cup was a distraction from financial trading at the end of the calendar year?

Strategically, CMC UK Invest (their share dealing platform) has expanded its offering, and CMC Singapore Invest is moving towards launch.

I was previously very excited about the spread betting companies launching share dealing platforms. However, it’s worth noting that share dealing itself is not very profitable for these companies, at least not compared to spread betting! So I think the value is more to do with the cross-selling of more profitable products, and getting users into the habit of logging in.

To give you an example of how profitable spread betting is, I recently investigated the overnight cost of holding a daily rolling spread bet, to see whether it could possibly be used as a tax-free alternative to buying physical shares.

It turned out that the bid-ask spread was the least of my worries! I calculated that the holding cost of the position was nearly 6.4% p.a. of its notional value, i.e. utterly prohibitive for someone trying to make a “normal” investment in this way. But you can imagine that with so many customers holding so many positions with large notional values overnight, these charges are wonderfully lucrative for the spread bet platforms.

Anyway, let’s get back to CMC and the commentary by Lord Cruddas (Founder, CEO and 59% shareholder):

2023 is set to be an exciting year for CMC as we continue our growth strategy. Our core initiatives of product expansion, new trading analytics, new pricing functions and enhanced onboarding initiatives remain on track across both our investing and trading platforms. Expansion of CMC Invest continues, with UK marketing spend accelerating over coming months coinciding with delivery of a steady stream of new products and functionality.

My view

Despite being a long-term IG shareholder, I also view CMC as a high-quality business (see its ROCE/ROE scores) and I think the market is being overly sceptical by awarding it these valuation metrics:

The StockRanks also think it looks good:

In October, I discussed some of the key themes around the stock, and why investors may be sceptical. One of these was volatility and whether it might fall back to pre-Covid levels.

Here’s the latest reading from the VIX (Volatility Index): 19, which is still above pre-Covid levels. Spread bet companies have been great beneficiaries of the volatility boom since 2020:

Given the macro forces at work (e.g. US government debt at $31 trillion, inflation, interest rates), I personally don’t see volatility returning to “normal” any time soon. But nobody really knows!

So for me, this is a quality company that’s trading well and is probably too cheap. Although not without risks, of course.

Pendragon (LON:PDG)

Share price: 20p (+2%)

Market cap: £279m

This motor retailer issues a full-year update for 2022.

Performance is slightly ahead of expectations, with underlying PBT of c. £57m (versus expectations of £53m - £55.3m).

The reasons given:

Trading during [Q4] was underpinned by strong volume growth in new cars, with the Group delivering like-for-like volume growth of 4.6%, and outperforming the retail new car market growth of 1.0%. Used car volumes also grew by 5.2% on a like-for-like basis in Q4, a notable improvement on the declines seen in the third quarter.

Outlook is “confident”, as “there are some early signs that new car supply may be beginning to improve which we expect to drive growth in new car volumes during 2023”.

Underlying PBT forecasts by Zeus Capital were recently reduced as follows (using round numbers):

FY 2023 PBT reduced 15% to £49m

FY 2024 PBT reduced 12% to £56m

My view

This is a brief update so there’s little reason to change your existing view on this stock. Paul recently noted the takeover interest (now expired) from the largest shareholder at 29p.

Car market statistics were gloomy in 2022. However, the “early signs” of improvement in supply, mentioned by Pendragon, are backed up by the national numbers, as new car volumes improved towards the end of the year.

Could 2023 be the year that the car market returns to normality? I’m not sure about that - even if supply returned to full health, what about demand? Is the consumer strong enough?

This is an interesting sector for those who like cheap earnings multiples and don’t mind taking on lots of economic risks:

Van Elle Holdings (LON:VANL)

Share price:47p (-12%)

Market cap: £50m

This is “the UK’s largest ground engineering contractor”.

H1 results (for the period to October) look good:

But of course these numbers are backward-looking. Why are the shares down 12% today?

We have the following outlook statement:

Trading is in line with expectations in H2 so far, and the company is “confident” it will achieve full-year expectations.

“The housing sector is expected to deliver lower volumes in the short-term, however, Van Elle’s Infrastructure and Construction markets remain healthy and typically deliver an improved margin mix”

Visibility is “much improved” out to FY 2025, thanks in particular to some highway and rail projects.

The CEO expands on these statements, confirming that “market conditions in the short term, especially in respect of new build housing, are expected to be more challenging”.

Kudos to Paul who emphasised the possibility that new building projects might struggle in November, despite Van Elle trading perfectly well at the time.

A broker note published today, again from Zeus Capital, sees FY April 2024 and FY April 2025 revenue forecasts each reduced by 3%. Underlying PBT forecasts for each year are reduced by c. 8% (to £6m and £6.6m, respectively).

My view

The good news is that Van Elle is not solely dependent on the residential sector for its revenues and indeed residential is only responsible for about 40% of the total.

What concerns me more is the lack of a substantial operating margin at the business, and the low returns.

The left-most column is FY April 2017, and the right-most column is FY April 2022:

For businesses in the construction industry, I don’t automatically expect high returns, but neither do I think they should trade at expensive multiples. So perhaps the market is pricing this one about right currently?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.